Holcim Bundle

How Does Holcim Thrive in the Construction Industry?

Holcim, a global leader in building solutions, recently celebrated a record-breaking 2024, showcasing its dominance in the construction sector. With net sales reaching CHF 26.4 billion and recurring EBIT exceeding CHF 5 billion for the first time, Holcim's financial prowess is undeniable. This success is fueled by its commitment to innovation and sustainability, making it a compelling case study for investors and industry professionals alike.

Beyond the impressive numbers, understanding Holcim SWOT Analysis is key to grasping its operational strategies and market position. The company's focus on sustainable building solutions, including ECOPact and ECOPlanet, demonstrates its commitment to decarbonization. This analysis will explore how Holcim operates, from its core products like cement and concrete to its global presence and contributions to infrastructure projects, providing a comprehensive view of its business model and future prospects, including its environmental impact and innovation in construction materials.

What Are the Key Operations Driving Holcim’s Success?

The Holcim company operates by manufacturing and distributing essential building materials. This includes cement, aggregates, and ready-mix concrete. Their operations serve a wide variety of customers, from large infrastructure projects to residential and commercial buildings.

The Holcim business model is centered around a global supply chain. They utilize over 150 recycling centers worldwide to integrate circular construction practices. This involves recycling construction and demolition materials, showcasing their commitment to sustainability.

In 2024, the company increased its recycling of construction demolition materials by 20% to 10.2 million tons, meeting its 2025 target ahead of schedule. This focus on sustainability is a key part of their value proposition and operational strategy.

Holcim offers sustainable building solutions like ECOPact and ECOPlanet, which are low-carbon concrete and cement products. These products help reduce the environmental impact of construction projects. This focus on sustainability is a key differentiator in the market.

The company invests in advanced technologies such as carbon capture, utilization, and storage (CCUS). They have seven large-scale CCUS projects underway in Europe. This commitment to innovation helps them provide comprehensive and environmentally conscious building solutions.

By the end of 2024, ECOPact represented 29% of ready-mix concrete net sales, and ECOPlanet accounted for 26% of cement net sales. These figures demonstrate the growing adoption of sustainable building materials. This shift reflects the company's commitment to meeting ambitious customer needs.

Holcim expands its offerings through strategic acquisitions, such as in advanced roofing systems. This strategy allows them to broaden their product portfolio. This approach strengthens their market position and enhances their ability to provide comprehensive building solutions.

The Holcim operations are characterized by a global supply chain and a commitment to sustainability. They focus on producing and distributing cement, aggregates, and ready-mix concrete. This includes a strong emphasis on low-carbon products and circular construction practices.

- Global Supply Chain: Operates worldwide with extensive recycling centers.

- Sustainable Products: Offers ECOPact and ECOPlanet to reduce carbon emissions.

- Technological Innovation: Invests in CCUS and other advanced technologies.

- Market Expansion: Uses strategic acquisitions to broaden its offerings.

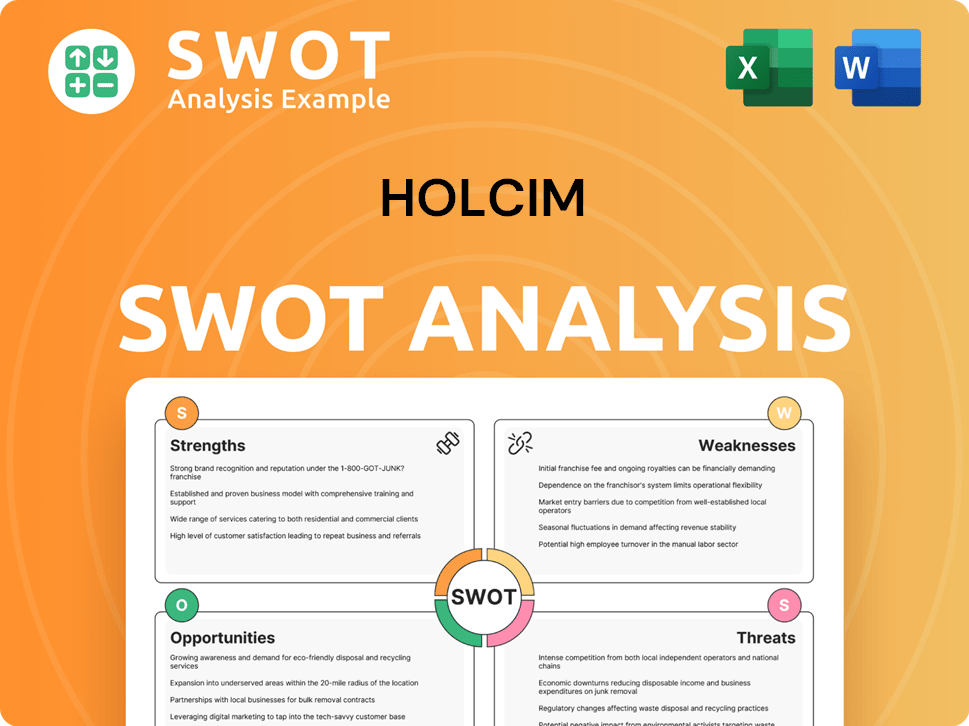

Holcim SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Holcim Make Money?

The Holcim company generates revenue primarily through the sale of building materials, including cement, aggregates, and ready-mix concrete. In addition to these core products, Holcim has expanded its offerings to include specialized building solutions and sustainable construction practices, which contribute significantly to its revenue streams. These strategies enable Holcim to maintain a strong financial position and drive growth.

The company's revenue model is diversified, incorporating both traditional product sales and higher-value solutions. This approach is supported by strategic acquisitions and a focus on innovation, such as the development of sustainable products like ECOPact and ECOPlanet. This diversification strategy helps the Holcim business model remain resilient and adaptable to market changes.

In 2024, Holcim reported full-year net sales of CHF 26.407 billion. The company's focus on profitable growth is evident in its recurring EBIT margin of 19.1% for the same year. This performance reflects the success of its monetization strategies and its commitment to delivering value to its stakeholders. You can learn more about the Growth Strategy of Holcim.

In 2024, cement sales reached CHF 13.159 billion, showing a 0.6% increase year-over-year. This segment remains a cornerstone of the company's revenue, demonstrating its continued importance in the construction industry.

Aggregates sales in 2024 were CHF 4.335 billion, reflecting a 0.2% increase year-over-year. Aggregates are essential for construction, and this segment’s performance highlights Holcim’s strong market position.

Ready-mix concrete sales totaled CHF 5.601 billion in 2024, although there was a 4% decrease year-over-year. This segment's performance is influenced by various market conditions and project timelines.

The 'Solutions & Products' segment, including advanced roofing systems, reached CHF 5.915 billion in net sales, a 7.4% increase year-over-year. This growth is driven by innovation and acquisitions.

Advanced branded solutions, such as ECOPact and ECOPlanet, accounted for 36% of total net sales in 2024. These sustainable products are key to the company's value proposition.

By recycling construction and demolition materials, Holcim reduces primary material use and generates revenue from end-of-use materials. This contributes to the company's sustainability initiatives.

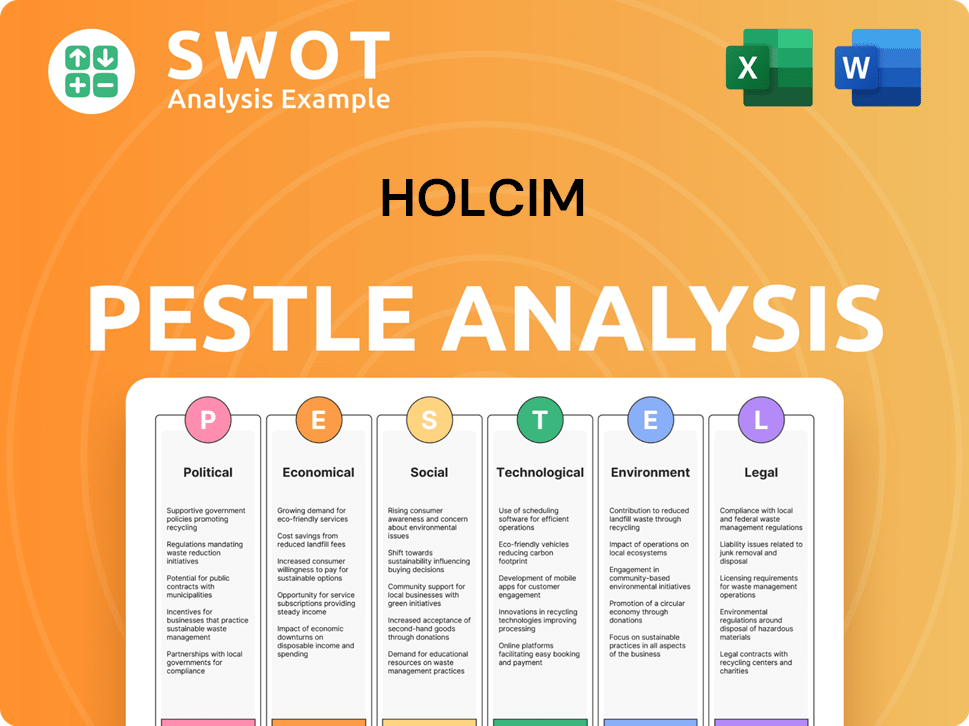

Holcim PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Holcim’s Business Model?

In 2024, the strategic journey of the Holcim company was marked by significant achievements and a strong dedication to sustainable and profitable growth. The company's financial performance reached record levels, with recurring EBIT surpassing CHF 5 billion for the first time, and free cash flow hitting CHF 3.8 billion. A key strategic move was the planned separation of its North American business, set to be named Amrize, which is on track for a 100% spin-off and expected to be listed on the New York Stock Exchange and SIX Swiss Exchange by the end of the first half of 2025. This move aims to unlock new value and enhance focus in key markets.

Operational challenges, such as foreign exchange effects, were effectively managed by Holcim's performance in 2024. The company responded by further expanding its industry-leading EBIT margin to 19.1% through a differentiated value strategy. Holcim's competitive advantages are multifaceted. Its advanced branded solutions, like ECOPact and ECOPlanet, which contributed 36% of total net sales in 2024, provide a significant differentiator by addressing the growing demand for low-carbon and circular construction materials. Furthermore, the company's aggressive M&A strategy, with 27 value-accretive transactions closed in 2024 across attractive markets, including four acquisitions in the fast-growing circular construction market in Europe, strengthens its portfolio and market reach.

Holcim's adaptability and commitment to innovation are evident in its investments in decarbonization and circular construction. The company increased recycled construction demolition materials by 20% to 10.2 million tons in 2024, achieving its 2025 target ahead of schedule. The pursuit of carbon capture, utilization, and storage (CCUS) projects, with seven large-scale projects underway, further underscores its commitment to a sustainable competitive edge. To understand the competitive landscape, consider the Competitors Landscape of Holcim.

Holcim achieved record financial performance in 2024. Recurring EBIT exceeded CHF 5 billion. Free cash flow reached CHF 3.8 billion.

The company is planning a full capital market separation of its North American business, Amrize. This spin-off is expected to be listed on the NYSE and SIX by the end of the first half of 2025.

Advanced branded solutions like ECOPact and ECOPlanet contributed 36% of total net sales in 2024. Holcim increased recycled construction demolition materials by 20% to 10.2 million tons in 2024.

Holcim closed 27 value-accretive transactions in 2024. Four acquisitions were made in the fast-growing circular construction market in Europe.

Holcim's competitive edge is built on several key factors. These include advanced branded solutions and a strong focus on sustainability, with a significant contribution from low-carbon and circular construction materials.

- Industry-leading EBIT margin of 19.1%

- Aggressive M&A strategy for market expansion

- Investments in decarbonization and circular construction

- Carbon capture, utilization, and storage (CCUS) projects

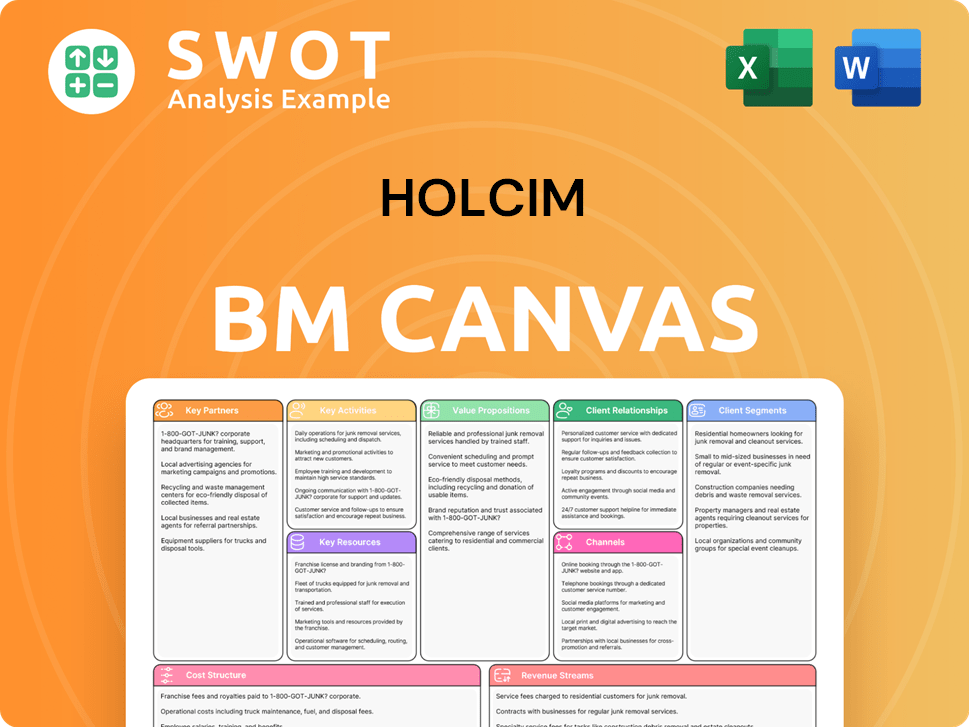

Holcim Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Holcim Positioning Itself for Continued Success?

The Holcim company maintains a leading global position in the building materials industry. This is supported by its strong financial performance, with net sales reaching CHF 26.4 billion in 2024. Its market position is reinforced by a broad portfolio of products, including cement, aggregates, and advanced building solutions. The company's global reach and diverse product offerings contribute to its resilience in the market.

The Holcim business model is strengthened by a differentiated value strategy, with advanced branded solutions like ECOPact and ECOPlanet gaining significant traction. These sustainable solutions accounted for 36% of total net sales in 2024, demonstrating the company's commitment to innovation and sustainability. The company's global presence and diverse product offerings contribute to its resilience in the market.

Holcim is a global leader in building materials, with a strong market position. Its success is highlighted by its record-breaking performance in 2024, supported by a diversified portfolio of products and services. The company's global reach and commitment to sustainable solutions further solidify its industry leadership.

Key risks include fluctuating foreign exchange rates and regional market challenges. Regulatory changes related to environmental standards and competition in sustainable building solutions also pose risks. Despite these, Holcim's diversified geographic presence helps mitigate downturns.

Holcim anticipates continued profitable growth, with projected mid-single-digit net sales growth in local currency for 2025. The company is focused on decarbonization and circular construction. The planned spin-off of Amrize is a strategic move to unlock further value.

Holcim is focused on decarbonization, with seven large-scale CCUS projects underway. The company aims to recycle 20 million tons of construction demolition materials by 2030. The spin-off of Amrize by mid-2025 is a key strategic move.

In 2024, Holcim demonstrated strong financial results, with net sales of CHF 26.4 billion. For 2025, the company projects mid-single-digit net sales growth in local currency and over-proportional growth in recurring EBIT. Free cash flow is expected to remain above CHF 3.5 billion.

- Continued innovation in sustainable building solutions.

- Strategic acquisitions to expand market presence.

- Optimized operational efficiency to improve profitability.

- Focus on decarbonization and circular construction.

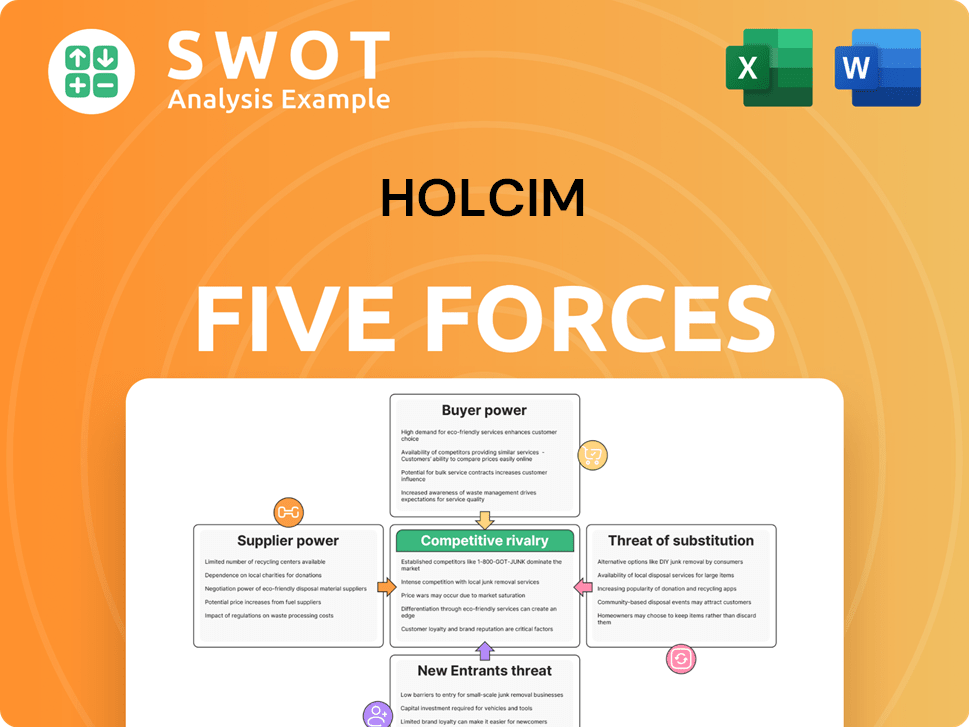

Holcim Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Holcim Company?

- What is Competitive Landscape of Holcim Company?

- What is Growth Strategy and Future Prospects of Holcim Company?

- What is Sales and Marketing Strategy of Holcim Company?

- What is Brief History of Holcim Company?

- Who Owns Holcim Company?

- What is Customer Demographics and Target Market of Holcim Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.