International Paper Bundle

Can International Paper Conquer the Future of Packaging?

International Paper, a titan in the International Paper SWOT Analysis, is navigating a dynamic landscape, driven by strategic shifts and a commitment to sustainable solutions. From its roots in the late 19th century to its current global footprint, the company's journey reflects a constant evolution to meet market demands. This analysis delves into International Paper's ambitious growth strategy and its potential to thrive in the years to come.

This report provides a comprehensive market analysis of International Paper, exploring its strategic initiatives and long-term growth projections. We'll examine the company's financial performance, competitive advantages, and expansion plans, while also considering the challenges facing International Paper in the ever-evolving paper industry. Understanding International Paper's future prospects requires a deep dive into its growth strategy, including its sustainability efforts and innovation in paper products.

How Is International Paper Expanding Its Reach?

The Owners & Shareholders of International Paper are driving significant expansion initiatives to bolster its market position and diversify its revenue streams. A primary focus is on sustainable packaging solutions, reflecting a broader industry trend towards eco-friendly products. This strategic direction is pivotal for the company's future prospects in the evolving Paper Industry.

International Paper's Growth Strategy involves both acquisitions and strategic investments in manufacturing. These moves are designed to enhance its global footprint and operational capabilities. The company's commitment to innovation and efficiency is evident in its approach to business development and market analysis.

The company's strategic moves are closely tied to its financial performance and long-term growth projections. These initiatives aim to improve its competitive advantages and adapt to the impact of e-commerce on the paper industry. The company is also focusing on sustainability efforts to drive growth.

International Paper completed the acquisition of DS Smith, a British multinational packaging business, on January 31, 2025. The deal was valued at $7.23 billion. This acquisition is a cornerstone of International Paper's expansion strategy, significantly increasing its presence in North America and EMEA.

In May 2025, International Paper announced the exploration of building a new sustainable packaging facility in Salt Lake City, Utah. This marks its entry into a new market in the western U.S., enhancing regional manufacturing capabilities. This expansion is part of its strategic initiatives to drive growth.

A new state-of-the-art sustainable packaging facility in Waterloo, Iowa, broke ground in May 2025. This facility aims to meet the growing demand for sustainable packaging. This investment supports International Paper's commitment to innovation in paper products.

As part of its strategic growth initiative, International Paper announced in May 2025 the consolidation of its Rio Grande Valley operations. This includes converting a sheet plant in Edinburg, Texas, into a warehouse and investing in its McAllen, Texas, facility. The Reynosa, Mexico, operations will move to a new facility.

International Paper plans to close four U.S. facilities by the end of April 2025. This includes the Red River containerboard mill in Campti, Louisiana. These closures are part of a broader strategy to streamline operations and reduce costs.

- The Red River mill closure is expected to reduce annual containerboard capacity by approximately 800,000 tons.

- The Edinburg, Texas, box plant and sheet plant are also slated for closure.

- These strategic moves aim to balance capacity with demand and improve financial performance.

- These actions reflect the company's focus on long-term growth and adapting to market changes.

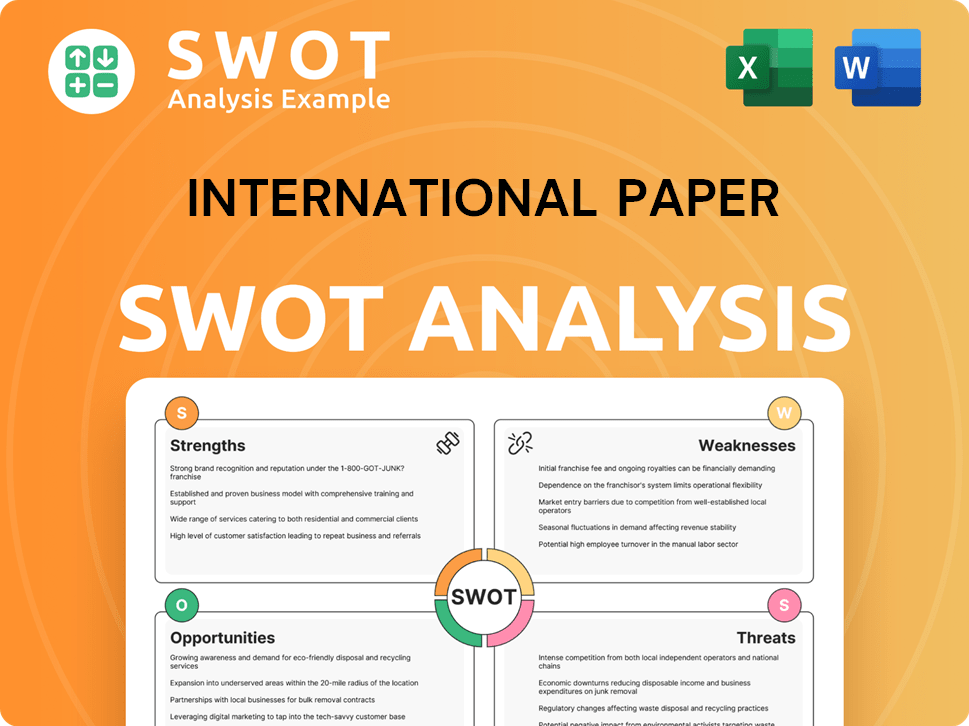

International Paper SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does International Paper Invest in Innovation?

International Paper's growth strategy heavily relies on innovation and technology to boost operational efficiency, drive digital transformation, and promote sustainable solutions within the paper industry. The company's strategic initiatives are designed to ensure it remains competitive and adaptable in a rapidly evolving market. These efforts are crucial for maintaining and expanding its market share and improving its financial performance.

The company is focused on becoming the leading provider of sustainable packaging solutions, aiming for cost leadership and high reliability. This focus is supported by significant investments in technology and process improvements. The integration of new technologies and the streamlining of operations are central to the company's long-term growth projections.

A key element of International Paper's strategy is the implementation of an 80/20 performance system across its operations. This disciplined approach aims to optimize processes and enhance productivity. Pilot programs have already shown promising results, with some box plants achieving a 20% productivity gain.

International Paper is focused on improving its operational efficiency through technology and process improvements. This includes the 80/20 performance system, which is being expanded to approximately 60 box plants in 2025.

The company is undergoing a digital transformation to improve customer service and drive performance. This involves leveraging technology to streamline operations and enhance decision-making processes.

International Paper is committed to providing sustainable packaging solutions. This includes investing in new technologies and processes to reduce environmental impact and meet customer demands for eco-friendly products.

The acquisition of DS Smith is expected to boost market share and provide access to new technologies and markets. This strategic move supports the company's growth strategy in the global market.

While acknowledging the potential impacts of AI, International Paper focuses on digital transformation and operational efficiencies. The company recognizes the need to adapt to evolving technologies and regulatory landscapes.

International Paper's recognition as one of the 'World's Most Ethical Companies' underscores its commitment to ethical practices, which likely extend to its technological and innovation endeavors.

International Paper's future prospects are closely tied to its ability to innovate and adapt. The company is investing in technology, expanding its market presence, and focusing on sustainable solutions to drive long-term growth. International Paper's strategic initiatives are designed to address the challenges facing the paper industry and capitalize on emerging opportunities.

- 80/20 Performance System: Expanding this system to more box plants to improve productivity and reduce costs.

- Sustainable Packaging: Focusing on innovative and sustainable packaging solutions to meet customer demands and reduce environmental impact.

- Acquisition of DS Smith: Integrating DS Smith to strengthen market share and access new technologies and markets.

- Digital Transformation: Leveraging technology to streamline operations, improve customer service, and enhance decision-making.

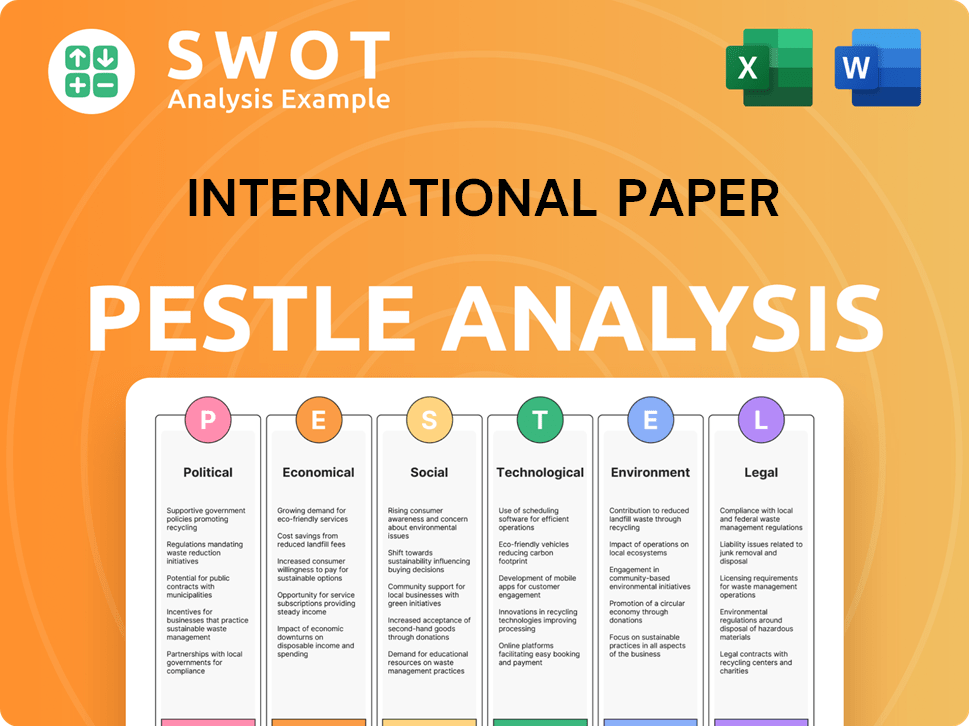

International Paper PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is International Paper’s Growth Forecast?

The financial outlook for International Paper in 2025 is shaped by strategic initiatives aimed at enhancing earnings and driving profitable growth. The company is focusing on a transformation to improve its financial performance. This involves restructuring and strategic acquisitions to boost its market position and financial health.

In 2024, the company reported net sales of $18.6 billion, slightly down from $18.9 billion in 2023. The fourth quarter of 2024 showed a net loss of $147 million. However, analysts project a strong rebound in fiscal 2025, with significant growth in earnings per share (EPS).

The acquisition of DS Smith, completed in January 2025, is a key driver of the projected improvements, expected to generate substantial pre-tax cash synergies and strengthen the company's European packaging business. The company's strategic moves are designed to position it for sustained growth and improved financial performance in the coming years, despite challenges in the Paper Industry.

In 2024, the company reported net earnings of $557 million, or $1.57 per diluted share. Adjusted operating earnings (non-GAAP) were $400 million, or $1.13 per diluted share. Full-year net sales were $18.6 billion, a slight decrease from $18.9 billion in 2023.

The fourth quarter of 2024 saw a net loss of $147 million, or $0.42 per diluted share. Adjusted operating loss was $7 million, or $0.02 per diluted share. These results were impacted by a pre-tax charge of $395 million for accelerated depreciation and restructuring.

Analysts project a robust rebound in fiscal 2025, with EPS expected to increase by 155.9% year-over-year to $3.02. Other analyst estimates for fiscal 2025 revenue range from $26.36 billion to $27.26 billion, with estimated EPS around $2.66 to $2.68.

The company projects 2025 revenue of approximately $27 billion. It also expects 2027 net sales of $26 billion to $28 billion and free cash flow of $2 billion to $2.5 billion, indicating strong Business Development.

The acquisition of DS Smith, completed in January 2025, is expected to deliver at least $514 million in pre-tax cash synergies. In the first quarter of 2025, net sales were $5.9 billion, up 27.8% year-over-year, largely attributed to this acquisition.

The company is targeting $1.1 billion in commercial improvement benefits by 2027, with $600 million expected by the end of 2023. International Paper expects to fall within its targeted range for 2025 adjusted EBITDA of $3.5 billion to $4 billion.

The company's financial strategy focuses on stabilizing and increasing earnings through strategic initiatives. This includes the integration of DS Smith and the completion of commercial contract restructuring.

Revenue is projected to increase significantly in 2025, driven by the DS Smith acquisition and other strategic moves. The company anticipates revenue to be approximately $27 billion in 2025.

The company anticipates adjusted EBITDA between $3.5 billion and $4 billion in 2025. Free cash flow is projected to be between $2 billion and $2.5 billion by 2027, indicating strong financial health.

Capital spending for 2025 is planned at approximately $1.2 billion. This investment supports the company's Growth Strategy and long-term goals.

The acquisition of DS Smith is a major factor in the company's financial outlook, expected to generate substantial synergies. This acquisition strengthens the company's position in the European packaging market.

The company is targeting $1.1 billion in commercial improvement benefits by 2027. This includes optimizing contracts and improving operational efficiencies to boost profitability. This is a critical part of the company's Future Prospects.

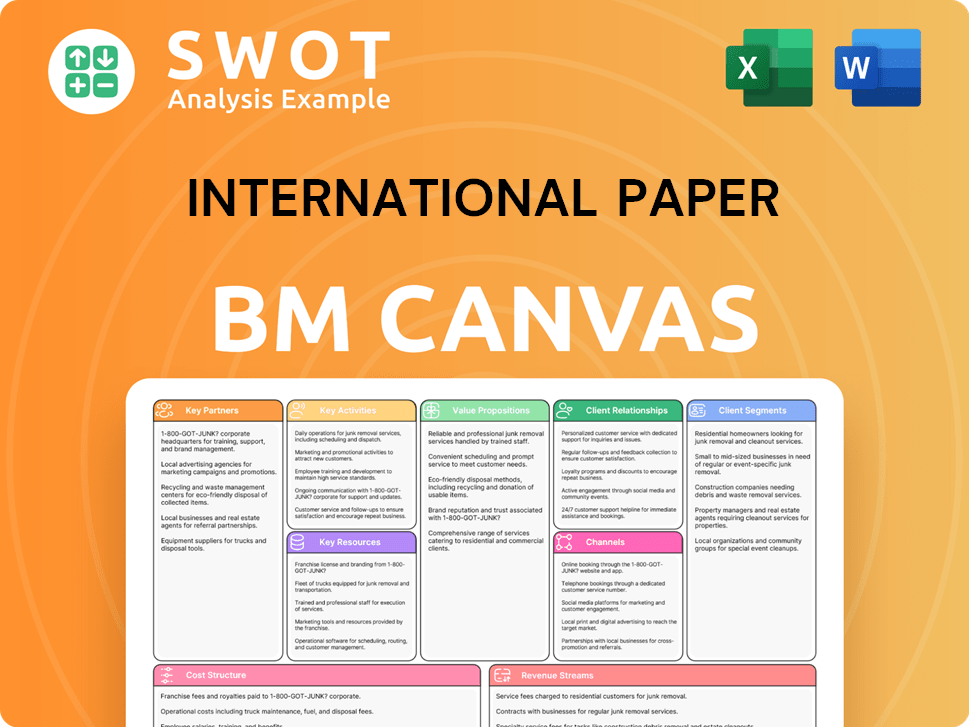

International Paper Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow International Paper’s Growth?

The International Paper faces several potential risks and obstacles as it pursues its Growth Strategy and aims for strong Future Prospects. These challenges span market dynamics, regulatory changes, supply chain vulnerabilities, and the impact of technological disruption. Understanding these risks is crucial for investors and stakeholders evaluating the company's long-term outlook within the Paper Industry.

Market competition and economic volatility are primary concerns. The packaging industry is cyclical, and demand is sensitive to economic downturns. The company's recent acquisition of DS Smith, while promising, also introduces integration risks. The company's ability to navigate these challenges will significantly influence its financial performance and ability to achieve its Business Development goals.

Furthermore, the company must navigate a complex landscape of regulatory changes and geopolitical tensions. Environmental regulations, tax implications, and supply chain disruptions all pose significant risks. Proactive risk management and strategic planning are essential for mitigating these challenges and ensuring sustainable growth within the current Market Analysis.

The packaging industry is cyclical, and downturns can significantly impact financial performance. The company's outlook for North American demand growth has been adjusted to flat to down approximately 1.5% year over year. This highlights the need for flexible strategies and proactive responses to market fluctuations.

Environmental regulations, such as those related to forestry practices and emissions, can increase operational costs. The implementation of the Pillar Two rule, effective in 2024 with a second component expected in 2025, could adversely impact the company's effective tax rate. Geopolitical tensions can disrupt supply chains and trade flows.

Fluctuations in raw material costs, energy prices, and transportation costs remain a concern. Facility closures, aimed at streamlining operations, carry risks of supply chain disruptions. The company is committed to minimizing the impact on affected employees by offering support and leveraging attrition and retirements.

The rapid evolution of AI presents both opportunities and risks, including uncertainty in the legal and regulatory regime. Internal resource constraints, such as challenges in attracting and retaining talent, could also affect operations. The company must adapt to these technological advancements to remain competitive.

The integration of DS Smith presents business combination risks, including integration costs and unanticipated liabilities. The company is focused on effective integration to realize projected synergies. Management continuously monitors market conditions and is prepared to pull 'levers' such as accelerating cost reduction strategies.

Challenges in attracting and retaining talent in a competitive labor market could impact operations. The company's ability to secure and retain skilled employees is crucial for its long-term success. This requires strategic planning and investment in employee development and retention programs.

International Paper addresses these risks through strategic initiatives and risk management frameworks. The company's disciplined 80/20 approach aims to reduce complexity and align resources. This approach helps to improve performance and mitigate operational risks. The company's focus on effective integration of recent acquisitions is crucial.

The company's financial performance and outlook are subject to these risks. While the first quarter of 2025 showed higher sales and earnings due to the DS Smith acquisition, demand weakness in both North American and European packaging markets has prompted adjustments to the company's outlook. For more details on the competitive landscape, see Competitors Landscape of International Paper.

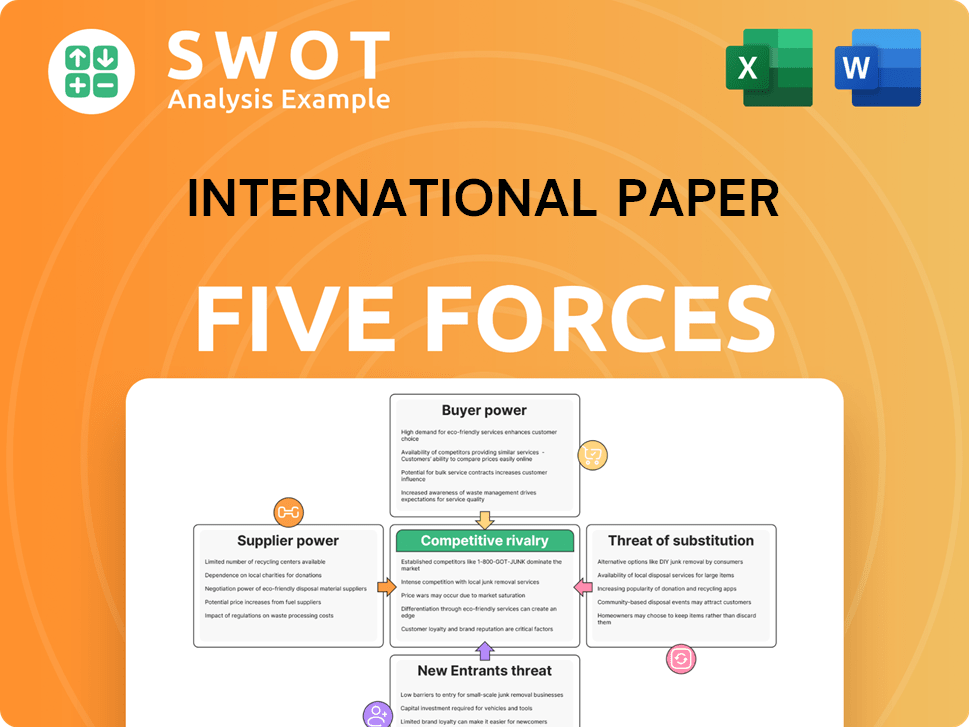

International Paper Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of International Paper Company?

- What is Competitive Landscape of International Paper Company?

- How Does International Paper Company Work?

- What is Sales and Marketing Strategy of International Paper Company?

- What is Brief History of International Paper Company?

- Who Owns International Paper Company?

- What is Customer Demographics and Target Market of International Paper Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.