International Paper Bundle

How Does International Paper Thrive in a Global Market?

International Paper (IP), a titan in the fiber-based products sector, is more than just a International Paper SWOT Analysis; it's a cornerstone of global commerce. Its recent $9.9 billion acquisition of DS Smith Plc, announced in April 2024, signals a bold move towards a leading position in sustainable packaging. This strategic expansion highlights IP's commitment to innovation and market leadership within the dynamic landscape of paper manufacturing.

This exploration delves into the core of IP Company, examining its operations across North America, Latin America, Europe, North Africa, and Russia. We'll dissect how IP generates revenue through its diverse Paper Products and sustainable Forestry practices, providing crucial insights for investors tracking International Paper stock price and industry observers alike. Understanding IP's Supply Chain and manufacturing process is key to appreciating its global presence and impact on the environment.

What Are the Key Operations Driving International Paper’s Success?

International Paper (IP Company) creates value through its core operations focused on paper manufacturing and packaging solutions. The company transforms renewable fiber into a variety of products, primarily serving the packaging and paper markets. Its operations are vertically integrated, spanning from sustainable forestry to advanced manufacturing and distribution, ensuring a consistent supply of high-quality Paper Products.

The company's value proposition centers on providing reliable supply, innovative packaging, and a reduced environmental footprint. This is achieved through its extensive timberland holdings, advanced manufacturing technologies, and optimized logistics. IP Company's commitment to sustainability and efficiency differentiates it in a competitive market.

IP Company's primary offerings include containerboard, corrugated packaging, pulp, and various grades of paper. These products serve diverse customer segments, from e-commerce businesses to commercial printers. The operational processes are designed to be efficient and sustainable, reflecting the company's long-term strategy.

IP Company manages millions of acres of forests to ensure a sustainable supply of raw materials. This commitment to responsible forestry provides a competitive advantage in sourcing. They focus on maintaining healthy forests and using sustainable practices.

The manufacturing process involves sophisticated pulp and paper mills that convert wood fiber into a variety of products. The company often incorporates recycled content to enhance sustainability. This process ensures consistent product quality.

IP Company's supply chain is extensive, leveraging a global network of mills, converting plants, and distribution centers. Strategic partnerships with suppliers and customers are integral to its operational efficiency. This network ensures products reach customers efficiently.

The company offers reliable supply, innovative packaging solutions, and a reduced environmental footprint. This differentiates IP Company in a competitive market. These benefits are achieved through efficient operations and a focus on sustainability.

IP Company's operations are characterized by their scale, commitment to sustainability, and continuous investment in advanced technologies. This approach ensures both operational efficiency and environmental responsibility. For more insights, explore the Brief History of International Paper.

- Vertical Integration: Controls the entire value chain from forest management to product distribution.

- Sustainability: Focuses on responsible forestry and the use of recycled content.

- Innovation: Continuously invests in advanced manufacturing and logistics.

- Global Presence: Operates a vast network of mills and distribution centers worldwide.

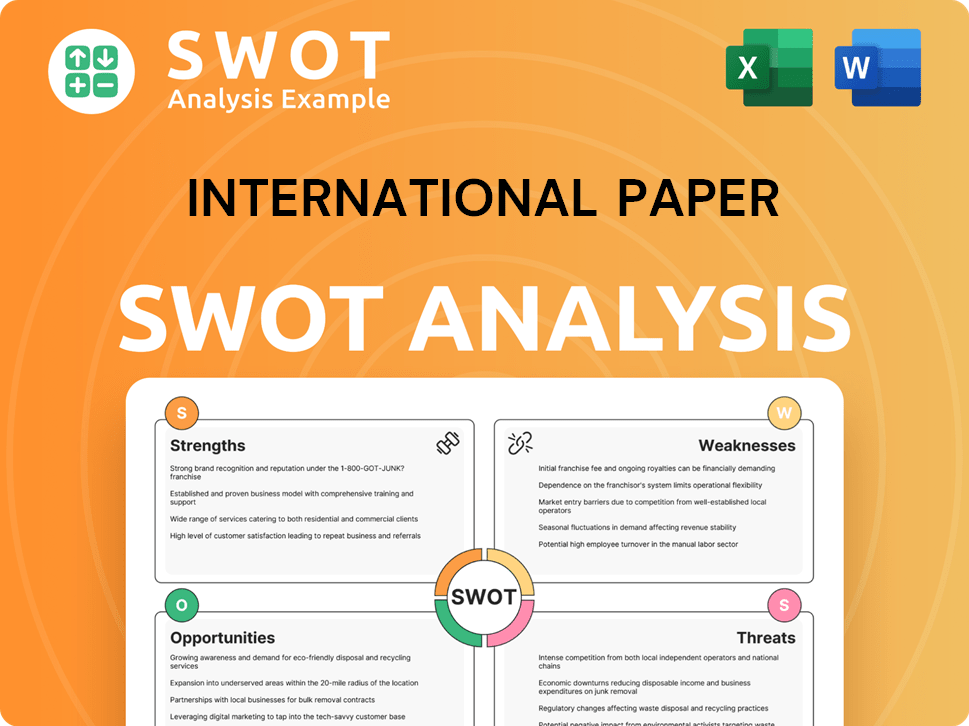

International Paper SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does International Paper Make Money?

The core of International Paper's (IP Company) business revolves around generating revenue through the sale of its fiber-based products. The company's revenue streams are primarily categorized into industrial packaging, global cellulose fibers, and printing papers. As of the first quarter of 2024, the company reported net sales of $4.6 billion, demonstrating the scale of its operations in the paper manufacturing industry.

The industrial packaging segment, which includes containerboard and corrugated packaging, is typically the largest contributor to revenue, driven by the increasing demand for e-commerce packaging and sustainable shipping solutions. Global cellulose fibers, encompassing fluff pulp and other specialty pulps, and printing papers also contribute significantly to the company's financial performance. The company's diversified product portfolio and global presence allow it to serve various markets and mitigate risks associated with regional economic fluctuations.

International Paper's monetization strategies are primarily centered on volume sales and market pricing. The company employs various pricing strategies based on market demand, raw material costs, and the competitive landscape. This approach is complemented by its large production capacity and global footprint, which enable cost-effective manufacturing and distribution. The strategic acquisition of DS Smith, expected to close in Q4 2024, is anticipated to significantly expand IP's packaging revenue streams, particularly in Europe, and enhance its overall monetization capabilities.

International Paper's financial success hinges on effective revenue generation and monetization strategies. The company focuses on maximizing sales volume and optimizing pricing across its diverse product lines. Understanding these strategies is crucial for anyone interested in the Owners & Shareholders of International Paper.

- Industrial Packaging: This segment, including containerboard and corrugated packaging, is a major revenue driver, benefiting from e-commerce and sustainable packaging trends.

- Global Cellulose Fibers: This segment provides fluff pulp and specialty pulps for hygiene and absorbent product manufacturers.

- Printing Papers: While smaller than packaging, printing papers still contribute significantly to revenue, serving commercial printing and office markets.

- Pricing Strategies: Pricing is determined by market demand, raw material costs, and the competitive environment.

- Economies of Scale: Large production capacity and global footprint enable cost-effective manufacturing.

- Strategic Acquisitions: The acquisition of DS Smith will expand packaging revenue, especially in Europe.

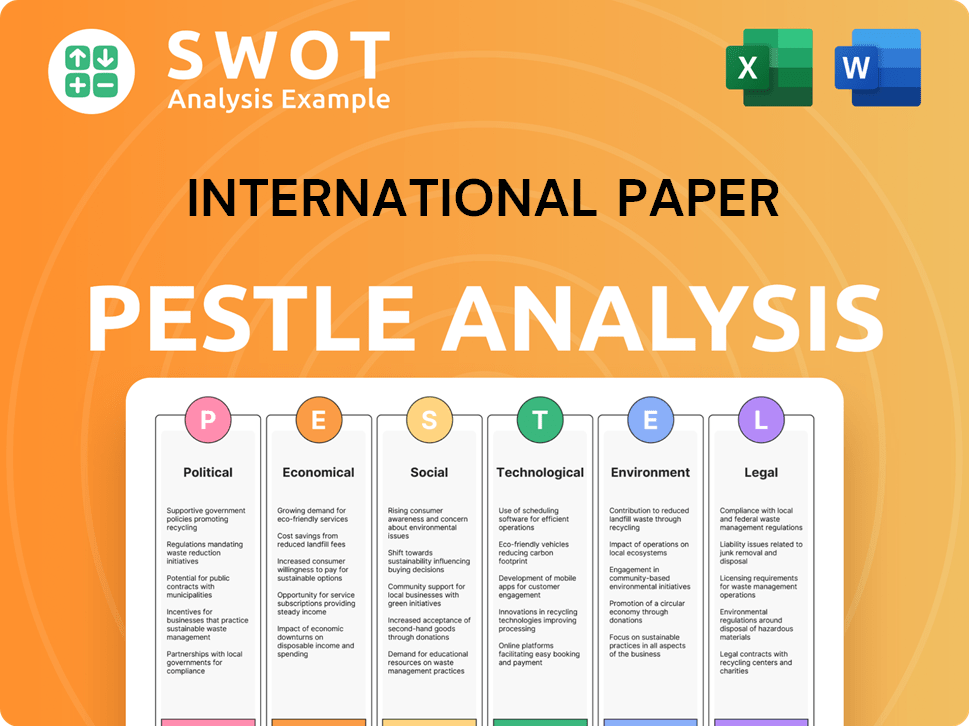

International Paper PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped International Paper’s Business Model?

The story of the IP Company is marked by significant milestones and strategic shifts that have shaped its position in the paper manufacturing industry. A major recent development is the agreement to acquire DS Smith Plc, announced in April 2024, a move set to bolster IP's global presence in sustainable packaging. This acquisition, valued at approximately $9.9 billion, underscores the company's commitment to expanding its sustainable packaging solutions.

Another pivotal strategic move was the spin-off of its Printing Papers business into Sylvamo Corporation in October 2021. This allowed IP to sharpen its focus on industrial packaging and global cellulose fibers. These actions reflect IP's ongoing efforts to adapt to changing market demands and to concentrate on its core strengths. The company has consistently invested in modernizing its mills and optimizing its supply chain.

IP has faced operational challenges, including fluctuating raw material costs and shifts in paper product demand. The company has responded by optimizing manufacturing, investing in renewable energy, and adapting its product portfolio. These strategies highlight IP's ability to navigate industry changes and maintain a competitive edge. The company's financial performance is closely watched, with stakeholders interested in its ability to manage costs and capitalize on market opportunities.

The acquisition of DS Smith Plc in April 2024 for $9.9 billion is a significant move to enhance its sustainable packaging business. The spin-off of the Printing Papers business into Sylvamo Corporation in October 2021 allowed IP to focus on industrial packaging and cellulose fibers. These strategic moves reflect IP's adaptation to market changes and its focus on core strengths.

IP has focused on optimizing its manufacturing processes and investing in renewable energy sources. The company adapts its product portfolio to meet market trends, particularly the growing demand for sustainable packaging. IP's strategies include modernizing mills and optimizing the supply chain to improve efficiency and reduce environmental impact.

IP benefits from substantial economies of scale due to its large production capacity and global distribution network. Strong brand recognition and long-standing customer relationships are key assets. Its commitment to sustainable forest management and fiber-based solutions provides a competitive advantage in an environmentally conscious market.

IP faces challenges from fluctuating raw material costs, especially for wood fiber and energy. Shifts in demand for different paper products also pose challenges. The company responds by optimizing manufacturing, investing in renewable energy, and adapting its product portfolio.

IP's competitive advantages include economies of scale, strong brand recognition, and a focus on sustainable practices. The company is investing in research and development for innovative packaging solutions and exploring opportunities in emerging markets. These efforts are detailed further in the Marketing Strategy of International Paper.

- Substantial economies of scale due to its large production capacity and global distribution network.

- Strong brand recognition and long-standing customer relationships.

- Commitment to sustainable forest management and fiber-based solutions.

- Continuous investment in research and development for innovative packaging solutions.

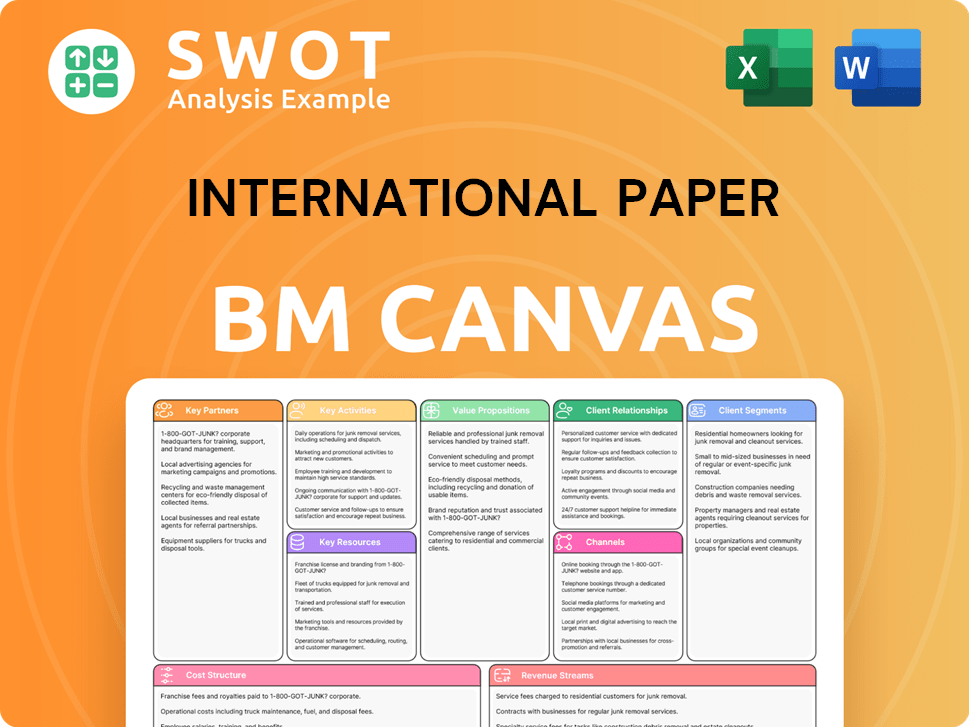

International Paper Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is International Paper Positioning Itself for Continued Success?

The IP Company holds a significant position in the global fiber-based packaging and pulp industries. It is a leading producer of corrugated packaging and containerboard in North America and a major global supplier of pulp. The company's market share is substantial, particularly in its core markets, supported by long-standing customer relationships. The planned acquisition of DS Smith Plc is poised to considerably boost its global reach and market share, especially in Europe, establishing a truly global leader in sustainable packaging. This strategic move aligns with the growing demand for eco-friendly packaging solutions.

Despite its strong market position, International Paper faces several key risks. These include fluctuations in raw material costs like wood fiber, energy, and chemicals, which can impact profitability. Regulatory changes concerning environmental protection and forestry practices could also introduce extra costs or operational limitations. The emergence of new competitors, particularly those focusing on alternative packaging materials or disruptive technologies, poses a threat. Shifts in consumer preferences towards digital media continue to affect demand for certain printing paper grades, although the company's focus on packaging helps mitigate this. The company's ability to navigate these challenges will be crucial for its future success.

International Paper is a leader in North American containerboard and corrugated packaging, and a significant global pulp supplier. Its market share is strong, especially in key markets. The planned acquisition of DS Smith Plc will expand its global footprint, particularly in Europe.

Key risks include volatile raw material costs, regulatory changes, and competition. Shifts in consumer preferences towards digital media also affect demand for printing paper. The company must navigate these challenges to maintain profitability and market share.

The company focuses on sustainable packaging, operational efficiency, and innovation. The acquisition of DS Smith is a key strategic move. The company aims to capitalize on growing demand and expand its market presence. Learn more about the Target Market of International Paper.

Focus on sustainable practices, operational excellence, and shareholder value. Strategic initiatives include expanding sustainable packaging, optimizing the global supply chain, and strategic acquisitions. These efforts are designed to drive long-term growth and profitability.

In recent financial reports, International Paper has demonstrated its resilience, with a focus on packaging solutions. The company's strategic moves, including acquisitions, are designed to boost its market share and enhance its product portfolio.

- The acquisition of DS Smith is expected to significantly increase its global reach, especially in Europe.

- The company is investing in operational efficiency and innovation to maintain its competitive edge.

- International Paper continues to emphasize sustainability and deliver value to shareholders.

- The company is focusing on the growing demand for sustainable packaging solutions.

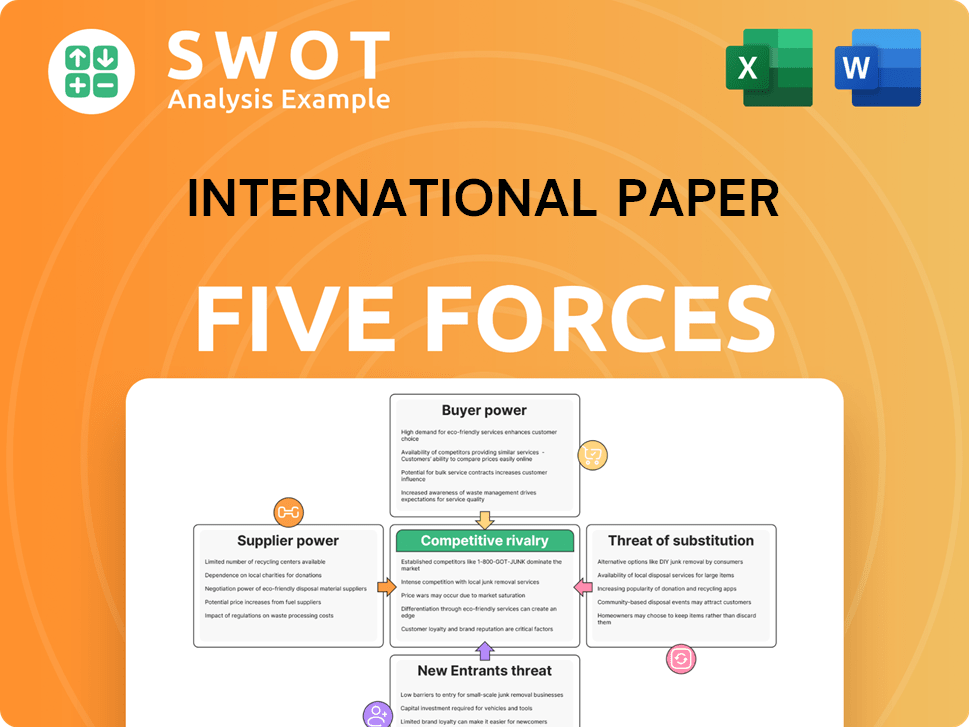

International Paper Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of International Paper Company?

- What is Competitive Landscape of International Paper Company?

- What is Growth Strategy and Future Prospects of International Paper Company?

- What is Sales and Marketing Strategy of International Paper Company?

- What is Brief History of International Paper Company?

- Who Owns International Paper Company?

- What is Customer Demographics and Target Market of International Paper Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.