International Paper Bundle

Who Really Owns International Paper Company?

Uncover the intricate web of ownership behind one of the world's leading paper and packaging giants. Understanding International Paper SWOT Analysis is key to grasping its market position. The recent acquisition of DS Smith marks a pivotal moment, fundamentally altering the company's structure and strategic direction. This deep dive will explore the key players shaping International Paper's future.

From its humble beginnings in 1898 to its current status as a global powerhouse, the ownership of International Paper Company has evolved dramatically. This analysis will dissect the influence of major IP shareholders, institutional investors, and the impact of strategic decisions on the company's trajectory. Learn about the International Paper executives and how the recent acquisition has reshaped the landscape.

Who Founded International Paper?

The story of the International Paper Company began in 1898. However, specific details about the founders, their individual backgrounds, and the initial equity distribution are not readily available. This information is often not widely publicized or easily accessible from general sources.

The company's formation marked the start of its journey in the paper and packaging sector. The early ownership details, including angel investors, or initial agreements like vesting schedules, are not detailed in the provided information. The original name was International Paper and Power Corporation.

The company's Certificate of Incorporation was filed with the Department of State of New York on June 23, 1941. This indicates a foundational structure established under corporate law, suggesting a formalized ownership framework from its early stages. Over time, the company's structure has evolved from its initial private or closely held form to a publicly traded entity with dispersed ownership.

While the precise details of the founders and early ownership of the IP Company are not fully available, the company's transition from a private or closely held entity to a publicly traded one is a key aspect of its history. The initial ownership structure likely involved a small group of individuals or entities who provided the capital and resources to launch the business. Over the years, IP shareholders have changed significantly.

- The company's evolution reflects the growth and expansion of its business operations.

- The shift to a publicly traded model allowed the company to raise capital and expand its investor base.

- The current ownership structure is characterized by a wide distribution of shares among institutional investors, and individual shareholders.

- Understanding the historical context of IP Company ownership provides valuable context for analyzing its current financial performance.

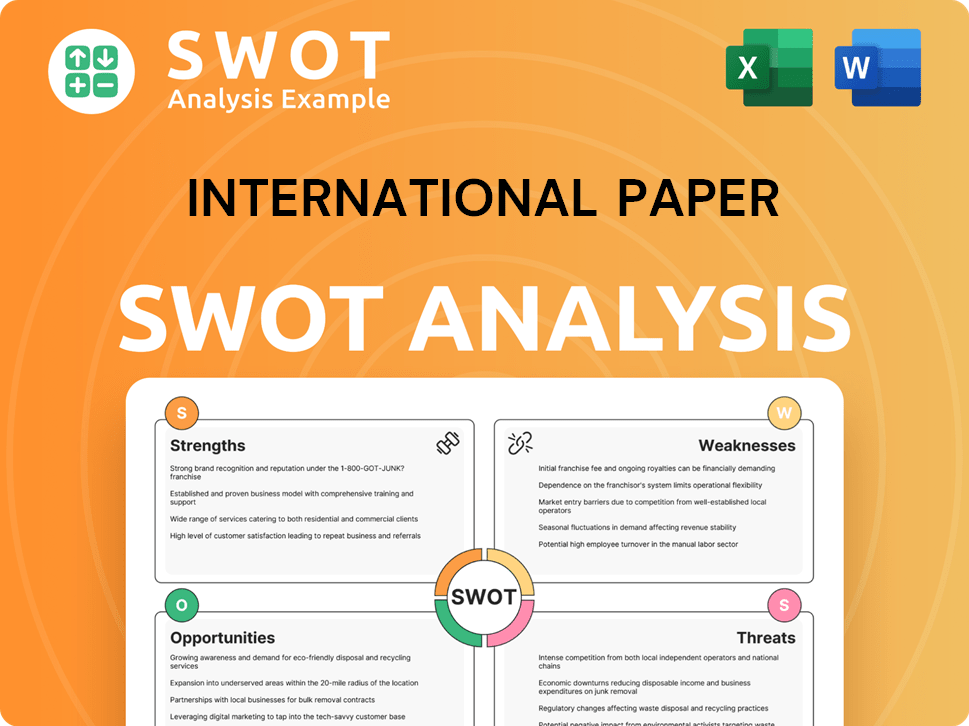

International Paper SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has International Paper’s Ownership Changed Over Time?

The ownership of International Paper Company (IP Company ownership) is primarily distributed among numerous shareholders as it operates as a publicly traded entity. The company's shares are listed on the New York Stock Exchange (NYSE), and following the acquisition of DS Smith, a secondary listing on the London Stock Exchange (LSE) commenced on February 4, 2025. As of June 2025, the market capitalization of International Paper was reported as $16.21 billion.

The ownership structure is dominated by institutional investors, including mutual funds, pension funds, insurance companies, and investment advisors. According to data from June 13, 2025, there are 1760 institutional owners and shareholders of International Paper (US:IP) who have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC), holding a total of 611,380,239 shares. This indicates a significant portion of the company is managed by large investment firms on behalf of their clients.

| Major Shareholders | Shares Held | Percentage of Ownership |

|---|---|---|

| BlackRock Advisors LLC | 34,555,291 | 6.568% |

| State Street Corp | 28,483,875 | 5.414% |

| Fidelity Management & Research Co. LLC | 26,119,144 | 4.964% |

A significant event impacting the ownership structure was the acquisition of DS Smith, finalized on January 31, 2025. This all-share combination resulted in legacy International Paper shareholders owning 65.9% of the combined company's stock, while legacy DS Smith shareholders own approximately 34.1%. This strategic move expanded International Paper's global footprint and capabilities in sustainable packaging solutions. To understand more about the company's background, you can read a Brief History of International Paper.

International Paper is a publicly traded company with ownership primarily held by institutional investors.

- Major institutional shareholders include BlackRock, State Street Corp, and Fidelity.

- The acquisition of DS Smith significantly altered the ownership structure.

- The company's market capitalization was $16.21 billion as of June 2025.

- Understanding IP shareholders is crucial for investors.

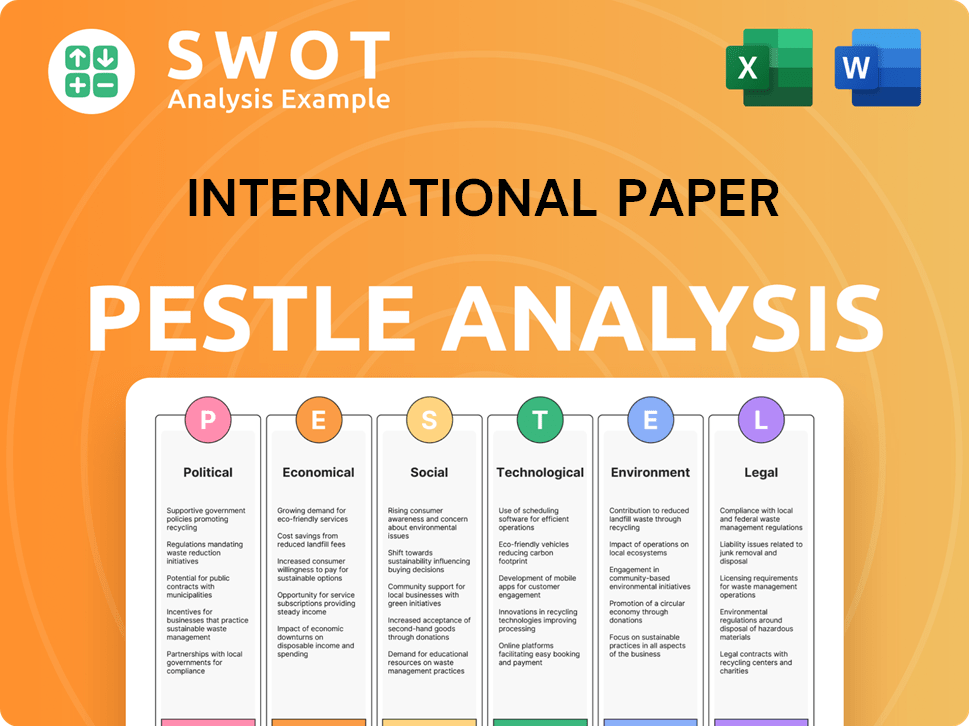

International Paper PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on International Paper’s Board?

The current leadership at International Paper Company, crucial for IP Company ownership, includes Andrew K. Silvernail as Chairman and Chief Executive Officer, who took on the CEO role on May 1, 2024, and became Chairman on October 1, 2024. Key executives also include Lance Loeffler, who became Senior Vice President and Chief Financial Officer on April 1, 2025, and Joy N. Roman, who became Senior Vice President, Chief People and Strategy Officer on February 1, 2025. Timothy S. Nicholls serves as Executive Vice President and President of DS Smith, an International Paper company, and Joseph R. Saab is the Senior Vice President, General Counsel, and Corporate Secretary. The board also includes independent directors such as Christopher M. Connor (Lead Independent Director), Jamie A. Beggs, Ahmet Cemal Doerduencue, Anders Gustafsson, and Jacqueline C. Hinman.

These individuals and the broader board of directors are responsible for overseeing the strategic direction and governance of International Paper. Understanding who owns IP is vital, and the board's composition reflects the company's commitment to diverse expertise and independent oversight. This structure ensures that the interests of IP shareholders are represented in key decision-making processes.

| Position | Name | Title |

|---|---|---|

| Chairman and CEO | Andrew K. Silvernail | Chairman and Chief Executive Officer |

| CFO | Lance Loeffler | Senior Vice President and Chief Financial Officer |

| Chief People and Strategy Officer | Joy N. Roman | Senior Vice President, Chief People and Strategy Officer |

The voting structure at International Paper is based on a one-share-one-vote principle for common stock holders. This means that each share of common stock generally entitles the holder to one vote on all matters submitted to a shareholder vote. However, holders of cumulative $4 preferred stock have specific voting rights, such as the right to elect one-third of the directors if dividends on their shares have not been paid for four full quarterly dividends. Additionally, certain corporate actions require a two-thirds vote of the outstanding $4 preferred stock. Recent corporate actions, such as the acquisition of DS Smith, involved shareholder approval for the issuance of new shares. On October 11, 2024, International Paper shareholders voted on the issuance of new shares in connection with the DS Smith combination, with the board recommending a vote 'FOR' these proposals. For more details on the competitive landscape, you can explore the Competitors Landscape of International Paper.

The board of directors is led by Andrew K. Silvernail and includes a mix of executive and independent directors.

- One-share-one-vote principle for common stock.

- Preferred stock holders have specific voting rights.

- Shareholders voted on the issuance of new shares for the DS Smith acquisition.

- The board recommended voting 'FOR' the proposals related to the DS Smith combination.

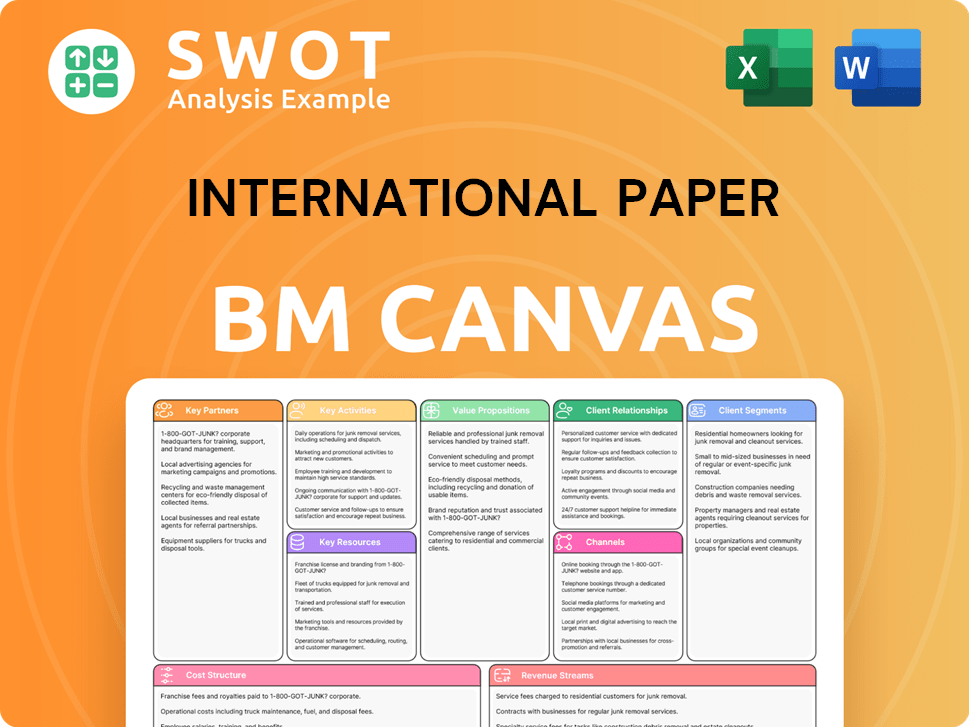

International Paper Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped International Paper’s Ownership Landscape?

Over the past few years, the ownership structure of the International Paper Company has seen significant shifts, mainly driven by strategic acquisitions. The most notable change is the acquisition of DS Smith, completed on January 31, 2025. This all-share combination valued DS Smith at approximately $9.9 billion. As a result of this deal, legacy International Paper shareholders now hold roughly 65.9% of the combined company, while legacy DS Smith shareholders own about 34.1%. This merger is designed to create a global leader in sustainable packaging solutions, enhancing International Paper's footprint in both North American and European markets. The European Commission approved the deal in January 2025, contingent on International Paper divesting five box plants in Europe to address competition concerns.

Further adjustments to IP Company ownership are underway. International Paper has entered exclusive negotiations to sell these five European corrugated box plants to PALM Group of Germany, with the transaction expected to close by the end of the second quarter of 2025. These changes reflect a dynamic period for IP shareholders and the company's overall strategic direction. The company's leadership has also been evolving, with Andrew Silvernail taking over as CEO on May 1, 2024, and subsequently becoming Chairman on October 1, 2024. These moves demonstrate the company's focus on operational efficiency and market adaptation.

| Metric | Value | Year |

|---|---|---|

| DS Smith Acquisition Value | $9.9 billion | 2025 |

| Legacy International Paper Shareholders' Ownership | 65.9% | 2025 |

| Legacy DS Smith Shareholders' Ownership | 34.1% | 2025 |

| 2024 Net Sales | $18.6 billion | 2024 |

In terms of executive leadership, Timothy S. Nicholls was named Executive Vice President and President of DS Smith, and Lance T. Loeffler became Senior Vice President and Chief Financial Officer, effective April 1, 2025. These moves reflect the company's commitment to strategic realignment and operational optimization within the evolving market. The company's financial performance also reflects these changes, with full-year net sales reaching $18.6 billion in 2024. International Paper is actively exploring strategic options for its Global Cellulose Fibers business. These actions, along with the closure of the containerboard mill in Campti, Louisiana, and the Georgetown, South Carolina pulp mill, and the construction of a new box plant in Waterloo, Iowa, all underscore the company's efforts to improve cost positions and meet changing market demands.

The acquisition of DS Smith, finalized in early 2025, reshaped the IP Company ownership structure and strategic direction.

Post-acquisition, legacy International Paper shareholders hold approximately 65.9% of the combined company.

To comply with regulations, International Paper is divesting five European box plants.

Andrew Silvernail became CEO in May 2024 and Chairman in October 2024, driving operational changes.

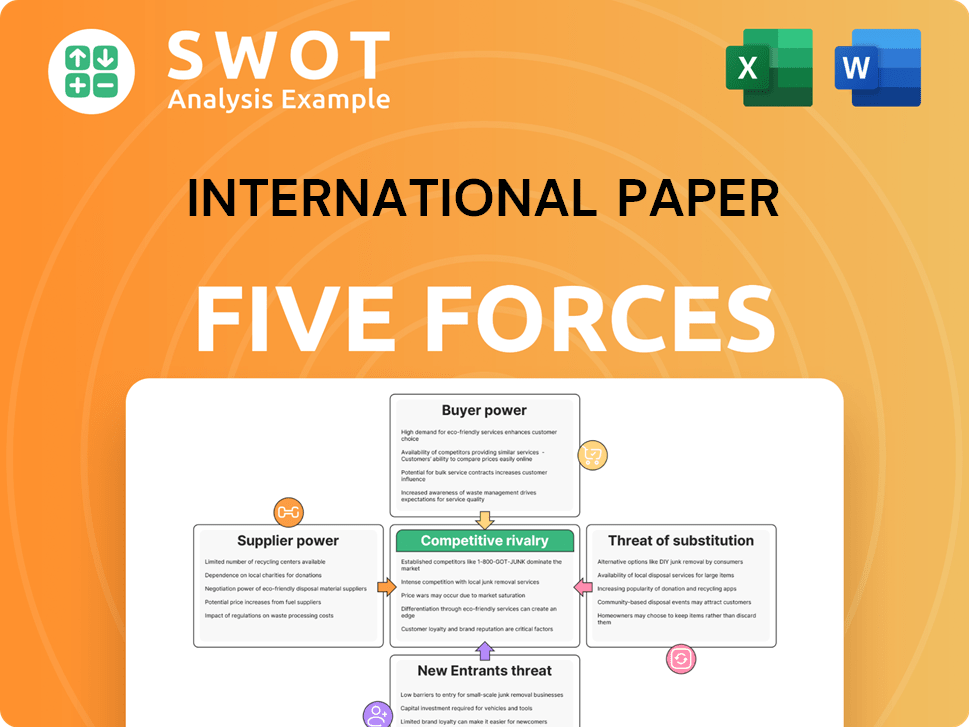

International Paper Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of International Paper Company?

- What is Competitive Landscape of International Paper Company?

- What is Growth Strategy and Future Prospects of International Paper Company?

- How Does International Paper Company Work?

- What is Sales and Marketing Strategy of International Paper Company?

- What is Brief History of International Paper Company?

- What is Customer Demographics and Target Market of International Paper Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.