International Paper Bundle

Navigating the Future: Who are International Paper's Key Customers?

In today's dynamic global market, understanding International Paper SWOT Analysis and its customer base is critical for sustained success. International Paper Company, a leader in renewable fiber-based products, has recently made a significant strategic move with the acquisition of DS Smith in early 2025, expanding its footprint in sustainable packaging. This shift necessitates a deep dive into the company's customer demographics and target market.

This exploration will uncover the evolving target market of the IP company, examining how it segments its market and defines its ideal customer. We'll analyze the industries International Paper serves, providing a detailed look at its customer base breakdown and customer needs analysis. Understanding the customer profile and acquisition strategy is key to grasping International Paper's future trajectory.

Who Are International Paper’s Main Customers?

Understanding the customer base of the International Paper Company involves recognizing its business-to-business (B2B) focus. Instead of targeting individual consumers, International Paper primarily serves businesses requiring packaging solutions and pulp products. This approach defines the customer demographics and shapes its target market.

The IP company maintains over 1,200 active B2B customer relationships across 24 countries. This indicates a broad and diversified customer base. No single customer accounts for more than 5% of total sales, highlighting the company's strategy to avoid over-reliance on any one client.

The primary customer segments for International Paper are businesses within the packaging, consumer goods, and industrial manufacturing sectors. Packaging solutions represent approximately 55% of the company's total revenue. The acquisition of DS Smith in early 2025 further expanded its reach in the sustainable packaging market, reinforcing its focus on fiber-based solutions.

International Paper serves various industries, with packaging solutions as a major revenue source. These include food and beverage, e-commerce, industrial, and healthcare packaging. This diversification helps the company manage risks and adapt to changing market needs.

As a B2B company, International Paper focuses on the characteristics of its business clients rather than individual consumer demographics. This customer profile is crucial for tailoring products and services to meet specific industry needs and preferences.

International Paper is increasingly focusing on sustainable packaging solutions. This shift is driven by consumer demand and regulations, targeting businesses that prioritize eco-friendly practices. This strategic move is detailed in the Growth Strategy of International Paper.

International Paper segments its market by industry, offering tailored solutions to meet the needs of each sector. This market segmentation approach allows the company to better serve its clients and maintain a competitive edge. This approach is crucial for International Paper's success.

International Paper focuses on understanding the specific needs of its business clients to provide customized packaging and pulp solutions. The company's customer acquisition strategy involves building strong relationships with businesses across various sectors.

- Focus on B2B relationships.

- Emphasis on sustainable solutions.

- Diversified customer base.

- Tailored solutions by industry.

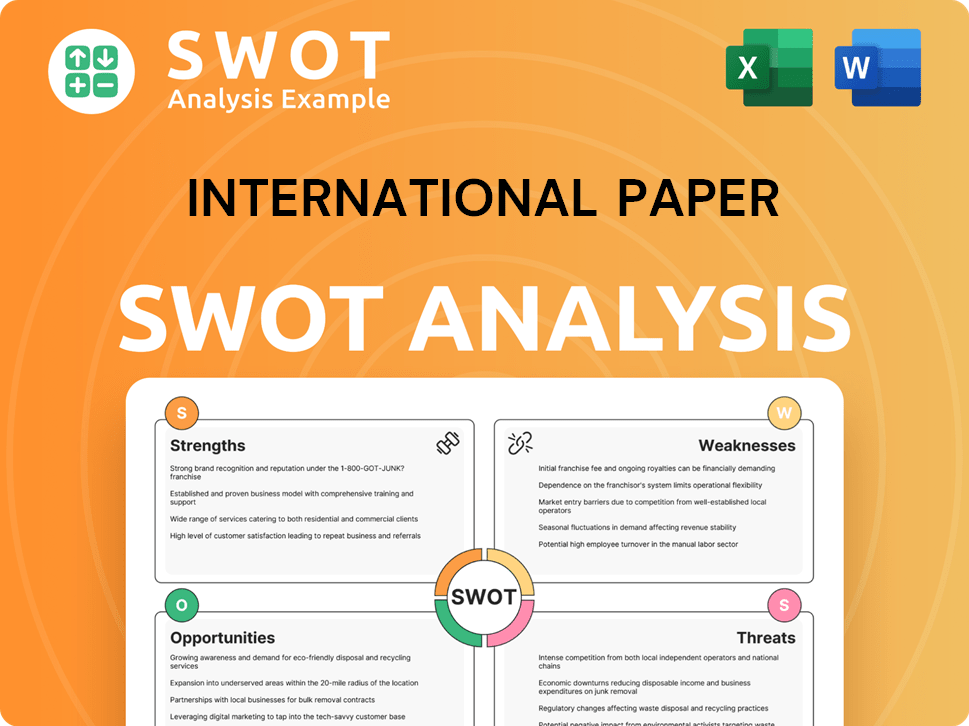

International Paper SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do International Paper’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business, and for the International Paper Company, this involves a deep dive into the evolving demands of its diverse customer base. The company's focus on sustainability, efficiency, and reliability reflects the changing landscape of consumer and business expectations. This focus directly influences the product development and market strategies of the IP company.

The primary drivers for International Paper's customers are increasingly centered around sustainability and eco-friendly solutions. This shift is fueled by consumer demand for paper-based packaging over plastics, aiming to reduce waste and environmental impact. International Paper responds by emphasizing the use of renewable fiber-based products and ensuring transparency in its supply chain, which builds trust and loyalty among its customers.

Customer preferences are also shaped by the need for efficient and reliable solutions. B2B buyers, in particular, prioritize the ability to reduce carbon footprints and manage supply chain disruptions. International Paper addresses these needs through innovative products and services, such as sustainable packaging designs and digital printing technologies. This approach allows the company to meet the demands of its customers while staying competitive in the market.

Sustainability is a key factor influencing customer decisions. A survey by DS Smith (acquired by International Paper in 2025) found that sustainability is the most important attribute of a shipping package for U.S. consumers.

Customers prefer paper-based packaging materials over plastics to minimize waste and plastic pollution. International Paper offers molded fiber and kraft carry sacks as eco-friendly alternatives.

Customers prioritize product usage patterns that offer protection, preservation, and convenience. B2B buyers seek solutions that reduce carbon footprints and ensure reliable delivery.

International Paper emphasizes transparency and traceability in its fiber supply chain. All fiber is traceable, and a portion carries forestry certifications, building customer trust.

Feedback and market trends drive product development. International Paper innovates in sustainable packaging design and digital printing technology integration.

International Paper tailors its marketing and product features to specific segments. It provides customizable packaging solutions for industries like food and beverage, e-commerce, and healthcare.

International Paper's approach to meeting customer needs involves several key strategies and innovations, including the '80/20 performance system' to reduce complexity and costs. The company has seen success with products like 'Round Wrap', which reduced carbon emissions by 20%. These efforts are aimed at aligning resources to better serve and delight customers. The company's focus on sustainable and renewable fiber-based products is a direct response to the growing demand for eco-friendly solutions, with a significant preference among consumers for paper-based packaging materials over plastics.

- Sustainable Packaging: Development of eco-friendly packaging solutions to reduce environmental impact.

- Custom Material Engineering: Tailoring materials to meet specific customer needs and product requirements.

- Digital Printing Technology: Integrating advanced printing techniques for enhanced product presentation and functionality.

- Supply Chain Optimization: Ensuring reliable delivery and minimizing disruptions through efficient supply chain management.

- Customer-Centric Approach: Focusing on customer feedback to drive innovation and improve product offerings.

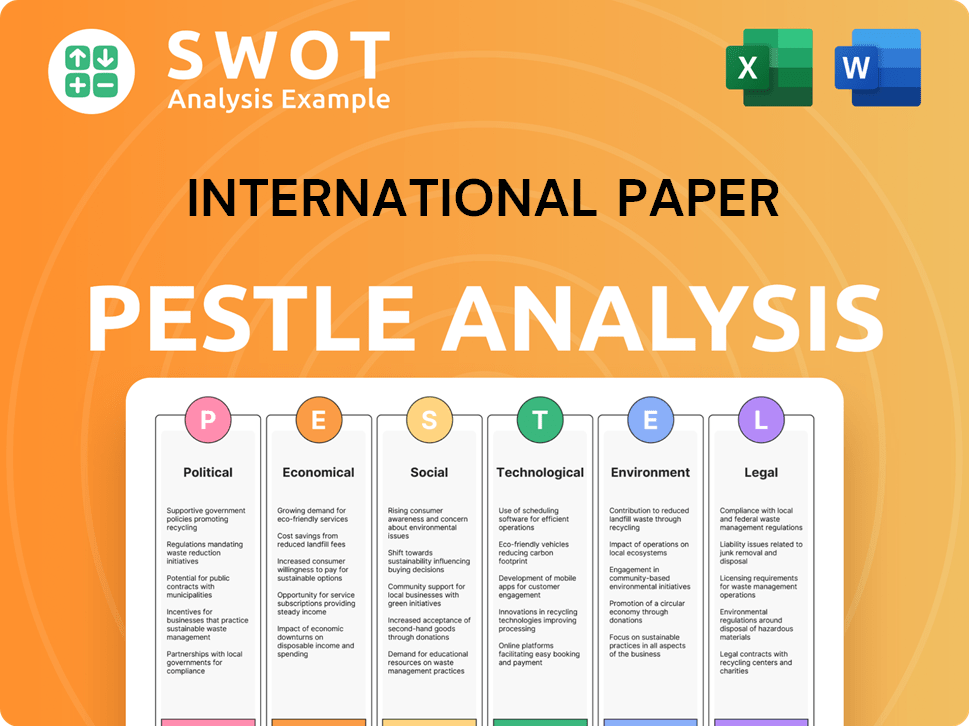

International Paper PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does International Paper operate?

The IP company maintains a strong global presence, focusing on key markets in North America, Latin America, Europe, and North Africa. Its operations span over 30 countries, with manufacturing facilities strategically located across these regions. The recent acquisition of DS Smith is set to enhance its capabilities and expand its customer base, particularly in North America and EMEA (Europe, Middle East, and Africa).

In 2024, the North American region held a significant share of the global paper and paperboard packaging market. Europe also played a crucial role, driven by the increasing demand for eco-friendly materials. The Asia Pacific region, though not explicitly listed as a primary market, presents a considerable growth opportunity, especially with the rising demand for sustainable packaging.

Understanding the nuances of customer demographics and preferences across different geographical areas is key for International Paper's market segmentation strategy. The company tailors its offerings and marketing approaches to suit the specific needs of each region. This localized strategy is crucial for success in diverse markets, supported by strategic expansions like the new sustainable packaging facility in Salt Lake City, Utah, and initiatives to optimize its box system and improve mill reliability in North America and Europe.

In 2024, the North American region accounted for 30.1% of the global paper and paperboard packaging market share. The U.S. market alone was valued at $100.8 billion. This region is a key focus for International Paper, with ongoing efforts to expand its footprint and serve existing and new customers. The company is optimizing its box system and improving mill reliability in this area.

Europe held 22.1% of the global paper and paperboard packaging market share in 2024. The demand for sustainable and eco-friendly packaging is a major driver in this region. International Paper is adapting its strategies to meet the growing customer demand for environmentally conscious products and solutions.

The Asia Pacific region held 35.3% of the global paper and paperboard packaging market share in 2024. The demand for sustainable packaging in China alone is projected to reach $89.8 billion by 2034. This presents a significant opportunity for International Paper to expand its market reach and cater to the evolving needs of its target market.

International Paper localizes its offerings and marketing to succeed in diverse markets, considering differences in customer demographics, preferences, and buying power. The company's recent acquisition of DS Smith is expected to enhance its market share in North America and Europe. Recent expansions include the exploration of a new sustainable packaging facility in Salt Lake City, Utah.

International Paper's customer base is diverse, including businesses across various industries such as food and beverage, consumer goods, and e-commerce. The company focuses on understanding the specific needs of each customer segment to tailor its products and services effectively. The target market includes businesses seeking sustainable and high-quality packaging solutions.

The company segments its market based on geography, industry, and customer needs. This allows for targeted marketing and product development efforts. For example, the focus on sustainability is particularly strong in Europe, driving specific product innovations and marketing strategies.

International Paper's ideal customer is a business that values sustainability, quality, and reliable supply chains. These customers often operate in industries where packaging plays a critical role in product protection and brand presentation. The company's customer acquisition strategy involves building strong relationships with key decision-makers within these target organizations.

International Paper's primary geographical markets include North America, Latin America, Europe, and North Africa. The company strategically expands its footprint to better serve its customers. Recent expansions, such as the new facility in Utah, demonstrate the company's commitment to meeting the needs of its target market.

The company conducts thorough customer needs analysis to understand the specific requirements of each market segment. This includes assessing the demand for sustainable packaging, supply chain efficiency, and cost-effectiveness. This analysis informs product development and marketing strategies.

International Paper aims to increase its market share through strategic acquisitions and expansions. The acquisition of DS Smith is expected to enhance its market share in North America and Europe. The company's focus on sustainability and innovation helps it maintain a competitive edge in the global market.

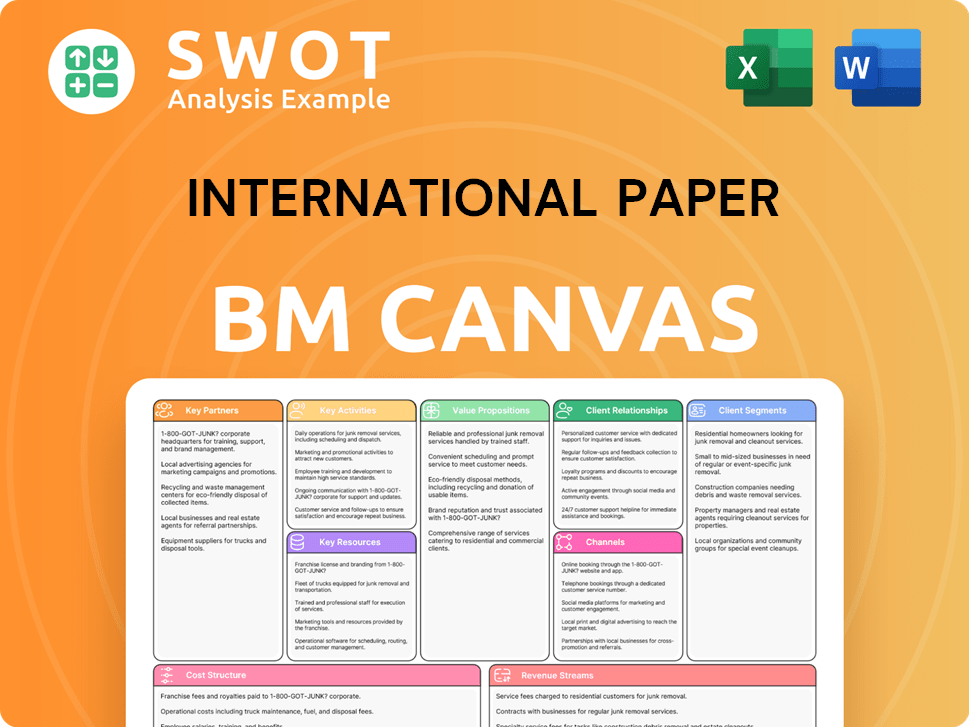

International Paper Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does International Paper Win & Keep Customers?

The focus of customer acquisition and retention for the IP company centers on a customer-centric strategy, emphasizing operational excellence. A key initiative is the '80/20 performance system,' launched in 2024, which is designed to streamline operations and allocate resources more effectively to serve key clients. This strategy is expanding in 2025 to approximately 60 box plants, building on productivity gains achieved in pilot programs.

IP's approach to attracting and keeping customers is heavily rooted in B2B marketing. The company allocated $37.5 million to B2B marketing in 2023. Digital platforms are a significant channel, reaching 89% of B2B customers and handling 62% of transactions, which generated $4.2 billion in annual digital sales. They also cultivate long-term relationships, maintaining over 1,200 active partnerships across 24 countries.

Key sales tactics and loyalty programs revolve around offering reliable, innovative, and sustainable packaging solutions. The push towards sustainable packaging is driven by consumer and regulatory pressures, which, in turn, boosts demand from business customers. A broader range of sustainable packaging options is being emphasized, especially after the DS Smith acquisition, which enhances innovation and service capabilities.

IP Company's customer acquisition relies heavily on B2B marketing, with a budget of $37.5 million in 2023. Digital platforms are key, reaching 89% of B2B customers and handling 62% of transactions. This strategy helps generate substantial digital sales, contributing $4.2 billion annually.

The company emphasizes offering a wider array of sustainable packaging options. This focus is driven by increasing consumer and regulatory pressures, which boosts demand from business customers. The DS Smith acquisition further strengthens their capacity for innovation and service.

IP Company concentrates on operational efficiency and supply chain optimization to ensure cost-effective product delivery. They achieved an average logistics efficiency of 92% in 2022. This focus helps them meet customer needs effectively.

The company is actively exploring strategic options for its Global Cellulose Fibers business, further emphasizing sustainable packaging solutions. The '80/20 performance system' aims to reduce complexity and costs, which is expanding to 60 box plants in 2025. This approach is designed to better serve their most valuable clients.

The company's strategy includes a strong focus on operational efficiency and supply chain optimization to ensure cost-effective product delivery. In 2022, they reported an average logistics efficiency of 92%. IP is also actively exploring strategic options for its Global Cellulose Fibers business to further focus on sustainable packaging solutions. The 80/20 approach and targeted investments have improved customer service performance, enhancing reliability.

IP Company employs multiple strategies to acquire and retain customers, focusing on customer-centric approaches and operational efficiency. The company's B2B marketing efforts are substantial, with significant investment in digital platforms. Their dedication to sustainable packaging and supply chain optimization are also key.

- B2B Marketing: Utilizes digital platforms extensively, reaching 89% of customers.

- Sustainable Packaging: Focuses on offering a broader range of sustainable options.

- Operational Efficiency: Achieved 92% average logistics efficiency in 2022.

- Strategic Initiatives: Implements the '80/20 performance system' to streamline operations.

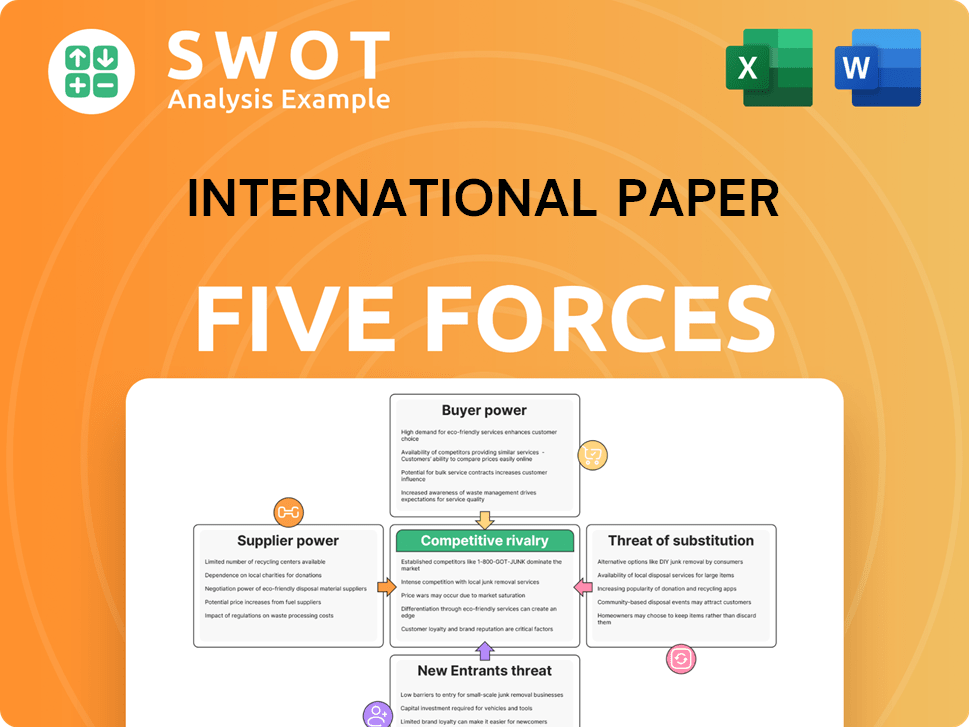

International Paper Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of International Paper Company?

- What is Competitive Landscape of International Paper Company?

- What is Growth Strategy and Future Prospects of International Paper Company?

- How Does International Paper Company Work?

- What is Sales and Marketing Strategy of International Paper Company?

- What is Brief History of International Paper Company?

- Who Owns International Paper Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.