JDE Peet's Bundle

Can JDE Peet's Continue to Brew Success?

JDE Peet's, a global titan in the coffee and tea industry, has a rich history rooted in strategic mergers and acquisitions, setting the stage for its current dominance. From its humble beginnings in the Netherlands to its current status as a global leader, JDE Peet's has continually adapted and innovated. The company's journey, marked by significant milestones like the 2015 merger and the 2020 IPO, showcases a relentless pursuit of growth and market leadership.

This analysis dives deep into JDE Peet's SWOT Analysis, exploring its ambitious JDE Peet's growth strategy and the exciting JDE Peet's future prospects. We'll examine the company's ability to navigate the ever-changing coffee market trends, capitalize on emerging markets, and leverage technological advancements to drive JDE Peet's financial performance and solidify its position within the coffee industry outlook. Understanding the key drivers behind JDE Peet's revenue growth and its strategic initiatives is crucial for investors and stakeholders.

How Is JDE Peet's Expanding Its Reach?

The company is actively pursuing a multi-faceted approach to expand its business, focusing on both geographical market entry and product portfolio diversification. A key aspect of their strategy involves strengthening their presence in emerging markets, particularly in Asia and Latin America, where coffee and tea consumption is on the rise. This approach is crucial for long-term growth, as it allows the company to tap into new customer bases and capitalize on demographic shifts.

In terms of product categories, the company continues to innovate and launch new products to cater to diverse consumer tastes and preferences. This includes expanding their offerings in the premium coffee segment, ready-to-drink (RTD) coffee, and sustainable coffee and tea options. Focusing on sustainability is not just a corporate responsibility but also a growth driver, as consumers increasingly seek ethically sourced and environmentally friendly products.

Mergers and acquisitions remain a potential avenue for growth, allowing the company to consolidate its market position and acquire complementary brands or technologies. These initiatives are pursued to diversify revenue streams, gain market share, and stay ahead of evolving industry trends, such as the increasing demand for convenience and personalized beverage experiences. The company aims to achieve mid-single-digit organic sales growth in the medium term, driven by these expansion efforts.

The company is focusing on expanding its presence in emerging markets, particularly in Asia and Latin America. This strategy aims to capitalize on the increasing coffee and tea consumption in these regions. Expansion in China is a key priority, with the goal of capturing a larger share of the rapidly growing coffee market.

The company is innovating and launching new products to cater to diverse consumer tastes. This includes expanding offerings in the premium coffee segment, ready-to-drink (RTD) coffee, and sustainable options. The focus on sustainability aligns with consumer demand for ethically sourced and environmentally friendly products.

Mergers and acquisitions are a potential avenue for growth, allowing the company to consolidate its market position. This strategy aims to acquire complementary brands or technologies. These initiatives diversify revenue streams and help the company stay ahead of industry trends.

The company aims to achieve mid-single-digit organic sales growth in the medium term. This growth is driven by expansion efforts in geographical markets and product innovation. The company's financial performance is closely watched by investors; more details can be found in Owners & Shareholders of JDE Peet's.

The company's expansion strategy focuses on geographical growth, product innovation, and strategic acquisitions. These initiatives are designed to capitalize on market trends and consumer preferences. The company's success hinges on its ability to adapt to changing market dynamics and consumer demands.

- Expansion in emerging markets, particularly Asia and Latin America.

- Innovation in product categories, including premium and sustainable options.

- Potential mergers and acquisitions to consolidate market position.

- Focus on achieving mid-single-digit organic sales growth.

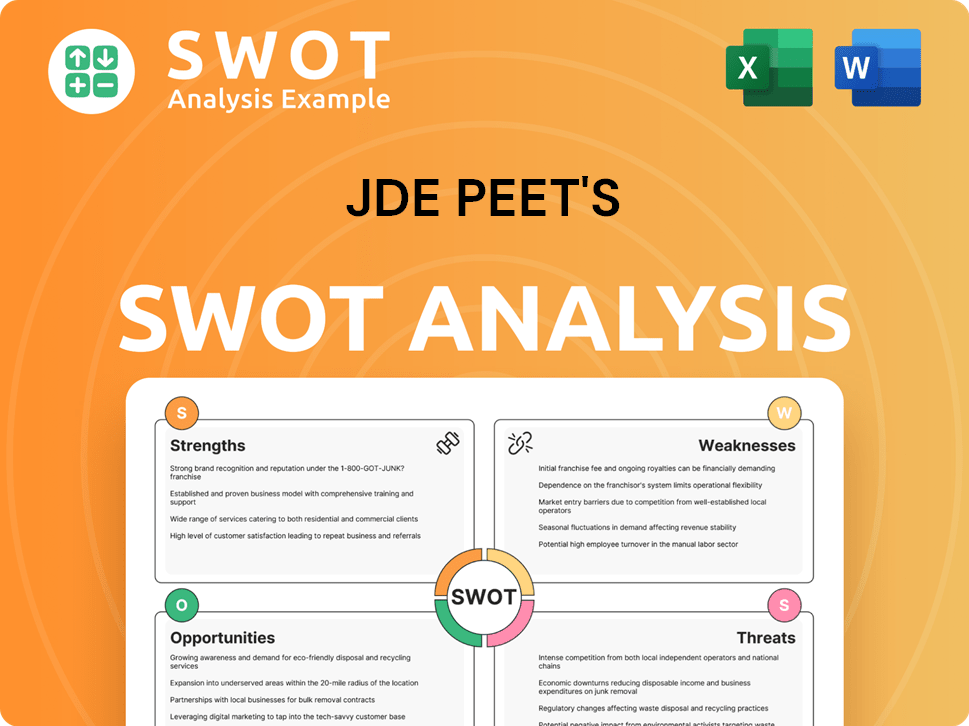

JDE Peet's SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does JDE Peet's Invest in Innovation?

The company's innovation and technology strategy is crucial for its future prospects in the competitive coffee industry. It focuses on enhancing product quality, operational efficiency, and meeting evolving consumer demands. This approach helps the company adapt to changing coffee market trends and maintain a strong position.

Digital transformation and sustainability are key components of the company's growth strategy. By leveraging technology and focusing on responsible sourcing, the company aims to improve consumer engagement and brand reputation. This strategy is designed to drive long-term growth and align with global sustainability goals.

The company's commitment to innovation and sustainability is evident in its initiatives to improve the livelihoods of farmers and minimize environmental impact. These efforts resonate with environmentally conscious consumers, contributing to brand reputation and long-term growth objectives. The company's focus on these areas is essential for its continued success.

The company invests in research and development (R&D) to create new coffee and tea blends, develop advanced brewing technologies, and improve packaging solutions. These investments are crucial for staying competitive in the coffee industry. This focus supports JDE Peet's growth strategy.

The company is undergoing digital transformation to optimize its supply chain, enhance e-commerce capabilities, and improve consumer engagement. This includes leveraging online platforms and direct-to-consumer models. This strategy is vital for reaching a broader audience.

The company is committed to responsible sourcing of coffee and tea, aiming to improve the livelihoods of farmers and minimize environmental impact. They are focused on sustainable farming practices and recyclable packaging. These efforts align with global sustainability goals.

The e-commerce segment has seen significant growth, especially due to shifting consumer purchasing habits. This involves leveraging online platforms and direct-to-consumer models to reach a broader audience. This helps enhance the company's market presence.

The company utilizes data analytics to understand consumer preferences and tailor product offerings. This contributes to increased market penetration and customer loyalty. This approach helps in better understanding consumer needs.

The company aims to have 100% of its coffee and tea sustainably sourced by 2025. This commitment demonstrates its dedication to environmental and social responsibility. This goal is a key part of its long-term strategy.

The company's innovation strategy includes investments in R&D, digital transformation, and sustainability. These efforts are designed to improve product quality, operational efficiency, and consumer engagement. The company's approach to digital transformation is evident in its e-commerce segment, which has seen significant growth. The company's commitment to sustainable sourcing and recyclable packaging also supports its long-term growth objectives. To learn more about the company's core values, check out Mission, Vision & Core Values of JDE Peet's.

- R&D: Development of new coffee and tea blends, advanced brewing technologies, and improved packaging.

- Digital Transformation: Optimization of the supply chain, enhanced e-commerce capabilities, and improved consumer engagement.

- Sustainability: Responsible sourcing of coffee and tea, sustainable farming practices, and recyclable packaging.

- Data Analytics: Understanding consumer preferences and tailoring product offerings.

- E-commerce: Leveraging online platforms and direct-to-consumer models for broader reach.

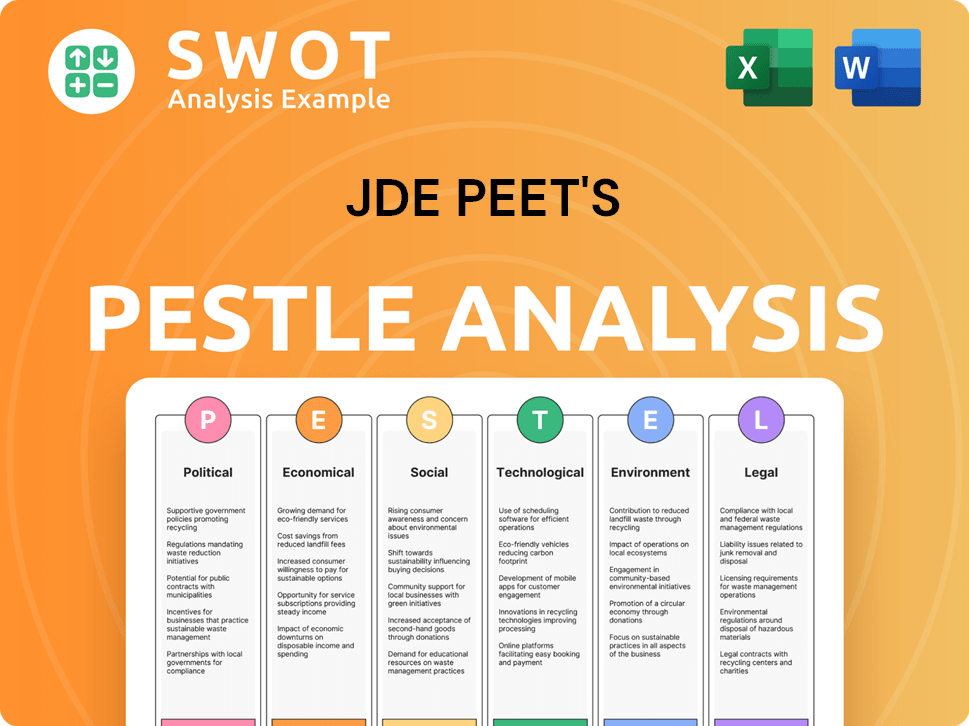

JDE Peet's PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is JDE Peet's’s Growth Forecast?

The financial outlook for JDE Peet's is positive, supported by its robust performance and strategic initiatives. The company's JDE Peet's growth strategy focuses on portfolio management, cost discipline, and targeted investments. This approach is designed to drive sustainable growth and enhance shareholder value in the coffee industry outlook.

In 2023, JDE Peet's reported total sales of €8,191 million, with organic sales growth of 3.3%. This growth was fueled by a combination of pricing strategies and improvements in volume/mix. The company's adjusted EBIT for the same period reached €1,173 million, reflecting an adjusted EBIT margin of 14.3%.

Looking ahead to 2024, JDE Peet's anticipates mid-single-digit organic sales growth and double-digit adjusted EBIT growth, excluding the effects of hyperinflationary economies. This positive forecast aligns with the company's commitment to operational efficiency and strategic investments, positioning it well within the evolving coffee market trends.

In 2023, JDE Peet's demonstrated strong financial health. The company achieved total sales of €8,191 million, showcasing its ability to navigate market dynamics. This performance underscores the effectiveness of its strategic initiatives and its position within the competitive landscape.

For 2024, JDE Peet's projects continued growth. The company anticipates mid-single-digit organic sales growth, reflecting its confidence in its strategic direction. This positive outlook is supported by its focus on innovation and expansion, positioning it for sustained success.

JDE Peet's maintained strong free cash flow generation, reaching €704 million in 2023. The net leverage ratio at the end of 2023 was 2.9x, indicating financial stability. This financial discipline supports investments in brand building and market expansion.

The company's financial ambitions are driven by a strategic focus on portfolio management and cost discipline. Targeted investments in growth areas are also key. These initiatives are designed to drive long-term value creation and strengthen its market position.

The company's strong financial position allows it to pursue strategic initiatives, including potential JDE Peet's expansion plans in Asia. The company's commitment to sustainability and operational efficiency further supports its financial goals. For more detailed insights into the company's performance, you can read a comprehensive JDE Peet's company analysis.

The primary drivers of revenue growth include pricing strategies, volume/mix improvements, and strategic market expansions. These factors contribute to the company's sustained financial performance. The company's ability to adapt to changing consumer preferences is also crucial.

JDE Peet's benefits from a strong brand portfolio and a global reach, providing significant competitive advantages. These strengths enable the company to navigate market challenges effectively. This also supports the company's JDE Peet's long term investment strategy.

The company actively manages the impact of inflation on JDE Peet's through pricing adjustments and cost-saving measures. These strategies help maintain profitability and protect margins in a dynamic economic environment. This also relates to JDE Peet's supply chain management.

JDE Peet's digital transformation strategy focuses on enhancing customer engagement and operational efficiency. This includes investments in e-commerce and digital marketing. These initiatives are designed to improve customer experience and drive sales growth.

JDE Peet's ESG performance is an integral part of its long-term strategy, focusing on sustainability and ethical sourcing. These efforts align with growing consumer demand for environmentally and socially responsible products. This also contributes to its JDE Peet's future prospects.

JDE Peet's holds a significant JDE Peet's market share in Europe, supported by its strong brand presence and distribution network. This strong position enables it to capitalize on growth opportunities in the region. The company's focus on innovation also helps.

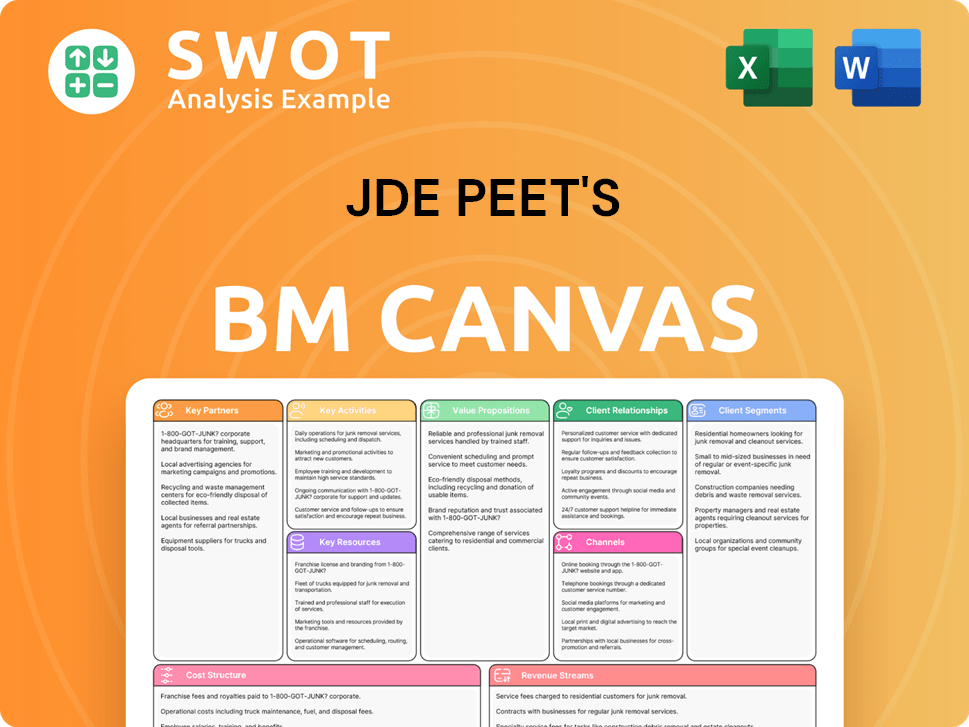

JDE Peet's Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow JDE Peet's’s Growth?

Analyzing the potential risks and obstacles is crucial when evaluating the JDE Peet's growth strategy and its future prospects. The company operates in a dynamic market, facing challenges that could influence its financial performance and overall success. Understanding these risks is essential for investors and stakeholders.

The coffee and tea market is highly competitive. This competition can lead to pricing pressures and the need for continuous investment in marketing and innovation. Furthermore, adapting to evolving consumer preferences and technological advancements is vital for maintaining market share and driving JDE Peet's revenue growth drivers.

Supply chain vulnerabilities and regulatory changes pose significant risks. Global sourcing of coffee beans and tea leaves makes the company susceptible to climate change impacts and geopolitical instability. Compliance with diverse international standards adds to operational costs. For a deeper dive into the company's background, consider reading the Brief History of JDE Peet's.

The coffee and tea markets are intensely competitive, featuring numerous global and local brands. This competition can lead to price wars and necessitate continuous investment in marketing and product innovation. Maintaining market share requires a strong focus on consumer preferences and efficient operations.

JDE Peet's relies on global sourcing, making it vulnerable to climate change, geopolitical instability, and commodity price fluctuations. Adverse weather in key coffee-producing regions can lead to supply shortages and increased raw material costs. Diversified sourcing and risk management are critical.

Regulatory changes, particularly concerning food safety, labeling, and sustainability standards, can create compliance burdens. Navigating diverse international regulations adds to operational costs and requires ongoing adaptation. Compliance is essential for market access and brand reputation.

The company must adapt to new brewing technologies, e-commerce trends, and digital marketing innovations. Consumer preferences are rapidly evolving, emphasizing personalization and sustainability. Failure to adapt could hinder growth and market competitiveness.

Internal resource constraints, including talent acquisition and retention in areas like digital marketing and data analytics, could impact growth initiatives. Securing and retaining skilled professionals is crucial for innovation and market expansion. This affects JDE Peet's company analysis.

Increasing consumer focus on environmental, social, and governance (ESG) practices necessitates investment in sustainable sourcing and transparent reporting. The company's commitment to sustainably sourced coffee and tea by 2025 is a proactive step. ESG performance impacts JDE Peet's long term investment strategy.

JDE Peet's mitigates risks through strategic diversification, proactive risk management, and scenario planning. Their broad portfolio of brands and geographical presence helps to cushion against localized market downturns. The company has shown its ability to adapt to challenges, such as the COVID-19 pandemic, by modifying its supply chain and accelerating e-commerce capabilities.

Recent financial data indicates that the company's ability to maintain profitability and manage costs effectively is essential. The ability to navigate Coffee market trends and adapt to changing consumer demands will be critical for future success. Evaluating JDE Peet's financial performance is vital for assessing its resilience.

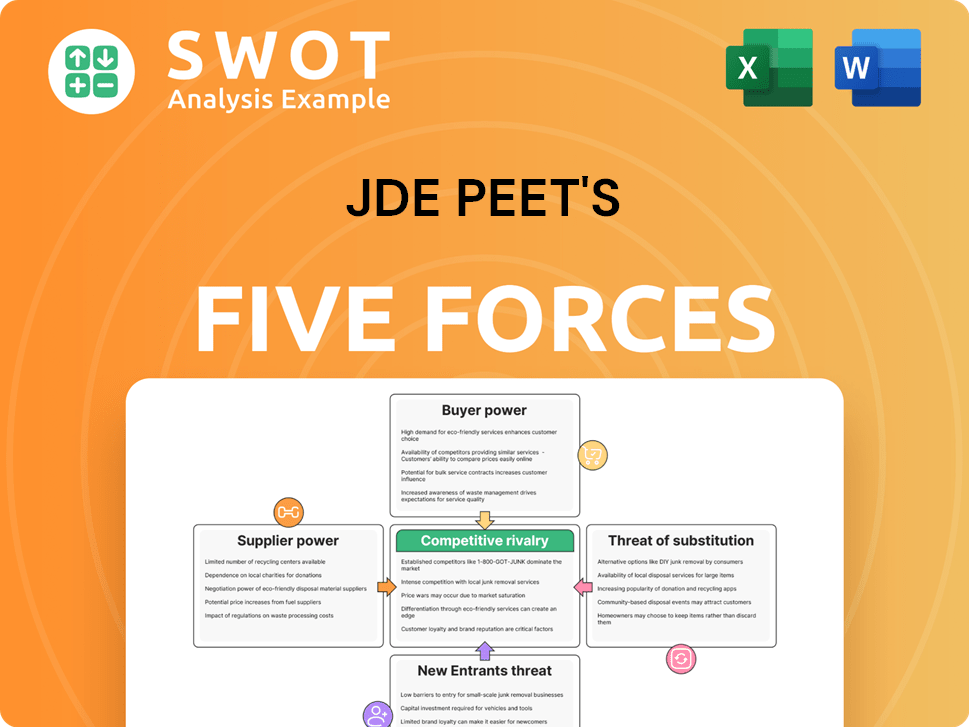

JDE Peet's Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JDE Peet's Company?

- What is Competitive Landscape of JDE Peet's Company?

- How Does JDE Peet's Company Work?

- What is Sales and Marketing Strategy of JDE Peet's Company?

- What is Brief History of JDE Peet's Company?

- Who Owns JDE Peet's Company?

- What is Customer Demographics and Target Market of JDE Peet's Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.