JDE Peet's Bundle

Decoding JDE Peet's: Who Buys Their Coffee?

In the bustling world of coffee and tea, understanding the JDE Peet's SWOT Analysis is crucial, but even more critical is knowing who fuels its success. JDE Peet's, a global coffee company, has expanded its reach through strategic acquisitions, such as the Maratá deal in Brazil and the Caribou license, signaling a dynamic evolution. Delving into the company's customer demographics and target market is key to grasping its global dominance and future growth prospects.

This exploration will dissect the JDE Peet's consumer profile, examining market segmentation, and uncovering insights into who buys JDE Peet's coffee products. We'll analyze JDE Peet's customer age range, geographic location, income levels, and consumer behavior. Understanding JDE Peet's brand perception among customers and their preferred coffee types will provide a comprehensive view of the company's strategic approach to its target market.

Who Are JDE Peet's’s Main Customers?

Understanding the customer demographics and target market for JDE Peet's is crucial for grasping its market position. The company, a major player in the coffee industry, caters to a diverse range of consumers and businesses. Its strategy involves a wide portfolio of brands and products, allowing it to serve various customer segments effectively.

JDE Peet's operates in both the Business-to-Consumer (B2C) and Business-to-Business (B2B) sectors. This dual approach allows it to capture a broad market share. The B2C segment focuses on individual consumers, while the B2B segment targets businesses, particularly in the foodservice industry. This structure is key to its market segmentation strategy.

The company's extensive brand portfolio, including names like L'OR and Jacobs, enables it to meet various consumer preferences. This includes different age groups, income levels, and lifestyles. The company's innovation, such as the introduction of L'OR Iced Coffee, highlights its focus on adapting to evolving consumer needs. The "In-Home" sales, which saw a 3.4% organic increase in the first half of 2024, show a significant consumer segment focused on at-home consumption.

The B2C segment of JDE Peet's targets a broad demographic, encompassing various age groups, income levels, and lifestyles. Brands like L'OR often appeal to consumers seeking premium experiences, while others target value-conscious individuals. The company's product offerings cater to diverse consumer preferences.

For its B2B customers, JDE Peet's serves the foodservice sector, providing coffee and tea solutions to businesses. This includes supplying coffee products for sale in coffeehouses, such as its long-term strategic arrangement with Caribou Coffee. This segment caters to businesses looking for quality beverages.

JDE Peet's focuses on both retail and foodservice channels to reach its target market. The retail segment includes consumers who purchase coffee for at-home consumption, while the foodservice segment provides coffee to businesses. The company adapts to market changes by emphasizing e-commerce and at-home coffee consumption.

JDE Peet's has shifted its focus to adapt to market changes, emphasizing e-commerce and at-home coffee consumption. This highlights a strategic adaptation to consumer behavior, particularly influenced by recent global shifts. These changes have bolstered the retail segment, showing the company's ability to respond to market trends.

JDE Peet's serves diverse customer segments with various needs and preferences. The company's approach includes both B2C and B2B strategies, which enables it to reach a wide audience. The company's innovation and strategic partnerships support its market position.

- Retail Consumers: Individuals who purchase coffee for at-home consumption.

- Foodservice Businesses: Restaurants, cafes, and other businesses that require coffee solutions.

- Premium Coffee Drinkers: Consumers who prefer high-quality, premium coffee experiences.

- Value-Conscious Consumers: Individuals seeking affordable coffee options.

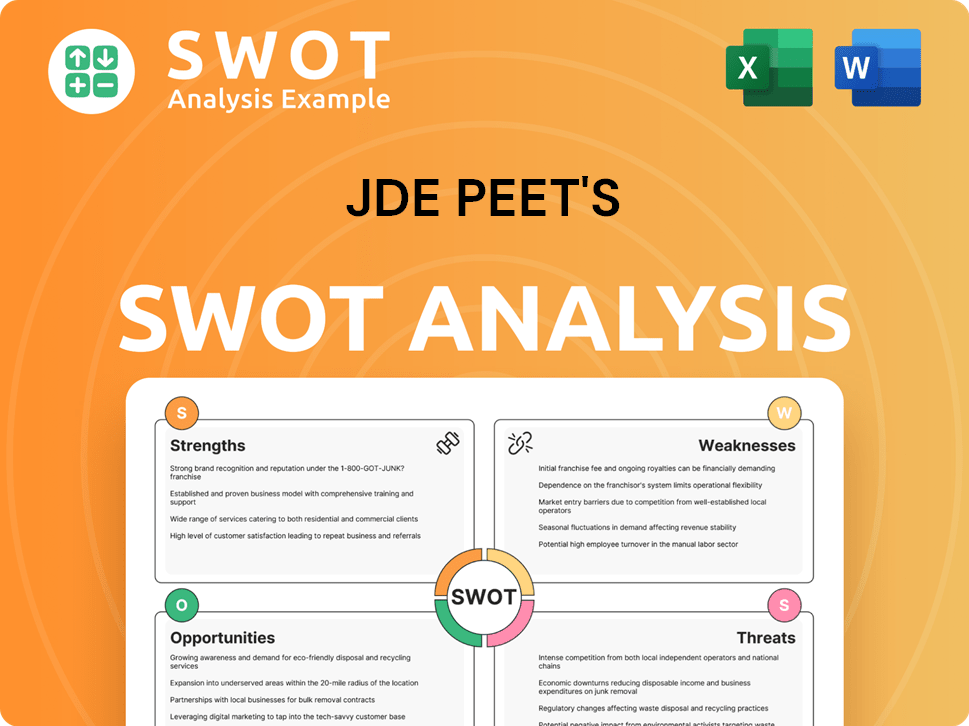

JDE Peet's SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do JDE Peet's’s Customers Want?

Understanding the needs and preferences of its customers is crucial for any coffee company, and this is especially true for a global player like JDE Peet's. The company's success hinges on its ability to cater to a diverse range of consumer demands, from the desire for high-quality, ethically sourced products to the need for convenience and varied taste experiences. This approach is essential in a competitive market, where customer demographics and target market expectations are constantly evolving.

The global coffee market, valued at approximately $120 billion in 2024, highlights the significant consumer choice and the importance of adapting to changing preferences. Factors such as brand loyalty and price sensitivity play a crucial role in influencing purchasing behaviors. Customers show varied product usage patterns, ranging from daily at-home consumption to out-of-home experiences, reflecting a dynamic market landscape. The company strategically addresses customer needs through continuous innovation and product development.

The company's approach involves a deep understanding of its consumer profile, including their lifestyles, income levels, and preferred coffee types. By analyzing these factors, the company can effectively tailor its marketing strategies and product offerings to meet the specific needs of different customer segments. This targeted approach helps in building brand loyalty and increasing market share.

Consumers increasingly demand high-quality and ethically sourced coffee. This includes a focus on sustainable practices and fair trade certifications. The company's commitment to these values influences purchasing decisions and brand perception.

Convenience is a key driver, with a growing preference for ready-to-drink options. The ready-to-drink coffee segment is projected to reach $37.8 billion globally in 2024. Products like L'OR Iced Coffee cater to this demand.

Customers seek diverse taste profiles, from traditional to specialty coffees. The 10% rise in specialty coffee sales in 2024 demonstrates this trend. The company's extensive brand portfolio offers a wide range of flavors.

A growing consumer consciousness drives demand for sustainable products. The 15% increase in sales of sustainable products since 2023 shows this trend. The company's recyclable packaging initiatives align with this demand.

Brand loyalty, as seen with brands like L'OR, reduces price sensitivity. This loyalty influences purchasing decisions and helps maintain market share. The company invests in building and maintaining strong brand relationships.

Market competition and price sensitivity remain significant factors. The company offers products at different price points to cater to various customer segments. Balancing value and quality is a key strategy.

To effectively target its target market, the company employs several strategies. These include product innovation, sustainable practices, and tailored marketing campaigns. The company's approach is detailed in the Marketing Strategy of JDE Peet's article.

- Product Innovation: Launching new products like L'OR Iced Coffee and Peet's Ultra Coffee Concentrate to meet evolving consumer demands.

- Sustainable Packaging: Implementing fully recyclable at-home paper refill packs for soluble coffee in multiple markets to cater to the demand for sustainable packaging.

- Diverse Brand Portfolio: Leveraging its extensive brand portfolio, which covers different price points, taste preferences, and drinking occasions, ensuring it can offer a coffee or tea to everyone.

- Market Segmentation: Segmenting its customers based on demographics, psychographics, and purchase patterns to tailor marketing and product features effectively.

- Customer Loyalty Programs: Implementing customer loyalty programs to enhance brand relationships and encourage repeat purchases.

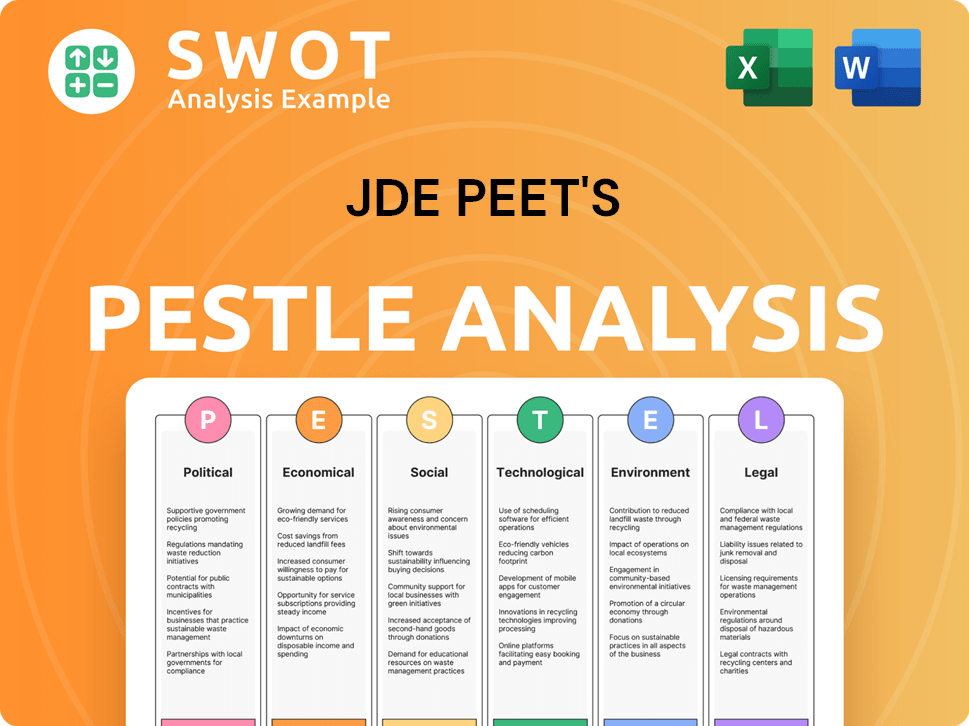

JDE Peet's PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does JDE Peet's operate?

JDE Peet's, a major player in the coffee company market, strategically positions itself across the globe, demonstrating a strong geographical market presence. The company's operations span over 100 markets worldwide, with a focus on key regions to maximize its reach and cater to diverse consumer preferences. This widespread presence is a critical component of its overall strategy, allowing it to capture significant market share and drive revenue growth.

The company's geographical segmentation includes Europe, Latin America, Russia, Middle East, and Africa (LARMEA), Asia-Pacific (APAC), and Peet's Coffee. Each region presents unique opportunities and challenges, requiring tailored strategies to effectively penetrate and maintain market share. Understanding the nuances of each market is crucial for JDE Peet's to succeed in a competitive global landscape.

The company's ability to adapt its offerings and marketing strategies to suit local tastes and preferences is key to its success in these diverse markets. This approach allows JDE Peet's to build strong brand recognition and customer loyalty in each region. This is crucial for the long-term sustainability and growth of the coffee company.

Europe remains a significant market for JDE Peet's, contributing to 54% of its total revenues in the first half of 2024. Sales in Europe increased by 1% to €2.3 billion during the same period. Strong performances were noted in the United Kingdom, Ireland, and the Nordics, indicating robust consumer demand in these areas.

LARMEA has become a key growth area for JDE Peet's, with sales increasing by 32.1% to €2.03 billion in 2024. This growth was significantly boosted by the consolidation of the Brazilian coffee brand Maratá. Brands like Pilão and Jacobs further supported organic sales growth in this region.

In Asia-Pacific, reported sales decreased by 0.7% in 2024. Performance varied geographically, with solid results in China, Australia, and the Philippines. Softer performances were observed in New Zealand and Malaysia, highlighting the need for tailored strategies.

Peet's Coffee, a key brand within the portfolio, saw its sales increase by 9% to €1.26 billion in 2024. Strong growth in its U.S. coffee stores and double-digit organic sales growth in Peet's China contributed to this positive performance. The brand's expansion continues to drive overall growth.

JDE Peet's focuses on localizing its offerings and marketing to succeed in diverse markets. This includes a mix of global brands, regional heroes, and local jewels. Recent expansions include the acquisition of Maratá's coffee and tea business in Brazil in January 2024 and a long-term global license agreement for Caribou consumer and foodservice coffee products in March 2024, which provides a platform to expand its premium coffee portfolio in North America. The company also expanded the direct distribution of its premium coffee ranges across Victoria, Australia, in July 2024.

- The company's diverse brand portfolio caters to different consumer preferences.

- Strategic acquisitions and licensing agreements drive market expansion.

- Local distribution efforts enhance market penetration.

- These strategies help JDE Peet's to effectively target its target market and strengthen its market share.

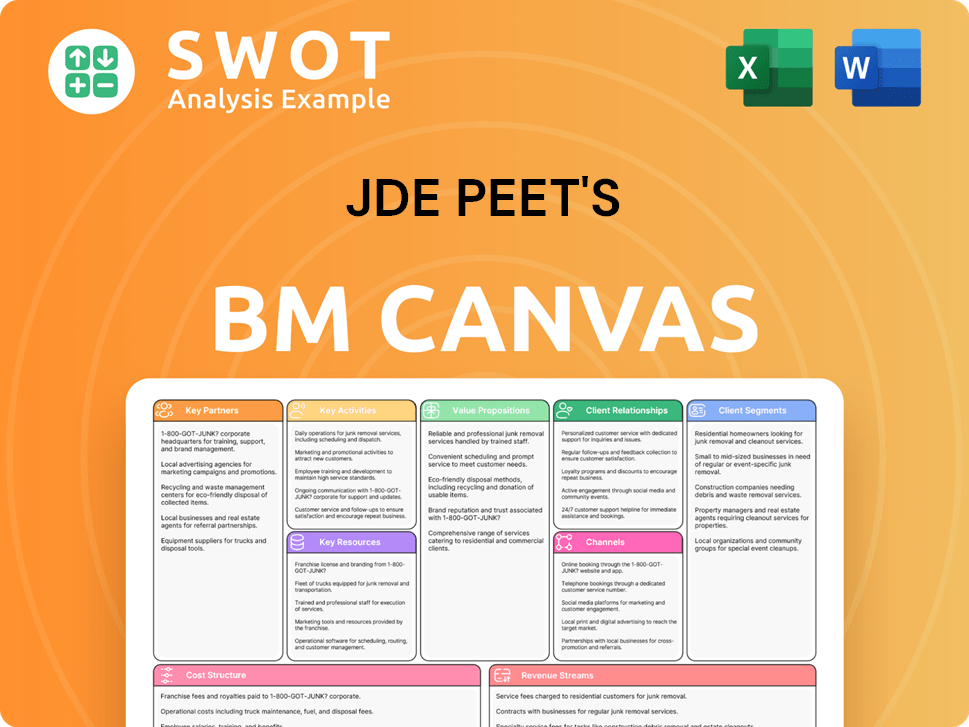

JDE Peet's Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does JDE Peet's Win & Keep Customers?

The strategies employed by JDE Peet's for customer acquisition and retention are multifaceted, focusing on both attracting new consumers and fostering loyalty among existing ones. A key element of their approach involves digital marketing and e-commerce expansion, recognizing the increasing importance of online channels. This includes investment in online platforms, social media marketing, and e-commerce capabilities to broaden reach and drive sales. The company aims to enhance its brand presence and connect with customers in a more personalized manner through these digital channels.

Traditional marketing methods likely complement digital efforts, given JDE Peet's global presence and diverse brand portfolio. The company emphasizes innovation and consumer relevance, launching new products to address evolving consumer needs, such as L'OR Iced Coffee and Peet's Ultra Coffee Concentrate in the U.S. in 2024. These product innovations serve as acquisition drivers by appealing to new tastes and preferences. Understanding the customer demographics and tailoring marketing efforts accordingly are crucial for success.

For retention, JDE Peet's focuses on building brand loyalty through its diverse portfolio of over 50 brands, each catering to different preferences and price points. The company's commitment to quality and sustainability also plays a role in retaining eco-conscious consumers. While specific loyalty programs are not extensively detailed in recent reports, the overall strategy of providing high-quality, innovative, and ethically sourced products contributes to customer satisfaction and repeat purchases. The company's strategy also involves understanding its target market and adapting to consumer behavior.

JDE Peet's leverages digital marketing and e-commerce to expand its reach. This includes investment in online platforms and social media. The company aims to connect with customers in a more personalized way through these channels. E-commerce expansion is crucial for driving sales in the current market.

The company launches new products to meet evolving consumer needs. Examples include L'OR Iced Coffee and Peet's Ultra Coffee Concentrate in 2024. These innovations attract new customers by appealing to different tastes. Such innovations are a key part of the customer acquisition strategy.

JDE Peet's offers a diverse portfolio of over 50 brands to build customer loyalty. Each brand caters to different preferences and price points. Commitment to quality and sustainability also plays a role in retaining consumers. The focus is on providing high-quality and ethically sourced products.

The new CEO, Rafael Oliveira, aims to improve resource allocation and digital marketing. The company is adapting to market changes, including a focus on retail and e-commerce. These strategic shifts have positively impacted financial performance. Adaptations contribute to customer loyalty and lifetime value.

The role of customer data and segmentation in targeting campaigns is evident in their personalized approach to marketing. The new CEO, Rafael Oliveira, appointed in November 2024, aims to improve resource allocation, step up efforts in digital marketing, and replicate successful brand strategies across similar markets. Changes in strategy over time have included a bolstered focus on the retail segment, particularly e-commerce and at-home coffee consumption, reflecting adaptations to market changes. This strategic shift has positively impacted their financial performance, suggesting a robust revenue model and contributing to customer loyalty and lifetime value by meeting evolving consumer demands. For further insights, explore Growth Strategy of JDE Peet's.

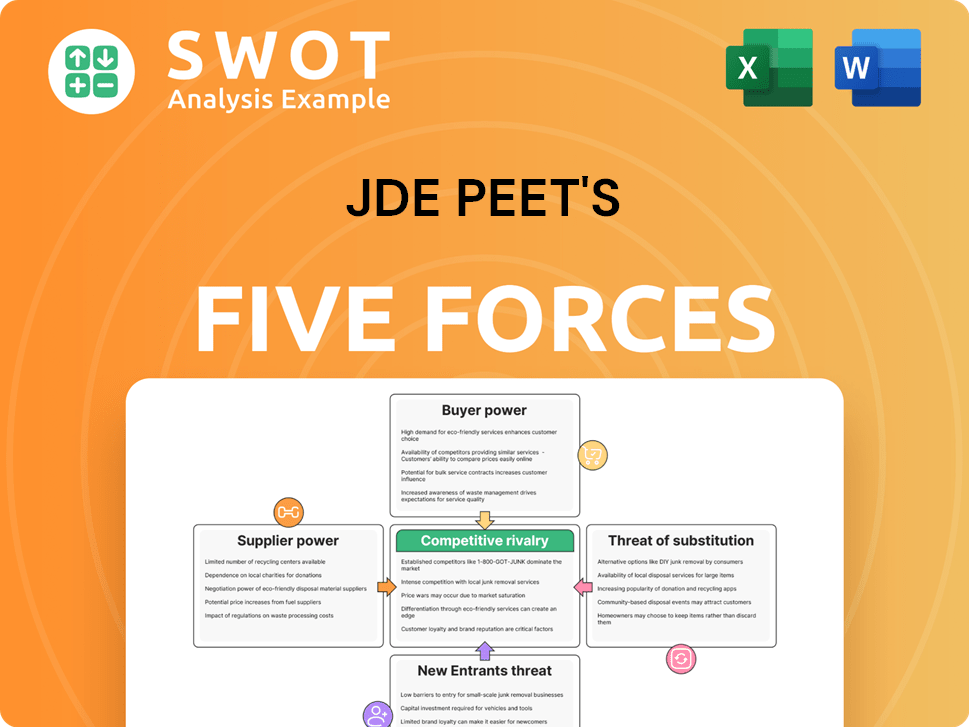

JDE Peet's Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JDE Peet's Company?

- What is Competitive Landscape of JDE Peet's Company?

- What is Growth Strategy and Future Prospects of JDE Peet's Company?

- How Does JDE Peet's Company Work?

- What is Sales and Marketing Strategy of JDE Peet's Company?

- What is Brief History of JDE Peet's Company?

- Who Owns JDE Peet's Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.