JDE Peet's Bundle

How Does JDE Peet's Brew Success?

JDE Peet's, a global coffee company, is a titan in the fast-moving consumer goods (FMCG) sector, boasting an impressive portfolio of beloved brands like Jacobs, Tassimo, and Peet's Coffee. With billions of cups served annually across over 100 countries, understanding how JDE Peet's works is key to unlocking its market dominance. In 2023, the JDE Peet's company reported impressive sales figures, solidifying its position as a global leader in the coffee and tea industry.

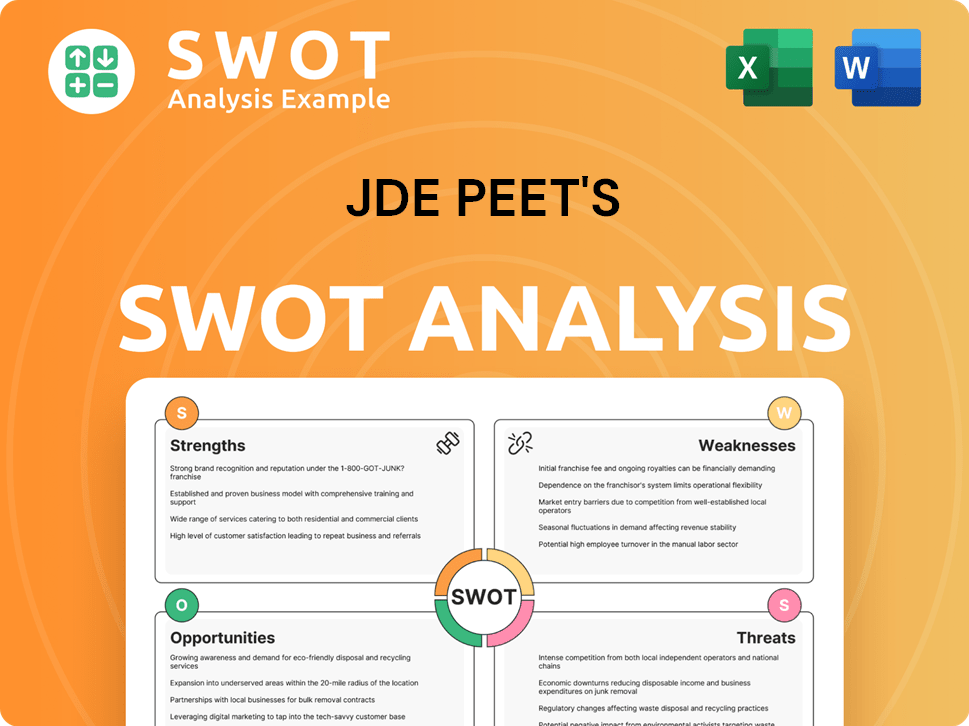

This in-depth analysis will explore the intricate workings of the JDE Peet's business model, from its diverse revenue streams to its strategic market positioning. Investors, consumers, and industry analysts alike will gain valuable insights into the company's financial performance and future growth potential. For a deeper dive into JDE Peet's strategic advantages, consider exploring the JDE Peet's SWOT Analysis, which provides a comprehensive look at its strengths, weaknesses, opportunities, and threats.

What Are the Key Operations Driving JDE Peet's’s Success?

JDE Peet's creates and delivers value by offering a wide range of coffee and tea products and services. The company caters to various consumer segments in both in-home and out-of-home settings. Its core offerings include roast and ground coffee, instant coffee, coffee pods and capsules, whole bean coffee, and various tea blends. This coffee company serves individual consumers through retail channels and businesses in the foodservice sector.

The operational processes that enable these offerings are multifaceted. They include sourcing, manufacturing, logistics, sales, and customer service. JDE Peet's maintains a global supply chain, sourcing high-quality coffee beans and tea leaves from various regions worldwide. The company operates numerous manufacturing and roasting facilities globally. Its logistics and distribution networks are extensive, ensuring efficient delivery of products to retailers, foodservice partners, and directly to consumers via e-commerce.

JDE Peet's leverages strong partnerships with retailers and foodservice providers to ensure broad market penetration. What makes JDE Peet's operations particularly effective is its scale and integrated approach, allowing for economies of scale in sourcing, production, and distribution. This global footprint and operational efficiency translate into customer benefits through widely available products, consistent quality, and competitive pricing. If you want to know more about the owners and shareholders, you can read this article: Owners & Shareholders of JDE Peet's.

JDE Peet's offers a diverse portfolio, including roast and ground coffee, instant coffee, coffee pods and capsules, whole bean coffee, and various tea blends. These products are designed to meet different consumer preferences and consumption occasions. The product range is a key aspect of how JDE Peet's works to maintain a broad market appeal.

The company uses multiple channels to reach consumers, including retail (supermarkets, hypermarkets, e-commerce) and foodservice (restaurants, hotels, offices, cafes). This multi-channel approach ensures wide product availability. This strategy is crucial for the JDE Peet's business model.

JDE Peet's operates globally with a strong presence in key markets. This international footprint allows the company to capitalize on diverse consumer preferences and market trends. The global scale supports efficient operations and market penetration.

The company's integrated approach allows for economies of scale in sourcing, production, and distribution. This efficiency translates into competitive pricing and consistent product quality. The operational efficiency is a key factor in JDE Peet's success.

JDE Peet's focuses on several key operational aspects to maintain its market position and drive growth. These include a robust supply chain, efficient manufacturing processes, and effective distribution networks. These elements are critical to understanding how JDE Peet's makes coffee and delivers its products.

- Supply Chain: The company sources high-quality coffee beans and tea leaves globally.

- Manufacturing: It operates numerous manufacturing and roasting facilities worldwide.

- Distribution: Extensive logistics networks ensure efficient product delivery.

- Market Penetration: Strong partnerships with retailers and foodservice providers.

JDE Peet's SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does JDE Peet's Make Money?

The JDE Peet's company generates revenue through the sale of coffee and tea products. Its business model focuses on multiple channels, including retail, foodservice, and e-commerce. In 2023, the company's total sales reached €8.19 billion, demonstrating its significant market presence.

JDE Peet's utilizes a variety of revenue streams and monetization strategies. These include tiered pricing for different product lines and formats, catering to diverse consumer preferences. The company also leverages cross-selling opportunities by offering complementary products such as coffee machines and accessories, enhancing its revenue potential.

The company's revenue streams are primarily driven by product sales across various segments. The retail segment, which includes sales to supermarkets and other consumer-facing outlets, constitutes a significant portion of its revenue. The foodservice segment contributes through sales to restaurants, cafes, hotels, and offices, providing bulk coffee and tea solutions, as well as brewing equipment. The e-commerce channel has seen substantial growth, especially in recent years, reflecting changing consumer habits.

JDE Peet's employs several strategies to generate revenue and maximize profitability. These strategies include product sales, tiered pricing, and cross-selling, all contributing to its financial performance. For more insights, consider reading the Brief History of JDE Peet's.

- Retail Sales: Sales through supermarkets and other consumer outlets.

- Foodservice Sales: Sales to restaurants, cafes, hotels, and offices.

- E-commerce Sales: Online sales through various platforms.

- Tiered Pricing: Offers different price points for various product lines.

- Cross-selling: Selling complementary products like coffee machines and accessories.

- Organic Sales Growth: In 2023, the company saw organic sales growth of 3.4%.

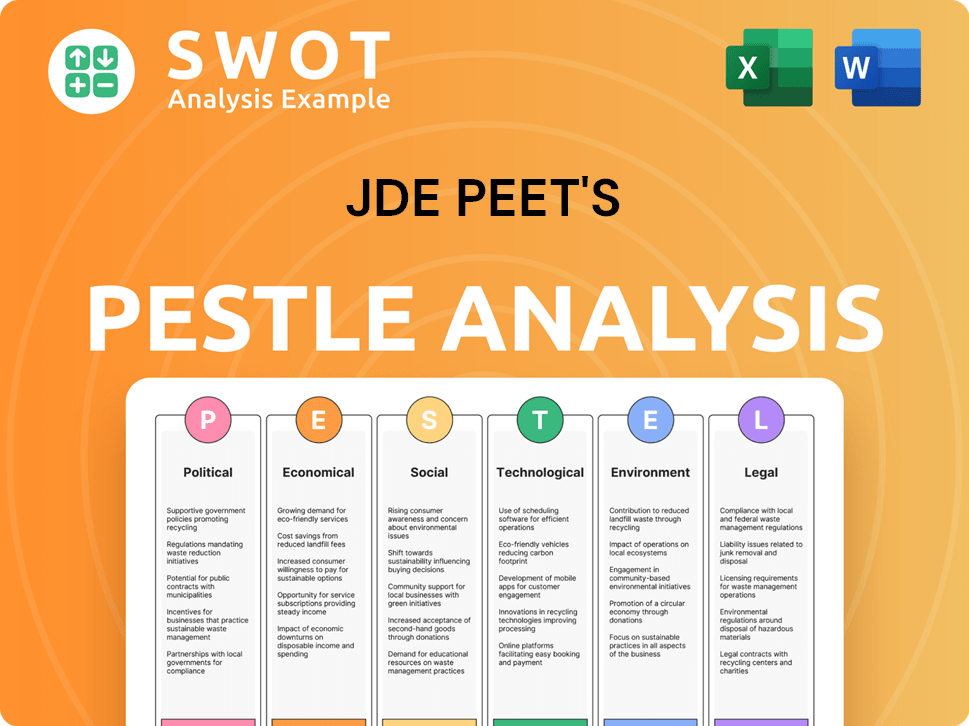

JDE Peet's PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped JDE Peet's’s Business Model?

JDE Peet's, a prominent coffee company, has a rich history marked by strategic moves and significant milestones. The company's formation in 2015 through the merger of Douwe Egberts and the coffee business of Mondelez International was a pivotal event, creating a global coffee giant. Subsequent acquisitions, including Peet's Coffee, have expanded its reach and brand portfolio. The initial public offering (IPO) in 2020 on Euronext Amsterdam was another critical milestone, providing capital for further growth and enhancing its market visibility.

The JDE Peet's company has navigated operational challenges, such as fluctuating raw material prices and supply chain disruptions. The company responded by optimizing sourcing, investing in resilient supply chains, and improving efficiencies across its manufacturing and distribution networks. Its competitive advantages stem from its strong brand portfolio, economies of scale, and extensive global distribution network, which provides a significant barrier to entry for new players.

How JDE Peet's works involves a multifaceted approach to the coffee and tea market. The company focuses on a diverse brand portfolio, global distribution, and adapting to consumer trends. It continues to invest in innovation and sustainability to maintain its competitive edge. For a deeper dive into the company's strategic growth, consider reading about the Growth Strategy of JDE Peet's.

The merger in 2015 was a major step. The IPO in 2020 provided capital for expansion. Acquisitions, like Peet's Coffee, expanded its brand portfolio.

Optimizing sourcing and investing in resilient supply chains. Implementing efficiency improvements across manufacturing and distribution. Expanding certified coffee and tea offerings to meet consumer demand.

Strong brand portfolio with high consumer loyalty. Economies of scale in sourcing, production, and distribution. Extensive global distribution network provides a significant barrier to entry.

In 2023, JDE Peet's reported revenue of approximately €8.2 billion. The company's adjusted EBIT was around €1.4 billion. The company continues to show growth in key markets.

JDE Peet's has faced challenges like fluctuating raw material prices and supply chain disruptions. The company has responded by optimizing sourcing and investing in resilient supply chains.

- Optimized Sourcing: Focused on securing raw materials at competitive prices.

- Supply Chain Resilience: Built more robust and diversified supply chains.

- Efficiency Improvements: Streamlined manufacturing and distribution processes.

- Sustainability Initiatives: Expanded certified coffee and tea offerings.

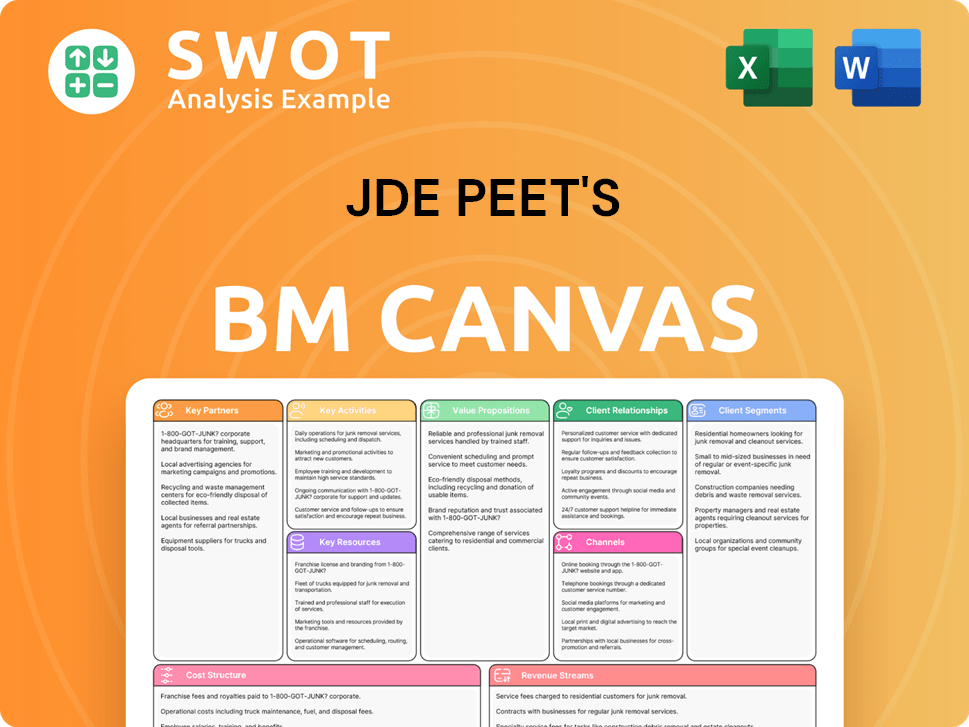

JDE Peet's Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is JDE Peet's Positioning Itself for Continued Success?

The JDE Peet's company holds a prominent position in the global coffee and tea market. It competes with major players like Nestlé and Starbucks, boasting a significant market share across numerous countries. Its diverse brand portfolio and extensive distribution network support its strong customer loyalty, solidifying its global presence in over 100 countries.

However, JDE Peet's faces various risks. These include volatility in raw material prices, particularly coffee beans and tea leaves, which can affect profitability. Changing consumer preferences, increased competition from smaller brands, and regulatory changes also pose challenges. Geopolitical instability and economic downturns in key markets could further impact consumer spending and supply chain stability.

JDE Peet's ranks among the top coffee and tea companies globally. It maintains a strong market share in key regions, supported by a diverse brand portfolio. Its extensive distribution network and established brands contribute to robust customer loyalty, driving its global reach.

The company faces risks such as fluctuating raw material prices and shifting consumer preferences. Increased competition from artisanal brands and regulatory changes also pose challenges. Geopolitical and economic factors can impact consumer spending and supply chains.

JDE Peet's focuses on expanding in emerging markets and investing in e-commerce. Innovation in product offerings, including plant-based options, is a priority. The company aims to maintain profitability through organic growth and strategic acquisitions.

Key strategies include expanding in emerging markets and investing in e-commerce to cater to evolving consumer tastes. The company is committed to sustainable sourcing, digital transformation, and brand building. These initiatives aim to ensure continued leadership.

JDE Peet's is actively pursuing strategic initiatives to mitigate risks and drive future growth. The company is focusing on expanding its presence in emerging markets, investing in e-commerce, and innovating its product portfolio to cater to changing consumer preferences, including plant-based and sustainable options. For more details, you can read about the Marketing Strategy of JDE Peet's. Leadership is committed to sustainable sourcing, digital transformation, and continued brand building. The company aims to sustain and expand its profitability through organic growth, strategic acquisitions, and operational efficiencies, ensuring its continued relevance and leadership in the global coffee and tea market.

JDE Peet's is focusing on several key areas to ensure future growth and maintain its market position in the coffee company industry. These strategies are designed to address current market trends and consumer demands.

- Expansion into emerging markets to capitalize on growing consumer bases.

- Investment in e-commerce platforms to enhance online presence and sales.

- Product innovation, including sustainable and plant-based options, to meet evolving consumer preferences.

- Focus on operational efficiencies to improve profitability and reduce costs.

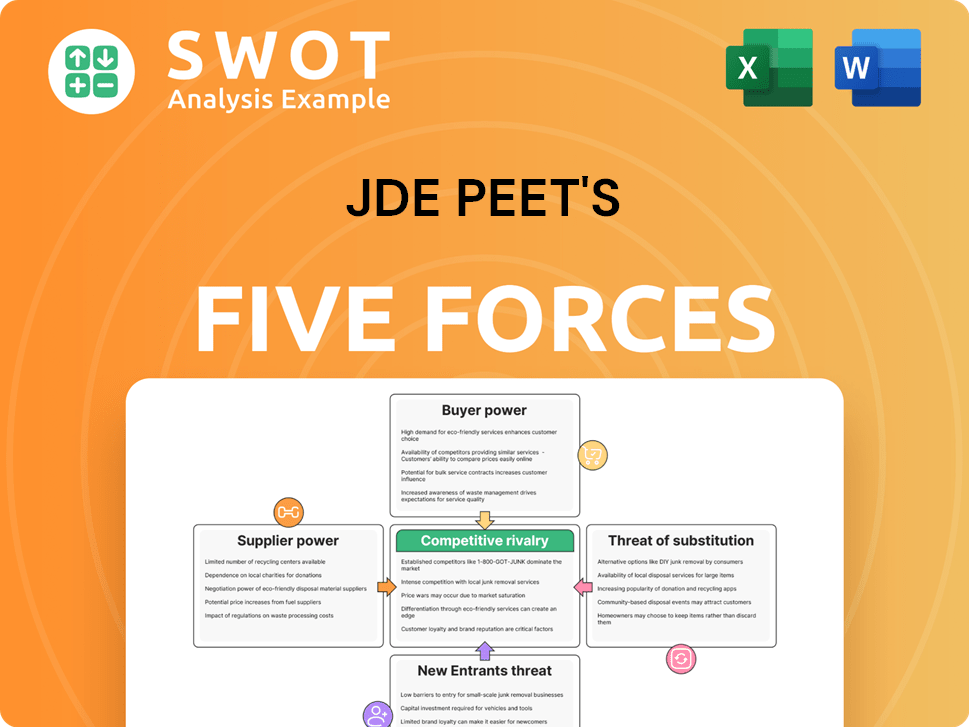

JDE Peet's Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JDE Peet's Company?

- What is Competitive Landscape of JDE Peet's Company?

- What is Growth Strategy and Future Prospects of JDE Peet's Company?

- What is Sales and Marketing Strategy of JDE Peet's Company?

- What is Brief History of JDE Peet's Company?

- Who Owns JDE Peet's Company?

- What is Customer Demographics and Target Market of JDE Peet's Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.