JDE Peet's Bundle

Who Really Owns JDE Peet's?

Ever wondered who pulls the strings at one of the world's largest coffee and tea companies? JDE Peet's, a global powerhouse born from a significant merger, has a fascinating ownership story. Understanding the JDE Peet's SWOT Analysis is key to understanding its strategic direction. This exploration unveils the intricate web of stakeholders behind this beverage giant, from its roots in the Netherlands and the United States to its current public status.

The JDE Peet's SWOT Analysis is crucial for understanding the company's position. Unraveling the JDE Peet's ownership structure is essential for anyone interested in the coffee company ownership landscape. This analysis will reveal the key players, from the initial founders to the current shareholders, providing a comprehensive view of who owns JDE Peet's and the evolution of its JDE Peet's parent company over time.

Who Founded JDE Peet's?

Understanding the current JDE Peet's ownership structure requires looking back at its origins. This global coffee and tea company is the result of mergers and acquisitions, primarily involving Jacobs Douwe Egberts (JDE) and Peet's Coffee. Therefore, the concept of a single founder or initial ownership is multifaceted.

The story of who owns JDE Peet's today is complex, rooted in the histories of its constituent companies. The early ownership structures of these companies provide insight into the evolution of the current ownership model. The journey from family-run businesses to a publicly traded entity is a testament to the growth and transformation of the coffee and tea industry.

The evolution of JDE Peet's parent company reflects a series of strategic decisions and market dynamics. The early ownership structures of Jacobs Douwe Egberts and Peet's Coffee set the stage for the company's current form. The history of these companies provides context for understanding the current ownership and the stakeholders involved.

Douwe Egberts, a key part of JDE, began in 1753 in the Netherlands. Founded by Egbert Douwes and Akke Thysses, it was a general store that evolved into a coffee, tea, and tobacco specialist.

Ownership of Douwe Egberts remained within the Douwes family for generations. This family-run business focused on quality and tradition as it expanded.

Alfred Peet founded Peet's Coffee in Berkeley, California, in 1966. He introduced custom coffee roasting to the U.S., influencing the specialty coffee movement.

Alfred Peet's initial ownership was a sole proprietorship. His focus was on direct control and maintaining the integrity of his roasting process.

Early funding for Peet's Coffee came from Alfred Peet's personal savings and initial revenues. There were no external angel investors or significant early backers.

These foundational entities, with their distinct origins and early ownership models, laid the groundwork for the complex structure seen today.

The evolution of JDE Peet's ownership is a story of mergers and acquisitions, with roots in family-run businesses. Understanding the early ownership of Jacobs Douwe Egberts and Peet's Coffee provides insight into the current structure. For more on the company's market position, consider reading about the Target Market of JDE Peet's.

- JDE Peet's is a publicly traded company.

- The early ownership of Douwe Egberts was family-based.

- Alfred Peet started Peet's Coffee as a sole proprietorship.

- The company has a complex ownership structure due to mergers and acquisitions.

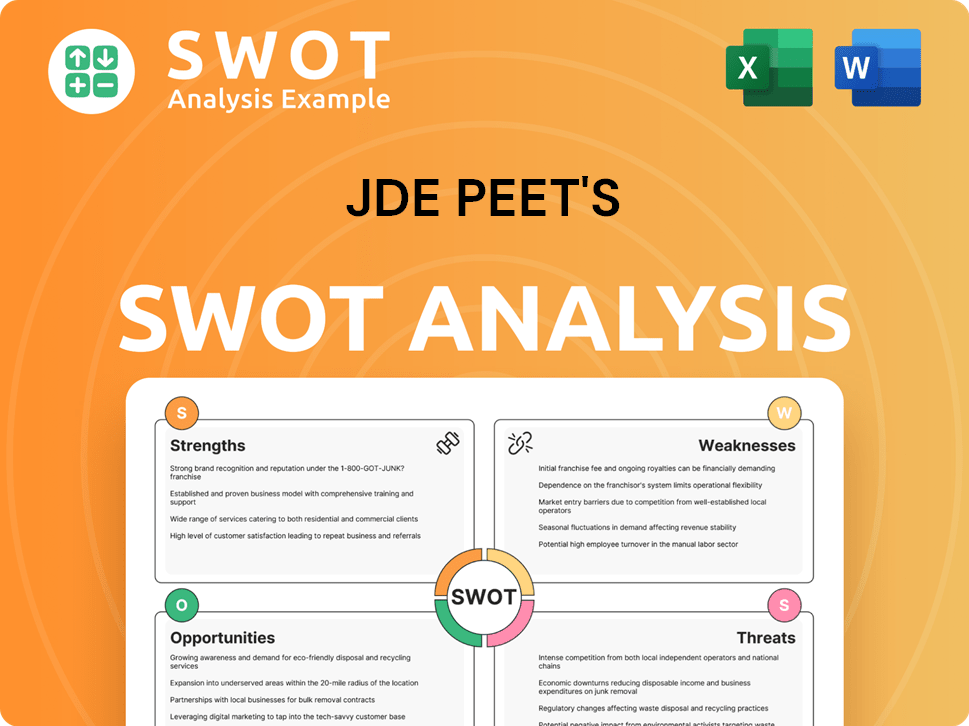

JDE Peet's SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has JDE Peet's’s Ownership Changed Over Time?

The evolution of JDE Peet's ownership is a story of strategic acquisitions and a significant initial public offering (IPO). The journey began with the separate development of its foundational components, including Douwe Egberts and Peet's Coffee. Douwe Egberts, after a long history of family ownership, experienced corporate shifts, notably its acquisition by Sara Lee Corporation in 1978. Sara Lee later spun off its international coffee and tea business, which included Douwe Egberts, in 2012, creating D.E Master Blenders 1753.

A pivotal change occurred with the involvement of JAB Holding Company. JAB, a private German conglomerate, strategically expanded its presence in the coffee industry through various acquisitions. In 2013, JAB acquired D.E Master Blenders 1753. Subsequently, in 2015, JAB merged D.E Master Blenders 1753 with the coffee business of Mondelez International, forming Jacobs Douwe Egberts (JDE). This merger brought together iconic brands and significantly expanded JDE's global footprint. Peet's Coffee, also acquired by JAB in 2012, was then integrated into this larger coffee platform. The culmination of this ownership evolution was the IPO of JDE Peet's on Euronext Amsterdam in May 2020.

| Key Event | Date | Impact |

|---|---|---|

| Sara Lee Acquires Douwe Egberts | 1978 | Marks the beginning of corporate ownership changes for Douwe Egberts. |

| JAB Acquires D.E Master Blenders 1753 | 2013 | Initiates JAB's significant involvement and consolidation in the coffee market. |

| Merger of D.E Master Blenders 1753 and Mondelez Coffee Business | 2015 | Forms Jacobs Douwe Egberts (JDE), expanding global reach. |

| IPO of JDE Peet's | May 2020 | JDE Peet's becomes a publicly traded company, with JAB remaining the largest shareholder. |

The IPO of JDE Peet's in May 2020, with an initial market capitalization of around €15.6 billion, marked a significant milestone. JAB Holding Company remained the primary shareholder post-IPO. As of early 2024, JAB, through its investment vehicles, continues to hold a substantial majority stake, ensuring strategic influence over the company. Other major stakeholders include institutional investors, mutual funds, and index funds that have acquired shares since the IPO. This concentrated ownership by JAB directly influences company strategy and governance, allowing for long-term planning and control over key decisions. For more details, you can check out the Brief History of JDE Peet's.

JDE Peet's is primarily owned by JAB Holding Company, a private German conglomerate, which holds a significant majority stake. The company's ownership structure also includes institutional investors and public shareholders following its IPO in 2020.

- JAB Holding Company is the parent company of JDE Peet's.

- Jacobs Douwe Egberts is a key brand within the JDE Peet's portfolio.

- Peet's Coffee is another major brand owned by JDE Peet's.

- The IPO allowed for public investment while maintaining JAB's control.

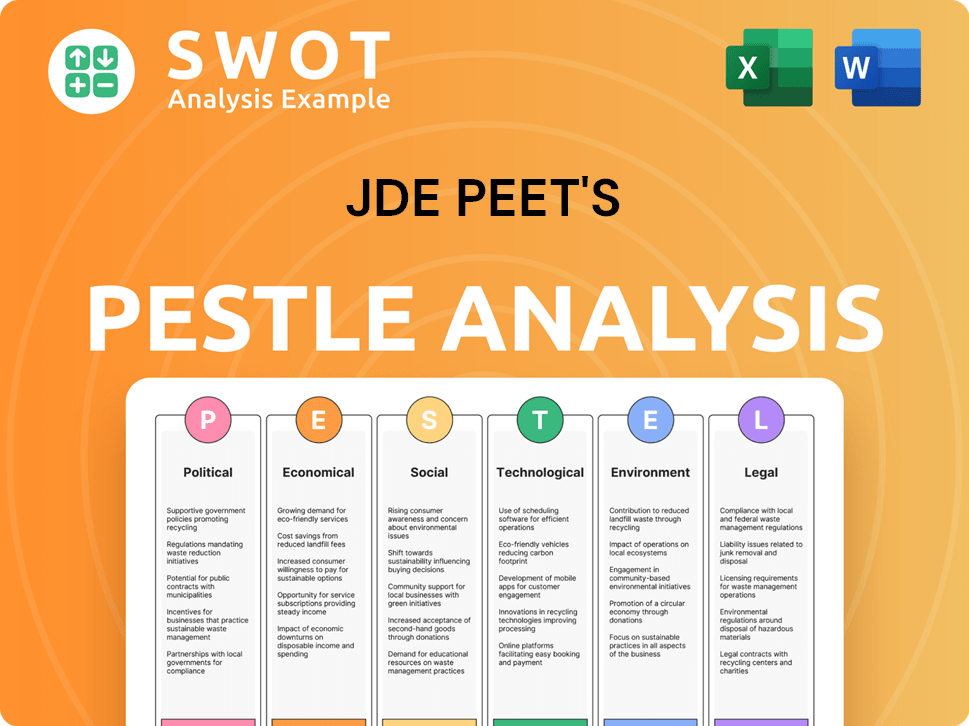

JDE Peet's PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on JDE Peet's’s Board?

The Board of Directors of JDE Peet's reflects its ownership structure, with significant representation from its largest shareholder, JAB Holding Company. As of early 2025, the board typically includes executive directors, non-executive directors representing major shareholders, and independent directors. Key individuals associated with JAB often hold prominent positions, including the Chairman of the Board. For instance, Olivier Goudet, a Partner at JAB, has historically served as the Chairman. Other board members include the CEO of JDE Peet's and various independent directors who bring external expertise. Understanding the Revenue Streams & Business Model of JDE Peet's can provide additional insights into the company's operations.

The composition of the board is crucial for understanding the company's strategic direction and governance. The presence of independent directors ensures a degree of oversight, even with JAB's controlling interest. The board's decisions significantly impact the company's performance and its response to market dynamics. The board's role in overseeing the company's financial performance, including its revenue and profitability, is also essential. The board's structure and the voting power dynamics are central to understanding the company's operations and strategic decisions.

| Board Member | Title | Affiliation |

|---|---|---|

| Olivier Goudet | Chairman | JAB Holding Company |

| Fabien Simon | CEO | JDE Peet's |

| Independent Directors | Various | Independent |

The voting structure of JDE Peet's is primarily based on a one-share-one-vote principle for its publicly traded shares. However, JAB Holding Company, through its substantial majority ownership, effectively wields outsized control. JAB's sheer volume of shares provides it with the dominant voting power on all significant corporate matters, including the election of directors, major strategic decisions, and approval of financial results. There have not been any widely reported proxy battles or activist investor campaigns against JDE Peet's since its IPO that have significantly challenged JAB's control.

JAB Holding Company is the primary owner of JDE Peet's, holding a majority stake and thus significant voting power.

- JAB's ownership ensures its influence over key decisions.

- The board composition reflects JAB's representation.

- One-share-one-vote principle, but JAB's volume dominates.

- No significant challenges to JAB's control have emerged.

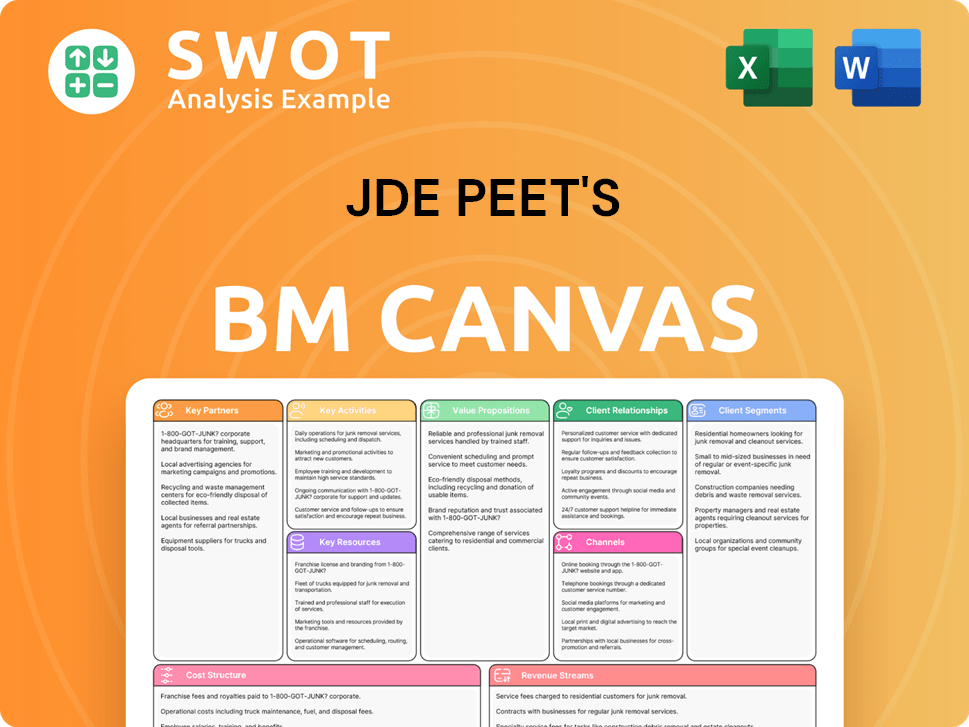

JDE Peet's Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped JDE Peet's’s Ownership Landscape?

In the past few years, the ownership landscape of the coffee giant, has seen key developments, particularly following its initial public offering (IPO) in May 2020. The primary driver of changes has been the company's post-IPO strategy, which focuses on organic growth, strategic acquisitions, and portfolio optimization. While the controlling ownership remains largely stable, with JAB Holding Company as the major shareholder, there have been movements in the publicly traded shares, reflecting the dynamic nature of institutional investment.

Institutional investors continue to show interest in the company. Various large asset managers and mutual funds have adjusted their holdings in late 2024 and early 2025, influencing the trading activity of the publicly available shares. There have been no significant share buybacks or secondary offerings that have drastically altered the overall ownership structure in recent years. The company's focus is on executing its strategy as a publicly listed entity with a strong anchor investor.

| Metric | Details | Recent Data (2024-2025) |

|---|---|---|

| IPO Date | Date of Initial Public Offering | May 2020 |

| Major Shareholder | Controlling Shareholder | JAB Holding Company |

| Recent Acquisitions | Strategic acquisitions to strengthen market position | Ongoing, bolt-on acquisitions |

The company has been pursuing strategic acquisitions to strengthen its market position and expand its product offerings. These acquisitions, while impacting the company's overall size and market reach, have not fundamentally altered the core ownership structure. Leadership changes have occurred as part of normal corporate succession planning. For instance, Fabien Simon was appointed CEO in September 2020, succeeding Casey Keller. For more details, explore the Growth Strategy of JDE Peet's.

The primary owner of the company is JAB Holding Company. The company is a publicly traded entity, and institutional investors also hold shares.

Yes, the company is listed on the Euronext Amsterdam stock exchange. This offers opportunities for public investment and influences the shareholder base.

The company's ownership structure has evolved through various acquisitions and the IPO. JAB Holding Company has been a consistent major shareholder.

Besides JAB Holding Company, various institutional investors hold significant stakes. These investors influence the trading activity and market perception.

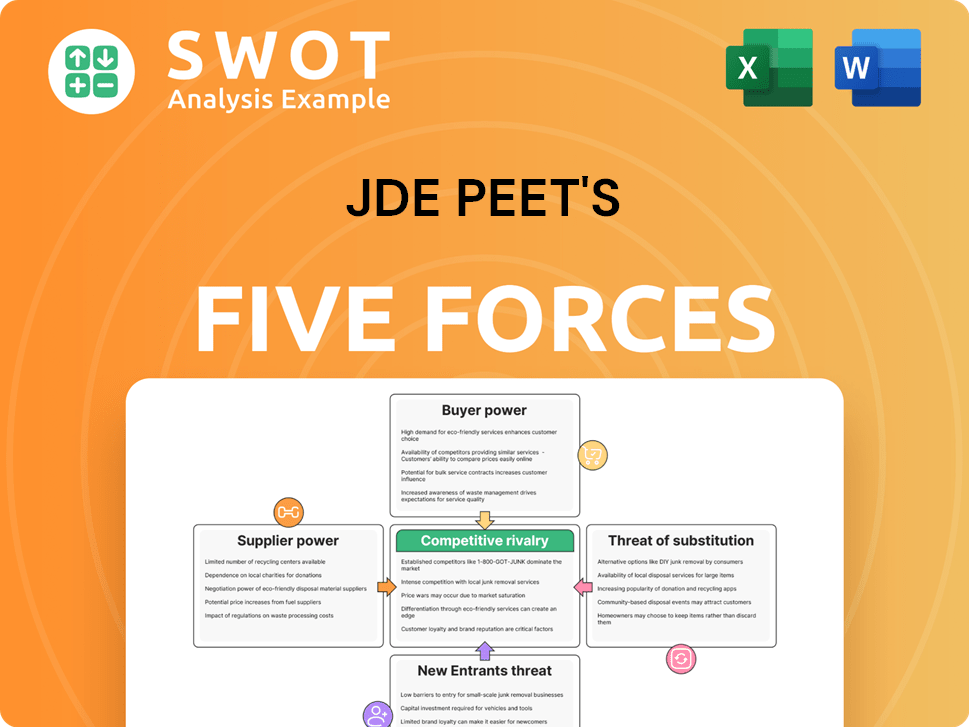

JDE Peet's Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JDE Peet's Company?

- What is Competitive Landscape of JDE Peet's Company?

- What is Growth Strategy and Future Prospects of JDE Peet's Company?

- How Does JDE Peet's Company Work?

- What is Sales and Marketing Strategy of JDE Peet's Company?

- What is Brief History of JDE Peet's Company?

- What is Customer Demographics and Target Market of JDE Peet's Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.