Jungheinrich Bundle

Can Jungheinrich Continue to Dominate the Intralogistics Landscape?

Jungheinrich AG, a titan in the intralogistics sector, is at a pivotal juncture, poised to leverage its rich history and innovative spirit to meet the evolving demands of the material handling equipment market. Founded in 1953, this forklift manufacturer has consistently pushed boundaries, evolving from its pioneering electric forklifts to comprehensive warehouse solutions. With ambitious strategies like Strategy 2025+ and 2030+, the company charts a course for sustained growth and market leadership.

This Jungheinrich SWOT Analysis delves into the company's strategic initiatives, examining its financial performance, market share analysis, and expansion plans. We will explore Jungheinrich's investment in automation, sustainability initiatives, and new product development, providing a comprehensive Jungheinrich company analysis. Furthermore, we'll assess the competitive landscape, supply chain optimization efforts, and long-term growth potential, offering actionable insights for investors and industry professionals alike, focusing on Jungheinrich's future prospects.

How Is Jungheinrich Expanding Its Reach?

The growth strategy of Jungheinrich, particularly under its Strategy 2030+, involves substantial global expansion, with a major focus on North America and the Asia-Pacific (APAC) region. This strategic direction aims to establish North America as a core market, comparable to Europe, and to secure a leading position (Top 3) in the APAC region. The company's approach is designed to capitalize on the increasing demand for intralogistics solutions worldwide.

A key element of this expansion strategy was the acquisition of the Storage Solutions group, based in Indiana, in 2023. This move was intended to enhance access to the attractive U.S. warehousing and automation market. The acquisition is expected to add over $300 million in annual revenues, supporting Jungheinrich's goal of generating over 20% of its sales outside of Europe, as outlined in its Strategy 2025+.

Beyond geographical expansion, Jungheinrich is actively extending its product portfolio and exploring new business models. These efforts are geared towards strengthening its position in the material handling equipment market and driving innovation in intralogistics.

The acquisition of Storage Solutions in 2023 was a pivotal step, providing enhanced access to the U.S. market. This move is expected to generate over $300 million in annual revenues, contributing significantly to Jungheinrich's goal of increasing sales outside Europe. The company is focused on establishing a strong presence in the North American market, aiming to make it a core market equivalent to Europe.

Jungheinrich aims to become a leading player (Top 3) in the Asia-Pacific (APAC) region. This expansion is part of the company's broader global growth strategy, focusing on increasing its market share and presence in key international markets. The APAC strategy is crucial for long-term growth and achieving the objectives outlined in Strategy 2030+.

Jungheinrich is actively expanding its product offerings to meet the evolving needs of the material handling equipment market. This includes strategic partnerships and new product development initiatives. The goal is to provide a comprehensive range of intralogistics solutions to customers worldwide.

The company is focused on productivity and sustainability initiatives to drive business transformation. These efforts are designed to improve operational efficiency and reduce environmental impact. This approach is essential for long-term competitiveness and aligns with the growing demand for sustainable solutions.

A significant initiative is the strategic partnership with EP Equipment, announced in May 2024, aimed at accelerating the global electrification of the material handling industry. This collaboration will introduce a new Mid-Tech brand, 'AntOn by Jungheinrich,' focusing on electric counterbalance and warehouse trucks, thereby broadening its product offerings and enhancing its position in the electric forklift market. The company anticipates that warehouse automation will grow by 8% annually over the next five years, and Jungheinrich aims to outperform this market growth. To learn more about the company's overall performance, please read our article on Jungheinrich's financial performance.

- Partnership with EP Equipment to drive electrification.

- Launch of 'AntOn by Jungheinrich' for electric trucks.

- Focus on outperforming the 8% annual growth in warehouse automation.

- Expansion into new markets and product segments.

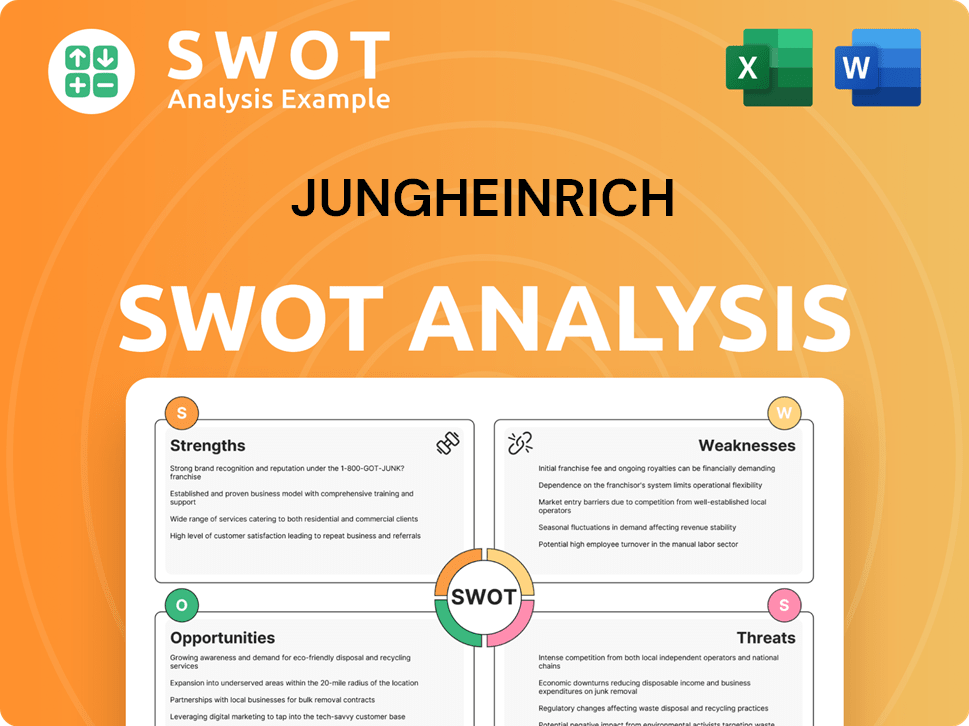

Jungheinrich SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Jungheinrich Invest in Innovation?

The Jungheinrich growth strategy is significantly shaped by its commitment to innovation and technological advancements. This focus is particularly evident in its investment in automation, digitalization, and energy systems. The company aims to meet evolving customer demands for efficient and sustainable intralogistics solutions.

Jungheinrich's future prospects are closely tied to its ability to integrate cutting-edge technologies into its product offerings. This includes the development of 'digital warehouses' using AI and Big Data, as well as the expansion of its electric forklift market. The company's strategic moves position it to capitalize on the growing demand for advanced material handling solutions.

Jungheinrich company analysis reveals a strong emphasis on research and development, particularly in areas like lithium-ion technology and mobile robotics. Through strategic acquisitions and internal innovation, the company is enhancing its capabilities to offer comprehensive intralogistics solutions.

Jungheinrich is heavily investing in automation and digitalization to optimize warehouse operations. The company is developing 'digital warehouses' that leverage AI and Big Data. This initiative aims to improve efficiency and streamline material flow within warehouses.

Jungheinrich is focusing on lithium-ion technology to enhance energy storage systems. The company aims for a lithium-ion equipment ratio of over 70% among the trucks it sells by 2025. This shift supports the company's sustainability goals and improves operational efficiency.

Jungheinrich has made strategic acquisitions to strengthen its technological capabilities. These include robotics specialist Magazino and autonomous mobile robot (AMR) technology company arculus. These acquisitions enhance Jungheinrich's ability to offer fully integrated warehouse solutions.

Jungheinrich is actively pursuing digital transformation to improve its offerings. The company aims for 75% of its trucks to be fully networked ex works, enabling intelligent data use. This focus on connectivity allows for enhanced operational insights and efficiency.

Jungheinrich is deeply committed to sustainability, aiming for net-zero greenhouse gas emissions for Scope 1 and 2 by 2030 and across Scope 1, 2, and 3 by 2050. This commitment is evidenced by its EcoVadis Platinum award for three consecutive years. This demonstrates the company's dedication to environmental responsibility.

Jungheinrich's R&D activities in the first half of 2024 concentrated on new material handling equipment. This included a strong emphasis on lithium-ion technology and the development of mobile robots. The company is continuously optimizing automated systems to meet market demands.

Jungheinrich's innovation strategy is centered on several key technological developments, including advancements in automation, digitalization, and sustainable energy solutions. These initiatives are critical for maintaining a competitive edge in the material handling equipment market.

- Artificial Intelligence (AI) and Big Data: Utilizing AI and Big Data to enhance warehouse efficiency and optimize operations.

- Mobile Robots: Developing and integrating mobile robots to automate material handling processes.

- Lithium-Ion Technology: Expanding the use of lithium-ion batteries to improve energy efficiency and sustainability.

- Digital Warehouses: Creating fully connected and automated warehouse solutions.

- Networked Trucks: Increasing the number of fully networked trucks to enable intelligent data use.

For further insights into the company's values and mission, you can read about the Mission, Vision & Core Values of Jungheinrich.

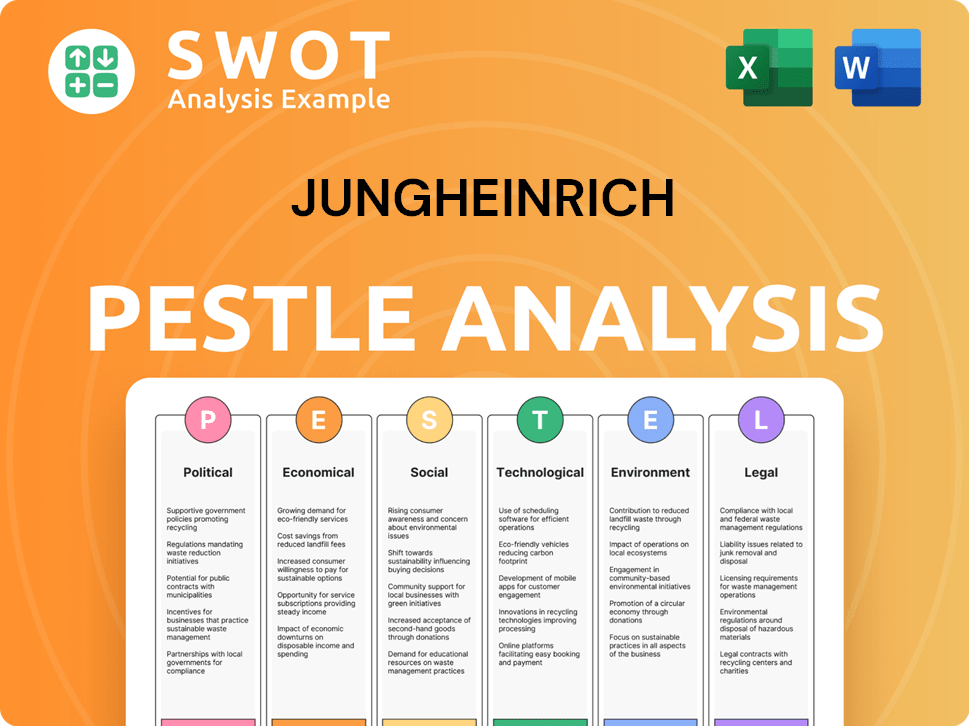

Jungheinrich PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Jungheinrich’s Growth Forecast?

The financial outlook for Jungheinrich is positive, with the company demonstrating resilience in the face of market challenges. For the fiscal year 2024, the company showed solid performance, and the projections for 2025 indicate continued growth. This positive trajectory is supported by strategic initiatives aimed at expanding market presence and enhancing operational efficiency.

In 2024, incoming orders reached €5.311 billion, reflecting a 1.4% increase year-on-year. Group revenue also saw an increase, reaching €5.392 billion. The company's focus on financial discipline resulted in a free cash flow of €431 million, significantly surpassing the guidance of over €300 million. This strong financial performance sets a solid foundation for future growth and expansion.

Jungheinrich's commitment to innovation and strategic investments positions it well to capitalize on the evolving demands of the material handling equipment market. The company's focus on intralogistics solutions, including electric forklifts and warehouse solutions, is expected to drive further growth. For a deeper understanding of the company's target market, you can explore the Target Market of Jungheinrich.

For 2025, Jungheinrich anticipates incoming orders to be between €5.5 billion and €6.1 billion. Group revenue is projected to be between €5.4 billion and €6.0 billion. These figures indicate a continued upward trend in both orders and revenue, reflecting the company's ability to secure and fulfill customer demand.

The company estimates EBIT for 2025 to be between €430 million and €500 million, with an anticipated EBIT return on sales of between 7.8% and 8.6%. These projections highlight the company's focus on maintaining profitability and operational efficiency.

EBT is expected to reach between €400 million and €470 million, with an EBT return on sales forecast between 7.3% and 8.1%. The Return on Capital Employed (ROCE) for 2025 is projected to be between 15.0% and 19.0%. These metrics demonstrate the company's ability to generate strong returns on its investments.

Jungheinrich anticipates free cash flow to be more than €300 million in 2025. Furthermore, the ambitious Strategy 2030+ targets revenues of €10 billion and an EBIT margin of 10% by 2030 through organic growth. The company also aims for an average cash conversion rate of over 80% within the strategy timeframe.

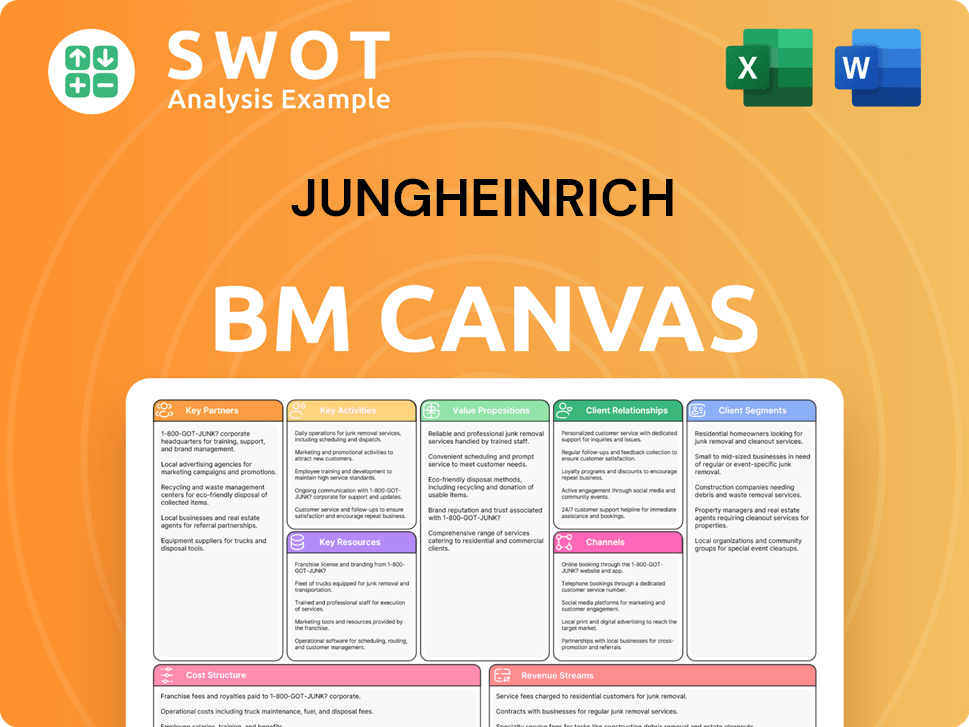

Jungheinrich Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Jungheinrich’s Growth?

The Jungheinrich growth strategy faces several potential risks and obstacles, particularly within the current global economic climate. The company's performance is sensitive to economic downturns and market volatility, which can impact its financial results. These challenges require strategic adaptability and proactive measures to maintain and enhance Jungheinrich's future prospects.

A key risk is the challenging market environment, especially in Europe, where economic weakness and fluctuating market conditions persist. These factors can affect demand for material handling equipment and intralogistics solutions, potentially leading to lower sales volumes and reduced profitability. The company's operations are also subject to risks related to geopolitical tensions, supply chain disruptions, and the competitive landscape within the material handling equipment market.

Internal factors, such as cautious personnel policies, can also influence operational effectiveness. For instance, a reduction in the workforce, as seen in the first half of 2024, may affect the company's capacity to meet market demands and execute its strategic initiatives. To navigate these challenges, Jungheinrich focuses on its long-term strategies.

Economic weakness, particularly in Europe, presents a significant challenge, impacting demand for material handling equipment and intralogistics solutions. The decline in new business, as observed in 2024, exemplifies the vulnerability to market fluctuations, directly affecting Jungheinrich's financial performance.

The material handling equipment market is highly competitive, with numerous suppliers vying for market share. This competitive pressure can affect pricing strategies and profitability margins, necessitating continuous innovation and differentiation to maintain a competitive edge. Marketing Strategy of Jungheinrich must adapt to the changing market conditions.

Geopolitical instability can disrupt supply chains and increase operational costs. The company's 2025 forecast relies on the assumption that geopolitical tensions will not escalate, highlighting the sensitivity of its business to global political developments. This affects Jungheinrich's supply chain optimization efforts.

Technological advancements require continuous investment in Jungheinrich's new product development and innovation. The rapid evolution of intralogistics solutions, including automation and electric forklifts, demands that the company stays at the forefront of these technological changes. This impacts Jungheinrich's innovation in intralogistics.

Cautious personnel policies and other resource limitations can affect the company's ability to meet market demands and implement its strategic initiatives. The reduction in employees observed in the first half of 2024 highlights the impact of internal resource constraints on operational capacity. This affects Jungheinrich's expansion plans in Europe.

Disruptions in the supply chain can impact production, increase costs, and delay deliveries. The company's reliance on global supply chains makes it vulnerable to external shocks, necessitating robust risk management and diversification strategies to maintain operational efficiency and customer satisfaction. This affects Jungheinrich's global presence.

To mitigate these risks, Jungheinrich is focused on its Strategy 2025+ and Strategy 2030+, which aim to boost profitability, efficiency, and sustainability. Cost-saving measures and price increases are implemented to protect earnings. Diversifying revenue streams, as seen with growth in after-sales services, is crucial. The company's commitment to a reliable dividend policy contributes to financial resilience, ensuring Jungheinrich's long-term growth potential.

The company proactively adjusts its operations to address market challenges. This includes optimizing supply chains, investing in automation, and expanding its service offerings. The focus on electric forklifts and warehouse solutions reflects the company's commitment to innovation and sustainability. These efforts are crucial for navigating Jungheinrich's challenges and opportunities.

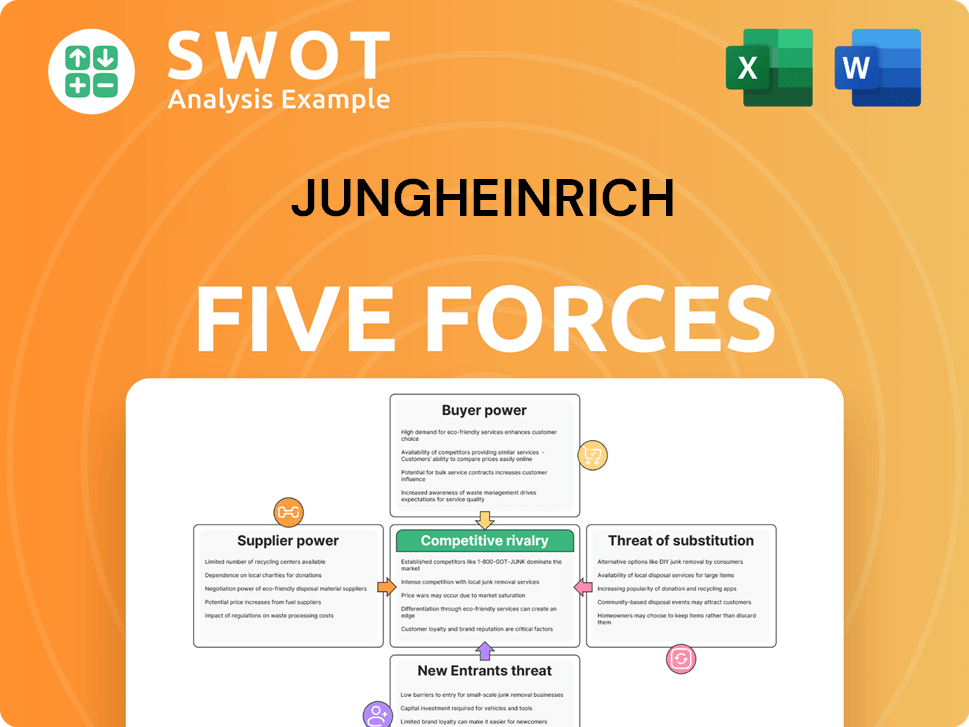

Jungheinrich Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Jungheinrich Company?

- What is Competitive Landscape of Jungheinrich Company?

- How Does Jungheinrich Company Work?

- What is Sales and Marketing Strategy of Jungheinrich Company?

- What is Brief History of Jungheinrich Company?

- Who Owns Jungheinrich Company?

- What is Customer Demographics and Target Market of Jungheinrich Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.