Kerry Properties Bundle

Can Kerry Properties Continue Its Ascent in the Real Estate Market?

In the ever-evolving world of real estate, understanding a company's growth strategy is crucial for savvy investors and industry professionals. Kerry Properties, a leading Real Estate Company, has a rich history and a significant presence in the Asian market. Founded in Hong Kong, this Property Development giant has consistently adapted to market dynamics. This article delves into Kerry Properties' strategic roadmap for future success.

To truly grasp Kerry Properties' future, we'll explore its Kerry Properties SWOT Analysis, examining its strengths, weaknesses, opportunities, and threats. We will also analyze the company's investment portfolio and expansion plans, particularly within the Hong Kong Market and China. This analysis will provide a comprehensive understanding of how Kerry Properties plans to navigate economic trends and maintain its competitive advantages in the real estate sector, including its residential property portfolio and commercial property portfolio.

How Is Kerry Properties Expanding Its Reach?

Kerry Properties, a prominent Real Estate Company, is actively pursuing expansion initiatives to strengthen its market position and diversify its revenue streams. The company's Growth Strategy centers on strategic investments in key locations within Mainland China and Hong Kong. This approach aims to capitalize on the rising demand for high-quality urban living and commercial spaces, ensuring sustained growth and profitability.

A core element of Kerry Properties' expansion strategy involves the development of integrated mixed-use projects. These projects combine residential, retail, and office components, creating vibrant and self-contained communities. This strategy is designed to attract a diverse customer base and generate multiple revenue streams, contributing to the company's long-term financial stability. The company's focus on prime locations reflects a commitment to delivering premium real estate offerings.

In 2024, Kerry Properties continued to focus on its core markets, with new residential project launches anticipated in Hong Kong and key Mainland Chinese cities. The company also aims to expand its logistics and industrial property portfolio, recognizing the increasing demand driven by e-commerce growth. These initiatives are designed to access new customer segments, enhance asset diversification, and stay ahead of evolving industry trends. For a deeper understanding of the company's origins and evolution, consider reading the Brief History of Kerry Properties.

Kerry Properties prioritizes investments in prime locations within Mainland China and Hong Kong. This strategy focuses on integrated mixed-use developments. These developments combine residential, retail, and office components to create comprehensive urban spaces.

The company is expanding its logistics and industrial property portfolio. This expansion recognizes the increasing demand driven by e-commerce growth. Exploring opportunities in strategic logistics hubs is a key focus.

Kerry Properties concentrates on its core markets, particularly Hong Kong and key Mainland Chinese cities. New residential project launches are planned in these areas. This focus ensures the company leverages its existing expertise and market knowledge.

The company aims to enhance asset diversification through its expansion initiatives. This diversification helps mitigate risks and ensures a more stable financial performance. Diversifying its portfolio is a key element of Kerry Properties' strategy.

Kerry Properties' expansion strategy includes investments in mixed-use developments and logistics properties. These initiatives are designed to capitalize on market trends and enhance the company's portfolio. The company is focusing on strategic growth in its core markets.

- Focus on prime locations in Mainland China and Hong Kong.

- Development of integrated mixed-use projects.

- Expansion of logistics and industrial property portfolio.

- Strategic focus on core markets for residential projects.

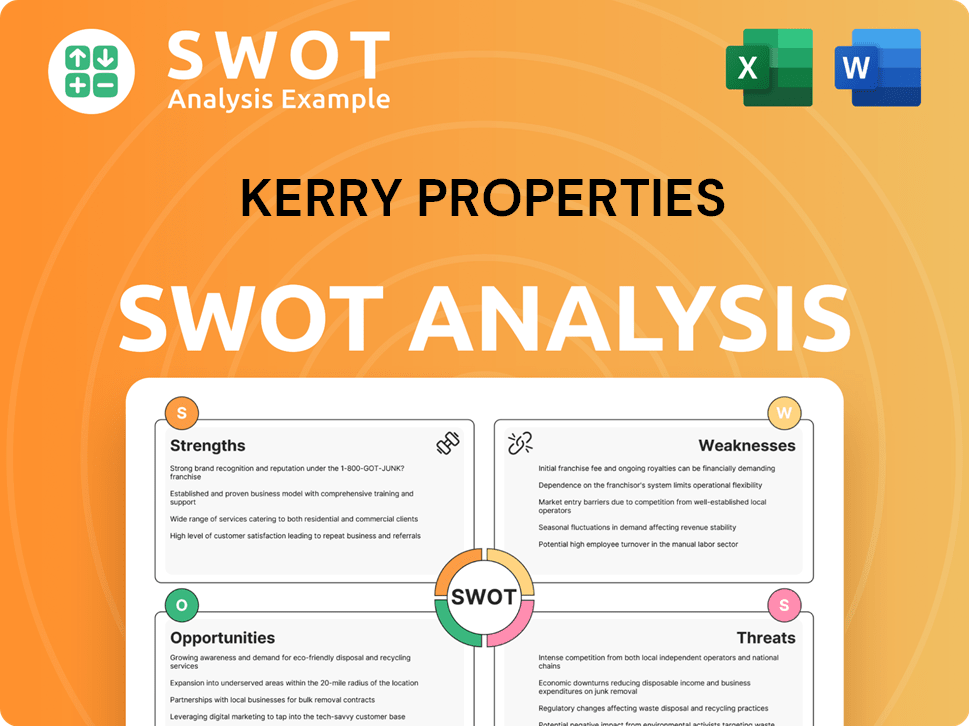

Kerry Properties SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kerry Properties Invest in Innovation?

Kerry Properties, a prominent real estate company, strategically integrates innovation and technology to enhance its growth strategy. This approach is crucial for maintaining a competitive edge in the dynamic Hong Kong market and beyond. The company's focus on technological advancements drives operational efficiency and improves the value proposition of its property offerings.

The company's commitment to digital transformation is evident in its adoption of smart building technologies and digital platforms. These initiatives aim to improve customer experiences and streamline property management. By leveraging technology, Kerry Properties aims to create modern, sustainable, and technologically advanced properties.

Kerry Properties utilizes data analytics to inform design, development, and marketing strategies. This enables more precise market targeting and product offerings, optimizing investment returns. Sustainability is also a key part of their strategy, aligning with global trends and regulatory requirements.

Kerry Properties implements smart building technologies to enhance operational efficiency and improve property value. These technologies include IoT solutions for property management, optimizing energy consumption, and improving security in both commercial and residential developments.

The company is increasingly adopting digital transformation initiatives to enhance customer experiences through digital platforms. This includes the use of data analytics to inform design, development, and marketing strategies. These initiatives allow for more precise market targeting and product offerings.

Sustainability initiatives, such as green building certifications and energy-efficient designs, are integral to Kerry Properties' strategy. These initiatives align with global trends and regulatory requirements. The company is committed to creating modern, sustainable, and technologically advanced properties.

Kerry Properties explores the use of data analytics to inform design, development, and marketing strategies. Data analytics allows for more precise market targeting and product offerings. This leads to more informed investment decisions and effective property development strategies.

While specific details on R&D investments or patents are not always publicly detailed, the company's commitment to technological advancements underscores its focus on innovation. This investment in technology is a key component of the company's growth strategy.

Kerry Properties leverages technology to drive operational efficiency. This includes the implementation of IoT solutions for property management, optimizing energy consumption, and improving security. These improvements contribute to the company's overall financial performance.

Kerry Properties integrates several key technological and innovation strategies to enhance its market position and drive Growth Strategy. These strategies are crucial for its Real Estate Company's success in the Hong Kong Market.

- Smart Building Integration: Implementing IoT solutions for property management, optimizing energy consumption, and enhancing security.

- Digital Platforms: Enhancing customer experiences and streamlining property management through digital platforms.

- Data Analytics: Using data analytics to inform design, development, and marketing strategies, leading to more precise market targeting.

- Sustainability Initiatives: Focusing on green building certifications and energy-efficient designs to align with global trends and regulations.

- R&D and Innovation: Continuous exploration of new technologies and sustainable practices to create modern and technologically advanced properties.

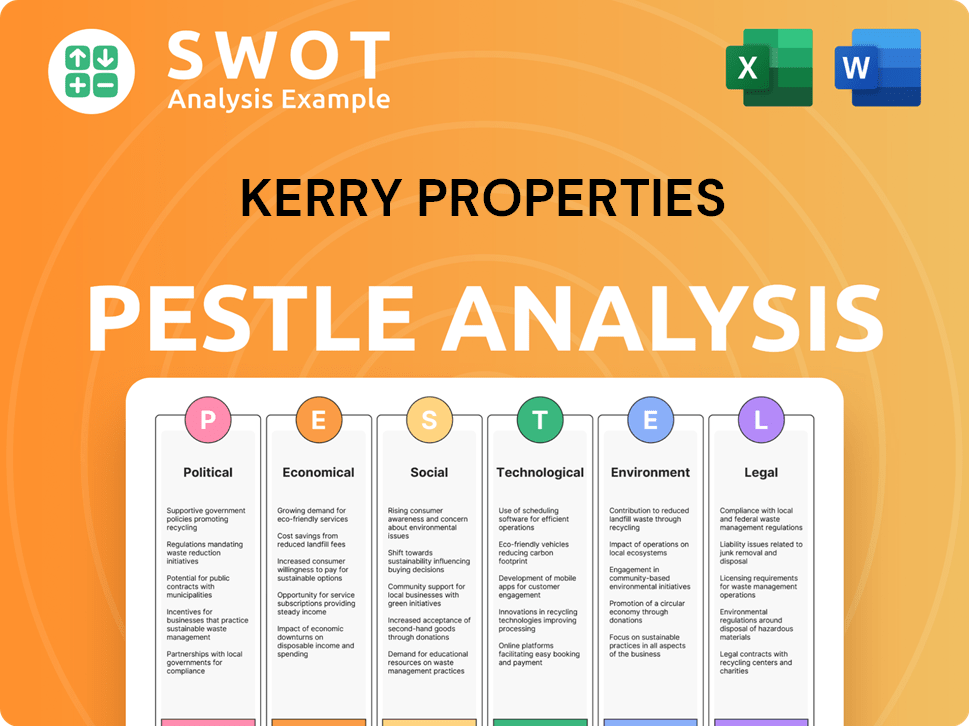

Kerry Properties PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Kerry Properties’s Growth Forecast?

The financial outlook for Kerry Properties, a prominent Real Estate Company, is largely shaped by its strategic investments and robust property portfolio. In the fiscal year 2023, the company showcased its resilience by reporting a core profit of HK$3,622 million. This performance underscores the effectiveness of its diversified business model, which includes both property development and investment holdings.

Looking ahead to 2024 and beyond, the Growth Strategy of Kerry Properties emphasizes disciplined capital deployment. The company aims to balance new investments with maintaining a healthy financial position. This approach is critical for navigating market fluctuations and ensuring long-term sustainability. Analysts are closely monitoring the company's strategies in the Hong Kong Market and its expansion plans.

The company's commitment to sustainable shareholder returns and expanding its asset base remains a key focus. The company's residential development pipeline is also expected to contribute significantly to future revenue, with several projects slated for completion and sale in 2024 and beyond. This includes strategic projects within its Investment Portfolio.

Kerry Properties generates revenue primarily from property development and investment properties. Property sales from residential and commercial projects form a significant portion of its income. Rental income from its investment portfolio, including commercial and retail spaces, provides a stable revenue stream.

In 2023, Kerry Properties reported a core profit of HK$3,622 million. The company's financial performance reflects its ability to adapt to market conditions. The strong balance sheet allows the company to pursue new opportunities and weather market fluctuations.

Kerry Properties' investment strategy focuses on long-term value creation through strategic acquisitions and developments. The company carefully selects projects that align with its growth objectives. The company's focus is on expanding its asset base and enhancing recurring income.

Future development projects include residential and commercial properties in key locations. The company has several projects slated for completion and sale in 2024 and beyond. These projects are expected to contribute significantly to future revenue.

Key financial metrics for Kerry Properties include revenue, core profit, and net asset value. The company's financial health is reflected in its strong balance sheet and disciplined approach to capital deployment. The company's long-term financial goals include delivering sustainable shareholder returns.

- Core Profit: HK$3,622 million (2023)

- Focus: Disciplined capital deployment

- Goal: Expanding asset base and enhancing recurring income

- Outlook: Stable revenue streams from investment properties

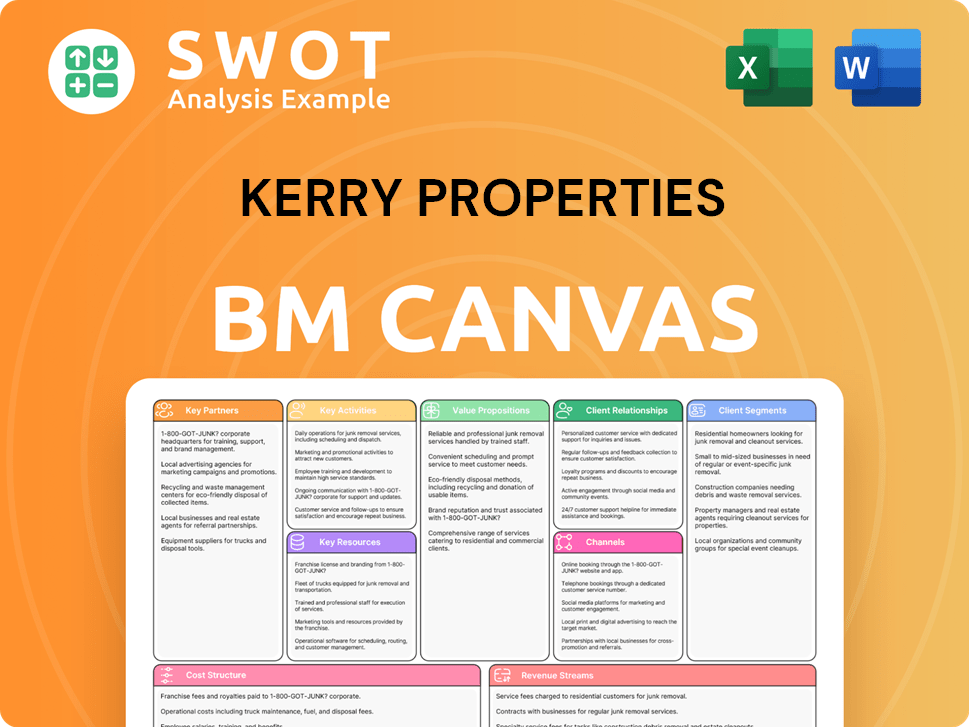

Kerry Properties Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Kerry Properties’s Growth?

As a leading Real Estate Company, Kerry Properties faces several potential risks that could influence its Growth Strategy. These challenges range from market competition to regulatory changes, each potentially impacting its Property Development and overall financial performance. Understanding these risks is crucial for evaluating the company's long-term prospects.

Market dynamics, particularly in key areas like the Hong Kong Market and Mainland China, present ongoing challenges. The company must navigate intense competition and adapt to changing economic conditions. Furthermore, external factors such as supply chain disruptions and geopolitical tensions can also introduce uncertainty.

Regulatory changes and economic fluctuations are significant factors that could affect Kerry Properties' performance. Changes in interest rates, mortgage policies, or environmental regulations can influence buyer demand and project viability. These factors contribute to the complexity of managing its Investment Portfolio.

The real estate market is highly competitive, especially in prime locations. Numerous developers, both local and international, compete for projects, which can affect profit margins and project timelines. Kerry Properties must continuously innovate and differentiate itself to maintain a competitive edge.

Changes in government regulations, including property cooling measures, land policies, and environmental standards, can impact development timelines and profitability. Adapting to these changes requires agility and strategic planning. For example, stricter building codes could increase construction costs.

Economic downturns in key markets and geopolitical tensions can reduce consumer confidence and investment activity. These factors can lead to decreased demand for properties and affect the company's financial performance. The company's exposure to economic cycles is a key risk factor.

Vulnerabilities in the supply chain, especially concerning construction materials and labor, can lead to project delays and increased costs. These disruptions can significantly impact project completion times and overall profitability. Efficient supply chain management is therefore critical.

Changes in interest rates and mortgage policies can affect buyer demand and project feasibility. Higher interest rates can increase borrowing costs for both developers and buyers, potentially cooling the market. Kerry Properties must monitor and adapt to these changes.

Increasingly stringent environmental regulations can affect development projects. Compliance with new standards may require additional investment and adjustments to project designs and timelines. Sustainable development initiatives are becoming increasingly important.

To mitigate these risks, Kerry Properties employs a diversified portfolio strategy, investing across different property types and geographies. This diversification helps spread risk and reduces the impact of any single market downturn. For instance, diversifying into both residential and commercial properties can provide stability.

The company maintains a strong risk management framework, including thorough due diligence on new projects and constant monitoring of market conditions. This proactive approach allows Kerry Properties to adapt its strategies swiftly. Regular market analysis and scenario planning are essential components.

Kerry Properties Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kerry Properties Company?

- What is Competitive Landscape of Kerry Properties Company?

- How Does Kerry Properties Company Work?

- What is Sales and Marketing Strategy of Kerry Properties Company?

- What is Brief History of Kerry Properties Company?

- Who Owns Kerry Properties Company?

- What is Customer Demographics and Target Market of Kerry Properties Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.