Kerry Properties Bundle

Who Really Controls Kerry Properties?

Unraveling the ownership of a real estate giant like Kerry Properties is key to understanding its strategic moves and future prospects. From its beginnings to its current status, the company's ownership structure has significantly influenced its trajectory in the dynamic Hong Kong property market and beyond. Discover how the evolving ownership landscape has shaped the Kerry Properties SWOT Analysis and its overall market position.

Understanding who owns Kerry Properties is crucial for anyone looking to invest in or analyze the Hong Kong property market. This exploration delves into Kerry Properties ownership, from its foundational roots to its current structure, revealing the key players and their influence. Explore the company's history, major shareholders, and how these elements impact its strategic direction and financial performance in the ever-changing real estate landscape.

Who Founded Kerry Properties?

The story of Kerry Properties, a prominent real estate company, begins with Robert Kuok, a Malaysian-born entrepreneur. His vision laid the foundation for what would become a significant player in the Hong Kong property market. Kerry Properties' origins are closely tied to the broader business empire built by Kuok, particularly through Kerry Group.

Officially incorporated in 1978, Kerry Properties' early structure was rooted in the Kuok family's and associated entities' ownership under the Kerry Group. This structure provided a solid base for the company's initial ventures. While specific equity splits among family members at the beginning aren't publicly detailed in early records, the company's beginnings were firmly within a larger private conglomerate.

Early financial backing for Kerry Properties came from the Kuok Group's strong financial standing and diverse business interests, rather than external investors. This internal funding model allowed the company to develop its initial property portfolio without immediate external equity dilution. The centralized control structure, driven by Robert Kuok's strategic foresight, enabled a focused approach to property development and investment in key Asian markets.

Kerry Properties was founded by Robert Kuok, a Malaysian-born businessman. He established the Kuok Group, which served as the parent company.

The initial ownership was primarily held within the Kuok family and entities under the Kerry Group. This structure provided a strong financial foundation.

The company was funded internally through the Kuok Group's resources. This approach avoided early external equity dilution.

Robert Kuok's vision led to a centralized control structure. This approach enabled focused property development and investment.

There were no publicly documented early ownership disputes or buyouts. Control remained firmly within the Kuok family.

Robert Kuok's strategic foresight was key to the company's early success. This laid the groundwork for future expansion.

Understanding the early ownership of Kerry Properties provides insight into its development. The company's roots in the Kuok Group and its internal funding model were critical. For more details, check out the Revenue Streams & Business Model of Kerry Properties.

- Kerry Properties' initial ownership was within the Kuok family and related entities.

- The Kuok Group provided financial backing, avoiding external equity dilution.

- Robert Kuok's strategic vision guided the company's early development.

- The centralized control structure enabled a focused approach to property development.

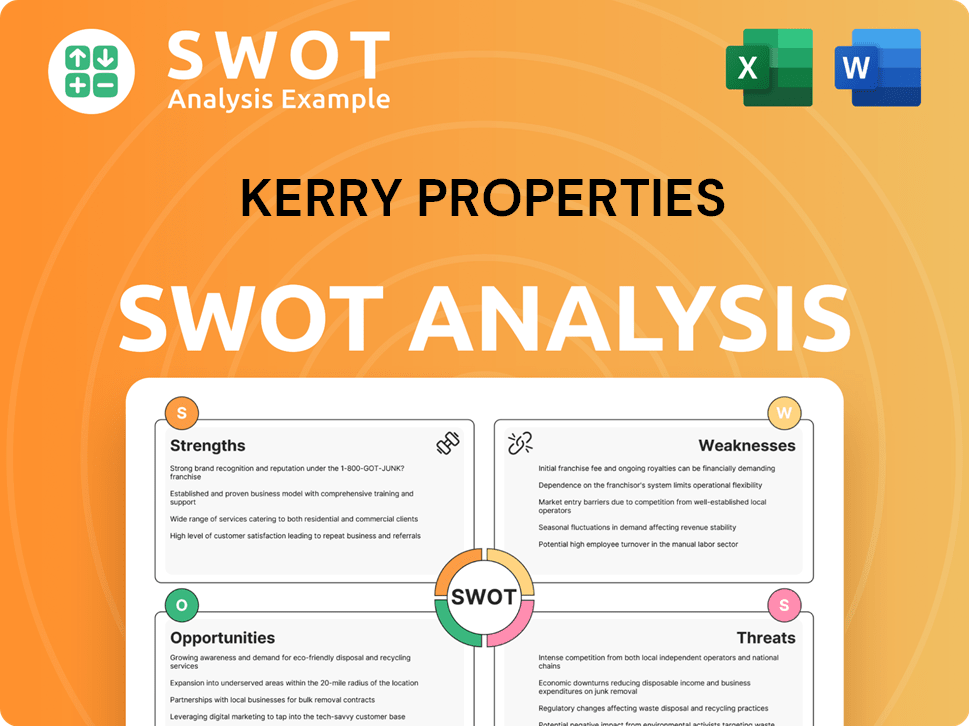

Kerry Properties SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Kerry Properties’s Ownership Changed Over Time?

The evolution of Kerry Properties' ownership structure has been marked by key events, most notably its initial public offering (IPO) in 1996. This transition to a publicly listed status on the Hong Kong Stock Exchange broadened its shareholder base, introducing institutional and individual investors. The IPO was a pivotal moment, solidifying its presence in the Hong Kong property market and setting the stage for future growth. The Brief History of Kerry Properties provides further insights into the company's journey.

Following the IPO, the Kuok family, through various holding companies, has consistently maintained a significant controlling interest in Kerry Properties. This sustained family ownership has been a defining characteristic, influencing strategic decisions and the company's long-term development approach. The Kuok family's continued influence has allowed Kerry Properties to focus on stability and strategic growth, often prioritizing long-term value creation over short-term market fluctuations.

| Event | Impact on Ownership | Date |

|---|---|---|

| Initial Public Offering (IPO) | Expanded shareholder base, introduction of public float | 1996 |

| Kuok Family's Continued Control | Maintained significant influence over strategic decisions | Ongoing |

| Institutional Investor Participation | Significant portion of public float held by asset management firms | Ongoing |

As of early 2025, the major stakeholder in Kerry Properties ownership remains the Kuok family, primarily through Kerry Holdings Limited. Recent filings indicate that Kerry Holdings Limited held approximately 56.09% of the shares as of the end of 2024. Institutional investors hold substantial portions of the remaining public float, but their collective ownership does not typically challenge the Kuok family's controlling stake. This structure ensures the family's continued influence over the real estate company's strategic direction and corporate governance.

The Kuok family, through Kerry Holdings Limited, maintains a controlling interest in Kerry Properties.

- The IPO in 1996 broadened the shareholder base.

- Institutional investors hold a significant portion of the public float.

- Family control influences long-term strategic decisions.

- The company's focus is on stability and strategic growth.

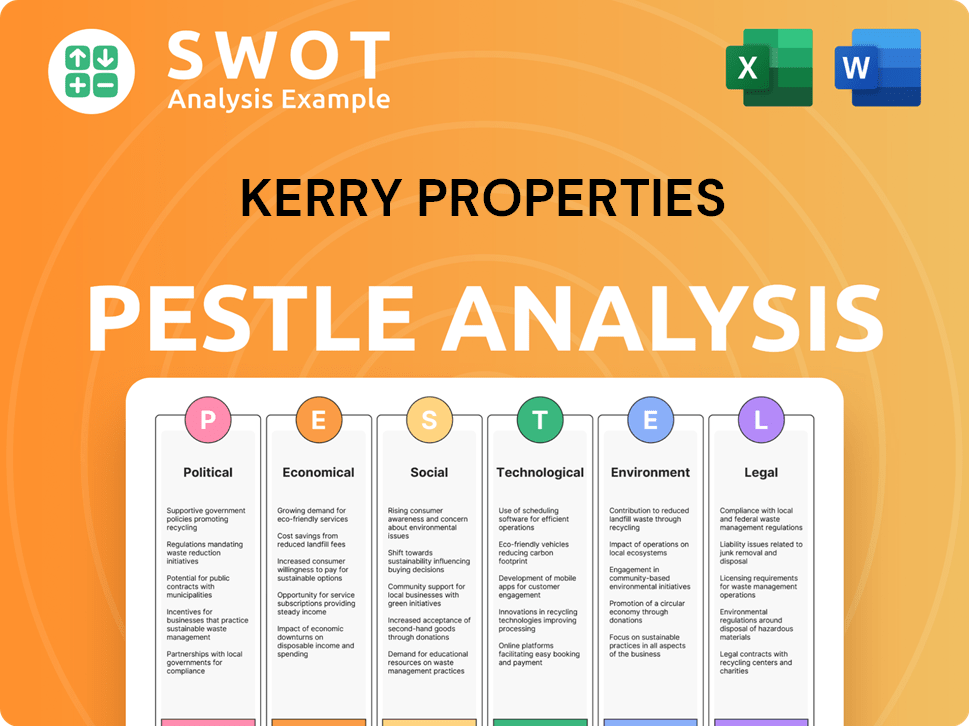

Kerry Properties PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Kerry Properties’s Board?

The current Board of Directors of Kerry Properties reflects a mix of family representation, long-standing executives, and independent non-executive directors, adhering to Hong Kong's corporate governance standards. As of early 2025, key board members often include members of the Kuok family, representing the major shareholder, Kerry Holdings Limited. Mr. Kuok Khoon Loong, also known as Mr. Beau Kuok, serves as the Chairman and an Executive Director, directly representing the interests of the controlling family. Other executive directors typically consist of experienced professionals with extensive experience in the property sector, often having risen through the ranks within Kerry Properties or the broader Kerry Group.

Independent Non-Executive Directors (INEDs) are appointed to provide independent oversight and contribute diverse perspectives, fulfilling regulatory requirements for listed companies. While these INEDs play a crucial role in corporate governance, the voting structure of Kerry Properties primarily operates on a one-share-one-vote basis for its ordinary shares. However, the substantial shareholding of Kerry Holdings Limited grants the Kuok family significant control and voting power, effectively allowing them to direct the company's strategic direction and approve major resolutions. There are no publicly disclosed dual-class shares or special voting rights that grant disproportionate power beyond the direct shareholding.

| Board Member | Title | Relationship |

|---|---|---|

| Kuok Khoon Loong (Beau Kuok) | Chairman and Executive Director | Represents Kerry Holdings Limited |

| Executive Directors | Various | Seasoned property professionals |

| Independent Non-Executive Directors | Various | Provides independent oversight |

The primary voting power rests with Kerry Holdings Limited, the major shareholder of Kerry Properties' marketing strategy. This structure ensures a consistent strategic vision, largely insulated from external pressures for radical shifts in direction. The board's composition and the family's voting power maintain a stable strategic direction.

The Kuok family, through Kerry Holdings Limited, holds significant voting power in Kerry Properties.

- The board includes family members, executive directors, and independent non-executive directors.

- One-share-one-vote structure, but the major shareholder has controlling influence.

- The company's strategic direction is largely determined by the controlling shareholder.

- Focus on long-term strategic vision and stability.

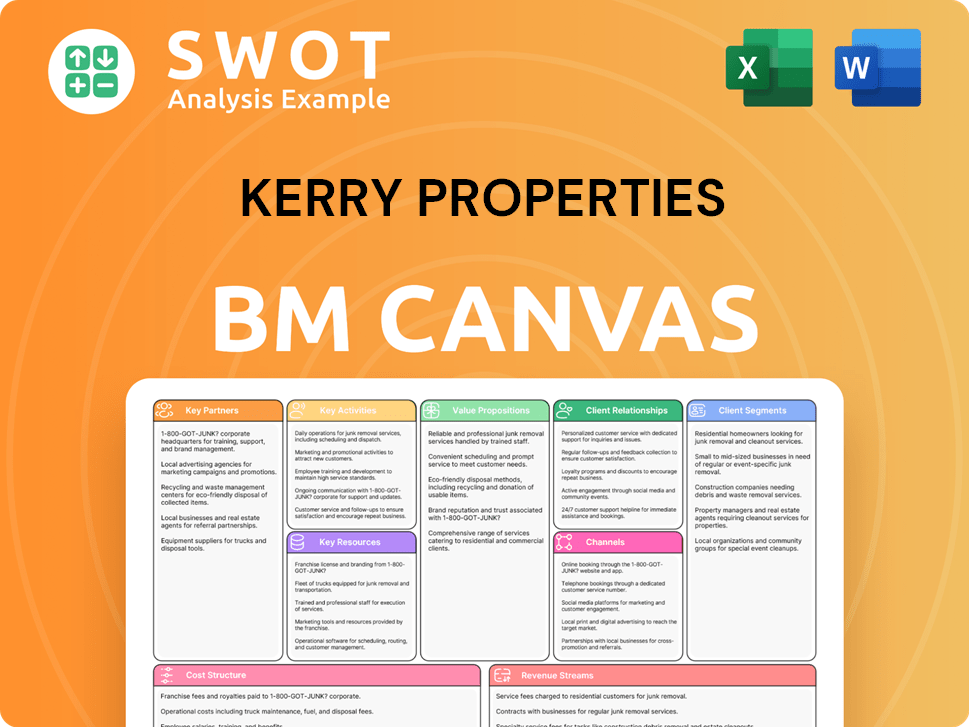

Kerry Properties Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Kerry Properties’s Ownership Landscape?

Over the past few years, the ownership structure of Kerry Properties has remained relatively stable. The Kuok family's significant stake continues to define the company's ownership profile. While there haven't been drastic changes like major share buybacks, the company's strategic moves, such as expanding its investment property portfolio, particularly in Mainland China, have been consistent.

Industry trends like the growing influence of institutional investors have had a limited impact due to the family's control. Mergers and acquisitions tend to be asset-specific, not corporate takeovers. Leadership changes are typically managed internally, and there are no public plans for privatization or significant ownership shifts, indicating a commitment to the current model. You can find more insights into the company's target market in this article: Target Market of Kerry Properties.

| Key Aspect | Details | Recent Data (2024-2025) |

|---|---|---|

| Ownership Stability | Kuok family's controlling stake | Maintained, no significant changes reported. |

| Institutional Investor Influence | Incremental increase in public float ownership | Minor increases observed, no major impact on control. |

| Strategic Investments | Focus on expanding investment property portfolio | Continued expansion in Mainland China and other regions. |

The stability in Kerry Properties ownership reflects a long-term strategic approach. The company’s emphasis on investment properties and its continued commitment to its current ownership structure are key factors. The absence of major ownership changes indicates a focus on sustainable growth and development within its existing framework.

The Kuok family maintains a strong controlling stake in Kerry Properties, ensuring stability.

Institutional ownership has seen incremental increases, but the family's control remains dominant.

Kerry Properties continues to expand its investment property portfolio, particularly in Mainland China.

No significant changes in the ownership structure are anticipated in the near future.

Kerry Properties Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kerry Properties Company?

- What is Competitive Landscape of Kerry Properties Company?

- What is Growth Strategy and Future Prospects of Kerry Properties Company?

- How Does Kerry Properties Company Work?

- What is Sales and Marketing Strategy of Kerry Properties Company?

- What is Brief History of Kerry Properties Company?

- What is Customer Demographics and Target Market of Kerry Properties Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.