Kerry Properties Bundle

How Does Kerry Properties Thrive in a Dynamic Market?

Founded in Hong Kong in 1978, Kerry Properties has become a major player in real estate development across Mainland China and Hong Kong. With a focus on premium properties, the company's portfolio includes residential, commercial, and mixed-use developments. Recent financial results highlight the need to understand Kerry Properties' operational strategies and revenue generation.

This exploration of Kerry Properties will provide critical insights into its operations, value proposition, and financial performance. We'll examine its revenue streams, key milestones, and competitive advantages within the competitive landscape of Kerry Properties SWOT Analysis. Understanding the company's approach to property investment and its projects in Hong Kong is key to evaluating its potential. This analysis is designed to help investors, industry observers, and anyone interested in the Hong Kong property market make informed decisions.

What Are the Key Operations Driving Kerry Properties’s Success?

Kerry Properties, a key player in the real estate development sector, generates value through its integrated approach to property development, investment, and management. Primarily focused on Hong Kong and Mainland China, with a growing presence in the Asia Pacific region, the company's core business revolves around creating premium properties. This includes luxury residential developments, high-end office buildings, retail spaces, and mixed-use projects, alongside owning and operating hotels and providing logistics services.

The company's operational framework is built on a comprehensive property development cycle. This includes land acquisition, design, construction, sales, and property management. Their strategic focus on investing in high-quality property developments in prime locations has been a cornerstone of their successful business model for many years. Their supply chain involves sourcing quality materials and engaging with contractors, while partnerships include joint ventures for specific projects.

Distribution networks encompass direct sales channels for residential properties and leasing arrangements for commercial and retail spaces. This structure supports the company's commitment to delivering high-quality living and working environments, differentiating them in the market through a portfolio of premium properties and a focus on sustainable development.

The company's core offerings include luxury residential developments, high-end office buildings, and retail spaces. They also develop mixed-use projects and operate hotels. Furthermore, they provide integrated logistics and international freight forwarding services.

Operational processes involve comprehensive property development cycles. These include land acquisition, design, construction, sales, and ongoing property management. The company focuses on investing in premium quality property developments in prime locations.

The company's value proposition lies in its niche in developing luxury projects and its strategy to retain commercial and hotel portions for long-term investment. This approach generates recurring income streams. This translates to high-quality living and working environments for customers.

Market differentiation is achieved through a portfolio of premium properties and a focus on sustainable development. This includes green building standards and carbon footprint reduction targets. This strategy helps the company stand out in the competitive Hong Kong property market.

The company's success is built on strategic investments in prime locations and the retention of commercial assets for long-term income. This approach supports sustainable growth and enhances shareholder value. The company's commitment to sustainability also plays a key role.

- Focus on luxury residential developments and high-end commercial properties.

- Strategic land acquisition in prime locations in Hong Kong and Mainland China.

- Integration of sustainable practices, including green building standards.

- Diversification through hotel operations and logistics services.

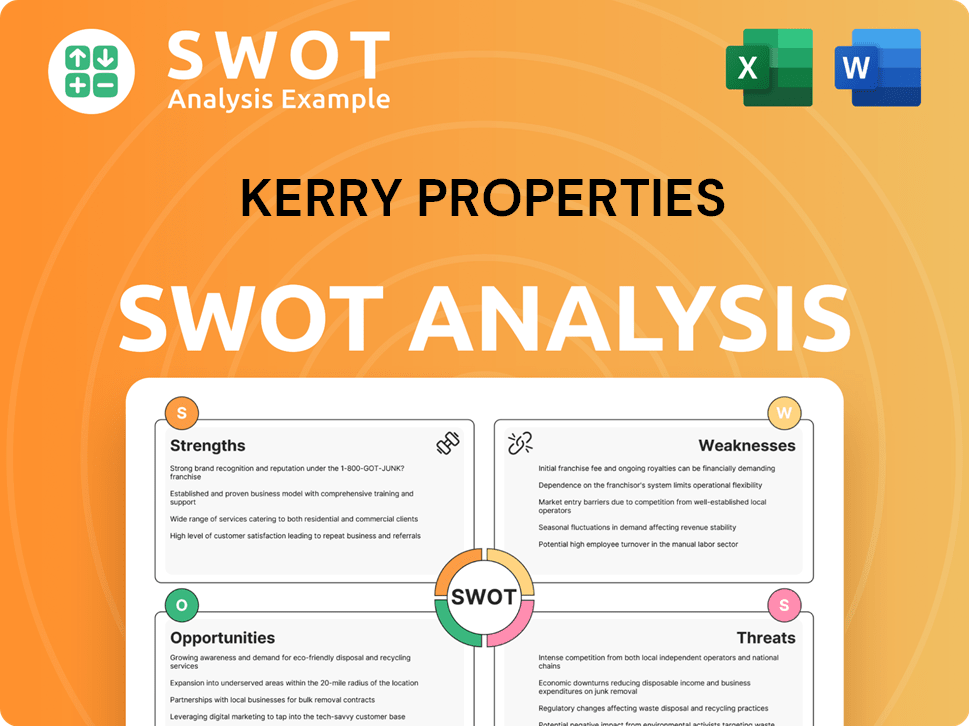

Kerry Properties SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kerry Properties Make Money?

The primary revenue streams for Kerry Properties stem from property sales, property rental and other sources, and hotel operations. For the year ended December 31, 2024, the company's consolidated revenue increased by 18% to HK$21,361 million, demonstrating a strong performance across its core business segments.

Property sales were the leading driver of this revenue growth, with a significant surge in 2024. This reflects the company's strategic focus on real estate development and its ability to capitalize on market opportunities. The company's monetization strategies include direct sales of developed residential properties and long-term leasing for its commercial and retail investment properties.

Kerry Properties, a key player in the Hong Kong property market, employs a diversified approach to generate income. The company's strategy includes retaining commercial and hotel assets in its mixed-use projects for long-term investment, fostering a recurring income stream.

In 2024, property sales saw a substantial increase, contributing the largest share of revenue. Property rental and other income experienced a slight decrease, while hotel operations normalized. The company's focus on property investment and development, particularly in Mainland China, is evident in its financial results.

- Property sales surged by 33% to HK$13,830 million in 2024. This segment accounted for approximately 66% of the total revenue, with the Mainland Property segment contributing HK$12.8 billion.

- Property rental and other income saw a slight decline of 2% year-on-year to HK$5,355 million in 2024.

- Hotel operations revenue declined by 4% year-on-year to HK$2,176 million in 2024.

- The company also benefits from hotel operations and, to a lesser extent, integrated logistics and international freight forwarding services.

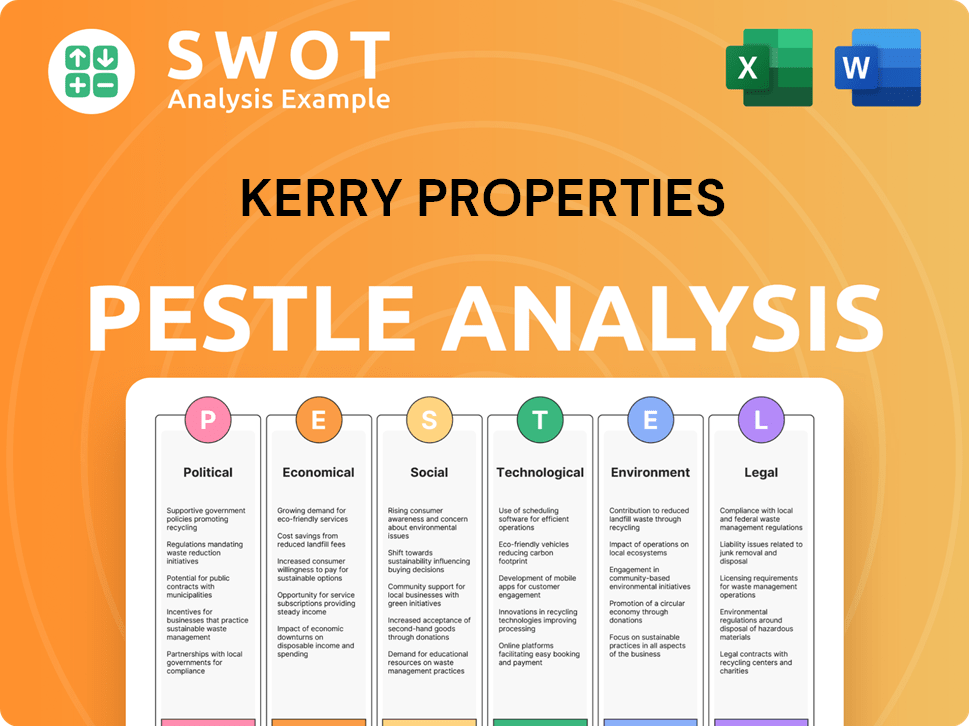

Kerry Properties PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Kerry Properties’s Business Model?

Kerry Properties has established itself as a key player in the real estate development sector, marked by significant achievements. The company's strategic focus on premium property development in prime locations has been a consistent driver of its operations. In 2023, the sales of luxury projects in Hong Kong, Hangzhou, and Shanghai demonstrated the success of this strategy, despite a challenging business environment. For those interested in the company's structure, more information can be found in this article about Owners & Shareholders of Kerry Properties.

A strategic move by Kerry Properties has been its focus on developing high-quality properties. This strategy has been evident in its project portfolio and sales performance. The company's contracted sales for the first half of 2024 reached HK$7,044 million. This demonstrates its ability to navigate market fluctuations and maintain a strong presence in both Hong Kong and Mainland China.

Operational and market challenges have included headwinds in the property sector across Hong Kong and Mainland China. The company has responded by rejuvenating its rental assets through renovations, such as MegaBox and Branksome Crest in Hong Kong, and Beijing Kerry Centre and Shenzhen Kerry Plaza in China, enhancing their competitiveness. The company's dedication to sustainable development, aiming for a 2% reduction in operational emissions annually until 2030 and striving for carbon neutrality by 2050, further strengthens its competitive edge.

Kerry Properties has achieved significant milestones, shaping its operations and financial performance. The company's strategic focus on developing premium quality properties in prime locations across Mainland China and Hong Kong has been a key driver of its success. The sales of luxury projects in Hong Kong, Hangzhou, and Shanghai in 2023 are a good example of this strategy.

A key strategic move has been the consistent focus on developing premium quality properties in prime locations. The company's response to market challenges includes rejuvenating rental assets through renovations. The Hong Kong government's removal of property cooling measures in February 2024 led to a significant increase in residential transactions in March and April 2024.

Kerry Properties' competitive advantages include its brand strength, built on years of experience. Its niche in developing luxury projects is a key differentiator. The company maintains a robust sales pipeline with upcoming development properties sufficient for the next five years and beyond, boasting a total attributable GFA of for-sale development properties of 10.1 million square feet as of June 30, 2024.

Contracted sales for the first half of 2024 totaled HK$7,044 million. The investment property segment faced a slight decline in rental income, and hotel operations normalized after a post-pandemic recovery. The company's commitment to sustainable development and achieving recognition in the Global Real Estate Sustainability Benchmark further enhances its competitive edge.

Kerry Properties' performance is significantly influenced by its strategic decisions and market conditions. The company's focus on premium properties and prime locations has been a consistent strategy. The company's commitment to sustainable development and its robust project pipeline are key strengths.

- Contracted sales in the first half of 2024 reached HK$7,044 million.

- The company is rejuvenating rental assets through renovations.

- Upcoming development properties have a total attributable GFA of 10.1 million square feet as of June 30, 2024.

- Kerry Properties aims for a 2% reduction in operational emissions annually until 2030.

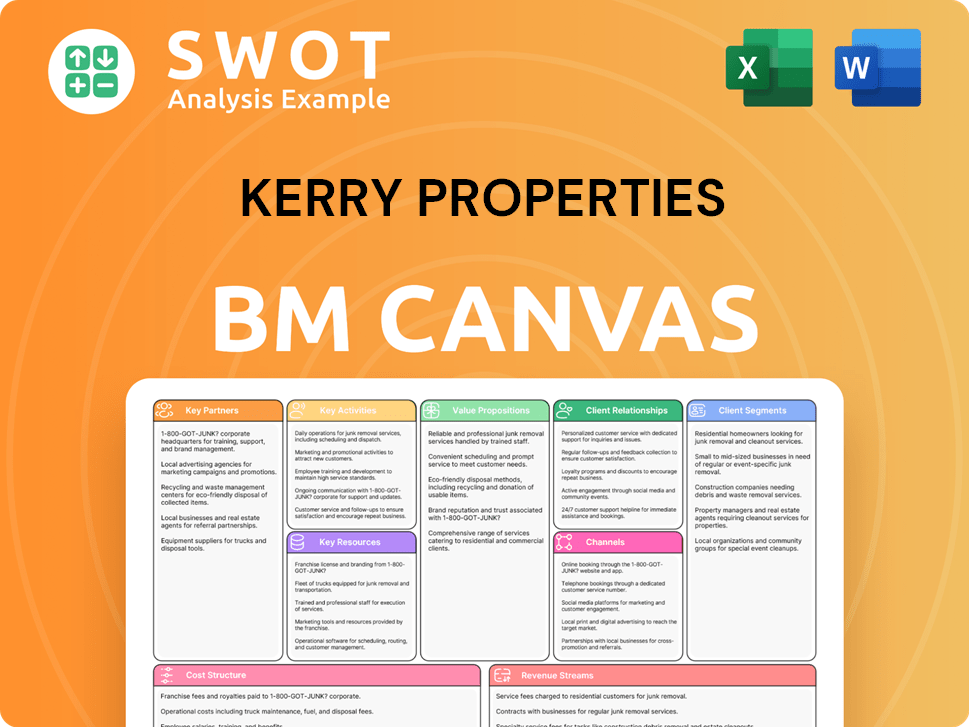

Kerry Properties Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Kerry Properties Positioning Itself for Continued Success?

As a prominent player in the real estate development sector, Kerry Properties holds a significant position in the Hong Kong and Mainland China markets. The company is recognized for its focus on premium-quality properties. As of December 31, 2024, the Group's property portfolio comprised 50.1 million sq ft of attributable GFA across the Mainland, Hong Kong, and other overseas locations, highlighting its substantial presence in the industry.

The future outlook for Kerry Properties involves navigating several challenges while capitalizing on strategic opportunities. The company's operations are influenced by market dynamics, including property demand and policy changes. Despite these challenges, the company is optimistic about long-term growth. To understand the company's journey, one can explore the Brief History of Kerry Properties.

Kerry Properties is a leading real estate developer with a strong presence in Hong Kong and Mainland China. It is known for its high-quality, premium properties. The company's extensive property portfolio includes residential and commercial properties.

Key risks include potential decreases in property demand in Hong Kong and China. Unfavorable housing policy changes also pose challenges. Additionally, the company faces risks related to its increased gearing ratio, which rose to 40.9% as of June 30, 2024.

Kerry Properties plans to leverage its diversified landbank and strategic projects for future growth. The company aims to maintain a conservative financial approach to navigate market uncertainties. Strategic initiatives include rejuvenating rental assets and pursuing a prudent landbanking strategy.

Kerry Properties is committed to reducing operational emissions. The company plans to reduce emissions by 2% annually until 2030. Its sustainability vision aims to achieve carbon neutrality by 2050.

Kerry Properties focuses on several strategic initiatives to drive growth and manage financial performance. The company is working on rejuvenating rental assets and pursuing a selective landbanking strategy. These efforts are designed to enhance the property portfolio and capitalize on emerging opportunities.

- Focus on prime locations for property development.

- Prudent financial management to mitigate risks.

- Emphasis on sustainable practices and carbon reduction.

- Continued delivery of stable dividends to shareholders.

Kerry Properties Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kerry Properties Company?

- What is Competitive Landscape of Kerry Properties Company?

- What is Growth Strategy and Future Prospects of Kerry Properties Company?

- What is Sales and Marketing Strategy of Kerry Properties Company?

- What is Brief History of Kerry Properties Company?

- Who Owns Kerry Properties Company?

- What is Customer Demographics and Target Market of Kerry Properties Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.