Linde Bundle

Can Linde's Growth Strategy Sustain Its Dominance?

Linde plc, a titan in the industrial gas industry, has a rich history dating back to 1879, evolving from a refrigeration pioneer to a global leader. With a market cap of $216 billion as of May 24, 2025, Linde's journey showcases remarkable strategic prowess. This exploration delves into Linde's Linde SWOT Analysis, examining its growth strategy and future prospects in a dynamic market.

This analysis will dissect Linde's expansion plans, including its strategic acquisitions and innovation in gas technology, to understand its future growth opportunities. We'll examine Linde's financial performance and competitive landscape, including its sustainability initiatives and hydrogen production strategy, providing insights into its long-term investment potential within the industrial gas industry. Understanding Linde's global market presence and revenue growth drivers is critical to assessing its ability to navigate the evolving demands of sectors like healthcare and renewable energy.

How Is Linde Expanding Its Reach?

The core of Linde's growth strategy involves strategic acquisitions, investment in new production facilities, and a strong focus on emerging opportunities, particularly in decarbonization projects. The company's expansion is evident in its industrial gas operations, especially in the Americas, supported by significant capital expenditures.

Linde is actively pursuing growth in the hydrogen sector, anticipating increased demand due to global efforts to reduce carbon emissions. This focus is complemented by the expansion of its on-site gas production capabilities, enhancing its network density and market reach. These initiatives are designed to drive revenue growth and strengthen its market position.

The company's commitment to innovation and strategic investments positions it well for future growth. For more insights, consider the perspective of Owners & Shareholders of Linde.

Linde's expansion strategy includes strategic acquisitions to broaden its market presence and capabilities. These acquisitions are carefully selected to complement existing operations and drive growth. This approach allows Linde to enter new markets and enhance its competitive position within the industrial gas industry.

Linde invests heavily in new production facilities to meet growing demand and improve operational efficiency. Capital expenditures in 2024 reached $4.497 billion, primarily for new plants and production equipment. These investments are crucial for expanding production capacity and supporting long-term growth.

Linde is heavily involved in decarbonization projects, particularly in hydrogen production and carbon capture. This focus aligns with global efforts to reduce carbon emissions. These projects are expected to be significant drivers of future revenue growth.

In 2024, Linde secured 59 new long-term agreements to build, own, and operate 64 small on-site nitrogen and oxygen plants. These plants use Linde's ECOVAR® technology. The expansion of on-site plants enhances network density and provides efficient gas supply solutions.

Linde's expansion initiatives are multifaceted, focusing on key areas to drive growth and maintain its competitive edge. These initiatives include strategic acquisitions, investments in new facilities, and a strong emphasis on decarbonization projects.

- Strategic Acquisitions: Expanding market presence and capabilities.

- Hydrogen Sales Growth: Capitalizing on increasing demand for hydrogen due to global decarbonization efforts.

- On-Site Plant Expansion: Enhancing network density and efficiency using ECOVAR® technology.

- Semiconductor Industry Expansion: Expanding ultra-high-purity industrial gas supply to major manufacturers.

- Project Backlog: A robust project backlog of $10.4 billion as of February 2025, with over $7 billion in sale-of-gas projects, indicating strong future revenue potential.

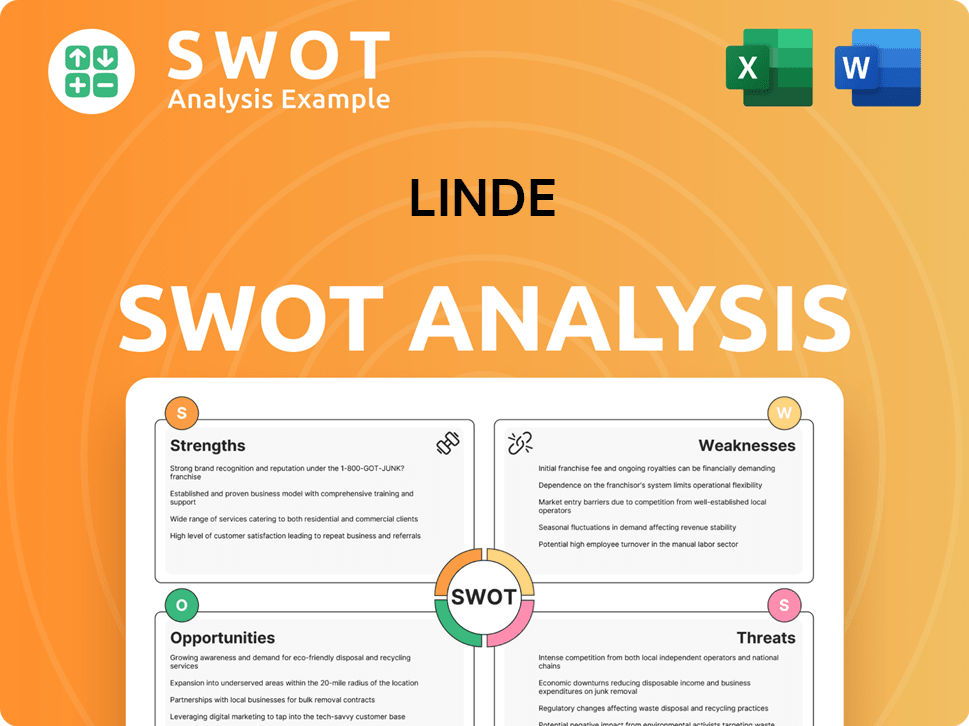

Linde SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Linde Invest in Innovation?

Linde's Linde growth strategy heavily relies on innovation and technology to drive its future. The company invests significantly in research and development, fostering both internal advancements and collaborative efforts to maintain its competitive edge. This approach is critical for meeting evolving customer needs and staying ahead in the industrial gas industry.

A key focus for Linde is its commitment to decarbonization projects. This includes the production of clean hydrogen and the development of carbon capture systems. These initiatives are central to the energy transition and are expected to contribute substantially to the company's growth in the coming years. This strategic direction supports its long-term vision and market leadership.

Linde's dedication to digital transformation and the integration of technologies like AI further enhances its operational efficiency. These advancements are crucial for margin expansion and overall business performance. The company's focus on continuous innovation underscores its commitment to providing cutting-edge solutions and maintaining its leadership in the market.

Linde is strategically positioned in the low-carbon hydrogen space. It anticipates delivering between $8 billion and $10 billion in projects over the next few years. This growth is supported by mechanisms like the 45Q tax credit, which incentivizes carbon capture and storage.

The company's proprietary ECOVAR® technology is a prime example of its commitment to efficiency, adaptability, and reliability. This technology is used in small on-site solutions, demonstrating Linde's focus on providing innovative and effective products.

Linde emphasizes digital transformation and the use of cutting-edge technologies, such as AI, to improve operations. Nearly 4,000 productivity projects were underway in Q1 2025, highlighting the company's dedication to operational excellence and margin expansion.

Linde maintains a leading-edge technology portfolio designed to meet evolving customer needs and reduce emissions. This portfolio is crucial for improving efficiency and supporting the company's long-term sustainability goals. This approach helps to ensure its Linde future prospects.

Linde's inclusion in the Dow Jones Sustainability™ World Index for the twenty-second consecutive year underscores its leadership in sustainability and innovation. This recognition reflects the company's strong performance and commitment to environmental stewardship.

Linde's continuous focus on innovation is reflected in its strategic investments and development efforts. This approach ensures the company remains at the forefront of technological advancements in the industrial gas industry. For more insights, check out the Competitors Landscape of Linde.

Linde's innovation strategy is multifaceted, focusing on several key areas to drive growth and maintain its competitive position. These strategies are critical for its Linde company analysis and long-term success.

- Research and Development: Significant investments in R&D to develop new technologies and improve existing products.

- Decarbonization: Focus on clean hydrogen production and carbon capture systems to support the energy transition.

- Digital Transformation: Implementation of AI and other cutting-edge technologies to improve operational efficiency and margin expansion.

- Sustainability: Commitment to sustainable practices and environmental stewardship, as evidenced by its inclusion in the Dow Jones Sustainability™ World Index.

- Customer-Centric Solutions: Development of innovative solutions like ECOVAR® to meet evolving customer needs and reduce emissions.

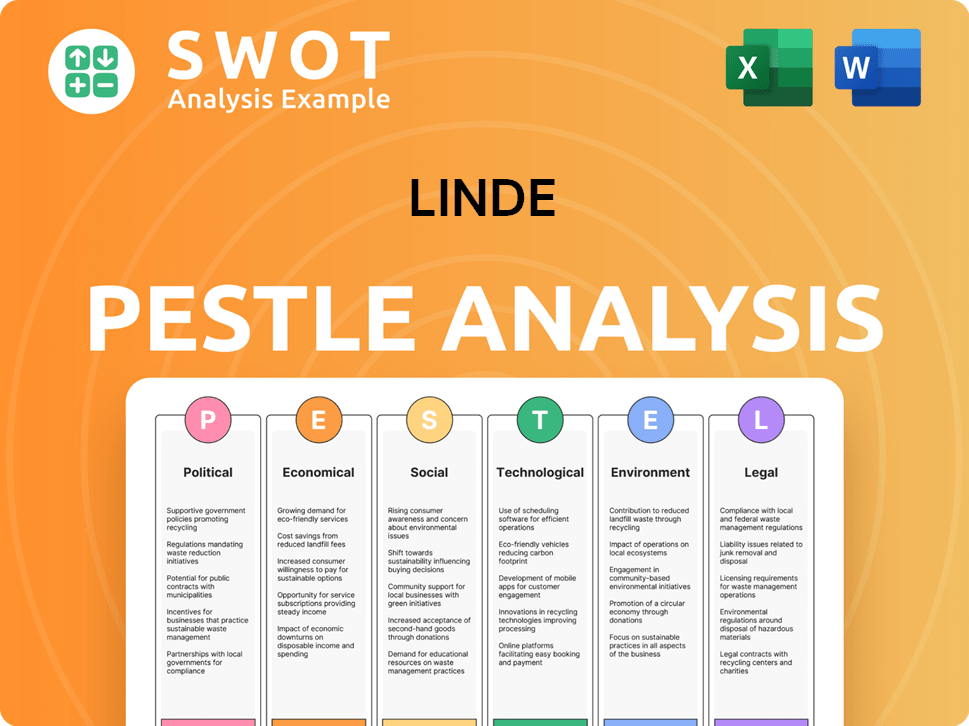

Linde PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Linde’s Growth Forecast?

The financial outlook for the company reflects a robust and resilient performance in the industrial gas industry. The company's strategic initiatives and operational efficiency have positioned it well for sustained growth, even amidst fluctuating economic conditions. Analyzing the financial performance provides critical insights into the company's ability to navigate market challenges and capitalize on emerging opportunities.

The company's financial health is supported by its strong market position and diverse customer base. The company's focus on operational excellence and strategic investments in high-growth areas, such as hydrogen and carbon capture, are expected to drive future expansion. A comprehensive Linde's target market analysis reveals the company's strategic focus on key sectors.

In 2024, sales remained flat at $33.0 billion, while adjusted operating profit increased by 7% to $9.7 billion. The adjusted operating profit margin expanded by 190 basis points to 29.5%. The company's financial performance demonstrates its ability to maintain profitability and efficiency.

For Q1 2025, sales were $8.112 billion, nearly unchanged year-over-year. The adjusted operating profit was $2.438 billion, up 4%, with a margin expansion of 120 basis points to 30.1%. Adjusted diluted EPS increased by 5% to $3.95.

The company projects adjusted diluted EPS in the range of $16.20 to $16.50 for 2025, indicating 4% to 6% growth over 2024, or 6% to 8% excluding currency fluctuations. Capital expenditures are expected to be between $5.0 billion and $5.5 billion to support operations and growth.

The substantial contractual sale of gas backlog stood at $7.0 billion as of May 2025, supporting future revenue streams. The company maintains a strong liquidity position, with $4.850 billion in cash and cash equivalents at the end of 2024.

The company's financial performance is supported by strong margins and strategic investments. Analysts forecast an annual revenue growth rate of 3.57% for 2025-2027, and an earnings growth rate of 13.51%. The gross profit margin peaked in March 2025 at 48.3%, and the operating income margin for the trailing 12 months ending March 31, 2025, was 26.42%.

- Strong Profitability: The company's robust margins reflect efficient operations and pricing strategies.

- Strategic Investments: Capital expenditures are focused on supporting operational needs and growth initiatives.

- Revenue Growth: Projected revenue growth indicates positive market trends and effective sales strategies.

- Earnings Growth: High earnings growth forecasts highlight the company's potential for increased profitability.

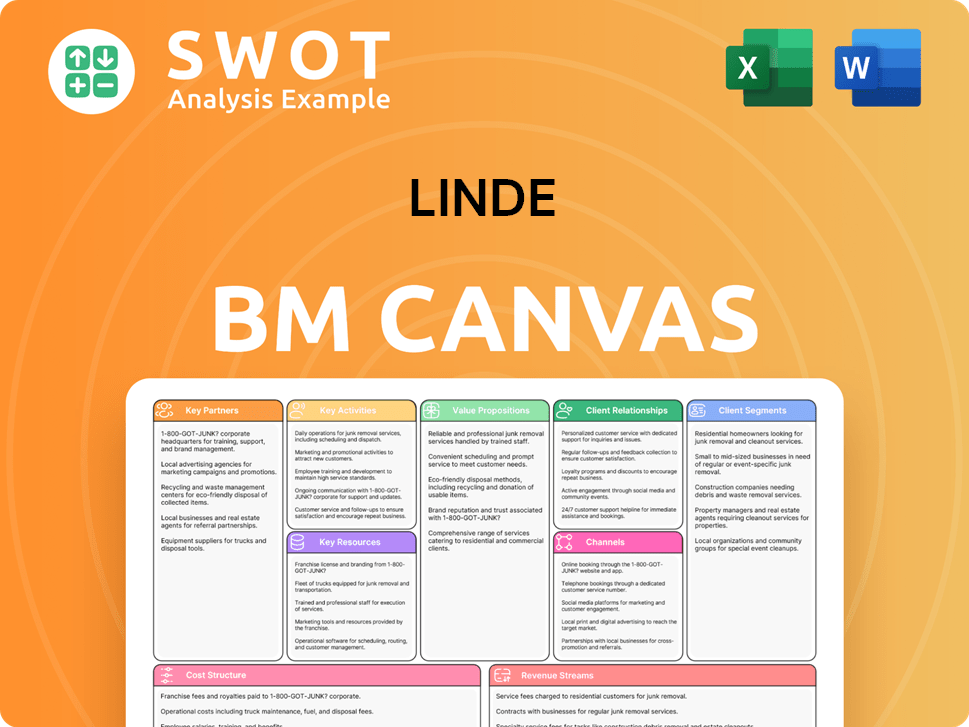

Linde Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Linde’s Growth?

The Linde growth strategy faces several potential risks and obstacles that could impact its Linde future prospects. These challenges range from market competition to geopolitical instability, requiring careful management and strategic planning. Understanding these risks is crucial for a comprehensive Linde company analysis and assessing its long-term investment potential.

Market competition, especially in commoditized product segments, can lead to margin compression, affecting Linde financial performance. Regulatory changes, particularly in environmental policies and emission regulations, could increase compliance costs. Additionally, geopolitical risks, including instability and trade conflicts, along with currency fluctuations, can adversely affect financial results. These factors necessitate proactive risk mitigation strategies.

Supply chain vulnerabilities and the capital-intensive nature of the industrial gas industry also pose significant operational risks. Plant outages or safety incidents could lead to unexpected costs. Furthermore, the slow development of the clean hydrogen market or changes in government support present risks to investments in this area. The company's ability to attract and retain skilled personnel is also crucial for its continued success.

Intense competition, especially in commoditized product segments, could compress profit margins. The Linde market share faces challenges from both established players and emerging competitors. Price wars and the need for continuous innovation are constant pressures within the industrial gas industry.

Changes in environmental policies and greenhouse gas emission regulations could increase compliance costs. The company must adapt to evolving standards to avoid penalties and maintain its operational licenses. Linde's sustainability initiatives are crucial for navigating these regulatory hurdles.

Geopolitical instability, trade conflicts, and currency fluctuations can adversely affect financial results. The company operates globally, making it vulnerable to economic downturns and political risks in various regions. Currency exchange rate volatility can impact reported earnings.

Disruptions from natural disasters or cybersecurity breaches pose significant operational risks. A robust and resilient supply chain is essential for uninterrupted operations. Linde's supply chain optimization is a key focus area to mitigate these risks.

The industrial gas industry requires substantial investment in plant and equipment. Potential plant outages or safety incidents could lead to unexpected costs and operational disruptions. Disciplined capital allocation is essential for managing these risks.

Slow development of the clean hydrogen market or changes in government support for such projects presents risks to expected returns on investments. Linde's hydrogen production strategy is closely tied to government incentives and market adoption rates. The company must adapt to changing market dynamics.

In 2023, the company reported a revenue of approximately $33 billion. The company's focus on productivity initiatives and maintaining a strong project backlog are crucial for managing risks. Linde's financial reports and analysis provide detailed insights into its performance and risk management strategies.

The company's Linde's expansion plans in Asia and other regions are critical for future growth. Linde's strategic acquisitions have played a significant role in its market presence. The company is also investing in Linde's innovation in gas technology and Linde's carbon capture and storage projects.

The Linde's competitive landscape analysis reveals a dynamic market with significant players. The industrial gas industry is characterized by high barriers to entry and intense competition. The company's ability to adapt to changing market conditions is vital for its success. For more details, you can read a Brief History of Linde.

Linde's revenue growth drivers include its focus on key end markets. The company sees Linde's future growth opportunities in renewable energy and other emerging sectors. The company's ability to navigate these challenges will determine its long-term success.

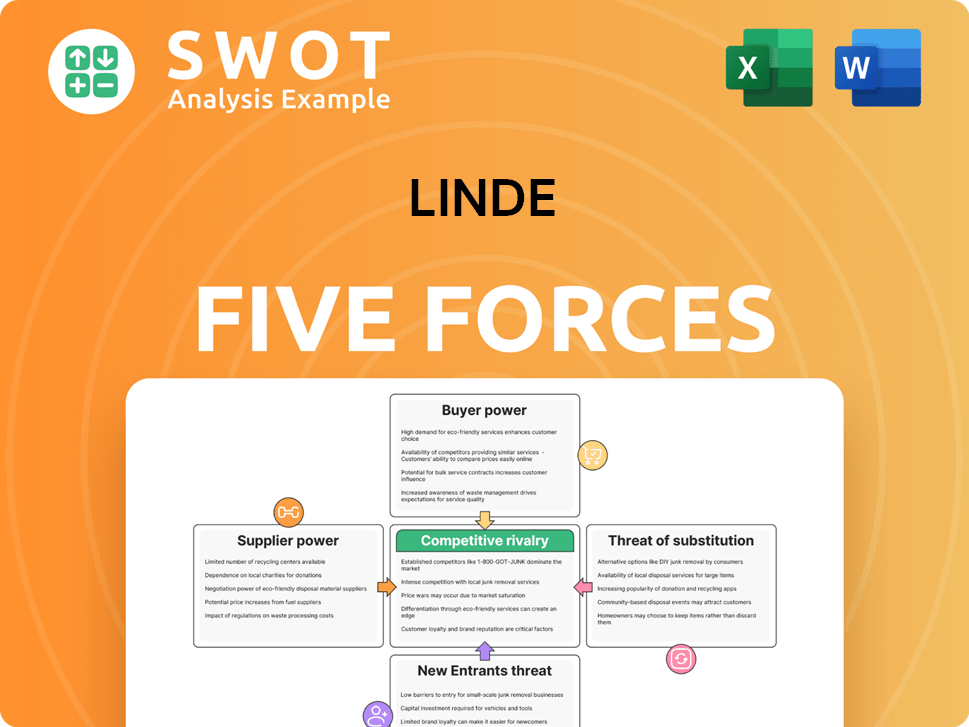

Linde Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Linde Company?

- What is Competitive Landscape of Linde Company?

- How Does Linde Company Work?

- What is Sales and Marketing Strategy of Linde Company?

- What is Brief History of Linde Company?

- Who Owns Linde Company?

- What is Customer Demographics and Target Market of Linde Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.