Linde Bundle

Who Buys Industrial Gases from Linde?

Understanding the Linde SWOT Analysis is just the beginning; knowing Linde's customers is key to grasping its market dominance. This deep dive explores the intricate world of Linde's customer demographics and target market, revealing the strategies behind its global success. From healthcare to manufacturing, discover the diverse industries that rely on Linde's innovative solutions.

This Linde Company analysis will illuminate the Linde target market and the factors driving its growth. We'll examine Linde's customer base through detailed market segmentation, geographical reach, and the specific needs of its diverse target audience. This analysis provides actionable insights into how Linde identifies and caters to its customers, ensuring its position as an industry leader.

Who Are Linde’s Main Customers?

Understanding the customer demographics and target market is crucial for analyzing a company like Linde. Linde operates primarily within a Business-to-Business (B2B) model, focusing on industrial and commercial clients. This strategic approach allows for a diversified customer base across various sectors, contributing to its resilience. This analysis provides insights into Linde's key customer segments and their significance.

Linde's target audience spans a wide range of industries, each with specific needs for industrial gases and related services. The company's customer base is segmented based on industry, geographical location, and the specific applications of its products. This segmentation strategy enables Linde to tailor its offerings and maintain strong relationships with its clients. This article aims to provide an in-depth look at who Linde's key customers are and how the company serves them.

The company's commitment to high-growth sectors, such as electronics and decarbonization, further shapes its customer demographics. Linde's focus on innovation and sustainability positions it well to meet the evolving needs of its target market. The following sections detail the primary customer segments and their characteristics.

This segment is a significant consumer of industrial gases for various processes, including petroleum refining and chemical production. In Q1 2025, underlying sales in the Americas segment saw increases primarily driven by the electronics, chemicals & energy end markets. This sector's demand is driven by the need for gases in production and refining processes.

This is a high-growth sector for Linde, driven by demand for high-purity and specialty gases essential in semiconductor manufacturing and electric vehicle (EV) battery production. Linde secured 59 new long-term agreements in 2024 for 64 small on-site plants, largely driven by growth in electronics. This segment also contributed to volume increases in the APAC region in 2024.

Linde provides life-saving medical oxygen and other medical gases, making this a resilient and critical segment. The growing healthcare sector, influenced by population growth and aging demographics, is a key driver for the overall industrial gases market. This segment's demand is consistently high due to essential medical applications.

This broad segment utilizes industrial gases for processes like metal fabrication, welding, and heat treatment. While volumes in the manufacturing end market saw a decrease in EMEA in 2024, it remained a primary driver for volumes in Americas in Q4 2024. This sector's needs are diverse, reflecting the wide range of manufacturing activities.

The metals & mining sector relies on gases for steelmaking and other metallurgical processes. In Q1 2025, volumes in this segment were lower in APAC and EMEA. The food & beverage industry uses industrial gases in food preservation, packaging, and beverage carbonation. These sectors represent important, though sometimes volatile, components of Linde's customer base.

- Metals & Mining: Gases are essential for steelmaking and other metallurgical processes.

- Food & Beverage: Industrial gases are used in food preservation, packaging, and beverage carbonation.

- Strategic Focus: Linde is shifting towards high-growth sectors like electronics and decarbonization.

- Financial Performance: 2024 sales were $33 billion, with 89% generated by geographical segments.

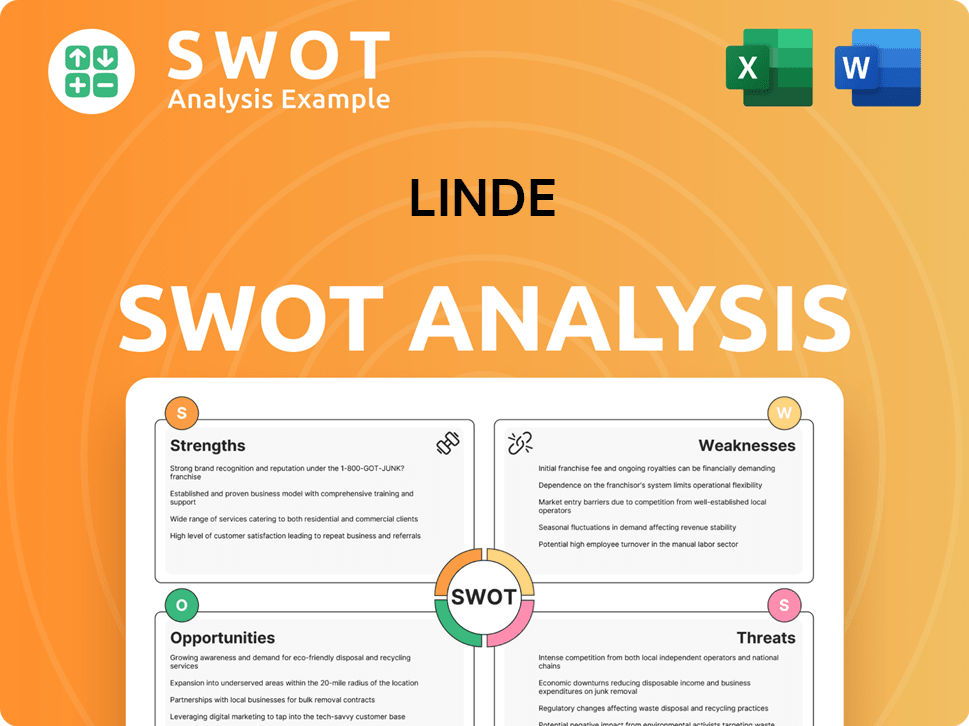

Linde SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Linde’s Customers Want?

Understanding the customer needs and preferences is crucial for a company like Linde. This analysis helps to define the customer demographics and target market, ensuring that products and services meet the specific demands of its clientele. A deep dive into these aspects provides insights into how Linde tailors its offerings to maintain its market position.

Linde's business-to-business (B2B) customers are primarily driven by reliability, efficiency, safety, and sustainability. These factors influence purchasing decisions and the long-term contracts that are common in the industrial gases sector. The company's strategic initiatives and technological advancements directly address these customer needs.

The customer base of Linde is diverse, spanning various industries that require industrial gases for their operations. This includes sectors such as healthcare, electronics, chemicals, and food and beverage. Linde's approach to market segmentation and its ability to cater to specific industry needs are key to its success. For a deeper understanding, consider the perspective of Owners & Shareholders of Linde.

Customers prioritize a stable and consistent supply of industrial gases. Linde's extensive network and on-site production capabilities directly address this need. In 2024, the company signed 59 new long-term agreements for small on-site plants, demonstrating its commitment to ensuring uninterrupted supply.

Customers seek solutions that enhance operational efficiency and reduce overall costs. Linde's ECOVAR technology, utilized in its small on-site plants, offers exceptional efficiency and adaptability. This helps customers optimize their processes and manage expenses effectively.

High-purity and specialty gases are crucial, particularly in sensitive sectors like electronics and healthcare. Linde ensures that its products meet the stringent quality requirements of these industries. This is a non-negotiable aspect for many of Linde's customers.

The handling and application of industrial gases require strict adherence to safety protocols. Linde prioritizes safety in all its operations, providing customers with the assurance that its products are handled and used in a safe manner. This is a critical factor for customer satisfaction.

A growing number of customers are focused on environmental goals, seeking partners who can help them reduce emissions. Linde is actively involved in decarbonization projects, including clean hydrogen production and carbon capture systems. The company's backlog for clean energy projects was at 58% of its total $10.4 billion backlog as of Q1 2025.

Linde addresses common pain points, such as supply chain disruptions, through its robust logistics and on-site production capabilities. This ensures customers have a reliable source of industrial gases. Customer feedback and market trends influence Linde's product development and strategic investments.

Linde's strategic investments and technological advancements are driven by customer needs and market trends. The company focuses on areas such as decarbonization and growth in sectors like electronics. For example, Linde is investing over $1 billion in decarbonization projects by 2028 and aims to triple clean hydrogen production.

- Customer Demographics: Linde serves a diverse range of industries, including healthcare, electronics, chemicals, and food and beverage.

- Market Segmentation: The company segments its customer base by industry and geographic location to tailor its offerings.

- Target Audience: Key customers include those in need of reliable, high-purity gases, and those focused on sustainability.

- Purchasing Behaviors: Customers often enter into long-term supply contracts, reflecting the critical nature of industrial gases in their operations.

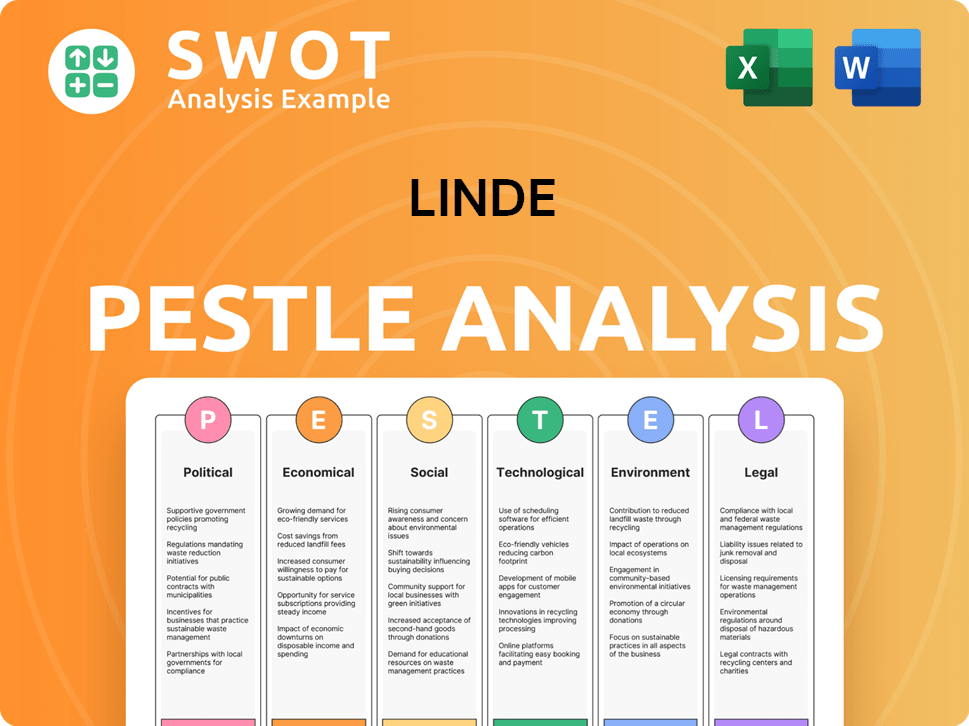

Linde PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Linde operate?

Understanding the geographical market presence of a company is crucial for a thorough analysis. This provides insights into its operational scope, revenue diversification, and risk management strategies. A detailed examination of its regional performance, market segmentation, and strategic expansions reveals the company's approach to global market dynamics.

The company's operations are primarily divided into three key geographical segments: Americas, EMEA (Europe, Middle East & Africa), and APAC (Asia Pacific). Each segment contributes differently to the overall revenue and growth of the company, reflecting the diverse industrial demands and economic conditions across various regions. The company's ability to adapt to these regional differences showcases its global market strategy.

The company's industrial gas operations are managed across three geographical segments, which is a key aspect of its business. This geographical diversification helps in mitigating regional risks and capitalizing on growth opportunities in different markets. The company's approach to localizing offerings and marketing strategies further enhances its market position.

The Americas segment includes operations in approximately 20 countries, with the United States, Canada, Mexico, and Brazil as key markets. In Q1 2025, sales in the Americas reached $3,666 million, a 3% increase year-over-year, driven by higher pricing and volumes. North America's industrial gases market is projected to exceed USD 46.96 billion by 2032, highlighting significant growth potential.

The EMEA segment covers operations in about 45 countries, including Germany, the United Kingdom, and France. EMEA sales in Q1 2025 were $2,031 million, a 3% decrease year-over-year, primarily due to cost pass-through. Europe continues to be a significant market share holder in the industrial gases sector.

The APAC segment includes operations in approximately 20 countries, such as China, Australia, and India. In Q1 2025, APAC sales were $1,539 million, a 3% decrease year-over-year. East Asia is projected to hold 38.4% of the global market by 2034. Demand in South Korea and China is expected to grow significantly.

The company localizes its offerings to meet regional demands and regulatory requirements. Recent expansions include numerous on-site projects in 2024, particularly in electronics and decarbonization initiatives. Capital expenditures in 2024 were mainly for new plant and production equipment, with 58% in the Americas segment, supporting backlog growth. For more insights, check out the Brief History of Linde.

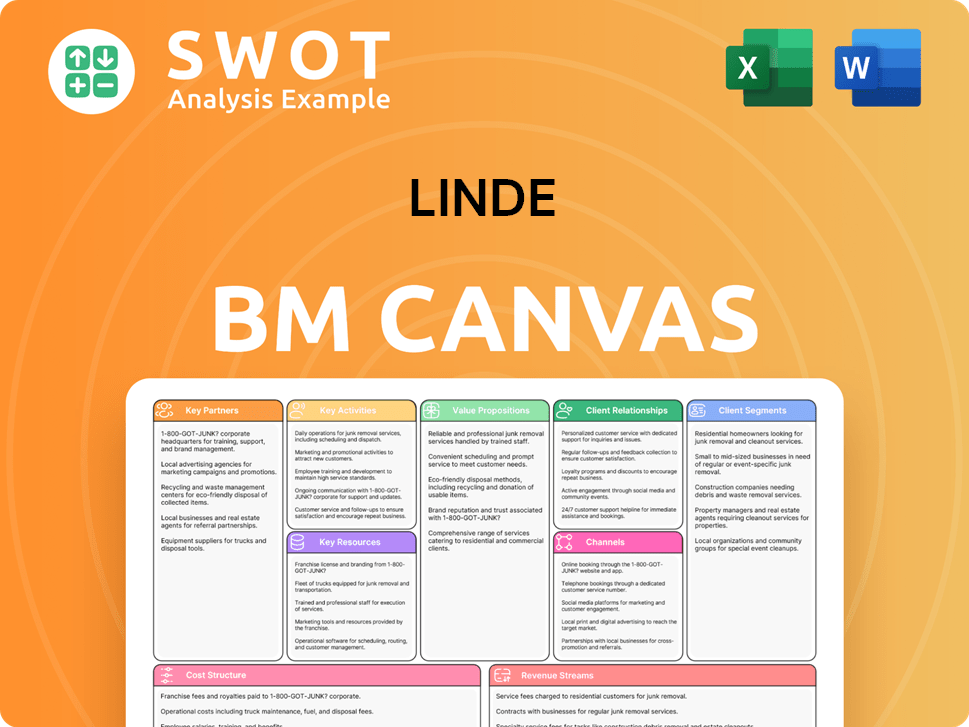

Linde Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Linde Win & Keep Customers?

The customer acquisition and retention strategies of the company are central to its business-to-business (B2B) model, emphasizing enduring relationships, technological leadership, and operational excellence. This approach is multifaceted, leveraging the company's strong market position and continuous innovation. Understanding the intricacies of the customer base is crucial for effective strategies. The company's success hinges on its ability to attract and retain a diverse range of clients across various industrial sectors.

The company's approach to customer acquisition and retention is deeply intertwined with its B2B model, focusing on long-term relationships, technological advancement, and operational excellence. The company leverages its strong market position and constant innovation to achieve its goals. The strategies employed are designed to ensure a reliable supply of essential industrial gases and related services. The company's focus on delivering value and meeting the evolving needs of its customers is also a key factor.

The company's customer acquisition and retention strategies are critical components of its operational success, particularly within its B2B framework. These strategies are designed to build and maintain strong relationships. The company's commitment to technological innovation and operational excellence further solidifies its market position and supports its customer-centric approach. This comprehensive strategy is designed to ensure long-term growth and customer satisfaction.

The company secures new customers through long-term agreements, especially for on-site gas production plants. In 2024, the company signed 59 new long-term agreements for 64 plants, reflecting a strategic focus on reliable supply. This 'build, own, and operate' model ensures steady revenue streams and strengthens customer relationships due to high switching costs.

The company actively pursues opportunities in growing markets such as electronics, including EV battery production, and decarbonization projects like clean hydrogen and carbon capture. These sectors represent significant growth potential and align with global trends. This focus helps identify the company's Competitors Landscape of Linde.

The company's investment in R&D and its proprietary technologies, like ECOVAR for efficiency, serve as a strong draw for customers seeking advanced and reliable solutions. This includes state-of-the-art gas processing solutions for efficiency improvements and emissions reductions. This attracts customers in various sectors.

The company expands its industrial gas operations through strategic acquisitions and investments in new production facilities, particularly in key growth regions like the Americas. These investments help to broaden the customer base and market reach. This helps to solidify its position in the industrial gas market.

The company’s strategies for customer retention are centered on operational excellence, tailored solutions, and sustainability partnerships. These strategies are designed to ensure customer loyalty and long-term relationships. The company aims to provide consistent, high-quality products and services.

- Operational Excellence and Reliability: Ensuring consistent, high-quality product delivery and reliable service is fundamental to retaining industrial clients whose operations depend on uninterrupted gas supply.

- Customer Service Automation: The company employs AI-driven chatbots and virtual assistants to streamline support processes and improve customer engagement, leading to faster response times and enhanced satisfaction.

- Tailored Solutions and Value-Added Services: By understanding specific customer needs, the company offers customized solutions and services that help customers enhance efficiency and reduce emissions, fostering loyalty. This includes helping customers avoid, capture, and utilize carbon dioxide emissions.

- Sustainability Partnerships: The company's commitment to sustainability and its efforts to help customers achieve their decarbonization goals create strong, long-term partnerships. The company aims to be a leader in sustainability, supporting its customers in reducing their carbon footprint.

- Robust Project Backlog: The company's record $10.4 billion project backlog as of Q1 2025, with $7 billion from sale-of-gas projects under long-term contracts, indicates strong future revenue visibility and ongoing customer relationships.

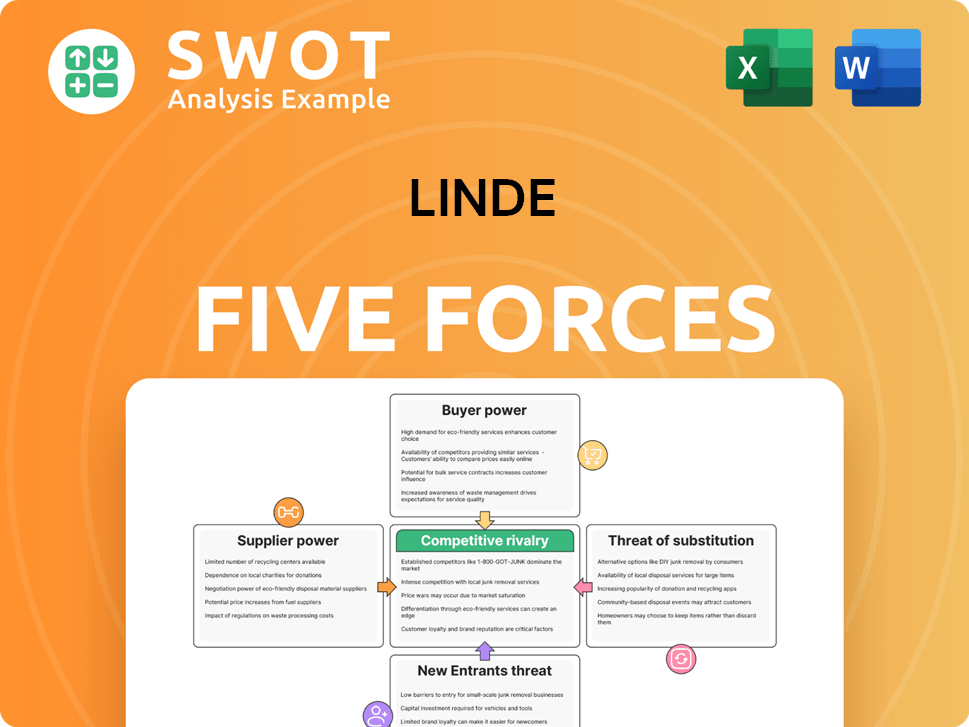

Linde Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Linde Company?

- What is Competitive Landscape of Linde Company?

- What is Growth Strategy and Future Prospects of Linde Company?

- How Does Linde Company Work?

- What is Sales and Marketing Strategy of Linde Company?

- What is Brief History of Linde Company?

- Who Owns Linde Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.