Linde Bundle

How Does Linde Company Thrive in the Global Market?

Linde plc, a global leader, plays a crucial role across major industries, generating $32.9 billion in sales in 2023. As a leading supplier of Linde SWOT Analysis, atmospheric and process gases, and a designer of industrial gas production plants, Linde's impact is far-reaching. Its products and services are essential in healthcare, manufacturing, and many other sectors.

This exploration of Linde's Linde SWOT Analysis will uncover the company's core Linde operations, diverse revenue streams, and strategic advantages. For investors, understanding the Linde business model and Linde products is vital to assess its stability and growth potential. We'll also examine Linde industrial gases and its global presence, providing a comprehensive view of its sustained profitability and influence.

What Are the Key Operations Driving Linde’s Success?

The core of the Linde Company's operations centers on the production, distribution, and sale of industrial gases, along with the engineering of related plants. This comprehensive approach allows the company to deliver value across various customer segments. The company's extensive portfolio includes atmospheric gases like oxygen, nitrogen, and argon, as well as process gases such as hydrogen, helium, and acetylene, alongside specialty gases and gas mixtures.

Linde gas plays a critical role across multiple industries, from healthcare to manufacturing. The company's operational processes are highly sophisticated, involving large-scale air separation units (ASUs) and a global logistics network for gas delivery. They also offer on-site gas generation solutions, integrating production directly into customer facilities. The Linde business model is built on providing reliable, high-quality gas supply tailored to specific industrial needs, combined with engineering expertise for plant design and construction.

Linde industrial gases are essential for various applications, including welding, cutting, and semiconductor fabrication. Their value proposition lies in their ability to provide reliable, high-quality gas supply tailored to specific industrial needs. Their global reach, technological leadership in gas applications, and commitment to safety and efficiency set them apart from competitors. For example, their expertise in clean hydrogen production and carbon capture technologies uniquely positions them to support industries transitioning to more sustainable practices.

Linde products include atmospheric gases (oxygen, nitrogen, argon), process gases (hydrogen, helium, acetylene), and specialty gases. These gases are crucial for healthcare, manufacturing, food and beverage, and electronics. The company also offers gas mixtures and on-site gas generation solutions to meet diverse industrial needs.

Linde operates through large-scale air separation units (ASUs), a global logistics network, and cylinder filling plants. They use pipeline networks and cryogenic tankers for bulk gas delivery. The company also provides on-site gas generation solutions. Their operations are characterized by a focus on safety, efficiency, and technological innovation.

Linde offers reliable, high-quality gas supply tailored to specific industrial needs. Their engineering expertise supports plant design and construction. This approach enhances operational efficiency, improves product quality, and reduces environmental impact for their customers. Their commitment to sustainability is also a key differentiator.

Customers benefit from enhanced operational efficiency and improved product quality. Linde's solutions help reduce environmental impact. Their global reach and technological leadership provide a competitive advantage. The company's focus on safety and efficiency ensures reliable gas supply and support.

Linde distinguishes itself through its global presence, technological leadership, and commitment to safety and efficiency. Their expertise in clean hydrogen production and carbon capture technologies is a significant advantage. They are well-positioned to support industries transitioning to more sustainable practices.

- Global Reach: Operations and customers worldwide.

- Technological Leadership: Advanced gas applications and innovations.

- Sustainability: Focus on clean hydrogen and carbon capture.

- Reliability: Consistent, high-quality gas supply.

For more insights into Linde's strategic initiatives, consider reading about the Marketing Strategy of Linde. As of 2024, Linde reported revenue of approximately $33 billion, demonstrating its significant market presence. The company's focus on sustainable solutions and operational efficiency continues to drive its success in the industrial gas market. Linde's commitment to innovation and its global footprint contribute to its strong financial performance and ability to serve diverse industries.

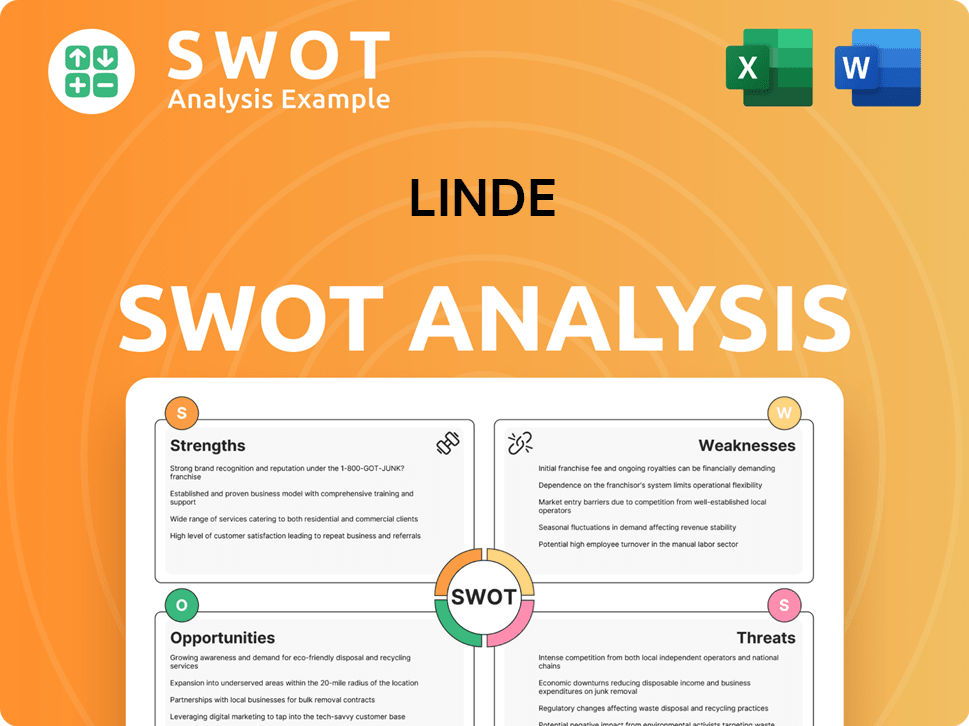

Linde SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Linde Make Money?

The Linde Company generates revenue through a diversified approach, primarily focusing on industrial gases and engineering solutions. Its revenue streams are strategically designed to leverage its expertise in gas production and related services, ensuring a stable and growing financial performance. The company's business model is built on long-term contracts and integrated solutions, which fosters strong customer relationships and recurring revenue.

The primary revenue source for Linde is the sale of Linde industrial gases, which includes atmospheric gases, process gases, and specialty gases. These gases are supplied through various methods, such as pipelines, cryogenic tanks, and cylinders, catering to a wide range of industries. The Engineering segment also contributes significantly to the revenue, designing and constructing industrial plants for gas production, thereby supporting the core gas business.

In 2023, the industrial gases segment brought in sales of $31.1 billion, demonstrating its dominance in the revenue structure. The Engineering segment added $2.4 billion in sales during the same year. These figures highlight the company's robust financial performance and its ability to maintain strong revenue streams across different sectors.

The sale of Linde gas is the primary revenue driver, encompassing atmospheric, process, and specialty gases. These gases are delivered via pipelines, tanks, and cylinders. The industrial gases segment accounted for $31.1 billion in sales in 2023.

The Engineering segment designs and constructs industrial plants for gas production. This segment provides specialized solutions to customers. In 2023, the Engineering segment generated $2.4 billion in sales.

Linde uses long-term supply contracts for bulk gases to ensure stable revenue. Pricing is based on gas volume, purity, and delivery method. The company also focuses on cross-selling opportunities and new technologies.

Linde offers services like equipment installation, maintenance, and gas management. These services complement gas sales and engineering projects. The company's integrated approach enhances customer relationships.

Pricing for Linde products often reflects the volume, purity, and delivery method of the gases. Specialty gases and customized solutions command premium prices. Long-term supply contracts provide a stable revenue stream.

Linde is expanding into new technologies like clean hydrogen and carbon capture. These areas are expected to create new revenue opportunities. The company is investing in sustainability initiatives.

Linde's monetization strategies include long-term supply contracts for bulk gases, which provide a stable revenue stream, and project-based contracts for its engineering services. Pricing strategies often reflect the volume, purity, and delivery method of the gases, with premium pricing for specialty gases and customized solutions. The company's focus on long-term relationships and integrated solutions allows for cross-selling opportunities. For more details, you can explore the Brief History of Linde.

Linde's revenue model is built on a combination of gas sales, engineering projects, and related services, supported by long-term contracts and strategic pricing. The company’s diversified approach helps to ensure financial stability and growth.

- Industrial Gases: Sales of atmospheric, process, and specialty gases via pipelines, tanks, and cylinders.

- Engineering: Design and construction of industrial plants for gas production.

- Services: Equipment installation, maintenance, and gas management solutions.

- Long-Term Contracts: Stable revenue from long-term supply contracts for bulk gases.

- Pricing: Volume, purity, and delivery method determine pricing, with premium pricing for specialty gases.

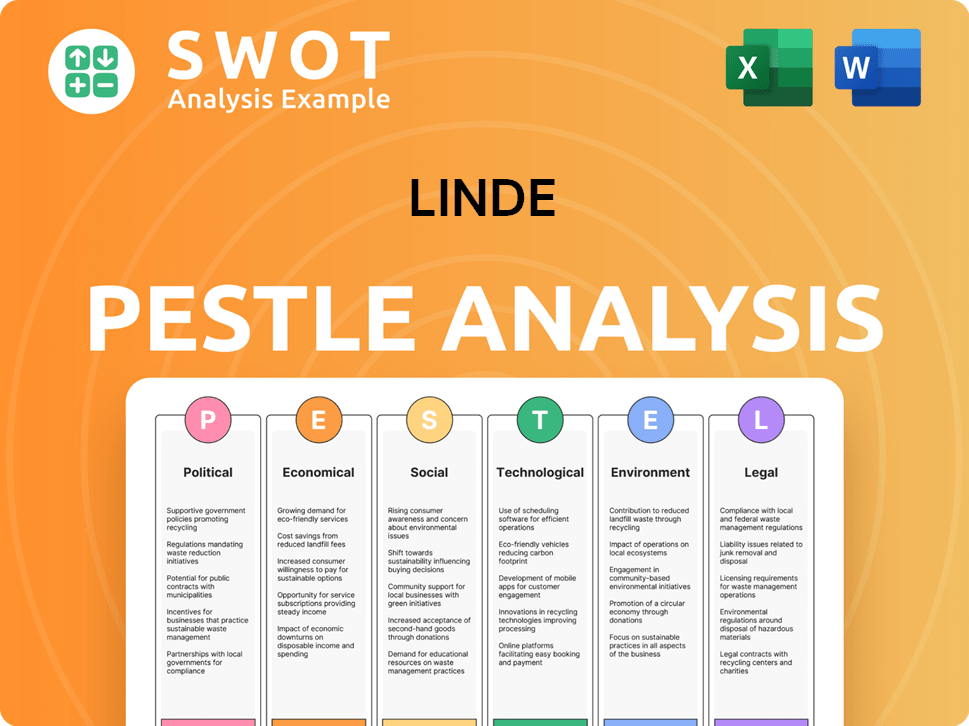

Linde PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Linde’s Business Model?

The journey of the Linde Company has been marked by significant milestones and strategic moves that have shaped its operations and financial performance, solidifying its competitive edge. A pivotal moment was the 2018 merger of Praxair and Linde AG, creating Linde plc, which resulted in the world's largest industrial gas company by market share. This strategic combination significantly expanded its global reach, enhanced its economies of scale, and diversified its customer base across various industries.

The company has consistently adapted to market challenges, such as supply chain disruptions and volatile energy prices, by optimizing its production networks and leveraging its global logistics capabilities. For instance, during periods of increased demand for medical oxygen, Linde rapidly scaled up production and distribution to support healthcare systems worldwide. Linde's competitive advantages are multifaceted.

Linde's technological leadership in gas production, purification, and application is a cornerstone, allowing it to offer high-purity gases and innovative solutions. The sheer scale of its operations provides significant economies of scale in production and distribution, making it difficult for smaller competitors to match its cost efficiency. Its extensive pipeline infrastructure and global distribution network create high barriers to entry. Furthermore, strong customer relationships, often secured through long-term contracts, contribute to stable revenue streams and customer loyalty.

The merger with Praxair in 2018 was a transformative event, creating the largest industrial gas company globally. This strategic move expanded the company's global footprint and diversified its customer base. The integration allowed for significant cost synergies and operational efficiencies.

Linde has focused on optimizing its production networks and logistics. The company has invested in clean hydrogen production, carbon capture, and carbon utilization technologies. These moves position Linde as a key player in the energy transition.

Technological leadership in gas production and application is a major advantage. Linde's scale provides significant economies of scale in production and distribution. Strong customer relationships, often through long-term contracts, ensure stable revenue streams.

In 2024, Linde continues to focus on sustainability initiatives, including investments in green hydrogen projects. The company's financial performance in 2024 shows continued growth, driven by demand in key markets like healthcare and manufacturing. Linde's global presence is expanding, with new facilities in strategic locations.

Linde's competitive advantages stem from its technological expertise, operational scale, and strategic customer relationships. The company’s focus on innovation and sustainability further strengthens its position in the market. Linde's extensive pipeline infrastructure creates high barriers to entry, protecting its market share.

- Technological Leadership: Linde excels in gas production, purification, and application, offering high-purity gases and innovative solutions.

- Economies of Scale: The company's large-scale operations provide significant cost efficiencies in production and distribution.

- Global Infrastructure: An extensive pipeline infrastructure and distribution network create high barriers to entry.

- Customer Relationships: Strong, long-term contracts contribute to stable revenue and customer loyalty.

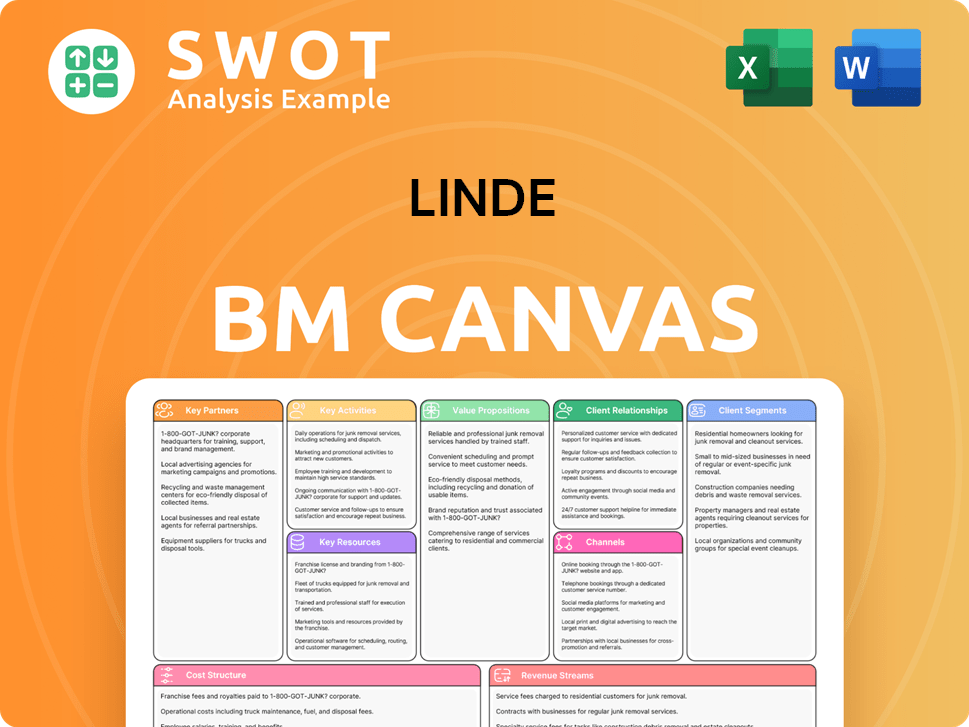

Linde Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Linde Positioning Itself for Continued Success?

As the world's largest industrial gas company, Linde Company holds a significant market share and serves a diverse customer base across various industries. Its extensive global reach, operational efficiency, and technological leadership distinguish it from competitors. Linde benefits from strong customer loyalty due to the critical nature of its products and the integrated solutions it provides, often through long-term supply agreements.

However, Linde faces several risks. Regulatory changes, especially those related to environmental protection and industrial emissions, could impact operational costs. The cyclical nature of some industries it serves can expose it to demand fluctuations. Intense competition necessitates continuous innovation and cost management. Geopolitical events and global economic downturns can also affect its supply chain and financial performance.

Linde dominates the industrial gas market, providing essential gases and related services globally. The company's strong market position is supported by its extensive infrastructure and long-term contracts. Its diversified customer base spans manufacturing, healthcare, energy, and electronics, among other sectors.

Linde faces risks including regulatory changes, particularly those related to environmental standards and emissions. Economic downturns and fluctuations in industrial production can affect demand. Competition from other gas suppliers and the need for continuous innovation also pose challenges.

Linde is focused on sustainable growth through innovation and sustainability initiatives. The company is investing in clean energy solutions, including hydrogen production and carbon capture technologies. Strategic moves are aimed at maintaining market leadership and capitalizing on energy transition opportunities.

Linde's products are essential across various sectors, including healthcare, where its gases are critical. The company's business model relies on long-term contracts and a global distribution network. Linde's commitment to sustainability is evident in its investments in clean energy solutions.

Linde is strategically focused on sustaining and expanding profitability through innovation and sustainability efforts. The company is investing in clean energy, particularly hydrogen, and carbon capture technologies. Leadership emphasizes operational excellence and leveraging its global network to capitalize on emerging opportunities.

- Investment in clean energy solutions, especially hydrogen production and distribution.

- Advancement of carbon capture, utilization, and storage (CCUS) technologies.

- Commitment to operational excellence and portfolio optimization.

- Leveraging the global network to capitalize on emerging opportunities in the energy transition.

In 2024, Linde's financial performance showed continued strength, with revenue and earnings growth driven by its diversified business model and strategic initiatives. The company's focus on operational efficiency and cost management, as well as its investments in sustainable technologies, are expected to support long-term value creation. For more insights, consider reading about the owners and shareholders of Linde.

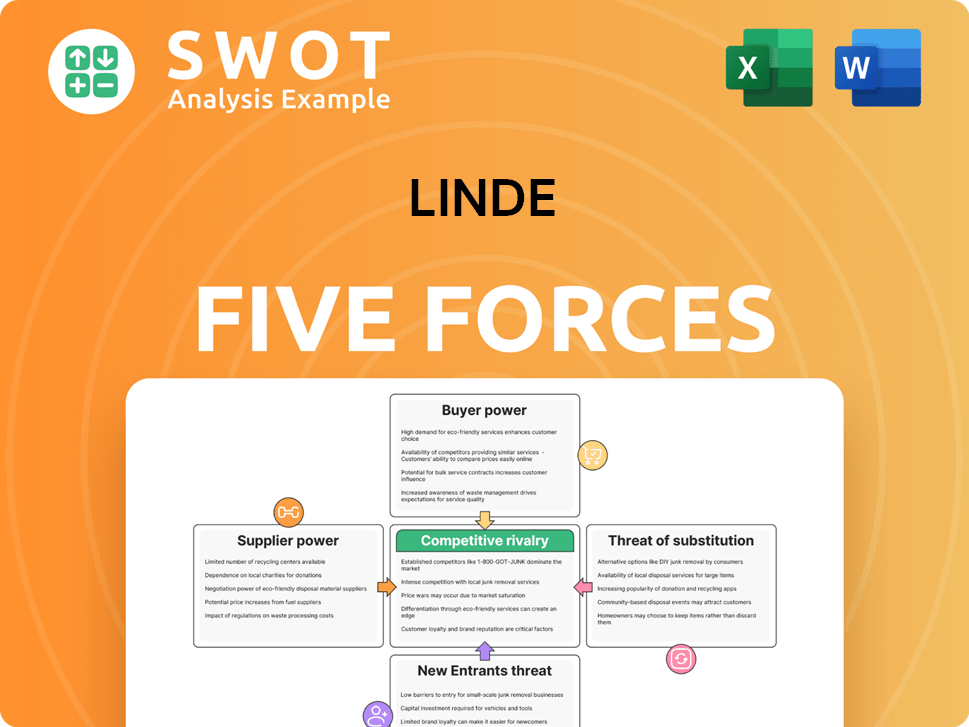

Linde Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Linde Company?

- What is Competitive Landscape of Linde Company?

- What is Growth Strategy and Future Prospects of Linde Company?

- What is Sales and Marketing Strategy of Linde Company?

- What is Brief History of Linde Company?

- Who Owns Linde Company?

- What is Customer Demographics and Target Market of Linde Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.