Origin Energy Bundle

How is Origin Energy Powering its Future?

Origin Energy, a leading Origin Energy SWOT Analysis, is at a pivotal moment, navigating the complexities of the energy sector. Its strategic shift towards renewable energy and customer-centric solutions marks a significant evolution. Founded in 2000, the company has transformed from its initial focus on gas and oil into a major player in electricity generation and energy retailing. This article dives deep into Origin Energy's growth strategy and future prospects.

Origin Energy's journey from its inception to its current market position showcases its remarkable growth as an Energy Company. Today, the company's future outlook is centered on its ability to lead the energy transition, expand its reach, and leverage innovation. This involves a close look at its expansion plans, commitment to renewable energy projects, and how it plans to achieve its long-term goals, including carbon emissions reduction, all while considering the competitive landscape and customer base.

How Is Origin Energy Expanding Its Reach?

The Owners & Shareholders of Origin Energy are keenly focused on the company's expansion initiatives, which are central to its growth strategy. These initiatives are designed to strengthen Origin Energy's position in the evolving energy market. This includes a significant pivot towards cleaner energy sources and expanding its customer base.

Origin Energy's growth strategy involves substantial investments in renewable energy projects and enhancing its retail offerings. The company's strategic focus is on both sustainable energy solutions and customer-centric services. This dual approach supports long-term financial performance and contributes to a sustainable energy future.

The company is actively working on its expansion plans, particularly in the renewable energy sector. Origin Energy's future prospects are closely tied to its ability to successfully execute these initiatives and adapt to changing market dynamics.

Origin Energy is committed to significantly increasing its renewable energy capacity. The company aims to add 4 gigawatts (GW) of new renewables and storage by 2030. This expansion includes investments in battery storage projects, such as the Mortlake Power Station battery, which is planned for a 300 MW, 600 MWh battery.

Origin Energy is exploring opportunities in green hydrogen. The company recognizes the potential of green hydrogen as a future energy source and export opportunity. This strategic move positions Origin to capitalize on emerging technologies and market demands.

Origin Energy is enhancing its retail offerings to provide more diversified and sustainable energy solutions. This includes offering smart energy solutions and electric vehicle charging infrastructure. The goal is to meet the evolving needs of residential, commercial, and industrial customers across Australia.

The company is actively managing its gas portfolio. This includes optimizing production from existing assets like Australia Pacific LNG (APLNG). The focus is on ensuring a reliable supply while investing in new gas developments to meet domestic and export demand.

Origin Energy's expansion strategy focuses on renewable energy, retail market growth, and gas portfolio optimization. These initiatives are crucial for achieving long-term goals and improving financial performance. The company's commitment to sustainability is evident in its investment choices and operational strategies.

- Investment in renewable energy projects, including solar, wind, and battery storage.

- Expansion of retail offerings to include smart energy solutions and EV charging infrastructure.

- Strategic management of the gas portfolio to ensure reliable supply and meet market demand.

- Exploration of green hydrogen opportunities to diversify energy sources.

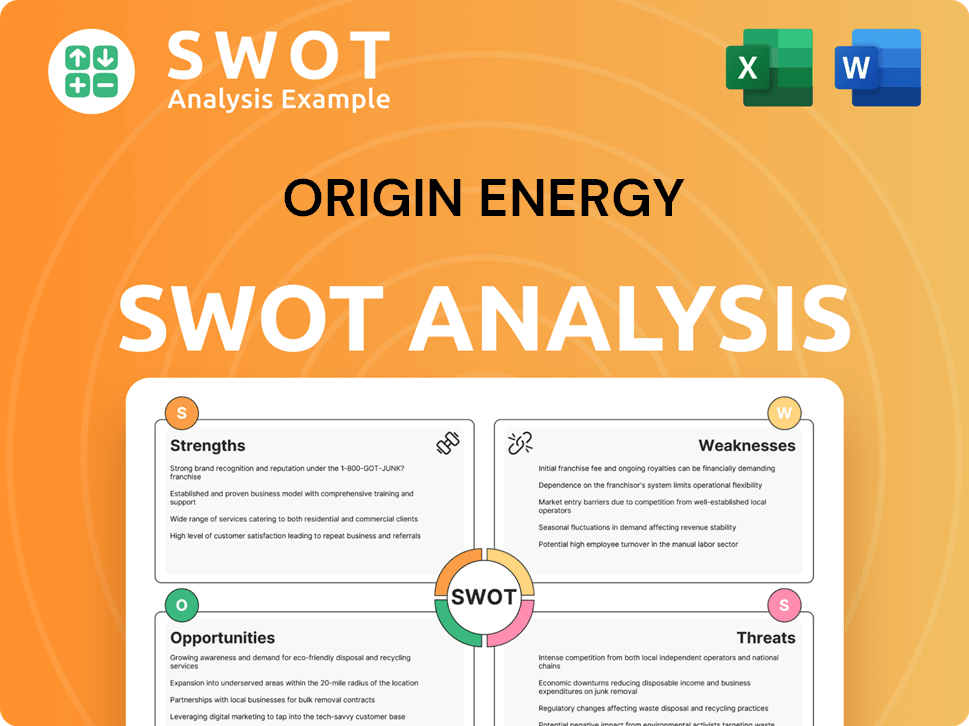

Origin Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Origin Energy Invest in Innovation?

Origin Energy is heavily invested in innovation and technology to drive its growth strategy and navigate the energy transition. The company's approach is centered on leveraging advanced technologies to enhance operational efficiency, improve customer engagement, and expand its renewable energy capabilities. This strategic focus is crucial for maintaining a competitive edge in the evolving energy market.

A key aspect of Origin Energy's strategy involves substantial investments in research and development. This includes both internal initiatives and collaborations aimed at advancing renewable energy and storage solutions. The company is also focused on digital transformation to optimize energy management and improve customer experiences. This comprehensive approach positions Origin Energy to capitalize on future opportunities in the energy sector.

Origin Energy's commitment to innovation is evident in its pursuit of green hydrogen production and carbon capture technologies, which are emerging solutions in the energy sector. By investing in these areas, Origin Energy aims to lead in the development of sustainable energy solutions. The company's proactive stance in adopting new technologies underscores its dedication to long-term growth and sustainability.

Origin Energy is actively developing renewable energy projects, including solar and wind farms, to increase its renewable energy portfolio. The company is also investing in utility-scale battery storage, such as the Eraring battery project, to enhance grid stability and reliability. These initiatives are key to Origin Energy's growth strategy.

Digital transformation is a core element of Origin Energy's strategy, with the company using advanced analytics and AI to optimize energy management. They are also focused on improving customer engagement through personalized services and smart energy solutions. This helps Origin Energy enhance operational efficiency.

Origin Energy is exploring innovative solutions in green hydrogen production and carbon capture technologies. These initiatives align with the company's sustainability goals and its commitment to reducing carbon emissions. This positions Origin Energy at the forefront of emerging energy solutions.

Origin Energy is investing significantly in research and development, both in-house and through collaborations, to advance its renewable energy and storage capabilities. This includes the development of new technologies and the improvement of existing ones. These investments are crucial for long-term growth.

Origin Energy is continuously evolving its digital platforms to offer seamless interactions and tailored energy plans. This includes providing customers with smart energy solutions and personalized services. The company aims to improve customer satisfaction and build stronger customer relationships.

Origin Energy utilizes advanced analytics and the Internet of Things (IoT) to optimize energy management and improve network performance. This helps the company reduce costs and improve the efficiency of its operations. These improvements contribute to the company's overall financial performance.

Origin Energy's technology and innovation strategy is multifaceted, focusing on renewable energy, digital transformation, and emerging technologies. This comprehensive approach is designed to support its growth strategy and ensure a sustainable future. The company's commitment to innovation is a key factor in its competitive advantage.

- Renewable Energy Projects: Origin Energy is expanding its portfolio of renewable energy projects, including solar and wind farms. As of 2024, the company has several projects in various stages of development, contributing to its renewable energy capacity.

- Battery Storage: The Eraring battery project is a significant investment in utility-scale battery storage, designed to provide firming capacity for the grid. This project is crucial for enhancing grid stability and integrating renewable energy sources.

- Digital Platforms: Origin Energy is continuously improving its digital platforms to offer seamless customer interactions and personalized energy plans. This includes the use of AI and advanced analytics to enhance the customer experience.

- Green Hydrogen: Origin Energy is exploring green hydrogen production to diversify its energy offerings and reduce carbon emissions. This initiative positions the company at the forefront of emerging energy solutions.

- Carbon Capture: The company is also investigating carbon capture technologies to mitigate the environmental impact of its operations. This supports Origin Energy's sustainability initiatives.

For a deeper understanding of how Origin Energy is positioned within the industry, consider exploring the Competitors Landscape of Origin Energy. This analysis provides valuable insights into the competitive environment and how Origin Energy's innovation strategy compares to its rivals.

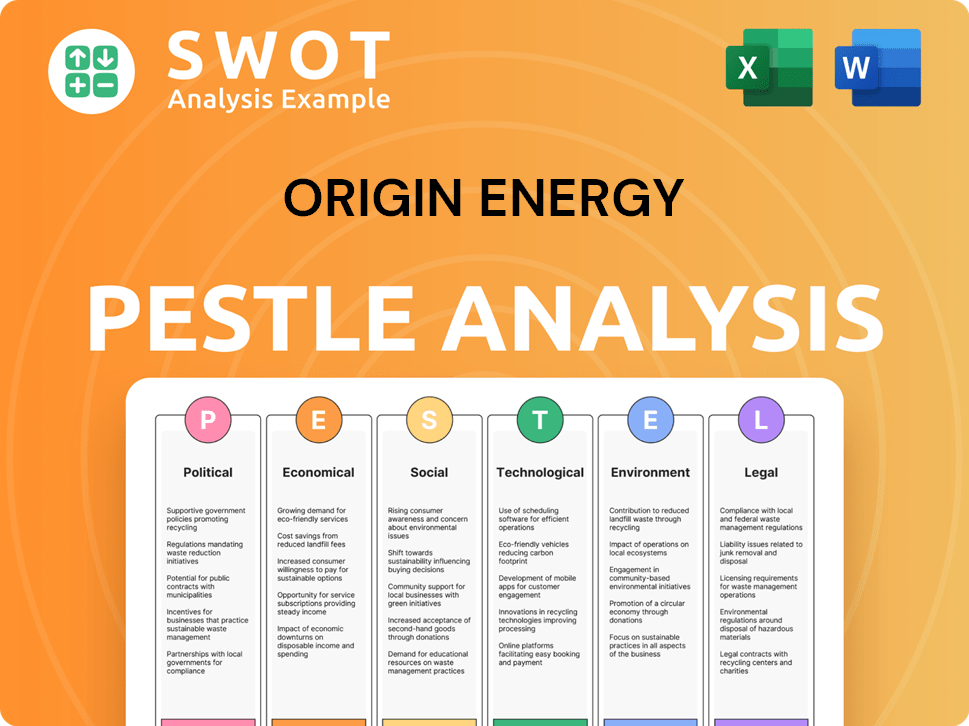

Origin Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Origin Energy’s Growth Forecast?

The financial outlook for Origin Energy, a prominent Energy Company, reflects its strategic shift towards cleaner energy sources and sustained expansion. The company's financial guidance for FY2024 indicates a strong performance across its energy markets and upstream gas segments. This outlook is underpinned by strategic investments and a focus on shareholder value.

Origin Energy's financial strategy centers on disciplined capital allocation. This approach involves optimizing its existing assets and strategically investing in projects that align with its decarbonization objectives and long-term shareholder value. The company's performance in the first half of FY2024 demonstrates the effectiveness of its financial strategies.

For FY2024, Origin Energy anticipates an adjusted EBITDA for Energy Markets ranging from $1,600 million to $1,800 million. Additionally, the company projects an adjusted EBITDA for Origin's share of APLNG production between $1,100 million and $1,300 million. These figures highlight the Growth Strategy and robust performance in both its retail and upstream gas sectors. Further insights into the company's business model can be found in this analysis: Revenue Streams & Business Model of Origin Energy.

In the first half of FY2024, Origin Energy reported an adjusted EBITDA of $1,350 million. This represents a 28% increase compared to the previous corresponding period. This growth was driven by strong performance in Energy Markets, primarily due to higher wholesale electricity prices and improved generation availability.

The company's capital expenditure for FY2024 is projected to be approximately $650 million. This investment reflects the company's commitment to its Renewable Energy projects and digital transformation initiatives. These investments are crucial for supporting its long-term Future Outlook and strategic objectives.

Origin Energy's financial health is marked by strategic investments and a focus on shareholder value. The company's financial performance in FY2024 is expected to be robust, driven by strong performance in its energy markets and upstream gas segments. The company's capital expenditure plans are focused on supporting its decarbonization goals.

Origin Energy is investing in Renewable Energy projects and digital transformation. These investments are designed to support the company's long-term Growth Strategy and Future Outlook. The company's focus on sustainable energy sources is a key part of its strategic direction.

The company's financial strategy emphasizes disciplined capital allocation and optimizing its existing asset base. This approach supports the company's Carbon Emissions Reduction targets. The goal is to create Origin Energy investment opportunities and enhance Origin Energy market share Australia.

Origin Energy's growth initiatives include investments in Renewable Energy and digital transformation. These initiatives are designed to support the company's long-term Goals and expand its Customer Base. These plans are key to How does Origin Energy plan to grow.

Origin Energy operates in a competitive landscape. The company's strategic investments and focus on Sustainability Initiatives are designed to maintain its market position. The company's financial performance is closely watched by Origin Energy stock forecast analysts.

Origin Energy's long-term goals include expanding its Expansion Plans and reducing carbon emissions. These goals are supported by strategic investments in renewable energy. The company's commitment to Origin Energy's renewable energy projects is evident in its financial outlook.

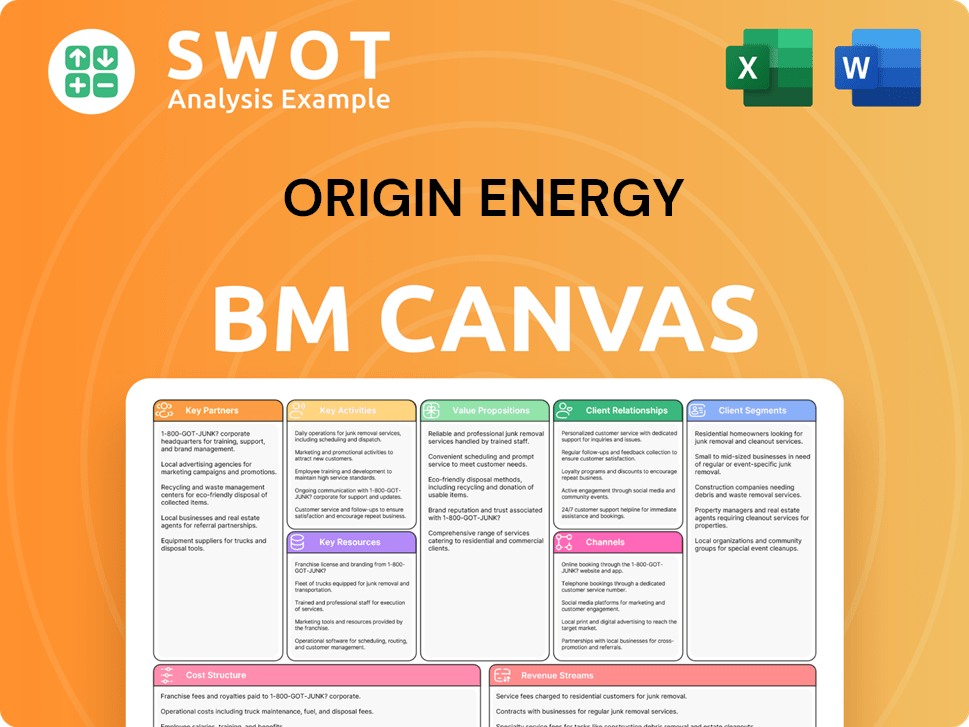

Origin Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Origin Energy’s Growth?

The Origin Energy faces several significant risks and obstacles that could impede its Growth Strategy and Future Outlook. These challenges range from regulatory uncertainties to intense competition in the energy market. Understanding these potential pitfalls is crucial for investors and stakeholders assessing the company's long-term viability.

One of the primary hurdles is the evolving regulatory landscape and policy uncertainty surrounding Australia's energy transition. Changes in government policies related to carbon emissions, renewable energy targets, and market mechanisms could significantly affect Origin's investment decisions and operational costs. Furthermore, technological disruption and supply chain vulnerabilities pose additional threats.

Internally, managing the transition of its workforce and assets towards a lower-carbon future requires significant investment in reskilling and adapting infrastructure. Proactive risk management and a focus on operational efficiency are vital for mitigating these challenges and ensuring sustainable growth.

Changes in government policies on carbon emissions and renewable energy targets can significantly impact Origin's operations. The Australian government's commitment to reducing emissions and increasing the share of Renewable Energy creates both opportunities and risks. Policy shifts can affect investment decisions and operational costs, potentially impacting the company's financial performance. For example, the introduction of new carbon pricing mechanisms or changes to renewable energy subsidies could alter Origin's profitability.

Intense competition in the energy market, especially from new entrants in the renewable sector, poses a continuous threat. Established players and emerging companies are vying for market share, putting pressure on profit margins. The rise of distributed energy resources and customer preferences for cleaner energy sources further intensify competition. This requires Origin to continuously innovate and adapt to maintain its market position. According to recent Market Analysis, the renewable energy sector is experiencing rapid growth, increasing competitive pressures.

Supply chain disruptions, particularly for critical components in Renewable Energy projects, can lead to delays and increased costs. Geopolitical events, trade restrictions, and logistical challenges can impact the availability and pricing of essential equipment. The increasing demand for solar panels, wind turbines, and battery storage systems exacerbates these vulnerabilities. Managing these risks requires robust supply chain management strategies and diversification of suppliers.

Rapid technological advancements, such as the development of more efficient solar panels or advanced battery storage, can disrupt the energy market. If Origin fails to adapt quickly to these innovations or if competitors introduce superior technologies, it could lose market share. The integration of smart grids, electric vehicles, and other emerging technologies requires significant investment and strategic planning. Staying ahead of technological trends is crucial for long-term success.

Transitioning the workforce and assets towards a lower-carbon future requires significant investment in reskilling and adapting infrastructure. The shift from traditional fossil fuels to renewable energy sources necessitates changes in operational models and employee skill sets. This includes investments in training programs, upgrades to existing infrastructure, and the development of new assets. Successfully managing this transition is critical for maintaining operational efficiency and meeting sustainability goals.

Origin Energy's financial performance is subject to fluctuations in energy prices, which can significantly impact revenue and profitability. The company's investment decisions, particularly in large-scale projects, carry inherent risks. The ability to secure financing for these projects and manage associated financial risks is essential for sustained growth. The company's financial health is crucial for its ability to invest in Renewable Energy and adapt to market changes. For a deeper understanding of the company's history, consider reading Brief History of Origin Energy.

To address these risks, Origin Energy employs several mitigation strategies. Diversifying its energy portfolio to include a mix of renewable and traditional sources helps to reduce reliance on any single source. Implementing robust risk management frameworks, including scenario planning, allows the company to anticipate and respond to market shifts. Proactive engagement with policymakers and a focus on operational efficiency are also critical for mitigating challenges. These strategies are essential for navigating the complex energy landscape and achieving long-term success.

Origin Energy's strategic adaptations involve several key areas. These include investing in new technologies, such as smart grids and energy storage solutions. The company is also expanding its renewable energy projects, including solar and wind farms. Furthermore, it is focused on enhancing customer engagement through innovative products and services. Adapting to the changing energy landscape requires ongoing strategic adjustments and a commitment to innovation. These adaptations are crucial for maintaining a competitive edge and ensuring Future Outlook.

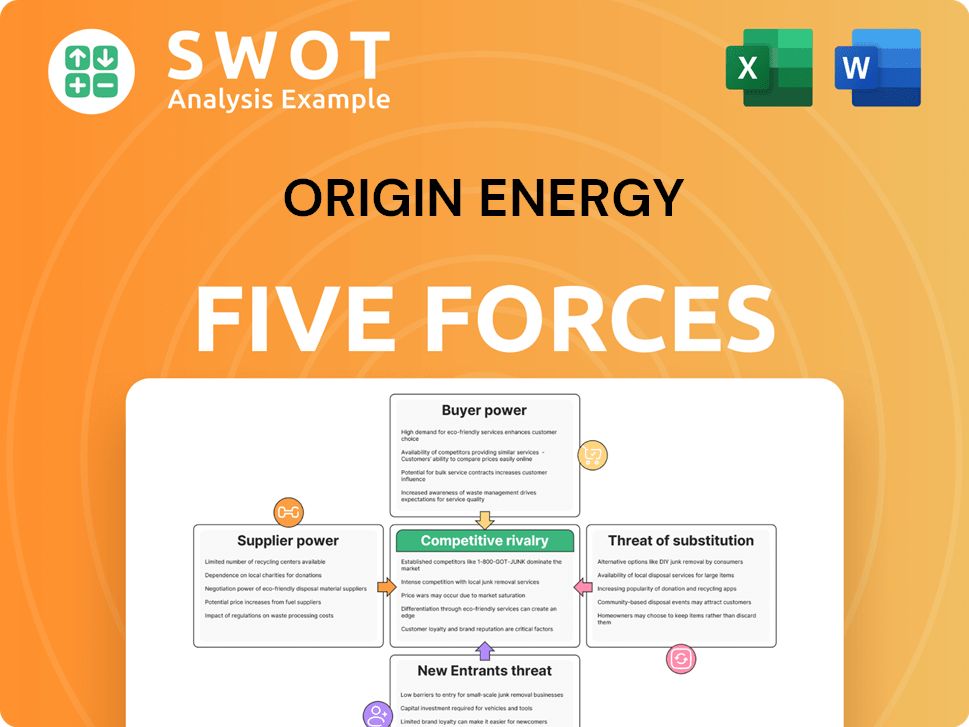

Origin Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Origin Energy Company?

- What is Competitive Landscape of Origin Energy Company?

- How Does Origin Energy Company Work?

- What is Sales and Marketing Strategy of Origin Energy Company?

- What is Brief History of Origin Energy Company?

- Who Owns Origin Energy Company?

- What is Customer Demographics and Target Market of Origin Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.