Origin Energy Bundle

Decoding Origin Energy: How Does This Energy Giant Operate?

Origin Energy Australia is a powerhouse in the Australian energy market, seamlessly integrating gas and oil exploration, power generation, and energy retailing. With approximately 4.7 million customer accounts, it's the country's largest energy retailer, playing a crucial role in powering homes and businesses across the nation. From its core operations to its financial performance, understanding Origin Energy is key to navigating the evolving energy landscape.

This deep dive into Origin Energy will explore its diverse offerings, including its role as an energy provider and electricity supplier, alongside its strategic initiatives and financial health. We'll examine how Origin Energy services its vast customer base, providing insights relevant to investors, customers, and industry analysts alike. Furthermore, we'll touch upon Origin Energy SWOT Analysis to help you understand the company's strengths, weaknesses, opportunities, and threats in the competitive market, considering its gas company operations, and how it adapts to the energy transition.

What Are the Key Operations Driving Origin Energy’s Success?

Origin Energy's core operations are structured around three main segments: Energy Markets, Integrated Gas, and Corporate. The Energy Markets segment focuses on energy retailing, power generation, and LPG operations, serving residential, commercial, and industrial customers across Australia. Integrated Gas concentrates on natural gas exploration, production, and managing LNG price risk.

The company's value proposition centers on providing energy solutions, leveraging its diverse energy supply, customer base, and the Kraken technology platform. This platform aims to improve customer experience through seamless processes, personalization, and automation while reducing costs. Origin Energy is committed to offering innovative energy solutions and maintaining a strong market position.

As of August 2024, Origin's total customer accounts increased by 132,000 to 4.7 million, driven by new electricity, gas, and broadband customers. Origin Zero, part of its Energy Markets business, has more than doubled the number of business customers on solutions beyond just electricity or natural gas.

This segment covers energy retailing, power generation, and LPG operations. It serves residential, commercial, and industrial customers across Australia. Origin Zero, part of this segment, offers solutions beyond electricity or natural gas.

This segment focuses on natural gas exploration and production. It also manages LNG price risk through hedging and trading activities. A key asset is Origin's stake in Australia Pacific LNG (APLNG).

The Kraken platform, in partnership with Octopus Energy, transforms retail operations. It aims to improve customer experience and reduce costs. By December 2024, contracted customer accounts reached 62 million globally.

In FY24, APLNG's production increased by 3% to 694 PJ. Origin operates APLNG's gas fields in Queensland and its main gas transmission pipeline.

Origin Energy maintains a competitive edge through its strong customer position, diverse energy supply, and the world-class Kraken platform. The company continues to adapt to market changes and customer needs.

- Strong customer base and market position.

- Diverse energy supply including gas and electricity.

- Advanced Kraken technology platform for operational efficiency.

- Focus on customer experience and innovative energy solutions.

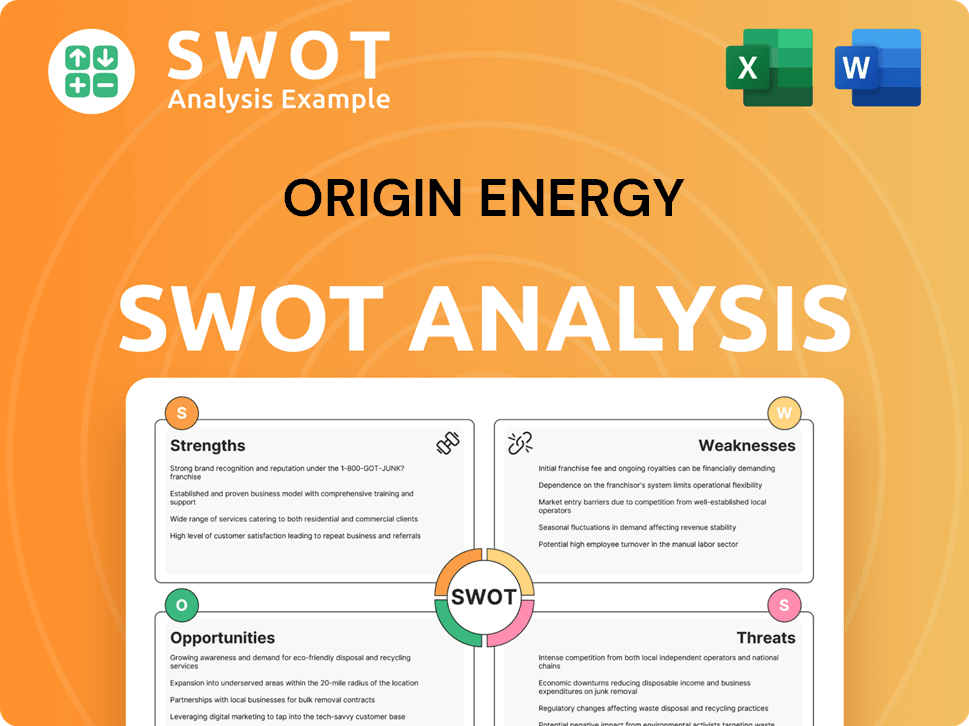

Origin Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Origin Energy Make Money?

Origin Energy, a prominent energy provider in Australia, generates revenue through various streams, primarily from selling electricity and natural gas to a diverse customer base. This includes residential, small to medium enterprises, business, and wholesale customers. The company also benefits from selling generated electricity into the National Electricity Market (NEM) and trading physical LNG cargoes.

In FY24, Origin Energy's total revenue reached a significant $16,138 million, showcasing its strong market presence. The company's financial performance reflects its strategic focus on energy markets and integrated gas operations, contributing to an underlying profit increase.

The company's revenue streams are diversified, with electricity sales accounting for a substantial portion. Gas sales and pool revenue also contribute significantly to the overall financial performance. Origin Energy's strategic initiatives and technological advancements further enhance its revenue generation capabilities.

The following is a breakdown of Origin Energy's major revenue streams for FY24:

- Electricity sales: $9,083 million

- Gas sales: $4,628 million

- Pool revenue: $2,165 million

- Solar and batteries: $100 million

- Broadband: $100 million

Origin Energy employs innovative monetization strategies to boost revenue and enhance customer value. A key strategy is the licensing of its Kraken technology platform, which saw a 73% increase in licensing revenue in FY24. By December 2024, Kraken had 62 million contracted customer accounts, generating over £300 million in annual recurring revenue. The expansion into broadband services in February 2025 added another 2.3 million customer accounts. Multi-product bundling, such as combining energy and broadband services, has also helped lower customer churn rates. Furthermore, Origin's investment in and expansion of its virtual power plant, Loop, to 1.4 GW of capacity, optimizes distributed assets and shifts demand. Origin Zero provides digital insights, demand management, and electric vehicle fleet and subscription solutions to business customers, diversifying revenue streams.

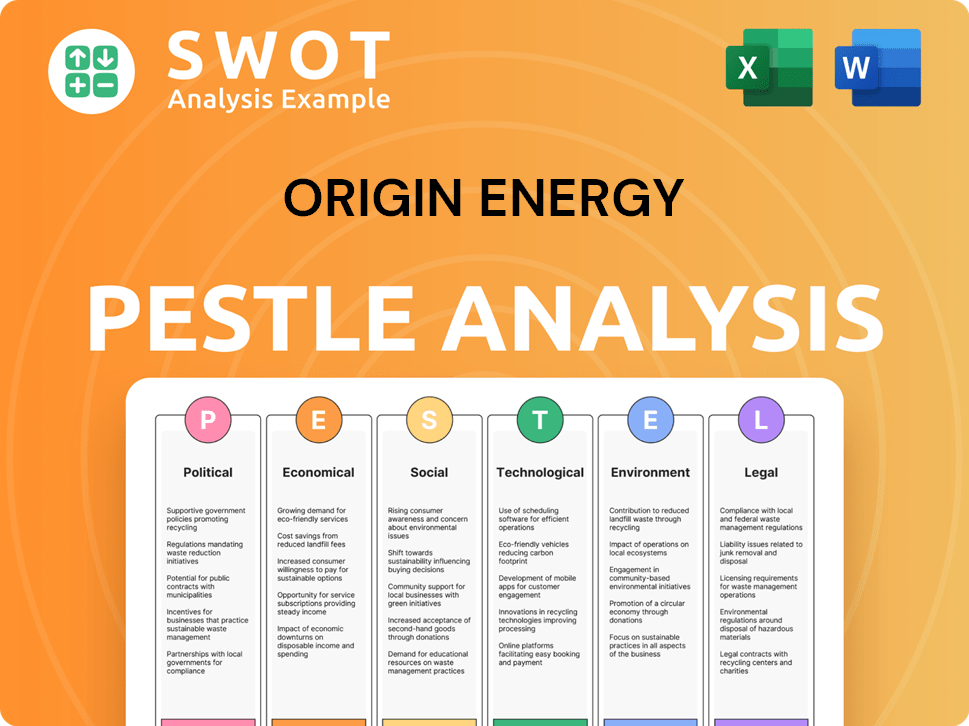

Origin Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Origin Energy’s Business Model?

Origin Energy has navigated a dynamic energy landscape, marked by significant strategic shifts and operational adjustments. A key move involved a strategic partnership with Octopus Energy, including a 20% stake acquisition and a license for the Kraken customer platform in Australia. This initiative aimed to transform Origin's retail operations, targeting pre-tax cash savings of $100-150 million annually from FY2024.

Operationally, Origin has faced challenges, including increased bad and doubtful debt expenses in FY24 due to economic pressures. Despite these hurdles, the company has demonstrated a commitment to supporting its customers by allocating $100 million across FY24 and FY25 to assist vulnerable customers, including tariff freezes. These actions reflect Origin's responsiveness to evolving market conditions and customer needs.

Origin's competitive advantages are multifaceted, underpinned by its leading customer position and brand recognition. The company leverages its world-class Kraken platform and advanced data analytics capabilities. Furthermore, Origin benefits from operating Australia's largest fleet of peaking gas-powered plants, providing a unique advantage in the firm capacity market. Its strong free cash flow profile, supported by Australia Pacific LNG (APLNG), and a standout gas portfolio with supply costs significantly below current contract prices, further bolster its competitive edge. Origin is actively adapting to new trends and technology shifts by investing in renewables and storage.

Origin's partnership with Octopus Energy and the adoption of the Kraken platform are central to its strategic transformation. By December 2024, Kraken had expanded to 62 million contracted customer accounts globally, showing substantial progress towards its 100 million account target by 2027. This move is designed to streamline retail operations and improve customer service.

The company has faced increased bad debt expenses, reflecting the impact of economic pressures on customers. Origin has responded by committing $100 million to support vulnerable customers through tariff freezes and other assistance programs. These initiatives demonstrate Origin's commitment to supporting its customer base during challenging times.

Origin's leading market position and brand recognition are key strengths. Its large peaking gas-powered plant fleet and strong free cash flow from APLNG provide a competitive edge. The company is actively investing in renewables and storage, including large-scale battery projects at Eraring and Mortlake, and expanding its virtual power plant, Loop, to 1.4 GW.

Origin is focused on adapting to the energy transition by investing in renewable energy and storage solutions. This includes the development of large-scale battery projects and the expansion of its virtual power plant. The company’s proactive approach to the energy transition positions it for long-term growth and sustainability. Learn more about Origin Energy's financial performance.

Origin is actively investing in renewable energy and storage projects to adapt to the changing energy landscape. This includes the construction of large-scale batteries at Eraring and Mortlake, securing battery offtake agreements, and expanding its virtual power plant, Loop, to 1.4 GW. These investments are designed to enhance the company’s long-term sustainability and competitiveness.

- Construction of large-scale batteries at Eraring and Mortlake.

- Securing battery offtake agreements.

- Expanding its virtual power plant, Loop, to 1.4 GW.

- Progressing major renewable energy developments like the Yanco Delta wind farm.

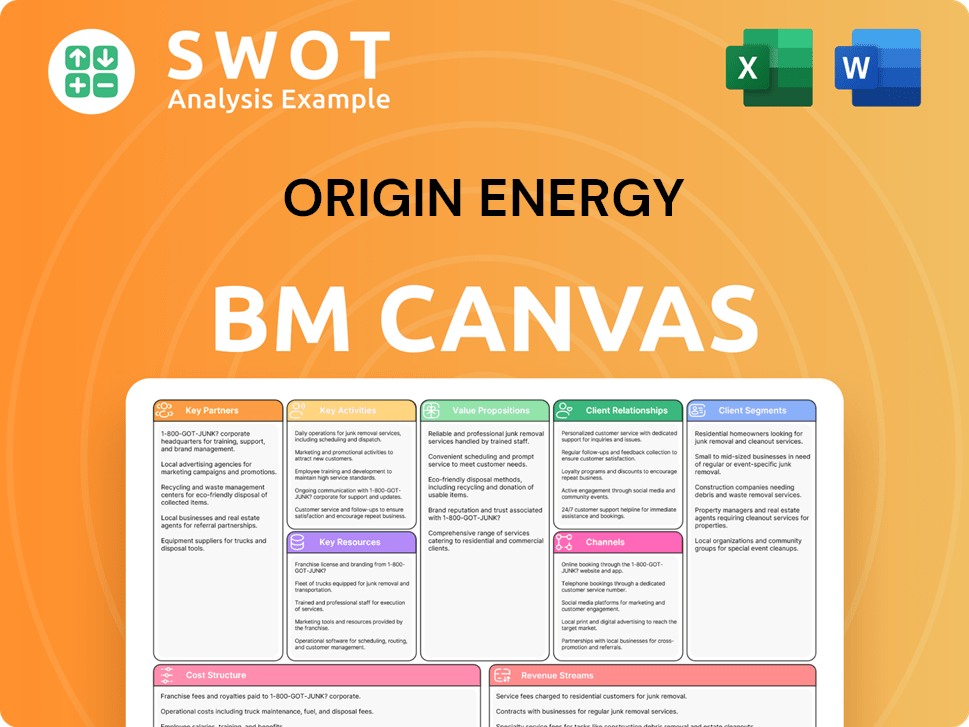

Origin Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Origin Energy Positioning Itself for Continued Success?

As a leading force in Australia's energy sector, Origin Energy Australia maintains a strong industry position. The company is the largest energy retailer, serving approximately 4.7 million customer accounts as of October 2024. Its customer loyalty is notable, with a churn rate of 13.2% in FY24, significantly better than the market average.

Origin Energy services are expanding globally through its investment in Octopus Energy. By December 2024, Octopus Energy had become the largest energy retailer in the UK, with 13.3 million accounts, and 1.8 million accounts outside the UK.

Origin Energy faces various risks, including volatility in global commodity prices. A 10% decline in Australia Pacific LNG revenue was seen in Q3 2024 due to lower LNG and LPG prices. Regulatory changes and the rising cost of living also impact customers' ability to pay bills. Competition within the energy market and the depletion of APLNG's coal seam gas fields pose long-term risks.

Origin Energy is focused on sustained revenue generation through strategic initiatives. The company plans to invest in renewables and storage, targeting 4-5 GW of capacity by 2030. Cost reductions of $100-150 million are targeted by FY26. The company expects its Octopus Energy investment to contribute positively to EBITDA, with a forecast of up to $100 million for FY25.

Origin Energy is actively pursuing strategies to strengthen its market position and navigate industry challenges. The company is committed to accelerating its investment in renewables and storage. This involves progressing large-scale battery projects and developing wind and solar farms.

- Investment in renewables and storage, aiming for 4-5 GW of capacity by 2030.

- Cost reduction targets of $100-150 million by FY26.

- Focus on leveraging its diverse portfolio and leading customer position.

- Anticipated positive contribution from Octopus Energy investment, despite recent challenges. For more details, see the Growth Strategy of Origin Energy.

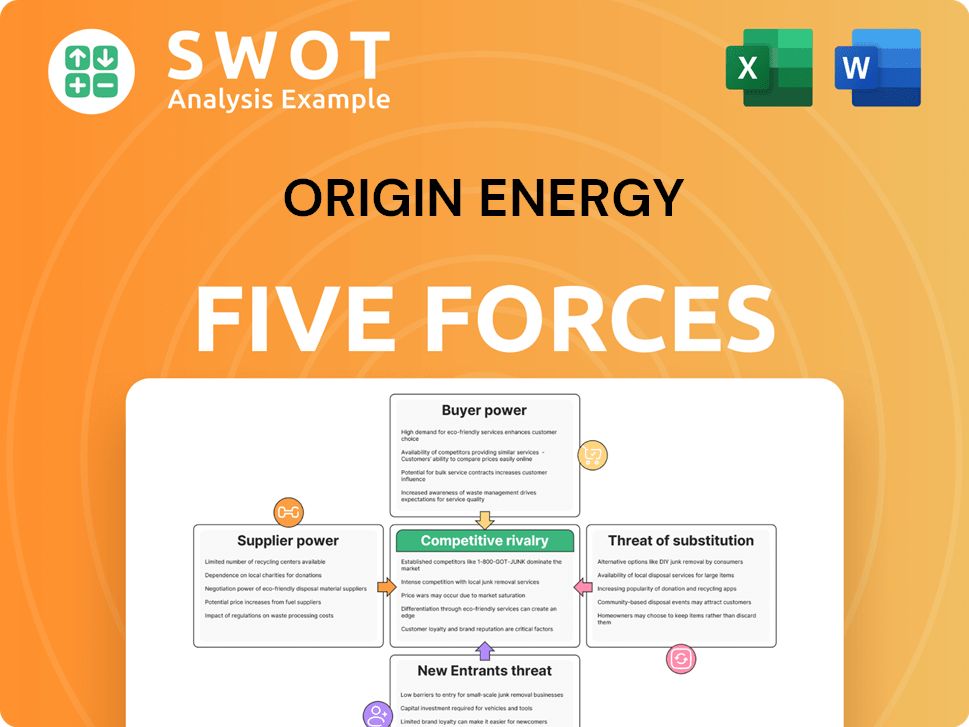

Origin Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Origin Energy Company?

- What is Competitive Landscape of Origin Energy Company?

- What is Growth Strategy and Future Prospects of Origin Energy Company?

- What is Sales and Marketing Strategy of Origin Energy Company?

- What is Brief History of Origin Energy Company?

- Who Owns Origin Energy Company?

- What is Customer Demographics and Target Market of Origin Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.