Red Lobster Bundle

Can Red Lobster Reclaim Its Former Glory?

The casual dining sector is a battlefield, constantly reshaped by consumer trends and economic forces. Red Lobster, a titan in the seafood restaurant industry, faces a critical juncture. Its 2020 acquisition by Thai Union Group marked a turning point, influencing its strategic direction and financial outlook. This analysis dives into Red Lobster's growth strategy and future prospects.

Founded in 1968, Red Lobster has expanded from a single restaurant to a global brand, demonstrating impressive adaptability. Understanding Red Lobster's Red Lobster SWOT Analysis is crucial for grasping its current position and future potential. This exploration will dissect its expansion plans, menu innovations (including Red Lobster new menu items 2024), and strategic initiatives, providing insights into its ability to navigate the competitive landscape and secure long-term viability. We'll also examine Red Lobster's market share analysis, financial performance review, and consider its challenges and opportunities within the seafood restaurant industry.

How Is Red Lobster Expanding Its Reach?

The expansion initiatives for the restaurant chain are primarily focused on optimizing its existing locations and exploring new avenues for customer engagement. The strategy emphasizes enhancing the performance of current restaurants, including potential remodels and operational efficiencies, to improve the guest experience and boost same-store sales. While large-scale new market entries are not the primary focus, the company still assesses opportunities for strategic restaurant openings in underserved markets or areas with strong demand for seafood casual dining.

A key aspect of the current expansion strategy involves diversifying revenue streams beyond traditional dine-in experiences. This includes a significant emphasis on off-premise dining, such as takeout and delivery services, which have seen considerable growth in the casual dining sector. The company is investing in technology and operational adjustments to streamline these services, aiming to capture a larger share of the at-home dining market.

The company is also exploring product innovation by introducing limited-time offers and seasonal menus that leverage popular seafood trends and customer preferences, aiming to attract new diners and encourage repeat visits. Partnership strategies, particularly with third-party delivery platforms, are crucial to expanding its reach and convenience for customers. For example, in 2023, the company saw a significant increase in off-premise sales, demonstrating the effectiveness of these strategies.

The company is focusing on improving the performance of existing locations through remodels and operational enhancements. This includes streamlining kitchen processes and enhancing the dining environment to boost customer satisfaction. These efforts aim to increase same-store sales and improve overall profitability. In 2024, several locations are undergoing renovations to reflect updated branding and improve functionality.

The company is investing heavily in off-premise dining options, including takeout and delivery services. This involves upgrading technology and optimizing operations to ensure efficient order fulfillment and delivery. The goal is to capture a larger share of the at-home dining market, which has seen substantial growth. This strategy is crucial for the company's Red Lobster brief history.

The company is introducing new menu items and limited-time offers to attract new customers and encourage repeat visits. This includes seasonal menus that highlight popular seafood trends and customer preferences. These initiatives are designed to keep the menu fresh and appealing, driving traffic and sales. New menu items are regularly tested and introduced based on market trends.

Partnerships with third-party delivery platforms are a key part of the expansion strategy. These collaborations expand the company's reach and provide convenience for customers. The company is working to optimize its online ordering and delivery processes to ensure a seamless customer experience. These partnerships have been instrumental in increasing sales in recent years.

The company's expansion strategy focuses on operational excellence, enhanced customer accessibility, and menu innovation. The primary goal is to fortify its market position within established markets. This includes a focus on improving the dining experience and streamlining operations.

- Enhancing existing restaurant performance through remodels and operational improvements.

- Expanding off-premise dining options, including takeout and delivery services.

- Introducing new menu items and seasonal offerings to attract customers.

- Forming strategic partnerships with delivery platforms to increase reach.

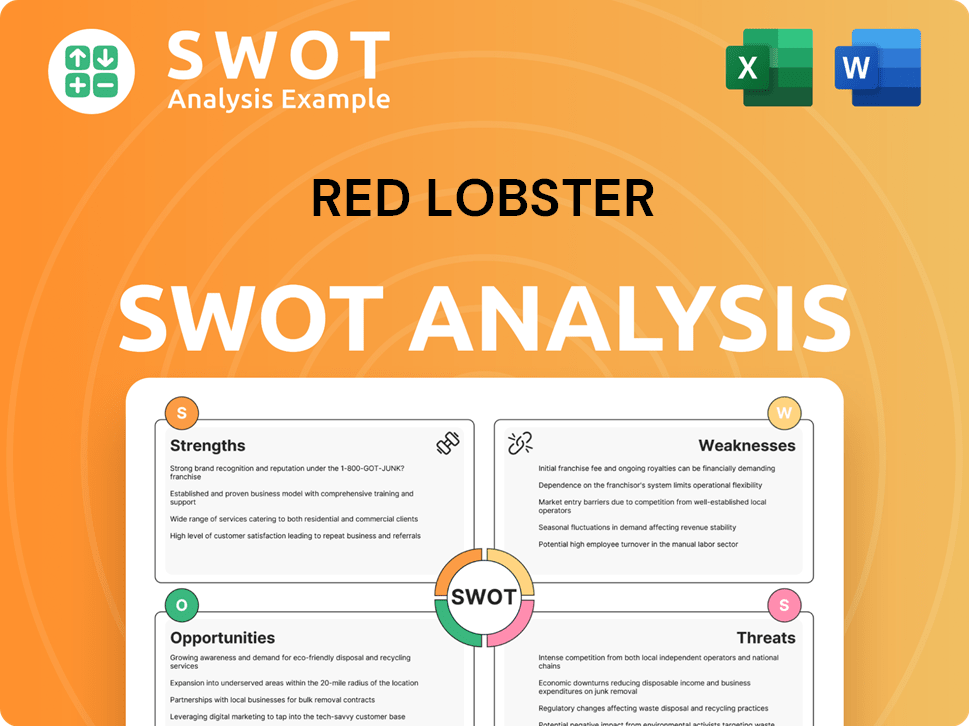

Red Lobster SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Red Lobster Invest in Innovation?

The company is actively leveraging technology and innovation to enhance its operational efficiency, improve customer experience, and drive growth. Digital transformation is a key focus, with efforts centered on streamlining online ordering, improving the loyalty program, and using data analytics to better understand customer preferences and optimize marketing.

This includes investments in a more robust online ordering platform and a mobile application to facilitate seamless takeout and delivery experiences. These are crucial for expanding off-premise sales, a significant area of growth for the restaurant chain. The company's approach to innovation also extends to its menu, with efforts to introduce new dishes and adapt existing ones to cater to evolving dietary trends and consumer tastes.

The restaurant chain is exploring how technology can enhance its supply chain management, ensuring the freshness and quality of its seafood offerings. Sustainability initiatives, while not purely technological, often leverage data and supply chain technology to ensure responsible sourcing of seafood, which aligns with consumer demand for ethically produced food.

The company is investing in its online ordering platform and mobile app. This is to facilitate seamless takeout and delivery experiences. This is crucial for expanding its off-premise sales.

Data analytics is used to understand customer preferences. This helps in optimizing marketing efforts. Analytics also supports menu innovation and ingredient sourcing.

Technology is explored to enhance supply chain management. This ensures the freshness and quality of seafood. It also supports sustainability initiatives.

The company is introducing new dishes and adapting existing ones. This is to cater to evolving dietary trends and consumer tastes. Data-driven insights support these efforts.

Sustainability initiatives leverage data and supply chain technology. This is to ensure responsible seafood sourcing. It aligns with consumer demand for ethically produced food.

Casual dining chains are increasingly adopting tools like AI and IoT. This is to optimize inventory, reduce waste, and personalize customer interactions. These are key areas for the future.

The company's focus on innovation and technology is crucial for its Red Lobster growth strategy in the competitive seafood restaurant industry. Continuous efforts to enhance digital capabilities and operational efficiency are integral to its Red Lobster future prospects. For a deeper understanding of the company's core values and mission, consider reading about the Mission, Vision & Core Values of Red Lobster.

The company's technology strategy is focused on enhancing customer experience and operational efficiency. This includes digital initiatives and supply chain improvements.

- Online Ordering and Delivery: Investments in platforms and apps to boost off-premise sales.

- Data Analytics: Using data to understand customer preferences and optimize marketing.

- Supply Chain Management: Leveraging technology to ensure seafood quality and sustainability.

- Menu Innovation: Adapting menus based on consumer trends and data insights.

- Sustainability: Using technology for responsible seafood sourcing.

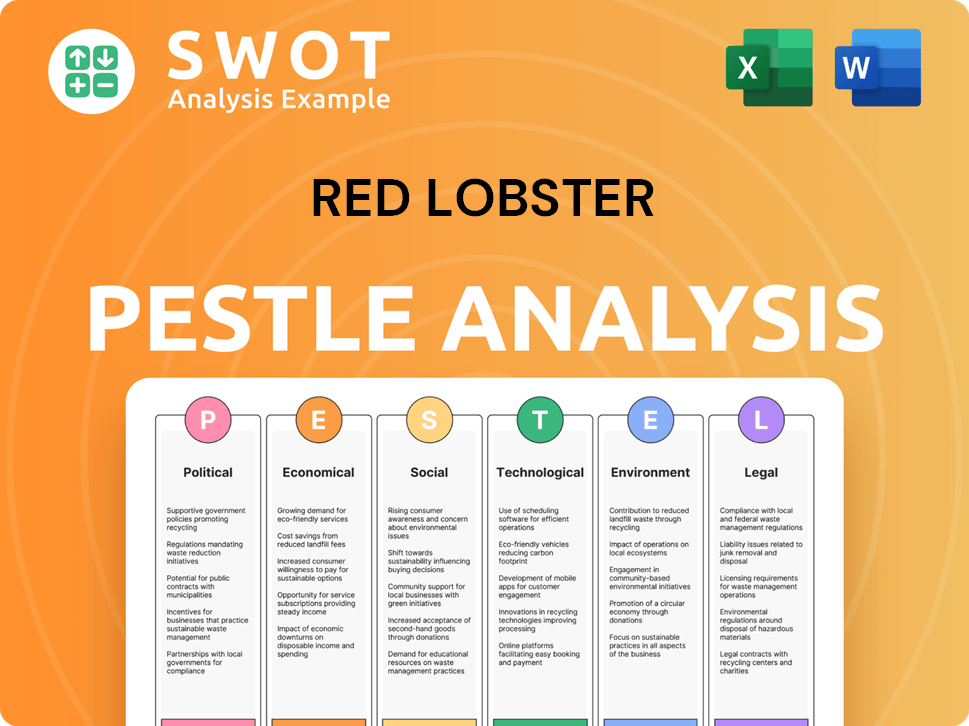

Red Lobster PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Red Lobster’s Growth Forecast?

The financial outlook for the company, a prominent player in the seafood restaurant industry, hinges on strategic decisions and its capacity to navigate the evolving casual dining market in 2024-2025. The company’s financial health is significantly influenced by its ownership structure and its ability to adapt to industry-wide challenges.

The company's financial strategy is likely centered on enhancing profitability through cost management, optimizing its restaurant portfolio, and expanding its off-premise sales channels. The company is focused on achieving a stronger financial position compared to its historical performance, capitalizing on its brand recognition and digital transformation efforts.

The ongoing support from Thai Union Group remains crucial for the company's strategic plans, though specific funding rounds or capital raises for 2024-2025 are not publicly announced. The company's financial strategy emphasizes sustainable growth via operational improvements, customer engagement, and a diversified revenue base to ensure long-term viability in a competitive market. For more details on the ownership structure, you can refer to Owners & Shareholders of Red Lobster.

The company's growth strategy likely involves a multi-faceted approach. This includes menu innovation, potentially introducing Red Lobster new menu items 2024 to attract customers. Furthermore, it focuses on enhancing the customer experience through improved service and atmosphere.

Analyzing Red Lobster market share analysis is crucial to understanding its position within the seafood restaurant industry. The company competes with other casual dining chains, and its market share reflects its ability to attract and retain customers. The company's market share is influenced by various factors, including menu offerings, pricing, and marketing efforts.

The company's business expansion strategies may include opening new locations, both domestically and internationally. Red Lobster expansion plans in the US could involve targeting specific geographic areas with high growth potential. The company's international expansion strategy may focus on regions with strong consumer demand for seafood.

A Red Lobster financial performance review would assess key metrics such as revenue, profit margins, and cash flow. The company's financial performance is influenced by factors such as sales volume, cost of goods sold, and operating expenses. The company's financial health is critical for its long-term sustainability and growth.

Red Lobster's competitive analysis 2024 involves evaluating its position relative to competitors in the seafood restaurant industry. This includes assessing its strengths, weaknesses, opportunities, and threats. Understanding the competitive landscape helps the company make informed strategic decisions.

Customer satisfaction surveys are essential for understanding customer preferences and identifying areas for improvement. Gathering feedback helps the company enhance its offerings and improve the overall dining experience. Analyzing customer feedback can inform strategic decisions.

The company's online ordering and delivery services are crucial for adapting to changing consumer preferences. Offering convenient options for customers to order and receive food enhances accessibility. Digital channels are essential for driving sales and customer engagement.

Effective marketing strategies are essential for attracting and retaining customers. Examples of marketing strategies include promotional campaigns, social media engagement, and loyalty programs. Successful marketing efforts drive brand awareness and sales growth.

The company's sustainability initiatives may include sourcing sustainable seafood and reducing environmental impact. Implementing sustainable practices enhances the company's brand reputation and appeals to environmentally conscious consumers. Sustainability is increasingly important for long-term viability.

Effective supply chain management is critical for ensuring the availability of high-quality ingredients. Optimizing the supply chain helps the company control costs and maintain product quality. Efficient supply chain management supports operational efficiency.

The company faces various challenges and opportunities in the competitive market. Understanding these factors is essential for strategic planning. Addressing challenges and capitalizing on opportunities drives growth and success.

- Economic fluctuations and changing consumer preferences pose challenges.

- Menu innovation and expansion into new markets present opportunities.

- Adapting to digital trends and enhancing customer service are crucial for success.

- Maintaining brand reputation and ensuring financial stability are ongoing priorities.

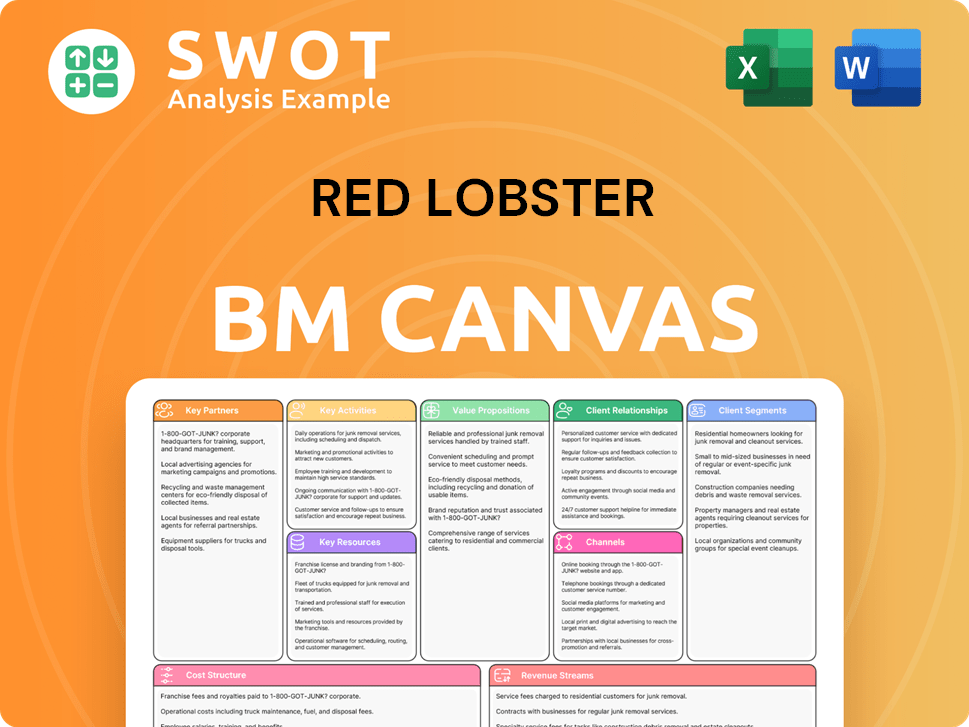

Red Lobster Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Red Lobster’s Growth?

The casual dining sector presents significant challenges for the successful execution of any Red Lobster growth strategy. The Red Lobster company faces risks related to market competition, regulatory changes, and supply chain vulnerabilities. These factors can influence operational costs, customer satisfaction, and overall financial performance, potentially impacting the Red Lobster future prospects.

Intense competition within the seafood restaurant industry and the broader dining market necessitates continuous adaptation and innovation. The need to attract and retain customers, manage pricing pressures, and respond to evolving consumer preferences requires strategic agility. Furthermore, the company must navigate complex regulatory landscapes and manage potential disruptions in its supply chain.

Internal and external challenges could affect the Red Lobster company. These challenges include labor shortages and shifts in consumer preferences. External risks include the impact of fluctuating seafood prices and the need to adapt to evolving consumer tastes, such as the demand for healthier or plant-based menu options.

The casual dining sector is highly competitive, with numerous established and emerging players. This competition can lead to pricing pressures and challenges in attracting and retaining customers. Competitors Landscape of Red Lobster shows that the company must constantly innovate to maintain its market position.

Regulatory changes, particularly concerning food safety, labor laws, and environmental regulations related to seafood sourcing, could impact operations. Evolving regulations around sustainable fishing practices could affect its supply chain and ingredient costs. Compliance costs can increase due to these regulations.

Fluctuations in seafood prices and disruptions in the global supply chain pose a substantial risk. Environmental factors or overfishing can affect seafood availability. These issues can directly impact ingredient costs and menu pricing. The company's relationship with Thai Union Group offers some vertical integration benefits.

Failing to keep pace with digital advancements in online ordering, delivery platforms, and customer relationship management poses a risk. Adapting to technological changes is crucial for enhancing customer experience and operational efficiency. Technological integration is a key factor for growth.

Labor shortages or difficulties in attracting and retaining skilled staff could affect service quality and operational efficiency. Addressing these internal constraints is essential for maintaining a positive customer experience. The company must focus on employee retention strategies.

Shifts in consumer preferences towards healthier or plant-based diets could necessitate further menu diversification. Increasing scrutiny over environmental impact and ethical sourcing requires transparent and sustainable business practices. Adaptability is key to meeting changing consumer demands.

The company faces challenges, including market competition and supply chain risks, but also has opportunities. These opportunities include menu innovation, digital enhancements, and strategic partnerships. Adapting to changing consumer behaviors and technological advancements is essential for future success.

Effective supply chain management is critical, especially given the reliance on seafood. The company must manage fluctuations in seafood prices and ensure sustainable sourcing practices. Strategic partnerships and vertical integration can help mitigate supply chain risks.

Red Lobster must continuously analyze its competitors and adapt its strategies to maintain its market position. This includes monitoring pricing, menu offerings, and marketing efforts. The competitive landscape requires constant evaluation and strategic adjustments.

Increasing consumer awareness of environmental issues necessitates a focus on sustainability. The company should implement sustainable sourcing practices and reduce its environmental footprint. Transparency and ethical sourcing are becoming increasingly important for Red Lobster's brand reputation.

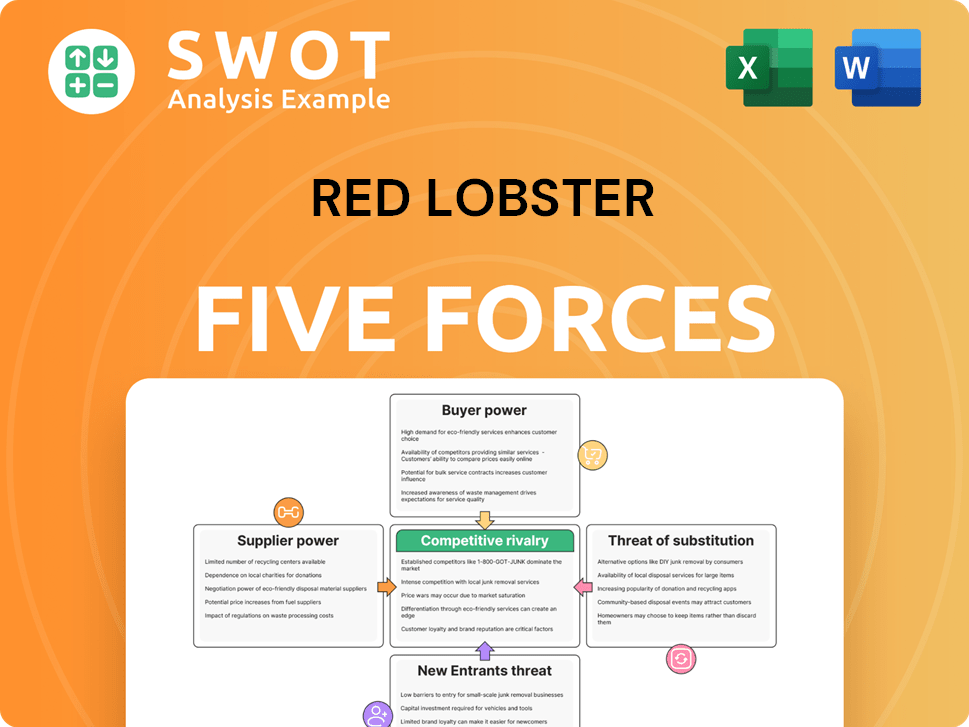

Red Lobster Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Red Lobster Company?

- What is Competitive Landscape of Red Lobster Company?

- How Does Red Lobster Company Work?

- What is Sales and Marketing Strategy of Red Lobster Company?

- What is Brief History of Red Lobster Company?

- Who Owns Red Lobster Company?

- What is Customer Demographics and Target Market of Red Lobster Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.