Red Lobster Bundle

Who Really Owns Red Lobster After Bankruptcy?

The May 2024 bankruptcy filing by Red Lobster sent shockwaves through the restaurant industry, raising critical questions about its ownership and future. Understanding "Who owns Red Lobster" is more crucial now than ever, as ownership directly dictates the company's strategic direction and financial health. This exploration delves into the complex history of Red Lobster's ownership, from its humble beginnings to its current struggles.

From its inception in 1968 by Bill Darden, to its current status, the Red Lobster SWOT Analysis reveals a company shaped by evolving ownership structures. This analysis of the Red Lobster company will examine the significant shifts in its parent company and the impact of these changes on its operations and financial performance. Knowing "Who owns Red Lobster" provides vital context for evaluating its future prospects and the strategies employed to navigate the challenging casual dining landscape. This deep dive will explore the Red Lobster history and ownership structure, answering questions like "Who is the current owner of Red Lobster" and "Did Red Lobster file for bankruptcy?"

Who Founded Red Lobster?

The story of the Red Lobster company begins in 1968 with founder Bill Darden. His vision was to create a seafood restaurant that was both accessible and appealing to a wide audience. The first Red Lobster opened its doors in Lakeland, Florida, marking the start of a culinary journey.

Initially, the ownership of Red Lobster was primarily vested in Bill Darden, the driving force behind the venture. While specific details of early equity distribution are not publicly available, Darden's role as the principal owner is well-documented. There were no angel investors or family members with initial stakes in the company during its early, pre-corporate phase.

The rapid success of the initial Red Lobster location quickly garnered the attention of larger corporations. This led to a significant change in ownership just two years after its founding. In 1970, General Mills, Inc. acquired Red Lobster, shifting the company from independent control to being part of a larger corporate entity. The terms of this early acquisition, including specific payouts or equity conversions for Darden, are not extensively detailed in publicly available historical records, but it effectively meant that General Mills became the sole owner of Red Lobster at that point, integrating it into their diverse portfolio of businesses.

Bill Darden founded Red Lobster in 1968.

The first restaurant opened in Lakeland, Florida.

Initially, Bill Darden was the principal owner.

General Mills acquired Red Lobster in 1970.

The acquisition marked a shift from Darden's independent control to a corporate structure.

General Mills began to shape the brand's direction.

The early history of Red Lobster's ownership is marked by its founding by Bill Darden and its quick acquisition by General Mills. This transition highlights how the Red Lobster company evolved from a single restaurant to a part of a larger corporate structure. Understanding the Red Lobster history provides context for later ownership changes.

- Bill Darden's vision was to make seafood accessible.

- General Mills' acquisition was a pivotal moment.

- The initial ownership was short-lived due to the buyout.

- The brand's direction was shaped by corporate strategy.

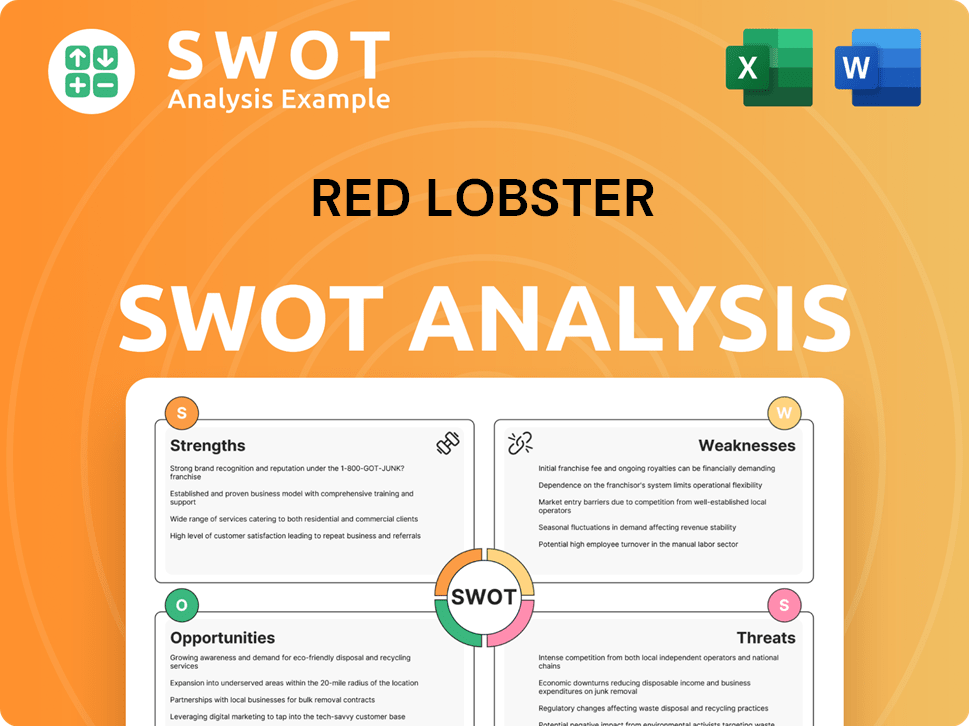

Red Lobster SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Red Lobster’s Ownership Changed Over Time?

The journey of Red Lobster ownership has seen several significant shifts since its inception. Initially part of General Mills, the seafood restaurant chain expanded its footprint nationally. In 1995, General Mills spun off its restaurant division, including Red Lobster, into Darden Restaurants, Inc., making it a publicly traded entity. Darden Restaurants, with its shares listed on the New York Stock Exchange, became the primary stakeholder, with ownership spread among institutional investors, mutual funds, and individual shareholders.

A crucial change occurred in 2014 when Darden Restaurants sold Red Lobster to Golden Gate Capital, a private equity firm, for approximately $2.1 billion. This transition took Red Lobster private. The most recent ownership change happened in 2020, when Thai Union Group PCL became a major stakeholder. Thai Union increased its stake over time, eventually becoming the majority owner. However, in May 2024, Thai Union announced its intention to divest its remaining equity investment in Red Lobster, leading to the company entering Chapter 11 bankruptcy protection. This move signifies a change in the major stakeholders, with the bankruptcy court now determining the future ownership structure.

| Year | Ownership Change | Details |

|---|---|---|

| 1970 | Acquisition by General Mills | Red Lobster becomes part of General Mills. |

| 1995 | Spin-off to Darden Restaurants | Red Lobster becomes part of a publicly traded company. |

| 2014 | Sale to Golden Gate Capital | Red Lobster is acquired by a private equity firm. |

| 2020 | Thai Union Group PCL becomes a major stakeholder | Thai Union Group PCL increases its stake in Red Lobster. |

| May 2024 | Bankruptcy Filing | Thai Union announces divestment, and Red Lobster files for Chapter 11 bankruptcy. |

The Red Lobster company's ownership history is a dynamic story of corporate restructuring. From being part of General Mills to becoming a publicly traded entity under Darden Restaurants, the brand has seen significant changes. The sale to Golden Gate Capital marked a shift to private equity ownership, followed by Thai Union's involvement. The recent bankruptcy filing indicates a period of uncertainty and transition, with the bankruptcy court now overseeing the future of the Red Lobster brand. To understand more about the company's financial operations, you can read about the Revenue Streams & Business Model of Red Lobster.

The ownership of Red Lobster has evolved significantly over time, impacting its strategic direction and financial performance.

- General Mills initially owned Red Lobster, then spun it off into Darden Restaurants.

- Darden Restaurants sold Red Lobster to Golden Gate Capital in 2014.

- Thai Union Group PCL became a major stakeholder, but the company filed for bankruptcy in May 2024.

- The bankruptcy filing will determine the future ownership structure.

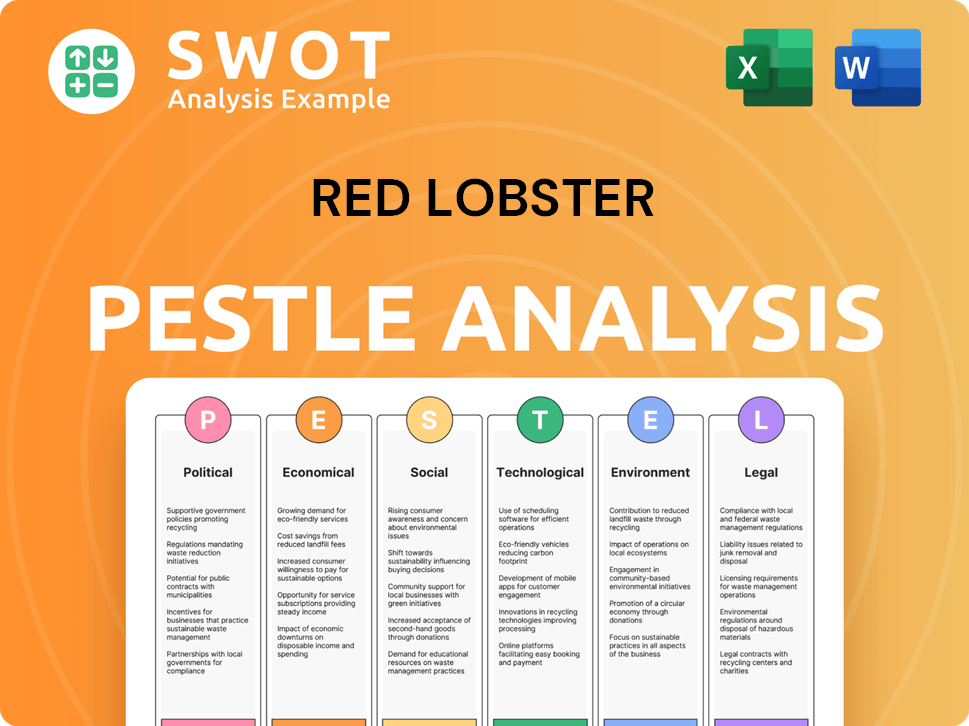

Red Lobster PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Red Lobster’s Board?

Following the May 2024 Chapter 11 bankruptcy filing, the governance of the Red Lobster company is under significant change. Before the bankruptcy, the Board of Directors included representatives from Thai Union Group PCL, the primary owner, along with other investors and independent directors. Thiraphong Chansiri, Thai Union's group CEO, served as the board chairman, highlighting the direct influence of the major shareholder.

The bankruptcy proceedings have shifted control dynamics. While the existing management and board typically remain, their authority is now subject to court oversight. Creditors, especially secured creditors, gain significant influence over the restructuring plan. This can lead to changes in the board and future ownership, reflecting the interests of a reorganized entity. The current board composition and the specific individuals serving are subject to ongoing changes as the bankruptcy progresses.

| Board Member | Title | Affiliation |

|---|---|---|

| Thiraphong Chansiri | Former Chairman | Thai Union Group PCL |

| (Information not available post-bankruptcy) | (Information not available post-bankruptcy) | (Information not available post-bankruptcy) |

| (Information not available post-bankruptcy) | (Information not available post-bankruptcy) | (Information not available post-bankruptcy) |

The voting structure before the bankruptcy was based on equity stakes, with Thai Union holding significant voting power. The bankruptcy has altered this, with the court and creditors now playing a crucial role in shaping the future of Red Lobster ownership. For more insights into the company's strategies, you can explore the Marketing Strategy of Red Lobster.

The ownership structure of Red Lobster has evolved significantly, especially with the bankruptcy filing. The board composition is in flux, with creditor influence growing. The future ownership will likely reflect the restructuring plan.

- Thai Union Group PCL was the primary owner before bankruptcy.

- Bankruptcy proceedings have shifted control to the court and creditors.

- The board's composition is subject to change during the restructuring.

- The current financial status of Red Lobster is undergoing significant changes.

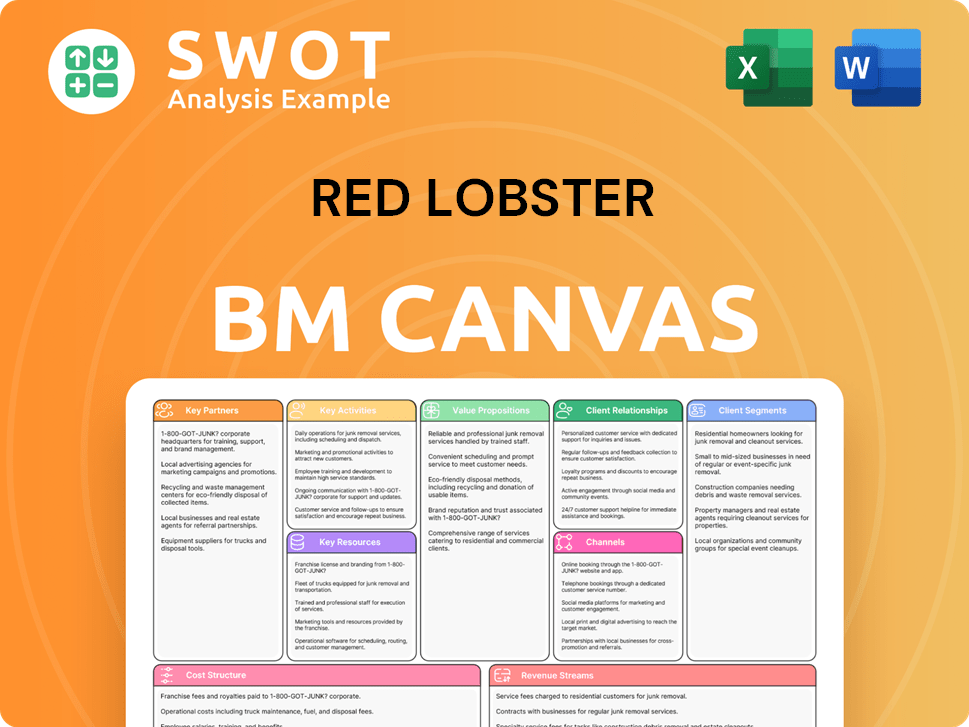

Red Lobster Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Red Lobster’s Ownership Landscape?

The past few years have been marked by significant shifts in Red Lobster ownership. The most recent development includes a Chapter 11 bankruptcy filing in May 2024. This followed Thai Union Group PCL's increasing stake, eventually becoming the majority owner in 2020. This move aligned with a broader trend of vertical integration within the seafood industry, where suppliers acquire restaurant chains to secure distribution channels. However, this ownership structure faced challenges, especially with profitability, which was further complicated by the COVID-19 pandemic and operational issues.

In May 2024, Thai Union announced its intention to divest its remaining equity investment in the company, citing continuous financial underperformance and the need for substantial capital to turn the business around. This decision directly preceded the bankruptcy filing. The bankruptcy filing signals a potential restructuring of the company's debt and operations, which could lead to a new ownership structure emerging from the Chapter 11 process. This might involve existing creditors converting debt to equity or new investors acquiring the reorganized company.

| Key Ownership Events | Date | Details |

|---|---|---|

| Thai Union Majority Ownership | 2020 | Thai Union Group PCL increased its stake, becoming the majority owner. |

| Divestment Announcement | May 2024 | Thai Union announced its intention to sell its remaining equity. |

| Chapter 11 Bankruptcy Filing | May 2024 | Red Lobster filed for Chapter 11 bankruptcy protection. |

Industry trends impacting ownership in the casual dining sector include increased institutional ownership in publicly traded companies. For private entities like the company, the focus is often on private equity firms or strategic corporate buyers. The bankruptcy proceedings are a clear indication of how financial distress can force significant ownership changes and a re-evaluation of strategic direction. Future ownership will likely be determined by the outcome of the bankruptcy court's decisions, with a focus on stabilizing the company and returning it to profitability.

The company faced profitability challenges even under new ownership. The COVID-19 pandemic and operational issues worsened the situation.

The Chapter 11 filing will likely lead to restructuring. This could result in new ownership or changes to the company's financial structure.

The bankruptcy court's decisions will shape the company's future. The focus will be on stabilizing the business and returning to profitability.

Casual dining ownership often involves private equity or corporate buyers. Financial distress can trigger significant ownership changes.

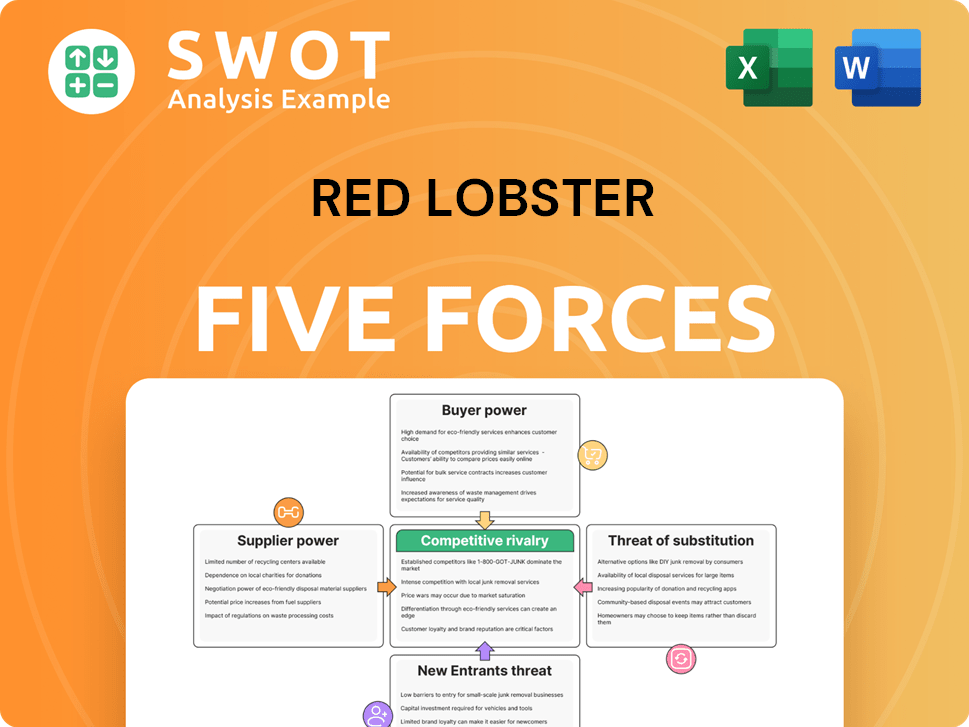

Red Lobster Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Red Lobster Company?

- What is Competitive Landscape of Red Lobster Company?

- What is Growth Strategy and Future Prospects of Red Lobster Company?

- How Does Red Lobster Company Work?

- What is Sales and Marketing Strategy of Red Lobster Company?

- What is Brief History of Red Lobster Company?

- What is Customer Demographics and Target Market of Red Lobster Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.