Teck Resources Bundle

Can Teck Resources Lead the Energy Transition?

In 2024, Teck Resources underwent a pivotal transformation, reshaping itself into a pure-play energy transition metals powerhouse. This strategic pivot underscores the critical need for a robust growth strategy within the mining sector, especially given the escalating global demand for essential minerals. Founded in 1906, Teck Resources, a diversified resource company, has evolved significantly, setting the stage for an exciting future.

This shift positions the Teck Resources SWOT Analysis as a crucial tool for understanding its strategic direction. With copper production surging and significant operations across the Americas, the company's future prospects are closely tied to its ability to capitalize on the green energy revolution. Exploring Teck Resources' growth strategy reveals how it plans to navigate market dynamics, boost financial performance, and expand its footprint in a competitive landscape. Understanding the long-term strategic plan is key.

How Is Teck Resources Expanding Its Reach?

The Teck Resources Growth Strategy is heavily focused on expanding its copper production capacity. This strategic shift is primarily driven by the increasing demand for copper in the energy transition, including electric vehicles, renewable energy infrastructure, and grid modernization. The company's strategic moves and investment decisions are designed to capitalize on this growing market.

Teck Resources Future Prospects appear promising, particularly with the company's focus on copper and zinc. The divestiture of its steelmaking coal business in 2024 allowed the company to concentrate its resources on these key metals. This strategic realignment is expected to enhance its market position and financial performance in the coming years.

As a Mining Company Strategy, Teck Resources is actively undertaking several expansion initiatives to bolster its production capabilities and meet the rising demand for copper. These initiatives are strategically aligned to ensure long-term growth and profitability.

The Quebrada Blanca (QB) mine in Chile is a cornerstone of Teck's expansion. The QB2 expansion project is a significant driver of production growth. The company plans to optimize and debottleneck QB, which is expected to increase throughput by an additional 15-25%.

In Canada, Teck is investing between US$1.3 billion and US$1.4 billion to extend the life of the Highland Valley Copper mine. This extension is projected to yield an average annual production of 137,000 tonnes of copper post-2024. This investment is crucial for maintaining its production capacity.

Teck has two near-term developments, Zafranal in Peru and San Nicolás in Mexico, positioned for potential sanction decisions in the second half of 2025. These projects are expected to contribute significantly to the company's copper and zinc production. These projects will diversify revenue streams.

The company aims to achieve an annual copper output of approximately 800,000 tonnes by the end of the decade. These initiatives are strategically pursued to access new customers in the energy transition market and maintain a leading position in the industry. The company is focused on sustainable mining practices.

These expansion initiatives are critical components of Teck Resources Company's long-term strategic plan. The company's focus on copper and zinc, coupled with strategic investments and project developments, positions it well to capitalize on the growing demand for these metals. For a detailed financial performance analysis, you can refer to information available on the company's recent quarterly earnings report.

The Quebrada Blanca (QB) mine in Chile is a key focus, with the QB2 expansion project already contributing to increased production. The Highland Valley Copper mine in Canada is also undergoing significant investment. These projects are crucial to Teck's growth.

- QB2 expansion reached full design throughput by the end of 2024.

- Highland Valley Copper mine extension investment is between US$1.3 billion and US$1.4 billion.

- Zafranal Project in Peru is expected to produce 126,000 tonnes of copper annually.

- San Nicolás Project in Mexico is expected to produce 63,000 tonnes of copper annually.

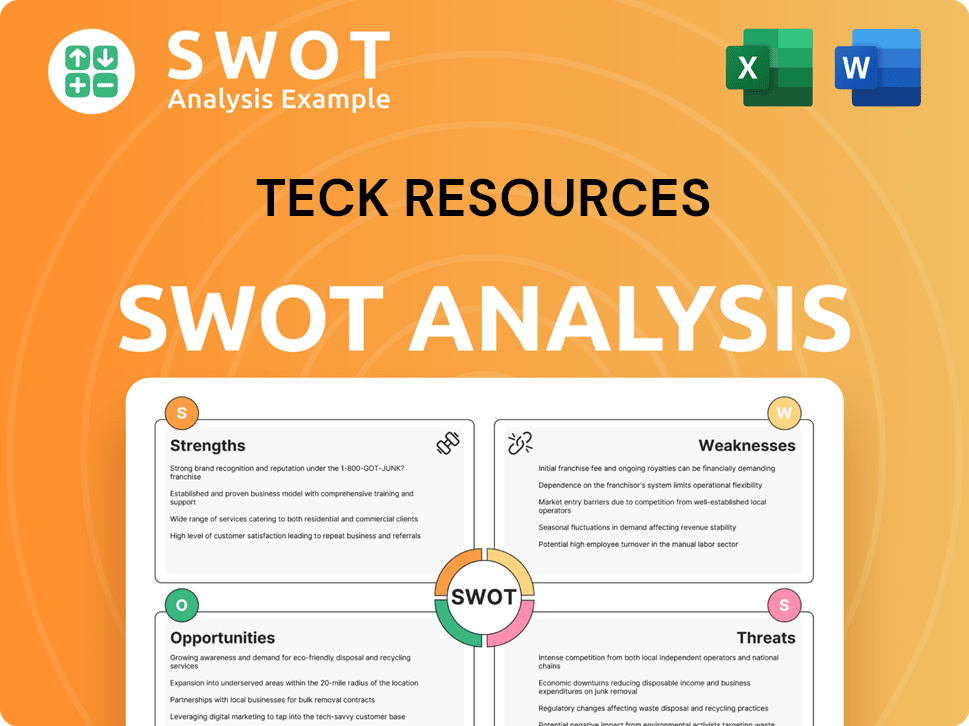

Teck Resources SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Teck Resources Invest in Innovation?

The growth strategy of Teck Resources centers on leveraging innovation and technology to enhance operational efficiency, minimize environmental impact, and drive expansion, especially in copper and zinc production, crucial for the energy transition. This approach involves substantial investments in research and development, internal advancements, and strategic collaborations. The company's focus on sustainable practices and technological integration is key to its future prospects and overall performance.

Teck Resources' commitment to innovation is evident in its strategic investments in advanced mining practices and the adoption of cutting-edge technologies. These efforts aim to streamline operations, reduce costs, and improve environmental sustainability. By prioritizing these areas, the company positions itself for long-term growth and resilience in the dynamic resources market. For a deeper dive into their business model, consider reading Revenue Streams & Business Model of Teck Resources.

The company's strategic initiatives, such as the enterprise resource planning (ERP) system slated for implementation in 2025, demonstrate its commitment to operational excellence. Furthermore, Teck Resources is actively engaged in sustainability projects, including partnerships for renewable energy solutions. These actions not only support environmental goals but also contribute to cost savings and risk reduction, reinforcing the company's dedication to responsible resource management.

At the Quebrada Blanca (QB) mine, debottlenecking strategies have boosted throughput by 15-25%. This focus on operational optimization at QB will inform a low capital-intensity debottlenecking project. These improvements highlight Teck's commitment to efficiency.

Teck Resources is investing in an ERP system, expected to commence in 2025. This system aims to streamline processes across the company. The ERP system is a key component of their operational efficiency strategy.

Teck is reducing reliance on diesel fuel and greenhouse gas emissions. A notable example is the solar power project at the Schaft Creek copper-gold-molybdenum-silver development project in British Columbia. This initiative showcases their commitment to environmental responsibility.

The solar array and battery installation at Schaft Creek is estimated to reduce carbon emissions for camp power by over 70%. Diesel fuel consumption was reduced by 83% in one month of full utilization in 2024. This project highlights the company's focus on sustainable energy solutions.

Teck has been included in the Dow Jones Best-in-Class World Index for 15 consecutive years. They released the Climate Change and Nature 2024 Report, integrating recommendations from the Taskforce on Nature-related Financial Disclosures and the Task Force on Climate-related Financial Disclosures. This recognition underscores their commitment to environmental stewardship.

Teck has partnered with Arras Minerals for a US$5 million generative exploration program in Kazakhstan in 2024-2025. This collaboration is aimed at identifying new mineral resources and advancing exploration activities. These alliances are crucial for expanding their resource base.

Teck Resources is focused on leveraging technology and strategic partnerships to drive growth and sustainability. These initiatives are central to their long-term strategic plan and market share analysis. The company's approach includes:

- Implementing advanced mining practices to boost efficiency.

- Investing in an ERP system to streamline operations.

- Deploying solar power projects to reduce emissions and costs.

- Forming strategic alliances for exploration and resource development.

- Maintaining a strong commitment to sustainability, as evidenced by inclusion in the Dow Jones Index.

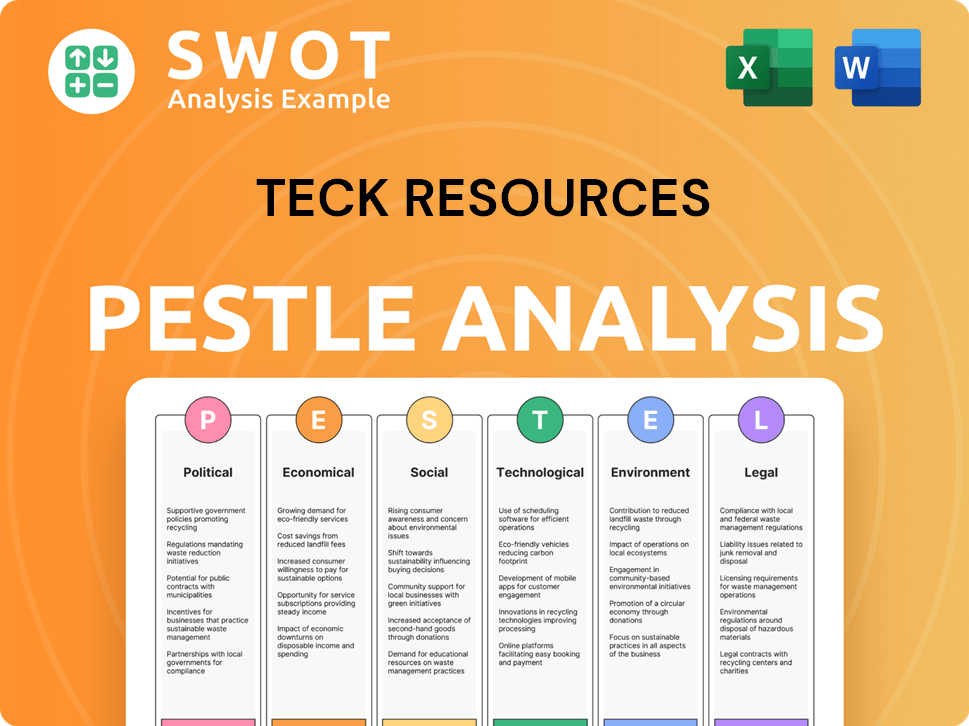

Teck Resources PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Teck Resources’s Growth Forecast?

The financial outlook for Teck Resources Company is robust, primarily driven by its strategic shift towards energy transition metals, particularly copper. This strategic pivot follows the significant sale of its steelmaking coal business in 2024, which has enabled the company to focus on high-growth areas. This transformation is expected to yield substantial financial benefits in the coming years, making it a key player in the resource company outlook.

Teck Resources' focus on copper is already showing results, with record production in 2024. The company's investment in copper projects and its disciplined capital allocation framework further support its growth trajectory. This strategic direction, combined with a strong balance sheet, positions Teck for sustained financial performance and the ability to return value to shareholders. For more insights, you can read about the Target Market of Teck Resources.

In 2024, Teck Resources demonstrated strong financial performance, highlighted by a significant increase in copper production and strategic debt reduction. The company's focus on copper, combined with disciplined capital allocation, is expected to drive future growth and shareholder value. The company's financial discipline is evident in its capital allocation framework.

Teck Resources saw record copper production in 2024, reaching 446,000 tonnes. For 2025, the company anticipates a further increase, with production expected to be between 490,000 and 565,000 tonnes. This growth is central to Teck Resources' growth strategy in copper.

With increased copper production, Teck expects a reduction in net cash unit costs. Forecasts for 2025 are between US$1.65 and $1.95 per pound, a decrease from US$1.90 to $2.30 per pound in 2024. This improvement will positively impact Teck Resources' financial performance analysis.

While copper production is increasing, zinc production is expected to decrease in 2025. Total zinc in concentrate production is projected to be between 525,000 and 575,000 tonnes, compared to 615,900 tonnes in 2024. This shift reflects strategic decisions within the company.

In 2024, Teck returned $1.8 billion to shareholders through dividends and share buybacks. The company also reduced debt by US$1.6 billion. These actions demonstrate Teck Resources' performance and commitment to shareholder value.

Analysts project a substantial increase in Teck's free cash flow, from $155 million in 2024 to $2.44 billion in 2029. This growth supports the company's plans for future investments and shareholder returns, reinforcing its position as a strong investment opportunity.

- Teck is targeting approximately 800,000 tonnes of annual copper production by the end of the decade.

- The company plans to invest up to US$3.9 billion over the next four years in its copper projects.

- Teck maintains a strong balance sheet with $10 billion in liquidity and a net cash position of CAD 2.1 billion.

- The sale of the steelmaking coal business for US$7.3 billion to Glencore.

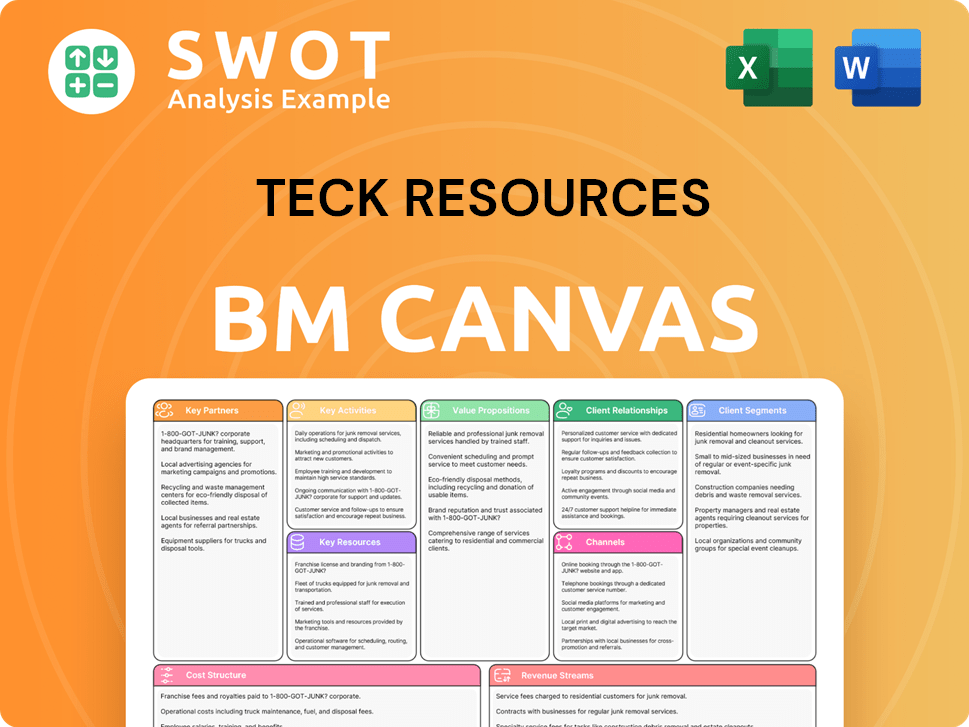

Teck Resources Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Teck Resources’s Growth?

The future of Teck Resources Company, while promising, is not without its potential pitfalls. Several factors could impede the company's growth strategy and affect its overall performance. Understanding these risks is crucial for investors and stakeholders evaluating the Teck Resources future prospects.

Market competition, commodity price volatility, regulatory changes, and geopolitical risks are among the main challenges. The company's operations across diverse regions also expose it to various operational and financial uncertainties. It's important to consider these aspects when analyzing Teck Resources's long-term strategic plan.

Teck Resources faces several potential risks and obstacles. Market competition is a significant challenge, especially in the energy transition metals sector. Fluctuations in commodity prices, particularly copper and zinc, pose inherent risks to revenue and profitability, which can affect Teck Resources Performance.

The mining industry is highly competitive, with new players constantly emerging. The global demand for energy transition metals, like copper, attracts new competitors. This competition can impact Teck Resources market share analysis and profitability.

Commodity prices, especially copper and zinc, are subject to significant fluctuations. These price swings directly impact revenue and profitability. The reliance on China's demand can also create uncertainty.

Teck Resources operates in diverse geographic locations, exposing it to varying regulatory environments and political instability. Changes in tax or royalty rates and social unrest can also affect operations. Drought conditions in regions like Carmen de Andacollo pose additional risks.

Supply chain disruptions, including unavailability of materials and equipment, can impede production. Industrial disturbances and adverse weather conditions also pose risks. These factors can impact project timelines and operational efficiency.

Failing to adapt quickly to new advancements in mining and processing technologies could be detrimental. Staying competitive requires ongoing investment in technology and innovation. This is crucial for the Mining Company Strategy.

Difficulties with plant or equipment operations, cost escalation, or delays in permits can impact project execution. These constraints can affect operational efficiency. Addressing these issues is vital for Teck Resources Growth Strategy.

Teck Resources employs a balanced approach to mitigate these risks. Diversified global operations in stable jurisdictions and strong logistics capabilities help minimize tariff exposure. Risk mitigation plans, such as increasing well field capacity, are also implemented.

Focus on operational optimization and the implementation of a new enterprise resource planning (ERP) system starting in 2025 aim to improve consistency and efficiency. This helps mitigate internal operational risks. For more insights, read about the Mission, Vision & Core Values of Teck Resources.

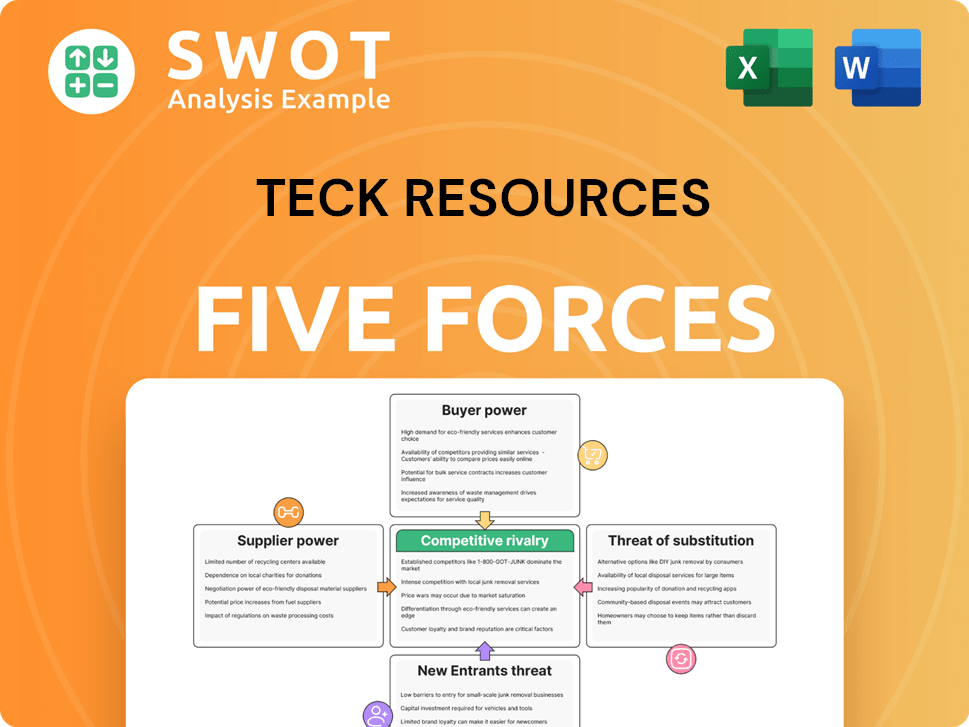

Teck Resources Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Teck Resources Company?

- What is Competitive Landscape of Teck Resources Company?

- How Does Teck Resources Company Work?

- What is Sales and Marketing Strategy of Teck Resources Company?

- What is Brief History of Teck Resources Company?

- Who Owns Teck Resources Company?

- What is Customer Demographics and Target Market of Teck Resources Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.