Teck Resources Bundle

How is Teck Resources Reshaping Its Sales and Marketing in the Energy Transition?

Teck Resources, a century-old mining giant, is undergoing a dramatic transformation. From its roots in gold to a focus on copper and zinc, Teck is strategically repositioning itself for the future. This evolution demands a completely new Teck Resources SWOT Analysis of its sales and marketing approach.

This strategic shift in Teck Resources' business strategy, driven by market analysis and a focus on the competitive landscape, is crucial for understanding its future financial performance. The company's move away from steelmaking coal and towards energy transition metals like copper and zinc necessitates a comprehensive overhaul of its sales and marketing strategy. This includes everything from new sales targets and goals to innovative marketing campaign examples and sustainability marketing initiatives.

How Does Teck Resources Reach Its Customers?

The sales channels of Teck Resources are primarily focused on direct sales to industrial customers. This approach is crucial for managing the distribution of its key products, including copper and zinc. In 2023, the company maintained dedicated industrial sales teams across North America, ensuring direct engagement with a substantial customer base globally.

Teck's sales strategy involves a multifaceted approach to reach its target markets. This includes direct sales, partnerships with trading companies and distributors, and participation in commodity exchanges. The company also uses digital platforms to enhance customer engagement and market its products effectively. The evolution of these channels has been significantly influenced by Teck's strategic transformation, particularly the sale of its steelmaking coal business in July 2024, which led to a greater focus on copper and zinc.

The company's sales and marketing approach is significantly influenced by its market analysis. This shift towards copper and zinc is driven by the increasing global demand for energy transition metals. The company's sales channels are optimized to support this strategic direction, ensuring efficient distribution and customer satisfaction. For more insights into the company's growth strategy, consider reading about the Growth Strategy of Teck Resources.

Teck's primary sales channel involves direct sales to industrial customers. In 2023, the company managed direct sales relationships with 87 industrial customers globally. This channel is crucial for maintaining control over product distribution and ensuring customer satisfaction.

Teck also uses partnerships with trading companies and distributors to expand its market reach. These partnerships are essential for reaching a broader customer base and optimizing sales channel optimization. This collaborative approach helps to navigate the complexities of global markets.

Participation in commodity exchanges is another key sales channel. This provides a platform for price discovery and efficient trading of its products. Commodity exchanges are particularly important for products like copper and zinc.

Teck leverages digital platforms and online resources to enhance customer engagement. This includes online portals, digital marketing campaigns, and customer relationship management (CRM) systems. These tools are vital for effective marketing and sales integration.

The sale of the steelmaking coal business in July 2024 has significantly altered Teck's sales strategy, shifting the focus to copper and zinc. This strategic move aligns with the growing demand for energy transition metals and the company's financial performance goals. Copper production increased by 50% in 2024 to 446,000 tonnes, with projections for 2025 between 490,000 and 565,000 tonnes.

- Long-term contracts with price adjustment mechanisms ensure stable revenue.

- Focus on Asian markets for steelmaking coal sales in Q1 2024.

- Emphasis on partnerships and joint ventures to expand market presence.

- Targeted marketing campaigns to promote copper and zinc products.

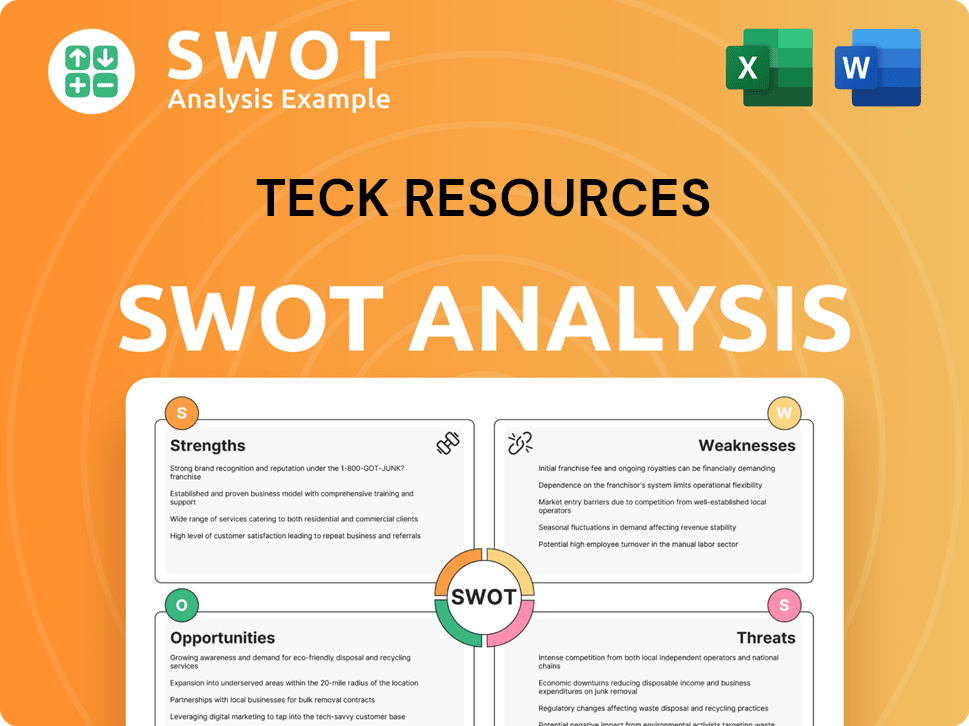

Teck Resources SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Teck Resources Use?

The marketing tactics employed by Teck Resources are multifaceted, emphasizing digital strategies, sustainability messaging, and investor relations to boost awareness and achieve its business objectives. The company uses online corporate communication platforms, which saw a total of 1.2 million digital engagement interactions in 2023. This suggests a strong focus on content marketing, investor presentations, and public relations distributed via its website and other digital channels.

Teck publishes detailed annual ESG (Environmental, Social, and Governance) reports, with the 2022 Sustainability Report highlighting significant investments in sustainability initiatives, such as $1.1 billion invested, and a 62% reduction in greenhouse gas emissions intensity since 2011. These reports serve as key content marketing pieces, demonstrating the company's commitment to responsible mining and mineral development. The company's approach reflects a shift towards becoming a pure-play energy transition metals company.

The company actively engages in investor conferences and webcasts to communicate its financial performance and strategic direction, such as the Q4 2024 earnings release on February 20, 2025, and Q1 2025 results on April 24, 2025. This indicates a strong focus on data-driven communication for its investor segment, which is a key component of its overall Teck Resources sales strategy.

Teck leverages digital platforms for corporate communications, resulting in 1.2 million digital engagement interactions in 2023. This includes content marketing, investor presentations, and public relations.

The company publishes annual ESG reports, showcasing investments in sustainability. The 2022 report highlighted $1.1 billion in sustainability investments and a 62% reduction in greenhouse gas emissions intensity since 2011.

Teck actively engages with investors through conferences and webcasts. This includes Q4 2024 earnings released on February 20, 2025, and Q1 2025 results on April 24, 2025, emphasizing data-driven communication for its investor segment.

Marketing efforts are highly targeted and B2B-oriented, with a focus on direct sales to industrial customers and participation in commodity exchanges. The emphasis is on the energy transition metals business.

Sustainability and its role in the energy transition are core marketing messages. This appeals to stakeholders interested in environmentally responsible resource development, reflecting the company's strategic pivot.

The marketing mix reflects the company's evolution from a broader resource company to a pure-play energy transition metals company, with an emphasis on

Teck Resources employs a multi-faceted approach to marketing, focusing on digital engagement, sustainability initiatives, and investor relations. This strategy supports its business objectives and communicates its strategic direction.

- Digital Marketing: Leveraging online platforms to build awareness and generate interest.

- Sustainability Reporting: Using ESG reports to demonstrate commitment to responsible mining.

- Investor Relations: Engaging through conferences and webcasts to communicate financial performance.

- B2B Focus: Targeting industrial customers and participating in commodity exchanges.

- Core Messaging: Highlighting sustainability and the company's role in the energy transition.

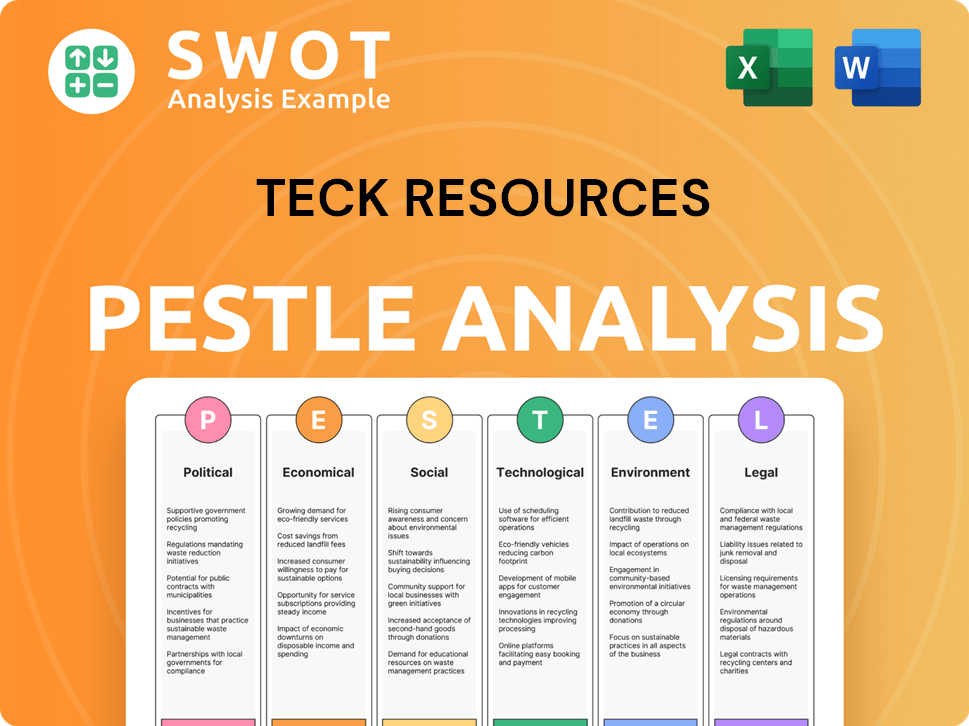

Teck Resources PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Teck Resources Positioned in the Market?

The brand positioning of Teck Resources centers on its commitment to responsible mining and the supply of essential metals for global development. This strategy is crucial in the mining industry, where environmental and social impacts are under constant scrutiny. Their core message emphasizes sustainability, focusing on caring for people, communities, and the land. This approach aims to differentiate Teck Resources within the competitive landscape.

Teck Resources strategically highlights its focus on copper and zinc, crucial materials for renewable energy technologies and infrastructure. This focus, combined with a commitment to a 'nature-positive future by 2030' and achieving 'net zero Scope 1 and Scope 2 emissions across its operations by 2050,' reinforces its brand as forward-thinking. Their approach appeals to a target audience that values environmental stewardship and social responsibility. This is a key element of their overall business strategy.

The company's commitment to sustainability and community engagement is a cornerstone of its brand identity. Teck Resources emphasizes its collaboration with local communities, particularly Indigenous Peoples, to generate economic benefits and advance reconciliation efforts. This approach is designed to build trust and enhance its reputation. This is a key aspect of their sales and marketing approach.

Teck Resources has consistently been recognized for its sustainability efforts. It was named to the S&P Dow Jones Sustainability World Index for 14 consecutive years as of 2023. This demonstrates a long-term commitment to environmental, social, and governance (ESG) principles.

The company's strategic shift towards prioritizing energy transition metals such as copper and zinc further strengthens its brand. Copper demand is expected to increase significantly due to its use in electric vehicles and renewable energy infrastructure. This positions the company well for future growth.

Teck Resources actively engages with local communities, including Indigenous Peoples, to foster economic benefits and support reconciliation. This approach is vital for building strong relationships and ensuring the long-term success of its operations. This is part of their marketing plan for copper and other metals.

Brand consistency is maintained through comprehensive ESG reports and active participation in industry associations that promote sustainability. This transparency and engagement help build trust with stakeholders and support the company's reputation. This is a key element of their marketing and sales integration.

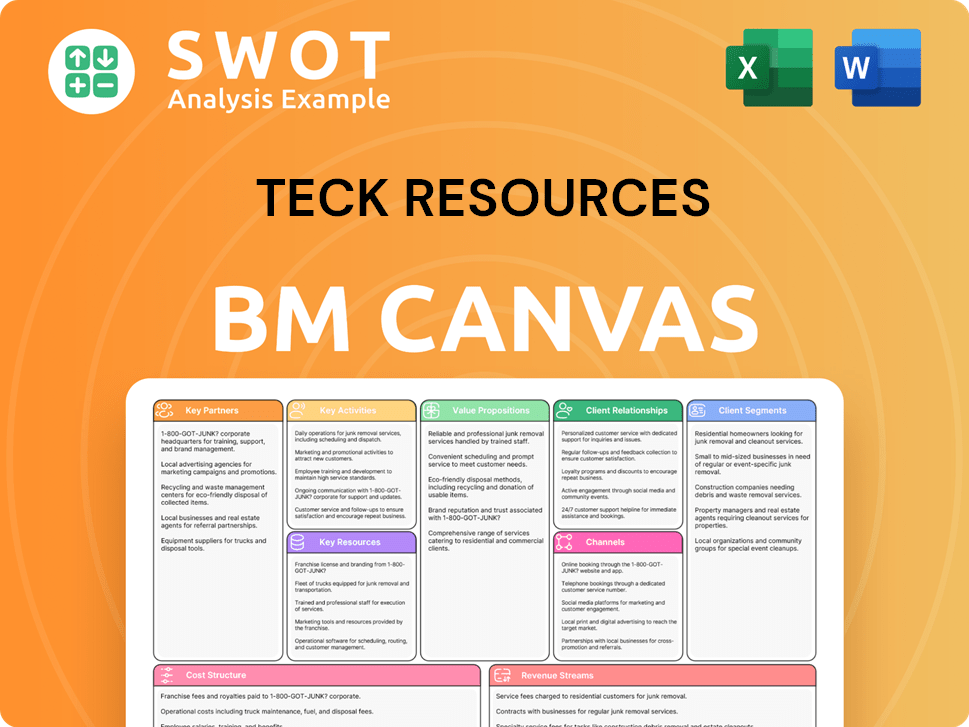

Teck Resources Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Teck Resources’s Most Notable Campaigns?

The sales and marketing strategies of Teck Resources are multifaceted, encompassing targeted campaigns and ongoing communication efforts. A key focus involves promoting the benefits of its products, such as copper, while simultaneously adapting to the evolving demands of the global market. The company's approach is designed to enhance brand recognition, drive sales, and maintain a strong position within the competitive landscape.

Teck Resources' marketing strategies are also geared towards communicating its strategic transformation to stakeholders. This includes highlighting its shift towards energy transition metals, particularly copper and zinc. These efforts aim to reassure investors, promote growth opportunities, and emphasize shareholder returns, all of which are critical for long-term value creation.

During the COVID-19 pandemic, Teck launched the 'Copper & Health' initiative. The campaign advocated for the use of antimicrobial copper in public spaces. It aimed to educate audiences on copper's health benefits, particularly its ability to reduce the spread of infections.

The 'Copper & Health' campaign utilized a multi-channel approach. This included paid image and video ads, out-of-home advertising in major cities, and educational stunts. The strategy also incorporated paid social media campaigns to drive engagement.

Teck's ongoing marketing efforts emphasize its strategic portfolio transformation. This includes the recent sale of its steelmaking coal business to Glencore and other investors. The focus is now on becoming a 'pure-play energy transition metals company'.

The company consistently communicates its strategy through investor calls, news releases, and corporate presentations. These communications aim to reassure investors and highlight growth opportunities in copper and zinc. The goal is to ensure Teck Resources' sales strategy aligns with its business model.

In 2024, Teck's copper production reached 446,000 tonnes. The company anticipates production to increase to between 490,000 and 565,000 tonnes in 2025. In 2024, shareholder returns totaled $1.8 billion through buybacks and dividends. These initiatives highlight the company's commitment to long-term value creation.

- Focus on Energy Transition Metals: Teck's strategic shift emphasizes copper and zinc.

- Sales Targets and Goals: The company aims to increase copper production.

- Investor Relations: Regular communication to manage market perception.

- Financial Strategy: Prioritizing shareholder returns through buybacks and dividends.

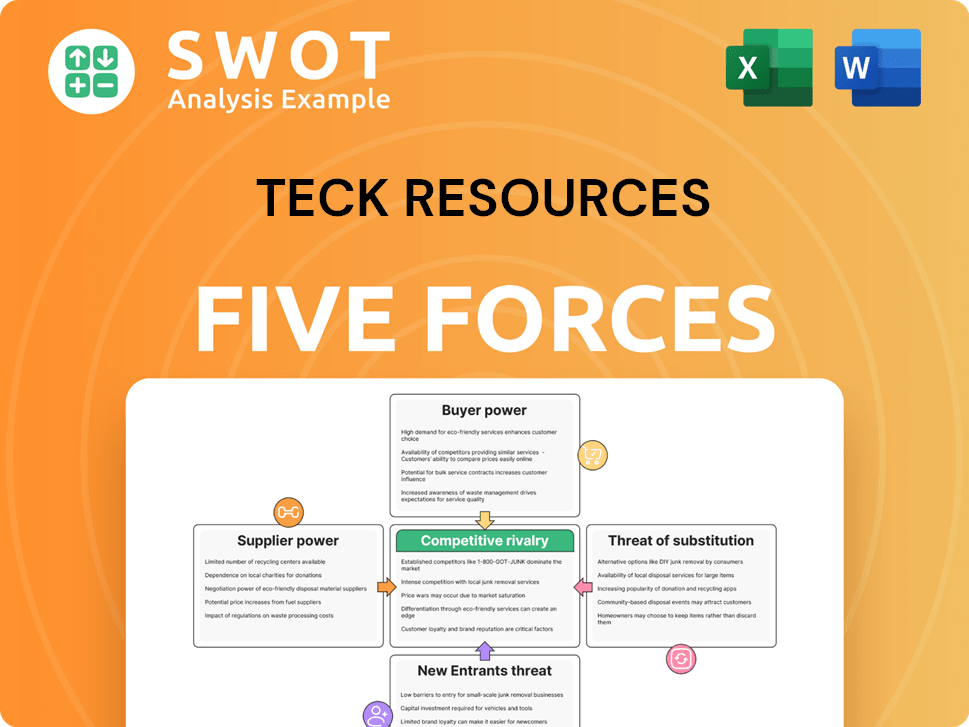

Teck Resources Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Teck Resources Company?

- What is Competitive Landscape of Teck Resources Company?

- What is Growth Strategy and Future Prospects of Teck Resources Company?

- How Does Teck Resources Company Work?

- What is Brief History of Teck Resources Company?

- Who Owns Teck Resources Company?

- What is Customer Demographics and Target Market of Teck Resources Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.