Teck Resources Bundle

How Does Teck Resources Thrive in the Global Mining Arena?

Teck Resources, a powerhouse in the natural resources sector, plays a vital role in supplying essential materials worldwide. From its roots as a Canadian mining company, Teck company has grown into a major player in copper, zinc, and steelmaking coal production. Understanding Teck's operations is key to grasping its influence on global markets and its commitment to responsible resource extraction.

Delving into Teck Resources's operational strategies is crucial for investors and stakeholders alike. This exploration will uncover how Teck Resources SWOT Analysis informs its decisions and shapes its future. We'll examine its diverse revenue streams, competitive advantages, and the impact of its mining operations on global commodity prices. Furthermore, we'll assess Teck's sustainability initiatives and how it navigates the complexities of environmental, social, and governance (ESG) factors, providing a comprehensive view of this influential player.

What Are the Key Operations Driving Teck Resources’s Success?

Teck Resources, a prominent Canadian mining company, creates and delivers value through its integrated operations. These operations span the entire mining lifecycle, from the initial exploration and development phases to production and eventual reclamation. The company's core offerings include copper, essential for electrical infrastructure and renewable energy; zinc, vital for galvanizing and batteries; and steelmaking coal, a key ingredient in steel production.

The company serves a diverse range of customer segments, including those in manufacturing, construction, automotive, and technology industries worldwide. The operational processes at Teck mining involve advanced mining techniques, sophisticated processing facilities, and robust logistics networks. This includes large-scale open-pit and underground mining, mineral processing plants that extract valuable metals from ore, and efficient transportation systems that move products to global markets.

Teck company's supply chain is characterized by its scale and complexity, involving numerous suppliers for equipment, materials, and services. Strategic partnerships, particularly in joint ventures for large-scale projects, enhance its operational capabilities and mitigate risks. The company’s distribution networks leverage global shipping routes and port facilities to ensure timely delivery of commodities. What sets Teck Resources apart is its strong focus on technological innovation to improve efficiency and reduce environmental impact, alongside a deep commitment to community engagement and responsible resource development. These core capabilities translate into customer benefits through a reliable supply of high-quality raw materials and market differentiation through its leadership in sustainable mining practices.

Teck Resources focuses on copper, zinc, and steelmaking coal. These products are essential for various industries globally. The company's customer base includes manufacturing, construction, automotive, and technology sectors.

The company uses advanced mining techniques, including open-pit and underground methods. It employs sophisticated processing facilities to extract valuable metals. Efficient transportation systems are crucial for delivering products to global markets.

Teck Resources has a complex supply chain with numerous suppliers. Strategic partnerships, particularly joint ventures, enhance operational capabilities. Global shipping routes and port facilities ensure timely delivery of commodities.

Teck Resources emphasizes technological innovation to improve efficiency and reduce environmental impact. It is deeply committed to community engagement and responsible resource development. This approach differentiates the company in the market.

Teck Resources focuses on sustainable practices, aiming to reduce its environmental footprint. The company has made significant investments in renewable energy projects. Teck Resources actively engages with local communities to ensure responsible resource development.

- Copper Production: In 2024, Teck Resources produced approximately 300,000 tonnes of copper.

- Coal Production: Steelmaking coal production in 2024 was around 21 million tonnes.

- Zinc Production: Zinc production in 2024 was approximately 250,000 tonnes.

- Sustainability Investments: The company has allocated over $1 billion towards sustainability initiatives.

For more details on how Teck Resources approaches its marketing, you can read about the Marketing Strategy of Teck Resources.

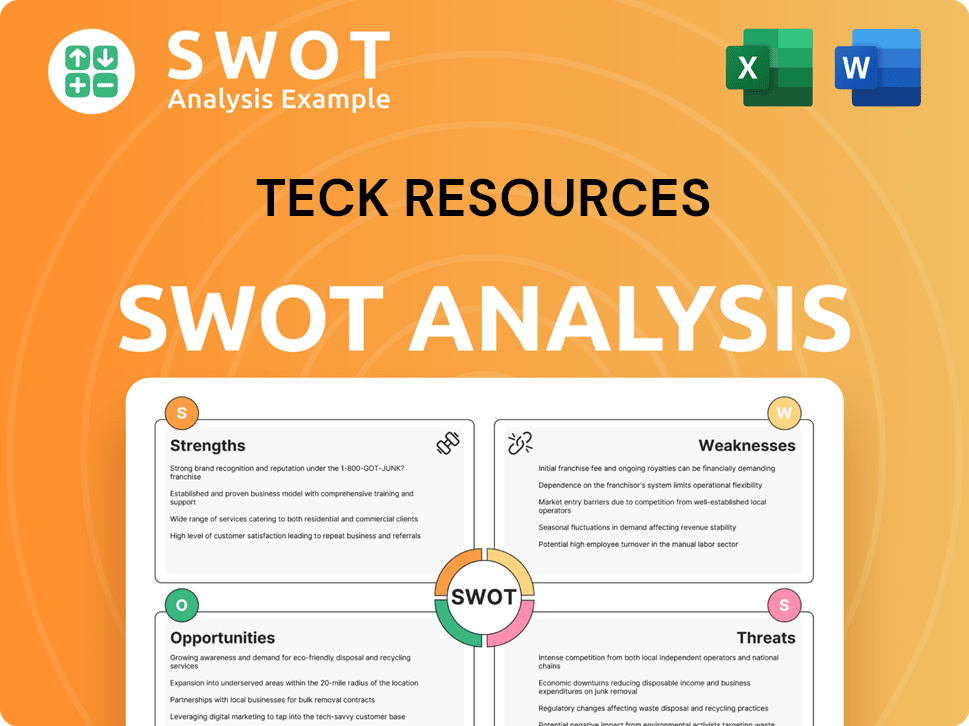

Teck Resources SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Teck Resources Make Money?

The primary revenue streams for Teck Resources, a prominent Canadian mining company, are derived from the sale of its key commodities. These include copper, zinc, and steelmaking coal, which are essential materials in various industries. The company’s financial performance is heavily influenced by the global market prices and production volumes of these resources.

In 2023, Teck company reported revenues of approximately C$13.8 billion, highlighting the scale of its mining operations. The contribution of each commodity to the total revenue can fluctuate based on market dynamics and production outputs. For instance, the first quarter of 2024 saw copper production reaching 67,000 tonnes, while refined zinc production was 68,000 tonnes.

The company's revenue model is centered on the direct sale of mined products on global commodity markets. Pricing is largely determined by supply and demand, as well as broader economic conditions. Strategic partnerships and joint ventures also contribute to revenue through profit sharing or royalties.

The Teck mining company's monetization strategies are centered on the direct sale of its mined products within the global commodity markets. Pricing is primarily determined by supply and demand, alongside broader economic conditions. The company also engages in strategic partnerships and joint ventures to generate additional revenue streams.

- Commodity Sales: The core strategy involves selling copper, zinc, and steelmaking coal.

- Strategic Partnerships: Joint ventures and partnerships provide additional revenue through profit sharing or royalties.

- Diversification: Expanding the copper business helps balance revenue exposure and capitalize on the growing demand for critical minerals.

- Market Dynamics: Revenue is significantly influenced by global commodity prices and production volumes.

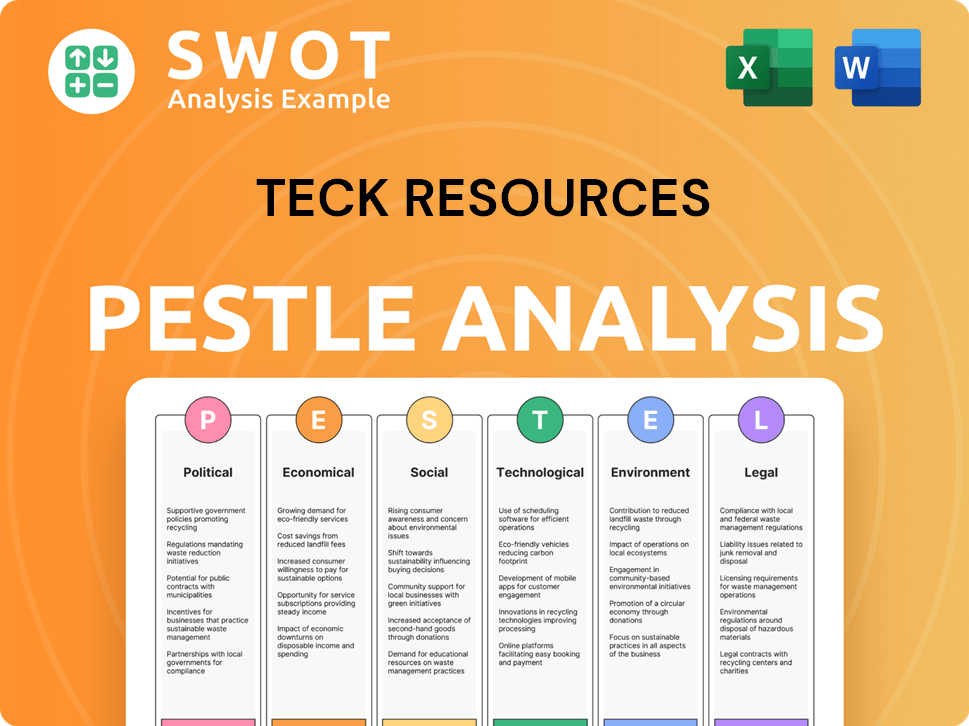

Teck Resources PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Teck Resources’s Business Model?

The journey of the Teck company has been marked by significant milestones and strategic shifts. A key recent move is the spin-off of its steelmaking coal business, Elk Valley Resources (EVR), which was announced in 2023 and progressed through 2024. This strategic decision allows the company to focus on its copper and zinc operations, aiming to enhance shareholder value and streamline its portfolio towards future-oriented metals. This move addresses market challenges related to the cyclical nature of coal prices and environmental pressures.

Operational challenges for Teck Resources have included navigating volatile commodity prices, managing complex regulatory environments across multiple jurisdictions, and ensuring operational continuity amidst global supply chain disruptions. The company has responded by focusing on cost efficiencies, embracing technological advancements in mining processes, and strengthening community and Indigenous relations. These efforts are crucial for the company's long-term sustainability and competitiveness.

Teck Resources' competitive advantages stem from its substantial reserve base of high-quality assets, particularly in copper and zinc, and its established expertise in large-scale mining operations. Furthermore, the company's commitment to responsible mining practices, including efforts to reduce greenhouse gas emissions and improve water management, provides a competitive edge in an increasingly ESG-conscious market. The company continues to adapt to new trends by investing in innovation, such as low-carbon technologies for its operations, and by strategically positioning itself to meet the growing demand for critical minerals vital for the green economy. For more details on the company's ownership structure, you can read about the Owners & Shareholders of Teck Resources.

The spin-off of Elk Valley Resources (EVR) in 2024 is a major strategic move. This allows the company to concentrate on copper and zinc. This focus is designed to improve shareholder value and streamline operations.

Focus on cost efficiencies and technological adoption are key. Strengthening community and Indigenous relations is also a priority. Investing in low-carbon technologies is part of adapting to new trends.

Substantial reserves of copper and zinc provide a strong foundation. Expertise in large-scale mining operations is a significant advantage. Commitment to responsible mining practices enhances its position in the market.

Teck Resources' financial performance is closely tied to commodity prices. The company's ability to manage costs and adapt to market conditions is crucial. The company's annual reports provide detailed financial data.

Teck Resources, a prominent Canadian mining company, demonstrates several key strengths. Its focus on copper and zinc positions it well for the future. The company's commitment to sustainability and innovation is a major advantage.

- Substantial copper and zinc reserves.

- Expertise in large-scale mining operations.

- Commitment to responsible mining practices.

- Strategic focus on future-oriented metals.

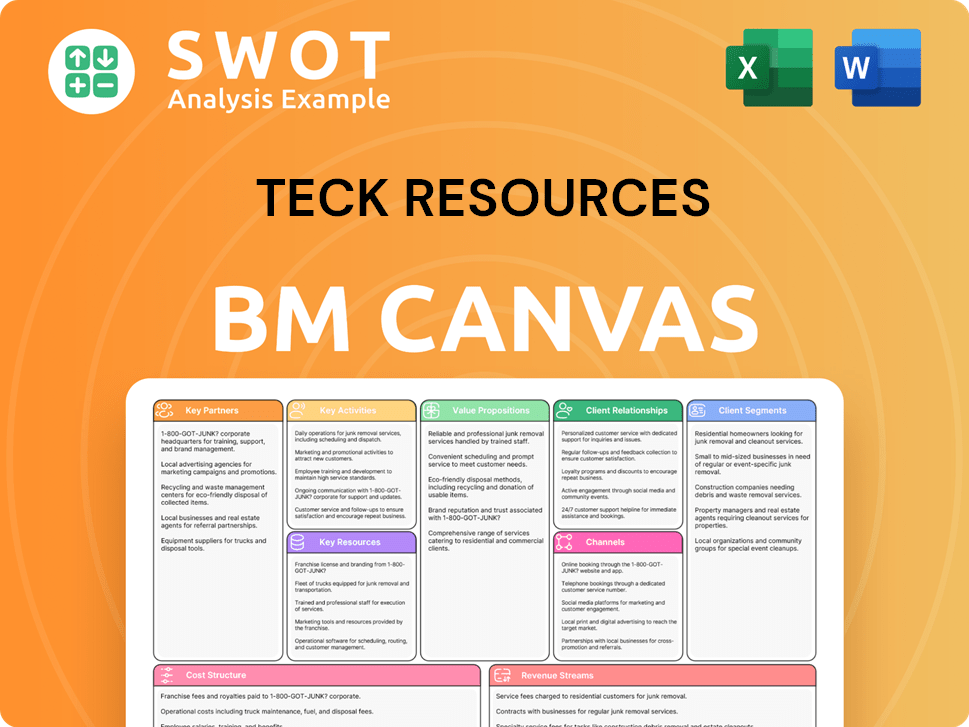

Teck Resources Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Teck Resources Positioning Itself for Continued Success?

Let's explore the industry position, risks, and future outlook for Teck Resources. As a major player in the global mining sector, Teck company is a significant producer of essential materials like copper, zinc, and steelmaking coal. Its operations span across key mining regions, serving diverse international markets and maintaining a strong reputation for reliable supply and responsible practices.

However, Teck mining, like other mining companies, faces various challenges. These include the volatility of commodity prices, regulatory hurdles, and the potential impact of new technologies and climate change. The company is proactively addressing these risks through strategic initiatives, ensuring a sustainable and profitable future.

Teck Resources holds a prominent position in the global mining industry. It is a major producer of copper, zinc, and steelmaking coal, with significant market share in each segment. The company's global reach extends to key mining regions, and it serves a diverse international customer base.

Teck Resources faces risks such as commodity price volatility, influenced by global economic trends and supply-demand dynamics. Regulatory changes, particularly those related to environmental protection, and the emergence of new competitors also pose challenges. Climate change and extreme weather events can impact operations.

The future outlook for Teck Resources focuses on capitalizing on the growing global demand for critical minerals, driven by the energy transition. The company is committed to responsible resource development and operational excellence to sustain and expand profitability. Strategic investments, like the QB2 project, are key to long-term growth.

Teck Resources is actively working to mitigate risks through investments in its copper growth pipeline. The company is also focused on optimizing existing operations and advancing its sustainability goals. These include efforts to achieve carbon neutrality across its operations by 2050.

In recent financial reports, Teck Resources has demonstrated resilience amidst market fluctuations. The company's financial performance is closely tied to commodity prices, with copper and steelmaking coal being significant contributors to revenue. For example, in 2024, copper production is projected to be around 330,000 to 390,000 tonnes. The QB2 project is a key factor in future copper production growth. The company's commitment to sustainability is also evident in its investments in renewable energy and emissions reduction technologies.

- Teck Resources is a leading Canadian mining company with a diversified portfolio of assets.

- Teck Resources' operations include mining operations and resource extraction.

- The company's strategic focus includes expanding its copper production capacity through projects like QB2.

- Teck Resources is committed to reducing its environmental footprint and achieving carbon neutrality by 2050.

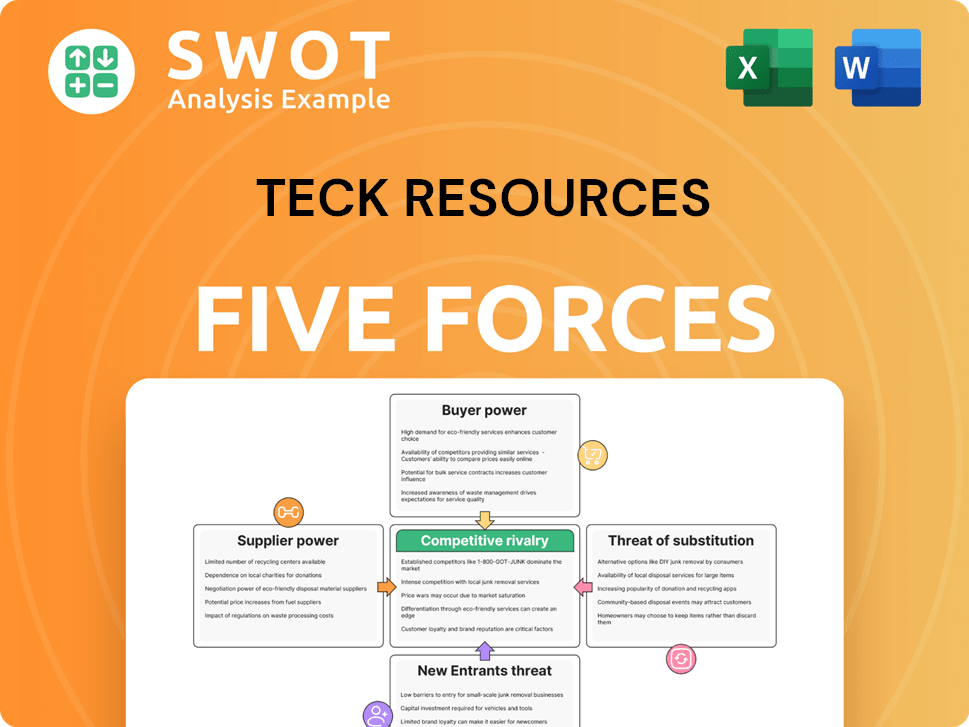

Teck Resources Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Teck Resources Company?

- What is Competitive Landscape of Teck Resources Company?

- What is Growth Strategy and Future Prospects of Teck Resources Company?

- What is Sales and Marketing Strategy of Teck Resources Company?

- What is Brief History of Teck Resources Company?

- Who Owns Teck Resources Company?

- What is Customer Demographics and Target Market of Teck Resources Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.