Teck Resources Bundle

Who Buys Teck Resources' Metals?

Following a major strategic shift in 2024, understanding Teck Resources SWOT Analysis and its customer base is more critical than ever. This Canadian mining company has transformed, moving from a diversified resources portfolio to a focused energy transition metals player. This evolution necessitates a deep dive into its current customer demographics and Teck Resources target market.

This analysis will explore the evolving Teck Resources customer analysis, focusing on the shift from steelmaking coal to copper and zinc. We'll examine the target audience for these key metals, considering factors like geographic distribution and industry sectors. Understanding the market segmentation and the specific needs of these mining company customers is key to evaluating Teck's future performance.

Who Are Teck Resources’s Main Customers?

Understanding the customer demographics and target market of Teck Resources is crucial for investors and stakeholders. The company, a major player in the mining industry, primarily operates in the business-to-business (B2B) sector. Its focus has shifted significantly, especially after divesting its steelmaking coal business in 2024. This strategic move has reshaped its target audience, with a strong emphasis on metals essential for the energy transition.

Teck Resources' primary customers are businesses. These include manufacturers, traders, and end-users across various sectors. These sectors are heavily reliant on commodities like copper and zinc. This shift is driven by global trends like urbanization and the expansion of the digital economy.

The company's customer analysis reveals a focus on industries driving the global energy transition. Copper is poised to generate around 80% of Teck's revenue by 2025. Zinc is expected to contribute the remaining 20%. This shift highlights the importance of understanding the needs of these key customer segments.

Teck Resources' primary customers are businesses involved in construction, automotive, electronics, and renewable energy. These industries require copper and zinc for their operations. The company's focus on copper and zinc aligns with the growing demand for electrification and energy transition technologies.

The divestment of the steelmaking coal business in 2024 was a pivotal change. This strategic move has led to a significant shift in Teck Resources' target market. The company is now more focused on the demand for copper and zinc driven by global economic growth.

The demand for copper and zinc is influenced by global economic growth, urbanization, and population growth. Infrastructure development and the expansion of the digital economy, including AI and data centers, also play a crucial role. Copper is particularly vital for electric vehicles and renewable energy technologies.

As the company focuses on copper and zinc, understanding the needs of these key customer segments becomes increasingly important. This strategic shift positions Teck Resources to capitalize on the growing demand for energy transition metals. For more insights into the company's financial performance, you can explore the details in Owners & Shareholders of Teck Resources.

Teck Resources' customer demographics are primarily B2B clients in industries using copper and zinc. Its target market has evolved, emphasizing energy transition metals. The company is adapting to global economic trends and the shift towards sustainable technologies.

- Focus on copper and zinc aligns with the energy transition.

- Divestment from steelmaking coal reshaped the customer base.

- Demand is driven by urbanization, infrastructure, and the digital economy.

- Understanding customer needs is crucial for future growth.

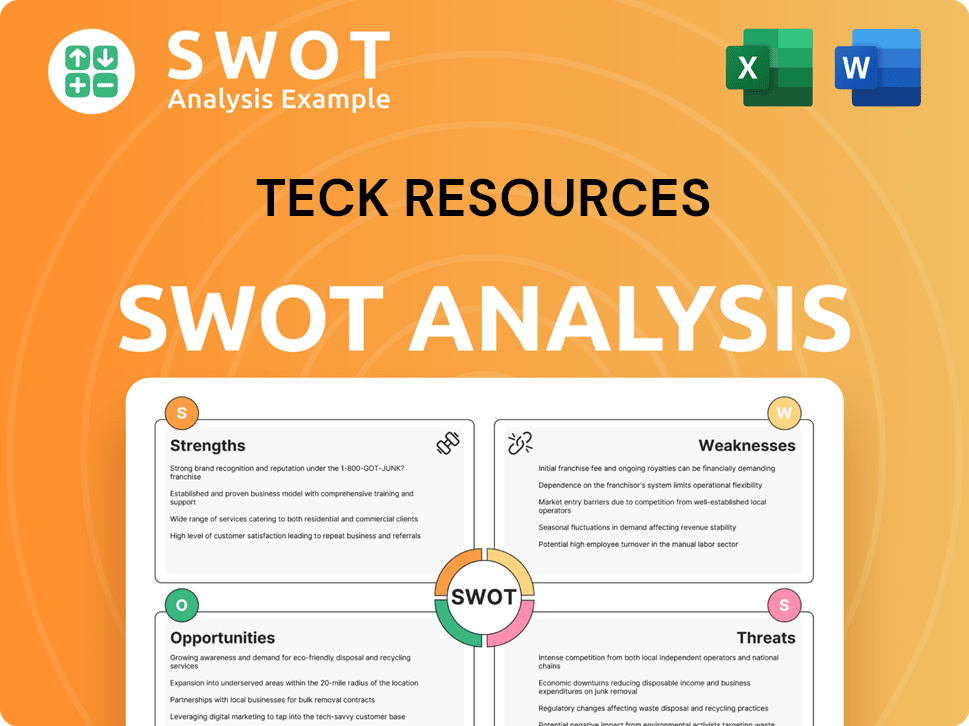

Teck Resources SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Teck Resources’s Customers Want?

The customer base for Teck Resources is primarily driven by the need for a reliable supply of high-quality copper and zinc. These metals are essential for various manufacturing and infrastructure projects. The purchasing behavior of these customers is significantly influenced by global economic trends and the increasing demand for metals in the energy transition and digital economy.

Customers of Teck Resources prioritize consistent product quality, secure supply chains, and competitive pricing. There's a growing emphasis on responsible and sustainable sourcing. This focus aligns with the company's commitment to environmental and social responsibility, including goals like achieving carbon neutrality by 2050.

The demand for copper and zinc stems from their critical roles in construction, electricity networks, electric vehicles, and industrial machinery. Teck Resources aims to meet the unmet needs of industries requiring energy transition metals, positioning itself as a leading provider. For example, Teck's expansion of copper production, targeting over 800,000 tonnes per annum by 2030, addresses the projected supply deficits due to decarbonization efforts. The company’s strategic investments, like the Quebrada Blanca (QB2) project in Chile and efficient zinc operations at Red Dog in Alaska, demonstrate its responsiveness to customer demands.

Teck's customers require a consistent and dependable supply of copper and zinc to support their operations. This reliability is crucial for maintaining production schedules and meeting market demands.

The quality of the copper and zinc is a critical factor. Customers need materials that meet stringent industry standards and specifications to ensure product performance and safety.

Pricing is a key consideration for customers. They seek competitive prices that allow them to maintain profitability in their own businesses. The cost-effectiveness of materials directly impacts their bottom line.

There is a growing preference for sustainably sourced materials. Customers are increasingly focused on the environmental and social impact of their supply chains, driving demand for responsibly produced metals.

Customers value secure and reliable supply chains to mitigate risks associated with disruptions. This includes ensuring consistent access to materials and minimizing potential delays in production.

Customers often require technical support and expertise from their suppliers. This includes assistance with product selection, application, and troubleshooting to optimize the use of copper and zinc.

Understanding the needs of the customer demographics is crucial for Teck Resources. The company's target market comprises industries that rely heavily on copper, zinc, and steelmaking coal. The Teck Resources customer analysis reveals that these customers seek reliability, quality, and sustainability in their suppliers.

- Reliable Supply: Customers need a consistent supply of materials. For example, the QB2 project aims to increase copper production to meet this demand.

- High Quality: Products must meet strict industry standards.

- Competitive Pricing: Cost-effectiveness is essential for customer profitability.

- Sustainable Practices: Customers increasingly prefer suppliers committed to environmental and social responsibility. Teck's goals include being carbon neutral by 2050.

- Supply Chain Security: Ensuring consistent access to materials is crucial.

- Technical Support: Customers value expertise and assistance from suppliers.

For more insights, see the Marketing Strategy of Teck Resources.

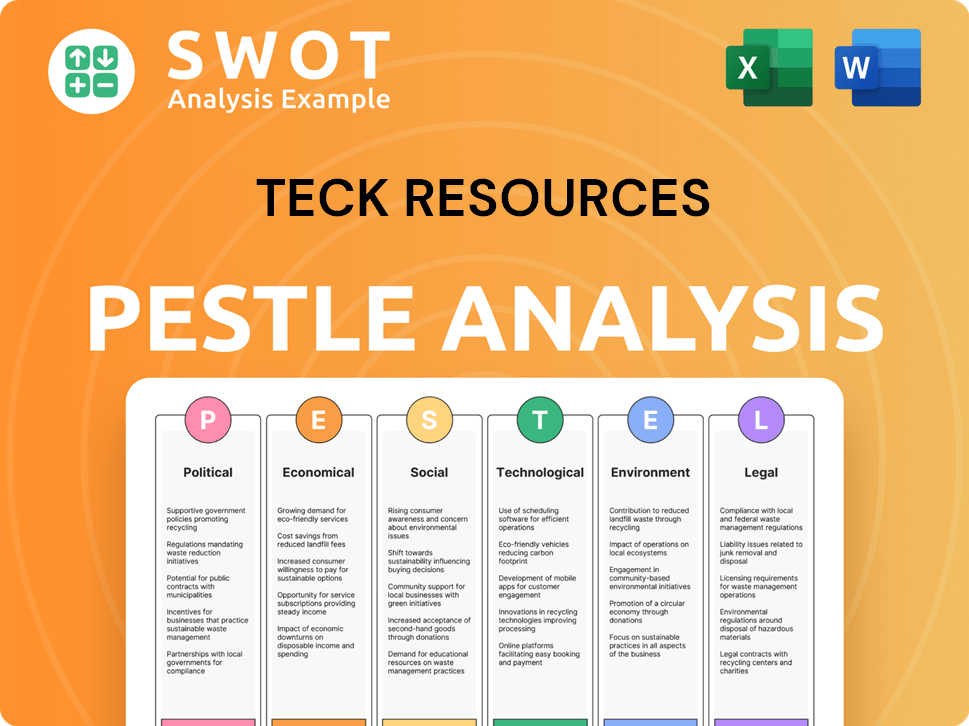

Teck Resources PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Teck Resources operate?

The geographical market presence of Teck Resources is substantial, with key operations and projects spanning across Canada, the United States, Chile, and Peru. This widespread presence allows for diversified revenue streams and access to various customer segments. Understanding the Teck Resources target market involves recognizing its global footprint and how it caters to different regional demands.

In North America, Teck operates significant assets like the Highland Valley Copper mine and the Red Dog zinc mine, vital for supplying the region. South America, particularly Chile and Peru, hosts major copper and zinc operations, including the Quebrada Blanca (QB) project, which is crucial for Teck's copper growth. The strategic locations of these assets are designed to serve global markets effectively.

The company's sales distribution in Q1 2025 reveals a broad customer base. Asia (excluding China) accounted for 36% of copper concentrate sales, with China taking 32%, Europe 20%, and the Americas (excluding the US) 12%. This distribution highlights the importance of understanding customer demographics and regional preferences to optimize sales strategies.

Teck's copper concentrate sales in Q1 2025 were distributed globally, with significant portions going to Asia, China, Europe, and the Americas. This distribution strategy is crucial for reaching diverse mining company customers and mitigating market risks. The global reach is a key factor in understanding the geographic distribution of Teck Resources customers.

Teck engages in strategic partnerships to meet international standards and adapt to regional demands. Collaborations with companies like Nippon Steel Corporation and POSCO, along with joint ventures in projects like San Nicolás and Zafranal, illustrate how Teck tailors its offerings. These partnerships are essential for effective Teck Resources customer analysis.

Teck's strategic shift towards energy transition metals reflects a global market demand for sustainable resources. This repositioning, highlighted by withdrawals from the steelmaking coal business, aligns with evolving Teck Resources customer needs and wants. This focus also influences how does Teck Resources identify its target market.

Historically, the Indo-Pacific region has been a critical market for Teck, representing an average of 61% of total revenues over the past five years, with India being a high-growth area. This underscores the importance of understanding regional economic trends and market segmentation. To learn more about the company's history, read Brief History of Teck Resources.

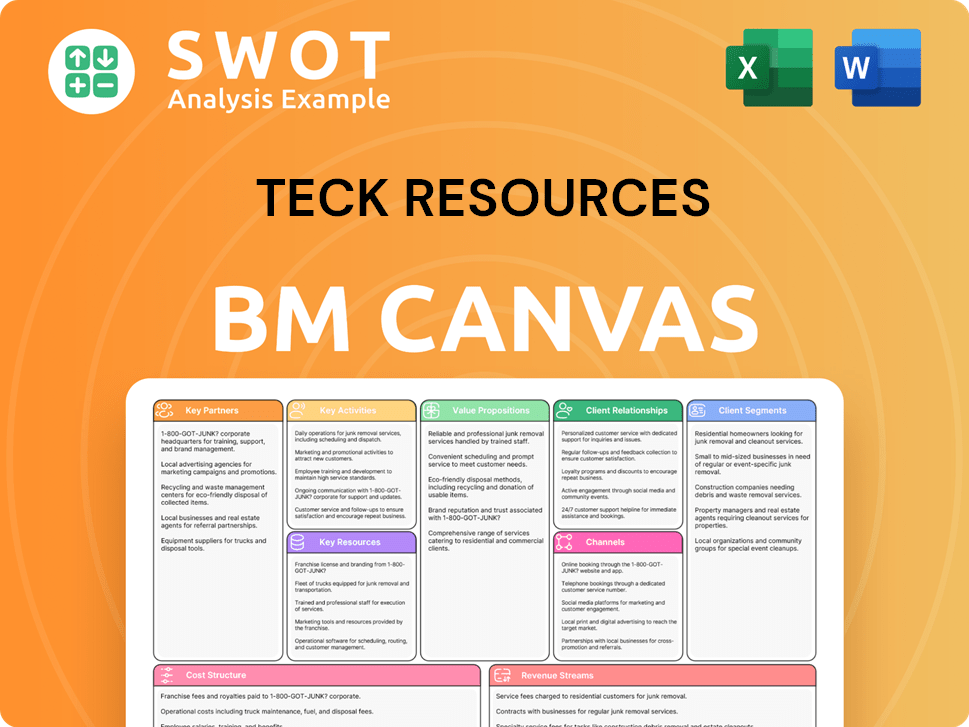

Teck Resources Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Teck Resources Win & Keep Customers?

Customer acquisition and retention strategies for Teck Resources are primarily focused on its business-to-business (B2B) relationships. The company's approach centers on long-term partnerships and supplying essential commodities to industries like construction, automotive, and renewable energy. This strategy differs from business-to-consumer (B2C) models, emphasizing reliability and sustainability.

Teck's value proposition includes providing essential commodities crucial for various sectors. This includes copper and zinc, vital for industries such as construction, automotive, electronics, and renewable energy. The company's focus is on securing and increasing supply to meet growing demand.

The emphasis on sustainability and environmental, social, and governance (ESG) performance plays a crucial role in customer retention. Teck's commitment to responsible resource development, including targets like being carbon neutral by 2050, resonates with customers who prioritize sustainable sourcing.

Teck Resources uses a B2B approach, focusing on long-term partnerships. The company's strategy involves supplying essential commodities to various industries. This includes construction, automotive, electronics, and renewable energy sectors.

Key retention strategies include ensuring consistent product quality and supply. Teck’s investments in projects such as Quebrada Blanca 2 (QB2) aim to increase copper supply. The company also focuses on operational efficiency and cost optimization.

Teck's strong ESG performance is a key differentiator and retention factor. The company has been recognized as one of Corporate Knights' 2024 Best 50 corporate citizens in Canada. This commitment to responsible resource development attracts customers prioritizing sustainable sourcing.

Customer data and internal CRM systems are likely used for targeted sales efforts. Teck engages in strategic partnerships and community investments. The focus on energy transition metals aligns with customer demands.

Teck Resources' customer acquisition and retention strategies are deeply rooted in its B2B model. This approach focuses on building lasting relationships with industrial and manufacturing clients that use copper and zinc. A detailed look at the strategies employed reveals a commitment to quality, sustainability, and strategic partnerships.

- Reliable Supply: Ensuring a consistent supply of high-quality products is critical. Investments in projects like QB2 aim to increase copper supply, reinforcing customer relationships.

- Operational Efficiency: Cost optimization contributes to competitive pricing and customer satisfaction. The expected reduction in 2025 copper net cash unit costs, compared to 2024, supports this.

- Sustainability Focus: Teck's ESG performance is a key differentiator. Recognition as a top corporate citizen and targets like carbon neutrality by 2050 align with customer priorities.

- Data-Driven Approach: Internal CRM systems help manage B2B relationships. Targeted sales efforts and personalized engagement are facilitated by customer data.

- Strategic Partnerships: Community investments and support for Indigenous businesses enhance Teck's reputation. This strengthens its social license to operate and benefits customer relations.

- Market Alignment: The transformation into a pure-play energy transition metals company aligns with market trends. This move supports long-term customer loyalty and value. You can read more about this in the Growth Strategy of Teck Resources article.

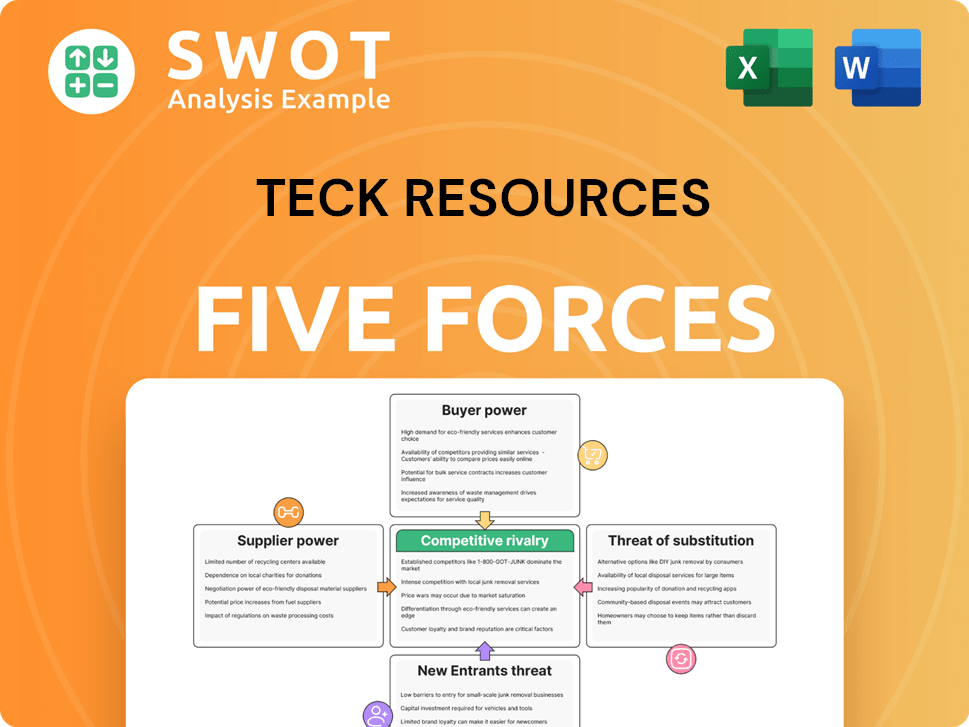

Teck Resources Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Teck Resources Company?

- What is Competitive Landscape of Teck Resources Company?

- What is Growth Strategy and Future Prospects of Teck Resources Company?

- How Does Teck Resources Company Work?

- What is Sales and Marketing Strategy of Teck Resources Company?

- What is Brief History of Teck Resources Company?

- Who Owns Teck Resources Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.