Vintage Wine Estates Bundle

Can Vintage Wine Estates Conquer the Wine Market?

Vintage Wine Estates (VWE) dramatically altered its market presence with a direct Nasdaq listing in June 2021, signaling its ambition to dominate the fragmented wine industry. Founded in 1992, VWE has evolved from a small collection of brands to a significant player through strategic acquisitions. This Vintage Wine Estates SWOT Analysis will explore its journey and future growth prospects.

This exploration into Vintage Wine Estates will uncover the intricacies of its growth strategy, revealing how it plans to navigate the complex wine industry. We'll examine the company's expansion plans, its embrace of technological innovation, and its financial planning to understand its potential for future success. Understanding the wine industry analysis and wine market trends is crucial to assessing this wine company prospects and the estate winery's future.

How Is Vintage Wine Estates Expanding Its Reach?

Vintage Wine Estates (VWE) actively pursues expansion initiatives to drive growth within the wine industry. Their strategy focuses on entering new markets and product categories, often through strategic mergers and acquisitions (M&A). This approach allows VWE to integrate established wine brands and vineyards, which enhances its market presence and diversifies its offerings, aligning with broader wine market trends.

A key element of VWE's growth strategy involves expanding its direct-to-consumer (DTC) channel. This includes enhancing e-commerce platforms, optimizing wine club offerings, and improving tasting room experiences. The DTC channel is particularly attractive due to its higher profit margins, offering a direct connection with consumers and a valuable opportunity for brand building. This focus is crucial for staying competitive in the evolving wine market.

Furthermore, VWE explores strategic partnerships to broaden its distribution network and reach. While specific timelines for future acquisitions are not publicly disclosed, the company's consistent M&A activity and focus on DTC growth demonstrate a clear commitment to expanding its business and diversifying revenue streams. This proactive approach helps VWE adapt to industry changes and capitalize on evolving consumer trends, ensuring long-term sustainability and growth within the competitive wine industry.

VWE frequently uses M&A to expand its portfolio. This strategy allows the company to acquire established brands and vineyards, which can lead to increased market share and diversification. Recent acquisitions have helped VWE cater to a wider range of consumer preferences and price points.

VWE focuses on growing its DTC channel, which includes e-commerce, wine clubs, and tasting rooms. This strategy is aimed at increasing profitability and building direct relationships with consumers. Enhanced online platforms and engaging tasting room experiences are key to this growth.

VWE explores strategic partnerships to broaden its distribution network. Collaborations can help the company reach new markets and expand its sales channels. These partnerships are vital for increasing the company's overall market presence and sales volume.

VWE aims to diversify its product offerings and market presence. This involves acquiring brands that complement its existing portfolio and entering new product categories. Diversification helps reduce risk and cater to a broader consumer base, ensuring sustainable growth.

VWE's expansion strategies are centered on strategic acquisitions, DTC channel growth, and strategic partnerships. These initiatives are designed to increase market share and revenue streams. The company's focus on these areas is crucial for its long-term success.

- Mergers and Acquisitions: Acquiring established brands to expand the portfolio.

- Direct-to-Consumer: Enhancing e-commerce and tasting room experiences.

- Strategic Partnerships: Broadening distribution networks.

- Market Diversification: Entering new product categories.

Vintage Wine Estates SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vintage Wine Estates Invest in Innovation?

The company, a prominent player in the wine industry, focuses on leveraging technology and innovation to improve its operational efficiency and enhance customer engagement. The core of its strategy revolves around digital transformation, particularly within its direct-to-consumer (DTC) channels. This approach includes investments in advanced e-commerce platforms, customer relationship management (CRM) systems, and data analytics tools.

This strategic focus allows the company to personalize consumer experiences, optimize marketing campaigns, and streamline order fulfillment. While specific details on investments in cutting-edge technologies like AI or IoT for winemaking are not explicitly highlighted, the company's innovation strategy appears centered on optimizing its supply chain and distribution networks. This is achieved through improved logistics software and inventory management systems.

Moreover, the company emphasizes sustainability initiatives, exploring environmentally friendly practices in viticulture and winemaking. These efforts can lead to process innovations and contribute to brand appeal. By concentrating on digital solutions for sales and marketing, along with operational efficiencies, the company aims to strengthen its competitive advantage and support its growth objectives in a dynamic market. For those interested in the business side, insights can be found at Owners & Shareholders of Vintage Wine Estates.

The company's innovation strategy is multifaceted, focusing on digital transformation, supply chain optimization, and sustainability. This approach is crucial for navigating the competitive landscape of the wine industry and achieving sustainable growth. The integration of technology and innovative practices is expected to drive operational efficiencies and enhance customer experiences.

- Digital Transformation: Investments in advanced e-commerce platforms, CRM systems, and data analytics tools to personalize consumer experiences and optimize marketing.

- Supply Chain Optimization: Implementation of improved logistics software and inventory management systems to streamline operations.

- Sustainability Initiatives: Exploration of environmentally friendly practices in viticulture and winemaking to enhance brand appeal and reduce environmental impact.

- Focus on DTC Channels: Prioritizing direct-to-consumer sales strategies to increase customer engagement and revenue.

Vintage Wine Estates PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Vintage Wine Estates’s Growth Forecast?

The financial outlook for Vintage Wine Estates reflects a strategic shift towards enhanced profitability and cash flow management. This follows a period of significant restructuring and portfolio optimization aimed at streamlining operations and improving financial performance. The company's recent financial results and future projections indicate a focus on sustainable growth and shareholder value.

For the third quarter of fiscal year 2024, the company reported net sales of $64.7 million, a decrease from the prior year. This decline is primarily attributed to the divestiture of underperforming assets, a key component of their strategic realignment. Despite this, the company demonstrated improved financial health, particularly in gross profit margins.

The company's financial strategy is designed to strengthen its balance sheet, reduce debt, and optimize its portfolio. These efforts are crucial for achieving sustainable long-term growth and enhancing shareholder value within the competitive wine market. This approach is vital for navigating the complexities of the Marketing Strategy of Vintage Wine Estates.

Net sales for the third quarter of fiscal year 2024 were $64.7 million. This figure reflects a strategic realignment and divestiture of underperforming assets.

Gross profit increased to $22.7 million, or 35.1% of net sales, up from 29.8% in the prior year. This improvement highlights the positive impact of operational streamlining.

The net loss for Q3 FY24 was $2.4 million, a significant improvement from a net loss of $27.9 million in the prior year. This demonstrates progress in reducing losses.

Adjusted EBITDA for Q3 FY24 was $6.2 million, a positive shift from an Adjusted EBITDA loss of $2.6 million in the prior year. This indicates improved operational efficiency.

For fiscal year 2024, the company projects net sales to be between $260 million and $265 million. This forecast reflects the company's strategic initiatives and market position.

The Adjusted EBITDA forecast for fiscal year 2024 is between $20 million and $25 million. This projection underscores the company's focus on profitability and operational improvements.

A key component of the financial strategy involves strengthening the balance sheet and reducing debt. This will provide greater financial flexibility and stability.

The company is actively optimizing its portfolio to focus on higher-margin products and markets. This strategic move aims to enhance overall profitability.

The financial strategy is designed to support sustainable long-term growth. This involves a combination of operational efficiencies and strategic investments.

The ultimate goal of the financial strategy is to improve shareholder value. This is achieved through increased profitability, debt reduction, and strategic portfolio management.

Vintage Wine Estates Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Vintage Wine Estates’s Growth?

The path for Vintage Wine Estates, like any wine company, is paved with potential obstacles. Navigating the complexities of the wine industry requires a keen understanding of both internal and external challenges. Successfully managing these risks is critical for achieving sustainable growth and capitalizing on wine market trends.

Market competition, regulatory changes, and supply chain vulnerabilities present significant hurdles. Economic fluctuations and shifting consumer preferences further complicate the landscape. The growth strategy of Vintage Wine Estates, particularly its acquisitions, introduces additional integration risks that must be carefully managed.

To understand the complete picture, it is important to study the Mission, Vision & Core Values of Vintage Wine Estates. The company's strategic approach involves diversification, disciplined acquisitions, and supply chain optimization to mitigate these challenges effectively.

The wine industry analysis reveals a highly competitive environment. Numerous established and emerging players vie for market share, putting pressure on pricing and sales strategies. New entrants and evolving consumer preferences require continuous adaptation.

Changes in alcohol production, distribution, and sales regulations pose a significant risk. These shifts at the federal, state, or local levels can impact operations and profitability. Compliance costs and potential legal challenges are ongoing concerns.

Supply chain disruptions, including weather-related impacts on grape harvests and logistical challenges, are critical. The estate winery's success depends on a reliable supply of quality grapes and efficient distribution networks. Climate change adds further uncertainty.

Economic downturns can reduce consumer spending on discretionary items like wine. Shifting consumer preferences towards other beverages or non-alcoholic options also pose a risk. Adapting product offerings and marketing strategies is essential.

Integrating acquired companies presents operational risks. Combining different corporate cultures, IT systems, and processes can be complex and time-consuming. Successful integration is crucial for realizing the benefits of acquisitions.

Vintage Wine Estates employs several strategies to mitigate risks. Portfolio diversification reduces reliance on any single brand or market segment. Disciplined acquisition criteria and supply chain optimization also play vital roles. Continuous market monitoring is essential.

The wine market is subject to fluctuations influenced by economic conditions. Factors such as inflation rates, consumer spending, and global events can significantly affect sales volumes and pricing strategies. Monitoring these trends is crucial for proactive planning.

Climate change poses a long-term risk to grape production. Changing weather patterns, including increased temperatures, droughts, and extreme weather events, can impact yields and grape quality. Sustainable farming practices are crucial for mitigating these effects.

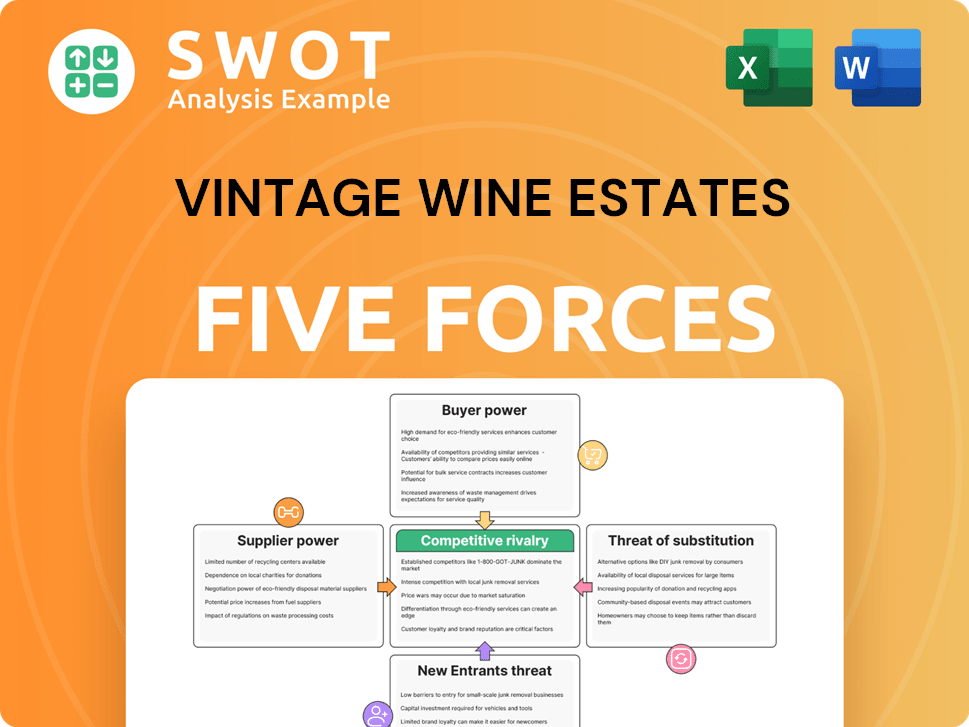

Vintage Wine Estates Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vintage Wine Estates Company?

- What is Competitive Landscape of Vintage Wine Estates Company?

- How Does Vintage Wine Estates Company Work?

- What is Sales and Marketing Strategy of Vintage Wine Estates Company?

- What is Brief History of Vintage Wine Estates Company?

- Who Owns Vintage Wine Estates Company?

- What is Customer Demographics and Target Market of Vintage Wine Estates Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.