Vintage Wine Estates Bundle

Who Owns Vintage Wine Estates Now?

Uncover the intricate ownership tapestry of Vintage Wine Estates (VWE), a wine company navigating a turbulent landscape. From its inception to its recent Chapter 11 bankruptcy filing, understanding who controls VWE is critical. This analysis explores the evolution of its ownership, revealing the key players and strategic shifts that have shaped its journey in the wine industry.

Vintage Wine Estates' story is a compelling case study in the wine industry, marked by significant mergers and acquisitions and a recent dramatic shift in its ownership structure. The company's decision to go public and its subsequent financial challenges have reshaped its investor base and strategic direction. This exploration will provide an in-depth look at the Vintage Wine Estates SWOT Analysis, its major stakeholders, and the factors that led to its current state, offering valuable insights for anyone interested in the company profile and the broader wine market.

Who Founded Vintage Wine Estates?

The story of Vintage Wine Estates, a prominent player in the wine industry, begins with its founder, Pat Roney. Roney's initial forays into wine started with the acquisition of the Girard winery in 2000, marking the genesis of what would become a significant wine company. This early phase set the stage for the company's growth through strategic acquisitions and brand building.

Early on, Roney collaborated with Leslie Rudd. However, Roney later acquired Girard outright from Rudd in 2000. The formal establishment of Vintage Wine Estates occurred in 2007, following the acquisition of Windsor Vineyards. This move consolidated Roney's various wine ventures under a single entity, reflecting his vision to create a strong presence in both direct-to-consumer and wholesale channels.

The details of the initial equity split or shareholding percentages between Pat Roney and Leslie Rudd are not extensively available in public records. However, it is clear that Roney was the driving force behind the company's early acquisitions and the formation of Vintage Wine Estates. The company's initial growth strategy focused on establishing its business case through individual acquisitions and brand development, indicating a grassroots approach to expansion. Beyond Roney and Rudd, early backers are not extensively detailed in public records.

The early days of Vintage Wine Estates were marked by strategic acquisitions and the vision of its founder, Pat Roney. The company's formation involved consolidating various wine ventures into a single entity. The focus was on building a diversified portfolio through both acquisitions and organic growth. For more insights into the competitive environment, you can explore the Competitors Landscape of Vintage Wine Estates.

- Pat Roney acquired Girard winery in 2000, setting the foundation.

- The company was officially named Vintage Wine Estates in 2007.

- The early strategy involved building the business case through individual acquisitions.

- The company's initial focus was on both direct-to-consumer and wholesale channels.

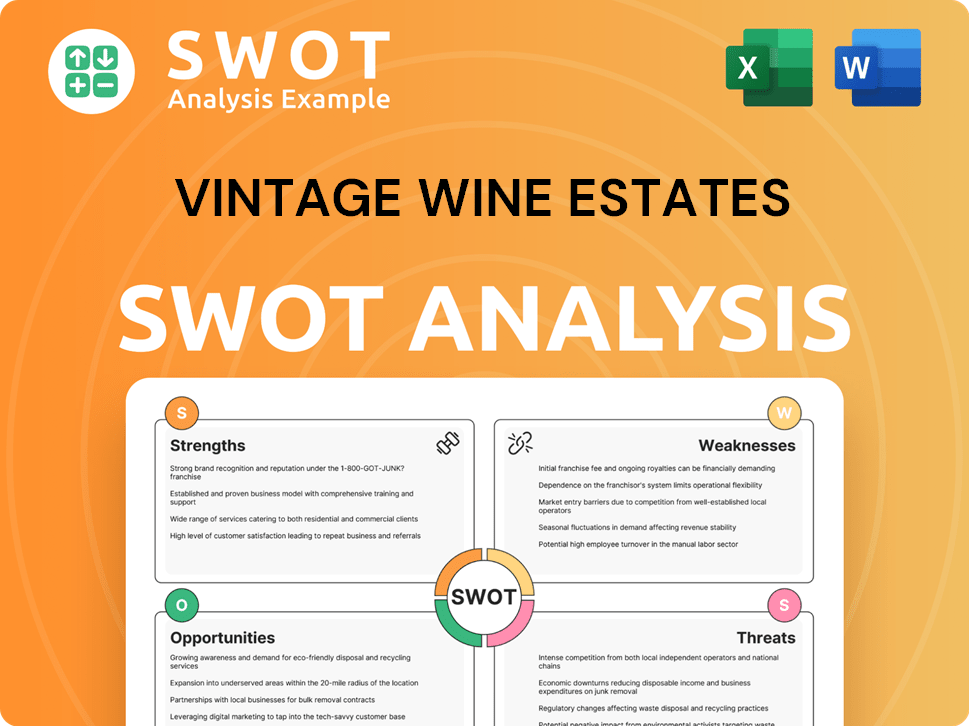

Vintage Wine Estates SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Vintage Wine Estates’s Ownership Changed Over Time?

The ownership structure of Vintage Wine Estates has seen significant shifts, particularly after its initial public offering (IPO) in June 2021. The company, trading under the ticker 'VWE' on the Nasdaq, began with a market capitalization of approximately $617.9 million. The IPO was a result of a merger with Bespoke Capital Acquisition Corp. (BCAC), a special purpose acquisition company. This event marked a pivotal moment, transforming the company from a privately held entity to a publicly traded one, thus broadening its shareholder base and opening it up to market dynamics.

The journey of Vintage Wine Estates took a sharp turn in July 2024 when the company filed for Chapter 11 bankruptcy protection. This led to the announcement of its intention to delist from the Nasdaq. The financial difficulties resulted in a restructuring process that involved the sale of its assets. The company's market capitalization as of October 4, 2024, had plummeted to $1.57 million USD, a stark contrast to its IPO valuation. This restructuring and asset sale significantly altered the ownership landscape, distributing its assets among various buyers.

| Event | Date | Impact on Ownership |

|---|---|---|

| IPO through de-SPAC merger | June 2021 | Public listing; initial market capitalization of $617.9 million. |

| Chapter 11 Bankruptcy Filing | July 2024 | Initiated restructuring and asset sales; delisting from Nasdaq. |

| Asset Sales Approved | Late 2024 | Fragmentation of assets among new owners, including Foley Family Wines Inc. and Ejnar Knudsen. |

Prior to the IPO, Vintage Wine Estates had secured $175 million across multiple funding rounds. Wasatch Global and AGR Partners were among the institutional investors. By February 2022, Wasatch Advisors Inc. held the largest stake at 17%, followed by Marital Trust D Under The Leslie G. Rudd Living Trust with 13%, and Patrick Roney with 11%. The general public held a 12% ownership stake, while private companies collectively owned 27% of the shares. The shift to bankruptcy and subsequent asset sales fundamentally changed this distribution, with assets being acquired by entities like Foley Family Wines Inc. and Ejnar Knudsen. This restructuring highlights the volatility within the Wine company ownership landscape.

The ownership of Vintage Wine Estates has evolved dramatically, from its initial public offering to its eventual bankruptcy and asset sales.

- The IPO in June 2021 marked a significant shift to public ownership.

- Bankruptcy filing in July 2024 and subsequent asset sales led to a fragmented ownership structure.

- Key stakeholders have changed significantly due to restructuring.

- The company's market capitalization drastically decreased before the asset sales.

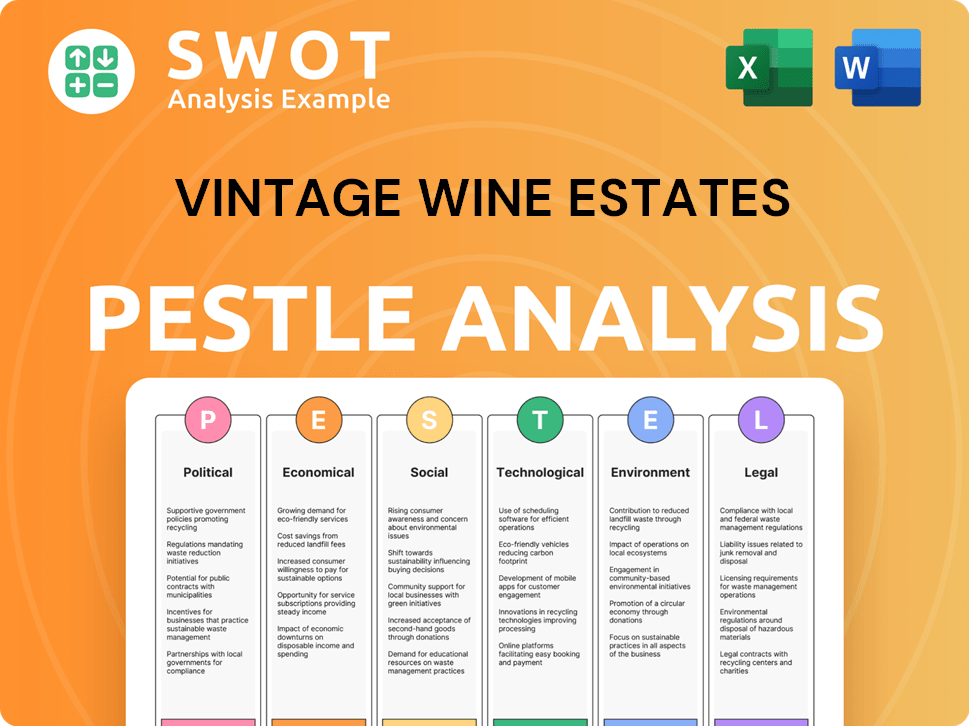

Vintage Wine Estates PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Vintage Wine Estates’s Board?

The Board of Directors of Vintage Wine Estates (VWE) has undergone significant changes, especially in response to the company's financial restructuring. As of recent updates, the board includes Steven Strom, who joined in March 2024 as an independent director and Chair of the Finance Committee, and Ivona Smith, who joined in July 2024. Other key members include Robert L. Berner III, Mark Harms, Jon Moramarco, Candice Koederitz, and D. Timothy Proctor.

Patrick Roney, the founder, transitioned from CEO to Executive Chairman in February 2023 but resigned effective August 1, 2024. Seth Kaufman took over as President and CEO in July 2023. Jon Moramarco briefly served as Interim CEO earlier in 2023. These changes reflect the company's efforts to navigate its financial challenges, including a Chapter 11 filing, and to bring in expertise relevant to restructuring and asset management within the wine industry.

| Board Member | Title | Appointment Date |

|---|---|---|

| Steven Strom | Independent Director, Chair of the Finance Committee | March 2024 |

| Ivona Smith | Director | July 2024 |

| Seth Kaufman | President and CEO | July 2023 |

The voting structure for Vintage Wine Estates typically follows a one-share-one-vote principle for common stock, aligning with standard practices for publicly traded companies. The company's financial difficulties, including a Chapter 11 filing, have influenced the board's composition and strategic direction. This has led to a focus on asset monetization and restructuring, rather than proxy battles or activist investor campaigns. Shareholders have also pursued legal action related to reporting errors, impacting the company's financial transparency and decision-making processes. To learn more about the company, you can check out this Vintage Wine Estates company profile.

The Board of Directors has seen significant changes due to financial restructuring. Key appointments include Steven Strom and Ivona Smith, bringing in financial expertise. The company's focus is on navigating Chapter 11 and improving financial reporting.

- Focus on restructuring and asset management.

- One-share-one-vote structure for common stock.

- Shareholder lawsuits related to reporting errors.

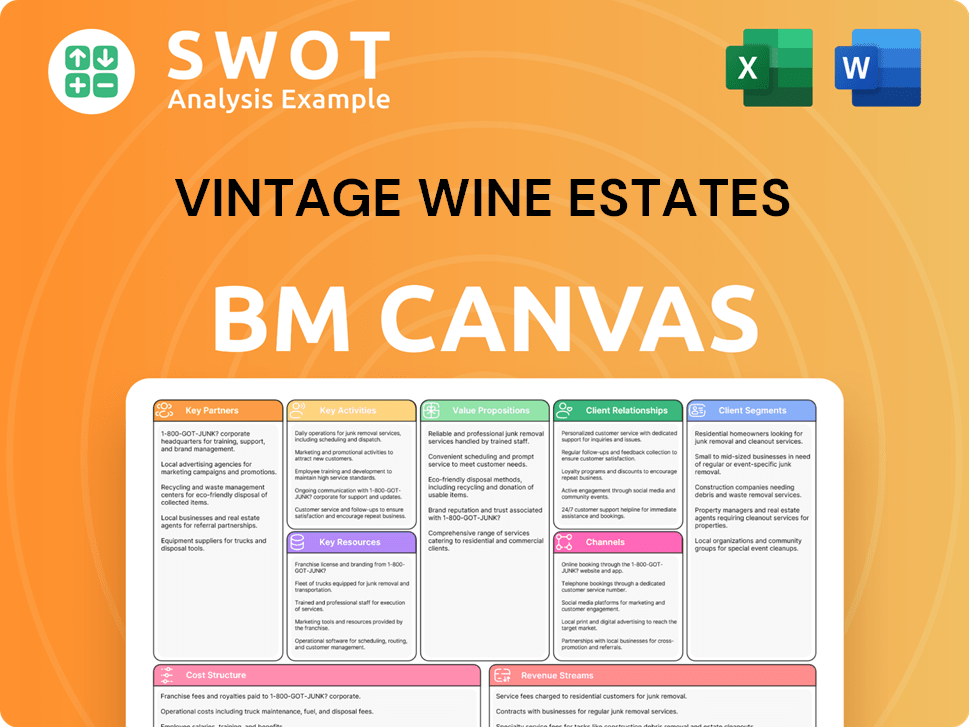

Vintage Wine Estates Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Vintage Wine Estates’s Ownership Landscape?

The past few years have been tumultuous for Vintage Wine Estates, marked by significant shifts in ownership and strategic direction. The company, which went public in June 2021, initially pursued an aggressive acquisition strategy. This led to the purchase of several businesses in 2021, including Kunde Family Wines and Vinesse Wines. However, financial difficulties, including substantial debt, eventually led to a major restructuring.

In July 2024, the company filed for Chapter 11 bankruptcy protection and announced its intention to delist from Nasdaq, changing its stock symbol to VWESQ on August 2, 2024, as it moved to an OTC market. This decision was driven by the need to address $60.5 million in debt and adverse financial conditions. The company's assets were slated for sale, leading to a significant fragmentation of its brand portfolio and a reshuffling of ownership within the wine industry.

| Key Events | Date | Details |

|---|---|---|

| IPO | June 2021 | Went public, initiating an acquisition-led growth strategy. |

| CEO Transition | February 2023 | Founder Pat Roney stepped down as CEO; Jon Moramarco served as interim CEO. |

| Bankruptcy Filing | July 2024 | Filed for Chapter 11 bankruptcy protection; announced delisting from Nasdaq. |

| Asset Sales | Late 2024 | Foley Family Wines acquired five wine brands for $15 million; Jay Adair acquired Girard and Clos Pegase wineries, and B.R. Cohn, Viansa, and Kunde Family Winery for $85 million. |

The bankruptcy and subsequent asset sales have significantly altered the landscape of wine company ownership. Foley Family Wines and Jay Adair emerged as key players, acquiring prominent brands and wineries. These changes reflect broader trends in the wine industry, including declining consumption and challenges in valuations. The situation has disrupted the mergers and acquisitions (M&A) market and depressed valuations for comparable assets.

In 2021, Vintage Wine Estates rapidly expanded its portfolio by acquiring four companies. This aggressive growth strategy aimed to solidify its market position. The acquisitions included Kunde Family Wines, Vinesse Wines, Sommelier Company, and Ace Premium Craft Ciders.

Despite initial growth, financial challenges mounted, leading to bankruptcy. The company faced significant debt and negative financial headwinds, causing a need for restructuring. Workforce reductions, including a 22% cut in the 12 months leading up to July 2024, were implemented to reduce costs.

The bankruptcy resulted in the sale of many assets. Foley Family Wines and Jay Adair acquired several brands and wineries. This shift in ownership reflects a changing landscape within the wine industry. The sales fragmented the original portfolio.

The bankruptcy of Vintage Wine Estates has had broader implications for the wine industry. It disrupted the M&A market and depressed valuations. The industry is facing declining consumption and increased scrutiny, impacting the valuations of assets.

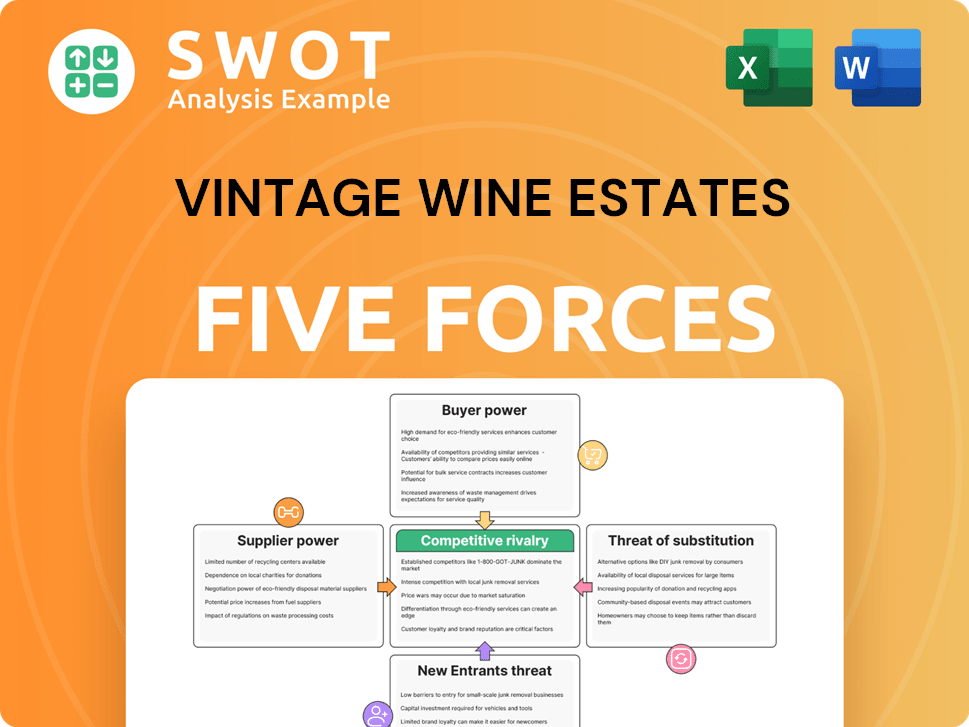

Vintage Wine Estates Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vintage Wine Estates Company?

- What is Competitive Landscape of Vintage Wine Estates Company?

- What is Growth Strategy and Future Prospects of Vintage Wine Estates Company?

- How Does Vintage Wine Estates Company Work?

- What is Sales and Marketing Strategy of Vintage Wine Estates Company?

- What is Brief History of Vintage Wine Estates Company?

- What is Customer Demographics and Target Market of Vintage Wine Estates Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.