Vintage Wine Estates Bundle

Can Vintage Wine Estates Recapture Its Market?

Understanding the Vintage Wine Estates SWOT Analysis is crucial for grasping its future. In the ever-evolving world of wine, knowing your customer is everything, especially when navigating financial headwinds. This is particularly true for Vintage Wine Estates (VWE), a company undergoing a dramatic transformation. The company's recent Chapter 11 bankruptcy filing has forced a strategic pivot, making a deep dive into its customer base more critical than ever.

This exploration into customer demographics and target market for Vintage Wine Estates is essential. The company's shift towards "Super Premium+" brands dictates a new understanding of the wine consumers it aims to serve. We'll analyze the target audience for premium wines, exploring factors influencing vintage wine purchases and the best marketing strategies for wine estates in this new era. This analysis will provide actionable insights into the future of VWE and the estate winery landscape.

Who Are Vintage Wine Estates’s Main Customers?

Understanding the customer demographics and target market of Vintage Wine Estates is crucial for assessing its strategic direction. The company serves both individual consumers (B2C) and businesses (B2B) through a multi-channel sales approach. This includes direct-to-consumer channels, wholesale distribution, and business-to-business partnerships, each catering to different customer needs and preferences.

As of June 30, 2023, the sales were split with Direct-to-Consumer at 29.4%, Wholesale at 30.6%, and Business-to-Business at 40.0%. This balance highlights the company's diverse reach within the wine industry. Initially, the company focused on wines priced between $10 and $20, but it is now shifting its focus towards a "Super Premium+" segment, with wines priced at $15 or more per bottle.

This strategic shift indicates a change in the target market, aiming for a more affluent customer base. This move is part of a broader restructuring effort, driven by financial challenges and a Five-Point Plan implemented in the latter half of fiscal 2023. The plan involves simplifying operations, reducing the number of products, and concentrating on key brands to improve profitability. The company is streamlining its operations by selling non-core assets to concentrate on its core "Super Premium+" portfolio.

The Direct-to-Consumer (DTC) segment includes wine enthusiasts who visit tasting rooms, join wine clubs, or purchase through e-commerce platforms. These customers are often looking for unique experiences and direct engagement with the wineries. They typically have a higher interest in the story and origin of the wines they purchase.

The Wholesale segment serves retailers, restaurants, and other businesses that sell wine to end consumers. These customers focus on product selection, pricing, and the ability to meet consumer demand. The wholesale channel is vital for broad market penetration and brand visibility.

The Business-to-Business (B2B) segment provides production and bottling services for major retail clients. This segment is essential for generating revenue through services and building partnerships within the wine industry. The B2B segment provides services for larger retail chains, which helps in increasing the volume of wines.

The company is focusing on its "Super Premium+" brands, which are generally priced at $15 or more per bottle. This strategic shift indicates a refinement of the target customer to those who appreciate and are willing to pay for higher-end wines. This segment includes brands like B.R. Cohn, Firesteed, Girard, Kunde, and Laetitia, alongside select lifestyle brands like ACE Cider, Bar Dog, Cherry Pie, and Layer Cake. The shift is intended to improve profitability and streamline operations.

The target market for Vintage Wine Estates is evolving, with a clear focus on the premium segment. The company is targeting wine consumers who are willing to spend more on high-quality wines. Understanding the customer demographics and their preferences is crucial for developing effective marketing strategies.

- Income Levels: The shift towards "Super Premium+" wines suggests targeting consumers with higher disposable incomes.

- Age Range: Wine consumption is often associated with older demographics, but the company also targets younger consumers through lifestyle brands.

- Geographic Location: The company's customer base is likely diverse, with a significant presence in regions with strong wine cultures and distribution networks.

- Customer Preferences: Customers likely value quality, brand reputation, and the overall experience associated with premium wines.

For further insights into the financial performance and ownership structure, you can refer to the article about Owners & Shareholders of Vintage Wine Estates.

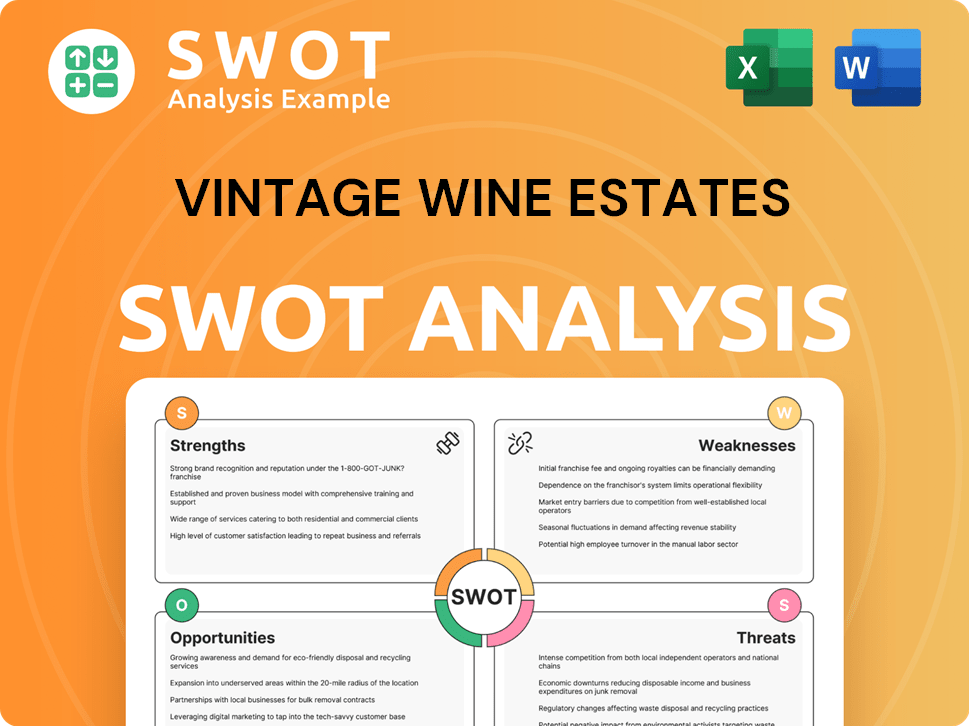

Vintage Wine Estates SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Vintage Wine Estates’s Customers Want?

Understanding the customer needs and preferences is crucial for success. For the company, this involves adapting to evolving consumer tastes and market trends. The company's shift towards 'Super Premium+' wines reflects a strategic focus on a segment willing to pay more for quality and a refined experience, indicating a clear understanding of their target market.

Historically, the company aimed at a broader audience with a range of wines. However, the current strategy emphasizes 'affordable luxury brands.' This suggests a focus on providing high-quality wines at a reasonable price point to attract a specific customer demographic. This targeted approach aims to drive brand desirability and create a strong emotional connection with consumers.

The company's multi-channel strategy, including Direct-to-Consumer sales and wholesale channels, caters to diverse customer needs. Direct-to-Consumer sales build loyalty through personalized experiences, while wholesale channels meet the needs of distributors and retailers. This multi-faceted approach allows the company to reach a wider audience and cater to various preferences within the wine consumer market.

The company's customers' needs are evolving, moving towards premium wines. The focus is now on quality, complexity, and a sense of place in their wines. This shift is driven by the 'premiumization' trend in the U.S. wine industry.

The company strategically targets consumers who are willing to pay more for quality wines. This target market appreciates the refined experience and is willing to spend more per bottle. This focus on 'affordable luxury' is a key element of the strategy.

The company utilizes a multi-channel approach, including Direct-to-Consumer sales and wholesale channels. Direct-to-Consumer sales foster personal connections and loyalty. Wholesale channels cater to distributors and retailers, meeting their specific needs.

The company emphasizes 'driving brand desirability' for its core brands. This involves creating a strong emotional connection and perceived value. This strategy aims to attract and retain customers in a competitive market.

Market trends, such as 'premiumization,' influence the company's product development. The company responds by focusing on higher-margin products that align with consumer preferences. Restructuring efforts, like SKU reduction, support this focus.

The company is streamlining its product portfolio to focus on higher-margin products. This strategy aims to meet current consumer preferences for premium wines. This focus allows for better resource allocation and customer satisfaction.

The company's customer preferences are influenced by factors such as quality, price, and brand experience. The shift towards premium wines indicates a desire for higher-quality products. The focus on 'affordable luxury' balances quality with value, appealing to a broader customer base.

- Quality: Consumers seek wines that offer superior taste and complexity.

- Price: Customers value a reasonable price point for the quality received.

- Brand Experience: Customers appreciate the overall experience, including tasting rooms and wine clubs.

- Authenticity: Consumers are drawn to wines that emphasize tradition and a sense of place.

- Convenience: The multi-channel strategy caters to different purchasing behaviors.

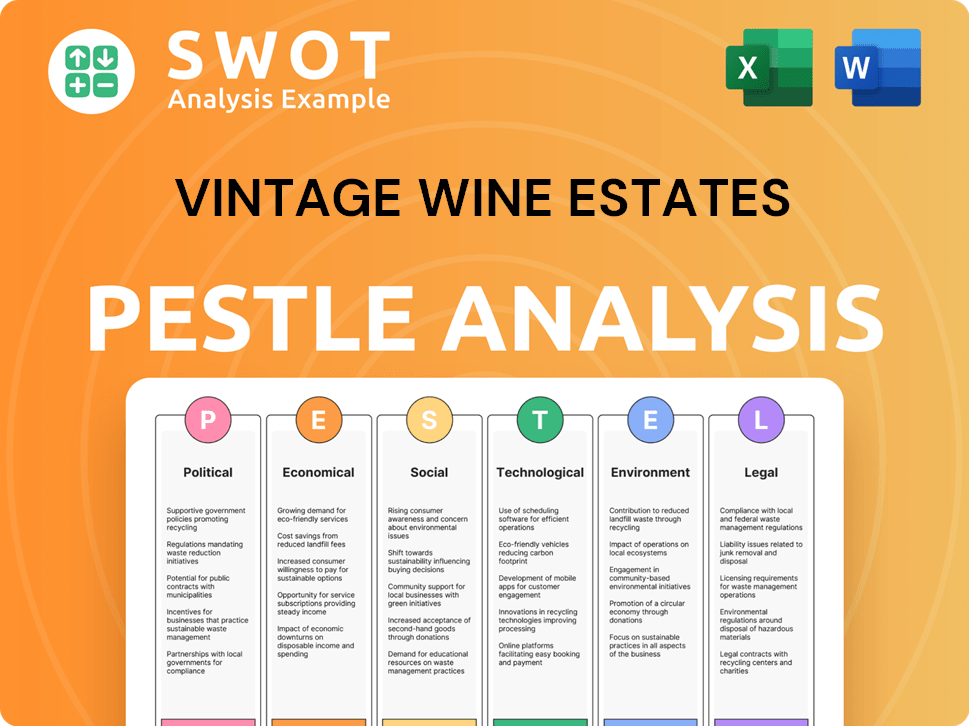

Vintage Wine Estates PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Vintage Wine Estates operate?

The geographical market presence of Vintage Wine Estates (VWE) is predominantly within the United States. The company strategically positions its wineries and vineyards in prime wine-growing regions, including Napa, Sonoma, California's Central Coast, Oregon, and Washington State. This focus allows VWE to capitalize on the diverse consumer base and regional preferences within the U.S. wine market.

VWE's operational footprint includes owning or leasing approximately 2,556 acres across these regions. This land supports the production of a significant portion of the fruit used in its wines. The company operates 12 wineries and 11 tasting rooms, enhancing its direct engagement with wine consumers and supporting local tourism.

While VWE primarily sells its wines within the U.S., the company's strategic direction is shifting. The emphasis is now on 'Super Premium+' brands, indicating a move towards targeting consumers with higher disposable incomes and a preference for luxury wines. This shift is part of a broader strategy to strengthen its position within the U.S. wine industry, as outlined in Brief History of Vintage Wine Estates.

VWE's core geographic focus is on the United States, with strategic locations in California (Napa, Sonoma, Central Coast), Oregon, and Washington State. These regions are known for their premium wine production and attract a diverse range of wine consumers.

The company's direct-to-consumer (DTC) platform, including tasting rooms and wine clubs, caters to local and regional wine tourism. This approach allows VWE to build direct relationships with wine consumers and gather valuable feedback on customer preferences.

VWE's wholesale and business-to-business (B2B) segments involve partnerships with national retailers and distributors. This strategy requires an understanding of regional market nuances and consumer behavior across different geographic areas.

Recent strategic moves include asset sales, such as the Clos Pegase and Viansa estates, and the winding down of certain custom crush and B2B services. These actions reflect a broader effort to streamline operations and focus on core brands within the most profitable markets.

VWE's shift towards 'Super Premium+' brands indicates a targeted approach to the customer demographics. This includes consumers with higher disposable incomes and a preference for luxury wines. The company's strategic focus aims to maximize profitability within its most valuable markets.

- Wine Consumers: Targeting individuals who appreciate and purchase premium wines.

- Income Levels: Focusing on customers with higher disposable incomes, who are more likely to purchase luxury wines.

- Geographic Location: Concentrating on regions within the U.S. known for their wine culture and consumer spending.

- Customer Preferences: Understanding and catering to the preferences of consumers who seek high-quality, premium wines.

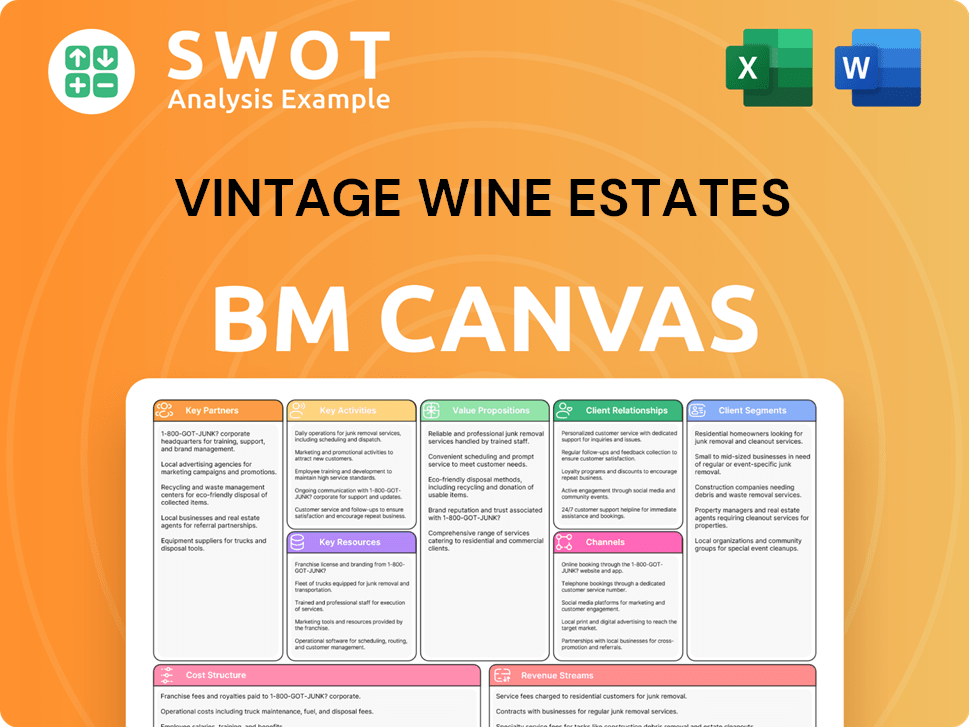

Vintage Wine Estates Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Vintage Wine Estates Win & Keep Customers?

The company employs an 'omni-channel strategy' for customer acquisition and retention, using a mix of direct-to-consumer (DTC), wholesale, and exclusive brand arrangements. This approach helps them reach a broad range of consumers and businesses. A key element of their strategy involves expanding wine club memberships, which are a significant channel for acquiring new customers. They also leverage partnerships with major distributors and retailers.

Customer retention is boosted through wine club memberships, which build lasting relationships with their brands. The company is focused on improving digital channels to encourage return visits and increase purchases. They emphasize creating 'incredible customer experiences' at their wineries and tasting rooms to foster repeat business. The company is increasingly using customer data and segmentation to better target campaigns and personalize experiences.

Recent strategic shifts, including a Five-Point Plan implemented in fiscal 2023, have significantly impacted their approach, focusing on margin expansion, cost reduction, and revenue growth in key brands. This involves streamlining the business and reducing the number of products offered. While DTC revenue decreased in the first quarter of fiscal 2024, improvements in tasting rooms and wine clubs partially offset this. The company is actively selling non-core assets to streamline operations and better allocate resources toward acquiring, engaging, retaining, and delighting consumers within their refined Super Premium+ portfolio, aiming to improve customer loyalty and lifetime value.

Key marketing channels include tasting rooms, wine clubs, e-commerce platforms, and digital marketing. The company acquired Vinesse, LLC in 2021, which specializes in wine clubs. They also use relationships with major distributors and retailers to expand their reach.

Wine club memberships are a central part of their strategy to retain customers. The company aims to drive return visits to its digital channels and increase purchasing activity. They are focused on creating memorable experiences at their wineries and tasting rooms.

The company is shifting towards a 'data-driven, consumer-centric culture' to better target campaigns and personalize experiences. This involves leveraging customer insights to understand preferences and behaviors. This approach helps in analyzing the target market for a winery.

The Five-Point Plan includes margin expansion, cost reduction, and revenue growth. They are simplifying the business and reducing SKUs to create stronger brand desirability. The company is selling non-core assets to streamline operations and focus on their core customer segments.

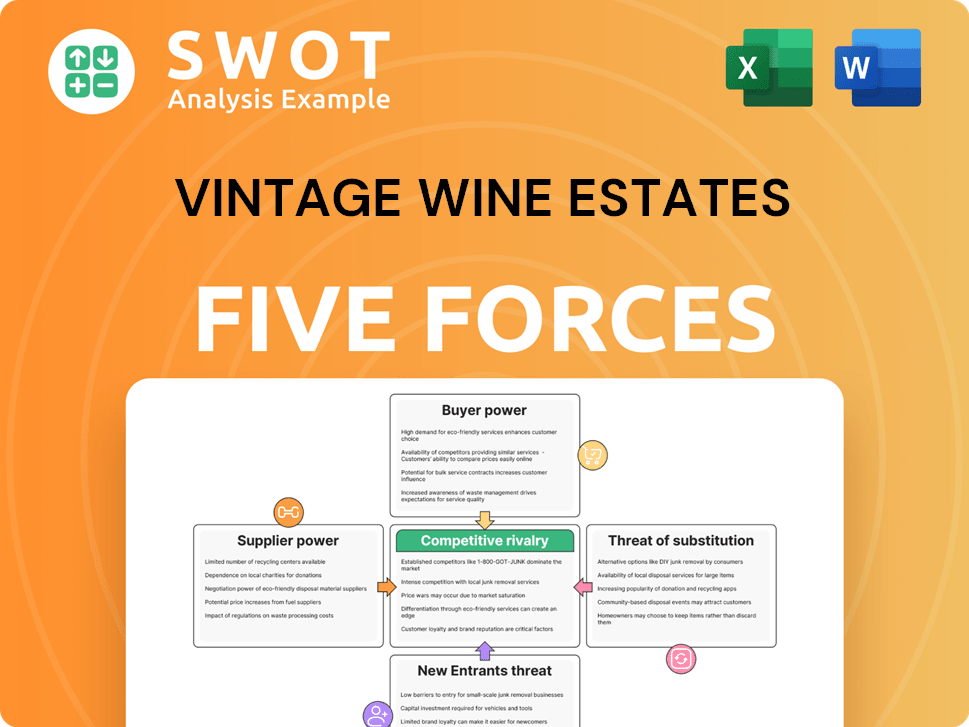

Vintage Wine Estates Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vintage Wine Estates Company?

- What is Competitive Landscape of Vintage Wine Estates Company?

- What is Growth Strategy and Future Prospects of Vintage Wine Estates Company?

- How Does Vintage Wine Estates Company Work?

- What is Sales and Marketing Strategy of Vintage Wine Estates Company?

- What is Brief History of Vintage Wine Estates Company?

- Who Owns Vintage Wine Estates Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.