Vintage Wine Estates Bundle

How Does Vintage Wine Estates Thrive in the Wine Industry?

Vintage Wine Estates (VWE) stands as a significant force in the American wine industry, but how does this Vintage Wine Estates SWOT Analysis reveal its inner workings? This wine company has strategically built a diverse portfolio through smart acquisitions and brand development. Understanding how VWE operates is key to grasping the evolving dynamics of the wine market and its investment potential.

Delving into Vintage Wine Estates' operations is essential for anyone interested in the wine industry. The company's success hinges on its ability to manage a wide array of wine brands and navigate the complexities of both wholesale and direct-to-consumer sales. Examining its business model, including how it makes money, offers valuable insights into its strategic approach and financial performance. Furthermore, exploring questions like "What wineries does Vintage Wine Estates own?" and "Is Vintage Wine Estates a public company?" helps to paint a clear picture of its market position.

What Are the Key Operations Driving Vintage Wine Estates’s Success?

The core operations of Vintage Wine Estates (VWE) are centered around the production and sale of a diverse portfolio of wines. This wine company caters to a wide range of consumers, from casual drinkers to wine connoisseurs, through a multi-channel distribution network. VWE's business model focuses on acquiring and developing established wine brands and vineyards, enabling it to offer wines at various price points and appeal to different taste preferences.

The value proposition of Vintage Wine Estates lies in its ability to provide a wide selection of wines under one umbrella. This includes everyday selections to premium and luxury offerings. This approach allows VWE to establish a strong market presence and efficient delivery of products. This strategy differentiates VWE from competitors that focus on organic growth or niche markets.

The operational processes involve vineyard management, winemaking, bottling, and distribution. The supply chain includes sourcing grapes from its own vineyards and external growers. Distribution channels include wholesale, direct-to-consumer (DTC) sales, and direct retail operations. This integrated approach ensures a wide market presence and efficient delivery of products. The company's strategy of acquiring and integrating existing brands and vineyards supports rapid portfolio expansion. This leverages established brand recognition and customer loyalty.

Vintage Wine Estates offers a diverse range of wines, from everyday selections to premium and luxury offerings. This wide variety caters to different consumer preferences and price points. The portfolio expansion is often achieved through acquisitions.

Key processes include vineyard management, winemaking, bottling, and distribution. The company sources grapes from its own vineyards and external growers. Distribution channels include wholesale, direct-to-consumer (DTC), and direct retail operations.

VWE utilizes multiple distribution channels to reach consumers. These include wholesale to retailers and restaurants, direct-to-consumer sales through tasting rooms, wine clubs, and e-commerce, and direct retail operations. This multi-channel approach ensures broad market coverage.

A key aspect of VWE's business model is the acquisition and integration of existing wine brands and vineyards. This strategy allows for rapid portfolio expansion. It leverages established brand recognition and customer loyalty, rather than building brands from scratch.

Vintage Wine Estates distinguishes itself through its acquisition-focused strategy, enabling rapid portfolio growth and brand recognition. This approach provides customers with a wider selection of trusted wines and a consistent supply of popular labels. This differentiates VWE from competitors.

- Wider Selection: Customers have access to a diverse range of wines.

- Brand Recognition: Leveraging established brand loyalty.

- Consistent Supply: Ensuring the availability of popular labels.

- Market Reach: Catering to a broad spectrum of consumers.

For a deeper dive into the marketing strategies employed by Vintage Wine Estates, you can explore the Marketing Strategy of Vintage Wine Estates. This will provide additional insights into how VWE positions and promotes its brands within the competitive wine industry.

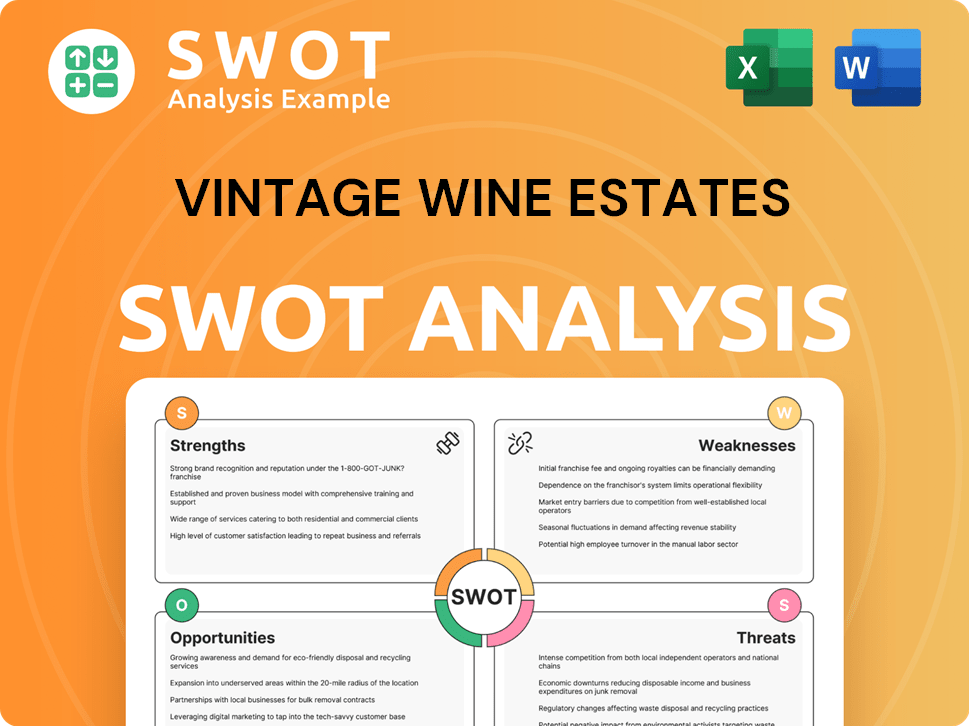

Vintage Wine Estates SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vintage Wine Estates Make Money?

The Wine company , primarily known as Vintage Wine Estates (VWE), generates revenue through a multi-faceted approach. Its business model focuses on leveraging a diverse portfolio of wine brands across various sales channels. This strategy allows VWE to reach a wide consumer base and maintain a robust financial structure within the competitive wine industry.

VWE's revenue streams are designed to maximize market penetration and profitability. The company's operations are structured to capitalize on both direct and indirect sales avenues, ensuring a diversified approach to revenue generation. The company's ability to integrate acquired wine brands into its existing network is a key component of its growth strategy.

The Vintage Wine Estates's revenue model is built on three main pillars: wholesale, direct-to-consumer (DTC), and retail sales. While specific percentages for 2024-2025 are not available in recent public releases, historical data indicates that wholesale has been a significant contributor, followed by DTC and retail. This balanced approach allows the company to adapt to market trends and consumer preferences effectively.

The wholesale channel involves selling wine to distributors, who then supply retailers, restaurants, and other on-premise accounts. This channel ensures broad market reach and consistent sales volumes. The DTC channel includes wine club subscriptions, online sales, and direct sales at winery tasting rooms, often yielding higher margins due to the elimination of intermediaries. Retail sales from the company's branded locations offer another direct point of sale.

- Wholesale: Sales to distributors, retailers, restaurants.

- Direct-to-Consumer (DTC): Wine club subscriptions, online sales, and tasting room sales.

- Retail: Sales through company-owned retail locations.

VWE employs several monetization strategies to boost its financial performance. Wine club memberships provide a recurring revenue stream, fostering customer loyalty and predictable income. Tiered pricing caters to various budgets, offering everyday wines, premium selections, and luxury offerings. The acquisition strategy itself is a monetization tool, integrating acquired brands into its sales and distribution networks for immediate revenue growth. For more insights into the company's strategy, you can refer to an article discussing the [Vintage Wine Estates business model](0).

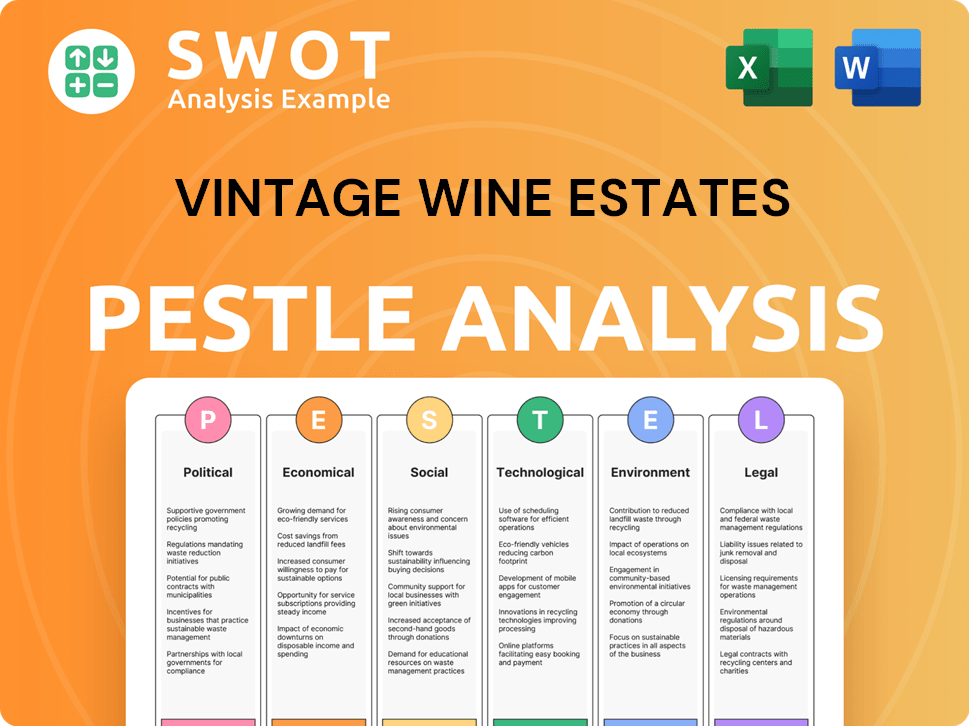

Vintage Wine Estates PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Vintage Wine Estates’s Business Model?

Vintage Wine Estates (VWE) has significantly shaped its operational and financial trajectory through strategic acquisitions. The company's approach involves integrating new wineries and brands into its portfolio, which expands its product offerings and market reach. This strategy has enabled VWE to scale its operations and diversify revenue streams rapidly. Understanding the Brief History of Vintage Wine Estates provides a deeper insight into its evolution.

A key strategic move for VWE has been the continuous integration of new wineries and brands. This has allowed the company to quickly scale its operations and diversify its revenue streams. Operational challenges have included navigating supply chain disruptions and adapting to evolving consumer preferences. VWE has responded by optimizing its logistics and investing in its direct-to-consumer channels.

VWE's competitive advantages stem from its strong brand portfolio, economies of scale, and multi-channel distribution. The company's focus on sustainability and adapting to market trends, such as the increasing demand for online wine sales, is crucial for maintaining its business model and competitiveness. VWE's approach to the wine industry has positioned it to navigate challenges and capitalize on opportunities.

VWE has grown through a series of acquisitions, expanding its portfolio and market presence. These acquisitions have included well-known wine brands and vineyards. The company's growth strategy has been centered on acquiring and integrating various wineries.

The company's strategic moves include optimizing logistics and diversifying sourcing to mitigate supply chain disruptions. VWE has invested in direct-to-consumer channels to increase control over sales. This strategy has allowed greater control over sales and customer relationships.

VWE's strong brand portfolio provides a competitive edge through established recognition. Economies of scale in production and distribution allow for efficient operations. A multi-channel distribution strategy provides broad market access and resilience.

Supply chain disruptions and changing consumer preferences have posed operational challenges. VWE has addressed these challenges by optimizing logistics and diversifying its sourcing. The company has also invested in its direct-to-consumer channels.

While specific 2024-2025 financial data for VWE may vary, the company's performance is closely tied to the wine industry trends. The wine industry's revenue in the United States was approximately $70.5 billion in 2023. VWE's ability to navigate market fluctuations and adapt to consumer preferences is crucial. The company's strategic moves and competitive advantages are key to sustaining its business model.

- VWE's revenue is influenced by its diverse wine brands and distribution channels.

- The company's investment in direct-to-consumer sales is a response to changing market dynamics.

- Acquisitions have been a primary driver of VWE's growth and market share.

- Sustainability and online sales are increasingly important for the wine industry.

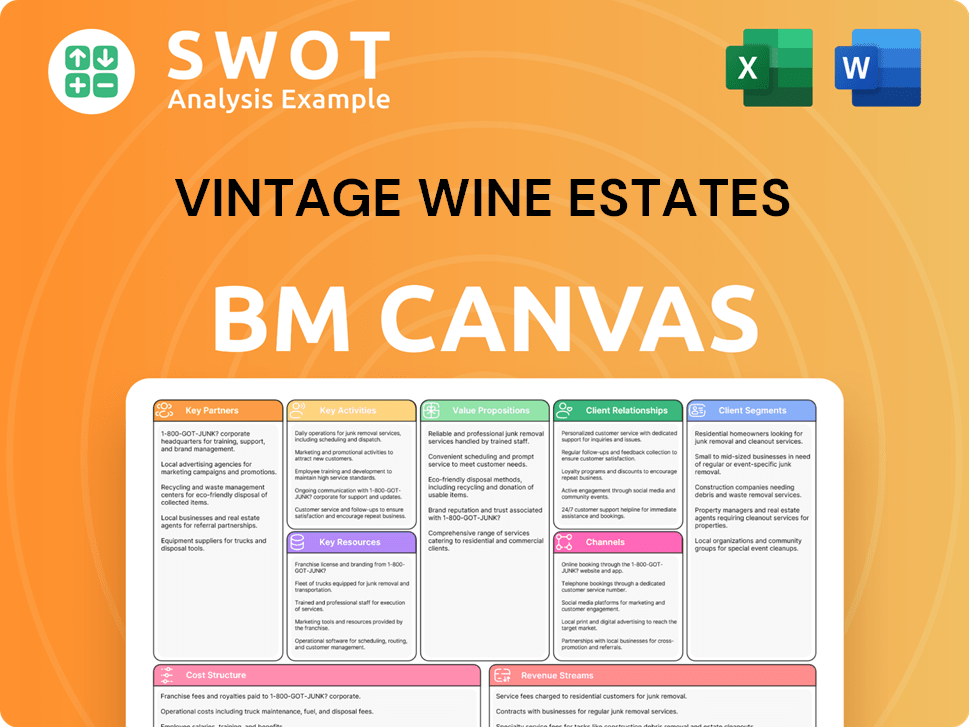

Vintage Wine Estates Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Vintage Wine Estates Positioning Itself for Continued Success?

In the competitive U.S. wine industry, Vintage Wine Estates (VWE) holds a notable position. The wine company competes with both large conglomerates and numerous smaller, independent wineries. VWE's market share benefits from its diverse portfolio of established wine brands and its multi-channel distribution approach. This helps it reach a wide customer base and build customer loyalty across various segments.

Acquisitions have been key to expanding VWE's reach, primarily within the North American market. However, the company faces several risks, including regulatory changes and increased competition. Technological disruptions and changing consumer preferences also pose challenges. For more details, you can read about Owners & Shareholders of Vintage Wine Estates.

VWE's position is strengthened by its diverse brand portfolio and multi-channel distribution. This allows it to reach a broad consumer base. The company has expanded its reach through strategic acquisitions, primarily within North America.

Key risks include regulatory changes, increased competition, and technological disruptions. Changing consumer preferences, such as a shift towards different beverage categories, also pose a challenge. These factors could affect the demand for its products.

VWE is focused on portfolio expansion through acquisitions and investment in direct-to-consumer capabilities. The company aims to leverage its brand equity and adapt to evolving consumer trends. It plans to expand market penetration through diversified channels.

Ongoing initiatives include portfolio expansion, investment in direct-to-consumer capabilities, and supply chain optimization. Leadership focuses on innovation in winemaking and marketing. They are also committed to using data to better understand and serve customers.

Recent financial data indicates the company's performance and market trends. The wine industry is dynamic, with changing consumer preferences and competitive pressures. Understanding these factors is crucial for VWE's strategic planning.

- The wine company's revenue and profitability are influenced by its brand portfolio and distribution strategies.

- Market share data provides insights into VWE's competitive standing within the wine industry.

- Consumer behavior trends, such as the demand for sustainable practices, impact VWE's product development and marketing strategies.

- Acquisitions continue to play a role in VWE's growth strategy, expanding its brand portfolio and market reach.

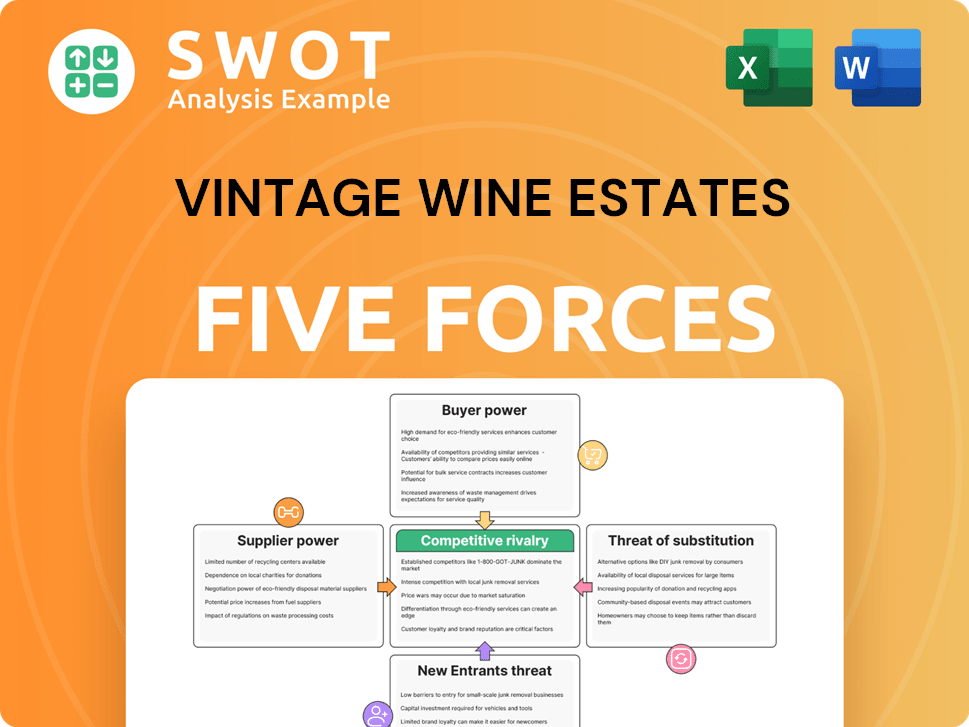

Vintage Wine Estates Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vintage Wine Estates Company?

- What is Competitive Landscape of Vintage Wine Estates Company?

- What is Growth Strategy and Future Prospects of Vintage Wine Estates Company?

- What is Sales and Marketing Strategy of Vintage Wine Estates Company?

- What is Brief History of Vintage Wine Estates Company?

- Who Owns Vintage Wine Estates Company?

- What is Customer Demographics and Target Market of Vintage Wine Estates Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.