Western Digital Bundle

Can Western Digital Thrive in the Data Storage Revolution?

Western Digital, a titan in the data storage market, has consistently adapted to the ever-changing digital landscape. From its early days manufacturing calculator chips to its current dominance in both HDD and SSD markets, the company's journey reflects the dynamic nature of technology. The 2016 acquisition of SanDisk was a game-changer, significantly expanding its presence in the Western Digital SWOT Analysis and solid-state drive (SSD) market.

This exploration of Western Digital's growth strategy will dissect its strategic initiatives, focusing on its expansion into new markets and continuous innovation in storage technologies. We'll analyze how WD Company Analysis plans to navigate the challenges and capitalize on the opportunities within the competitive data storage market. Understanding Western Digital's future prospects requires a deep dive into its financial performance, strategic initiatives, and how it's adapting to the evolving demands of the digital world, including the shift from HDD vs SSD.

How Is Western Digital Expanding Its Reach?

As part of its Western Digital Growth Strategy, the company is actively pursuing several expansion initiatives. These initiatives are designed to fuel future growth by focusing on both geographical reach and product diversification. A key aspect of this strategy involves strengthening its presence in high-growth markets, particularly those driven by artificial intelligence (AI) and cloud computing.

WD Company Analysis reveals that the company is strategically positioning its high-capacity HDDs and performance-oriented SSDs to meet the escalating data storage demands of AI workloads and hyperscale data centers. This includes the continued strong demand for its 28TB SMR HDDs and upcoming 32TB SMR HDDs, which are crucial for efficient data storage in cloud environments. The company is also expanding its product offerings to address emerging opportunities within the client and enterprise segments.

The company is also exploring new business models, such as 'Storage-as-a-Service,' to provide more flexible and scalable solutions to its enterprise customers. Partnerships are also a critical component of its expansion, with collaborations aimed at integrating storage solutions into broader technology ecosystems, such as those supporting edge computing and IoT applications. For further insights, you can explore a Brief History of Western Digital.

The company is focusing on expanding its presence in high-growth markets, especially those driven by AI and cloud computing. This involves strategic investments and partnerships to tap into the increasing demand for data storage solutions in these regions. The goal is to capture a larger share of the Data Storage Market.

The company is diversifying its product offerings to meet the evolving needs of client and enterprise segments. This includes introducing new NVMe SSDs for high-performance computing and client applications, as well as advancements in its enterprise SSD portfolio. This strategy aims to provide a broader range of Digital Storage Solutions.

The company is actively forming partnerships to integrate its storage solutions into broader technology ecosystems. Collaborations are focused on areas like edge computing and IoT applications. These partnerships are crucial for expanding market reach and providing comprehensive solutions, which is part of its Western Digital Future Prospects.

The company is exploring new business models, such as 'Storage-as-a-Service,' to offer more flexible and scalable solutions to its enterprise customers. This approach aims to provide tailored storage options that meet the specific needs of different clients. This is part of the company's Western Digital strategic initiatives 2024.

The company’s expansion efforts are centered around high-growth markets, product diversification, strategic partnerships, and new business models. These initiatives are designed to capitalize on the increasing demand for data storage solutions, particularly in areas like AI and cloud computing. Western Digital investment opportunities are focused on these key areas.

- High-Capacity HDDs: Continued focus on high-capacity HDDs like the 28TB and 32TB SMR models for cloud environments.

- NVMe SSDs: Introduction of new NVMe SSDs for high-performance computing and client applications.

- Enterprise SSDs: Advancements in the enterprise SSD portfolio to meet diverse storage needs.

- Storage-as-a-Service: Exploring new business models to offer flexible and scalable solutions.

Western Digital SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Western Digital Invest in Innovation?

The growth trajectory of Western Digital (WD) is deeply intertwined with its innovation and technology strategy. This strategy is characterized by substantial investments in research and development (R&D) and a focus on cutting-edge storage solutions. WD's ability to anticipate and adapt to the evolving demands of the data storage market is crucial for its sustained success.

WD's approach encompasses both hard disk drives (HDDs) and solid-state drives (SSDs), ensuring a broad portfolio to cater to diverse customer needs. The company's commitment to innovation is evident in its continuous development of advanced technologies, such as energy-assisted magnetic recording (EAMR) and OptiNAND, which enhance storage capacity and performance. WD's strategic initiatives, including new product launches, are key to maintaining its competitive edge.

WD's innovation strategy also includes integrating AI and machine learning into its storage management software. This integration optimizes data access and improves system performance. Furthermore, the company is focusing on sustainability initiatives, developing energy-efficient storage solutions to meet environmental standards. This comprehensive approach underscores WD's commitment to innovation and its ability to adapt to the changing storage landscape.

WD is at the forefront of HDD technology, developing advanced solutions like EAMR and OptiNAND. These technologies are crucial for increasing storage capacity and improving performance. The push towards higher-capacity HDDs, such as the 28TB and 32TB SMR models, demonstrates WD's commitment to innovation.

In the SSD market, WD continues to innovate with NVMe SSDs, leveraging advancements in NAND flash technology. This results in higher speeds and greater efficiency for both client and enterprise applications. WD's SSD offerings are designed to meet the growing demand for faster and more reliable storage solutions.

WD is integrating AI and machine learning into its storage management software. This integration optimizes data access and improves system performance, enhancing the overall user experience. This strategic move positions WD to offer smarter and more efficient storage solutions.

Sustainability is a growing focus for WD, with efforts to develop more energy-efficient storage solutions. These initiatives align with global environmental standards and demonstrate WD's commitment to corporate responsibility. This focus is becoming increasingly important in the data storage market.

WD's strong patent portfolio and consistent introduction of new product generations underscore its leadership in data storage innovation. WD's ability to bring new products to market is a key factor in maintaining its competitive position. These innovations help WD stay ahead in the Competitors Landscape of Western Digital.

WD's participation in industry forums and collaborations with technology leaders further solidifies its position as a key driver of advancements in the storage landscape. These collaborations allow WD to share knowledge and drive innovation. This helps the company stay ahead of market trends.

WD's strategic initiatives in 2024 and beyond are focused on enhancing both HDD and SSD technologies, integrating AI, and promoting sustainability. WD's investment in R&D is a critical driver of its future growth. The company's ability to adapt to the evolving data storage market is essential for its long-term success.

- HDD Advancements: WD continues to push the boundaries of HDD capacity with technologies like EAMR and OptiNAND. The roadmap includes 32TB SMR HDDs.

- SSD Innovations: WD is focused on NVMe SSDs, leveraging advancements in NAND flash technology for higher speeds and efficiency.

- AI and Machine Learning: Integration of AI and machine learning in storage management software to optimize data access and improve system performance.

- Sustainability: Development of energy-efficient storage solutions to meet environmental standards.

- Strategic Partnerships: Collaborations with technology leaders to drive innovation and market expansion.

Western Digital PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Western Digital’s Growth Forecast?

The financial outlook for Western Digital (WD) is cautiously optimistic, supported by strategic adjustments and anticipated market recovery. The company's strategy focuses on capitalizing on the recovery in the NAND flash market and the sustained demand for high-capacity HDDs. This approach is designed to navigate the fluctuations in the data storage market effectively. Owners & Shareholders of Western Digital should take note of these developments.

For the third fiscal quarter of 2025, WD projects revenue between $3.60 billion and $3.80 billion. Non-GAAP gross margin is expected to be between 33.5% and 35.5%, with non-GAAP earnings per share forecasted at $0.80 to $1.10. These projections reflect expectations of a recovering NAND flash market and continued strong demand for high-capacity HDDs, which are crucial in the digital storage solutions landscape.

The company's financial ambitions are supported by ongoing efforts to optimize operational efficiency and manage inventory levels. WD's diversified portfolio across both Flash and HDD segments provides resilience in the face of market volatility. Long-term financial goals include improving profitability and generating robust free cash flow to fuel future growth initiatives and potentially return value to shareholders. This strategic focus aims to leverage market upturns while maintaining disciplined cost management.

Analysts project WD's revenue to reach approximately $15.54 billion in fiscal year 2025. They anticipate an increase to around $17.37 billion in fiscal year 2026, indicating a positive trajectory for the company's financial performance.

The data storage market is influenced by the ongoing HDD vs SSD debate. WD's strategic initiatives in both areas position it to benefit from diverse market demands. WD's adaptability to the evolving storage technology landscape is key.

WD's strategic initiatives for 2024 include enhancing profitability. These efforts are designed to support the company's long-term goals. WD's cloud storage strategy is also a key element.

WD aims to generate strong free cash flow. This financial health supports investment in future growth. The company's revenue streams are diversified.

WD's financial performance is closely watched by investors. The company's ability to navigate challenges and opportunities is crucial. WD's market share analysis provides insights into its competitive position.

- Revenue Projections: Approximately $15.54 billion in fiscal year 2025.

- Anticipated Growth: Revenue expected to reach around $17.37 billion in fiscal year 2026.

- Strategic Initiatives: Focus on profitability and free cash flow generation.

- Market Dynamics: Adaptability to HDD vs SSD and cloud storage demands.

Western Digital Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Western Digital’s Growth?

The data storage industry, where Western Digital (WD) operates, is characterized by intense competition and rapid technological advancements, posing significant challenges to its growth strategy. The company faces the constant pressure to innovate and adapt to evolving market demands. Understanding these potential risks and obstacles is crucial for a thorough WD company analysis.

One of the primary challenges for WD involves navigating the competitive landscape of the data storage market, including the ongoing transition from Hard Disk Drives (HDDs) to Solid State Drives (SSDs). Furthermore, external factors such as supply chain disruptions and regulatory changes can significantly impact the company's operations and financial performance. These factors need to be considered when assessing Western Digital's future prospects.

To maintain its market position, WD must proactively address these risks through strategic initiatives and robust management practices. This includes a focus on digital storage solutions and adapting to shifts in consumer preferences and technological innovations.

The data storage market is highly competitive, with established players and emerging innovators in both HDD and SSD segments. Competition can lead to pricing pressures and reduced profit margins. WD's market share analysis reveals the impact of these competitive dynamics.

Rapid advancements in NAND flash technology and alternative storage solutions pose a threat to WD's product portfolio. Shifts towards cloud-based storage and new memory technologies could impact demand for traditional storage products. WD's innovation in storage technology is vital to stay ahead.

Geopolitical tensions, natural disasters, and component shortages can disrupt manufacturing and product availability. These disruptions can lead to increased costs and delayed product launches. Robust supply chain management is essential for WD's operations.

Changes in data privacy and intellectual property regulations can impose new compliance burdens. These regulations may also limit market access. WD must adapt to these changes to maintain its competitive edge.

Increasing cybersecurity threats pose a risk to data integrity and customer trust. Cybersecurity breaches can result in significant financial and reputational damage. WD needs to invest in robust cybersecurity measures.

Growing pressure for sustainable manufacturing practices requires WD to adopt eco-friendly processes. Meeting environmental standards can increase costs and impact operations. WD's sustainability efforts are critical for its long-term success.

WD addresses these risks through diversification, continuous R&D, and robust supply chain management. Scenario planning helps assess the impact of market and geopolitical events. The company's ability to adapt to market changes is crucial for its long-term goals.

Market downturns and pricing pressures have historically impacted WD's financial performance. The company's revenue streams and profitability are sensitive to these factors. Analyzing WD's financial performance is essential for understanding its investment opportunities.

WD's strategic initiatives, including new product launches and acquisitions, are vital for maintaining competitiveness. Adapting to the evolving data center market and cloud storage strategy are key. Understanding WD's strategic initiatives in 2024 is essential.

The competitive landscape includes major players in the data storage industry. WD's ability to navigate this landscape will determine its future prospects. For a deeper dive, consider reading an article about the WD competitive landscape.

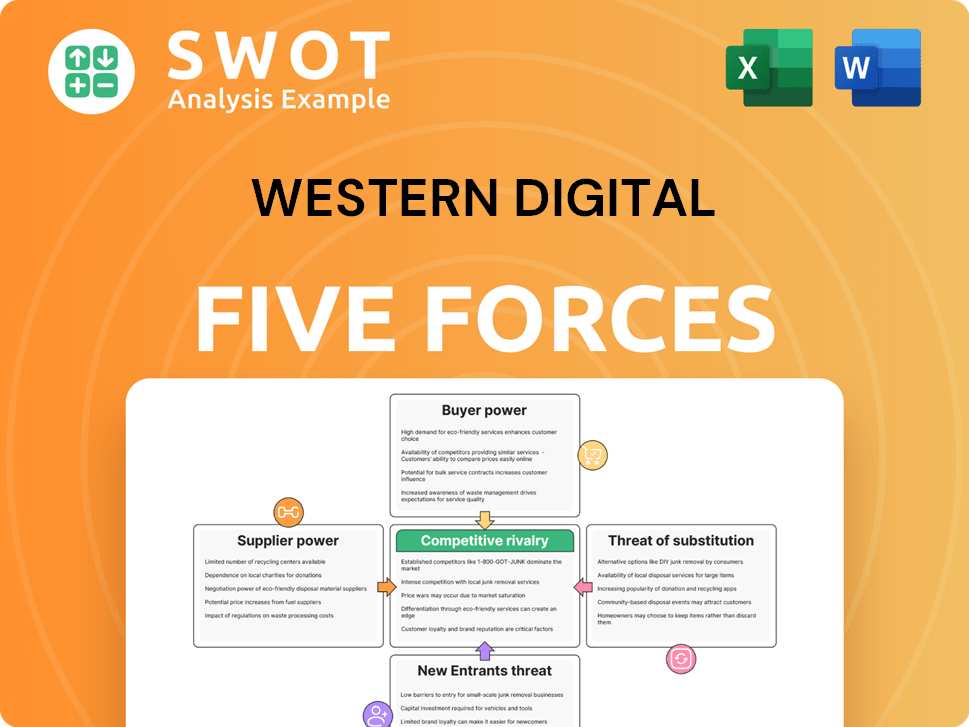

Western Digital Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Western Digital Company?

- What is Competitive Landscape of Western Digital Company?

- How Does Western Digital Company Work?

- What is Sales and Marketing Strategy of Western Digital Company?

- What is Brief History of Western Digital Company?

- Who Owns Western Digital Company?

- What is Customer Demographics and Target Market of Western Digital Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.