Waste Management Bundle

Can Waste Management Inc. Continue to Dominate the Waste Industry?

Explore the dynamic world of Waste Management Inc. (WM), a leader in environmental solutions, and its ambitious growth strategy. From its humble beginnings in 1968 to its current status as a North American powerhouse, WM's journey reflects the evolving landscape of waste disposal and sustainability. Discover how strategic acquisitions, like the Stericycle deal in late 2024, are shaping its future prospects and market position.

The waste management market is experiencing substantial growth, driven by increasing waste generation and a global push towards a circular economy. This analysis dives deep into WM's Waste Management SWOT Analysis, examining its strategic initiatives, including technological advancements and sustainable waste management solutions. Understanding the challenges facing waste management companies and the impact of regulations is crucial for investors and strategists looking to capitalize on investment opportunities in waste management and the future of recycling and waste reduction.

How Is Waste Management Expanding Its Reach?

The company is actively pursuing several expansion initiatives to drive future growth. These initiatives focus on strategic acquisitions, market diversification, and new service offerings. The goal is to strengthen its position in the waste management sector and capitalize on emerging opportunities.

A key element of this strategy involves expanding service offerings. This includes enhancing recycling capabilities, entering the healthcare waste industry, and developing renewable energy projects. These efforts are designed to meet evolving customer needs and contribute to a more sustainable approach to waste management.

The company's growth strategy also addresses the growing demand for sustainable practices. By investing in renewable energy and recycling facilities, the company aims to reduce its environmental impact and provide innovative solutions for its customers. This approach aligns with the broader trend towards a circular economy.

A significant move in late 2024 was the acquisition of Stericycle, North America's largest medical waste service provider, for $7.2 billion. This acquisition expands the company's recycling capabilities and provides entry into the healthcare waste industry. The company invested approximately $800 million in other acquisitions in 2024, focusing on solid waste businesses through 'tuck-in' acquisitions.

The company is diversifying its revenue streams by expanding into new markets and services. The Stericycle acquisition is expected to generate approximately $250 million in synergies over a three-year period, with about $100 million anticipated in 2025. For 2025, the company anticipates closing on over $500 million in solid waste acquisitions.

The company is expanding its renewable energy footprint by developing and operating landfill gas-to-energy facilities. The company plans to invest approximately $3 billion in its sustainability growth strategy from 2022-2026. This includes the development of 20 new company-owned renewable natural gas (RNG) facilities and 39 new or upgraded recycling facilities.

As of April 2025, the company has completed eight of its 20 planned RNG facilities and 27 of its 39 planned recycling facilities. Once all planned facilities are complete, this expansion is projected to add over 2.8 million incremental tons of annual recycling capacity and 25 million MMBtu of renewable natural gas each year. The company is also leveraging technology to improve Marketing Strategy of Waste Management.

The company's expansion initiatives are designed to access new customer segments and diversify revenue streams. These efforts aim to maintain a leadership position in the evolving waste management industry and capitalize on the growing emphasis on sustainability and the circular economy. The company's strategic investments in acquisitions and renewable energy position it well for future growth.

- Continued investment in acquisitions to expand market presence.

- Development of renewable energy projects to enhance sustainability.

- Focus on technological advancements to improve operational efficiency.

- Expansion of recycling capabilities to meet increasing demand.

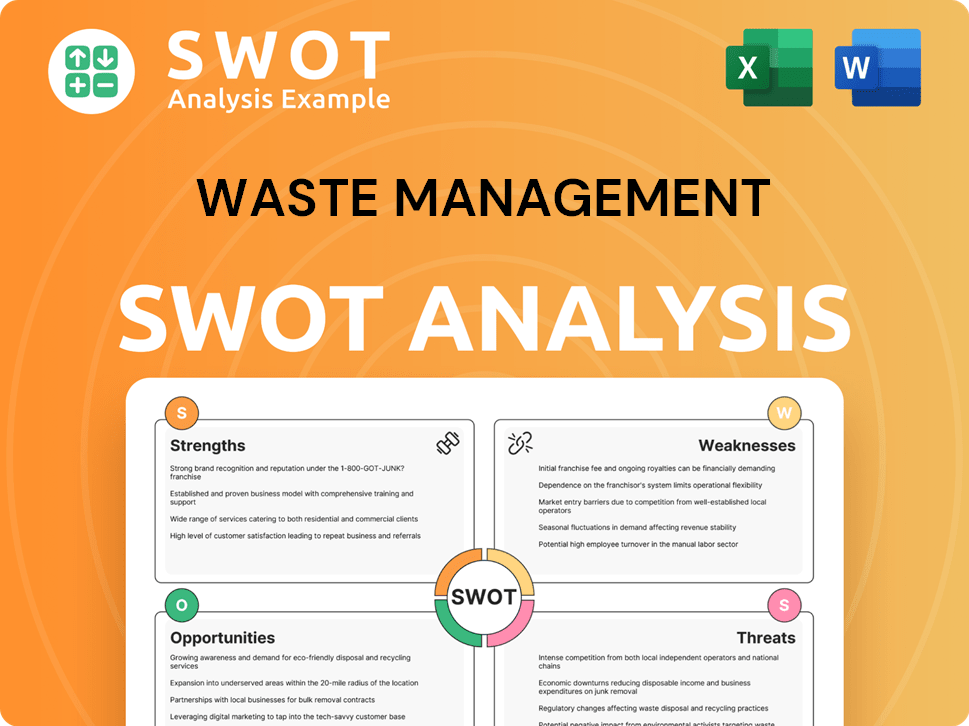

Waste Management SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Waste Management Invest in Innovation?

The company is heavily investing in innovation and technology to fuel its growth. This focus includes digital transformation, automation, and cutting-edge technologies to enhance operational efficiency and sustainability. These investments are crucial for meeting environmental targets and contributing to a circular economy.

In 2024, the company allocated $443 million towards recycling automation and growth initiatives. This investment included upgrades at 12 recycling facilities, aiming to boost revenue and lower operational costs by producing cleaner recycling streams. The integration of advanced technologies like artificial intelligence (AI) and automation is central to these upgrades.

The waste management industry is experiencing a significant shift towards smart solutions, driven by the integration of IoT, AI, and machine learning. The smart waste management market was valued at $2.58 billion in 2024. It is projected to reach $2.96 billion by 2025, with a CAGR of 14.5%, and is expected to reach $5.02 billion by 2029. This growth is fueled by innovations such as smart compactors and robots.

The company's digital transformation efforts involve leveraging data analytics and digital platforms to optimize operations. This includes implementing advanced software solutions for route optimization and waste tracking.

Automation plays a key role in recycling facilities, enhancing the capture of materials for reuse. Automated sorting systems powered by AI can significantly improve the efficiency and accuracy of waste processing.

AI is used to automate waste sorting, optimize collection routes, and reduce emissions. Machine learning algorithms improve the accuracy and efficiency of waste sorting processes, reducing contamination.

Smart bins equipped with sensors optimize collection routes and schedules, lowering operational costs and emissions. These smart solutions are a growing trend in the waste management sector.

The company converts captured landfill gas into pipeline-quality renewable natural gas. This process positions landfill assets as community energy partners, contributing to sustainability efforts.

Former landfills are repurposed as solar farms, contributing to local grids and supporting renewable energy initiatives. This is part of the company's broader sustainability strategy.

The company's investments in technology and innovation are critical for its waste management growth strategy. These initiatives not only enhance operational efficiency but also support sustainability in waste management and the development of a circular economy. For more insights into the company's market positioning, explore the Target Market of Waste Management.

The company's focus on innovation and technology is driving significant changes in the waste management industry, offering promising waste management future prospects.

- AI-Powered Sorting: Implementing AI to automate waste sorting processes, improving efficiency and reducing contamination.

- Smart Collection Systems: Utilizing smart bins and optimized collection routes to lower operational costs and emissions.

- Renewable Energy Initiatives: Converting landfill gas into renewable natural gas and developing solar farms to support sustainable energy production.

- Data Analytics: Using data analytics for route optimization, waste tracking, and overall operational improvements.

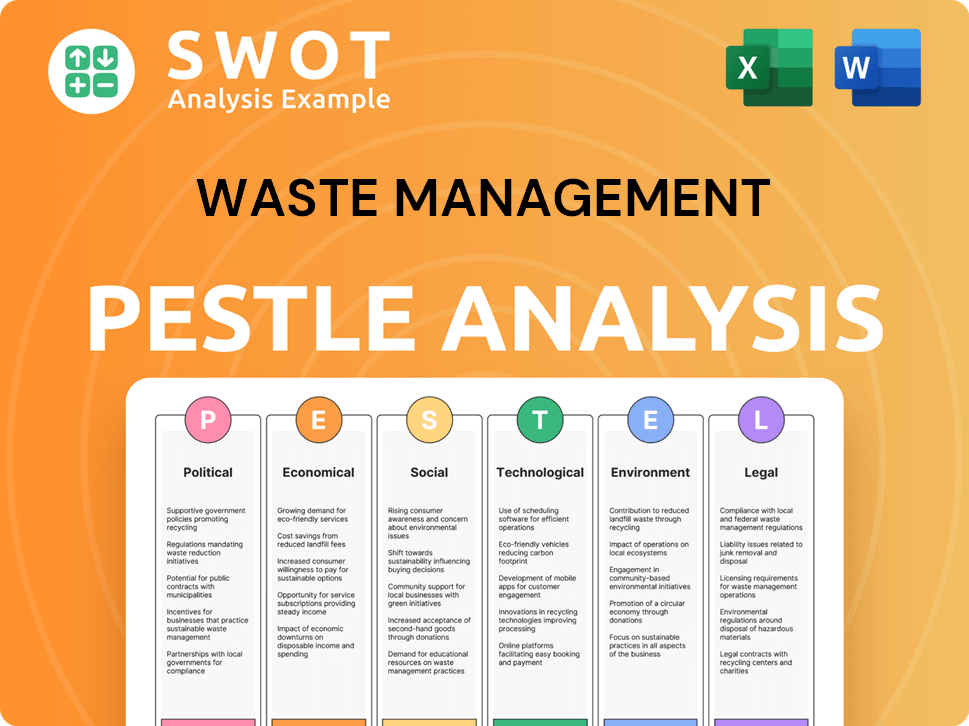

Waste Management PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Waste Management’s Growth Forecast?

The financial outlook for a leading waste management company indicates robust performance and promising growth prospects. In 2024, the company demonstrated significant financial gains, reflecting its effective Mission, Vision & Core Values of Waste Management. This positive trajectory is expected to continue, driven by strategic investments and operational efficiencies.

The company's strong financial results are a testament to its strategic initiatives and operational excellence. The company's ability to generate substantial free cash flow and maintain healthy margins underscores its financial stability and growth potential. This positions the company favorably for future investments and expansion within the waste management market.

The company's financial strategy involves significant capital expenditures to support its growth plans. These investments are focused on expanding landfill assets and advancing its sustainability initiatives. The company's commitment to returning value to shareholders through dividends and share repurchases further reinforces its financial strength and investor confidence.

In 2024, the company achieved an impressive 11% growth in adjusted operating EBITDA. The company also reported a 30% margin growth, marking the highest since its inception. Free cash flow increased by 21.8% during the same period.

Analysts anticipate the company's Earnings Per Share (EPS) for fiscal 2025 to reach $7.63, a 5.5% increase from $7.23 in fiscal 2024. Looking ahead to 2026, EPS is projected to increase by 13.4% annually to $8.65.

The consensus rating for the company's stock is a 'Moderate Buy'. The average target price is $244.50, suggesting a potential upside of 5.3% from current market prices. The stock has shown strong performance, increasing by 13.1% over the past 52 weeks.

The company plans to invest approximately $845 million in 2025 and $1.8 billion in 2026 and 2027 combined on landfill asset development. This is part of a broader plan to invest about $3 billion in its sustainability growth strategy from 2022-2026.

In November 2024, the company issued $5.2 billion in senior notes to repay borrowings. In July 2024, an additional $1.5 billion in senior notes were issued to reduce outstanding commercial paper. In 2024, the company returned $1.472 billion to shareholders through dividends and stock repurchases.

The company announced its intention to increase dividends by $0.30 to $3.30 in 2025. This reflects the company's commitment to returning value to its shareholders and its confidence in future financial performance, contributing to its Waste management growth strategy.

The company's stock performance has significantly outperformed the broader market. Over the past 52 weeks, it surged 13.1%, surpassing the S&P 500 Index's 5.5% gains and the Industrial Select Sector SPDR Fund's 3.3% returns, indicating strong investor confidence.

The company's strategic investments in landfill development and sustainability initiatives are key drivers for future growth. These investments are aligned with the increasing demand for sustainable waste disposal solutions and the circular economy.

The company's approach to financial management includes strategic debt management, significant capital expenditures, and consistent returns to shareholders through dividends and share repurchases. This balanced approach supports its long-term growth objectives.

The company's focus on sustainability, including investments in waste-to-energy and recycling technologies, positions it well to capitalize on the growing demand for sustainable solutions. This approach is critical for the company's long-term success and its ability to navigate the complexities of the waste management market.

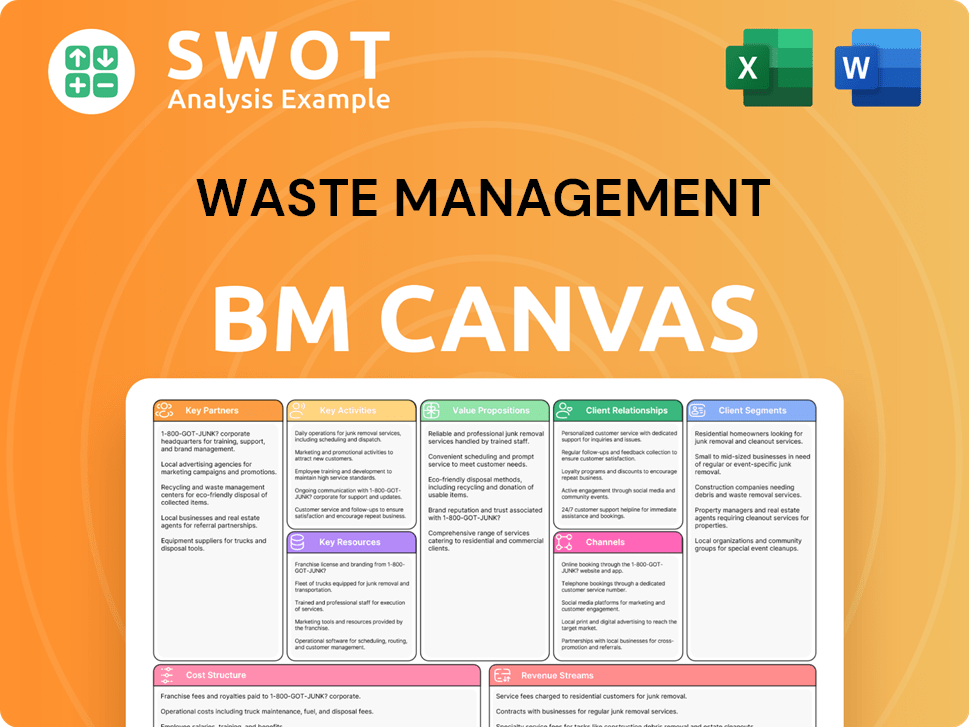

Waste Management Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Waste Management’s Growth?

The path to growth for a waste management company faces several hurdles. The industry is highly competitive, and regulatory changes are constantly reshaping the landscape. Furthermore, supply chain issues and the need for significant capital investments can also limit expansion.

Market competition remains a constant challenge. Major players are also investing in advanced technologies and strategic acquisitions. The waste management market is characterized by numerous global and regional players.

Adapting to these obstacles requires continuous strategic adjustments and investments. The company must stay agile, embracing new technologies and responding to evolving environmental and economic factors to ensure sustained growth and success.

The waste management industry is intensely competitive, with numerous companies vying for market share. This competition drives the need for innovation and efficiency. Companies must differentiate themselves through service offerings and pricing strategies.

Regulatory shifts pose a significant challenge. New commercial waste management rules in England, effective by March 31, 2025, mandate the separation of food waste and recyclables. Stricter environmental regulations globally drive the need for advanced waste management technologies.

Supply chain issues and internal resource limitations can hinder growth. The industry faces capacity constraints. Companies must invest in infrastructure and technology to overcome these challenges.

Rapid technological advancements present both opportunities and risks. The integration of IoT, AI, and robotics in smart waste management is accelerating. Companies must adapt quickly to leverage these technologies.

Economic fluctuations and environmental concerns influence the waste management sector. Changes in commodity prices and the push for sustainability impact profitability. Companies must adapt to these external factors.

Political changes, such as a potential new presidential administration in the U.S. in 2025, can impact regulations. These shifts can create uncertainty and require strategic adjustments. Companies must monitor and respond to these changes.

To navigate these risks, companies employ strategic diversification, such as expanding into healthcare waste management. They also focus on technology improvements, including recycling automation and landfill gas-to-energy projects, to reduce operational costs. This approach helps insulate them from commodity price swings and enhances Brief History of Waste Management.

For instance, the company reported earnings of $1.603 billion from recycling processing and sales in 2024. Companies continuously evaluate acquisition opportunities to scale their core business. They maintain a robust pipeline of 'tuck-in' opportunities, demonstrating a commitment to growth and market consolidation.

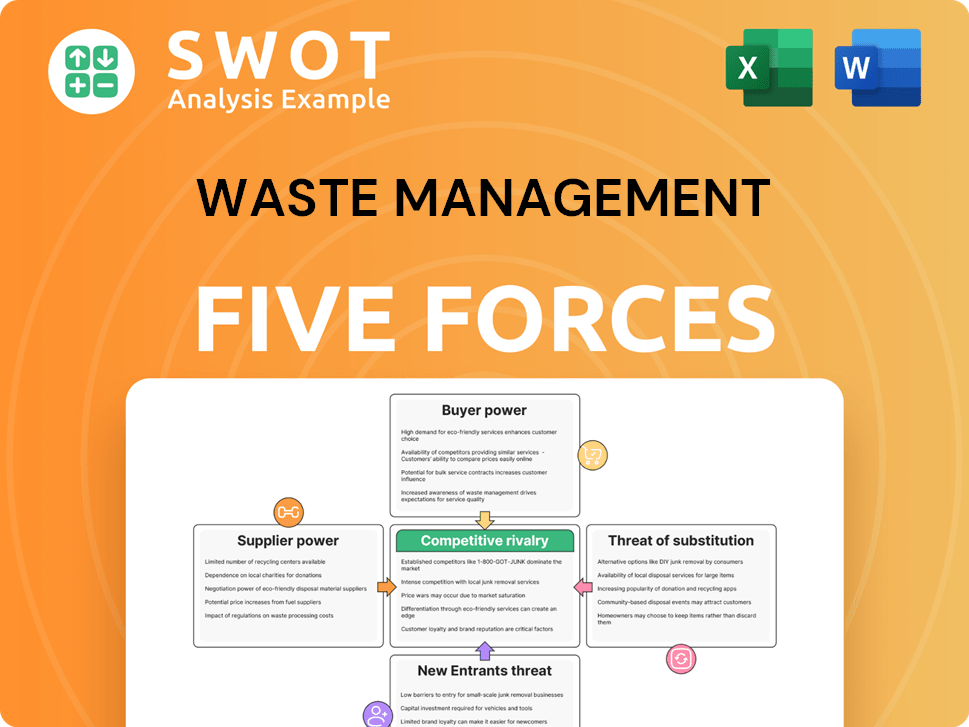

Waste Management Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Waste Management Company?

- What is Competitive Landscape of Waste Management Company?

- How Does Waste Management Company Work?

- What is Sales and Marketing Strategy of Waste Management Company?

- What is Brief History of Waste Management Company?

- Who Owns Waste Management Company?

- What is Customer Demographics and Target Market of Waste Management Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.