Waste Management Bundle

Who Really Owns Waste Management?

Unraveling the Waste Management SWOT Analysis is key to understanding its future. The question of "Who owns the Waste Management company?" is more than just a matter of curiosity; it's a gateway to understanding the company's strategic direction and financial performance. Discovering the WM company owner is crucial for investors and stakeholders alike.

Knowing who controls Waste Management helps decipher its operational strategies and its role in the environmental services landscape. The evolution of Waste Management ownership, from its founders to the current blend of institutional and individual shareholders, has profoundly shaped its trajectory. Understanding the major shareholders of Waste Management and the influence of Waste Management executives provides valuable insights into this publicly traded company's future, including its Waste Management stock performance and the company's overall direction.

Who Founded Waste Management?

The Waste Management company, a leading name in waste and environmental services, was established in 1968. The company's origins are rooted in the vision of its founders, who saw an opportunity to consolidate and professionalize the waste management industry. This chapter delves into the founders and early ownership of this significant corporation.

Dean Buntrock and H. Wayne Huizenga were the key figures behind the founding of the WM company. Buntrock, with his background in accounting, played a crucial role in the company's financial and operational strategies. Huizenga, a well-known entrepreneur, contributed his business acumen, which was instrumental in the early growth phases.

While specific initial equity distributions are not publicly available, the founders' combined efforts and investments established the foundation for the company's future success. The early stages of the WM company involved strategic decisions regarding ownership and management, setting the stage for its expansion.

Dean Buntrock and H. Wayne Huizenga were the primary founders. Their combined skills in finance and business strategy were crucial.

Initial funding likely came from the founders and close associates. Specific details on early investors are not widely documented.

The founders aimed to consolidate the waste management sector. Their strategy included aggressive acquisitions to grow market share.

Typical startup agreements, such as vesting schedules, would have been in place. These agreements aimed to align the founders' interests.

There is no widely publicized information regarding initial ownership disputes or significant buyouts among the founders in the very early stages.

The aggressive acquisition strategy increased the company's footprint and market share, thus increasing the value of their initial stakes.

The early WM company's ownership structure was primarily driven by its founders, Dean Buntrock and H. Wayne Huizenga. Their combined expertise and strategic vision were crucial in establishing the company. The initial focus was on consolidating the waste management industry, which led to an aggressive acquisition strategy. Today, WM is a publicly traded company, and its ownership is diversified among institutional investors and the public. In 2024, WM reported annual revenues of approximately $20.6 billion, demonstrating the substantial growth since its inception. The company's headquarters are located in Houston, Texas. The WM board of directors oversees the company's strategic direction, ensuring the interests of its shareholders are represented.

- The founders' vision was key to the company's early success.

- The company's growth strategy was based on acquisitions.

- WM is now a publicly traded company.

- The company's financial performance has been strong, with revenues in the billions.

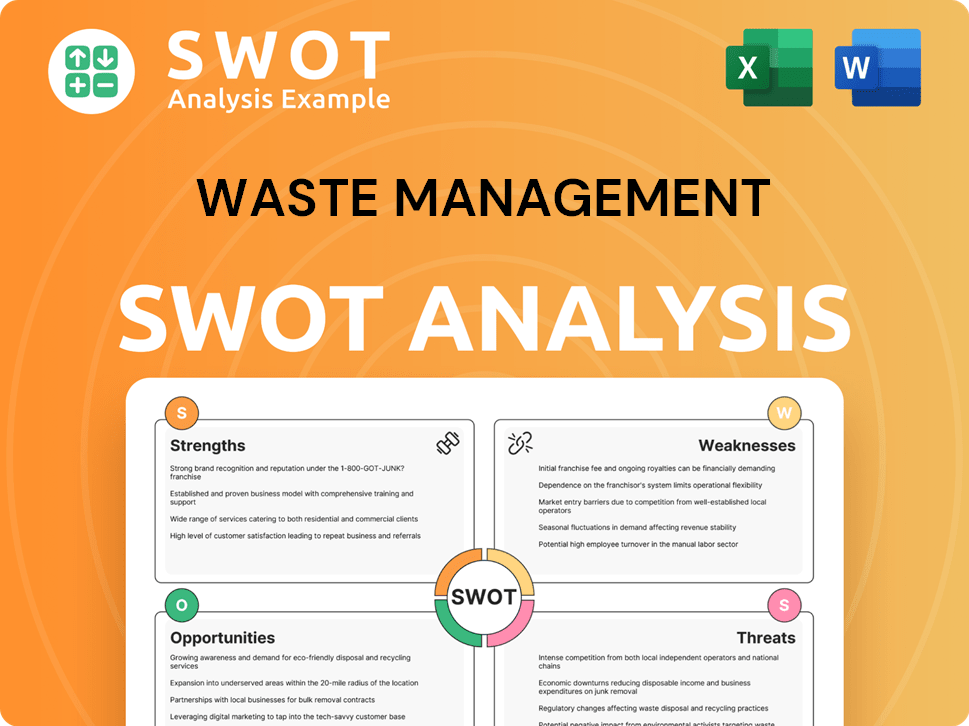

Waste Management SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Waste Management’s Ownership Changed Over Time?

The evolution of Waste Management ownership is a story of transformation from private beginnings to a publicly traded giant. The pivotal moment arrived in 1971 when the WM company owner decided to go public with an initial public offering (IPO). This strategic move opened the door for significant capital infusion, fueling the company's ambitious expansion and acquisition endeavors throughout the 1970s and 1980s. This transition broadened the shareholder base, moving away from the founders and early investors to include a diverse group of public shareholders.

Today, the ownership structure of the Waste Management company is largely shaped by institutional investors. This reflects its status as a large-cap, publicly traded entity. Major players in the market, such as asset management firms and mutual funds, hold substantial stakes. As of early 2024, Vanguard Group Inc. held approximately 9.39% of the company's shares, while BlackRock Inc. held around 8.16%. State Street Corp. also maintains a significant position, holding about 4.19%. These figures underscore the confidence the market has in Waste Management's stability and future growth.

| Key Event | Impact on Ownership | Year |

|---|---|---|

| Initial Public Offering (IPO) | Transition from private to public ownership, allowing for capital infusion and expansion. | 1971 |

| Strategic Acquisitions | Consolidation of the waste management industry, increasing market share and shareholder value. | 1970s-1990s |

| Growth of Institutional Investors | Shift towards institutional ownership, influencing corporate strategy and governance. | Ongoing |

The shift from founder-led ownership to a structure dominated by institutional investors has profoundly influenced the company's strategic direction. The focus is now on consistent financial performance, returns for shareholders, and adherence to best practices in corporate governance. The company's strategic decisions, such as investments in recycling technologies and renewable energy, are often aligned with the long-term investment horizons of these major institutional stakeholders. This focus is also reflected in the company's commitment to sustainability and environmental responsibility, as highlighted in the Target Market of Waste Management article.

The ownership of Waste Management has evolved significantly since its IPO in 1971.

- Institutional investors, like Vanguard and BlackRock, hold the majority of shares.

- This shift has influenced the company's focus on financial performance and sustainability.

- Understanding the ownership structure is key to understanding the company's strategic direction.

- The company's strategic decisions align with the long-term investment horizons of major stakeholders.

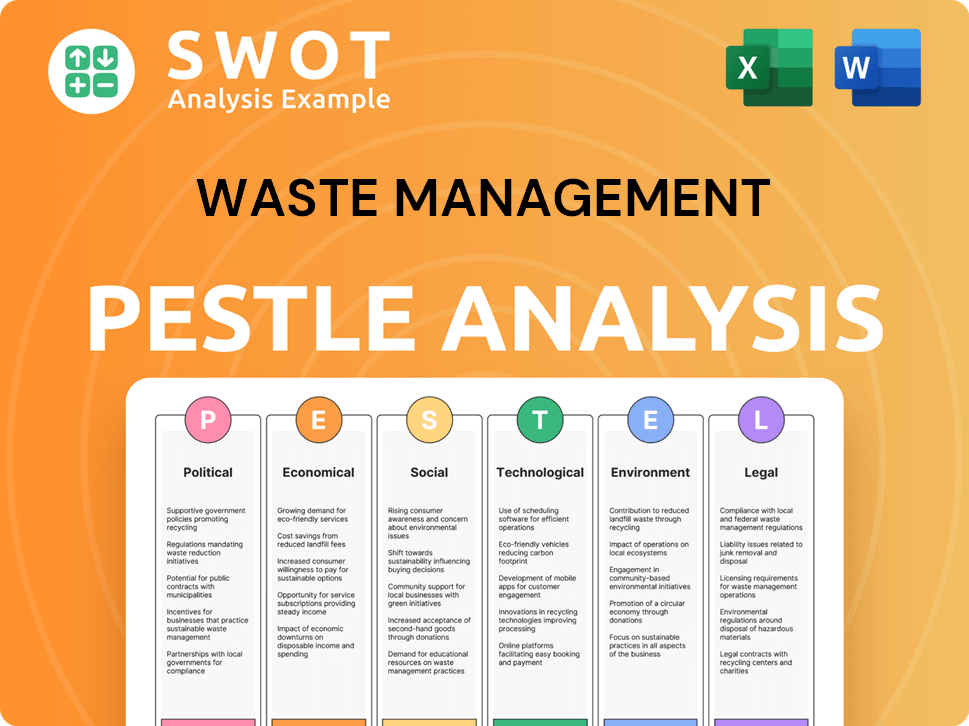

Waste Management PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Waste Management’s Board?

The Waste Management company is overseen by a Board of Directors that includes both independent directors and company executives. As of mid-2024, the board includes James C. Fish, Jr., who serves as President and Chief Executive Officer. The other board members typically bring expertise in areas such as finance, operations, and environmental policy. This structure is designed to provide objective oversight and ensure decisions benefit all shareholders. Understanding the Waste Management ownership structure is key for investors.

The board's composition reflects a commitment to corporate governance, with regular disclosures about board structure, committee functions, and executive compensation. This transparency supports accountability to shareholders and helps maintain investor confidence. The focus on independent directors helps ensure that the WM company owner operates with integrity and in the best interests of all stakeholders. For more details on the company's financial operations, you can read about Revenue Streams & Business Model of Waste Management.

| Board Member | Title | Affiliation |

|---|---|---|

| James C. Fish, Jr. | President and CEO | Waste Management, Inc. |

| John C. Martin | Lead Independent Director | Independent |

| Devon W. Spurgeon | Director | Independent |

The voting structure for Waste Management stock generally follows a one-share-one-vote principle. This structure promotes equitable distribution of voting power among shareholders. Major institutional investors like Vanguard and BlackRock hold significant portions of the company's stock, but their influence is primarily through voting on proposals and director elections.

The Board of Directors oversees Waste Management company operations and strategic direction.

- The board includes a mix of independent directors and company executives.

- Voting power is primarily based on a one-share-one-vote principle.

- Major shareholders influence decisions through voting rights.

- The company emphasizes corporate governance and transparency.

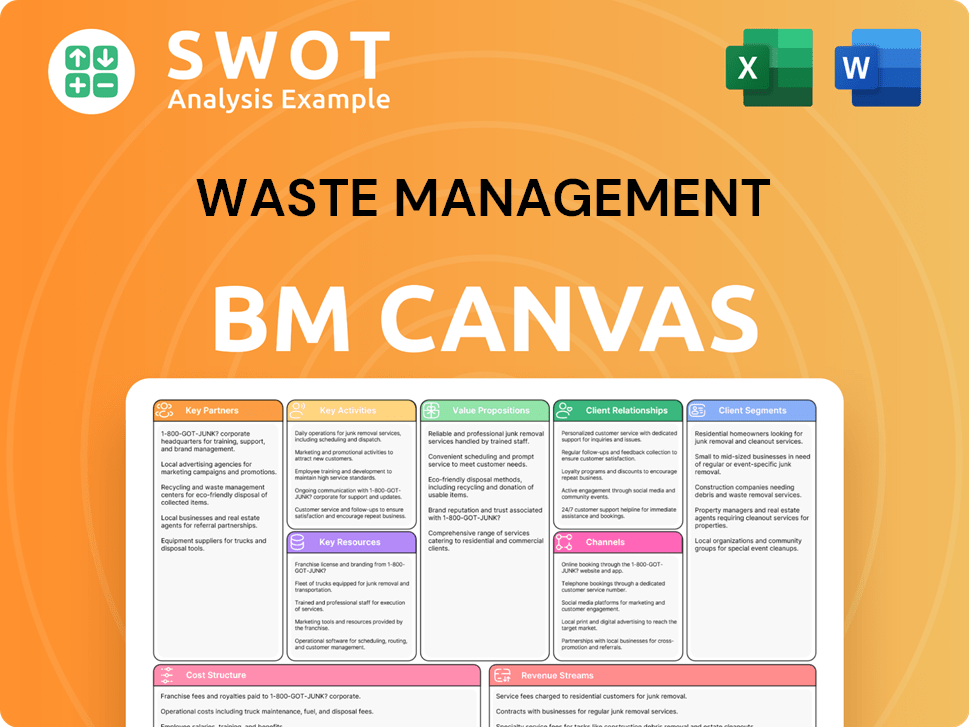

Waste Management Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Waste Management’s Ownership Landscape?

In the past few years, the Waste Management company has focused on strengthening its market position. This has involved strategic moves and adjustments in its ownership structure, mirroring broader industry trends. A significant event was the acquisition of Advanced Disposal Services, Inc. in October 2020, which expanded the company's reach and market share. Such acquisitions often lead to slight short-term dilution for existing shareholders, but they are typically viewed as long-term value-creation strategies, attracting continued institutional investment.

Industry trends show that large, established companies like the WM company often see increased institutional ownership. This is a natural outcome of their inclusion in major market indices and the growth of passive investment funds. The influence of large institutional investors continues to grow. These investors increasingly focus on environmental, social, and governance (ESG) factors, pushing companies like Waste Management to enhance their sustainability efforts and reporting. This is evident in Waste Management's investments in recycling infrastructure, renewable energy projects, and initiatives to reduce landfill emissions, aligning with the ESG mandates of many major shareholders.

| Metric | Value | Year |

|---|---|---|

| Annual Revenue | Approximately $20.6 billion | 2023 |

| Institutional Ownership | Approximately 70-80% | 2024 (Estimated) |

| Market Capitalization | Approximately $75 billion | 2024 (Approximate) |

Looking ahead, Waste Management is likely to maintain its appeal to investors. The company's focus on technology and sustainability may attract new investors interested in green initiatives. The company's consistent performance and strategic growth are likely to maintain its appeal to a broad base of institutional and individual investors. The company's 2024 and 2025 outlooks often emphasize capital allocation for growth projects and shareholder returns, indicating a stable ownership outlook. For more details on the company's history and operations, you can refer to this [overview of Waste Management](0).

Major shareholders include large institutional investors such as investment management firms and mutual funds. These entities collectively hold a significant portion of the Waste Management stock.

Waste Management is increasingly focused on ESG factors, including investments in recycling and renewable energy. This focus aligns with the priorities of many institutional investors.

The company's focus on technology and sustainability is expected to attract new investors. The company is likely to maintain its appeal to a broad base of investors.

The acquisition of Advanced Disposal Services, Inc. is a key example of Waste Management's strategic initiatives to expand its market share. This is a part of the Waste Management company long-term growth strategy.

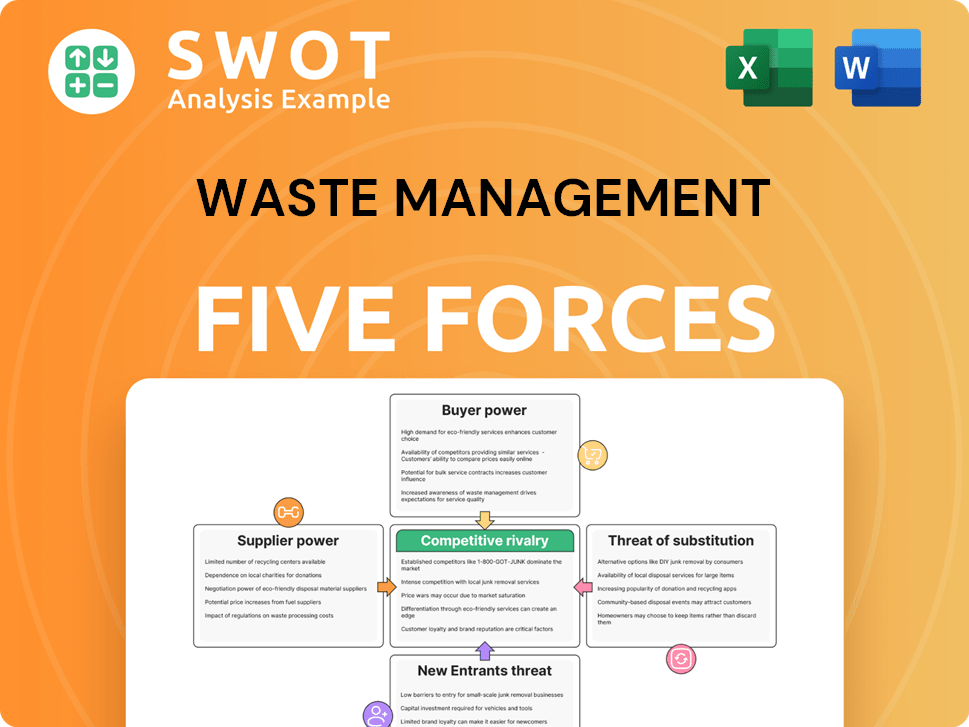

Waste Management Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Waste Management Company?

- What is Competitive Landscape of Waste Management Company?

- What is Growth Strategy and Future Prospects of Waste Management Company?

- How Does Waste Management Company Work?

- What is Sales and Marketing Strategy of Waste Management Company?

- What is Brief History of Waste Management Company?

- What is Customer Demographics and Target Market of Waste Management Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.