Masraf Al Rayan Bundle

How Does Masraf Al Rayan Company Thrive in Qatar's Financial Landscape?

Dive into the world of Masraf Al Rayan SWOT Analysis and discover how this leading Islamic bank shapes Qatar's economy. Understanding How Masraf Al Rayan works is key to unlocking insights into its financial strategies and operational success. This exploration is essential for investors, customers, and anyone interested in the dynamic realm of Islamic banking. Uncover the secrets behind Masraf Al Rayan's enduring presence.

Masraf Al Rayan company's operations are a cornerstone of Qatar financial institutions, offering a wide array of Banking services that adhere to Islamic banking principles. From Masraf Al Rayan account opening process to exploring Masraf Al Rayan online banking features, the bank provides comprehensive solutions. Whether you're seeking details on Masraf Al Rayan customer service contact or exploring Masraf Al Rayan branches locations, understanding its framework is crucial for informed decisions and strategic planning.

What Are the Key Operations Driving Masraf Al Rayan’s Success?

Masraf Al Rayan, a key player in the Islamic banking sector, operates by offering a wide array of Sharia-compliant financial products and services. This approach caters to diverse customer segments, including individuals, businesses, and institutions. Its core mission revolves around delivering value through ethical and faith-based financial solutions, distinguishing it from conventional banking models.

The bank's operations encompass retail banking, corporate banking, treasury services, and investment products, all adhering to Islamic finance principles. Masraf Al Rayan company leverages both physical branches and digital platforms to ensure accessibility and convenience. This multi-channel strategy supports efficient transaction processing and account management, reflecting a modern approach to Islamic banking.

The value proposition of Masraf Al Rayan lies in its commitment to Sharia compliance, offering financial solutions that align with customers' faith-based values. This focus on ethical finance contributes to market differentiation, attracting a specific segment seeking Sharia-compliant alternatives. The bank's dedication to transparency and fairness, coupled with its comprehensive service offerings, positions it as a trusted financial institution in the region.

Masraf Al Rayan provides a comprehensive suite of banking services. These include retail banking (personal financing, deposits, credit cards), corporate banking (trade finance, project finance), treasury services (liquidity management, FX), and investment products. All services are designed to comply with Sharia principles, ensuring ethical financial practices.

The bank utilizes a multi-channel approach, combining physical branches with digital platforms. This strategy includes online banking and mobile applications, enhancing customer accessibility and convenience. Digital transformation enables efficient transaction processing and account management, reflecting a modern approach to Islamic banking.

A key differentiator for Masraf Al Rayan is its unwavering commitment to Sharia compliance across all products and services. This involves rigorous internal Sharia review processes and adherence to Islamic ethical guidelines. This commitment ensures transparency and fairness in all financial dealings, building trust with customers seeking ethical financial solutions.

The bank's core capabilities translate into customer benefits by providing financial solutions that align with faith-based values. This focus on ethical finance contributes to market differentiation, attracting a specific segment seeking Sharia-compliant alternatives. It offers peace of mind and ethical investment opportunities, enhancing its appeal in the market.

Masraf Al Rayan's operations are centered around Sharia-compliant banking, offering a range of services through multiple channels. This approach ensures that all financial products and services adhere to Islamic principles, providing customers with ethical and faith-based options. The bank's commitment to digital transformation enhances customer convenience and operational efficiency.

- Sharia Compliance: All products and services are rigorously vetted to ensure adherence to Islamic law.

- Multi-Channel Approach: Combines physical branches with digital platforms for accessibility.

- Customer-Centric Solutions: Focuses on providing financial solutions aligned with customer values.

- Ethical Investment: Offers investment opportunities that comply with Islamic ethical guidelines.

Masraf Al Rayan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Masraf Al Rayan Make Money?

Understanding the revenue streams and monetization strategies of the Masraf Al Rayan company is crucial for grasping its operational dynamics. This overview details how Masraf Al Rayan generates income through Sharia-compliant financial instruments and services. The bank's approach reflects its commitment to Islamic banking principles while aiming for sustainable financial performance.

Masraf Al Rayan leverages a diversified portfolio of revenue sources. These include financing activities, investment returns, and fee-based services, all structured to comply with Islamic finance guidelines. This strategic diversification helps the bank maintain profitability and adapt to market changes.

Masraf Al Rayan generates revenue through various Sharia-compliant methods, reflecting its Islamic banking model. A significant portion of its income comes from financing activities, including Murabaha, Ijarah, Mudaraba, and Musharaka contracts. These are Islamic alternatives to conventional loans and leases, avoiding interest (riba) and adhering to Sharia principles. Investment activities also contribute, encompassing returns from equity investments, real estate, and other Sharia-compliant instruments. The bank further earns fees and commissions from services like trade finance, remittances, and advisory services.

The primary revenue streams of Masraf Al Rayan are multifaceted, designed to comply with Islamic banking principles. These streams include financing, investment, and fee-based services. For instance, in its financial results for the nine months ended 30 September 2023, Masraf Al Rayan reported a net profit attributable to shareholders of QAR 1.25 billion, showcasing the overall profitability generated from these diverse streams. The bank's ability to generate profit through Sharia-compliant methods is a core aspect of how Masraf Al Rayan works.

- Financing Activities: This is a major revenue source, including profits from Murabaha, Ijarah, Mudaraba, and Musharaka contracts.

- Investment Activities: Returns from equity investments, real estate, and other Sharia-compliant instruments.

- Fee and Commission Income: Revenue from services such as trade finance, remittances, and advisory services.

- Strategic Focus: Masraf Al Rayan adapts its revenue strategies based on market conditions and strategic shifts.

Masraf Al Rayan employs various monetization strategies within the framework of Islamic finance. For example, in corporate banking, it offers bundled Sharia-compliant financing and advisory services. In retail banking, tiered pricing structures are used for deposit or financing products, based on customer relationships or transaction volumes, all while adhering to Sharia principles. Cross-selling is another key strategy, offering additional Sharia-compliant products like Takaful (Islamic insurance) or investment accounts to existing customers. To learn more about the bank's journey, you can read a Brief History of Masraf Al Rayan.

Masraf Al Rayan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Masraf Al Rayan’s Business Model?

The journey of Masraf Al Rayan company has been marked by strategic moves and significant milestones. A key development was the merger with Al Khalij Commercial Bank (Al Khaliji) in December 2021, creating a major Sharia-compliant bank in Qatar and the MENA region. This merger expanded the bank's asset base, customer reach, and operational scale, strengthening its competitive position within the Qatar financial institutions landscape.

Operational and market challenges faced by Masraf Al Rayan include adapting to evolving regulatory frameworks and navigating global economic conditions. The bank has invested in digital transformation to enhance customer experience and operational efficiency, particularly focusing on digital channels to ensure resilience. This adaptation is crucial in a competitive market where banking services are constantly evolving.

Masraf Al Rayan's competitive advantages are multifaceted, including a strong brand in Islamic banking, economies of scale from the merger, and a robust network of branches and digital presence. The bank continues to invest in fintech solutions and integrate emerging technologies to sustain its business model and address competitive threats effectively. For more insights, you can explore the Competitors Landscape of Masraf Al Rayan.

The merger with Al Khaliji in December 2021 was a pivotal event, creating one of the largest Sharia-compliant banks in the region. This strategic move significantly increased the bank's assets and customer base. The combined entity aimed to optimize operational efficiencies and expand its service offerings.

Investment in digital transformation has been a key strategic focus, enhancing customer experience and operational efficiency. The bank continues to explore fintech solutions and integrate emerging technologies into its Sharia-compliant offerings. This includes improvements to the Masraf Al Rayan online banking features and the Masraf Al Rayan mobile app features.

Masraf Al Rayan benefits from strong brand recognition within the Islamic finance sector, fostering customer trust and loyalty. Economies of scale, amplified by the merger, allow for efficient resource utilization. The bank's established branch network and growing digital presence provide a robust ecosystem for customer engagement and service delivery, including easy access to Masraf Al Rayan branches locations and Masraf Al Rayan ATM locations Qatar.

The bank is focused on adapting to evolving regulatory frameworks in Islamic finance and navigating global economic conditions. Digital channels have become increasingly important for resilience, particularly during periods of reduced physical interaction. The bank's approach ensures it can continue to provide services, including Masraf Al Rayan international transfers and Masraf Al Rayan financing options.

Masraf Al Rayan's competitive strengths include its strong brand reputation and commitment to Masraf Al Rayan Sharia compliant banking. The merger with Al Khaliji enhanced operational efficiency and expanded its service offerings. The bank's focus on digital transformation and fintech solutions supports its ability to adapt to market changes and address competitive threats.

- Strong brand in Islamic finance.

- Economies of scale from the merger.

- Investment in digital transformation.

- Robust customer engagement ecosystem.

Masraf Al Rayan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Masraf Al Rayan Positioning Itself for Continued Success?

The Masraf Al Rayan company holds a strong position in the Qatari banking sector, especially as a leading Islamic financial institution. Following the merger with Al Khaliji, it became one of Qatar's largest banks by asset size. This enhanced its market share and customer loyalty across Islamic and conventional banking segments. Its global reach is mainly focused on Qatar and specific international markets where Islamic finance is growing. Understanding how Masraf Al Rayan works is crucial for anyone looking at Qatar financial institutions.

Key risks include potential regulatory changes in Islamic finance, increased competition, and technological disruption. Global economic downturns or fluctuations in oil prices could also impact liquidity and demand for banking services. For more insights, you can also explore the Target Market of Masraf Al Rayan.

Masraf Al Rayan is a key player in Qatar's financial sector, particularly in Islamic banking. The merger with Al Khaliji strengthened its position, making it a major bank by asset size. This has increased its market share and customer base within both Islamic and conventional banking.

Risks include regulatory changes in Islamic finance, increased competition from both Islamic and conventional banks, and technological disruptions from fintech. Economic downturns and oil price fluctuations also pose significant challenges. These factors can impact Banking services and overall profitability.

The bank is focused on digital transformation, enhancing customer experience, and sustainable growth. Innovation includes developing digital platforms, introducing new Sharia-compliant products, and potentially expanding into new markets. Their strategy aims to leverage their market position and capitalize on the growing global demand for Islamic finance.

Ongoing initiatives include digital transformation, customer experience enhancements, and sustainable growth exploration. This involves further development of digital platforms and introducing new Sharia-compliant products tailored to customer needs. Potential expansion into new markets or specialized segments is also considered.

In recent years, Masraf Al Rayan has shown resilience, with steady growth in assets and customer deposits. The demand for Islamic banking services continues to rise globally, driven by ethical and Sharia-compliant finance principles. The bank's ability to adapt to technological advancements and changing customer preferences is crucial for maintaining its competitive edge.

- Continued focus on digital banking and mobile app features.

- Expansion of Masraf Al Rayan branches locations and ATM networks.

- Introduction of new Masraf Al Rayan financial products review tailored to customer needs.

- Strategic investments in cybersecurity to protect customer data and transactions.

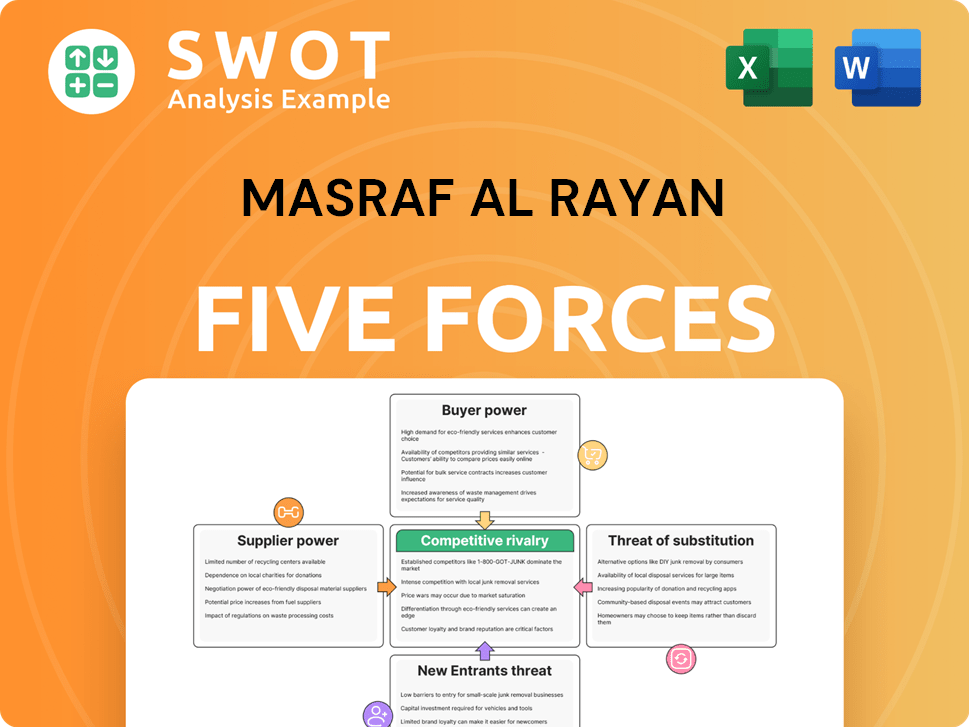

Masraf Al Rayan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Masraf Al Rayan Company?

- What is Competitive Landscape of Masraf Al Rayan Company?

- What is Growth Strategy and Future Prospects of Masraf Al Rayan Company?

- What is Sales and Marketing Strategy of Masraf Al Rayan Company?

- What is Brief History of Masraf Al Rayan Company?

- Who Owns Masraf Al Rayan Company?

- What is Customer Demographics and Target Market of Masraf Al Rayan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.