Masraf Al Rayan Bundle

Who Are Masraf Al Rayan's Customers?

Understanding the customer base is crucial for any financial institution's success, and for Masraf Al Rayan, it's especially critical given the dynamic nature of the Masraf Al Rayan SWOT Analysis. The 2021 merger significantly reshaped the landscape, making a deep dive into Customer Demographics and Target Market essential. This analysis helps uncover who Masraf Al Rayan's customers are, their needs, and how the bank can best serve them.

As a leading Financial Institution in Qatar, Masraf Al Rayan's strategic decisions are inherently tied to its understanding of its customer base. This includes detailed analysis of Customer segmentation Masraf Al Rayan, including factors like age range, income levels, and geographic location. This knowledge allows Masraf Al Rayan to tailor its services and marketing efforts, ensuring it remains competitive within the evolving Banking Sector and attracts its Target Market.

Who Are Masraf Al Rayan’s Main Customers?

Understanding the Customer Demographics and Target Market of Masraf Al Rayan is crucial for grasping its business strategy. This Financial Institution, operating primarily in Qatar, serves a diverse customer base across multiple segments. The bank's approach to Customer Segmentation is key to its operations and revenue generation.

Masraf Al Rayan's primary customer segments include Corporate Banking, Retail Banking, and Al Rayan Investment. Each segment caters to different needs and offers a range of financial products and services. The bank's focus on Sharia-compliant products also influences its Target Market, attracting customers who prioritize ethical and faith-based financial solutions within the Banking Sector.

The bank's operations and strategic decisions are shaped by its customer segments. For example, Al Rayan Bank UK's shift towards Commercial Banking and Premier Banking in 2024 demonstrates an adaptation to market dynamics and a focus on higher-value clients. This strategic realignment, building on the success of a 2022 strategy, highlights the bank's responsiveness to evolving customer needs.

The Corporate Banking segment serves corporate, commercial, and multinational clients. It provides Islamic financing, deposit services, and investment advisory. This segment is a core driver of the bank's business, contributing the majority of its revenue. Customers include government entities, large corporations, and SMEs.

The Retail Banking segment caters to individual customers. It offers investment accounts, credit cards, and Islamic financing. While specific demographic data isn't publicly detailed, the focus on Sharia-compliant products suggests a target audience that prioritizes ethical financial solutions. Al Rayan Bank PLC in the UK also focuses on Premier Banking customers in the GCC.

This segment includes asset management services. It caters to customers seeking investment opportunities within a Sharia-compliant framework. The bank's investment products are designed to meet the needs of various investors, from individuals to institutional clients. This segment is part of the broader customer base.

Masraf Al Rayan's operations are primarily centered in Qatar and expanding in the GCC region. Al Rayan Bank PLC, its UK subsidiary, focuses on the GCC, including Qatar, Saudi Arabia, and the UAE. This geographic focus highlights the bank's strategic expansion within key markets. The bank is also increasing the use of aggregators to secure retail customers for savings products.

Masraf Al Rayan's customer base is diverse, spanning corporate, retail, and investment segments. The bank strategically adapts its offerings to meet evolving market demands, as seen in the UK subsidiary's focus on Commercial and Premier Banking. The bank's commitment to Sharia-compliant products attracts a specific customer demographic.

- Corporate Banking: Serves large corporations, government entities, and SMEs.

- Retail Banking: Focuses on individual customers with Sharia-compliant products.

- Investment Services: Offers asset management and investment opportunities.

- Geographic Reach: Primarily in Qatar, with expansion in the GCC and the UK.

Masraf Al Rayan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Masraf Al Rayan’s Customers Want?

The primary driver for customers of Masraf Al Rayan is the need for Sharia-compliant banking products and services. This preference for ethical and faith-based financial solutions shapes their purchasing behaviors and decision-making processes. The bank offers a range of products and services designed to meet these specific needs, catering to both retail and corporate clients within the Qatar banking sector.

For retail customers, the appeal of Masraf Al Rayan's offerings includes adherence to Islamic principles, trust in the bank's Sharia compliance, and the convenience of its branch network and digital channels. The bank aims to address common pain points through services like the Al Rayan Go app, which has contributed to expanding its customer base and increasing active users and retail financial transactions. This focus on customer needs is crucial for understanding the bank's target market.

Corporate clients are driven by the need for comprehensive Islamic credit facilities, investment advisory, and cash management services. Masraf Al Rayan's focus on wealth management for high-net-worth individuals in the GCC region also indicates a preference for sophisticated Sharia-compliant investment solutions. Understanding the Customer Demographics and the Target Market is key to the bank's strategy.

Retail customers prioritize adherence to Islamic principles, trust in Sharia compliance, and convenience. The Al Rayan Go app is a key service for expanding the customer base.

Corporate clients seek comprehensive Islamic credit facilities, investment advisory, and cash management services. The bank's services cater to diverse financial needs.

The bank focuses on wealth management for high-net-worth individuals in the GCC region. This indicates a preference for sophisticated Sharia-compliant investment solutions.

Masraf Al Rayan is planning to implement a new core banking system in Q1 2025. This will enhance efficiency, agility, and responsiveness in serving customers.

The bank offers a variety of products and services, including current and savings accounts, financing, and wealth management. These offerings meet specific customer needs.

All products and services are designed to be Sharia-compliant. This is a fundamental aspect of the bank's value proposition.

Understanding the specific needs and preferences of customers is essential for the success of any Financial Institution. This includes both retail and corporate clients within the Qatar market. Masraf Al Rayan's approach to meeting these needs is centered around providing Sharia-compliant products and services.

- Adherence to Islamic Principles: Customers prioritize ethical and faith-based financial solutions.

- Trust and Sharia Compliance: Confidence in the bank's adherence to Islamic law is crucial.

- Convenience: Accessible branch networks and digital channels are essential.

- Comprehensive Services: Meeting a wide range of financial needs, from retail banking to corporate finance.

- Wealth Management: Providing sophisticated investment solutions for high-net-worth individuals.

Masraf Al Rayan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Masraf Al Rayan operate?

The geographical market presence of Masraf Al Rayan is primarily centered in Qatar, where it operates a network of branches and digital channels. As a significant financial institution in Qatar, the bank plays a crucial role in the Islamic finance sector. This strategic focus allows the bank to cater to the specific financial needs of the local population and businesses within Qatar.

Beyond Qatar, Masraf Al Rayan has expanded its footprint internationally, establishing operations in the UK, France, and the UAE. These international locations enable the bank to serve a broader customer base and tap into diverse markets. The expansion into these regions reflects the bank's strategic vision to grow its operations and diversify its revenue streams.

The bank's international presence is particularly notable in the UK, where its subsidiary, Al Rayan Bank PLC, focuses on expanding its customer base in Qatar, Saudi Arabia, and the UAE. This targeted approach, especially towards Premier Banking customers in the GCC region, highlights the bank's strategy to cater to high-net-worth individuals and families. For more details on the bank's overall strategy, you can read about the Growth Strategy of Masraf Al Rayan.

In 2024, Qatar's Islamic finance sector reached QR 683 billion, demonstrating its significant size and importance. Islamic banks accounted for 87.4% of these assets, highlighting the dominance of Islamic banking in the country. This data underscores the strong demand for Islamic financial products and services in Qatar.

Masraf Al Rayan, along with Qatar Islamic Bank, held over 68% of Qatar's Islamic banking assets in 2024. This substantial market share indicates their strong position in the banking sector. The combined market share of these two banks highlights their influence and leadership in the Islamic finance industry in Qatar.

London is a top global destination for GCC investment, attracting significant capital from the region. GCC investors plan to spend an average of $92 million in the UK property market over the next five years. This investment trend aligns with Al Rayan Bank's strategic focus on the GCC region.

Al Rayan Bank has two branches in the UAE and one in Paris, France, through Al Khaliji France S.A. These additional locations expand the bank's reach and provide services to a wider international customer base. This global presence allows the bank to cater to the needs of its Target Market across multiple regions.

While specific details on Customer Demographics or buying power differences across regions are not explicitly provided, the bank's localized offerings and focus on Premier Banking in the GCC suggest an adaptation to regional wealth and investment patterns. Masraf Al Rayan's strategic approach involves understanding and catering to the unique financial needs and preferences of its customers in each geographical market.

Masraf Al Rayan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Masraf Al Rayan Win & Keep Customers?

The customer acquisition and retention strategies of Masraf Al Rayan are designed to attract and retain a diverse customer base within the Qatar and international banking sector. The Financial Institution employs a multi-channel strategy, combining traditional methods with digital innovation to reach its Target Market. This approach is crucial for maintaining a competitive edge and driving sustainable growth in a dynamic market.

For retail customers, the focus is on offering Sharia-compliant products and enhancing digital banking services. The launch of the Al Rayan Go app is a key initiative to broaden the customer base and increase user engagement. Moreover, the bank actively leverages incentives and referral programs to encourage customer acquisition and loyalty, ensuring a robust and growing customer portfolio. These strategies are vital for effective Customer Demographics management.

Retention efforts center on personalized experiences and operational excellence. The implementation of a new core banking system aims to improve efficiency and responsiveness. The UK subsidiary, Al Rayan Bank, aligns with the parent company's strategic goals, focusing on Premier and Commercial Property Finance (CPF) customers. This alignment leverages strong relationships in the GCC region, contributing to growth and mitigating competition. The overall strategy aims to deliver long-term growth and enhance the customer experience through digital transformation. Read more about the Growth Strategy of Masraf Al Rayan.

The launch of the Al Rayan Go app is a central part of the digital banking strategy. This app aims to expand the customer base and increase the number of active users for retail financial transactions. Digitalization is a key focus for attracting and retaining customers, providing them with convenient and accessible banking solutions.

The 'Personal Finance Campaign 2025' offers attractive incentives to attract new customers. These include a profit rate of 3.95% per annum and a 5% cashback on the first salary transferred for Premier Banking customers. Referral programs provide rewards of up to QAR 1,000, encouraging word-of-mouth acquisition.

Masraf Al Rayan emphasizes personalized experiences to enhance customer satisfaction and loyalty. Ongoing innovation and operational excellence, including a new core banking system implemented in Q1 2025, are critical. This commitment aims to improve efficiency and responsiveness in serving customers.

Al Rayan Bank, the UK subsidiary, aligns with the parent company's strategic direction. The focus is on serving Premier and Commercial Property Finance (CPF) customers with competitive Sharia-compliant products and digitalized services. This alignment leverages strong relationships in the GCC region.

The bank's strategies are driven by a clear focus on long-term sustainable growth. The goal is to enhance customer experience through digital transformation. This approach aims to build a strong and loyal customer base.

- Digital Banking: Expanding digital services through Al Rayan Go and other platforms.

- Incentive Programs: Offering competitive rates and rewards to attract new customers.

- Personalization: Providing tailored experiences to enhance customer satisfaction.

- Operational Excellence: Implementing new systems to improve efficiency and responsiveness.

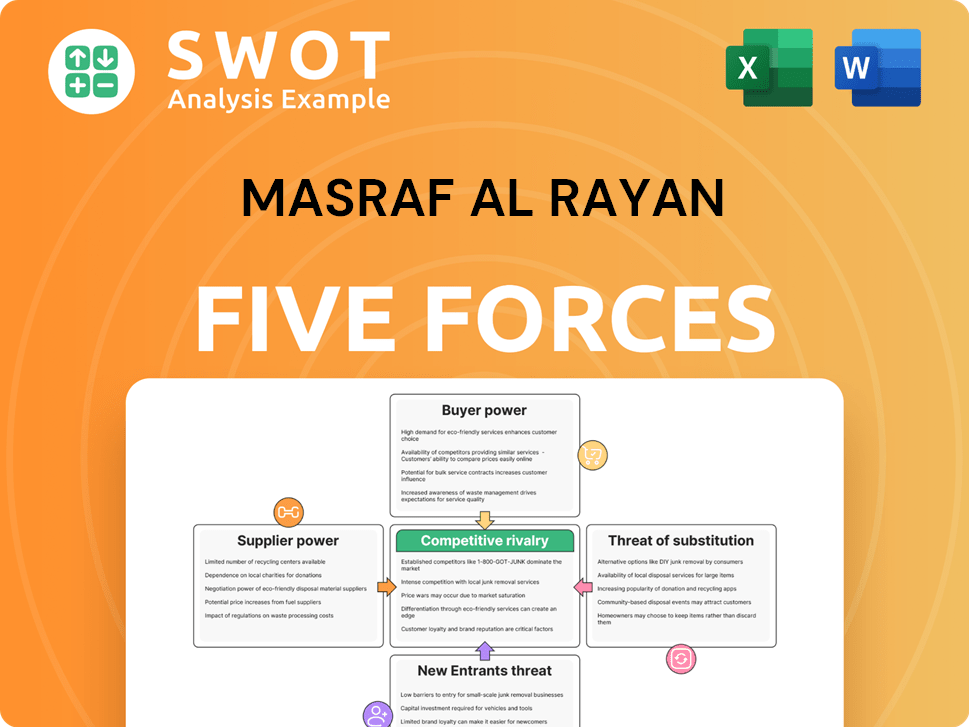

Masraf Al Rayan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Masraf Al Rayan Company?

- What is Competitive Landscape of Masraf Al Rayan Company?

- What is Growth Strategy and Future Prospects of Masraf Al Rayan Company?

- How Does Masraf Al Rayan Company Work?

- What is Sales and Marketing Strategy of Masraf Al Rayan Company?

- What is Brief History of Masraf Al Rayan Company?

- Who Owns Masraf Al Rayan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.