Masraf Al Rayan Bundle

How is AlRayan Bank Redefining Islamic Banking Sales and Marketing?

AlRayan Bank, formerly Masraf Al Rayan, is undergoing a remarkable transformation, and its sales and marketing strategies are at the forefront of this evolution. With a fresh brand identity launched in November 2024, the bank is strategically positioning itself to lead in the competitive Islamic finance sector. This strategic shift is crucial for understanding how the bank plans to attract and retain customers in Qatar and beyond.

This analysis delves into AlRayan Bank's Masraf Al Rayan SWOT Analysis, exploring its sales strategies, marketing tactics, and brand positioning within the Qatar financial sector. We'll examine its digital marketing initiatives, customer relationship management, and how it leverages Islamic banking marketing principles to connect with its target audience. Understanding the bank's approach provides valuable insights into sales strategies of Islamic banks and its overall market performance, especially in light of its impressive 2024 financial results and expansion strategy.

How Does Masraf Al Rayan Reach Its Customers?

The sales and marketing strategy of the company is built upon a multi-channel approach, leveraging both physical and digital platforms to reach its target audience. This strategy is designed to enhance customer accessibility and convenience, reflecting the evolving landscape of the financial sector. The bank's focus on digital transformation, including its mobile banking app and integration with instant payment services, is a key element of its sales strategy.

The company's sales strategy is also influenced by its international presence, with branches and operations in key financial hubs like the UK, France, and the UAE. This global footprint allows the bank to serve a diverse customer base and expand its market reach. The bank's approach to customer relationship management and digital marketing initiatives plays a crucial role in attracting and retaining customers in a competitive market.

The company's sales channels are designed to cater to the diverse needs of its customers, ensuring accessibility and convenience through a combination of physical and digital platforms. This approach is part of the broader Growth Strategy of Masraf Al Rayan, which aims to strengthen its market position and enhance customer satisfaction.

The bank's offline sales channels include a network of retail branches and ATMs strategically located across Qatar. These physical locations provide direct customer service and support. As of April 2024, the bank operated 16 branches and 112 ATMs within Qatar.

The bank has invested heavily in its digital platforms to enhance the customer experience and improve competitiveness. This includes a website and a mobile banking app, offering 24/7 banking services. The launch of 'AlRayan Go' in December 2024, marked a significant advancement in digital banking.

The company extends its sales reach through international branches and operations. The bank has a presence in the UK, France, and the UAE. This international network supports its global customer base and facilitates cross-border transactions.

The bank's digital transformation includes the 'AlRayan Go' mobile banking app, which offers features like account management and faster money transfers. The integration with Qatar Central Bank's 'Fawran' service streamlines transactions. These initiatives align with Qatar's Third Financial Sector Strategy.

The bank's sales strategy emphasizes digital adoption and omnichannel integration to enhance customer experience and competitiveness. This includes the launch of 'AlRayan Go' and partnerships with services like 'Fawran' to streamline transactions.

- The 'AlRayan Go' app was launched in December 2024.

- The bank has integrated with Qatar Central Bank's 'Fawran' for instant payments.

- The bank operates 16 branches and 112 ATMs in Qatar as of April 2024.

- The bank has an international presence in the UK, France, and the UAE.

Masraf Al Rayan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Masraf Al Rayan Use?

The marketing tactics of AlRayan Bank are designed to boost its sales and strengthen its market position within the Qatar financial sector. The bank employs a comprehensive strategy that blends digital innovation with traditional marketing methods. This approach aims to enhance customer engagement, drive sales, and reinforce its brand identity in the Islamic banking sector.

AlRayan Bank's marketing efforts are heavily influenced by its commitment to customer-centric solutions and innovation. The bank's strategies are built to cater to a wide array of customers, from tech-savvy users to those who prefer more traditional banking interactions. This dual approach helps the bank to attract and retain a diverse customer base.

The bank's approach to sales and marketing strategy includes a strong focus on digital platforms and data-driven marketing. This is complemented by traditional media campaigns and a commitment to ESG principles. This integrated approach helps the bank to maintain a competitive edge and meet the evolving needs of its customers.

AlRayan Bank heavily invests in digital tools to enhance customer experience. The 'AlRayan Go' mobile banking app, launched in December 2024, is a prime example. The bank utilizes data-driven marketing to identify new leads.

The rebranding to 'AlRayan Bank' in November 2024, along with the slogan 'Leading Forward', highlights its commitment to innovation. This strategic move aims to redefine Islamic banking standards and enhance brand recognition.

AlRayan Bank focuses on providing seamless and personalized banking services. The bank's focus is on customer satisfaction, which is central to its sales strategy. This includes the development of AI-powered financial solutions.

The bank's launch of Qatar's first Sharia-compliant Green Deposit and Islamic Sustainable Finance framework is a key part of its marketing. This initiative appeals to environmentally conscious consumers. This approach is crucial for attracting customers.

A dedicated Data and Analytics Team and a comprehensive data strategy are in place. The bank uses AI-driven insights for enhanced decision-making. This data-driven approach is central to its marketing strategy.

While specific details are limited, the bank likely uses traditional media like TV, radio, and print. These campaigns support the overall marketing mix. Events also play a role in customer engagement.

AlRayan Bank's marketing tactics are designed to attract customers. The bank's strategy involves a mix of digital and traditional methods. The bank's approach is focused on innovation and customer satisfaction.

- Digital Banking: 'AlRayan Go' mobile app with biometric authentication.

- Data-Driven Marketing: Use of AI for customer insights and lead generation.

- Rebranding: New visual identity and slogan to reflect the bank's vision.

- ESG Focus: Launch of sustainable finance products to attract ethical consumers.

- Customer-Centric Approach: Personalized services and solutions.

Masraf Al Rayan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Masraf Al Rayan Positioned in the Market?

The brand positioning of the bank is centered on being a leader in modern Islamic banking. This approach balances tradition with innovation. The core message, conveyed through the slogan 'Leading Forward,' emphasizes resilience, innovation, and strong values. This positioning aligns with Qatar's Vision 2030 for sustainable development. The bank differentiates itself through its commitment to Sharia-compliant principles, advanced digital solutions, and customer-centricity.

A key element of its brand strategy is the refreshed visual identity, unveiled in November 2024. The new logo and vibrant blue palette symbolize trust, growth, and progress. This reflects a dedication to delivering seamless, personalized, and innovative banking experiences. The color scheme is carefully chosen to communicate the bank's core values and aspirations consistently across all channels.

The bank's commitment to ethical banking, sustainability, and exceptional customer experience appeals to its target audience. This is further reinforced by its robust financial performance. In 2024, the bank reported a net profit of QAR 1,507 million and a capital adequacy ratio of 23.92%, solidifying its position as a stable and trusted financial institution. This financial strength supports its brand promise and enhances its reputation in the Qatar financial sector.

The new visual identity, introduced in November 2024, includes a new logo and a vibrant blue palette. The colors are specifically chosen to reflect trust, growth, and progress. This refreshed look is consistent across all customer touchpoints, including the mobile banking app, AlRayan Go.

The bank emphasizes its commitment to Sharia-compliant principles. It also focuses on advanced digital solutions and customer-centricity. These values are communicated through its marketing and sales strategies. The bank aims to provide an exceptional and modern customer experience.

The bank targets customers who value ethical banking and sustainability. The focus is on providing a modern and exceptional customer experience. The bank's commitment to these principles attracts a specific segment of the market.

The bank's strong financial results in 2024 support its brand positioning. The net profit of QAR 1,507 million and a capital adequacy ratio of 23.92% demonstrate financial stability. These figures reinforce the bank's reputation as a trusted financial institution. For more insights, explore the Growth Strategy of Masraf Al Rayan.

Masraf Al Rayan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Masraf Al Rayan’s Most Notable Campaigns?

The most impactful campaign for Masraf Al Rayan, a key player in the Qatar financial sector, has been its comprehensive rebranding initiative, culminating in the unveiling of 'AlRayan Bank' in November 2024. This strategic move aimed to redefine modern Islamic banking, emphasizing innovation and customer empowerment. This campaign is a core element of the bank's overall Brief History of Masraf Al Rayan and its evolution within the financial landscape.

The rebranding campaign, centered around the slogan 'Leading Forward,' highlighted a balance of tradition and modernity, aiming to deliver seamless and personalized banking experiences. The launch of the 'AlRayan Go' mobile banking application in December 2024 was a direct outcome, designed to enhance the digital customer experience and accelerate innovation. This initiative is a key example of Masraf Al Rayan's digital marketing initiatives.

The success of this rebranding is evident in the bank's continued strong financial performance in 2024. The bank's net profit reached QAR 1,507 million, reflecting a 3.8% year-on-year growth, with an expanded balance sheet by 4.2%. These results underscore the effectiveness of the bank's Masraf Al Rayan sales strategy and its ability to adapt and innovate within the competitive Islamic banking market.

The primary objective was to signal a new era for the bank. It aimed to redefine modern Islamic banking through innovation and customer empowerment. The campaign also sought to align with Qatar's Vision 2030.

The rebranding included a high-profile event attended by key stakeholders. Significant coverage in financial news outlets was also a critical component. The launch of the 'AlRayan Go' mobile application was a major part of the digital transformation.

The campaign utilized a mix of channels, including exclusive events and financial news coverage. Social media marketing played a role, although specific details are not available in the provided context. The digital channels were crucial for the launch of the mobile app.

The campaign contributed to the bank's strong financial performance in 2024. Net profit grew to QAR 1,507 million, a 3.8% increase year-on-year. The balance sheet expanded by 4.2%, indicating growth in assets.

The campaign's success can be attributed to several factors, including clear communication and a forward-looking vision. The reinforcement of the bank's foundational Islamic values was also crucial. Effective brand positioning strategy helped in attracting customers.

- Emphasis on innovation and customer empowerment.

- Strategic alignment with Qatar's Vision 2030.

- Successful digital transformation efforts.

- Strong financial performance post-rebranding.

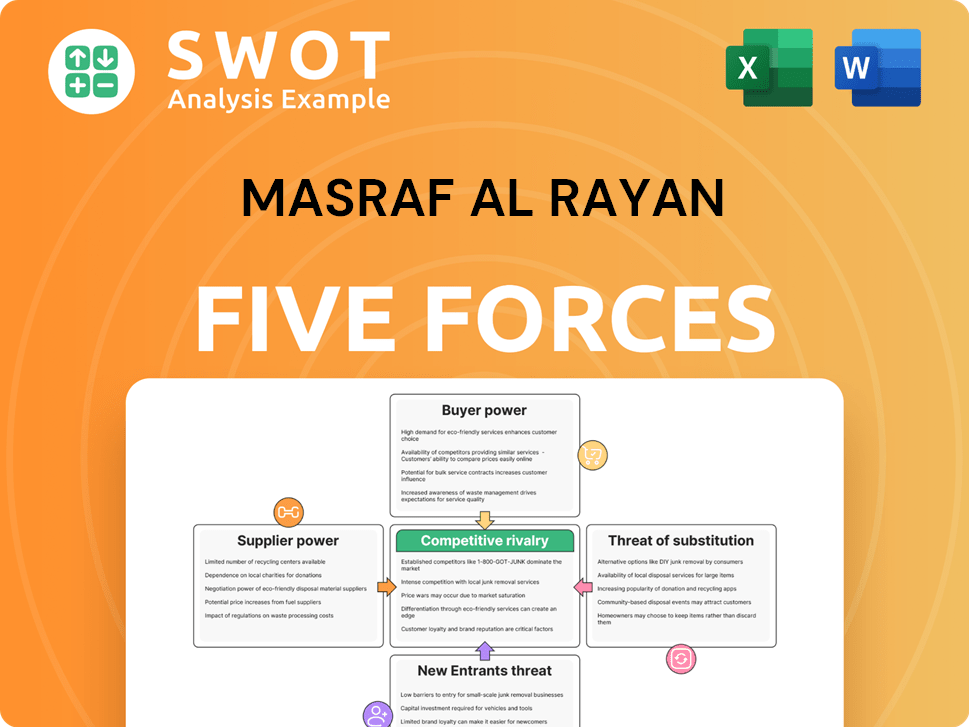

Masraf Al Rayan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Masraf Al Rayan Company?

- What is Competitive Landscape of Masraf Al Rayan Company?

- What is Growth Strategy and Future Prospects of Masraf Al Rayan Company?

- How Does Masraf Al Rayan Company Work?

- What is Brief History of Masraf Al Rayan Company?

- Who Owns Masraf Al Rayan Company?

- What is Customer Demographics and Target Market of Masraf Al Rayan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.