AQ Group Bundle

How Does AQ Group Thrive in a Competitive Market?

AQ Group, a global leader in industrial component manufacturing, has consistently delivered impressive financial results, achieving profitability for 117 consecutive quarters since 1994. With net sales reaching SEK 8,554 million in 2024, and a market capitalization of $1.75 billion USD as of June 2025, AQ Group demonstrates significant influence in its sector. This success, despite a 5% decrease in sales in 2024, makes understanding AQ Group SWOT Analysis and its operational model crucial.

This deep dive into the AQ Group will explore its diverse product offerings, including electrical cabinets and wiring harnesses, and how it serves critical sectors like electric vehicles and defense. We'll examine the AQ Group business model, its strategic acquisitions, and its sustained profitability to uncover how AQ Group operations contribute to its remarkable success. This analysis will provide valuable insights into the company's financial strategies and competitive positioning, answering the question of what does AQ Group do and how it maintains its market leadership.

What Are the Key Operations Driving AQ Group’s Success?

The core of how the AQ Group company works revolves around creating and delivering value through its expertise in developing, manufacturing, and assembling components and systems. This is achieved by focusing on demanding industrial customers, providing them with high-quality products. The company's operations are structured to ensure reliability and long-term partnerships with its clients.

AQ Group operates across seven key business areas, including Electric Cabinets, Wiring Systems, and System Products. These diverse offerings serve various customer segments, with significant growth observed in sectors like electrification, commercial vehicles, and the defense industry in 2023. The company's commitment to total quality and a decentralized leadership culture further enhances its competitive advantage.

The company's value proposition is centered on providing a reliable supply of complex industrial components. AQ Group often acts as a long-term partner to its customers. This is due to its commitment to total quality and its ability to deliver products on time and sustainably. For more insights, you can explore the Marketing Strategy of AQ Group.

AQ Group has a global network spanning 17 countries, including Sweden, China, and the USA, with approximately 8,000 employees. This extensive network supports its operational processes, ensuring efficient production and supply chain management. The company's global footprint enables it to serve a diverse customer base effectively.

AQ Group specializes in customized inductive components for the railway industry, ranging from 1VA to 2MVA. These components are used in applications such as main converters and electric cabinet assemblies, demonstrating the company's technical expertise. The company's focus on specialized products highlights its ability to meet specific customer needs.

AQ Group emphasizes a decentralized leadership culture, empowering individuals with significant responsibility and freedom. This approach is a key competitive advantage, fostering innovation and responsiveness. This structure allows for quicker decision-making and adaptation to market changes.

The core capabilities of the AQ Group translate into customer benefits through a reliable supply of complex industrial components. The company often acts as a long-term partner due to its commitment to total quality. This approach ensures customer satisfaction and builds lasting relationships.

AQ Group's operations are designed to ensure high-quality products and timely delivery. The company's success is built on a global network and a commitment to customer satisfaction.

- Global Manufacturing Network: Operates in 17 countries, ensuring a broad reach and diverse capabilities.

- Specialized Component Production: Focuses on customized inductive components for industries like railways.

- Decentralized Management: Empowers employees, fostering innovation and quicker responses to market needs.

- Customer-Centric Approach: Prioritizes long-term partnerships and total quality to meet customer expectations.

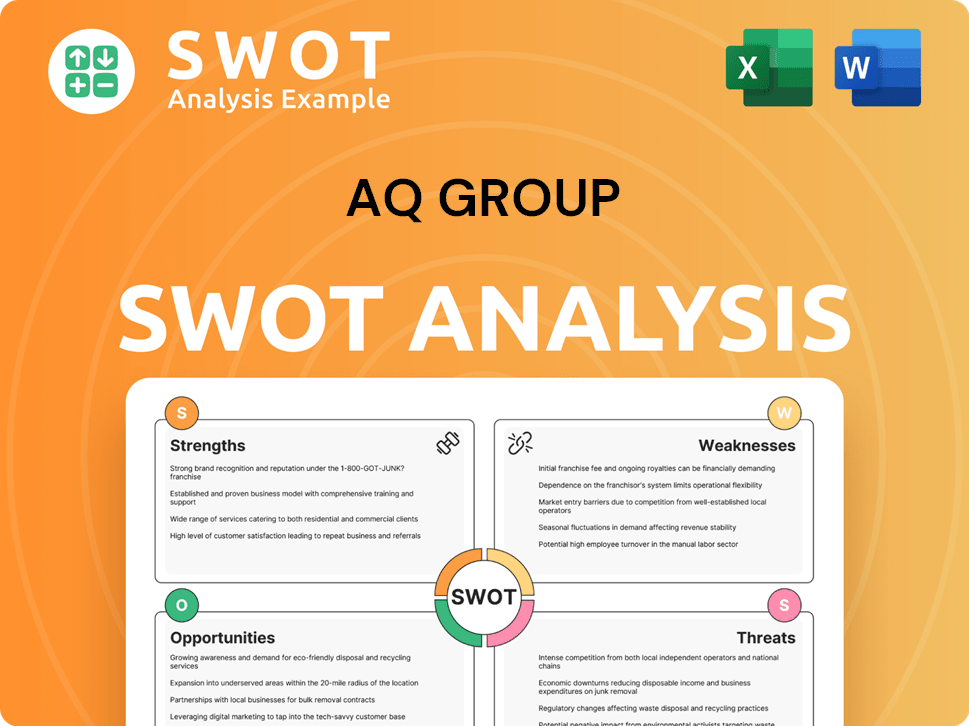

AQ Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AQ Group Make Money?

The primary revenue streams for the company, also known as the AQ Group company, are derived from the sale of components and systems tailored for industrial applications. This encompasses a broad range of products, reflecting the company's focus on serving diverse industrial needs. The financial performance of the company is closely tied to these sales, demonstrating the importance of its product offerings.

The company's monetization strategy centers around its manufacturing and assembly capabilities, serving demanding industrial customers. This approach allows the company to generate revenue through direct product sales across various business segments. The company's ability to meet specific customer needs is a key factor in its financial success.

The AQ Group company's financial performance in recent periods highlights its revenue generation capabilities. For the full year 2024, net sales were SEK 8,554 million. In Q1 2025, net sales increased by 3% to SEK 2,290 million, compared to SEK 2,225 million in Q1 2024. The growth in Q1 2025 demonstrates the company's ability to increase sales.

The company's revenue is primarily generated from two segments: Components and Systems. The Components segment, which includes areas like Precision Stamping and Injection Molding, contributes the majority of the revenue. The Systems segment focuses on Electric Cabinets and System Products. The company actively pursues growth through acquisitions to expand its market reach and product portfolio. For example, the acquisition of mdexx magnetronics and Michael Riedel in January 2025 is expected to increase annual net sales by approximately SEK 500 million.

- The Components segment includes Precision Stamping, Injection Molding, Inductive Components, Wiring Systems, Sheet Metal Processing, and Special Technologies and Engineering.

- The Systems segment focuses on Electric Cabinets and System Products.

- Acquisitions contributed 8% to revenue growth in Q1 2025, offsetting a 5% organic sales decline.

- The company's approach to revenue generation and market expansion is detailed in the Brief History of AQ Group.

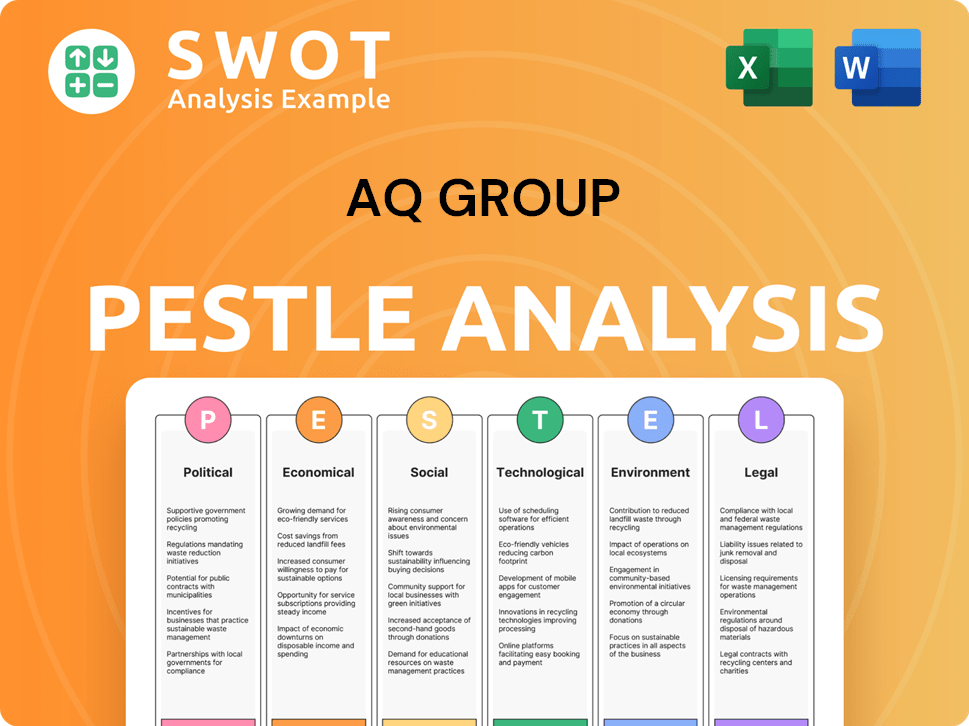

AQ Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped AQ Group’s Business Model?

The AQ Group company has achieved significant milestones and strategic moves that have shaped its operations and financial performance. A key achievement is its consistent profitability, having been profitable every quarter since its founding in 1994, totaling 117 consecutive quarters. In 2024, AQ Group celebrated 30 years of growth, with sales increasing from SEK 18 million to SEK 8.5 billion. This sustained performance highlights the company's resilience and effective business strategies.

Strategic moves in 2024 included the acquisition of seven factories and two engineering offices, which has been a key driver for growth, particularly in the defense, electrification, forestry automation, aerospace, and gas turbine markets. The acquisition of Rockford Components Holdings Limited in July 2024, and TechROi Engineering AB and TechROi Scandinavia AB in September 2024, further expanded AQ Group's capabilities. The acquisition of mdexx magnetronics and Michael Riedel, completed in January 2025, further strengthened AQ Group's capabilities in inductive components.

The company has faced operational challenges, such as delivery delays and quality issues in 2023 due to rapid expansion, particularly for a battery systems customer where turnover related to this customer amounted to SEK 250 million. However, AQ Group has implemented initiatives to improve quality and delivery precision. These initiatives demonstrate AQ Group's commitment to operational excellence and customer satisfaction.

AQ Group has maintained consistent profitability since 1994, with 117 consecutive profitable quarters. In 2024, the company marked its 30th anniversary, showing substantial growth. Sales have increased significantly, reflecting successful market strategies and operational efficiency.

Acquisitions in 2024 included seven factories and two engineering offices, expanding into defense, electrification, and aerospace markets. Key acquisitions include Rockford Components Holdings Limited, and TechROi Engineering AB and TechROi Scandinavia AB. The acquisition of mdexx magnetronics and Michael Riedel, completed in January 2025, further strengthened AQ Group's capabilities.

In 2023, AQ Group faced delivery delays and quality issues due to rapid expansion, particularly with a battery systems customer. Turnover related to this customer amounted to SEK 250 million. The company has since implemented measures to improve quality and delivery performance.

AQ Group's decentralized leadership model empowers employees and fosters customer focus. A strong balance sheet and modern production units support its operations. The company's commitment to quality and on-time delivery enhances its reputation. AQ Group is adapting to new trends by investing in areas like electrification and defense.

The company benefits from a decentralized leadership model, fostering customer focus. This structure allows for quicker decision-making and better responsiveness to customer needs. AQ Group's strong financial position and modern production facilities further enhance its competitive edge.

- Decentralized Leadership: Empowers employees and promotes customer focus.

- Financial Strength: Supported by a robust balance sheet.

- Modern Production: Equipped with advanced production units.

- Adaptability: Investments in electrification and defense sectors.

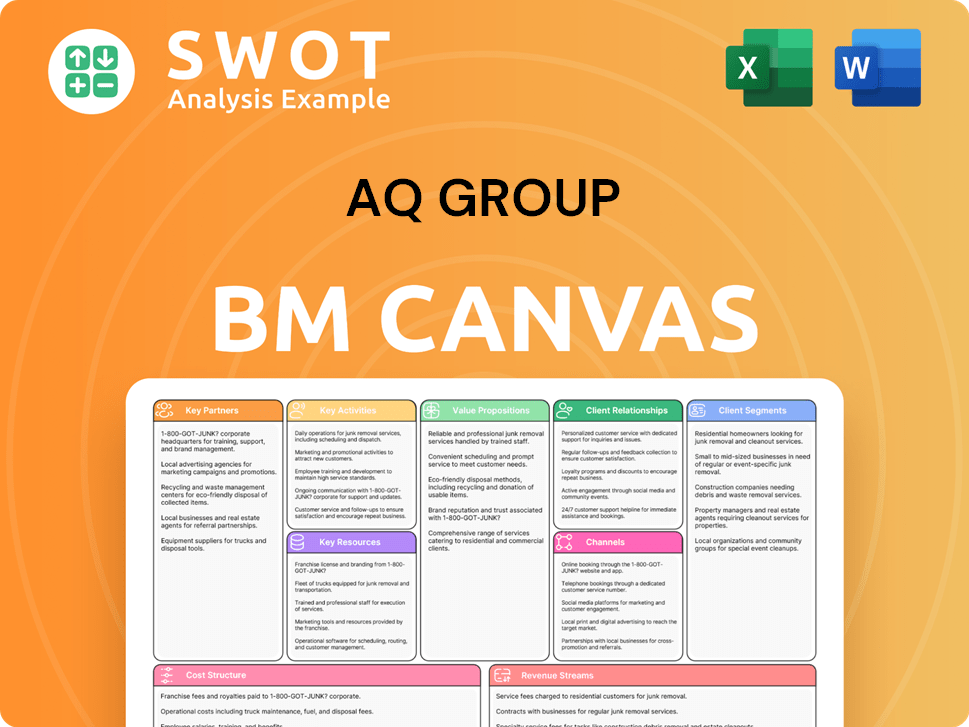

AQ Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is AQ Group Positioning Itself for Continued Success?

The AQ Group company holds a strong position as a global manufacturer, specializing in components and systems for demanding industrial applications. As of June 2025, its market capitalization is approximately $1.75 billion USD. The company's extensive global presence includes operations and employees across 17 countries spanning Europe, Asia, and North and South America.

Key risks include production disruptions, delivery delays, and quality issues, as experienced in 2023. Organic growth has faced headwinds, with a -5% decrease in Q1 2025 and -7% for the full year 2024, primarily due to reduced demand in sectors such as construction equipment and agriculture. Despite these challenges, the company maintains a positive outlook.

The company has a global reach with operations in 17 countries. AQ Group has consistently shown profitability since 1994, demonstrating an established presence within its niche. While specific market share data is not readily available, the company's 30-year track record of growth highlights its customer loyalty.

Production disruptions, delivery delays, and quality problems are potential risks. Organic growth has been a challenge, with a decrease in demand in key segments. The company is actively addressing these challenges to maintain its market position.

AQ Group aims for over 15% annual growth and an EBT margin exceeding 8%. Strategic initiatives include expanding capacity and focusing on acquisitions. The company's strong balance sheet supports its continued investments and acquisitions.

AQ Group maintains a strong balance sheet with a net cash position of SEK 284 million. This financial strength enables continued investments and acquisitions. The company is confident in its business model and decentralized leadership.

Looking ahead, AQ Group is focused on strategic initiatives to sustain and expand its profitability. The company is actively expanding capacity and integrating recent acquisitions, such as Rockford, JIT Mech, and TechROi. The mdexx and Michael Riedel acquisitions are expected to contribute significantly to future net sales.

- Expansion of capacity includes investments like SEK 10 million in a fiber laser cutting machine.

- Expansion of the transformer factory in the US due to a full order book for 2025.

- Acquisitions remain a core part of their growth strategy.

- The company anticipates continued growth and profitability in collaboration with its industrial customers.

AQ Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AQ Group Company?

- What is Competitive Landscape of AQ Group Company?

- What is Growth Strategy and Future Prospects of AQ Group Company?

- What is Sales and Marketing Strategy of AQ Group Company?

- What is Brief History of AQ Group Company?

- Who Owns AQ Group Company?

- What is Customer Demographics and Target Market of AQ Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.