African Rainbow Minerals Bundle

How Does African Rainbow Minerals Thrive in the Mining Sector?

African Rainbow Minerals (ARM), a powerhouse in the South African mining landscape, has a compelling story. Founded in 1997 by Patrice Motsepe, ARM quickly ascended, becoming a major player listed on the Johannesburg Stock Exchange (JSE) in 2002. Its strategic mergers and diverse portfolio, including platinum group metals (PGMs), iron ore, and coal, make it a critical entity to understand.

With a significant workforce of approximately 23,369 employees as of December 31, 2024, and operations spanning South Africa and Malaysia, the African Rainbow Minerals SWOT Analysis is crucial for stakeholders. Despite market fluctuations, ARM, a prominent resource company, demonstrates resilience with a strong financial position and a commitment to sustainable practices. Exploring the company's structure and operational strategies is vital for anyone seeking to understand the dynamics of the South African mining sector and the future of ARM mining.

What Are the Key Operations Driving African Rainbow Minerals’s Success?

African Rainbow Minerals (ARM) is a significant player in the South African mining sector, generating value through its diverse mining and beneficiation operations. The company focuses on key commodities, including platinum group metals (PGMs), iron ore, manganese ore, chrome ore, nickel, and coal. ARM also produces manganese alloys and has a strategic investment in gold through Harmony Gold Mining Company Limited. These operations are central to its business model, serving a global customer base.

The company's operational processes encompass exploration, development, and the operation of mines and related infrastructure. Mining activities are primarily located in South African provinces such as the Northern Cape, Limpopo, Mpumalanga, and KwaZulu-Natal, with the Sakura Ferroalloys smelter in Malaysia. ARM emphasizes long-life, low unit-cost operations to ensure operational efficiency. This approach supports its ability to provide essential minerals to various industries.

ARM's diversified portfolio provides resilience against commodity price volatility, which is a key element of its value proposition. Strategic partnerships and a commitment to responsible and sustainable mining further enhance its market position. For example, its joint venture with Glencore Operations South Africa for coal and its investment in Assmang, which mines manganese, iron ore, and chrome, contribute to its operational reach and market differentiation. Furthermore, ARM's initiatives, such as the 100 MW solar PV facility expected to deliver power by August 2025, address environmental concerns and potentially reduce operational costs.

ARM's core offerings include platinum group metals (PGMs), iron ore, manganese ore, chrome ore, nickel, and coal. It also produces manganese alloys and has a strategic investment in gold. These commodities are essential for various industries, from automotive to steel production.

Mining operations are concentrated in key South African provinces, including the Northern Cape, Limpopo, Mpumalanga, and KwaZulu-Natal. The Sakura Ferroalloys smelter is located in Sarawak, Malaysia. ARM's extensive supply chain involves extraction, processing, and beneficiation of raw materials.

ARM's diversified portfolio provides resilience against commodity price volatility. Strategic partnerships and a commitment to responsible and sustainable mining enhance its market position. The company's focus on long-life, low unit-cost operations contributes to its operational efficiency.

ARM has formed strategic partnerships, such as a joint venture with Glencore Operations South Africa for coal. Additionally, its investment in Assmang, which mines manganese, iron ore, and chrome, strengthens its operational reach and market differentiation. These partnerships are crucial for its success.

ARM is committed to responsible and sustainable mining practices, including the development of a 100 MW solar PV facility, expected to be operational by August 2025. This initiative aims to address environmental concerns and potentially reduce operational costs. The company's focus on sustainable practices positions it well for the future.

- Diversification: The company's diversified portfolio helps mitigate risks associated with commodity price fluctuations.

- Operational Efficiency: Emphasis on long-life, low unit-cost operations enhances profitability.

- Strategic Alliances: Partnerships with other industry players expand its market reach and operational capabilities.

- Sustainability Initiatives: Commitment to environmental responsibility, such as the solar PV project, improves its long-term prospects.

For more insights into the competitive landscape, you can explore the Competitors Landscape of African Rainbow Minerals.

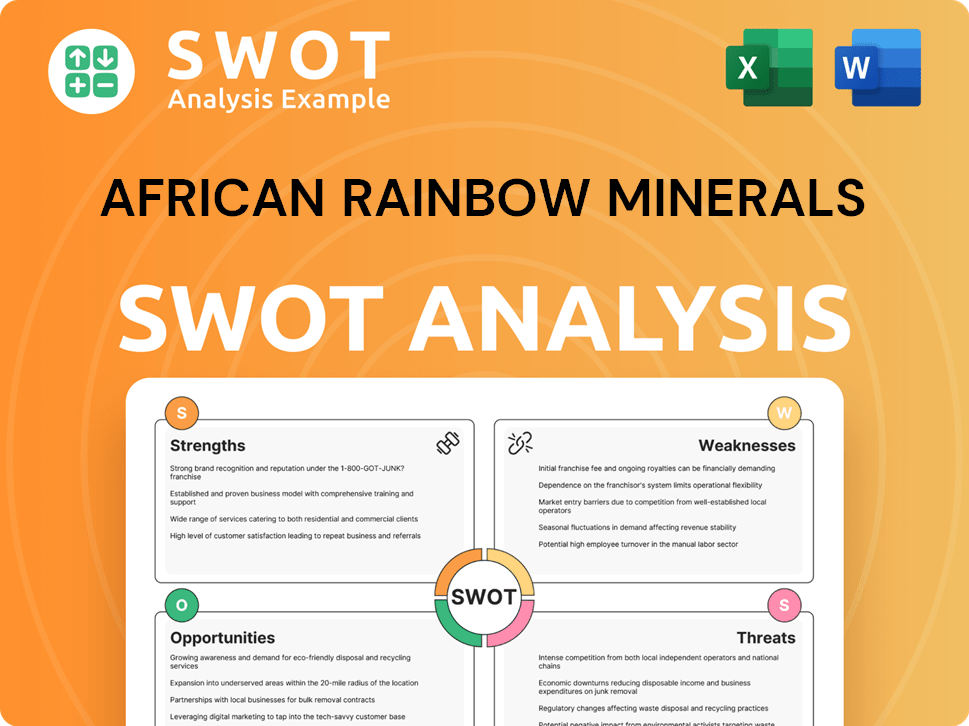

African Rainbow Minerals SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does African Rainbow Minerals Make Money?

The ARM Company generates revenue primarily through the sale of mined and beneficiated commodities. Its operations are segmented into ARM Ferrous, ARM Platinum, and ARM Coal divisions, alongside an investment in gold through Harmony Gold. This diversified approach helps manage risks associated with commodity price fluctuations.

As of the six months ended December 31, 2024 (1H F2025), the company reported a turnover of R6,381 million. The revenue streams are significantly influenced by global demand and market prices for its commodities, with ferrous metals historically contributing the largest share.

The company's monetization strategies are closely linked to global commodity markets. The company's diversified portfolio helps mitigate volatility. The company is investing in growth and existing businesses, with a net cash outflow from investing activities of R914 million in 1H F2025, including R640 million in expansionary capital.

The ARM mining operations are significantly impacted by commodity price movements and sales volumes. In 1H F2025, headline earnings decreased by 49% to R1,520 million. This was primarily driven by a 22% reduction in average realized US dollar iron ore prices, lower iron ore and manganese ore sales volumes, higher cash costs, and a stronger rand/US dollar exchange rate. The company's strategic decisions and market conditions shape its financial performance.

- Ferrous metals (iron ore, manganese ore) historically contribute the largest share of revenue, at 65.1% in the 2023/24 financial year.

- Platinum group metals contributed 28.4% and coal contributed 6.5% in the 2023/24 financial year.

- Total iron ore sales volumes decreased by 3% to 7.0 million tonnes in 1H F2025.

- Manganese ore sales volumes decreased by 4% to 2.3 million tonnes in 1H F2025, despite price increases.

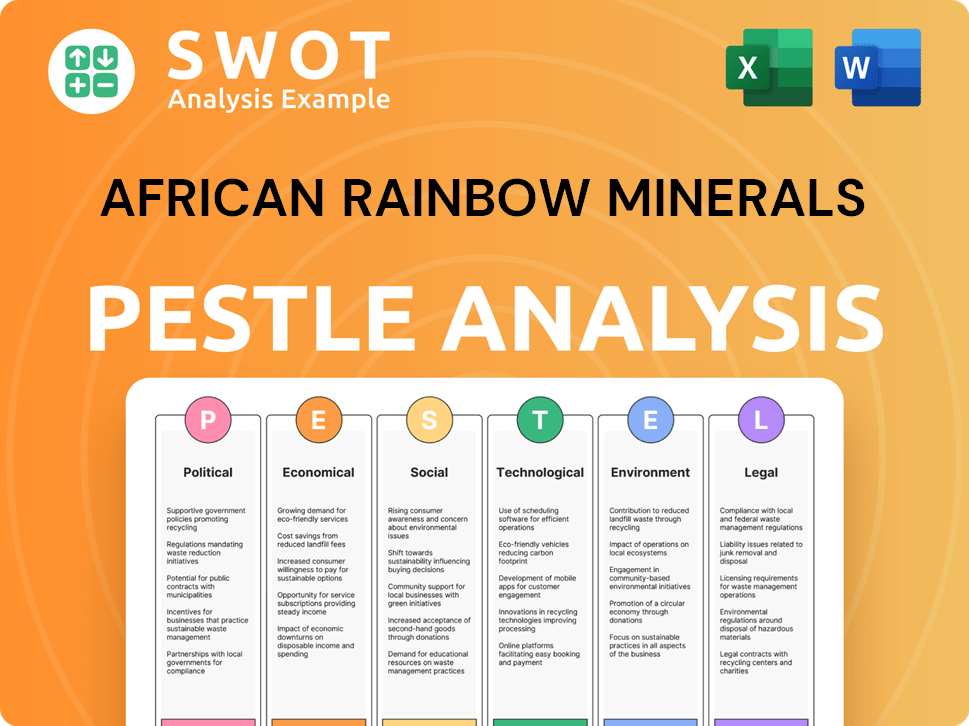

African Rainbow Minerals PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped African Rainbow Minerals’s Business Model?

African Rainbow Minerals (ARM) has a history marked by significant strategic moves and operational adjustments. A foundational milestone was the 2003 merger of ARMGold with Harmony Gold Mining and Anglovaal. This created a diversified mining group and positioned ARM as a major black-controlled enterprise in the South African mining sector. Over time, ARM has focused on optimizing its existing operations and adapting to market shifts, especially in response to volatile commodity prices.

Operational challenges and market dynamics have driven ARM to make strategic responses. For example, in the six months ending December 31, 2024 (1H F2025), the company faced a difficult PGM market, which led to a substantial drop in earnings for ARM Platinum. The company has also been dealing with logistical constraints and infrastructure challenges, including the impact of rail crises. These factors have influenced ARM's strategic decisions and operational focus.

ARM's competitive advantages are rooted in its diversified portfolio of long-life, low unit-cost assets across key commodities. This diversification provides resilience against market fluctuations. The company's commitment to sustainability, including investments in renewable energy, and its strategic partnerships further enhance its long-term competitiveness. For more insights, consider exploring the Growth Strategy of African Rainbow Minerals.

The 2003 merger of ARMGold with Harmony Gold Mining and Anglovaal was a pivotal moment, creating a diversified mining group. This strategic move established ARM as a major black-controlled entity in the South African mining sector. This initial step set the stage for ARM's subsequent growth and diversification efforts.

In response to market challenges, ARM has deferred major expansion plans at the Bokoni PGM mine and initiated a Section 189 process. The company is also focused on conventional stoping to reduce operational losses. ARM is investing in renewable energy, such as a 100 MW solar PV facility, to curb costs and reduce emissions.

ARM's diversified portfolio of long-life, low unit-cost assets provides resilience against market fluctuations. Strategic investments in gold through Harmony Gold Mining Company strengthen its portfolio. The company's commitment to sustainable practices and established joint ventures enhance its operational performance.

ARM maintained a robust net cash position of R6,073 million as of December 31, 2024. In 1H F2025, ARM Platinum faced a challenging PGM market, leading to a 144% drop in headline earnings. Increased unit costs were noted due to lower production volumes and above-inflation increases in costs at its iron ore and coal operations in 1H F2025.

ARM's strategic focus includes optimizing operations and adapting to market shifts, particularly in response to volatile commodity prices. The company's commitment to sustainable practices, such as the construction of a 100 MW solar PV facility, is a key strategic move. ARM's established joint ventures and partnerships leverage combined capabilities for better operational performance.

- ARM's diversification across key commodities provides a degree of resilience.

- The company is navigating logistical and infrastructure challenges.

- ARM is exploring renewable energy integration and focusing on resource optimization.

- ARM's financial performance in 1H F2025 reflects the impact of market conditions.

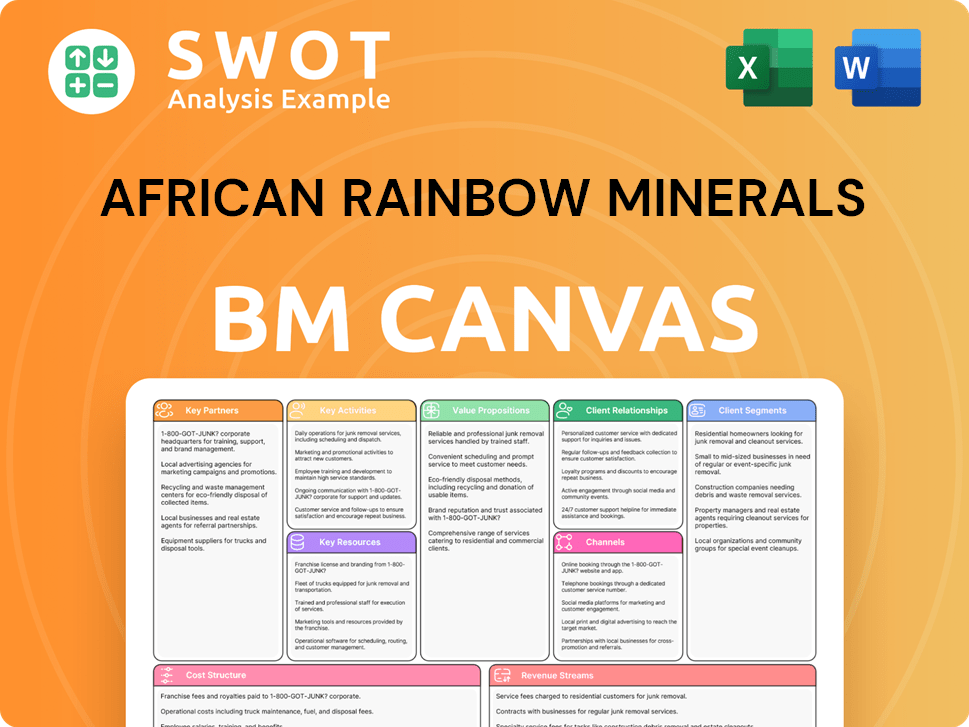

African Rainbow Minerals Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is African Rainbow Minerals Positioning Itself for Continued Success?

African Rainbow Minerals (ARM) stands as a prominent player in South Africa's mining sector, with a diversified portfolio that includes platinum group metals (PGMs), iron ore, and coal. Its operations also extend to Malaysia. The company's broad commodity exposure and focus on long-life, low unit-cost operations contribute to its established industry standing. ARM's consistent supply of essential raw materials to various global industries implicitly fosters customer loyalty.

Despite its strong position, ARM faces challenges. Commodity price volatility, operational risks, and regulatory changes present ongoing headwinds. However, the company is actively pursuing strategic initiatives, including renewable energy integration and sustainable development, to sustain and expand its profitability. These initiatives, combined with a focus on responsible environmental stewardship, underpin its future outlook.

ARM holds a significant position as a leading diversified mining and minerals company in South Africa, with operations in Malaysia. Its market share is robust within its diversified portfolio of platinum group metals (PGMs), iron ore, manganese ore, chrome ore, nickel, coal, and a strategic investment in gold. ARM's broad commodity exposure and long-life, low unit-cost operations contribute to its established industry standing.

Commodity price volatility remains a significant headwind, as evidenced by the 49% decrease in headline earnings for the six months ended December 31, 2024 (1H F2025). A stronger rand/US dollar exchange rate also negatively impacted earnings during this period. Operational risks include higher cash costs and logistical challenges. Regulatory changes and the global push for decarbonization also present ongoing challenges and opportunities.

ARM is focused on strategic initiatives to sustain and expand its profitability. The company is investing in growth and its existing businesses, with expansionary capital amounting to R640 million in 1H F2025. ARM is also actively pursuing renewable energy integration, with a 100 MW solar PV facility expected to deliver power by August 2025, aiming to curb operational costs and reduce carbon emissions.

ARM anticipates growing earnings by 4.9% and revenue by 14.3% per annum, with EPS expected to grow by 11.5% per annum. The company continues to balance dividend declarations with long-term investments, reinforcing investor confidence and its strategy for sustained value creation. The company is focused on sustainable development and responsible environmental stewardship.

The company's financial performance in 1H F2025 was impacted by commodity price volatility, particularly in iron ore. Despite these challenges, ARM is committed to strategic investments, including expansionary capital of R640 million. The integration of a 100 MW solar PV facility by August 2025 underscores its commitment to sustainable operations.

- Headline earnings decreased by 49% in 1H F2025.

- Average realized US dollar iron ore prices decreased by 22%.

- Expansionary capital amounted to R640 million in 1H F2025.

- The company anticipates growing earnings by 4.9% per annum.

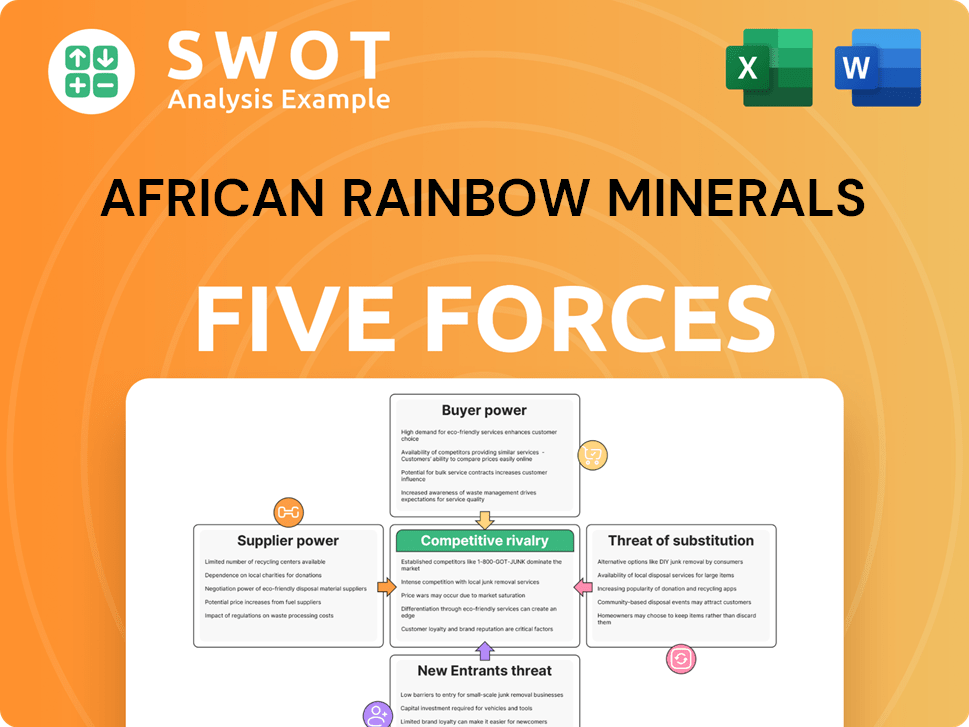

African Rainbow Minerals Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of African Rainbow Minerals Company?

- What is Competitive Landscape of African Rainbow Minerals Company?

- What is Growth Strategy and Future Prospects of African Rainbow Minerals Company?

- What is Sales and Marketing Strategy of African Rainbow Minerals Company?

- What is Brief History of African Rainbow Minerals Company?

- Who Owns African Rainbow Minerals Company?

- What is Customer Demographics and Target Market of African Rainbow Minerals Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.