African Rainbow Minerals Bundle

Who Does African Rainbow Minerals Serve?

In the high-stakes world of mining, understanding your customer is paramount. For African Rainbow Minerals SWOT Analysis, a deep dive into customer demographics and target markets unlocks critical insights. This exploration is essential for strategic planning and ensuring ARM remains competitive within the dynamic mining industry.

This analysis of African Rainbow Minerals (ARM) will uncover the core customer segments driving its success. We'll examine the demographic profile of ARM's customer base, including their geographic location, income levels, and specific needs. Furthermore, we'll investigate how ARM identifies its target market and tailors its strategies to meet evolving market demands, ensuring sustained growth and market resilience within the complex global landscape of the mining industry.

Who Are African Rainbow Minerals’s Main Customers?

Understanding the Customer demographics and Target market of African Rainbow Minerals (ARM) requires a B2B perspective, focusing on the industries that utilize its mined resources. ARM's primary customer base consists of large industrial clients, manufacturers, and commodity traders globally. This approach contrasts with businesses that target individual consumers, as ARM's operations serve the needs of various industrial sectors.

The ARM company primarily serves industries that utilize raw materials for their production processes. These industries include automotive manufacturers, steel producers, power generation companies, and chemical industries. The specific customer segments are categorized by the type of mineral they require, such as platinum group metals (PGMs), iron ore, coal, copper, and gold. The company's strategic focus is evident in its investments and operational decisions within these core B2B segments.

The mining industry is a significant sector for ARM, with its customer base spanning across various geographical locations. The company's market segmentation is based on the type of mineral and the industry it serves. For example, automotive manufacturers are key customers for PGMs used in catalytic converters, while steel manufacturers are major consumers of iron ore. Analyzing the market analysis of ARM reveals its strategic alignment with global industrial demand.

ARM’s customers are primarily industrial entities. They are categorized by the type of mineral they use and the industry they operate in. The main customer segments include automotive, steel, power generation, and chemical industries.

While traditional demographic data like age or gender are not applicable, relevant criteria include company size, production capacity, geographic location, and technological sophistication. These factors help ARM tailor its services and maintain strong relationships with its clients.

Iron ore and PGM operations are significant revenue drivers for ARM, reflecting the strong demand from the steel and automotive industries. In 2023, the ferrous metals division contributed significantly to overall earnings. The company's investments in Assmang further solidify its position in these key industrial supply chains.

ARM adapts its focus and investment strategies in response to shifts in global industrial production, technological advancements (e.g., the rise of electric vehicles impacting PGM demand), and environmental regulations. This adaptability ensures the company remains competitive in its core B2B segments.

ARM’s customer base is primarily composed of large industrial clients involved in manufacturing and commodity trading. The company’s focus on B2B operations means that its success is tied to the performance of these industries. For a broader understanding of the competitive landscape, consider exploring the Competitors Landscape of African Rainbow Minerals.

- Who are the customers of African Rainbow Minerals: Large industrial clients, manufacturers, and commodity traders.

- What is the target audience for ARM: Industries that utilize raw materials, such as automotive, steel, and power generation.

- How does ARM identify its target market: By analyzing mineral demand from various industrial sectors and their specific needs.

- What industries does African Rainbow Minerals serve: Automotive, steel, power generation, chemical, and other manufacturing industries.

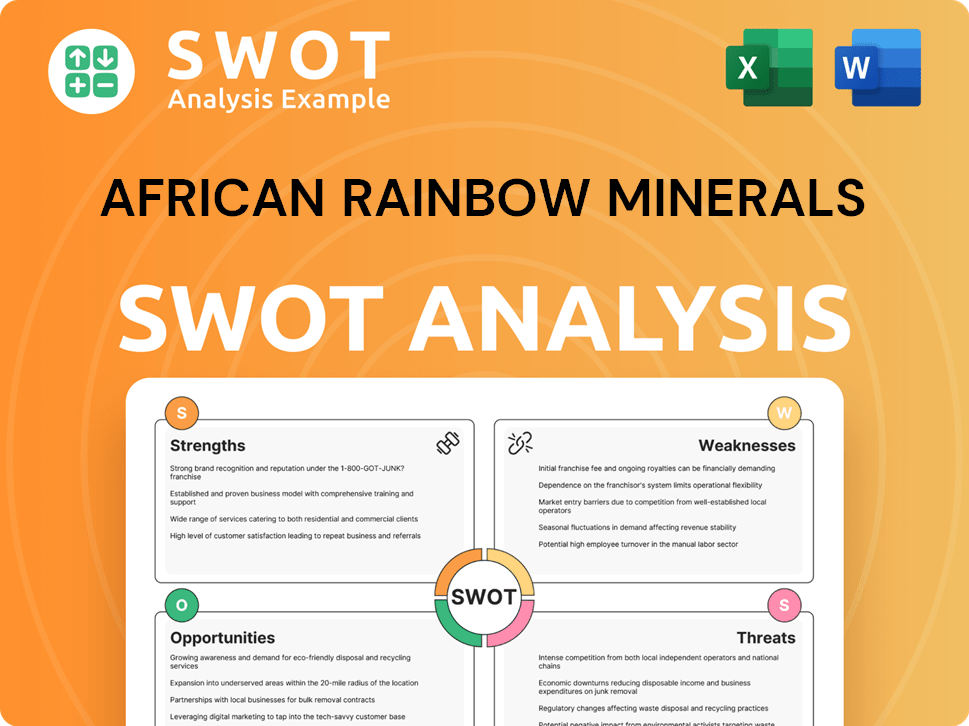

African Rainbow Minerals SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do African Rainbow Minerals’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of the Growth Strategy of African Rainbow Minerals. The primary focus for African Rainbow Minerals (ARM) in the mining industry is on business-to-business (B2B) relationships. The target market for ARM includes industries that require raw materials like iron ore, manganese ore, chrome ore, and platinum group metals (PGMs).

The key customer demographics for ARM are primarily industrial entities such as steel manufacturers, ferrochrome producers, and platinum refineries. These customers are driven by the need for reliable supply, consistent quality, and competitive pricing. ARM's market analysis indicates that these clients often operate on long-term supply agreements, ensuring a stable demand for its products.

ARM's customer base is geographically diverse, with a significant presence in regions with established industrial sectors. The company tailors its B2B engagements by emphasizing its operational efficiency, adherence to international standards, and commitment to responsible mining, which are crucial for its industrial clientele.

Customers prioritize consistent quality and a dependable supply chain. This is essential for maintaining production efficiency and minimizing disruptions. ARM addresses this need through rigorous quality control and robust supply chain management.

Competitive pricing is a key factor in customer decision-making. ARM strives to offer cost-effective solutions while maintaining profitability. This involves efficient mining operations and strategic pricing models.

Increasingly, customers are demanding sustainable and ethically sourced materials. ARM is responding to this trend by focusing on responsible mining practices and transparency. This includes initiatives to reduce environmental impact and ensure ethical sourcing.

Many customers prefer long-term supply agreements to secure their raw material needs. These agreements provide stability for both ARM and its customers. This helps ARM forecast demand and manage its operations effectively.

Customers require materials that meet strict quality specifications. ARM ensures compliance through rigorous testing and quality control processes. This is particularly important for industries with precise material requirements.

Consistent delivery schedules are vital for maintaining production efficiency. ARM focuses on reliable logistics and supply chain management. This helps customers avoid disruptions and maintain their operations.

ARM's target market is segmented based on the specific needs of each industry. The primary customer segments include steel manufacturers, ferrochrome producers, and platinum refineries. These segments have distinct requirements that ARM addresses through tailored solutions.

- Steel Manufacturers: Require consistent quality and volume of iron ore.

- Ferrochrome Producers: Need high-grade chrome ore for alloy production.

- Platinum Refineries: Demand PGMs with specific purity levels.

- Sustainability Focus: There is an increasing demand for ethically sourced materials.

- Risk Mitigation: Customers seek assurance of supply to mitigate risks.

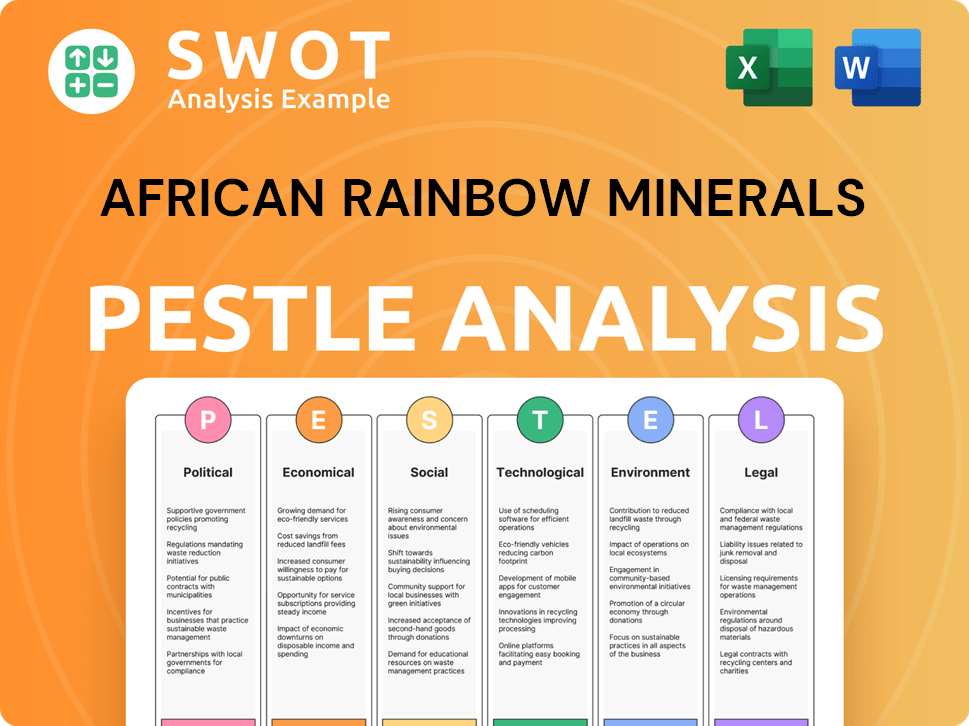

African Rainbow Minerals PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does African Rainbow Minerals operate?

The geographical market presence of African Rainbow Minerals (ARM) is primarily centered in South Africa, where its mining operations are concentrated. However, its market reach extends globally, with a diverse customer base spread across multiple continents. This is largely driven by the international demand for the minerals it produces, which are essential raw materials for various industries worldwide. The company strategically leverages its South African base to supply global markets, adapting to regional demands and regulations.

ARM's customer base includes entities from Asia, Europe, and North America, reflecting the global nature of the mining industry. The company's ability to adapt to different regional preferences and buying powers is crucial for its success. For instance, the demand for iron ore from South Africa, including that from ARM, is significantly driven by China's steel industry. Similarly, the platinum group metals (PGMs) find substantial markets in Europe and North America, particularly within the automotive sector. This global presence requires a flexible approach to sales, distribution, and customer relationship management.

The company's approach to market localization involves ensuring that its products meet international quality standards. It adapts its logistical and sales strategies to the specific needs of each region. This includes collaborating with global shipping partners and establishing long-term supply contracts. These contracts cater to diverse international regulations and trade practices. Understanding the Marketing Strategy of African Rainbow Minerals is crucial to understanding its global market approach.

China is a major consumer of South African iron ore, a key product for ARM. Europe and North America are significant markets for PGMs used in the automotive industry. ARM's customer base is diverse, spanning multiple continents.

Customer preferences vary across regions, with some prioritizing cost-effectiveness and others emphasizing quality and environmental compliance. ARM adapts its offerings to meet these diverse needs. The company ensures its products meet international quality standards.

ARM works with global shipping partners to ensure efficient distribution. It establishes long-term supply contracts tailored to international regulations. The company's distribution network effectively reaches major industrial hubs worldwide.

Recent expansions or strategic withdrawals are influenced by global commodity market dynamics. The long-term outlook for specific minerals also plays a role. ARM's strategies are shaped by these global market trends.

The target market for ARM includes industries that require its minerals, such as steel manufacturing, automotive, and others. These industries are located across the globe. ARM's customer base is diverse, spanning multiple continents.

ARM's primary mining operations are based in South Africa. Its target market's geographic location is global, including Asia, Europe, and North America. The company's sales and distribution network effectively reaches major industrial hubs across the globe.

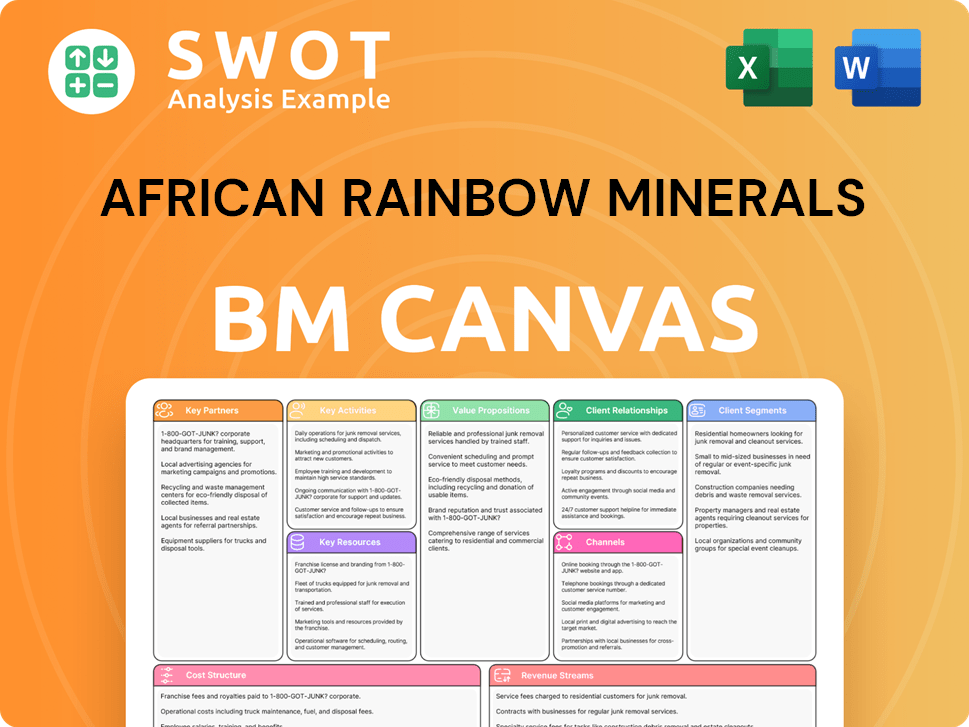

African Rainbow Minerals Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does African Rainbow Minerals Win & Keep Customers?

Customer acquisition and retention strategies for African Rainbow Minerals (ARM) in the mining industry are specialized, focusing on long-term contracts and industry relationships. Unlike consumer-facing businesses, ARM's approach centers on direct sales, participation in global tenders, and leveraging existing industry connections. These strategies are crucial for navigating the B2B landscape of the mining sector.

The company's customer acquisition strategy involves expert negotiation and demonstrating a consistent supply of high-quality mineral products. Retention efforts are centered on reliability, competitive pricing, and meeting specific client requirements. The customer relationship management (CRM) systems are key to managing large contracts and tracking global commodity prices.

Successful acquisition often involves securing long-term off-take agreements with major industrial players. Retention initiatives focus on maintaining strong relationships, proactively addressing any supply chain issues, and adapting to evolving market demands. The company's focus on operational efficiency and ESG factors is also crucial.

ARM acquires customers primarily through direct sales engagement. This involves direct interaction with major industrial buyers and commodity traders. This approach allows for tailored negotiations and the establishment of long-term supply agreements.

Participating in global commodity tenders is a key acquisition method. ARM competes in these tenders by offering competitive pricing and demonstrating its ability to consistently meet the quality and volume requirements of large-scale buyers. This is an important part of its Brief History of African Rainbow Minerals.

ARM utilizes industry conferences and trade shows as key marketing channels. These events provide opportunities to connect directly with procurement departments of major manufacturers. This allows ARM to showcase its products and services.

Retention is built on long-term contractual agreements, ensuring a consistent supply of minerals to key clients. These agreements are the foundation of ARM's business model, providing stability and predictability in revenue streams.

ARM's customer retention strategies focus on maintaining strong relationships and adapting to changing market demands. This includes operational efficiency and a strong emphasis on environmental, social, and governance (ESG) factors.

- Reliability: Consistently meeting supply commitments.

- Competitive Pricing: Offering attractive pricing to maintain long-term contracts.

- Quality Assurance: Ensuring high-quality mineral products.

- Adaptability: Responding to evolving market demands, including ESG considerations.

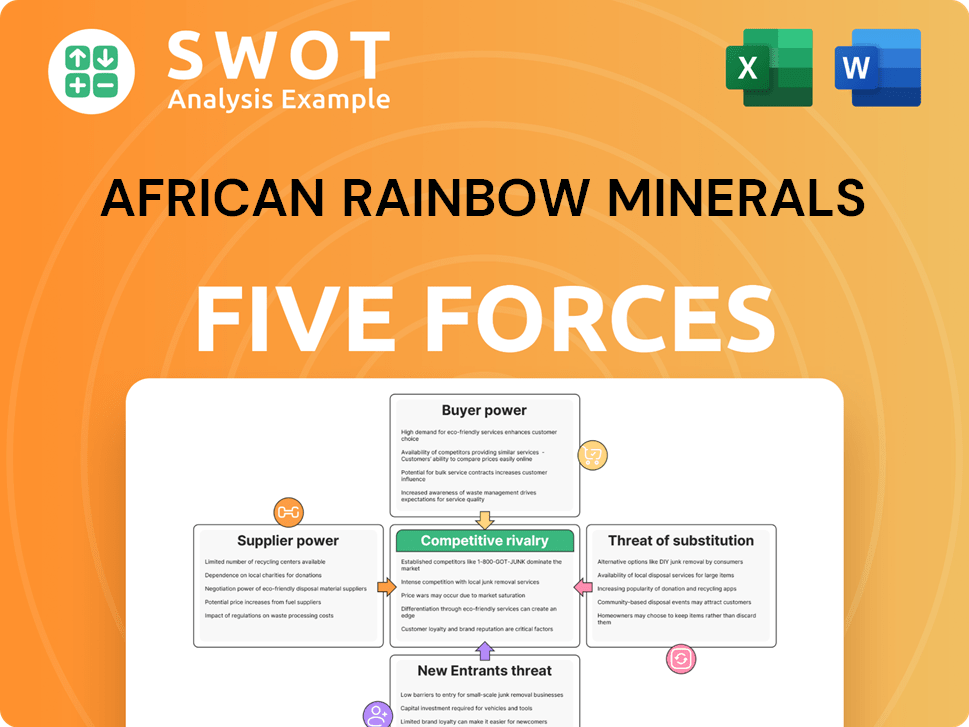

African Rainbow Minerals Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of African Rainbow Minerals Company?

- What is Competitive Landscape of African Rainbow Minerals Company?

- What is Growth Strategy and Future Prospects of African Rainbow Minerals Company?

- How Does African Rainbow Minerals Company Work?

- What is Sales and Marketing Strategy of African Rainbow Minerals Company?

- What is Brief History of African Rainbow Minerals Company?

- Who Owns African Rainbow Minerals Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.