African Rainbow Minerals Bundle

How Does African Rainbow Minerals Navigate the Global Mining Market?

African Rainbow Minerals (ARM), a key player in South Africa's mining sector, faces the dynamic challenges of the global market. Its strategic approach to sales and marketing is crucial, especially given its diverse portfolio of platinum group metals, iron ore, coal, copper, and gold. Understanding ARM's strategies is vital for anyone interested in the mining industry and investment opportunities.

This analysis delves into African Rainbow Minerals SWOT Analysis, examining its sales and marketing strategies. We'll explore how ARM adapts its ARM sales and marketing tactics to stay competitive, focusing on its financial performance and market positioning within the Mining industry in South Africa. Furthermore, we will uncover ARM's business model and how ARM's marketing campaigns and initiatives are shaping its future in a fluctuating global market, providing valuable insights into the company's approach to sales strategies for mining companies in Africa.

How Does African Rainbow Minerals Reach Its Customers?

The sales strategy of African Rainbow Minerals (ARM) centers on direct sales channels, catering primarily to industrial buyers and commodity traders worldwide. This approach is fundamental to the mining sector, where long-term relationships and direct contracts are crucial. ARM's sales and marketing efforts are deeply intertwined with its operational structure, ensuring a streamlined process from extraction to delivery.

ARM's sales are mainly facilitated through direct contracts and supply agreements for its diverse portfolio of minerals. These include iron ore, manganese ore, chrome ore, platinum group metals (PGMs), nickel, and coal. The company's strategic investments, such as its stake in Assmang, further strengthen its position within established supply chains. The Competitors Landscape of African Rainbow Minerals highlights the importance of these direct sales strategies within the competitive mining environment.

The performance of these sales channels is directly linked to global commodity demand and prices, significantly impacting sales revenue. For example, the average realized US dollar iron ore prices decreased by 22% in the six months ended December 31, 2024, which, along with lower sales volumes, contributed to a decrease in headline earnings.

ARM primarily uses direct sales channels, which are essential for the mining industry. This model allows for direct contracts and supply agreements with major industrial consumers. The focus is on building long-term relationships and ensuring a stable market for its mineral products.

ARM's diverse portfolio includes iron ore, manganese ore, chrome ore, PGMs, nickel, and coal. The company's sales strategy is tailored to each mineral, with specific agreements in place to meet the needs of different customers. This diversification helps to mitigate risks associated with fluctuations in demand for any single commodity.

Global commodity demand and prices have a direct impact on ARM's sales revenue. Factors like the average realized rand exchange rate and international commodity prices significantly affect financial performance. The company closely monitors these market dynamics to adapt its sales strategies effectively.

ARM's strategic investments, such as its stake in Assmang, solidify its position within established supply chains. These investments enhance the company's ability to manage costs and maximize value from existing agreements. They also contribute to market share stability in a cyclical industry.

ARM's sales strategy focuses on optimizing logistics and supply chain efficiencies to manage costs and maximize value. This includes managing costs and maximizing value from existing agreements. The company’s approach involves long-term contracts with major industrial consumers.

- Direct Contracts: Establishing direct contracts with key industrial consumers ensures a stable market for minerals.

- Supply Chain Optimization: Focus on logistics and supply chain efficiencies is crucial for managing costs.

- Market Dynamics: Monitoring global commodity demand and prices is essential for adapting sales strategies.

- Strategic Investments: Investments like the stake in Assmang strengthen supply chains and market position.

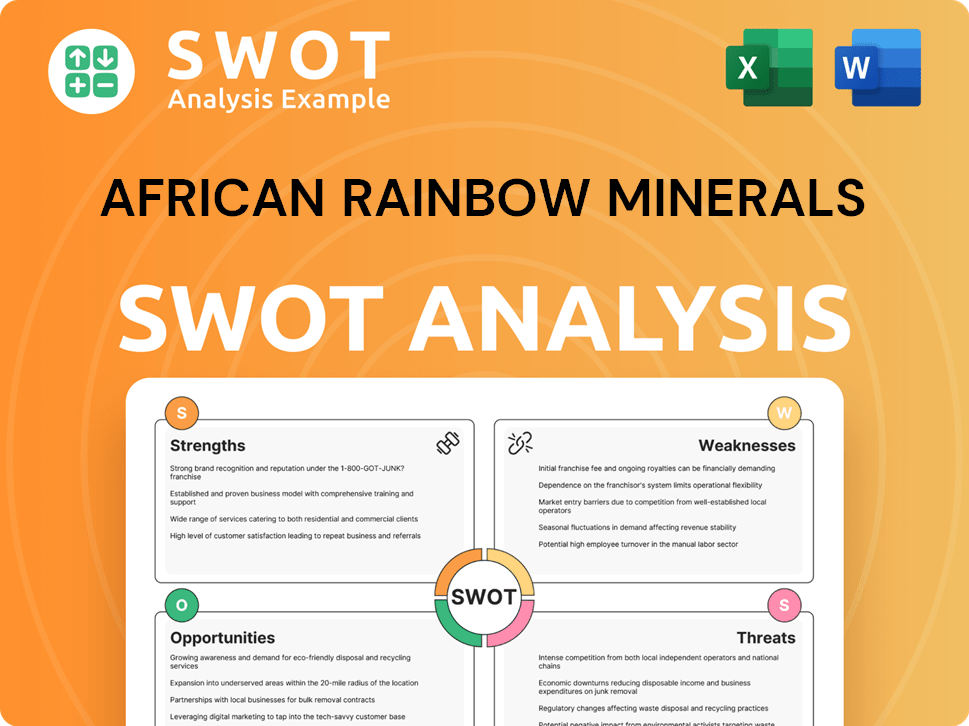

African Rainbow Minerals SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does African Rainbow Minerals Use?

The marketing tactics of African Rainbow Minerals (ARM) are primarily business-to-business (B2B) focused, prioritizing investor relations, corporate communication, and sustainability reporting. The company's approach aims to build awareness and generate interest among investors, analysts, and other stakeholders. This strategy is crucial in the mining industry, where transparency and trust are paramount for attracting investment and maintaining a positive reputation.

ARM's marketing efforts center around transparent financial reporting and strategic communication. Key digital tactics include a comprehensive company website that serves as a central hub for information. Traditional media engagement involves press releases and announcements to the Johannesburg Stock Exchange (JSE) and financial news outlets. This ensures compliance and keeps the market informed about financial results and operational updates.

While traditional advertising is not typical for a mining company, ARM engages in stakeholder engagement, such as the launch of the UP-ARM Virtual Conference Centre with the University of Pretoria in October 2024. This indirectly enhances its reputation and access to future expertise. Data-driven marketing is also employed, focusing on environmental, social, and governance (ESG) performance to appeal to socially responsible investors.

A comprehensive company website is maintained, providing easy access to integrated annual reports, financial statements, and ESG reports. This is a key component of ARM's digital marketing strategy. The website serves as a central hub for information for investors and financial professionals.

ARM focuses heavily on investor relations. This includes regular communication through press releases and announcements to the JSE. The company aims to build and maintain trust with investors through transparent and timely information.

ARM emphasizes environmental, social, and governance (ESG) performance in its marketing. This includes data on water recycling, energy consumption, and community development investments. This data is crucial for attracting socially responsible investors.

ARM engages with academic institutions and other stakeholders to enhance its reputation and access future expertise. This includes initiatives like the UP-ARM Virtual Conference Centre. These efforts indirectly boost the company's brand.

Regular financial reporting is a cornerstone of ARM's marketing strategy. This includes reporting on financial results and dividend declarations. This ensures compliance with listing requirements and keeps the market informed.

ARM likely uses technology platforms and analytics tools internally for operational optimization and financial analysis. This helps improve efficiency and supports data-driven decision-making. This is part of the ARM business model.

ARM's marketing strategy is tailored to the mining industry's specific needs, emphasizing transparency and stakeholder engagement. The company's approach focuses on building trust and attracting investment through detailed financial reporting and strategic communication. For more insights, check out the Owners & Shareholders of African Rainbow Minerals.

- Digital Communication: Maintaining a comprehensive website with readily available reports and financial statements.

- Investor Relations: Regular press releases and announcements to the JSE and financial news outlets.

- ESG Focus: Reporting on environmental, social, and governance performance to attract socially responsible investors.

- Stakeholder Engagement: Collaborating with academic institutions and other stakeholders.

- Data-Driven Approach: Utilizing technology and analytics for operational efficiency and financial analysis.

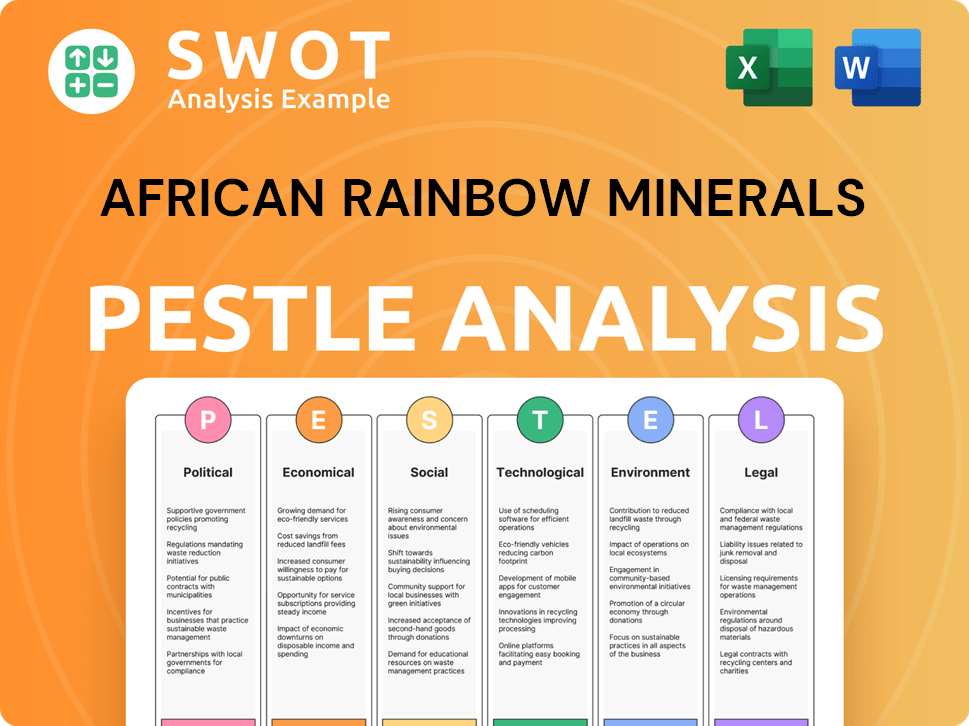

African Rainbow Minerals PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is African Rainbow Minerals Positioned in the Market?

African Rainbow Minerals (ARM) positions itself as a leading diversified mining company in South Africa. Its brand emphasizes a commitment to sustainable value creation and responsible mining practices. This approach is central to its sales and marketing strategy, aiming to build trust with investors and stakeholders.

The core message of ARM revolves around responsible mining and beneficiation, focusing on zero harm to employees, communities, and the environment. This is supported by detailed Environmental, Social, and Governance (ESG) reports. These reports outline the company's performance on key environmental, social, and governance matters, reinforcing its commitment to responsible practices.

ARM differentiates itself through its diversified portfolio, which includes platinum group metals (PGMs), iron ore, manganese ore, chrome ore, nickel, coal, and a strategic investment in gold through Harmony Gold Mining Company Limited. This diversification is presented as a key strength, allowing the company to remain resilient in volatile market conditions, as highlighted in its F2024 review. The company's focus on long-term value, financial stability, and responsible corporate citizenship appeals to its target audience, primarily investors and financial stakeholders.

ARM's diversified portfolio includes PGMs, iron ore, manganese ore, chrome ore, nickel, coal, and a strategic investment in gold through Harmony Gold Mining Company Limited. This diversification strategy aims to provide resilience against market volatility.

Despite a 49% decrease in headline earnings for the six months ended December 31, 2024, ARM maintained a strong financial position with net cash of R6,073 million. This demonstrates the company's financial stability and ability to navigate challenging market conditions.

ARM is prioritizing sustainability initiatives, such as the construction of a 100 MW solar PV facility for ARM Platinum, expected to deliver its first power in August 2025. This initiative aims to reduce operational costs and carbon emissions.

ARM demonstrates its commitment to community development by investing R764 million in community development over the last five years. Additionally, the company has improved Historically Disadvantaged South African (HDSA) representation in management to 73% in F2024.

ARM's brand positioning is built on several key elements that shape its sales and marketing strategy.

- Diversification: A diversified portfolio across various commodities provides resilience.

- Sustainability: A strong focus on ESG factors and environmental initiatives.

- Financial Stability: Maintaining a robust financial position, even during market downturns.

- Community Engagement: Investments in community development and HDSA representation.

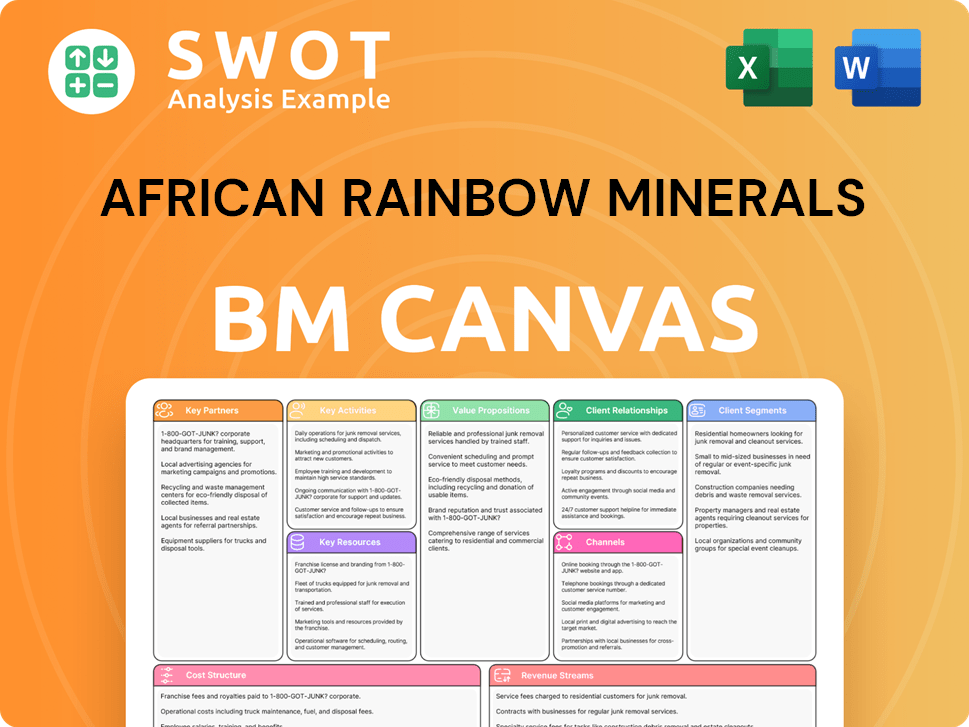

African Rainbow Minerals Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are African Rainbow Minerals’s Most Notable Campaigns?

For a company like African Rainbow Minerals, the focus of its sales and marketing strategy extends beyond traditional consumer-facing campaigns. Instead, it centers on strategic initiatives designed to enhance operational efficiency, attract investors, and build a strong reputation within the mining industry in South Africa. These initiatives are crucial for ARM's business model and overall financial performance.

The company's approach emphasizes long-term value creation through sustainable practices and community engagement. This strategy aims to secure a 'social license to operate' and build climate resilience. This approach supports ARM's market share and strengthens its relationship with customers.

The following sections detail key campaigns that showcase ARM's approach to sales and marketing, emphasizing strategic initiatives and investor relations efforts.

ARM's strategic focus on renewable energy integration and sustainability is a key campaign. The main objective is to improve operational efficiency, reduce reliance on the national grid, lower electricity costs, and significantly decrease its carbon footprint. This also serves to attract environmentally conscious investors.

The core concept revolves around ARM's commitment to sustainable mining. Information is disseminated through official company reports, investor presentations, and news releases to financial media. The construction of ARM Platinum's 100 MW solar PV facility, expected to generate first power in August 2025, is a tangible demonstration of this commitment.

The initiative is expected to curb operational costs and reduce carbon emissions. This strategic investment is aimed at long-term value creation and strengthening ARM's competitive advantage. This is a key aspect of ARM's sales and marketing strategy.

Another significant campaign focuses on community engagement and socio-economic development initiatives. The objectives are to foster positive relationships with host communities and contribute to local socio-economic development. This is a crucial part of the Brief History of African Rainbow Minerals.

ARM positions itself as a responsible corporate citizen investing in the well-being of communities. This is communicated through the ESG report, community engagement programs, and partnerships. Over the last five years, ARM operations invested R764 million in community development and R1.4 billion in training initiatives.

These initiatives aim to improve community resilience, provide employment opportunities, and enhance skills development. In F2024, ARM employed 23,369 employees and contractors and improved Historically Disadvantaged South African (HDSA) representation in management to 73%. Strong community relations are crucial for the long-term viability of mining operations. This is a key factor in ARM's sales and revenue analysis.

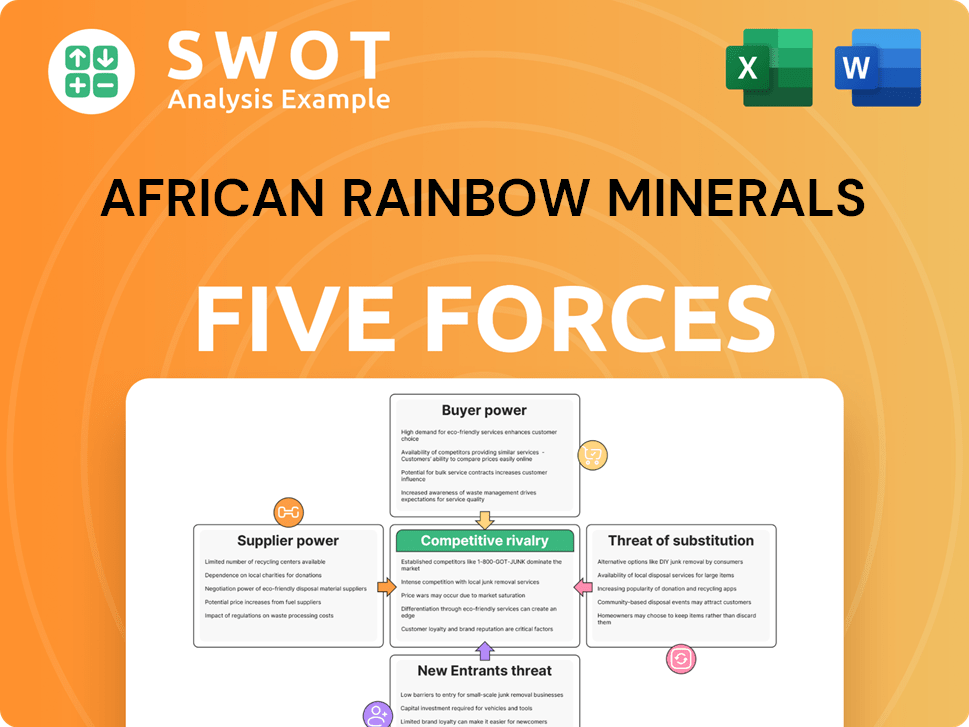

African Rainbow Minerals Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of African Rainbow Minerals Company?

- What is Competitive Landscape of African Rainbow Minerals Company?

- What is Growth Strategy and Future Prospects of African Rainbow Minerals Company?

- How Does African Rainbow Minerals Company Work?

- What is Brief History of African Rainbow Minerals Company?

- Who Owns African Rainbow Minerals Company?

- What is Customer Demographics and Target Market of African Rainbow Minerals Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.