Costco Wholesale Bundle

What Makes Costco Wholesale a Retail Powerhouse?

Costco Wholesale (COST) stands out in the retail world, achieving remarkable financial results, including $249.6 billion in net sales in fiscal year 2024. With a massive membership base of nearly 137 million cardholders and a 90% renewal rate, Costco demonstrates exceptional customer loyalty and market dominance. This success stems from its unique Costco Wholesale SWOT Analysis, strategic approach, and commitment to providing value.

Understanding the Costco business model is key to appreciating its success, especially when considering questions like "How does Costco make money?" and "Is Costco membership worth it?". Costco offers a wide array of Costco products at competitive prices, driving high sales volume and fostering strong customer relationships. Exploring Costco benefits, including its low prices and diverse offerings, provides valuable insights for both consumers and investors alike, making it a fascinating case study in retail strategy.

What Are the Key Operations Driving Costco Wholesale’s Success?

The core of Costco Wholesale's operations revolves around a membership-based warehouse model, offering a curated selection of high-quality, bulk products at competitive prices. This approach allows the company to attract a loyal customer base seeking significant savings on a wide range of items, from groceries and electronics to apparel and home goods. The value proposition extends beyond just products, encompassing services like optical, pharmacy, and travel, enhancing the overall member experience and driving customer loyalty.

Operational efficiency is a cornerstone of the Costco business model. By streamlining processes and leveraging its buying power, Costco keeps costs low. This includes an efficient supply chain, strategic product selection, and a strong distribution network across numerous global locations. The company's commitment to its employees, offering competitive wages and benefits, also contributes to a stable and dedicated workforce, which in turn enhances the customer experience.

This operational excellence, coupled with a focus on customer satisfaction and strategic product selection, differentiates Costco from competitors. For example, the growth in e-commerce sales, which reached 13.2% in Q1 2025, demonstrates the success of its omnichannel strategy. This strategy includes partnerships with delivery services, such as Instacart. This translates into tangible customer benefits and market differentiation, solidifying Costco’s position in the retail landscape.

Costco's supply chain is highly efficient, allowing it to negotiate favorable terms with suppliers. This efficiency helps minimize costs and maintain competitive pricing. The focus on bulk buying and high-volume sales further supports this streamlined approach.

Costco carefully curates its product offerings, focusing on the most productive items. This limited selection approach helps with inventory management and allows the company to bring goods to market in high volumes. The Kirkland Signature private label also plays a key role.

The Costco membership model is central to its value proposition. Members pay an annual fee to access exclusive deals. This model fosters customer loyalty and provides a reliable revenue stream, contributing to the company's financial stability.

Costco has successfully implemented an omnichannel strategy, including both brick-and-mortar stores and e-commerce platforms. This strategy is supported by strategic partnerships with delivery services like Instacart. In Q1 2025, e-commerce sales grew by 13.2%, outpacing brick-and-mortar sales growth of 7.1%.

Costco offers several benefits to its members, making the membership worth the cost. These benefits include access to bulk products at discounted prices, a wide range of services, and a positive shopping experience.

- Competitive Pricing: Costco offers low prices on a variety of products.

- Exclusive Products: The Kirkland Signature brand provides high-quality products at competitive prices.

- Additional Services: Costco provides services such as optical, pharmacy, and travel.

- Customer Experience: Costco is known for its customer-friendly policies and services.

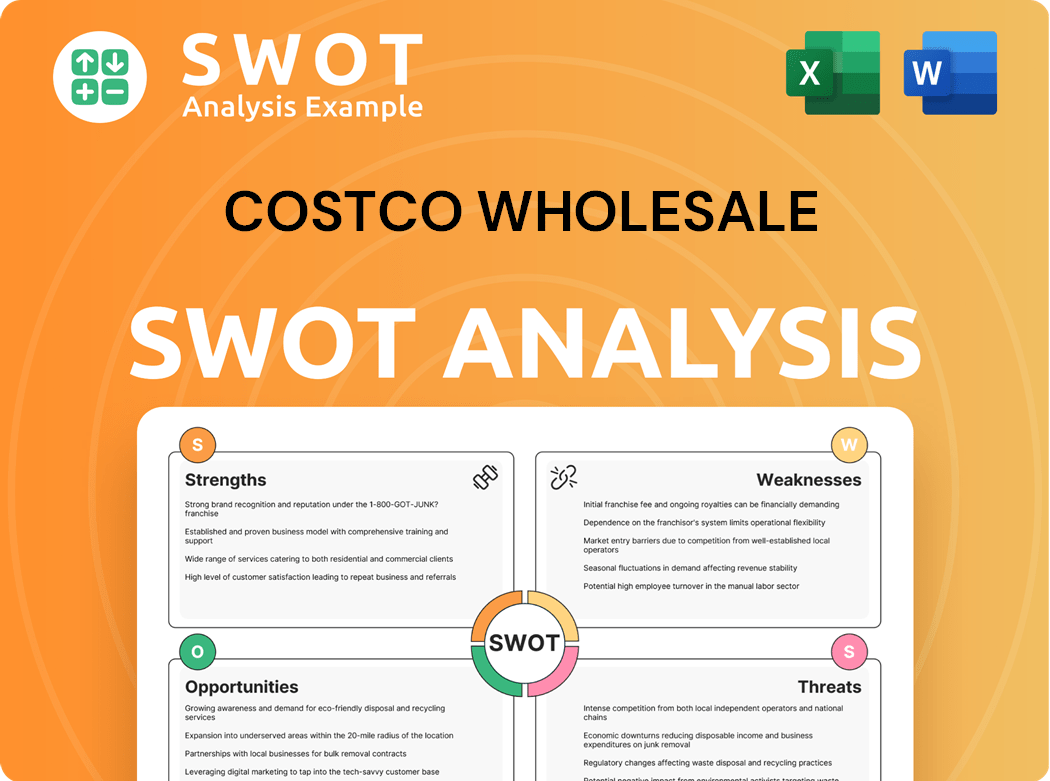

Costco Wholesale SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Costco Wholesale Make Money?

The revenue streams and monetization strategies of Costco Wholesale are centered around product sales and membership fees. This dual approach allows Costco to maintain competitive pricing on its products while generating a stable income stream from its membership base. This business model has proven successful, driving consistent growth and customer loyalty.

In fiscal year 2024, Costco's net sales reached $249.6 billion, marking a 5% increase from the previous year. For the twelve months ending February 28, 2025, revenue was $264.086 billion, a 6.13% year-over-year increase. This growth reflects the company's strong performance in product sales and its ability to attract and retain customers.

Membership fees are a critical component of Costco's financial strategy, providing a predictable source of revenue. In fiscal 2024, membership fees increased by 5% to $4.8 billion. The recent increase in membership fees, with the basic Gold Star membership rising to $65 and the Executive membership to $130, is expected to further boost future operating income.

The core of Costco's revenue model involves two main streams: product sales and membership fees. The company's ability to offer low prices on Costco products is a key factor in attracting and retaining members. Furthermore, Costco is exploring new avenues for revenue generation, such as retail media and personalized promotions.

- Product Sales: In Q3 2025, net sales contributed $61.97 billion to the total revenue of $63.20 billion, an 8.0% increase compared to the same period last year.

- Membership Fees: In Q3 2025, membership fees generated $1.24 billion. The Executive membership, which offers a 2% reward, has a high renewal rate of 91% in Q1 2025, demonstrating strong customer satisfaction and retention.

- Gasoline Sales: Gasoline sales accounted for approximately 12% of total net sales in fiscal 2024, highlighting their significance. Costco gas prices often attract customers.

- E-commerce: E-commerce operations contributed approximately 7% to total net sales in 2024, with an 18.9% increase in e-commerce sales reported in Q4 2024. Costco online shopping is growing.

- Retail Media: The company is beginning to work with brand partners on digital advertising campaigns and testing personalized promotions through digital communications.

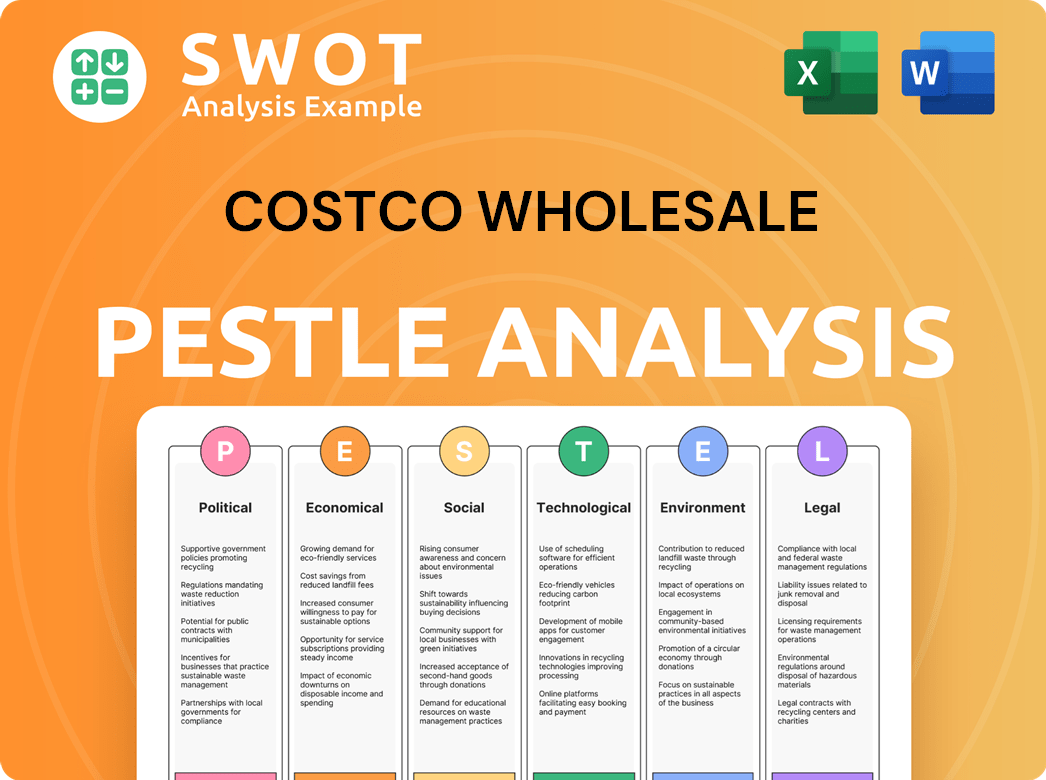

Costco Wholesale PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Costco Wholesale’s Business Model?

The operational and financial trajectory of the retailer has been shaped by several key milestones and strategic initiatives. A notable move in fiscal year 2024 was the increase in employee wages across the U.S., Canada, and other regions. This investment in its workforce is a strategic move to maintain a stable and loyal employee base, which is a key competitive advantage. Furthermore, in September 2024, the company implemented its first membership fee increase since 2017, raising the basic Gold Star membership to $65 and the Executive membership to $130, a strategic decision expected to significantly boost operating income.

The company continues its aggressive expansion strategy, with plans to open 28 new warehouses in fiscal year 2025. This includes six immediate openings in the U.S. and a milestone 900th location in Sharon, Massachusetts. This global expansion, with approximately 30% of its nearly 900 warehouses outside the U.S., has diversified revenue bases and buffered the company from localized downturns. The company has also made strategic investments in enhancing its e-commerce platform. This includes new app features for checking local warehouse inventory and expanding its online marketplace, Costco Next.

The company's competitive advantages are rooted in its membership-driven model, which provides a predictable revenue stream and fosters high customer loyalty, with a renewal rate of 92.7% in the U.S. in 2024. Its ability to offer high-quality bulk goods at competitive prices, often at razor-thin margins, is sustained by efficient inventory management, superior supply chain management, and significant bulk buying power. The Kirkland Signature private label brand further strengthens customer loyalty by offering quality products at lower prices than national brands. The company's disciplined cost structure and focus on passing savings to members further reinforce its value proposition. Costco has also adapted to changing consumer behaviors by tightening membership verification systems and requiring memberships for food court purchases, effective April 2024, to preserve the value of paid memberships.

The company has made significant strategic moves to strengthen its market position. These include wage increases for employees, membership fee adjustments, and aggressive warehouse expansion. These moves are designed to enhance customer loyalty and improve profitability.

The company is investing in its e-commerce platform to meet evolving consumer demands. This includes new app features for inventory checks and expanding its online marketplace. These enhancements aim to boost online sales and improve the overall customer experience.

The company's membership model is a cornerstone of its business strategy. It provides a predictable revenue stream and fosters high customer loyalty. The high renewal rates demonstrate the value that members place on their memberships.

The company's competitive advantages include its membership model, high-quality bulk goods, and the Kirkland Signature brand. Efficient inventory management and a disciplined cost structure also contribute to its success. For more insights, explore the Competitors Landscape of Costco Wholesale.

The company's financial performance is marked by key metrics that reflect its strategic initiatives and market position. These figures highlight the company's growth and customer loyalty.

- Membership Renewal Rate: 92.7% in the U.S. in 2024.

- E-commerce Sales Growth: 18.9% increase in Q4 2024 and 13.2% growth in Q1 2025.

- Planned Warehouse Openings: 28 new warehouses in fiscal year 2025.

- Membership Fee Increase: Basic Gold Star membership to $65, Executive membership to $130.

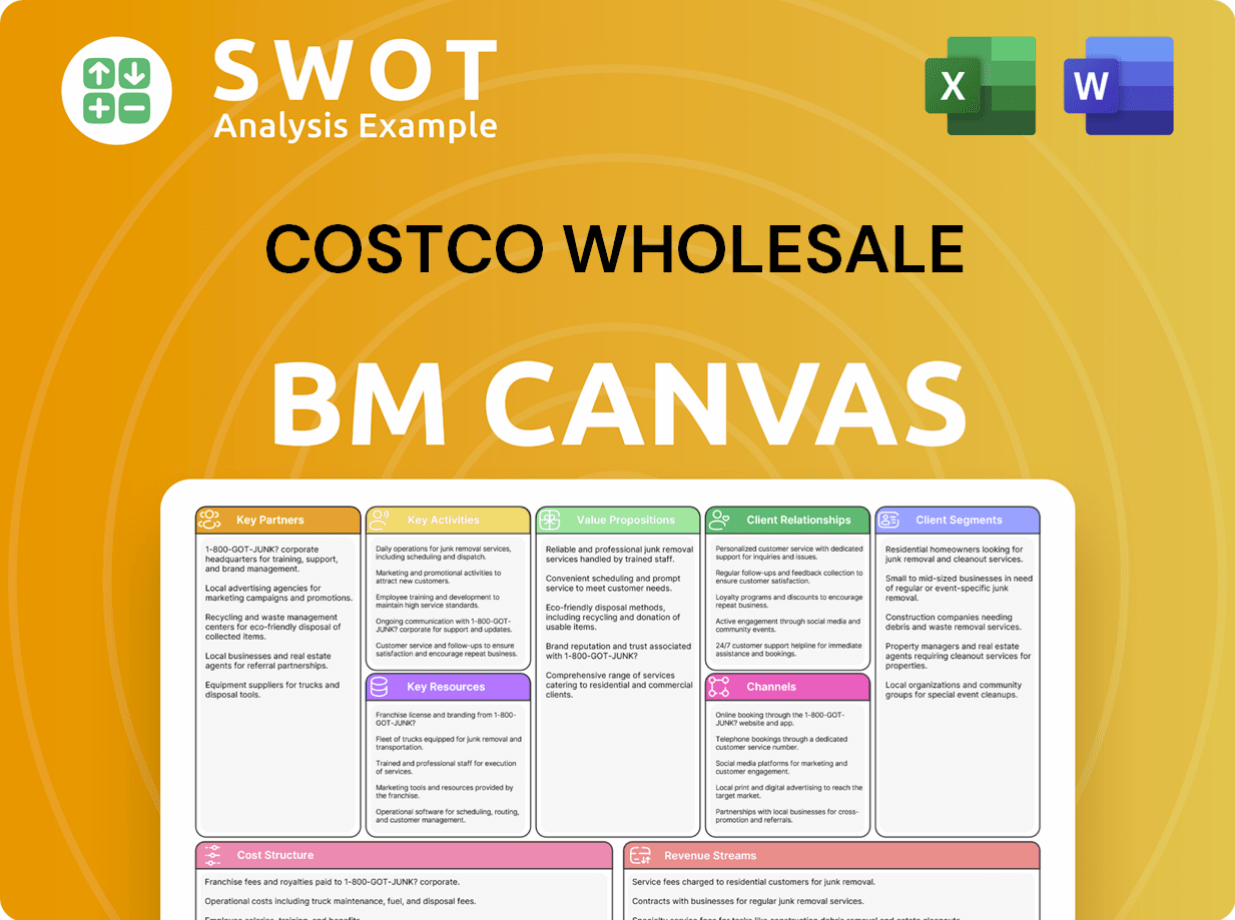

Costco Wholesale Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Costco Wholesale Positioning Itself for Continued Success?

As of August 2024, Costco Wholesale holds a dominant position in the wholesale club market, with a 55.5% market share. This strong market presence is a testament to its successful business model, which focuses on providing high-quality products at competitive prices. The company's commitment to value has cultivated exceptional customer loyalty, making it a resilient player in the retail landscape.

Costco's global presence includes 905 warehouses worldwide as of May 2025, with 86% located in North America. The company's robust membership model, exemplified by a 92.7% renewal rate in the U.S. and a 90% global renewal rate in fiscal 2024, further solidifies its market position. The Marketing Strategy of Costco Wholesale has also played a significant role in its success.

Costco faces risks from inflationary pressures and supply chain disruptions, which could impact profit margins. The competitive retail landscape, including rivals like Amazon, poses a continuous challenge to maintaining its competitive differentiation. Regulatory changes and potential political pressures also represent reputational risks.

Costco is well-positioned for sustained growth, planning to open 28 new warehouses in fiscal year 2025. Strategic investments in technology and supply chain improvements are expected to support long-term growth objectives. The company's focus on optimizing member value and expanding the Kirkland Signature brand is expected to sustain profitability.

Costco's online sales were only 7% of net sales in fiscal 2024, which is lower than some competitors. This could make its general merchandise more susceptible to online competition. The company anticipates capital expenditures of approximately $5 billion for fiscal 2025, primarily for new warehouses.

- Inflation and supply chain issues could affect margins.

- Competition from online retailers like Amazon is a constant challenge.

- Regulatory changes and political pressures could pose reputational risks.

- Expansion plans include opening approximately 30 warehouses annually in the coming years.

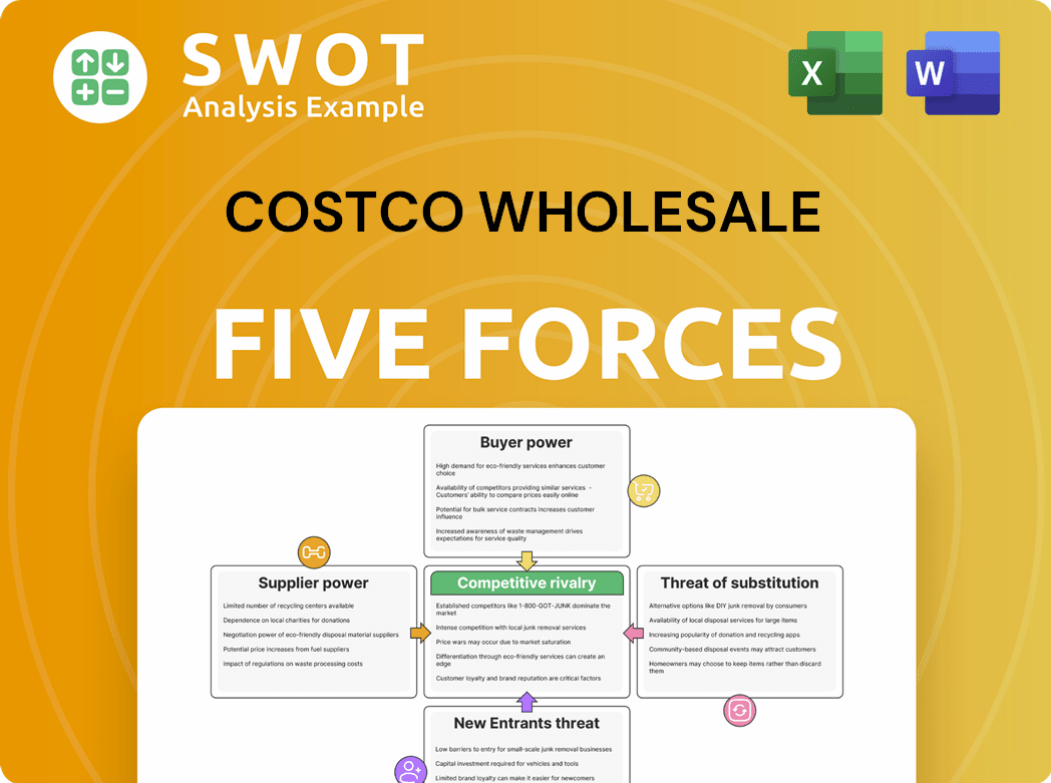

Costco Wholesale Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Costco Wholesale Company?

- What is Competitive Landscape of Costco Wholesale Company?

- What is Growth Strategy and Future Prospects of Costco Wholesale Company?

- What is Sales and Marketing Strategy of Costco Wholesale Company?

- What is Brief History of Costco Wholesale Company?

- Who Owns Costco Wholesale Company?

- What is Customer Demographics and Target Market of Costco Wholesale Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.