Equity Bank Bundle

How is Equity Bank Redefining Banking in the Heartland?

Equity Bancshares, Inc., through its subsidiary Equity Bank, is making waves in the financial sector across Kansas, Missouri, Oklahoma, and Arkansas. Offering a comprehensive suite of financial services to both businesses and individuals, Equity Bank positions itself as a community bank. They provide high-quality, relationship-based customer service alongside sophisticated financial solutions.

Equity Bank's impressive Q1 2025 performance, with revenue exceeding expectations and a strategic merger with NBC Corp, highlights its commitment to growth. This success underscores the importance of understanding Equity Bank SWOT Analysis, its operational model, and revenue generation for investors and industry observers. Delving into Equity Bank operations reveals how it navigates the competitive landscape and builds long-term value.

What Are the Key Operations Driving Equity Bank’s Success?

Equity Bank, part of Equity Group Holdings, delivers value through a wide range of financial solutions tailored for both businesses and individuals. Its core operations include providing deposit accounts, various loans (commercial, consumer, and mortgage), trust and wealth management, and treasury management services. The bank focuses on building strong customer relationships and actively supports the communities it serves.

Operationally, Equity Bank leverages technology to boost efficiency and achieve economies of scale, enabling it to serve a broad customer base, including the mass market. This tech integration allows for effective management of a large volume of accounts and transactions, giving it a competitive edge in attracting low-cost deposits, which many competitors struggle to match. The bank's operational processes encompass technology development for its digital platforms, efficient sales channels, and dedicated customer service.

Equity Bank's value proposition is built on a blend of customized, sophisticated financial solutions and a traditional, community-focused approach. This hybrid model allows it to offer a wide array of products and services, including savings and current accounts, cards, investment opportunities, brokerage, and insurance. The bank's ability to adapt to changing customer demands and leverage technology for improved service delivery, such as through online platforms and mobile banking, further differentiates it in the market, leading to significant customer benefits. For more information, you can check out this article about the Equity Bank operations.

Equity Bank provides various financial products, including deposit accounts, loans, and wealth management services. These services cater to both individual and business needs, ensuring a broad market reach. The bank's offerings are designed to be comprehensive and adaptable to evolving customer demands.

Equity Bank uses technology to enhance its operational efficiency. This includes digital platforms and efficient sales channels. This allows the bank to manage a large volume of transactions while keeping costs down.

The bank emphasizes building strong relationships with its customers. It provides dedicated customer service and support. This approach helps in retaining customers and attracting new ones.

Equity Bank actively supports the communities it serves. This includes various corporate social responsibility initiatives. Such initiatives enhance the bank's reputation and foster goodwill.

Equity Bank differentiates itself through a hybrid model that combines customized financial solutions with a community-focused approach. This allows it to offer a wide array of products and services, including savings and current accounts, cards, investment opportunities, brokerage, and insurance. The bank's ability to adapt to changing customer demands and leverage technology for improved service delivery, such as through online platforms and mobile banking, further differentiates it in the market.

- Technology Integration: Equity Bank's digital banking platform and mobile banking app, which includes features like mobile money transfers and bill payments, have seen significant growth.

- Customer Service: The bank focuses on providing excellent customer service through various channels, including branches, online platforms, and customer care centers.

- Community Engagement: Equity Bank actively engages in corporate social responsibility initiatives, supporting education, health, and environmental sustainability.

- Financial Performance: In recent financial reports, Equity Group Holdings has demonstrated strong financial performance, with increased profits and customer deposits.

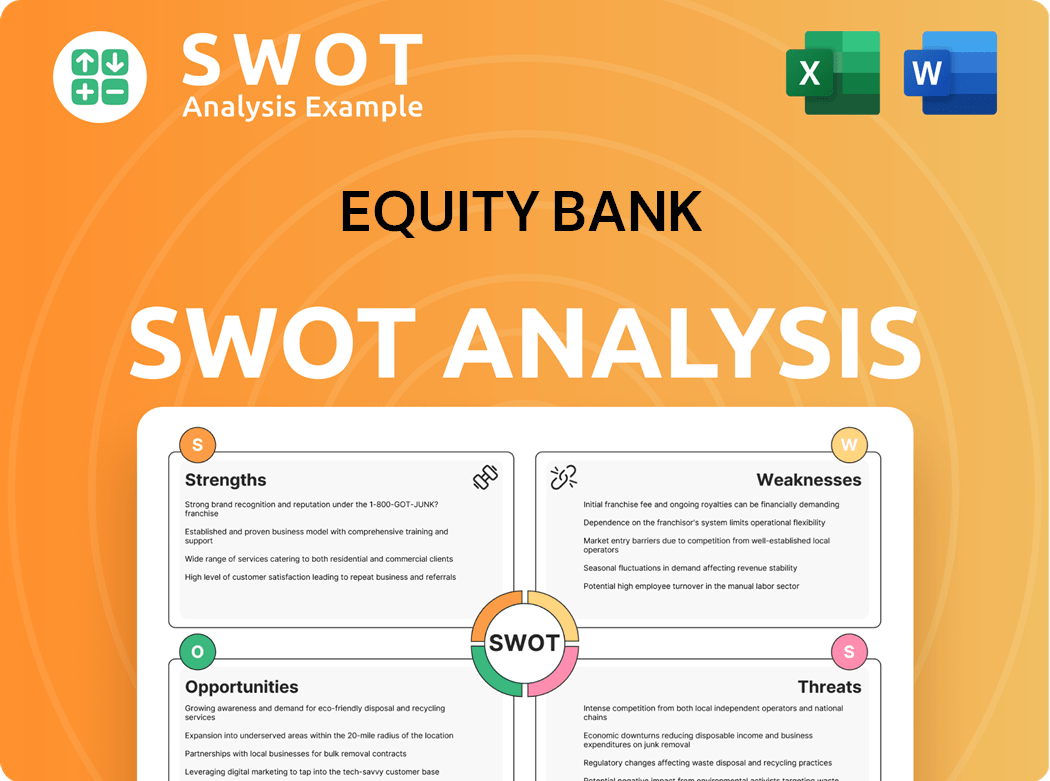

Equity Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Equity Bank Make Money?

Equity Bank, a prominent player in the African financial landscape, generates revenue through a diverse range of financial products and services. The bank's operations are primarily fueled by interest income and non-interest income, which are key drivers of its financial performance. Understanding these revenue streams is crucial for assessing Equity Bank's overall financial health and strategic direction.

The bank's monetization strategies involve offering bundled services, tiered pricing, and cross-selling across its diverse product lines. Equity Bank also actively engages with Small and Medium Enterprises (SMEs) through initiatives like 'Tupange Business Ne Equity' to promote economic growth. These strategies are designed to maximize revenue generation and enhance customer engagement.

For the full year ended December 31, 2024, Equity Group Holdings Plc reported a 9.2% increase in total interest income, reaching KES 170.3 billion. This growth was due to a 5.3% increase in interest income from loans and advances and a 9.9% rise in government securities income. Additionally, interest income from deposits and placements with banking institutions surged by 194.7%, from KES 1.9 billion in FY 2023 to KES 5.5 billion in FY 2024. Non-interest income increased by 10.7% to KES 85.1 billion in FY 2024, supported by higher lending fees. Overall, total revenue grew by 6.7% to KES 193.8 billion in FY 2024.

Equity Bank's revenue model is built on several key pillars. The bank leverages both traditional and digital channels to generate income and enhance customer value. The bank's digital channels now process 87% of all transactions, with the Equity Mobile App and USSD handling 39.5 million transactions valued at KSh 942.7 billion in Q1 2025. The bank's focus on digital transformation and customer-centric services is further detailed in an article about the Target Market of Equity Bank.

- Net Interest Income: This is the primary revenue source, derived from the difference between interest earned on loans and interest paid on deposits. In Q1 2025, net interest income rose by 3% to KES 28.6 billion.

- Non-Funded Income: This includes fees and commissions from various services such as transaction fees, forex trading, and other banking services. Non-interest income increased by 10.7% to KES 85.1 billion in FY 2024.

- Digital Banking: Equity Bank's digital platforms, including the Equity Mobile App and USSD, are significant revenue drivers. These channels facilitate a large volume of transactions.

- SME Initiatives: Programs like 'Tupange Business Ne Equity' are designed to support SMEs, driving economic activity and generating revenue through various financial products and services.

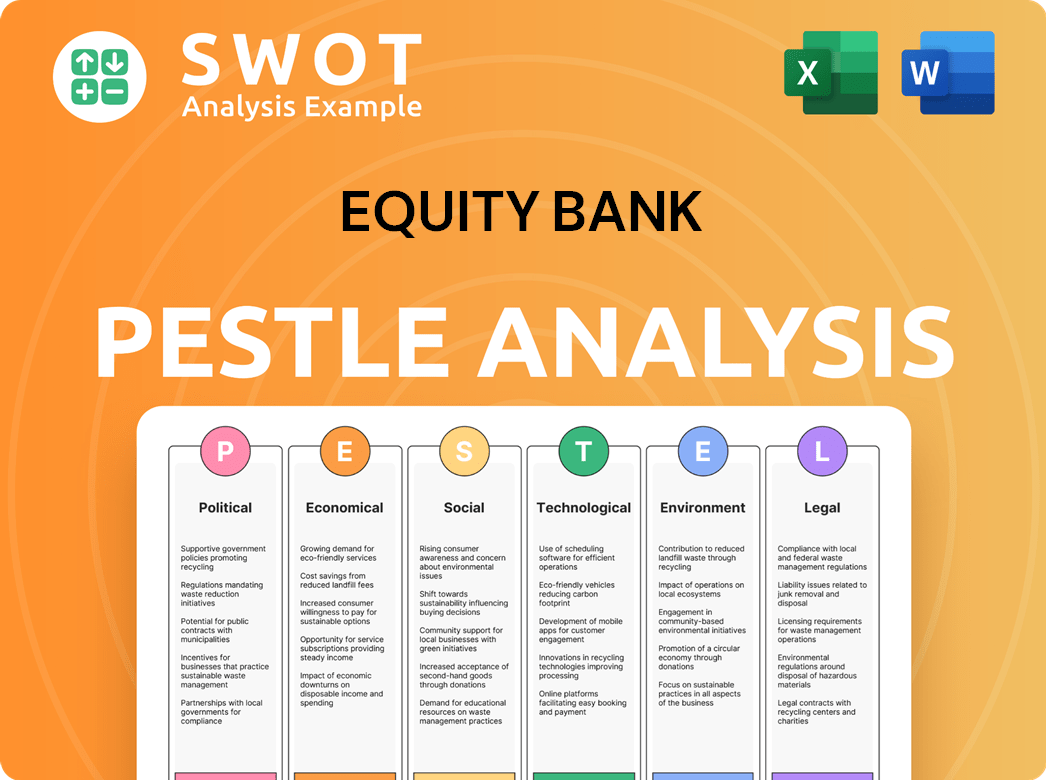

Equity Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Equity Bank’s Business Model?

Equity Bank, a prominent player in the financial sector, has significantly shaped the landscape of Banking in Kenya and beyond through strategic initiatives and a commitment to financial inclusion. The bank's journey is marked by key milestones and strategic shifts that have fueled its growth and solidified its position in the market. These moves have enabled it to serve a vast customer base and maintain a competitive edge in a dynamic industry.

A pivotal transformation occurred in 1994 when the bank transitioned from a mortgage provider to a microfinance institution. This strategic pivot addressed the lack of financial services among the unbanked population in Kenya, laying the foundation for its extensive customer base. This focus on financial inclusion has been a cornerstone of Equity Bank's strategy, enabling it to reach a broad segment of the population and foster economic empowerment. Recent strategic moves, such as the announced partnership with NBC Oklahoma in April 2025, highlight its commitment to expansion and innovation.

Equity Bank's financial performance in 2025 reflects its strong market position and effective strategies. The company reported a net income of $15 million, or $0.85 per diluted share, in the first quarter of 2025. This financial success was driven by net interest margin expansion and an annualized loan growth of 15.2%, demonstrating its ability to generate robust returns and sustain growth. These figures underscore the bank's financial health and its capacity to capitalize on market opportunities.

Equity Bank's evolution includes a strategic shift in 1994 from a mortgage provider to a microfinance institution, crucial for its expansion. By the end of 2020, the bank had grown to over 10 million customers, showcasing its impact. The partnership with NBC Oklahoma in April 2025 marks a recent strategic move.

The 1994 transition to microfinance was a key strategic move, focusing on financial inclusion. The partnership with NBC Oklahoma in April 2025 is aimed at expanding its Oklahoma franchise. These moves are part of a broader strategy to enhance its market presence and service offerings.

Equity Bank's early technology adoption has provided process efficiencies and economies of scale. The bank emphasizes a variety of products, high technology levels, and strong customer care. Digital transformation, with 86% of transactions processed digitally in FY 2024, further strengthens its edge.

In the first quarter of 2025, the company reported a net income of $15 million, or $0.85 per diluted share. This was driven by net interest margin expansion and an annualized loan growth of 15.2%. These figures highlight the bank's financial health and growth potential.

Equity Bank's competitive advantages are rooted in its early adoption of technology, which has led to process efficiencies and a low-cost deposit base. The bank's focus on providing a variety of products, high levels of technology, competent staff, attractive interest rates, and strong customer care further enhances its market position.

- Early adoption of technology for process efficiencies and economies of scale.

- Diversified product offerings and expanded branch/regional presence.

- Innovative strategies, including Equitel SIM cards and 'blue ocean strategies'.

- Emphasis on digital transformation, with 86% of transactions processed digitally in FY 2024.

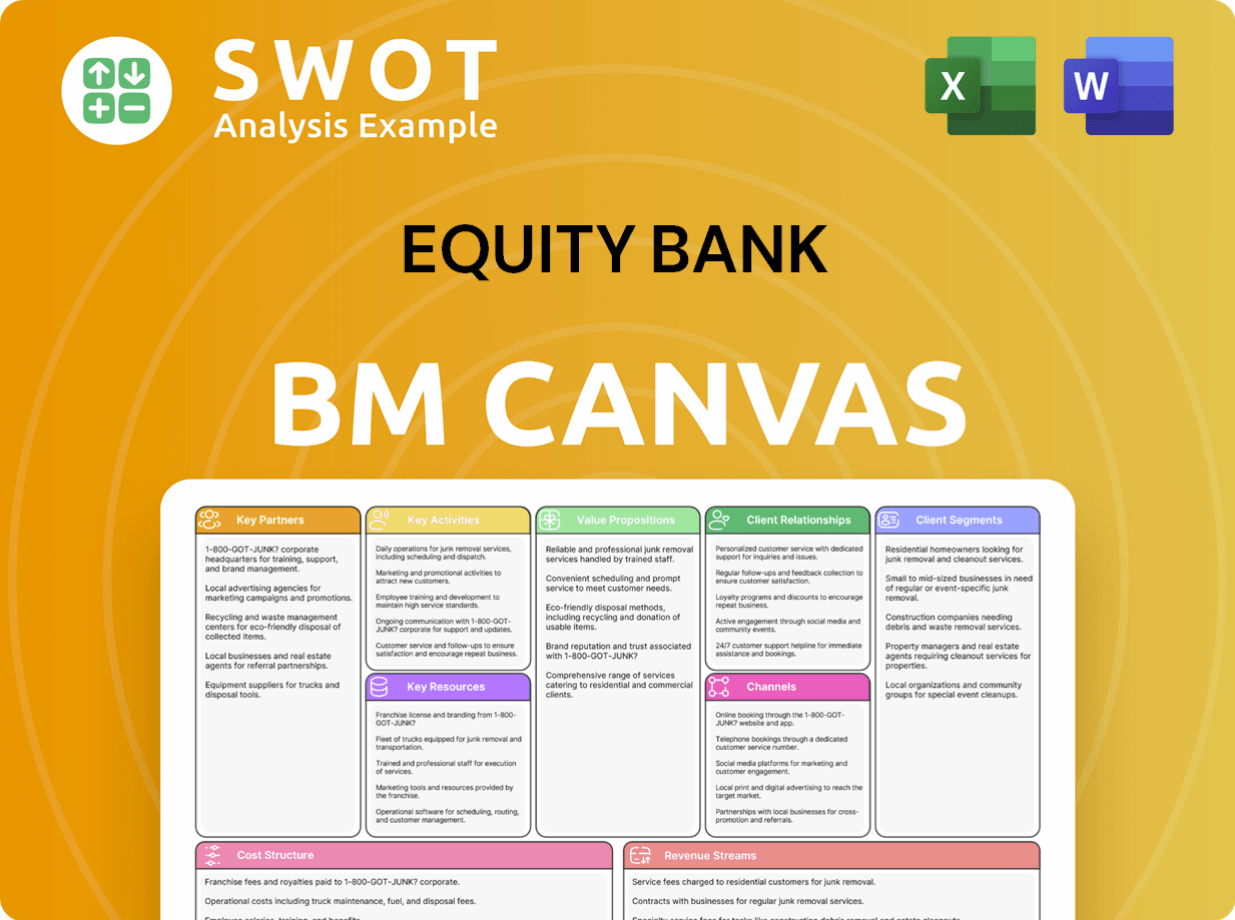

Equity Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Equity Bank Positioning Itself for Continued Success?

Equity Group Holdings Plc, operating as Equity Bank, holds a leading position in the financial services sector across East and Central Africa. As of March 2024, the group managed assets exceeding KSh 1.70 trillion (approximately US$13 billion) and served over 20 million customers across several countries. Equity Bank's strong regional presence and focus on customer satisfaction have solidified its market standing, making it a key player in the financial landscape.

Despite its robust market position, Equity Bank faces several risks. These include macroeconomic challenges that can increase non-performing loans, which stood at 12.96% in FY 2024, and competitive pressures from both traditional banks and fintech companies. Regulatory changes and the need to adapt to technological advancements also pose ongoing challenges. The bank's performance is also influenced by currency movements and the performance of its subsidiaries.

Equity Bank is the largest financial services conglomerate in East and Central Africa by market capitalization. It serves over 20 million customers and has assets exceeding KSh 1.70 trillion. The bank is a regional systemic financial services provider, ranking second in three key markets.

Key risks include macroeconomic pressures leading to rising non-performing loans, intense competition, and regulatory changes. The bank also faces challenges from technological disruption and currency fluctuations. The non-performing loan (NPL) ratio was at 12.96% in FY 2024.

Equity Group is focused on business diversification, innovation, and regional expansion. The bank aims to grow its deposit and loan books in FY 2025. Digital channels are a key focus, with 86% of transactions processed digitally in FY 2024.

The bank is expanding its deposit book by 7.5%-12.5% and anticipates loan book growth of approximately 7.5% to 12.5% in FY 2025. The transformation of regional subsidiaries and non-banking subsidiaries, such as insurance, are expected to contribute to future profitability.

Equity Group is implementing strategic initiatives to drive sustainable growth, including business diversification, innovation, and regional expansion. The bank's focus on digital channels and expansion into new markets will be crucial for future success. Read more about the Growth Strategy of Equity Bank to understand how Equity Bank operations are evolving.

- Equity Group aims to expand its deposit book by 7.5%-12.5% and loan book by approximately 7.5% to 12.5% in FY 2025.

- The regional subsidiaries contributed 54% of the KES 60.7 billion Profit Before Tax in FY 2024, supporting bottom-line growth.

- Non-banking subsidiaries, such as insurance, are expected to contribute to future profitability, with insurance profit before tax rising by 58% to KES 1.5 billion in FY 2024.

- Digital channels processed 86% of transactions in FY 2024, highlighting the bank's commitment to technology.

Equity Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Equity Bank Company?

- What is Competitive Landscape of Equity Bank Company?

- What is Growth Strategy and Future Prospects of Equity Bank Company?

- What is Sales and Marketing Strategy of Equity Bank Company?

- What is Brief History of Equity Bank Company?

- Who Owns Equity Bank Company?

- What is Customer Demographics and Target Market of Equity Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.