Equity Bank Bundle

How Does Equity Bank Thrive in a Competitive Market?

Equity Bank's journey offers a compelling case study in how a community-focused approach can fuel significant growth within the financial services sector. This analysis delves into the Equity Bank SWOT Analysis, exploring the bank's sales and marketing strategies that have been pivotal to its success. Discover how Equity Bank has cultivated a strong market presence by prioritizing customer relationships and local engagement.

Equity Bank's success story highlights the effectiveness of a well-defined Equity Bank sales strategy and marketing strategy in the competitive banking sector. This exploration will uncover the key elements of Equity Bank strategy, including its customer acquisition strategy and digital marketing initiatives. Understanding Equity Bank's approach provides valuable insights into sales and marketing in banking, offering lessons for financial institutions aiming to enhance their market position and attract new customers, including strategies for SME's.

How Does Equity Bank Reach Its Customers?

The sales strategy of Equity Bank, a prominent player in the banking sector, leverages a multi-channel approach to reach its diverse customer base. This strategy encompasses both traditional and digital channels, reflecting an adaptation to evolving customer preferences and technological advancements. The bank's focus is on providing accessible and convenient financial solutions, ensuring a seamless customer experience across all touchpoints.

A core component of Equity Bank's sales strategy is its physical branch network. These branches serve as essential hubs for personalized service, relationship building, and the handling of complex financial transactions. The bank's strategic branch locations facilitate direct sales of various financial products, including deposit accounts and loan products, fostering a community-centric approach. This physical presence allows the bank to directly engage with customers, offering tailored financial solutions.

Equity Bank's digital channels play a crucial role in expanding its reach and enhancing customer convenience. The company website and mobile banking application are vital online platforms for account management, online loan applications, and information access. These digital tools facilitate lead generation and streamline the customer journey, contributing to the overall sales and marketing strategy. The bank continues to integrate these channels to provide a seamless customer experience.

Equity Bank maintains a robust branch network, serving as a primary sales channel. These branches are strategically located to ensure accessibility and provide direct customer interaction. As of early 2024, the bank operates numerous branches across key states, supporting its customer acquisition strategy.

Digital platforms, including the company website and mobile app, are essential for online banking and lead generation. These channels facilitate account management, loan applications, and information access. The bank's digital initiatives enhance customer convenience and expand its market reach, supporting its Owners & Shareholders of Equity Bank.

Direct sales teams focus on acquiring and retaining high-value clients, particularly in commercial banking and wealth management. These teams engage in direct outreach and relationship management to offer tailored financial solutions. Their efforts are crucial for the bank's customer acquisition strategy.

Strategic acquisitions, such as the 2024 acquisition of Almena State Bank, expand the branch network and customer base. These acquisitions effectively integrate new physical sales channels and customer portfolios. This inorganic growth strategy strengthens the bank's market presence.

Equity Bank's sales strategy is a blend of traditional and digital channels, designed to meet diverse customer needs. The strategy includes a robust branch network, digital platforms, and direct sales teams. The bank continually integrates these channels to provide a seamless customer experience.

- Branch Network: Provides personalized service and direct customer interaction.

- Digital Channels: Enhance customer convenience and expand market reach.

- Direct Sales Teams: Focus on high-value client acquisition and relationship management.

- Strategic Acquisitions: Expand the branch network and customer base.

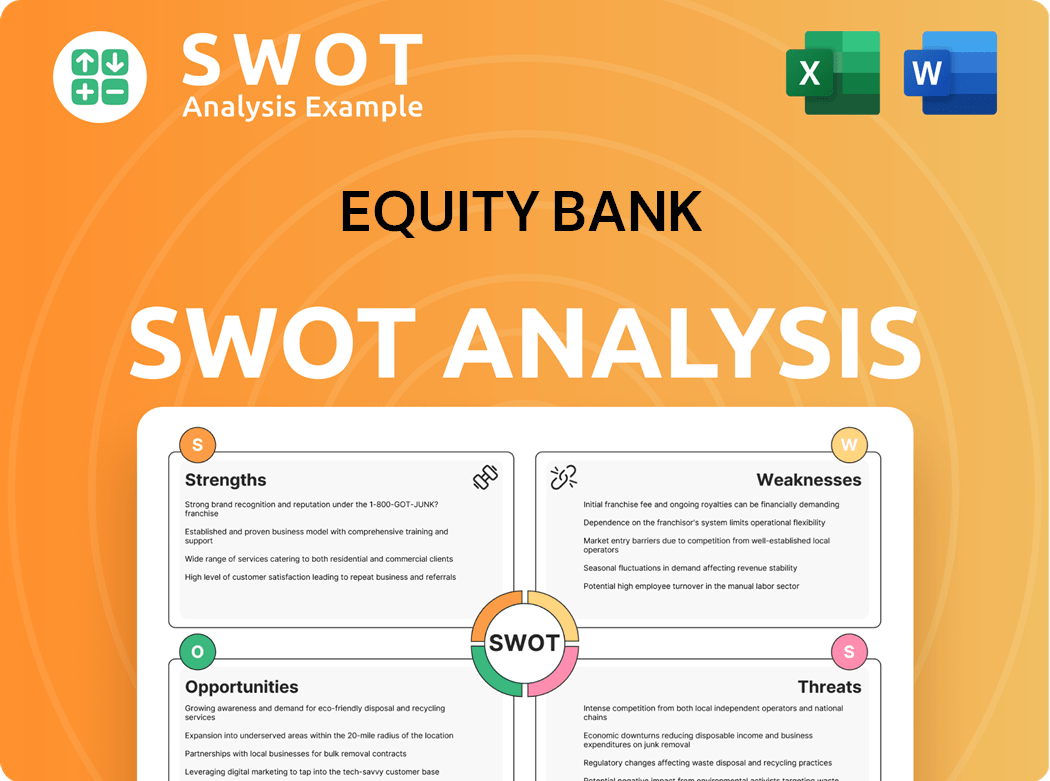

Equity Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Equity Bank Use?

The marketing tactics employed by Equity Bank, as part of its overall Growth Strategy of Equity Bank, are designed to build brand awareness, generate leads, and drive customer acquisition. This approach combines digital and traditional methods to reach a broad audience and engage with potential customers effectively. The bank's strategy focuses on creating a strong presence both online and within the communities it serves.

Equity Bank's strategy integrates various digital and traditional marketing channels to achieve its objectives. Digital strategies include content marketing, SEO, paid advertising, and email marketing, while traditional methods involve local media, event sponsorships, and community engagement. The bank also leverages data-driven marketing techniques to personalize communications and product offerings.

The bank uses a multifaceted approach to marketing, blending digital and traditional tactics to enhance brand awareness, generate leads, and encourage customer acquisition. This comprehensive strategy allows Equity Bank to connect with a wide range of customers and maintain a strong presence in the market.

Equity Bank utilizes content marketing to provide valuable financial insights and educational resources through its website and blog. This positions the bank as a trusted advisor. SEO is implemented to improve online visibility for key financial products and services.

Paid advertising, including SEM and social media advertising on platforms like LinkedIn and Facebook, targets specific demographics and businesses with tailored messages. This helps in reaching potential customers efficiently.

Email marketing campaigns are used for lead nurturing, customer communication, and promoting new products or services. This is a key component of the bank's customer relationship management (CRM) strategy.

Equity Bank continues to use local television, radio, and print media to reach broader audiences within its service areas. This includes general brand awareness and community engagement initiatives.

Sponsorship of local events, charities, and community programs reinforces its commitment to the communities it serves. This also generates positive brand association.

The bank increasingly adopts data-driven marketing techniques, utilizing customer segmentation to personalize communications and product offerings based on individual needs and behaviors.

Equity Bank's Equity Bank marketing strategy focuses on a mix of digital and traditional methods to reach a wide audience. The bank's approach includes content marketing, SEO, paid advertising, and email marketing to enhance its online presence. Traditional methods, such as local media and community engagement, are also used to build brand awareness.

- Digital Channels: Content marketing, SEO, SEM, social media advertising, and email marketing are used to engage customers online.

- Traditional Channels: Local television, radio, print media, and event sponsorships are used to maintain a strong local presence.

- Data-Driven Approach: Customer segmentation and personalized communications are used to improve marketing effectiveness.

- Customer Acquisition: The bank focuses on attracting new customers through targeted advertising and promotions.

- Customer Relationship Management (CRM): The bank uses CRM systems to manage customer interactions and analyze campaign performance.

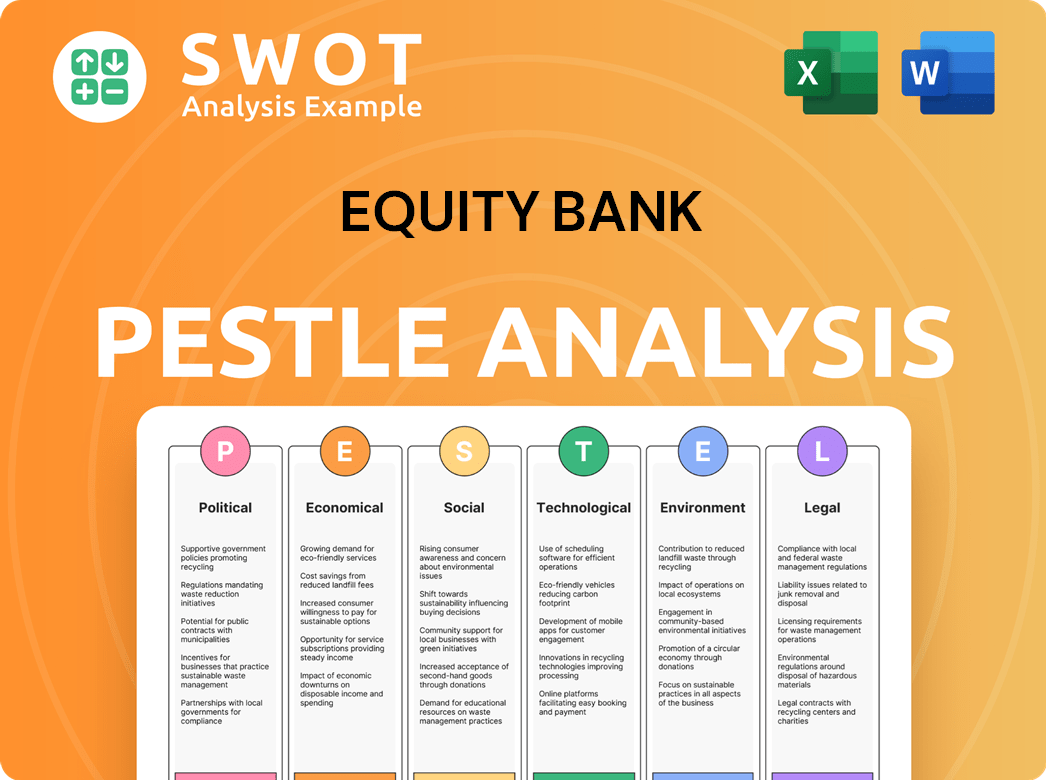

Equity Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Equity Bank Positioned in the Market?

The brand positioning of Equity Bank centers on being a community-focused financial partner. This approach differentiates it from larger national banks by emphasizing personalized service and accessibility. The core message revolves around building strong, lasting customer relationships, which is a key aspect of its Equity Bank sales strategy.

Equity Bank's visual identity likely conveys trustworthiness and approachability, aligning with its community-oriented ethos. The tone of voice in its communications is generally supportive and informative, aiming to make financial services accessible to a broad audience. The bank’s Equity Bank marketing strategy focuses on creating a customer experience of attentive service and tailored solutions.

The bank appeals to its target audience, which includes small business owners and individual consumers within its regional footprint, by emphasizing local decision-making and direct access to banking professionals. This resonates with those who value a personal touch and a bank that understands their local economy. This is a crucial element of how Equity Bank's competitive advantage in sales is achieved.

Equity Bank positions itself as a financial partner deeply rooted in the communities it serves. This strategy emphasizes local engagement and understanding of regional economic needs. The bank's approach fosters strong relationships, which is a key aspect of its Equity Bank strategy.

The bank differentiates itself through personalized service, offering tailored solutions to meet individual and business needs. Direct access to banking professionals enhances customer experience. This personalized approach is a cornerstone of their sales and marketing in banking efforts.

Accessibility is a key component, with a focus on making financial services readily available to a broad audience. This includes a network of branches and digital platforms. This accessibility is part of the Equity Bank Kenya strategy to attract new customers.

Equity Bank continually enhances its online and mobile banking capabilities. This is in response to the increasing demand for digital convenience while preserving its relational banking model. This is a key part of their digital marketing initiatives.

The bank's brand positioning hinges on several key elements that collectively define its market strategy.

- Local Decision-Making: Emphasizing local control and understanding of regional economies.

- Direct Access: Providing direct access to banking professionals to build relationships.

- Community Support: Commitment to community support and local investment.

- Responsive Service: Delivering responsive and tailored solutions.

- Digital Innovation: Enhancing digital platforms while maintaining personal service.

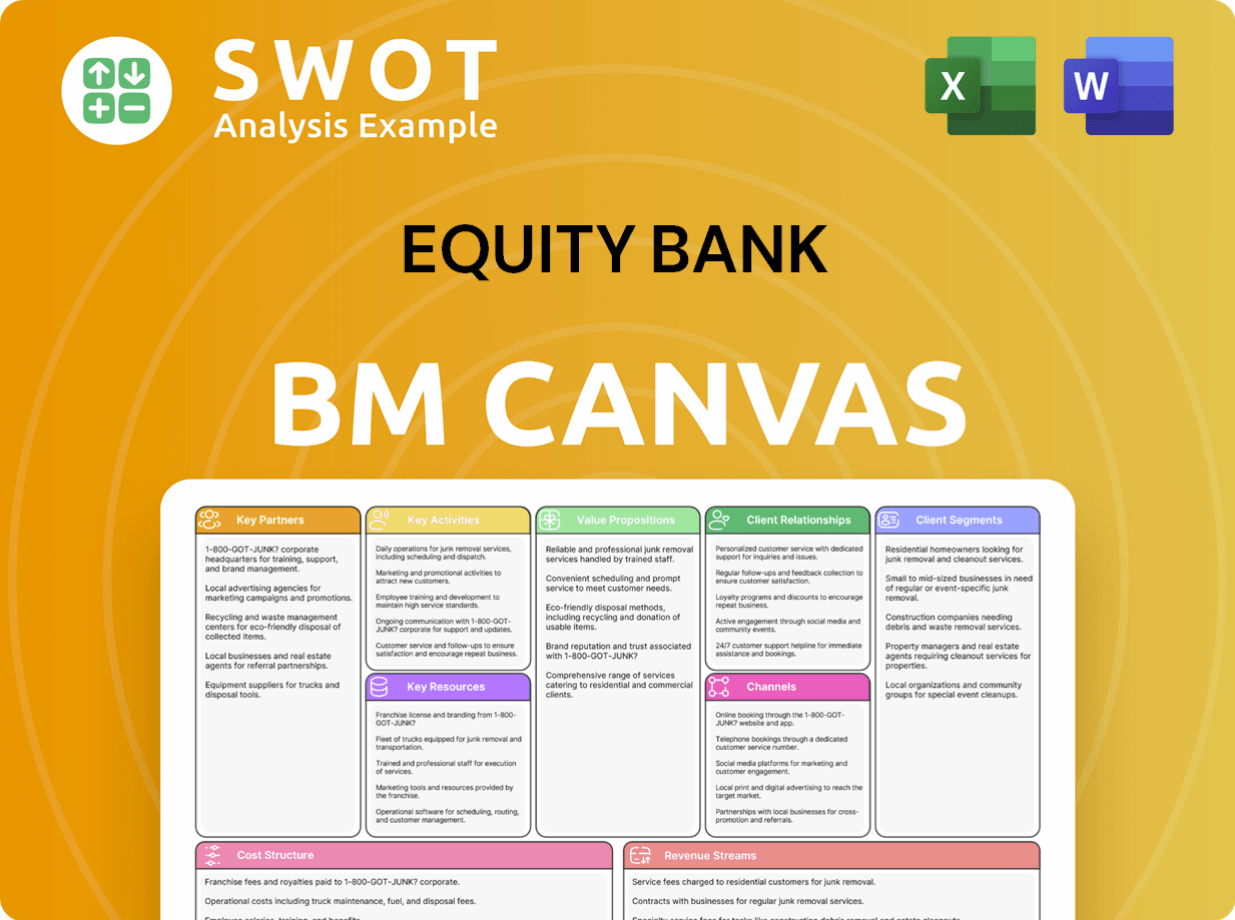

Equity Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Equity Bank’s Most Notable Campaigns?

The sales and marketing strategy of Equity Bank, focusing on building strong customer relationships and community engagement, is a key part of its success. While not always involving large-scale advertising campaigns, the bank's approach is deeply rooted in local community support and strategic acquisitions. This strategy aims to foster trust, generate leads, and expand its market presence organically.

Equity Bank's marketing strategy emphasizes local community engagement and strategic acquisitions to expand its customer base. This involves sponsoring local events, supporting charitable causes, and providing financial literacy programs, all designed to build trust and generate leads. The bank also leverages acquisitions, integrating new customers and reinforcing the brand through targeted communication. This approach is crucial for growth and brand reinforcement.

Equity Bank's sustained growth, as reflected in its financial reports, highlights the effectiveness of this relationship-driven strategy. For example, as of early 2024, Equity Bancshares reported continued growth in its loan and deposit balances, demonstrating successful customer acquisition and retention. The bank's focus on local engagement and strategic acquisitions continues to be a cornerstone of its sales and marketing efforts, contributing to its competitive advantage in sales.

Equity Bank actively supports local events, charities, and financial literacy programs. The objective is to build trust and generate leads through positive word-of-mouth. Main channels include local media, in-branch promotions, and direct employee involvement.

Acquisitions are a key part of Equity Bank's growth strategy. The integration process includes marketing and communication to onboard new customers. The goal is to retain the acquired customer base and cross-sell additional products.

Equity Bank focuses on retaining customers through community engagement and seamless integration during acquisitions. These efforts are measured by customer retention rates and account transitions.

Providing financial literacy programs is a key component of the bank's community-focused approach. These programs help build trust and demonstrate the bank's commitment to its customers' financial well-being.

Equity Bank's sales strategy for SMEs, and its overall Equity Bank marketing strategy, benefits from these initiatives. The bank's digital marketing initiatives and brand positioning strategy are also supported by these efforts. For more details, you can read more about Equity Bank's success in the article, "How Equity Bank attracts new customers".

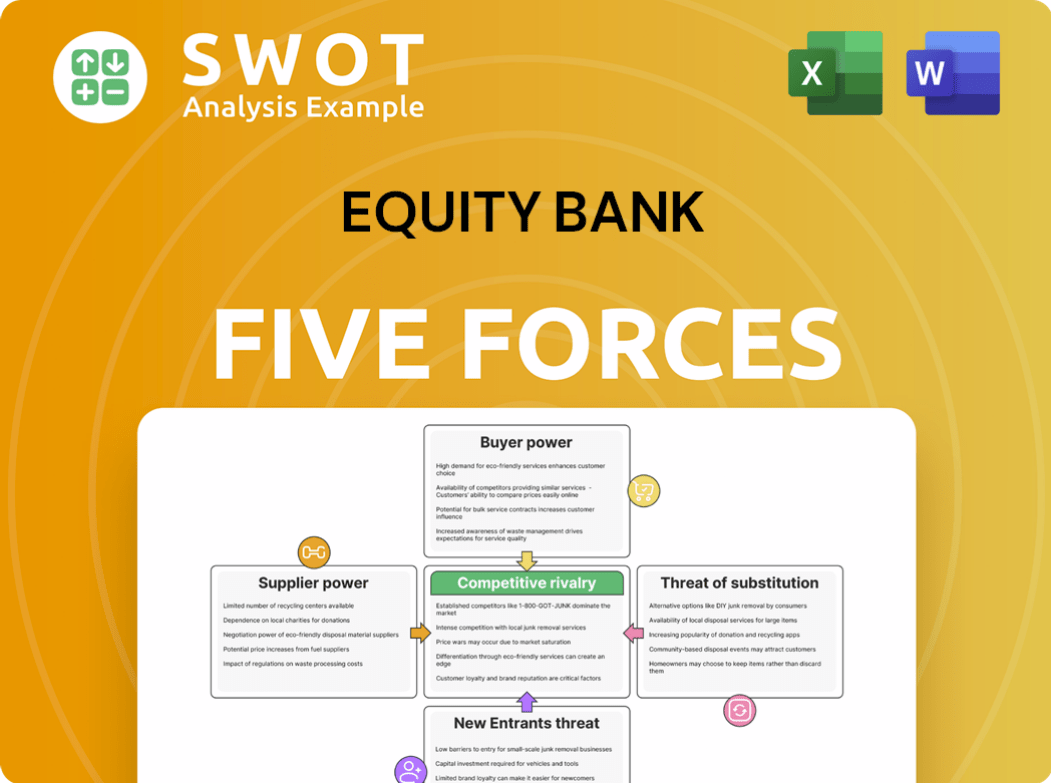

Equity Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Equity Bank Company?

- What is Competitive Landscape of Equity Bank Company?

- What is Growth Strategy and Future Prospects of Equity Bank Company?

- How Does Equity Bank Company Work?

- What is Brief History of Equity Bank Company?

- Who Owns Equity Bank Company?

- What is Customer Demographics and Target Market of Equity Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.