Hercules Offshore, Inc. Bundle

What Happened to Hercules Offshore?

Hercules Offshore, a former titan in the offshore drilling industry, once played a critical role in supporting global oil and gas exploration. Its operations were a complex web of Hercules Offshore, Inc. SWOT Analysis, marine services, and specialized support for offshore projects. Understanding the rise and fall of a company like Hercules Offshore is essential for anyone seeking to navigate the volatile world of energy investments.

Even though Hercules Offshore is no longer active, its story provides a compelling case study for understanding the offshore oil and gas sector. Examining its business model, from its drilling contractor operations to its financial strategies, offers valuable lessons on risk management and market dynamics. This exploration will delve into the company's history, providing insights into how it operated offshore rigs and the factors that ultimately shaped its fate.

What Are the Key Operations Driving Hercules Offshore, Inc.’s Success?

The core operations of Hercules Offshore Inc. revolved around providing essential services to the offshore oil and gas industry. The company specialized in offshore drilling, primarily in shallow-water environments, offering critical infrastructure for energy companies. Their services extended beyond drilling to include well service operations and marine services, creating a comprehensive suite for clients.

Hercules Offshore's value proposition centered on delivering reliable, efficient, and safe offshore services. This enabled clients to meet their energy production goals. The company's focus on shallow water markets and bundled service offerings provided a competitive advantage. The operational model involved mobilizing, deploying, and operating drilling rigs and marine vessels, supported by a skilled workforce.

The company served a diverse clientele, including major oil companies and independent exploration and production firms. Their operational processes involved mobilizing, deploying, and operating their drilling rigs and marine vessels, supported by a skilled workforce of engineers, drillers, and marine crew. Key operational strengths included their focus on shallow water markets, which often presented different logistical and engineering challenges compared to deepwater operations, and their ability to provide a bundled suite of services, from initial drilling to ongoing maintenance and eventual decommissioning.

Hercules Offshore's primary function was contract drilling for oil and natural gas exploration and development. This involved the deployment and operation of specialized drilling rigs. These rigs were designed to operate in shallow-water environments, a key niche for the company.

Beyond drilling, the company offered well service operations. These services were crucial for maintaining and enhancing the productivity of existing wells. This included tasks such as well maintenance and repair to ensure optimal oil and gas extraction.

Hercules Offshore provided comprehensive marine services. These services encompassed platform inspection, maintenance, and decommissioning activities. These services supported the lifecycle of offshore oil and gas platforms.

The company served a diverse clientele within the energy sector. This included major oil companies, independent exploration and production firms, and national oil companies. This diversified client base helped to mitigate risk.

Hercules Offshore's operational strengths were rooted in its focus on shallow water markets and its ability to provide a bundled suite of services. This approach allowed the company to offer a more comprehensive solution to its clients. The company also had a skilled workforce of engineers, drillers, and marine crew.

- Focus on shallow water markets.

- Bundled service offerings.

- Skilled workforce.

- Efficient operations.

Hercules Offshore, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hercules Offshore, Inc. Make Money?

The revenue streams and monetization strategies of Hercules Offshore, Inc. centered on its role as an offshore drilling contractor and provider of marine support services. The company primarily generated income by offering its drilling rigs and associated personnel to exploration and production companies. This business model was heavily reliant on dayrate contracts, where clients paid a fixed daily fee for rig usage, regardless of oil or gas production.

The company's financial performance was significantly influenced by fluctuations in drilling activity and dayrates, which were, in turn, affected by global oil and gas prices. In addition to contract drilling, Hercules Offshore also derived revenue from its marine services segment. This segment provided services like platform inspection, maintenance, and decommissioning projects, offering a supplementary income stream.

While specific revenue percentages for 2024/2025 are unavailable due to the company's liquidation, contract drilling historically represented the dominant portion of its total revenue. This reflected the capital-intensive nature of the offshore sector and the high demand for specialized drilling assets. For more information on the company's background, you can read Brief History of Hercules Offshore, Inc.

Hercules Offshore, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Hercules Offshore, Inc.’s Business Model?

The story of Hercules Offshore, Inc. involves significant milestones, strategic decisions, and the challenges of the offshore drilling industry. The company's journey includes periods of expansion and adaptation, particularly in response to fluctuating market conditions. Understanding these elements provides insight into its operational approach and competitive positioning within the offshore oil and gas sector.

A key strategic focus for Hercules Offshore was its specialization in shallow water markets. This allowed the company to differentiate itself from competitors concentrating on deepwater drilling operations. This strategic choice, combined with fleet expansion and modernization efforts, shaped its operational capabilities and market presence. However, external factors, such as oil price volatility, significantly impacted its trajectory.

The company's operational model and strategic moves were heavily influenced by the dynamics of the offshore drilling industry. The fluctuations in oil prices, technological advancements, and the competitive landscape all played crucial roles in shaping Hercules Offshore's business decisions and overall performance. The company's history reflects the broader trends and challenges faced by drilling contractors in the offshore oil and gas sector.

Hercules Offshore experienced several key milestones, including fleet expansions and strategic acquisitions aimed at bolstering its market position. These moves were often in response to changing market demands and opportunities within the offshore drilling sector. The company's history is marked by periods of growth and adaptation, reflecting its efforts to remain competitive.

A primary strategic move was the company's focus on shallow water markets, which allowed it to establish a niche within the broader offshore drilling industry. This specialization enabled Hercules Offshore to tailor its services and operations to a specific segment of the market. Further strategic decisions included fleet modernization and cost-management initiatives.

Hercules Offshore's competitive edge came from its specialized shallow water fleet, operational efficiency, and established client relationships. These strengths allowed the company to compete effectively in its chosen market segment. However, the company's advantages were tested by the downturn in the oil market.

The most significant challenge for Hercules Offshore was the sharp decline in oil prices that began in 2014. This led to reduced demand for offshore drilling services, lower dayrates, and contract cancellations. The company responded with cost-cutting measures and asset divestitures, but ultimately faced financial restructuring.

Hercules Offshore, a drilling contractor, focused on providing services in the offshore oil and gas sector. The company's operations included the management and operation of drilling rigs, catering to various clients. This involved a complex interplay of technical expertise, logistical management, and adherence to safety and environmental regulations.

- Specialized Fleet: Operated a fleet of offshore drilling rigs, primarily focusing on shallow water environments.

- Client Relationships: Maintained relationships with major oil and gas companies, providing drilling services under contract.

- Operational Efficiency: Focused on efficient rig management and cost control to maximize profitability.

- Market Dynamics: Faced challenges from fluctuating oil prices and oversupply of rigs in the market.

For a deeper dive into the company's strategic approach, consider reading about the Growth Strategy of Hercules Offshore, Inc.

Hercules Offshore, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Hercules Offshore, Inc. Positioning Itself for Continued Success?

Before its liquidation, the company held a significant position in the shallow water offshore drilling and marine services sector. It was a notable provider in its niche, serving a variety of clients in key shallow water basins. Its market share was concentrated in specific regions where its fleet was deployed, and its customer loyalty was built on operational reliability and safety records. The company's operational focus was on providing drilling services and support to the offshore oil and gas industry, concentrating on areas with established shallow water infrastructure.

The company faced considerable risks typical to the offshore drilling industry. These included volatility in oil and gas prices, which directly impacted demand for drilling services and dayrates; substantial capital expenditure requirements for fleet maintenance and upgrades; regulatory changes impacting environmental compliance and operational safety; and intense competition from other offshore drilling contractors. The cyclical nature of the energy sector meant that economic downturns or shifts in energy policy could severely impact its financial performance. The company's history serves as a case study for the risks and challenges inherent in the highly capital-intensive and cyclical offshore energy services industry.

The company, a drilling contractor, specialized in shallow water offshore drilling. Its operations were concentrated in regions like the Gulf of Mexico, the North Sea, and Southeast Asia. The company's business model centered on providing drilling services to oil and gas companies, with its revenue dependent on dayrates and rig utilization.

The company faced significant risks, including fluctuating oil prices, which directly affected demand for drilling services. Capital-intensive operations required substantial investment in rig maintenance and upgrades. Regulatory changes and environmental compliance also posed challenges. Competition from other offshore drilling contractors was intense.

The company ceased operations in December 2016 following Chapter 11 liquidation. There is no ongoing strategic initiative, innovation roadmap, or leadership statement about its future direction. The company's history serves as a case study for the risks and challenges inherent in the highly capital-intensive and cyclical offshore energy services industry.

The company provided offshore drilling services. These services were essential for offshore oil and gas exploration and production. The company operated various rig types suited for shallow water operations, supporting a range of projects for its clients.

The company's financial performance was heavily influenced by oil price fluctuations, with downturns in oil prices leading to reduced demand for drilling services. Capital expenditures for maintaining and upgrading rigs were substantial, impacting profitability. The company's operations were subject to stringent safety and environmental regulations, adding to operational costs.

- The company's business model was vulnerable to cyclical downturns in the energy sector.

- The company faced intense competition from other offshore drilling contractors.

- Changes in energy policy and environmental regulations posed significant risks.

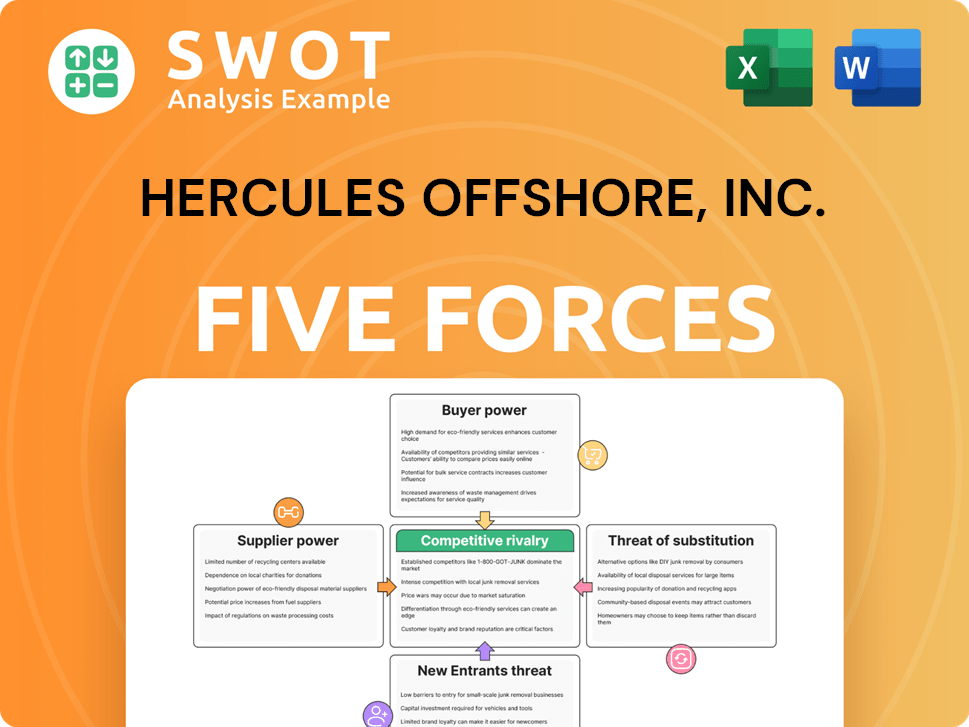

Hercules Offshore, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hercules Offshore, Inc. Company?

- What is Competitive Landscape of Hercules Offshore, Inc. Company?

- What is Growth Strategy and Future Prospects of Hercules Offshore, Inc. Company?

- What is Sales and Marketing Strategy of Hercules Offshore, Inc. Company?

- What is Brief History of Hercules Offshore, Inc. Company?

- Who Owns Hercules Offshore, Inc. Company?

- What is Customer Demographics and Target Market of Hercules Offshore, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.