Hercules Offshore, Inc. Bundle

What Went Wrong with Hercules Offshore's Sales Strategy?

Explore the rise and fall of Hercules Offshore, Inc., a key player in the volatile offshore drilling market. This analysis unveils the company's approach to sales and marketing within the competitive energy sector. Discover how Hercules Offshore, Inc. SWOT Analysis can help to understand the company's position in the market.

Despite the substantial growth of the offshore drilling market, Hercules Offshore faced significant hurdles, ultimately leading to its closure. Understanding the Hercules Offshore sales strategy and marketing plan provides crucial lessons for businesses navigating the oil and gas industry. This examination will dissect the company's sales team structure, customer acquisition strategies, and brand positioning to reveal the key factors that influenced its performance, offering insights into both challenges and opportunities within this dynamic sector.

How Does Hercules Offshore, Inc. Reach Its Customers?

The sales channels for a company like Hercules Offshore, focusing on offshore contract drilling and marine services, primarily revolved around direct sales. This meant building relationships with integrated energy companies, independent oil and natural gas operators, and national oil companies. Their approach involved direct negotiation and bidding for projects, along with establishing long-term service agreements for their fleet of jackup rigs and liftboats.

As of March 2016, the company operated a fleet of 18 jackup rigs and 19 liftboats. These assets served clients globally across segments like Domestic Offshore, International Offshore, and International Liftboat. Given the nature of the industry, e-commerce or retail locations were not relevant sales channels for Hercules Offshore. Instead, a highly skilled direct sales team was essential for client relationship management.

The evolution of these channels for a company like Hercules Offshore would have been less about adopting new platforms and more about adapting to market conditions and client needs. Securing long-term contracts and exclusive distribution deals with major oil and gas companies would be vital for sustained growth and market share in a competitive market. Understanding the Growth Strategy of Hercules Offshore, Inc. is crucial for a complete view of their business model.

Direct sales were the primary method, involving direct negotiation and bidding processes. This approach was essential for securing projects and establishing long-term service agreements. Direct engagement allowed for tailored solutions and relationship-building with key clients in the oil and gas industry.

Maintaining strong client relationships was critical for Hercules Offshore's business success. This involved a dedicated sales team with deep industry knowledge. The focus was on building trust and providing excellent service to retain clients and secure repeat business.

Adapting to market conditions and client needs was crucial for survival. This included focusing on specific water depths or rig types based on demand. The ability to adjust to broader market trends was essential for maintaining a competitive edge.

Strategic partnerships and exclusive distribution deals were common in the industry to secure consistent work. These alliances helped in securing long-term contracts and exclusive deals with major oil and gas companies. These partnerships were vital for consistent revenue generation.

The offshore drilling market is competitive, with major players like Transocean, Valaris PLC, and Seadrill. The deepwater segment held the largest revenue share in the offshore drilling market in 2024, while shallow water is observed to be the fastest-growing. Understanding the competitive landscape and market trends is critical for a successful sales and marketing strategy.

- Market Analysis: Continuously monitor market trends and client needs.

- Client Focus: Prioritize building and maintaining strong client relationships.

- Strategic Alliances: Consider partnerships to secure consistent work.

- Adaptability: Adapt to changing market conditions and technological advancements.

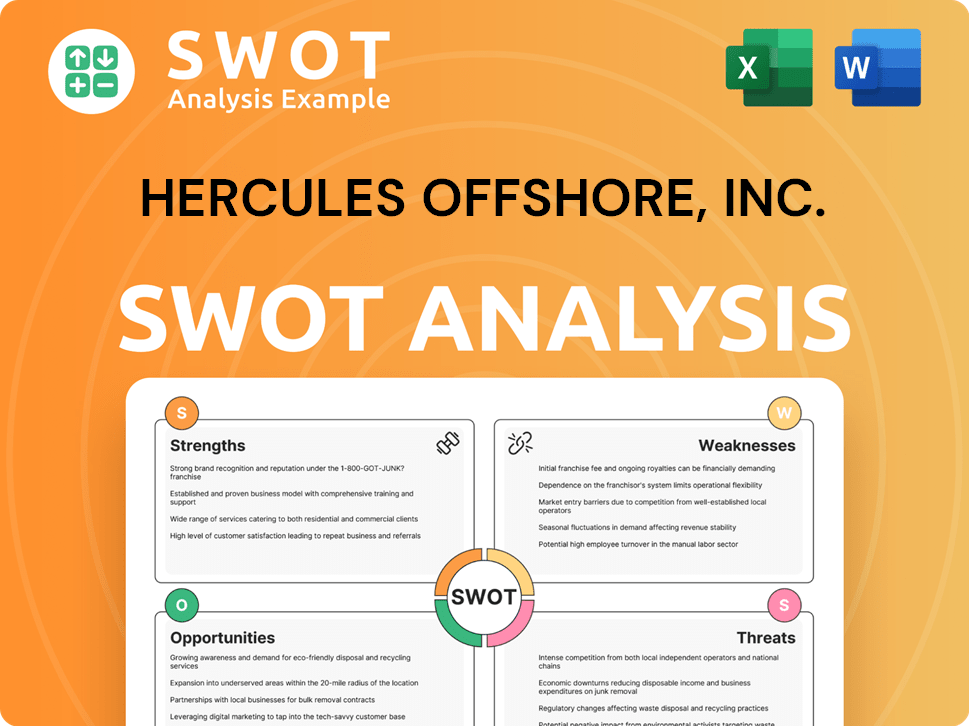

Hercules Offshore, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Hercules Offshore, Inc. Use?

For a company like Hercules Offshore, Inc., the marketing tactics would have been primarily business-to-business (B2B), focusing on building strong relationships with clients in the oil and gas industry. The goal would be to highlight the company's expertise, safety record, and technical capabilities in the offshore drilling market. This approach is crucial for attracting and retaining clients in this specialized sector.

Digital marketing, content creation, and targeted advertising would have been essential components of their strategy. Building a robust online presence and providing valuable information to potential clients would have been key to generating leads and demonstrating their value. The emphasis would be on showcasing their services and expertise in shallow-water drilling and marine services.

Traditional methods like industry events and direct client communication would have complemented digital efforts. This integrated approach aimed to create a strong brand presence and build trust within the oil and gas industry, which is vital for securing contracts and maintaining a competitive edge. The Revenue Streams & Business Model of Hercules Offshore, Inc. article provides additional insights into the company's operations.

A strong corporate website would have been the central hub, showcasing the fleet, safety data, and operational capabilities. SEO was crucial for visibility in specialized searches by energy companies. Content marketing included white papers and case studies to demonstrate expertise.

Paid advertising would have been targeted towards industry publications, trade shows, and professional networking platforms like LinkedIn. The focus was on reaching key decision-makers within the energy sector. Email marketing would have been used for direct communication with clients.

Influencer partnerships would have involved collaborations with industry experts and consultants. Social media would have been used for corporate communications and sharing industry news. This approach helped build credibility and reach a wider audience.

Print advertising in industry-specific journals and participation in major oil and gas conferences were essential. These activities were crucial for networking, lead generation, and demonstrating market presence. This helped in building relationships and increasing brand visibility.

Data-driven marketing, customer segmentation, and personalization would have been key. Analyzing client needs and operational data would have allowed for tailored service offerings. Technology platforms and analytics tools would have been used for CRM and project management.

The marketing mix would have evolved with technological advancements and increasing emphasis on efficiency and safety. Innovations might have included virtual reality tours of rigs. The offshore drilling rigs market is projected to grow to $100.03 billion in 2025.

The Hercules Offshore sales strategy would have focused on building relationships and highlighting technical expertise. The Hercules Offshore marketing strategy would have emphasized digital presence and targeted advertising. The Hercules Offshore business model relied on securing contracts in the offshore drilling market.

- Offshore drilling market valued at USD 40.04 billion in 2024.

- Focus on lead generation through various marketing channels.

- Customer segmentation to tailor service offerings.

- Use of technology platforms for CRM and project management.

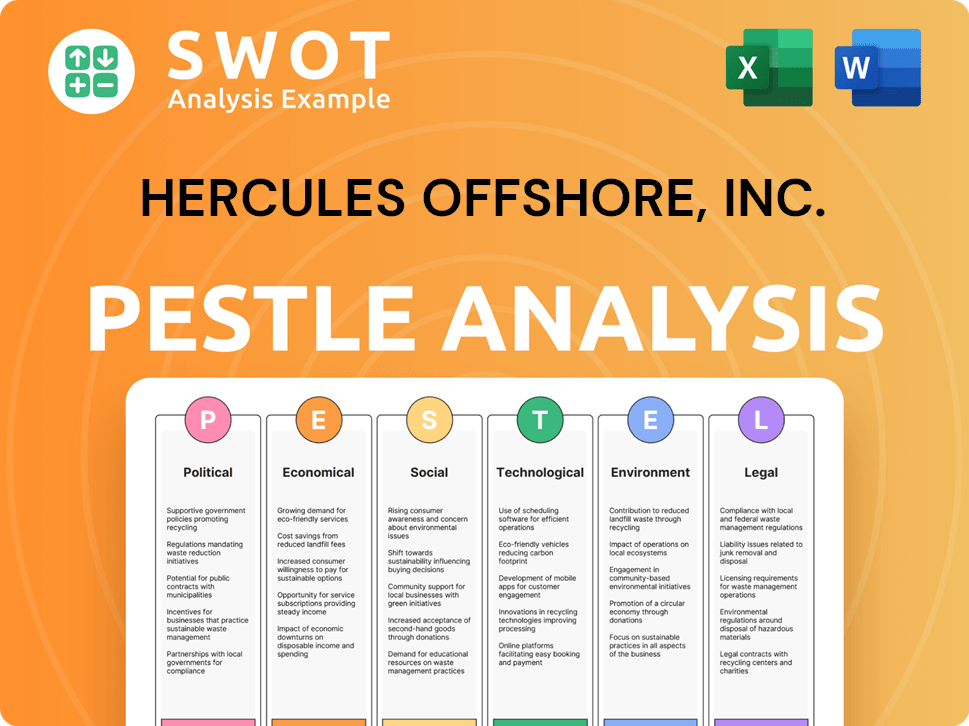

Hercules Offshore, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Hercules Offshore, Inc. Positioned in the Market?

The brand positioning of Hercules Offshore focused on being a key provider of shallow-water drilling and marine services. Their identity would have emphasized reliability, safety, and efficiency, crucial elements in the oil and gas industry. This positioning was designed to resonate with a target audience that valued dependable operations and a strong partnership approach for complex offshore projects.

The company's visual identity likely reflected strength and precision, aligning with the operational excellence expected in the heavy industry sector. The tone of voice would have been professional and authoritative, highlighting technical competence and problem-solving abilities. This approach was intended to build trust and establish a reputation for dependable service delivery within the competitive offshore drilling market.

The primary target audience for Hercules Offshore included integrated energy companies, independent oil and natural gas operators, and national oil companies. These entities rely on services like those provided by Hercules Offshore for their exploration and production activities. Understanding this target audience is crucial for crafting effective sales and marketing strategies.

Hercules Offshore's USP would have been its expertise in shallow-water environments and its comprehensive service offerings, including drilling, maintenance, and decommissioning. In an industry where safety and uptime are critical, this specialization would have been a key differentiator. This focus on specialized services helped the company to stand out from competitors.

Brand consistency would have been maintained through standardized operational procedures, uniform branding on its fleet and corporate materials, and consistent messaging from its sales and operational teams. This uniformity ensures that the brand's values are consistently communicated across all customer touchpoints. Consistent branding is vital for building and maintaining customer trust.

The offshore drilling market is subject to fluctuations in oil prices, regulatory changes, and technological advancements. A significant drop in oil prices directly impacted contract rates, affecting the financial health of companies like Hercules Offshore. The Growth Strategy of Hercules Offshore, Inc. provides additional insights into the company's strategic responses to market shifts.

The offshore drilling market faces challenges such as fluctuating oil prices, evolving regulatory landscapes, and technological advancements. The current market correction, influenced by inflationary pressures and weakening demand, necessitates agile brand positioning. The company had to adapt to these changes to maintain its market position.

- Adapting to fluctuating oil prices.

- Responding to evolving regulatory landscapes.

- Integrating new technological advancements.

- Addressing the impact of market corrections.

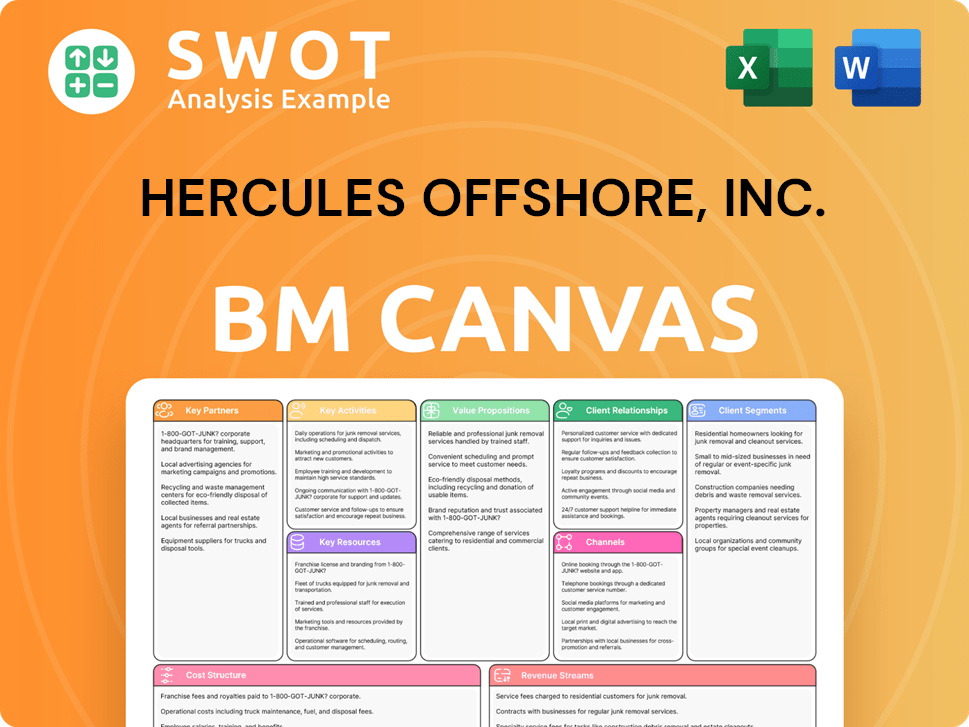

Hercules Offshore, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Hercules Offshore, Inc.’s Most Notable Campaigns?

For a company like Hercules Offshore, operating in the business-to-business (B2B) offshore drilling sector, the concept of 'key campaigns' differs from traditional marketing. Instead of broad advertising, their focus was on securing substantial contracts and highlighting operational achievements. These campaigns were pivotal for maintaining operations, securing revenue, and reassuring stakeholders, especially during periods of financial instability.

One of the most critical 'campaigns' involved restructuring debt following the initial Chapter 11 bankruptcy filing in August 2015. The aim was to ensure business continuity and maintain client and stakeholder confidence amidst financial challenges. This involved converting over $1.2 billion in senior notes into new equity and securing $450 million in new debt financing. The company communicated directly with senior noteholders, achieving a remarkable 99% approval for the pre-packaged plan, showcasing their commitment to viability.

Another ongoing 'campaign' was the consistent effort to secure and extend drilling contracts for their fleet. In the offshore drilling market, securing new contracts is a continuous process. Each successful contract award, particularly for their jackup rigs and liftboats, would have been a significant win, reflecting their operational capabilities and safety record. These campaigns involved direct sales presentations, showcasing the company's fleet capabilities, such as operating in water depths up to 400 feet and drilling to 35,000 feet, and emphasizing their experience in diverse shallow-water provinces. The results were measured by the secured contract backlog and rig utilization rates.

This campaign focused on financial restructuring, which was crucial for survival. It involved converting debt into equity and securing new financing to maintain operations. The success of this campaign was vital for regaining stakeholder trust and ensuring the company's ability to continue serving its clients.

The core of the Hercules Offshore sales strategy was securing and extending drilling contracts. This involved direct sales efforts, showcasing the capabilities of their rigs and emphasizing their experience. The success of these efforts directly impacted revenue and rig utilization rates.

This was an ongoing effort to maintain high operational standards, safety records, and efficiency. It supported the company's ability to secure contracts and build client confidence. High performance in this area was essential for long-term sustainability.

Building and maintaining strong relationships with clients in the offshore drilling market was a continuous campaign. This involved understanding client needs, delivering successful projects, and providing excellent service. Strong relationships were essential for repeat business and contract extensions.

Adapting to market fluctuations and the volatility of crude oil prices was a constant challenge. This involved adjusting pricing strategies, fleet deployment, and operational focus. The ability to adapt was critical for survival in the dynamic energy sector.

Open and transparent communication with stakeholders, including investors, clients, and employees, was essential. This helped build trust and manage expectations during challenging times. Effective communication was critical for maintaining confidence and support.

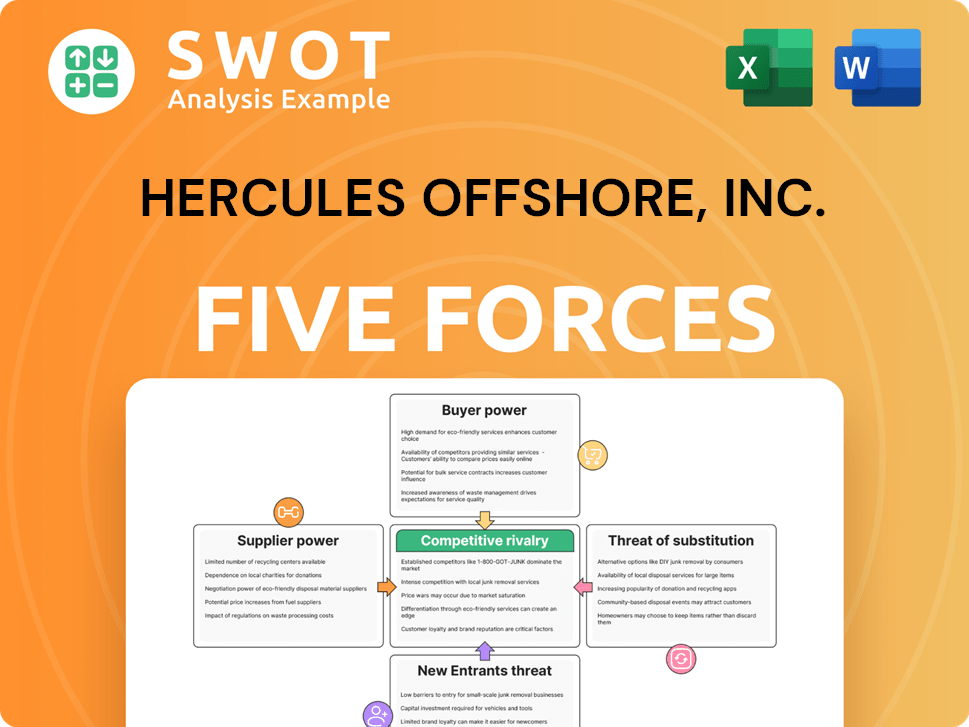

Hercules Offshore, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hercules Offshore, Inc. Company?

- What is Competitive Landscape of Hercules Offshore, Inc. Company?

- What is Growth Strategy and Future Prospects of Hercules Offshore, Inc. Company?

- How Does Hercules Offshore, Inc. Company Work?

- What is Brief History of Hercules Offshore, Inc. Company?

- Who Owns Hercules Offshore, Inc. Company?

- What is Customer Demographics and Target Market of Hercules Offshore, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.