Hercules Offshore, Inc. Bundle

Who Were Hercules Offshore's Customers?

Delving into the customer demographics and target market of Hercules Offshore, Inc. is essential for understanding its strategic trajectory. The offshore drilling industry is dynamic, and Hercules Offshore, Inc. SWOT Analysis provides a framework for understanding the company's position within this landscape. This exploration illuminates how market shifts influenced Hercules Offshore's client base and operational focus.

Understanding the customer profile of Hercules Offshore, Inc. is crucial for any market analysis of the offshore drilling sector. Examining the company's target market reveals the specific needs and geographic locations that shaped its service offerings. Analyzing customer demographics provides insights into the buying behaviors and market share dynamics that influenced Hercules Offshore's success and challenges.

Who Are Hercules Offshore, Inc.’s Main Customers?

Understanding the customer demographics and target market of Hercules Offshore, Inc. is crucial for grasping its business model. The company primarily operated within the business-to-business (B2B) sector, focusing on the oil and gas industry. Its services, including offshore drilling and well services, were directed towards a specific set of clients.

The target market for Hercules Offshore, Inc. mainly comprised exploration and production (E&P) companies. These included both major integrated oil companies and independent operators involved in oil and gas exploration and development. These companies would contract Hercules Offshore for services related to their offshore activities.

The financial health of Hercules Offshore, Inc. was closely linked to the capital expenditure cycles of these E&P companies, which were influenced by global oil and gas prices and regulatory environments. The company's operations were concentrated in shallow water markets, and its revenue streams were tied to the demand for offshore drilling services in these areas.

The core customer demographics for Hercules Offshore, Inc. were large corporations. These companies had substantial capital expenditure budgets. They also had long-term project timelines for oil and gas exploration and development. These factors influenced the demand for Hercules Offshore's services.

Shifts in crude oil prices and the rise of unconventional resources, such as shale, impacted the demand for shallow water offshore drilling services. This led to changes in activity levels within the target market segments. The company's performance was subject to these market fluctuations.

The primary customers of Hercules Offshore, Inc. were E&P companies, both major integrated oil companies and independent operators. These companies required services such as offshore drilling, well services, and platform maintenance. The demand for these services was directly tied to the capital expenditure budgets of these companies.

- Customer Segmentation for Offshore Drilling Companies: Major integrated oil companies and independent operators.

- Customer Geographic Location: Focused on shallow water markets.

- Buying Behaviors of Hercules Offshore Customers: Driven by long-term project needs and capital expenditure cycles.

- Market Analysis: Influenced by global oil and gas prices and regulatory environments.

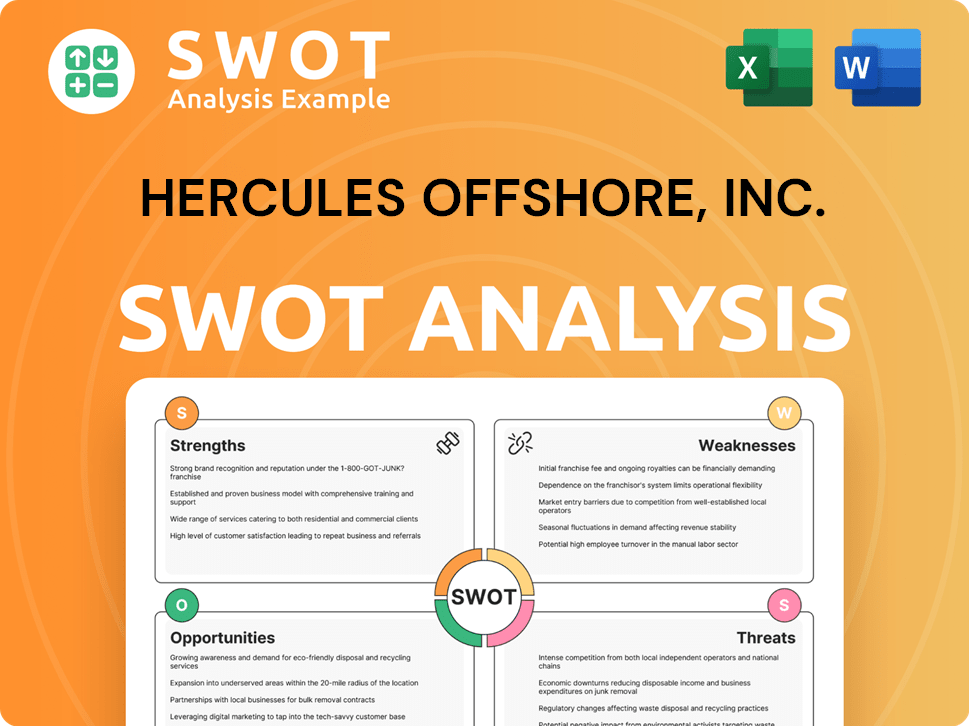

Hercules Offshore, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Hercules Offshore, Inc.’s Customers Want?

Understanding the customer needs and preferences is crucial for any company, especially in a specialized industry like offshore drilling. For Growth Strategy of Hercules Offshore, Inc., the primary focus was on meeting the operational demands of its clients in the oil and gas sector. This involved providing services that enhanced efficiency, ensured safety, and offered cost-effective solutions.

The core of Hercules Offshore's business revolved around providing offshore drilling and marine services to exploration and production (E&P) companies. These clients sought partners capable of minimizing downtime, adhering to strict safety regulations, and delivering projects within predictable timelines and budgets. The demand for specialized equipment and skilled personnel drove their purchasing decisions.

The psychological and practical drivers behind choosing Hercules Offshore's offerings stemmed from the critical nature of oil and gas extraction. Any operational failure could lead to significant financial losses, environmental damage, and reputational harm. Hercules Offshore aimed to address common pain points such as unexpected equipment failures or delays by maintaining a modern fleet and experienced crews. The company's offerings were intrinsically tailored to the highly specialized and demanding requirements of the offshore energy sector.

The target market for Hercules Offshore, Inc. consisted mainly of E&P companies operating in the offshore oil and gas industry. These companies prioritized operational efficiency, safety, and cost-effectiveness. Understanding these needs was critical for Hercules Offshore's success.

- Operational Efficiency: Clients sought to minimize downtime and maximize production.

- Safety: Adherence to stringent safety regulations was paramount.

- Reliability: Predictable project timelines and dependable equipment were essential.

- Cost-Effectiveness: Competitive pricing and efficient operations were crucial.

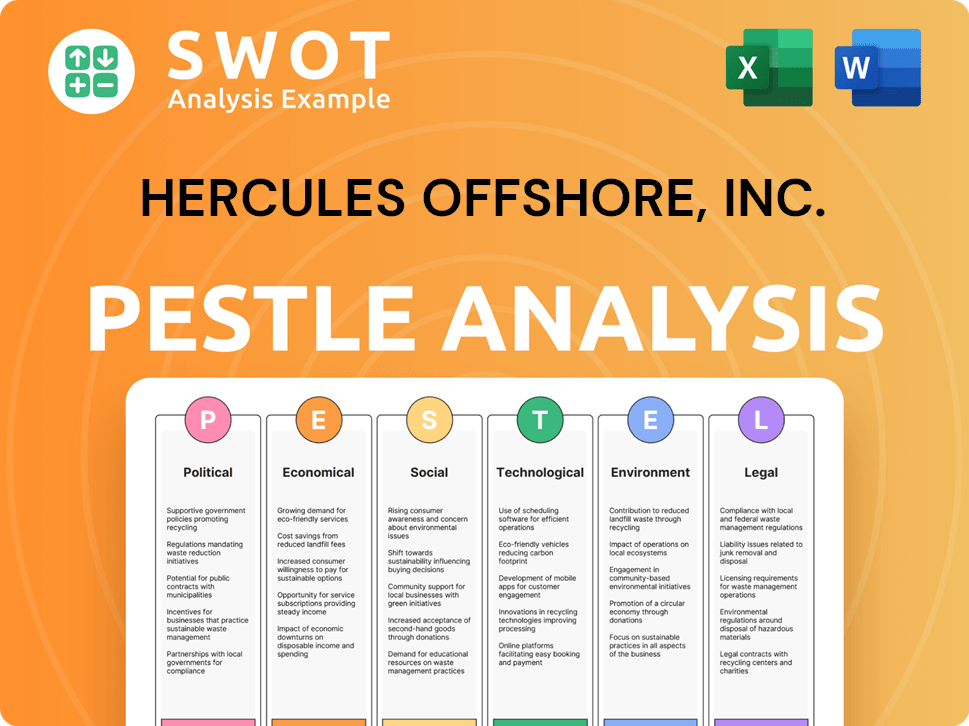

Hercules Offshore, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Hercules Offshore, Inc. operate?

The geographical market presence of Hercules Offshore, Inc. was primarily focused on shallow water markets, a strategic decision influenced by the company's specialization in offshore drilling services. While specific market share data by region is not readily available for the entirety of its operational history, the company's footprint was notably concentrated in key areas such as the U.S. Gulf of Mexico, West Africa, and the Middle East. This strategic focus allowed Hercules Offshore to capitalize on the demand for shallow water drilling services within these regions.

The U.S. Gulf of Mexico represented a significant market for Hercules Offshore, given its established infrastructure and the presence of both major and independent operators. West Africa and the Middle East also offered opportunities, although these markets presented different operational and regulatory landscapes. The company's ability to adapt to these diverse environments was crucial for its success. Understanding the nuances of each region, from regulatory compliance to local partnerships, was essential for effective market penetration.

Differences in customer demographics, preferences, and buying power were primarily related to the maturity of the oil and gas industry in each area, local regulatory frameworks, and the types of E&P companies operating there. For instance, the U.S. Gulf of Mexico had a well-established regulatory environment and a mix of major and independent operators, while emerging markets in West Africa might have involved different contractual structures and a greater presence of national oil companies. To delve deeper into the company's financial structure, you can explore Owners & Shareholders of Hercules Offshore, Inc..

The U.S. Gulf of Mexico was a core market for Hercules Offshore due to its established infrastructure and the presence of numerous oil and gas operators. This region provided a stable demand for shallow water drilling services. The company's operations in this area were supported by a well-defined regulatory environment.

West Africa presented a different set of challenges and opportunities, with emerging markets and varying regulatory landscapes. Hercules Offshore had to adapt its strategies to navigate the contractual structures and the presence of national oil companies in this region. This market required a flexible approach.

The Middle East offered another strategic market for Hercules Offshore, with its own unique set of operational and regulatory conditions. The company's success in this region depended on its ability to comply with local regulations and establish effective partnerships. Adaptability was key.

Hercules Offshore localized its operations by adhering to regional regulations and establishing local partnerships where necessary. Its strategic decisions were influenced by oil prices and the demand for shallow water drilling. The competitive landscape also played a crucial role in its expansion or withdrawal strategies.

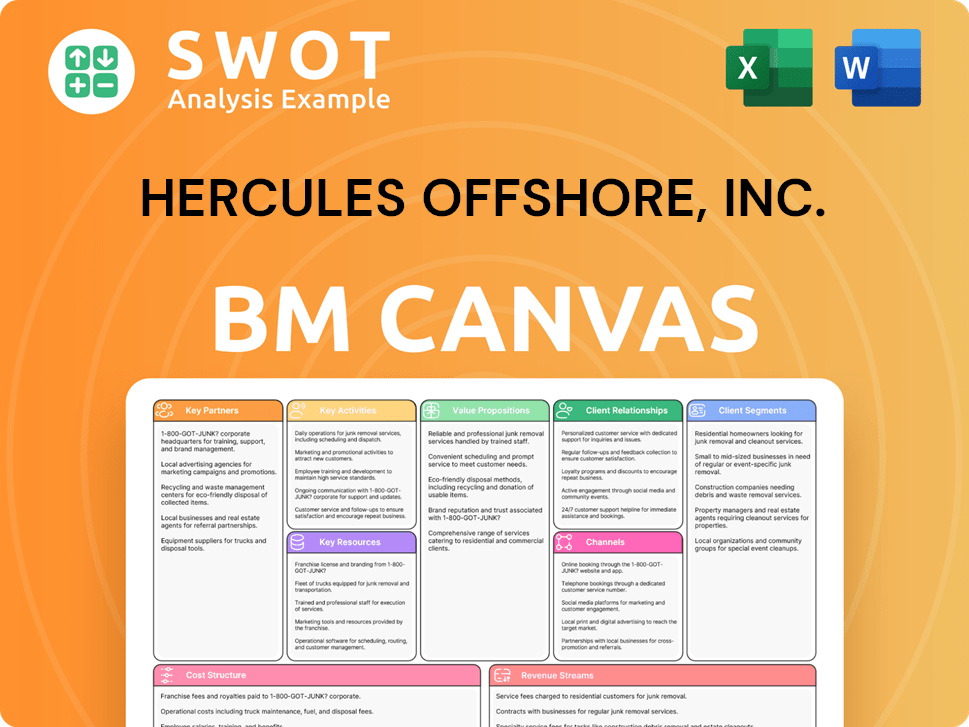

Hercules Offshore, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Hercules Offshore, Inc. Win & Keep Customers?

For a company like the one in question, specializing in offshore drilling services, customer acquisition and retention strategies would have been highly specialized. The focus was on building strong relationships and securing long-term contracts within the business-to-business (B2B) sector. The primary customer profile consisted of large oil and gas exploration and production companies seeking offshore drilling services. Understanding the specific needs of these clients was crucial for success.

The core of the strategy revolved around direct sales efforts, participation in industry conferences, and leveraging professional networks. Digital marketing would have played a smaller role compared to a business-to-consumer (B2C) model. Instead, the company would have relied heavily on industry publications and specialized trade shows to reach its target audience. This targeted approach was essential given the niche nature of the offshore drilling market and the high value of each contract.

Sales tactics involved providing detailed technical proposals, participating in competitive bidding processes, and demonstrating a strong track record of safety and operational performance. Retention strategies went beyond simple loyalty programs. They focused on consistently delivering reliable service, fostering strong client relationships, and adhering to project deadlines and budgets. Customer relationship management (CRM) systems were vital for tracking client interactions, understanding operational needs, and managing contract negotiations. The focus was always on providing value and building trust within the industry.

Direct sales teams were critical for identifying and engaging potential clients. Building and maintaining strong relationships with key decision-makers within oil and gas companies was essential. This involved regular communication, attending industry events, and providing personalized service to meet specific client needs.

Participating in industry-specific conferences and trade shows provided opportunities to connect with potential customers. These events allowed the company to showcase its services, network with industry professionals, and stay informed about market trends and competitor activities. These events were vital for customer acquisition and maintaining a strong industry presence.

Winning contracts often involved submitting detailed technical proposals that demonstrated the company's capabilities and expertise. The competitive bidding process required the company to offer competitive pricing while highlighting its operational excellence and safety record. These proposals were meticulously crafted to meet the specific requirements of each project.

A strong emphasis on operational excellence and a proven safety record were crucial for attracting and retaining customers. Clients prioritized companies with a history of safe and efficient operations. This involved investing in well-maintained equipment, skilled personnel, and rigorous safety protocols. These factors directly impacted the company's ability to secure and retain contracts.

The company's ability to adapt to market fluctuations was also important. During downturns, strategies might have included more aggressive pricing strategies or seeking opportunities in niche markets. The Brief History of Hercules Offshore, Inc. reveals that the company had to navigate significant industry changes, which would have influenced its acquisition and retention strategies. Maintaining a modern fleet of jackup rigs and marine vessels was fundamental for attracting and retaining clients. A skilled workforce was another key factor in providing the reliable services that customers demanded.

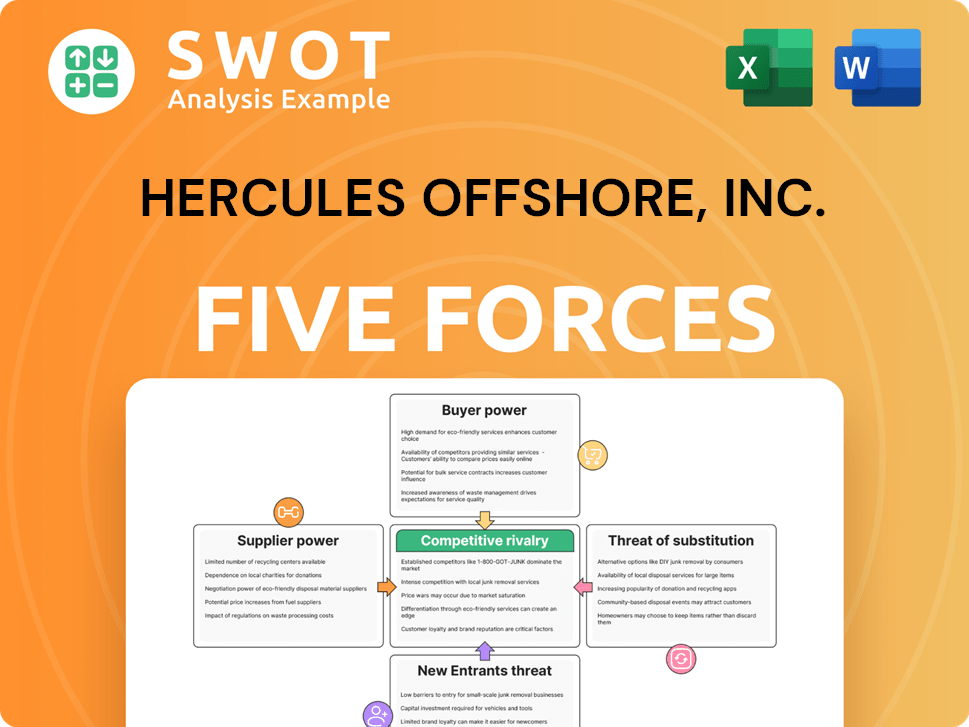

Hercules Offshore, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hercules Offshore, Inc. Company?

- What is Competitive Landscape of Hercules Offshore, Inc. Company?

- What is Growth Strategy and Future Prospects of Hercules Offshore, Inc. Company?

- How Does Hercules Offshore, Inc. Company Work?

- What is Sales and Marketing Strategy of Hercules Offshore, Inc. Company?

- What is Brief History of Hercules Offshore, Inc. Company?

- Who Owns Hercules Offshore, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.