Himadri Bundle

Decoding Himadri: How Does This Chemical Giant Operate?

Himadri Speciality Chemical Ltd. (Himadri Company) is making waves in the specialty chemical sector, showcasing impressive financial growth and strategic expansions. In fiscal year 2024-25, Himadri reported substantial revenue and profit increases, highlighting its strong market position. This analysis will unravel Himadri's operational model, providing crucial insights for investors and industry professionals alike.

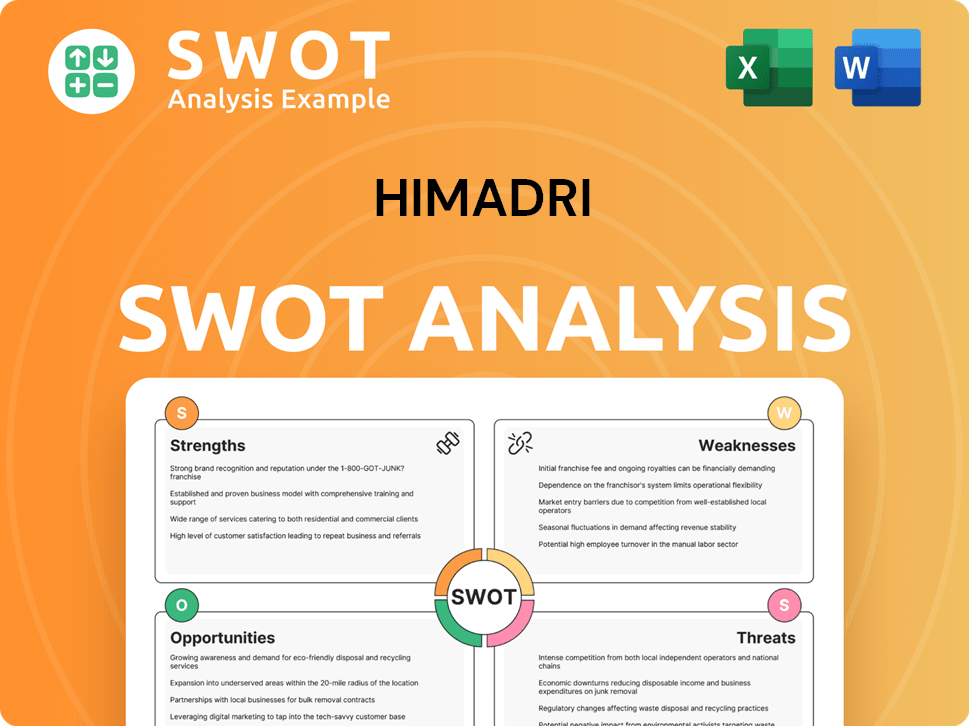

Himadri's influence spans key industries, supplying essential raw materials and solutions. With initiatives like its new export terminal, Himadri Chemicals is solidifying its position in the market. To understand the full potential of Himadri products and its strategic direction, consider a deep dive with a Himadri SWOT Analysis to explore its strengths, weaknesses, opportunities, and threats in detail, offering a comprehensive view of the company's operations and future prospects within the Indian market and beyond.

What Are the Key Operations Driving Himadri’s Success?

The core operations of Himadri Company revolve around the production and distribution of carbon materials and specialty chemicals. These products serve key industries, including lithium-ion batteries, aluminum, and infrastructure. The company's integrated approach, particularly in manufacturing, allows it to maintain a strong market position and deliver value to its customers.

Himadri Chemicals focuses on backward integration and in-house research and development (R&D) to enhance its operational efficiency. This strategy supports its position as a key player in the domestic market for coal tar pitch (CTP) and carbon black. The company's commitment to sustainable practices, such as energy conservation and zero effluent discharge, is also a critical part of its operations.

The value proposition of Himadri products lies in their quality, reliability, and application across various sectors. By offering a diverse range of products, the company caters to the evolving needs of its customers while also contributing to environmental sustainability. The company's integrated business model and focus on customer relationships further enhance its market differentiation and value delivery.

Himadri Company produces a variety of essential materials. These include specialty carbon black, coal tar pitch (CTP), refined naphthalene, and advanced materials. These products are crucial for several industries.

The company has a significant coal tar distillation capacity. It operates a 5 lakh metric tonne per annum (MTPA) facility. Himadri India also runs a 28-MW power plant to support its operations.

The supply chain involves both suppliers and buyers. Himadri Company has strong relationships with both. This integration supports its business model and market position.

Himadri Chemicals is committed to sustainability. They focus on energy conservation and clean energy. The company aims for zero effluent discharge.

Himadri's operational effectiveness is driven by its integrated business model, which supports its market position in domestic CTP and carbon black. This integration, along with established relationships, helps translate core capabilities into customer benefits and market differentiation. The company's focus on sustainable practices is also crucial.

- Backward integration and in-house R&D.

- Largest coal tar distillation capacity in India.

- Strong relationships with customers and suppliers.

- Commitment to sustainable practices.

Himadri SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Himadri Make Money?

The primary revenue stream for the Himadri Company comes from its Carbon Materials and Chemicals segment. A smaller portion of its revenue is generated by the Power segment, which sells electricity produced by windmills to the state grid.

For the fiscal year 2024-25, Himadri reported consolidated revenue of ₹4,612.63 crore, demonstrating a growth from ₹4,184.89 crore in FY24. The company's net profit for FY25 was ₹555.09 crore, reflecting a year-on-year increase of over 35%.

Himadri's revenue for the quarter ending March 31, 2025, was ₹1,148.16 crore. The company has shown strong financial performance over the past five years, with revenues growing at a Compound Annual Growth Rate (CAGR) of 29% since FY21.

Himadri's monetization strategies involve the sale of a diverse product portfolio. These products cater to various industries, including lithium-ion batteries, paints, plastics, tires, technical rubber goods, aluminum, graphite electrodes, agrochemicals, defense, and construction chemicals. The company is also expanding into high-value specialty products.

- The company focuses on product sales across multiple sectors.

- Himadri is expanding into specialty products like anthraquinone, carbazole, and fluorene.

- This diversification aims to reduce import dependency.

- Strategic investments in new facilities enhance revenue streams.

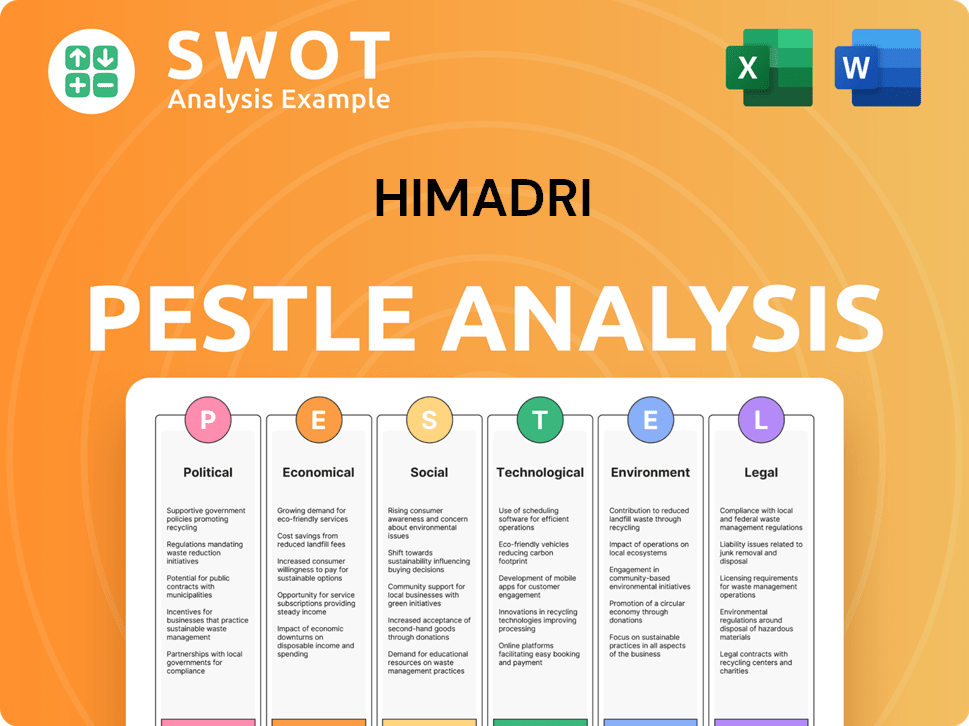

Himadri PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Himadri’s Business Model?

The following outlines the key milestones, strategic moves, and competitive advantages of the Himadri Company. Himadri Speciality Chemical has made significant strides in its operations and financial performance. The company's strategic initiatives, particularly in the lithium-ion battery value chain, are designed to capitalize on the growing demand for electric vehicles and energy storage systems.

Himadri's commitment to innovation and sustainability, coupled with its strong market position and financial health, positions it well for future growth. These strategic moves are aimed at strengthening its market position and expanding its product offerings. The company's focus on both organic and inorganic growth strategies underscores its commitment to long-term value creation.

The company's strategic focus on the lithium-ion battery value chain, including a facility for Lithium Iron Phosphate (LFP) Cathode Active Material, is a significant move. This initiative aligns with India's push for electric vehicles (EVs) and energy storage systems (ESS). Himadri's expansion plans and sustainability initiatives reflect its commitment to long-term value creation.

Himadri is investing around ₹20,000 million collectively over FY25-FY28 towards the lithium-ion value chain project. The company announced an exclusive technology licensing partnership with Sicona in May 2025 to access and commercialize Silicon-Carbon (SiCx) anode technology in India. The company expanded its specialty carbon black capacity to 130,000 MTPA by Q1 FY26 with a capex of ₹220 crore.

Himadri is investing ₹4,800 crores in a facility for Lithium Iron Phosphate (LFP) Cathode Active Material. The company is investing ₹120 crore in a new facility at its Singur plant to produce high-value specialty products. The commencement of its high-temperature liquid coal tar pitch export terminal at Haldia Port in October 2024 has also strengthened its export capabilities.

Himadri has a long track record, large scale, and backward-integrated manufacturing operations. The company holds a strong market position in the domestic coal tar pitch (CTP) and carbon black businesses. Himadri emphasizes sustainability, having achieved a 'B' rating in its first CDP assessment for 2024. The company's robust financial footing, with a net positive cash balance of ₹371 crore as of FY25, positions it well for future strategic opportunities.

Himadri's strategic investments and market position contribute to its financial health. The company's net positive cash balance of ₹371 crore as of FY25 indicates a strong financial position. Himadri's focus on expanding its product portfolio and entering the lithium-ion battery value chain is expected to drive future revenue growth. For more insights, consider reading about the Marketing Strategy of Himadri.

Himadri Company benefits from its established market position and diversified product portfolio. The company's focus on sustainability and ESG compliance enhances its brand value. The company's robust financial health provides a solid foundation for growth and strategic investments.

- Strong market position in CTP and carbon black businesses.

- Diversified product portfolio catering to various industries.

- Commitment to ESG and sustainability initiatives.

- Robust financial footing with a net positive cash balance.

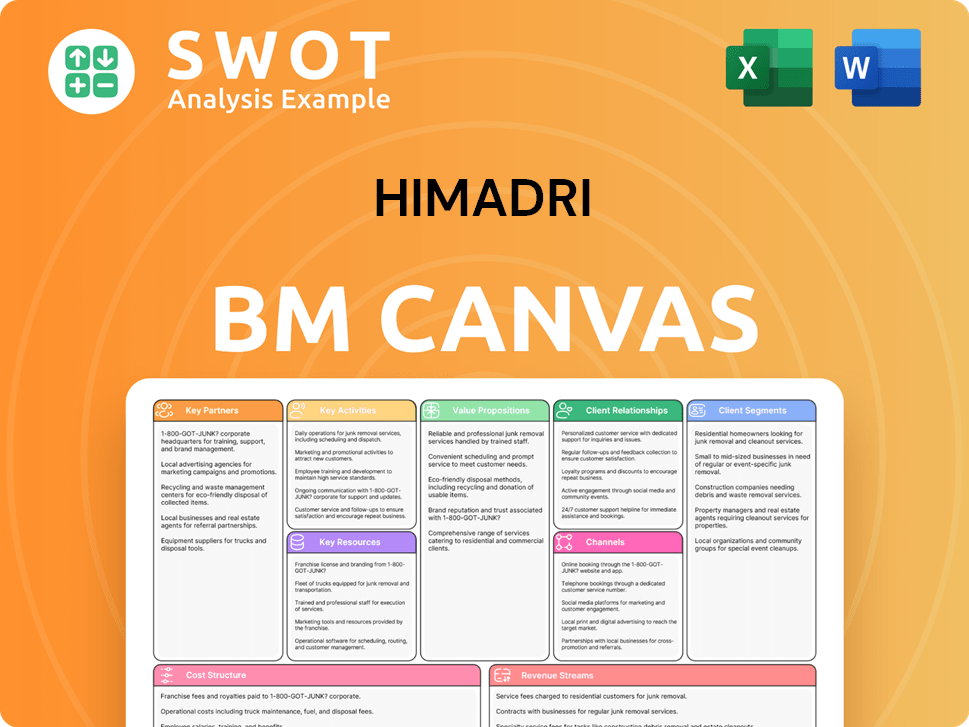

Himadri Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Himadri Positioning Itself for Continued Success?

Himadri Speciality Chemical, referred to as the Himadri Company, holds a strong market position within the domestic coal tar pitch (CTP) industry, and a robust standing in the carbon black (CB) market. This is built on its integrated business model and established relationships with customers and suppliers. The company's diverse product portfolio serves various sectors, including aluminum, graphite, tires, and plastics. Exports accounted for around 19% of consolidated revenue in FY24.

The company faces certain risks despite its strong position. More than 45% of its sales volume comes from the cyclical aluminum and graphite electrode industries, which can lead to fluctuating returns. Project execution risk, including potential delays and cost overruns, is also a concern, especially given its significant capital expenditure plans. While the company has submitted its GHG reduction goals to SBTi, the lack of formal validation and the early stages of absolute emission reductions present a moderate risk. The company's energy and Scope 1 and 2 emission intensity remain high.

The Himadri Company is a key player in the domestic coal tar pitch (CTP) and carbon black (CB) markets. Its integrated model and strong relationships support this position. The company's diverse product range caters to a wide array of industries, showcasing its versatility and market reach. This helps to understand the Target Market of Himadri.

The company is exposed to business cycles, with a significant portion of sales tied to cyclical industries. Project execution risks are present due to large capital expenditures, particularly in the lithium-ion value chain. While sustainability goals are set, formal validation and emission reduction progress are still developing, representing a moderate risk.

Himadri Chemicals plans approximately ₹20,000 million in capex over FY25-FY28 for the lithium-ion value chain project and specialty carbon black expansion. A new facility for high-value specialty products, with an investment of ₹120 crore, is expected to be operational by September 2026. The company aims to de-carbonize its value chain by 5% by 2025.

The company is focused on strategic initiatives to sustain and expand profitability. This includes investments in the lithium-ion value chain and specialty carbon black expansion. The recent technology licensing partnership for Silicon-Carbon (SiCx) anode technology further strengthens its position in advanced battery materials. The company is committed to sustainability and aims to de-carbonize its value chain.

Himadri products are well-positioned within the CTP and CB markets, supported by a strong business model. The company faces risks related to cyclical industries and project execution. Future plans include significant investments in the lithium-ion value chain and specialty products, along with sustainability initiatives.

- Strong market position in CTP and CB industries.

- Exposure to cyclical markets and project execution risks.

- Focus on lithium-ion value chain and specialty product expansion.

- Commitment to sustainability and de-carbonization targets.

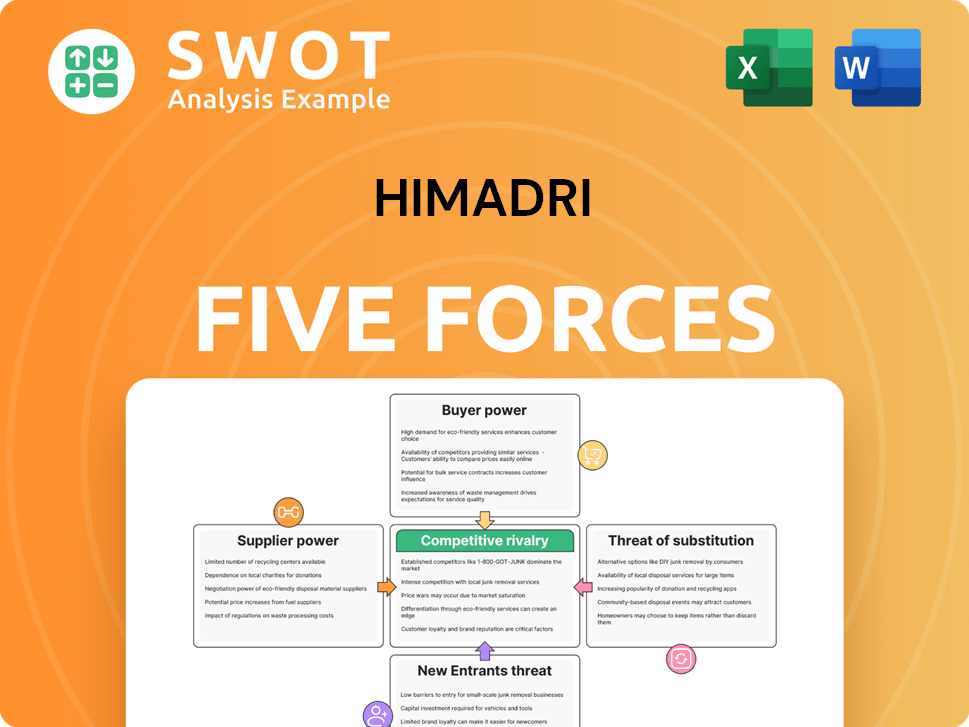

Himadri Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Himadri Company?

- What is Competitive Landscape of Himadri Company?

- What is Growth Strategy and Future Prospects of Himadri Company?

- What is Sales and Marketing Strategy of Himadri Company?

- What is Brief History of Himadri Company?

- Who Owns Himadri Company?

- What is Customer Demographics and Target Market of Himadri Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.