Himadri Bundle

Who Really Owns Himadri Company?

Unraveling the Himadri SWOT Analysis is just the beginning; understanding the Himadri Company's ownership is key to grasping its strategic moves and market influence. From its humble beginnings as Himadri Castings Pvt Ltd. to its current status as a specialty chemical powerhouse, the company's evolution is intertwined with its ownership structure. Knowing the Himadri Chemicals ownership is vital for anyone looking to invest or understand the company's future trajectory.

This exploration of Himadri Company ownership will delve into the intricacies of its shareholder base, including the Himadri Group's major shareholders and key personnel. We'll examine the Himadri Chemicals ownership structure, from founder stakes to current public ownership, providing insights into who controls Himadri Group and the company's leadership. Whether you're researching Himadri business strategies or seeking Himadri Company owner details, this analysis offers a comprehensive overview of this important player in the specialty chemicals sector, including its financial backers and board of directors.

Who Founded Himadri?

Himadri Speciality Chemical Limited, initially known as Himadri Castings Pvt Ltd., was established on July 28, 1987. The Choudhary group spearheaded the company's promotion and management, marking the beginning of its journey in the specialty chemicals sector. The early focus was on producing coal tar and related products, setting the foundation for its future operations.

Key figures like Mr. D.P. Choudhary and Mr. S.S. Choudhary played pivotal roles in the company's initial setup. Other significant contributors included Mr. B.L. Choudhary, Mr. V.K. Choudhary, Mr. M.L. Jalan, Mr. R.N. Jhunjhunwala, and Mr. G.S. Biyani. Their collective efforts drove the company's early strategic decisions and operational execution.

In 1990, the company initiated a Coal Tar Distillation Unit in Liluah-Howrah, West Bengal, which began commercial production in December 1990. This unit had an initial capacity of 4,800 MTs. The company's evolution continued with a name change to Himadri Chemicals & Industries Pvt Ltd on November 20, 1991, and its subsequent conversion to a public limited company on November 27, 1991. This transition marked a significant step in broadening its ownership structure.

The early ownership of Himadri Chemicals primarily rested with the Choudhary group and the key individuals involved in its promotion. The company's initial public offering (IPO) in 1993 and a rights offer in 1994 broadened the shareholder base, moving beyond the founding group. This expansion was crucial for funding capacity increases and supporting the company's growth trajectory.

- The initial public issue in 1993 raised Rs 30,000,000.

- A rights offer in March 1994 issued 4,984,000 shares.

- The rights offer was priced at a premium of Rs 5, totaling Rs 747.66 lakhs.

- These financial moves helped Himadri Company expand its operations.

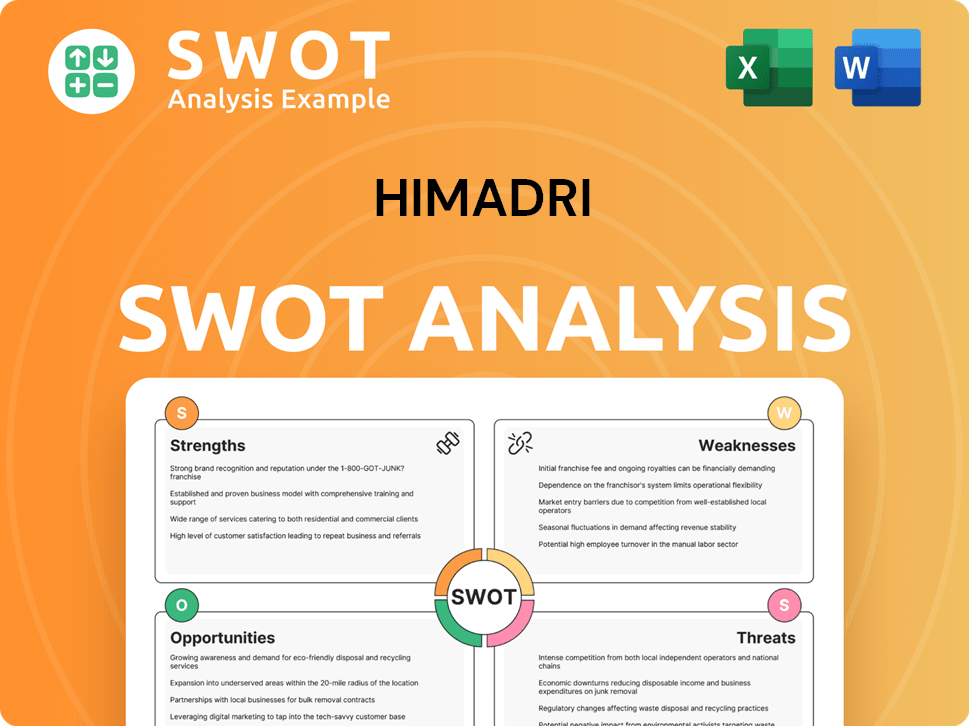

Himadri SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Himadri’s Ownership Changed Over Time?

The ownership structure of Himadri Speciality Chemical Limited, also known as Himadri Company, reveals a dynamic landscape. As of March 2025, the promoters and the promoter group collectively hold a significant stake, controlling 51.61% of the company. This indicates a strong influence from the founding entities. Modern Hi-rise Private Limited is a major shareholder within this group, holding 37.55% of the shares.

Public shareholding constitutes 48.39% of Himadri's shares. Institutional investors, including Foreign Institutional Investors (FIIs) and Mutual Funds, play a crucial role. FIIs increased their holdings from 5.15% to 5.38% in the March 2025 quarter, with the number of FII/FPI investors rising from 153 to 158. Mutual Funds also increased their holdings from 2.74% to 2.82% during the same period, and the number of schemes investing in the company increased from 14 to 18. Narantak Dealcomm Limited is the largest public shareholder, with 2.94% ownership. Other Domestic Institutions hold 1.81%.

| Shareholder Category | Stake as of March 2025 | Changes in Holdings (March 2025 Quarter) |

|---|---|---|

| Promoters and Promoter Group | 51.61% | - |

| Foreign Institutional Investors (FIIs) | 5.38% | Increased from 5.15% |

| Mutual Funds | 2.82% | Increased from 2.74% |

Strategic moves, such as the acquisition of a 16.24% stake in International Battery Company, Inc. for $4.4 million in April 2025, and the acquisition of a 40% stake in Invati Creations Private Limited in FY25, highlight how changes in Himadri Chemicals' ownership and strategic investments can influence the company's direction, particularly in expanding into new technologies like lithium-ion battery components. This demonstrates the Himadri Group's commitment to growth and innovation.

Himadri's ownership is primarily controlled by promoters, with significant public and institutional investor participation.

- Promoters and promoter groups hold a majority stake, ensuring significant control.

- FIIs and Mutual Funds are increasing their investments, reflecting positive sentiment.

- Strategic acquisitions indicate a focus on expanding into new markets and technologies.

- The ownership structure is dynamic, with ongoing changes reflecting the company's growth strategy.

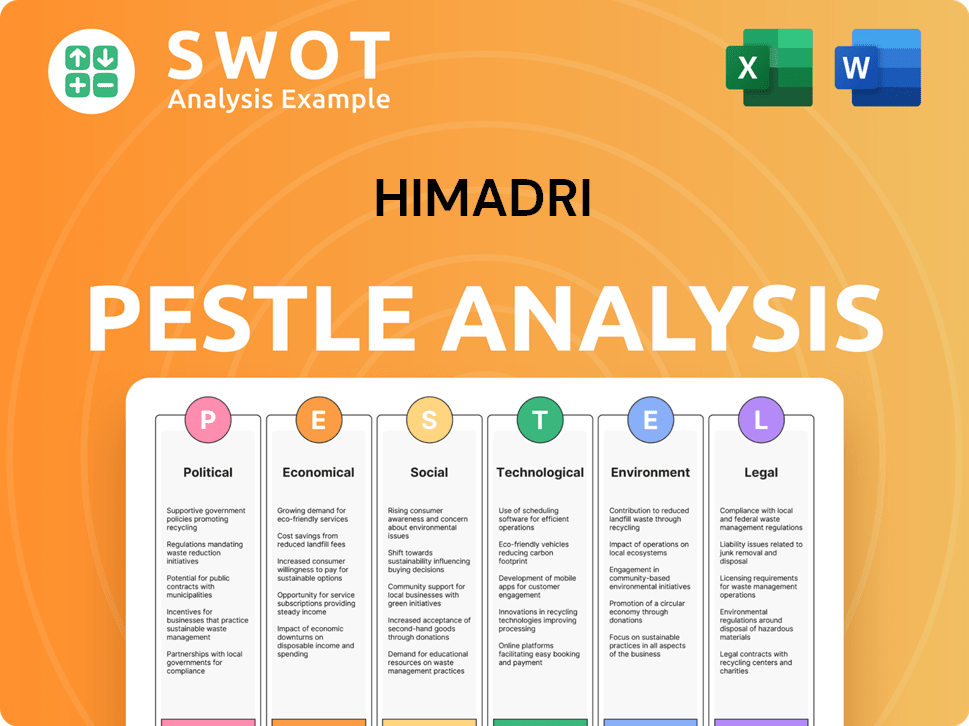

Himadri PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Himadri’s Board?

The Board of Directors of the Himadri Company plays a vital role in its governance and strategic direction. As of 2025, the board includes a mix of executive and independent directors, reflecting the company's ownership and operational structure. The board's composition is designed to ensure a balance of perspectives and expertise, guiding the company's long-term vision.

Key figures on the board include Anurag Choudhary, who serves as the CMD & CEO, and Amit Choudhary and Shyam Sundar Choudhary, who are Whole-time Directors. These individuals highlight the continued influence of the Himadri Group, the company's promoters. Independent directors such as Gopal Ajay Malpani, Girish Paman Vanvari, and Rita Bhattacharya, appointed in 2025, bring diverse expertise to the board. The appointment of Mr. Amitabh Srivastava as an Independent Director effective April 21, 2025, further diversifies the board's composition.

| Board Member | Title | Role |

|---|---|---|

| Anurag Choudhary | CMD & CEO | Executive Director |

| Amit Choudhary | Whole-time Director | Executive Director |

| Shyam Sundar Choudhary | Whole-time Director | Executive Director |

| Gopal Ajay Malpani | Independent Director | Independent Director |

| Girish Paman Vanvari | Independent Director | Independent Director |

| Rita Bhattacharya | Independent Director | Independent Director |

| Amitabh Srivastava | Independent Director | Independent Director |

The voting structure of Himadri Chemicals generally follows a one-share-one-vote principle, common for publicly listed companies. The Himadri Group, as the promoters, hold a significant stake, approximately 51.61% of the shares as of March 2025. This substantial ownership grants the promoters considerable influence over major decisions and strategic initiatives. The board also oversees environmental, social, and governance (ESG) practices, integrating safety and sustainability into strategic initiatives.

Understanding the Himadri Company's ownership structure is crucial for investors and stakeholders. The Himadri Group, the promoters, hold a majority stake, influencing the company's direction.

- The board includes executive and independent directors.

- Promoters hold 51.61% of the shares.

- The board focuses on ESG practices.

- For more details, see the Growth Strategy of Himadri.

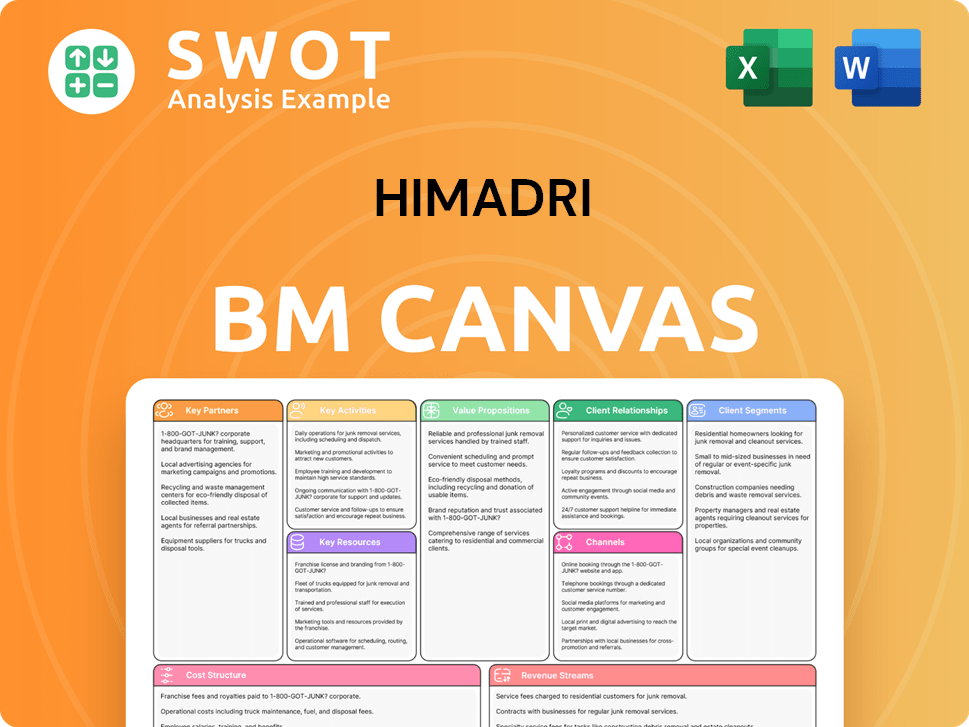

Himadri Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Himadri’s Ownership Landscape?

Over the past few years, the ownership structure of Himadri Speciality Chemical Ltd. has seen some interesting shifts. According to the latest data from March 2025, the promoters slightly increased their holdings to 51.61%. This indicates continued confidence from the founding entities. Foreign Institutional Investors (FIIs) also increased their stake, rising from 5.15% to 5.38% in the March 2025 quarter, with the number of FIIs investing growing from 153 to 158. Similarly, Mutual Funds have increased their stake from 2.74% to 2.82% during the same period, reflecting broader investor interest.

These changes highlight a positive trend in the Himadri ownership profile, as both institutional and retail investors are showing increased interest in the company. This is likely driven by the company’s strategic moves and its expansion into high-growth sectors like lithium-ion battery materials. For more insights into the company's origins, you can check out Brief History of Himadri.

| Ownership Category | March 2024 | March 2025 |

|---|---|---|

| Promoters | 51.56% | 51.61% |

| FIIs | 5.15% | 5.38% |

| Mutual Funds | 2.74% | 2.82% |

Recent strategic initiatives further define the Himadri business trajectory. In April 2025, the company agreed to acquire a 16.24% stake in International Battery Company, Inc. for approximately INR 37.47 crores, representing a strategic move into the lithium-ion battery materials sector. Furthermore, in FY25, Himadri acquired a 40% stake in Invati Creations Private Limited and established Himadri Speciality Inc. as a wholly-owned subsidiary in Delaware, USA, on February 7, 2025. These acquisitions and investments, alongside the 2024 acquisition of Sicona Battery Technologies Pty Ltd, demonstrate a strong commitment to the clean energy space. The company is also building a manufacturing facility for Lithium-ion Battery (LiB) components with a total annual production capacity of 200,000 MTPA, involving an investment of Rs 4800 Crores in 2024.

Mr. Shyam Sundar Choudhary re-appointed as Whole-time Director effective April 1, 2025.

Acquisition of a 16.24% stake in International Battery Company, Inc. for $4.4 million (INR 37.47 crores) in April 2025.

Final dividend of ₹0.60 per equity share declared for FY 2024-25.

Mr. Amitabh Srivastava appointed as an Independent Director effective April 21, 2025.

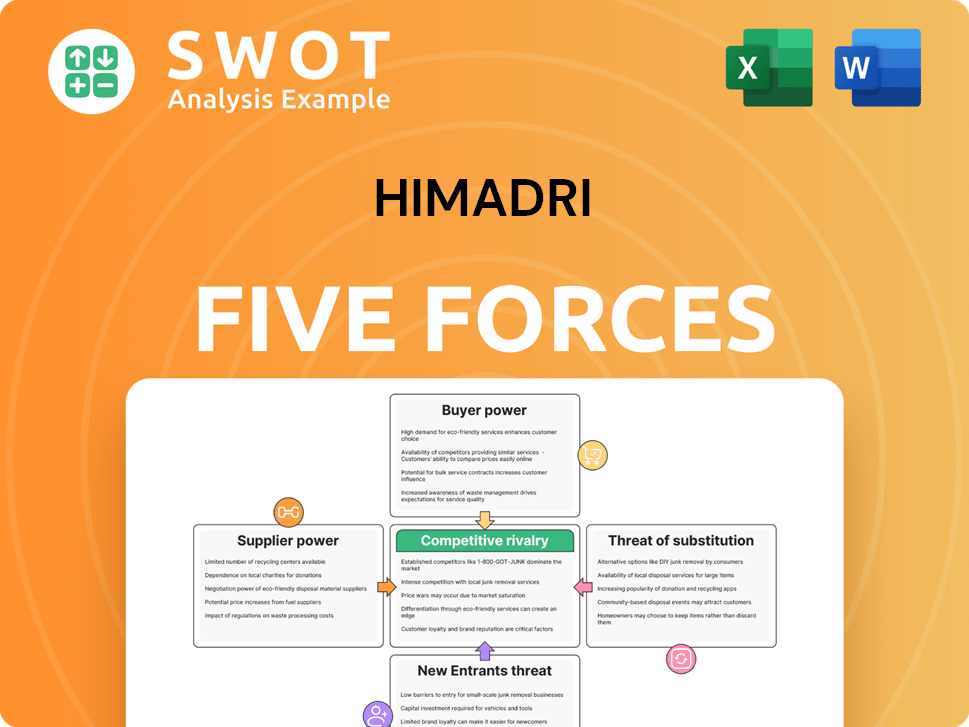

Himadri Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Himadri Company?

- What is Competitive Landscape of Himadri Company?

- What is Growth Strategy and Future Prospects of Himadri Company?

- How Does Himadri Company Work?

- What is Sales and Marketing Strategy of Himadri Company?

- What is Brief History of Himadri Company?

- What is Customer Demographics and Target Market of Himadri Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.