Ryan Specialty Group Bundle

How Does Ryan Specialty Group Thrive in the Insurance World?

Ryan Specialty Group (RYAN) stands out as a key player in the specialty insurance sector, but how does it actually work? As a leading international specialty insurance organization, understanding its operations is crucial. Its influence is evident through its impressive revenue and strategic expansions in the global insurance market.

This deep dive into Ryan Specialty Group SWOT Analysis will explore its core operations and revenue streams. We'll dissect its business model, focusing on high-value, complex risks within the Insurance industry, to uncover its recipe for success. Learn about the company's strategic moves and future outlook, providing valuable insights for investors and industry observers alike.

What Are the Key Operations Driving Ryan Specialty Group’s Success?

Ryan Specialty Group (RSG) creates value by focusing on complex, specialized insurance risks. It acts as an intermediary and expert within the insurance market. Its core operations are divided into two main segments: Wholesale Brokerage and Underwriting Management.

The Wholesale Brokerage segment connects retail brokers with specialty insurance carriers. This provides access to a wide range of specialized insurance products. The Underwriting Management segment manages delegated underwriting authority on behalf of insurance carriers. This includes program administrators and managing general underwriters.

RSG’s approach is unique due to its focus on specialized risks and extensive network. This network includes relationships with both retail brokers and specialty carriers. It also has deep underwriting expertise. This specialized approach provides access to critical coverage for risks that traditional insurers may not underwrite.

Connects retail brokers with specialty insurance carriers. Provides access to a wide array of specialized insurance products. Focuses on unique and challenging risks. Leverages deep market knowledge and relationships.

Manages delegated underwriting authority for insurance carriers. Includes program administrators and managing general underwriters. Develops and manages specialized insurance programs. Offers tailored coverage and underwriting expertise.

Focus on specialized risks. Extensive network of relationships. Deep underwriting expertise. Ability to identify emerging risks. Efficiently matches complex risks with appropriate capital.

Access to critical coverage for risks that traditional insurers may not underwrite. Mitigates potential financial exposures. Provides innovative insurance products. Offers tailored solutions for specific industries.

In recent financial reports, RSG has demonstrated strong growth, reflecting its successful business model. The company's ability to navigate the complex landscape of specialty insurance has positioned it favorably within the market. RSG's focus on specialized risks and its extensive network of partners have been key drivers of its success.

- RSG operates in a market that is continuously evolving, with new risks and challenges emerging.

- The company's ability to adapt and innovate is crucial for maintaining its competitive edge.

- RSG's commitment to providing specialized insurance solutions has made it a leader in the industry.

- The company's financial performance reflects its strong market position and growth potential.

Ryan Specialty Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ryan Specialty Group Make Money?

Understanding the revenue streams and monetization strategies of Ryan Specialty Group (RSG) is key to grasping its financial performance. The company primarily generates revenue through its Wholesale Brokerage and Underwriting Management segments within the specialty insurance market. RSG's ability to navigate complex risks and provide specialized services drives its financial success.

For the fiscal year 2023, Ryan Specialty Group reported a total revenue of $1.96 billion, reflecting substantial growth. The company also demonstrated strong profitability, with an adjusted net income of $418.1 million for the full year 2023. This financial performance underscores the effectiveness of its revenue model and market position.

The Wholesale Brokerage segment earns revenue through commissions on premiums placed with specialty carriers. These commissions vary based on risk complexity and market conditions, contributing significantly to RSG's overall revenue. This segment leverages RSG's extensive network and expertise in placing complex risks.

The Underwriting Management segment generates revenue through underwriting fees, profit commissions, and other service fees. Underwriting fees are a percentage of gross written premiums, while profit commissions are earned based on the performance of managed programs. This segment capitalizes on RSG's specialized underwriting capabilities.

- Wholesale Brokerage: Commission-based revenue on premiums placed with specialty carriers.

- Underwriting Fees: Percentage of gross written premiums for managed programs.

- Profit Commissions: Earned when managed programs perform favorably.

- Other Service Fees: Additional revenue from various services provided.

Ryan Specialty Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Ryan Specialty Group’s Business Model?

Ryan Specialty Group (RSG) has marked significant milestones that have shaped its operational and financial trajectory. A pivotal strategic move was its initial public offering (IPO) in July 2021, which injected substantial capital, fueling expansion and acquisitions. Since its IPO, Ryan Specialty Group's Brief History shows a consistent acquisition strategy.

The company has integrated specialized firms to broaden its geographic reach, product offerings, and underwriting expertise. For instance, the acquisition of certain assets of Southern Insurance Underwriters, Inc. in late 2023 strengthened its wholesale brokerage capabilities in the Southeast. The acquisition of Castel Underwriting Agencies Limited in April 2024, a leading MGA formation platform in the UK, is expected to enhance its international underwriting management capabilities.

Operational challenges include navigating the dynamic insurance market, characterized by evolving risks and increasing competition. Ryan Specialty has responded by investing in technology and talent, enhancing its data analytics capabilities to improve underwriting precision and operational efficiency. The company’s competitive advantages stem from its deep expertise in specialty insurance, its extensive network of retail brokers and carriers, and its entrepreneurial culture that fosters innovation in product development.

The IPO in July 2021 provided capital for expansion. Acquisitions have expanded geographic reach and product offerings. The acquisition of Castel Underwriting Agencies Limited in April 2024 is a strategic move to enhance international underwriting capabilities.

Ryan Specialty Group has a strong focus on acquisitions. The company is constantly investing in technology and talent. They are developing new programs and expanding specialized offerings to adapt to new trends.

Deep expertise in specialty insurance is a key advantage. An extensive network of retail brokers and carriers provides a competitive edge. The ability to offer tailored solutions for complex risks differentiates the company.

The company's scale allows it to achieve economies of scale. Ryan Specialty attracts top talent, solidifying its market position. The company is adapting to new trends, such as the increasing demand for cyber insurance.

Ryan Specialty Group continues to adapt to market changes by expanding its specialized offerings. The company is focused on innovation in product development to meet emerging risk demands, such as cyber insurance. RSG's strategic acquisitions and focus on technology position it for continued growth.

- The acquisition of Castel Underwriting Agencies Limited in April 2024 expands its international underwriting capabilities.

- Ongoing investments in technology and data analytics improve underwriting precision.

- The company's focus on tailored solutions for complex risks provides a significant differentiation in the market.

- Ryan Specialty's broad platform allows it to attract top talent and achieve economies of scale.

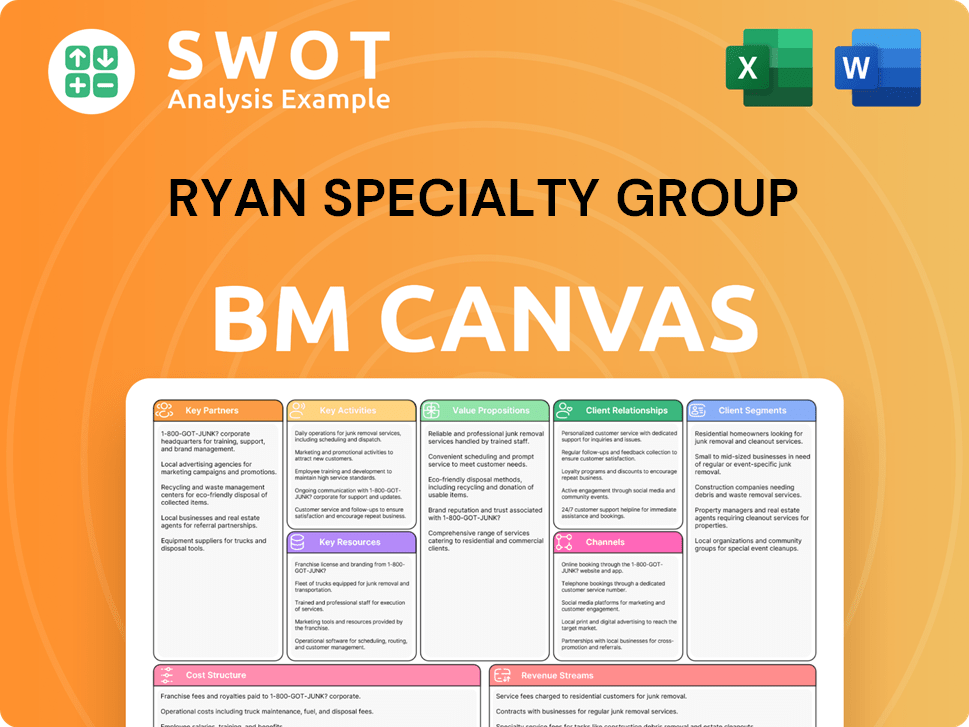

Ryan Specialty Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Ryan Specialty Group Positioning Itself for Continued Success?

Ryan Specialty Group (RSG) holds a prominent position in the specialty insurance market, acting as a leading intermediary for complex and niche risks. The company distinguishes itself through deep specialization, extensive market access, and proprietary programs. Its substantial market share in wholesale brokerage and Managing General Underwriter (MGU) segments reflects its strong relationships and expertise. RSG's global reach is expanding, with strategic acquisitions strengthening its international footprint. For instance, in 2023, RSG completed several acquisitions to broaden its capabilities and market presence.

Despite its strong market position, Ryan Specialty faces risks, including regulatory changes, emerging competitors, and economic fluctuations. Catastrophic events also pose inherent risks to the insurance industry. The company's ability to adapt to these challenges and maintain its competitive edge is crucial. According to recent financial reports, the insurance industry is continually evolving, with new risks and challenges emerging regularly, such as those related to climate change and cyber security.

Ryan Specialty is a leading wholesale brokerage and MGU, specializing in complex and niche risks. Its market share is significant, reflecting strong relationships and expertise. The company's global presence is expanding through strategic acquisitions. For a detailed view of the competitive landscape, consider reading about the Competitors Landscape of Ryan Specialty Group.

Key risks include regulatory changes, emerging competitors, and economic fluctuations. Catastrophic events also pose significant challenges. Adapting to these risks is crucial for maintaining a competitive edge. Regulatory changes and economic conditions can significantly impact the insurance sector.

Ryan Specialty focuses on organic growth and strategic acquisitions to generate revenue. Innovation includes developing new specialized insurance products. The company is committed to leveraging technology for efficiency and client experience. RSG plans to expand into new geographic markets and niche areas.

RSG aims to maintain leadership in specialty insurance and deliver sustained value. Key initiatives include deepening client relationships and expanding into new markets. Continuous innovation in products and services is a priority. The company's strategic focus supports long-term growth and market leadership.

Ryan Specialty is focused on expanding through organic growth and strategic acquisitions. The company is developing new specialized insurance products to address evolving risks. Technology plays a crucial role in enhancing efficiency and client experience, solidifying its competitive advantage.

- Deepening existing client relationships.

- Expanding into new geographic markets.

- Identifying new niche areas within specialty insurance.

- Leveraging technology for operational efficiency.

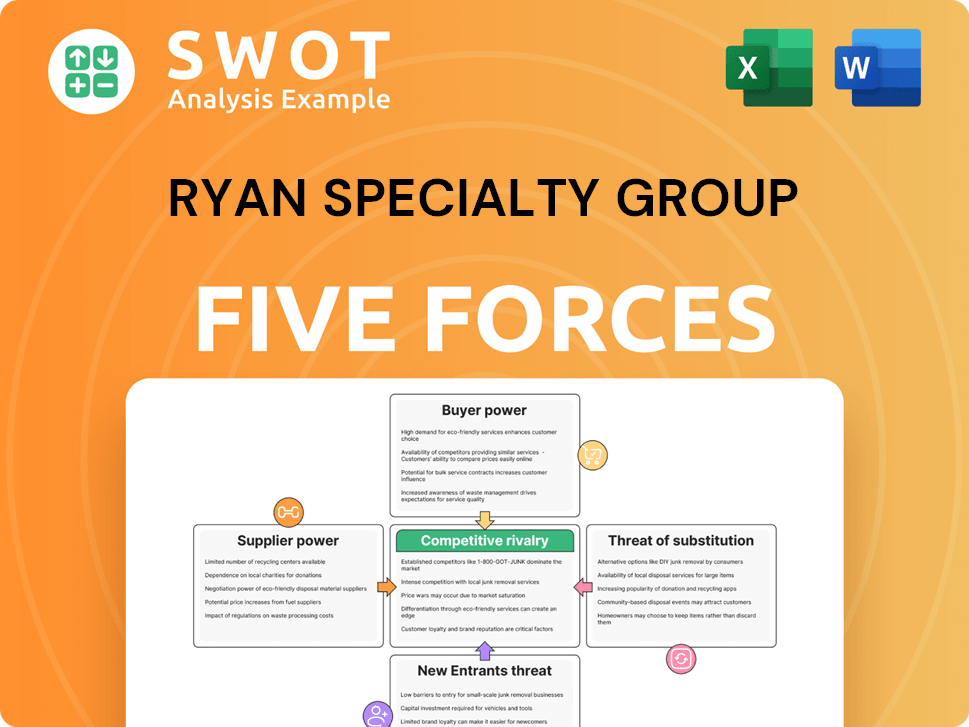

Ryan Specialty Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ryan Specialty Group Company?

- What is Competitive Landscape of Ryan Specialty Group Company?

- What is Growth Strategy and Future Prospects of Ryan Specialty Group Company?

- What is Sales and Marketing Strategy of Ryan Specialty Group Company?

- What is Brief History of Ryan Specialty Group Company?

- Who Owns Ryan Specialty Group Company?

- What is Customer Demographics and Target Market of Ryan Specialty Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.