Tata Steel Bundle

How Does Tata Steel Thrive in the Global Steel Market?

Tata Steel, a titan in the steel manufacturing industry, boasts a century-long legacy of adapting to global market dynamics. From its humble beginnings to its current status as a leading steel producer, the company's journey reflects remarkable strategic evolution. Its influence spans continents, impacting critical sectors with a diverse portfolio of steel products.

In the fiscal year ending March 31, 2024, Tata Steel showcased its robust Tata Steel SWOT Analysis, producing 19.86 million tonnes of crude steel. This significant Tata Steel production capacity underscores its pivotal role in the global steel supply chain and the Indian steel industry. This exploration will delve into Tata Steel operations, revenue streams, and the strategic elements driving its success, offering a comprehensive view for investors and industry observers alike. Understanding the Steel production process is key.

What Are the Key Operations Driving Tata Steel’s Success?

Tata Steel's core operations center around integrated steel production, encompassing everything from raw material extraction to the manufacturing of finished steel products. The company serves diverse sectors, including automotive, construction, and engineering, tailoring its offerings to meet specific industry needs. Its value proposition lies in delivering high-quality, innovative steel solutions alongside reliable supply chain management and customer-focused services.

The operational journey begins with sourcing iron ore and coal, largely from its captive mines in India, ensuring raw material security. Steelmaking involves blast furnaces and electric arc furnaces, followed by processes like hot and cold rolling, and various coatings to produce specialized steel grades. The supply chain is extensive, involving global logistics for raw materials and finished product distribution. Tata Steel utilizes a vast network of sales offices, distributors, and service centers to reach its global customer base.

What sets Tata Steel apart is its strong emphasis on research and development, resulting in advanced, high-strength steels and innovative materials. These innovations enhance performance and enable lightweighting, particularly in the automotive sector. Furthermore, its 'green steel' initiatives and investments in hydrogen-based steelmaking technologies aim to reduce its carbon footprint, appealing to environmentally conscious customers and contributing to a sustainable future. For more information about the people behind the company, check out Owners & Shareholders of Tata Steel.

The steel manufacturing process at Tata Steel involves several key stages. It starts with the sourcing of raw materials like iron ore and coal, often from captive mines. These materials are then processed in blast furnaces and electric arc furnaces to produce molten steel, which is further refined and shaped into various steel products.

Tata Steel's operations are highly integrated, encompassing the entire steel production chain. This integration ensures control over quality and supply. The company's global presence includes manufacturing facilities, sales offices, and distribution networks, enabling it to serve customers worldwide.

The value proposition of Tata Steel is centered around providing high-quality, innovative steel products. This includes advanced steel grades that meet specific customer needs. The company also emphasizes reliable supply chain management and customer-centric services to ensure customer satisfaction.

Tata Steel is actively involved in sustainability initiatives. These include 'green steel' projects and investments in hydrogen-based steelmaking technologies. These efforts aim to reduce the company's carbon footprint and contribute to a more sustainable future, appealing to environmentally conscious customers.

In fiscal year 2024, Tata Steel's crude steel production in India reached approximately 19.6 million tons. The company invested significantly in research and development, allocating a substantial portion of its budget to innovation. Tata Steel's focus on sustainability is evident through its aim to reduce its CO2 emissions intensity by 20% by 2030.

- Integrated steel production from raw materials to finished products.

- Emphasis on research and development for innovative steel solutions.

- Commitment to sustainability through 'green steel' initiatives.

- Global supply chain and customer-centric services.

Tata Steel SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Tata Steel Make Money?

The primary revenue streams for Tata Steel are centered around the sale of its diverse steel products. These products include flat products, like hot-rolled and cold-rolled coils, and long products, such as wire rods and structural steel. The company's financial success is closely tied to its ability to efficiently produce and sell these steel products across various global markets.

In fiscal year 2024, Tata Steel reported a consolidated turnover of ₹2,29,171 crore (approximately $27.5 billion USD), demonstrating its significant market presence. The company uses a variety of monetization strategies, including long-term supply contracts, spot sales, and a focus on premium steel products to maximize its revenue and profitability.

Tata Steel also generates revenue from value-added services, including processing and customized solutions, which enhance the utility of its steel products. By focusing on these services, the company aims to increase its revenue streams and customer satisfaction. The company is expanding its product portfolio to cater to evolving industry needs, such as lightweighting solutions for electric vehicles. The company's strategic focus on sustainability also opens avenues for monetizing 'green' steel products as industries increasingly prioritize environmentally responsible sourcing.

Tata Steel employs several strategies to generate revenue and maximize profitability in the steel manufacturing sector. These strategies are crucial for sustaining its operations and maintaining its competitive edge within the Growth Strategy of Tata Steel and the broader Indian steel industry.

- Long-Term Supply Contracts: Establishing long-term contracts with key industrial clients ensures a steady stream of revenue and provides stability in fluctuating market conditions.

- Spot Sales: Engaging in spot sales based on prevailing market prices allows Tata Steel to capitalize on immediate demand and optimize its pricing strategies.

- Premium and Specialty Steel Products: Focusing on high-margin premium and specialty steel products enhances profitability by catering to specific customer needs and applications.

- Value-Added Services: Offering value-added services like processing and customized solutions increases the utility of steel products, thereby increasing revenue and customer satisfaction.

- Emerging Markets and Product Portfolio Expansion: Exploring opportunities in emerging markets and expanding its product range, including lightweighting solutions for electric vehicles, helps Tata Steel adapt to evolving industry needs and capture new revenue streams.

- Sustainability Initiatives: Monetizing 'green' steel products supports environmental responsibility and aligns with the growing demand for sustainable sourcing, opening new avenues for revenue.

Tata Steel PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Tata Steel’s Business Model?

The journey of Tata Steel, a prominent player in the steel manufacturing sector, is marked by significant milestones and strategic decisions. A pivotal moment was the acquisition of Corus Group in 2007, which significantly broadened its global footprint and production capacity. More recently, the company has focused on deleveraging its balance sheet and optimizing its European operations.

In early 2024, Tata Steel announced plans to restructure its UK operations, including the closure of blast furnaces at Port Talbot and a transition to electric arc furnace steelmaking. This strategic shift aims to reduce carbon emissions and improve cost efficiency, addressing both environmental concerns and operational challenges in a competitive European market.

Tata Steel's operations have faced challenges such as raw material price volatility and global economic slowdowns. The company's response has often involved a dual strategy of operational efficiency improvements and strategic investments in advanced technologies. Furthermore, the company has shown resilience and adaptability in navigating the complexities of the Indian steel industry and global markets.

The acquisition of Corus Group in 2007 was a major expansion move. Recent restructuring in the UK, including the closure of blast furnaces, reflects a shift towards sustainable steel production. These moves have shaped the company's global presence and operational strategies.

Focus on deleveraging its balance sheet and optimizing European operations. Investments in advanced technologies and sustainable practices are key. These strategies aim to improve efficiency and reduce environmental impact.

Integrated operations and strong brand reputation provide a competitive advantage. Commitment to sustainability and innovation in steelmaking are also crucial. The company is adapting to new trends, including digital transformation.

Volatility in raw material prices and economic slowdowns pose challenges. Intense competition from global steel producers requires continuous adaptation. Addressing these challenges is vital for maintaining market position.

Tata Steel's competitive advantages stem from its integrated operations, providing cost control through captive raw material sources, and its strong brand reputation. The company is also focused on innovation in steelmaking and sustainability initiatives, aligning with global environmental regulations. Furthermore, the company's ability to adapt to new trends, such as digital transformation, is crucial.

- Sustainability Initiatives: Investments in green steel production and decarbonization are becoming a significant competitive edge.

- Digital Transformation: Investing in digital transformation across its operations to improve efficiency and decision-making.

- Market Adaptation: Adapting to changing market dynamics and customer demands.

- Financial Performance: The company's financial performance is influenced by global steel prices and operational efficiency.

Tata Steel Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Tata Steel Positioning Itself for Continued Success?

In the global steel market, Tata Steel holds a significant position, ranking among the top steel producers worldwide. Its influence spans across various regions, including Europe, Southeast Asia, and North America, in addition to its strong presence in India. The company's diverse product portfolio and established customer relationships further solidify its standing in the competitive steel manufacturing landscape.

Tata Steel operations are subject to several key risks. These include fluctuations in global steel demand and prices, volatility in raw material costs, regulatory changes concerning environmental emissions, and geopolitical instability affecting trade flows. The emergence of new steelmaking technologies and increasing competition from emerging economies also present potential threats. To mitigate these challenges and ensure long-term viability, the company is actively pursuing strategic initiatives.

Tata Steel is a leading global steel producer, with a significant market share in various regions. Its strong presence in India, Europe, and Southeast Asia contributes to its global footprint. The company's diverse product range and established customer base provide a competitive advantage.

Fluctuations in global steel demand and prices pose a risk to Tata Steel's profitability. Volatility in raw material costs, such as iron ore and coal, can impact production costs. Regulatory changes concerning environmental emissions and geopolitical instability also present challenges. Rising competition from emerging economies adds to the risks.

Tata Steel is focusing on sustainable growth and operational excellence. The company is investing in decarbonization technologies, targeting net-zero emissions by 2045. It aims to expand its portfolio of value-added steel products for higher margins. Digital technologies are being leveraged to optimize supply chains and manufacturing.

Investments in decarbonization technologies, such as hydrogen-based steelmaking and CCUS, are underway. The company is expanding its value-added and specialty steel product offerings. Emphasis is placed on sustainable growth, operational excellence, and digital transformation. The company plans to sustain and expand its ability to make money by focusing on high-growth segments.

Tata Steel is committed to achieving net-zero emissions by 2045. This involves significant investments in decarbonization technologies, such as hydrogen-based steelmaking and carbon capture. The company is also expanding its portfolio of value-added and specialty steel products.

- Focus on sustainable growth and operational excellence.

- Leveraging digital technologies for supply chain and manufacturing optimization.

- Expanding recycling capabilities and innovating in materials science.

- Strategic focus on high-growth segments.

The company's strategic approach includes a focus on high-growth segments and increased recycling capabilities, and innovation in materials science to meet future industry demands. For more details about the company's target market, you can read about it here: Target Market of Tata Steel.

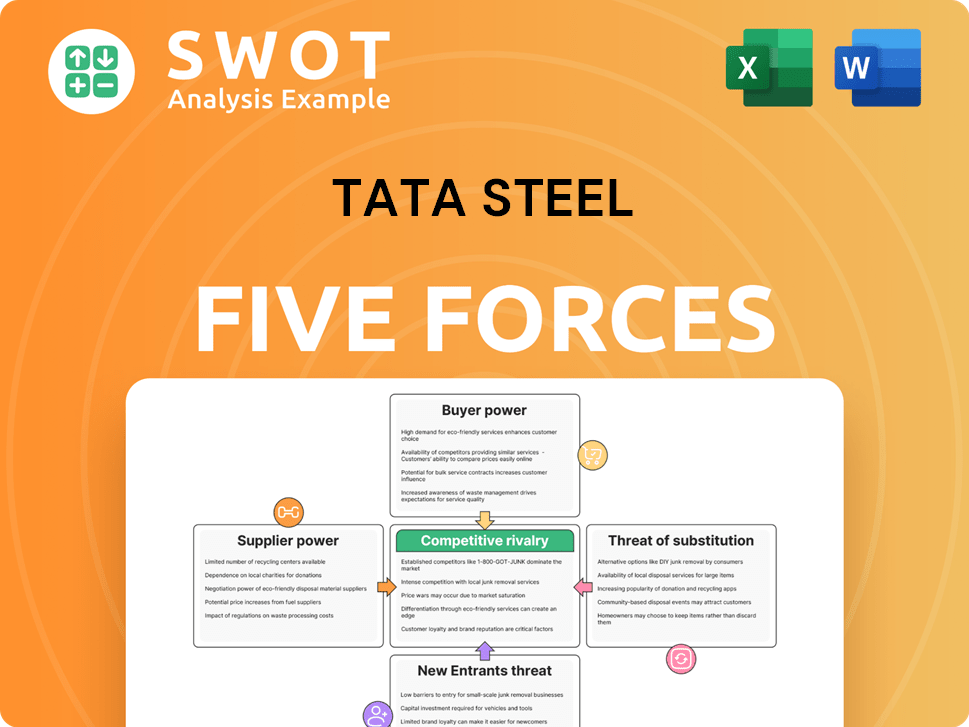

Tata Steel Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tata Steel Company?

- What is Competitive Landscape of Tata Steel Company?

- What is Growth Strategy and Future Prospects of Tata Steel Company?

- What is Sales and Marketing Strategy of Tata Steel Company?

- What is Brief History of Tata Steel Company?

- Who Owns Tata Steel Company?

- What is Customer Demographics and Target Market of Tata Steel Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.