Hackett Group Bundle

How Does Hackett Group Drive Business Transformation?

In today's fast-paced business world, optimizing Hackett Group SWOT Analysis is crucial for success. The Hackett Group company stands out as a leading strategic consultancy, helping global organizations enhance their business performance. But how does this firm, with its impressive client roster and focus on digital transformation, actually operate and generate value?

The Hackett Group's influence in the industry is undeniable, with its strategic advisory services and benchmarking processes helping clients achieve significant improvements. Understanding the Hackett Group's methodology and its impact on client ROI is key for anyone looking to navigate the complexities of modern business. This exploration will delve into the core of what makes Hackett Group consulting a driving force in the market, analyzing its services, solutions, and financial performance.

What Are the Key Operations Driving Hackett Group’s Success?

The Hackett Group enhances business performance through strategic consulting and digital transformation solutions. Their core operations center around improving efficiency and effectiveness for global companies. This is achieved primarily through benchmarking, executive advisory, and managed services, all supported by a vast database of industry insights.

The Hackett Group company offers digital transformation consulting, enterprise analytics, and business strategy services. They assist clients with cloud migration, modern architecture, and intelligent automation, among other areas. Their value proposition is rooted in helping businesses modernize operations through intelligent automation and ERP optimization.

Their approach is unique due to proprietary tools like AI XPLR™ and ZBrain™, which integrate benchmarking with generative AI. This allows for rapid identification of high-impact improvements. The company's collaborative model, working closely with clients, translates into tangible benefits like significant cash flow improvements and reduced SG&A expenses.

The Hackett Group provides a range of services designed to optimize business functions. These include digital transformation, enterprise analytics, and strategic advisory. They focus on improving operational efficiency and driving measurable results for their clients.

The company distinguishes itself through its extensive benchmarking database and proprietary tools. AI XPLR™ and ZBrain™ enable rapid identification of high-value opportunities. Their collaborative approach, working closely with clients, sets them apart in the consulting landscape.

The Hackett Group's value lies in its ability to deliver quantifiable improvements in business performance. They focus on cost reduction, process optimization, and digital transformation. This results in enhanced profitability and competitive advantage for their clients.

Clients of the Hackett Group consulting often experience significant improvements. These include increased cash flow, reduced SG&A expenses, and optimized operational efficiency. The company's data-driven approach ensures tangible and measurable outcomes.

The Hackett Group uses a data-driven methodology, leveraging its extensive benchmarking database. They employ proprietary tools like AI XPLR™ and ZBrain™ to identify opportunities. Their approach emphasizes collaboration and the application of proven best practices.

- Benchmarking: Access to over 27,000 studies provides fact-based insights.

- AI-Powered Tools: AI XPLR™ and ZBrain™ enable rapid opportunity assessment.

- Collaborative Approach: Working closely with clients to implement solutions.

- Focus on ROI: Delivering measurable improvements in business performance.

Hackett Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hackett Group Make Money?

The Hackett Group's revenue model is built upon providing intellectual property-based strategic consultancy and digital transformation services. Their approach is centered on delivering value through a range of consulting services, executive advisory programs, and digital solutions. This diversified strategy allows the Hackett Group company to cater to a broad client base and maintain a robust financial performance.

The Hackett Group consulting firm generates revenue through various streams, including benchmarking, executive advisory programs, business transformation, enterprise analytics, and managed services. This multifaceted approach ensures multiple revenue sources, contributing to the company's financial stability and growth. The company's focus on intellectual property and its digital transformation services are key differentiators in the market.

In Q1 2025, the Hackett Group reported total revenue of $77.9 million, with revenue before reimbursements at $76.2 million, showing a 1% year-over-year increase. For the full year 2024, the company achieved $307.03 million in revenue, reflecting a 5.41% growth. These figures highlight the company's consistent financial performance and its ability to generate substantial revenue.

The company leverages its Gen AI engagements, which positively impact gross margins. Their AI-related offerings, such as AI XPLR™ and ZBrain™ platforms, are highly differentiated and drive higher gross margins compared to traditional consulting and implementation revenues. The company also offers subscription-based executive advisory programs, providing recurring revenue and fostering long-term client relationships. Understanding the growth strategy of Hackett Group reveals more about their financial approaches.

- Gen AI consulting and implementation revenue in the Global S&BT segment grew 13% year-over-year in Q1 2025, excluding weaker practices.

- The company's focus on expanding its Gen AI capabilities and scaling implementation capacity is expected to significantly impact 2025 results, suggesting increased SaaS revenue.

- The acquisition of Spend Matters in May 2025 strengthens their procurement and supply chain technology expertise.

- The integration of new software platforms from Spend Matters supports market intelligence and executive advisory programs, potentially introducing new monetization avenues.

Hackett Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Hackett Group’s Business Model?

The journey of The Hackett Group company has been marked by significant milestones and strategic moves that have shaped its operational and financial performance. Founded in 1991 as Answerthink, Inc., the company rebranded to The Hackett Group in 2008, solidifying its identity as a leading strategic consultancy. A pivotal strategic move was the acquisition of Archstone Consulting in 2009, which bolstered its supply chain consulting capabilities.

More recently, in February 2025, The Hackett Group acquired LeewayHertz Technologies, a Gen AI implementation firm, for $7.8 million, significantly enhancing its generative artificial intelligence capabilities. This was further solidified in May 2025 with the acquisition of Spend Matters, a leader in procurement and supply chain solutions market intelligence, aiming to offer a more complete view of the procurement and supply chain technology landscape. These moves highlight the company's commitment to expanding its service offerings and staying ahead of industry trends.

Operational and market challenges, such as economic uncertainty and cost pressures, have been consistently addressed by The Hackett Group through its emphasis on digital transformation and AI-driven solutions. For example, their 2025 Key Issues Study highlighted that approximately 50% of supply chain leaders are testing Gen AI, and the company actively assists clients in accelerating AI-driven transformation. The firm's response to these challenges includes continuous investment in AI and Gen AI solutions, such as the launch of AI XPLR™ version 3 in April 2025, which enhances Gen AI capabilities and provides thousands of industry-specific AI solutions.

The Hackett Group was founded in 1991 and rebranded in 2008. A major acquisition was Archstone Consulting in 2009. Recent acquisitions include LeewayHertz Technologies in February 2025 and Spend Matters in May 2025.

The company focuses on digital transformation and AI-driven solutions. Investments in AI and Gen AI solutions are ongoing, including the launch of AI XPLR™ version 3. These moves aim to enhance capabilities and provide industry-specific solutions.

The company leverages its intellectual property and extensive benchmarking data. With over 27,000 benchmarking studies completed, they offer data-driven guidance. Executive advisory programs and a technology-agnostic approach provide a distinct advantage.

The Hackett Group is adapting to new trends and technology shifts. They prioritize and invest in Gen AI capabilities. They expect increased demand and investment in these initiatives, integrating Gen AI content and SaaS offerings.

The Hackett Group's competitive advantages are deeply rooted in its intellectual property and extensive benchmarking data. Their executive advisory programs, which offer personalized support and tools backed by decades of performance benchmarking data, also provide a distinct competitive edge. The company continues to adapt to new trends and technology shifts by prioritizing and investing in Gen AI capabilities, expecting increased demand and investment in these initiatives, and integrating Gen AI content and SaaS offerings for new value creation opportunities.

- Extensive benchmarking data from over 27,000 studies.

- Technology-agnostic approach for selecting and implementing the best solutions.

- Executive advisory programs providing personalized support.

- Focus on digital transformation and AI-driven solutions.

- Strategic acquisitions to enhance service offerings.

Hackett Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Hackett Group Positioning Itself for Continued Success?

The Hackett Group company holds a strong position as a leading strategic consultancy and digital transformation firm. Its focus is on intellectual property-based solutions within the competitive management consulting industry. With a significant client base, including many Fortune 100 and Dow Jones Industrials companies, the company demonstrates a strong presence and customer loyalty. The company's global reach is supported by offices in the United States, Europe, and Asia/Pacific.

Key risks that could impact The Hackett Group's operations and revenue include potential tariff negotiations and broader market uncertainties. The consulting industry is also subject to rapid technological disruption and evolving client needs, particularly with the acceleration of generative AI. Regulatory changes and the ability to attract and retain skilled talent in a competitive market also pose ongoing risks. For more insights, check out the Marketing Strategy of Hackett Group.

The Hackett Group's strong market position is supported by a significant client base. They serve a substantial portion of Fortune 100 and Dow Jones Industrials companies. Their global presence is maintained through offices in the United States, Europe, and Asia/Pacific.

Potential risks include market uncertainties and technological disruptions. The consulting industry faces rapid changes and evolving client needs. Attracting and retaining skilled talent remains a key challenge. Weakness in traditional practices requires strategic rebalancing.

The company is heavily focused on strategic initiatives centered around generative AI. They aim to expand their Gen AI capabilities and leverage AI XPLR™ and ZBrain™ platforms. The recent acquisition of Spend Matters in May 2025 is expected to deepen insights.

The Hackett Group is emphasizing sustained growth driven by AI-driven solutions. They are focused on digital transformation to deliver quantifiable value to their global clientele. Licensing of AI XPLR™ is anticipated to begin in July 2025.

The Hackett Group is focusing on generative AI to drive future growth. They aim to scale their AI capabilities and implement AI solutions across their client base. Leadership is committed to being 'key architects' of their clients' Gen AI journeys.

- Gen AI can increase staff productivity by 44%.

- Gen AI can lead to a 40% cost reduction.

- Acquisition of Spend Matters in May 2025.

- Licensing of AI XPLR™ anticipated to begin in July 2025.

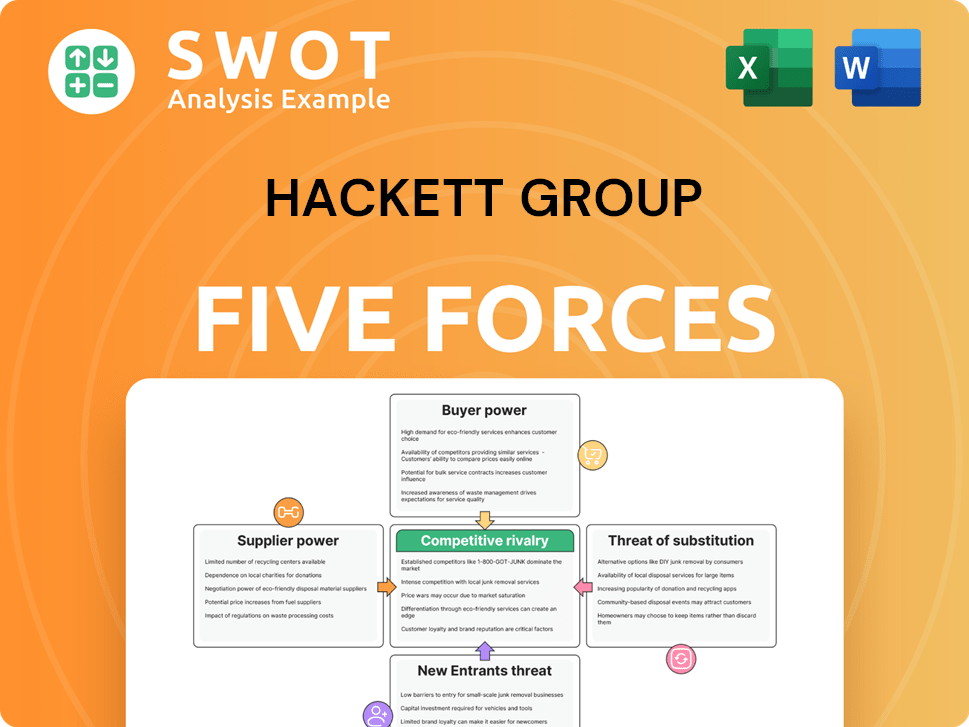

Hackett Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hackett Group Company?

- What is Competitive Landscape of Hackett Group Company?

- What is Growth Strategy and Future Prospects of Hackett Group Company?

- What is Sales and Marketing Strategy of Hackett Group Company?

- What is Brief History of Hackett Group Company?

- Who Owns Hackett Group Company?

- What is Customer Demographics and Target Market of Hackett Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.