Veritex Community Bank Bundle

Unveiling Veritex Community Bank: How Does It Thrive?

In the dynamic world of finance, understanding the inner workings of successful institutions is key. Veritex Community Bank, a prominent Texas bank, offers a compelling case study in community-focused banking. But how does this Veritex Community Bank SWOT Analysis help it stand out in a competitive market?

This analysis is crucial for investors, customers, and industry watchers eager to understand the bank's operational strategies and financial performance. From its personalized banking services to its robust financial products, Veritex Bank's approach provides valuable insights. Exploring Veritex's commitment to its customers, and its impact on the Texas banking landscape, is essential for anyone seeking to navigate the complexities of the financial world. Discover how Veritex Community Bank leverages its strengths to provide exceptional banking services.

What Are the Key Operations Driving Veritex Community Bank’s Success?

Veritex Community Bank, often referred to as Veritex Bank, creates value by offering a broad range of banking services. It primarily serves small and medium-sized businesses and individuals within Texas. Their core offerings include deposit accounts and various loan products. This approach is designed to build strong, personalized relationships with customers, providing more flexible service.

Operationally, Veritex utilizes a network of branches across key Texas markets like Dallas, Fort Worth, and Houston, along with digital banking platforms. Loan origination involves thorough credit analysis and a deep understanding of local market dynamics. For deposits, the bank emphasizes competitive rates and excellent customer service. Treasury management services are also a key offering, particularly for business clients.

The bank's relationship-based model is a key differentiator. Experienced bankers work closely with clients to understand their specific financial needs. This contrasts with the more transactional approach of larger institutions. Their focus on the Texas market allows for specialized local expertise, translating into effective service. This localized approach, coupled with robust product offerings, fosters strong customer relationships and drives business growth. If you're interested in seeing how Veritex stacks up against the competition, check out the Competitors Landscape of Veritex Community Bank.

Veritex Bank provides a comprehensive suite of financial products. These include deposit accounts like checking, savings, and CDs. They also offer various loan products, such as commercial real estate loans, commercial and industrial loans, construction loans, and consumer loans. These services are designed to meet the diverse needs of their customer base.

Veritex operates through a network of branches and digital platforms. Loan origination involves detailed credit analysis and local market knowledge. Customer service and competitive rates are emphasized to foster customer loyalty. Treasury management services are offered to streamline financial operations for business clients.

The bank focuses on building strong, personalized relationships with its customers. They provide more flexible and responsive service. Their local expertise and understanding of the Texas market enable them to offer tailored solutions. This approach fosters strong customer relationships and drives business growth.

Veritex primarily concentrates on the Texas market. This allows for specialized local expertise and a deeper understanding of the regional economy. This focus enables them to provide effective and responsive service. They aim to offer personalized attention and expertise that large banks often struggle to match.

Veritex Community Bank distinguishes itself through its relationship-based banking model and local market expertise. They offer personalized service and tailored solutions. This approach helps them stand out from larger institutions.

- Relationship-based banking with personalized service.

- Focus on the Texas market with local expertise.

- Comprehensive suite of financial products and services.

- Emphasis on customer service and competitive rates.

Veritex Community Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Veritex Community Bank Make Money?

Veritex Community Bank, also known as Veritex Bank, generates revenue primarily through net interest income and non-interest income. These two streams form the foundation of how Veritex monetizes its services and maintains financial health. The bank's focus on commercial clients and relationship-centric model significantly influences its revenue strategies.

The bank's financial performance is heavily influenced by its ability to manage these income streams effectively. This includes optimizing interest rates on loans and deposits, as well as expanding the range of fee-based services offered to customers. Veritex continuously seeks to improve its revenue mix and strengthen its customer relationships.

Veritex Community Bank's primary revenue source is net interest income. This is the difference between the interest earned on loans and investments and the interest paid on deposits and borrowings. For the year ended December 31, 2023, Veritex reported net interest income of $432.8 million, demonstrating the significance of its loan portfolio, particularly in commercial real estate and commercial and industrial loans.

Non-interest income, though smaller, is a crucial part of Veritex's revenue. This includes fees from various banking services, such as treasury management, deposit account service charges, ATM fees, and debit card interchange fees. In 2023, non-interest income was $36.4 million. This diversification helps stabilize revenue and reduces dependence on interest rate fluctuations.

Veritex employs a relationship-centric model to monetize its services. This approach focuses on building strong relationships with clients to offer a range of financial products and services. The bank's strategies include:

- Providing comprehensive treasury management services to businesses, which generates fees and strengthens client relationships, leading to cross-selling opportunities.

- Implementing tiered pricing for deposit accounts and services to incentivize larger relationships and encourage customer loyalty.

- Continuously enhancing non-interest income streams by expanding service offerings and leveraging technology to deliver more value-added solutions.

- Focusing on commercial real estate and commercial and industrial loans to cater to business clients.

- Expanding its services to include a wide array of financial products. To learn more about the bank's journey, check out the Brief History of Veritex Community Bank.

Veritex Community Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Veritex Community Bank’s Business Model?

Veritex Community Bank, or Veritex Bank, has charted a course of strategic growth and market adaptation, primarily within the Texas banking landscape. This journey has been characterized by a blend of organic expansion and strategic acquisitions, solidifying its presence in a competitive market. The bank's focus on community banking principles, coupled with its ability to navigate economic fluctuations, has been key to its sustained performance.

A pivotal moment in Veritex Bank's history was its initial public offering (IPO) in 2014. This move provided the financial resources necessary for further expansion and strategic initiatives. The bank has consistently demonstrated its commitment to enhancing its service offerings and adapting to the evolving needs of its customer base. This commitment is reflected in its investments in digital banking and personalized customer service.

The bank's approach to growth has been deliberate, with acquisitions playing a significant role in expanding its footprint. The acquisition of Green Bank in 2019, for example, was a strategic move that significantly increased its presence in the Houston market. This acquisition strategy has been pivotal in extending its geographic reach and diversifying its customer base. These actions have allowed Veritex to broaden its service offerings and enhance its market position.

The IPO in 2014 provided capital for expansion. The acquisition of Green Bank in 2019 was a major strategic move. These milestones highlight the bank's growth trajectory and strategic vision.

Acquisitions have been a cornerstone of Veritex Bank's strategy. Geographic expansion and diversification of the customer base are key outcomes. Investments in digital banking and customer service have also been important.

A deep understanding of the Texas market is a key advantage. A relationship-based banking model fosters customer loyalty. Agility and local decision-making enable quick responses to market changes.

Navigating interest rate fluctuations and regulatory changes are ongoing challenges. Maintaining a disciplined credit culture is crucial. Investing in technology to enhance efficiency is also important.

Veritex Community Bank distinguishes itself through its deep understanding of the Texas market and a relationship-focused banking model. Its strong brand recognition within its target communities and a reputation for personalized service contribute to high customer loyalty. While it may not possess the economies of scale of national banks, its agility and local decision-making capabilities enable it to respond rapidly to market opportunities and customer needs. For more insights into the bank's operations, consider reading an article about Veritex Community Bank.

- Strong Texas market presence.

- Relationship-based banking.

- Agility in decision-making.

- Adaptation to digital trends.

Veritex Community Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Veritex Community Bank Positioning Itself for Continued Success?

Veritex Community Bank, operating primarily as Veritex Bank, holds a strong position in the Texas banking sector. As a Community bank, it focuses on serving small and medium-sized businesses within key metropolitan areas. Its strategy emphasizes personalized service to build customer loyalty, differentiating it from larger institutions.

However, Veritex faces challenges, including interest rate fluctuations impacting net interest margins and credit risk in a dynamic economy. Regulatory changes and competition from larger banks and fintech companies also pose significant headwinds. Despite these challenges, Veritex is focused on sustained organic growth and strategic initiatives.

Veritex Bank is a significant player in the Texas banking market, especially for small and medium-sized businesses. Its regional focus allows it to maintain a strong market share in key areas. The bank's personalized service model fosters high customer loyalty.

Veritex faces risks from interest rate changes, credit risk, and regulatory changes. Competition from national banks, regional banks, and fintech firms adds pressure. Economic fluctuations can also significantly impact its performance.

The bank's future strategy includes organic growth within existing markets, leveraging its relationship-based model. Investment in digital banking and expansion into new markets are likely. Veritex aims to deepen customer relationships and explore strategic acquisitions.

Veritex plans to enhance customer experience and operational efficiency through digital banking. The bank is committed to prudent risk management and maintaining strong asset quality. This approach supports its community-focused mission and market expertise.

Veritex Bank is focused on organic growth and strategic acquisitions to expand its market presence. It is enhancing its digital banking capabilities to improve customer service and operational efficiency. The bank’s leadership is committed to prudent risk management. For more insights, see Growth Strategy of Veritex Community Bank.

- Veritex Bank is investing in digital banking to improve customer experience.

- The bank is expanding its suite of financial products to meet diverse customer needs.

- Strategic acquisitions are considered to align with its community-focused mission.

- Emphasis is placed on maintaining strong asset quality and prudent risk management.

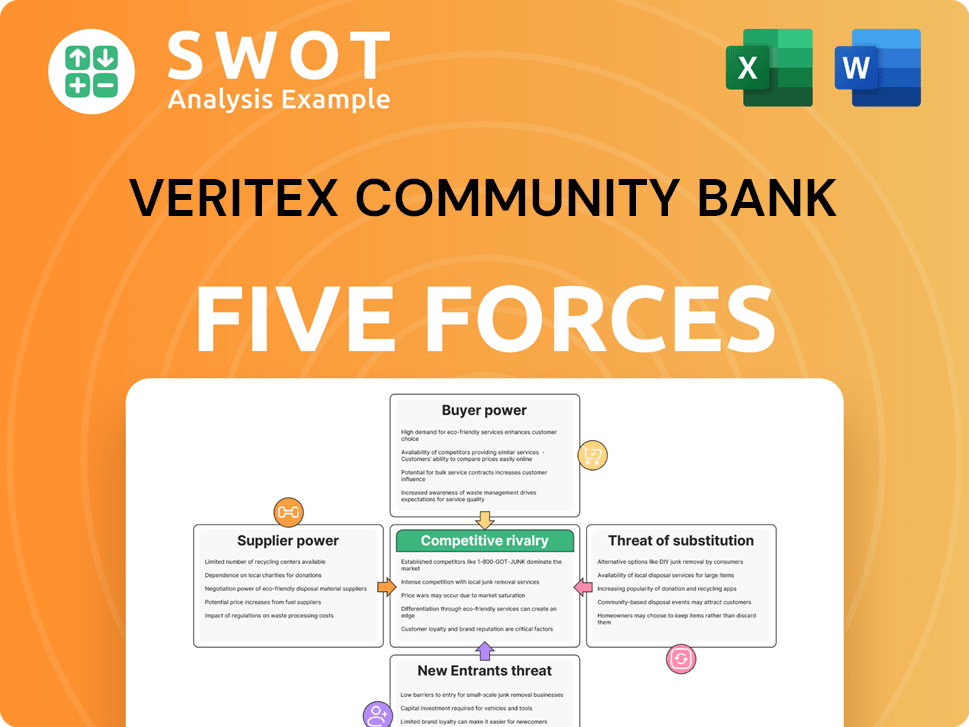

Veritex Community Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Veritex Community Bank Company?

- What is Competitive Landscape of Veritex Community Bank Company?

- What is Growth Strategy and Future Prospects of Veritex Community Bank Company?

- What is Sales and Marketing Strategy of Veritex Community Bank Company?

- What is Brief History of Veritex Community Bank Company?

- Who Owns Veritex Community Bank Company?

- What is Customer Demographics and Target Market of Veritex Community Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.